The EVENT is building.

The WWWIII false flag EVENT keeps building with several scenarios being covered in relatively main stream news publications.

There have been quite a few high profile deaths over the past couple of weeks and it sounds like this is just the tip of the iceberg.

We’re still waiting on word of Hillary Clinton’s demise, as are we of Queen Elizbeth II, who “left the building” in December, 2019. The code for making this public is called “London Bridge is Falling,” and I expect it before the current week is over.

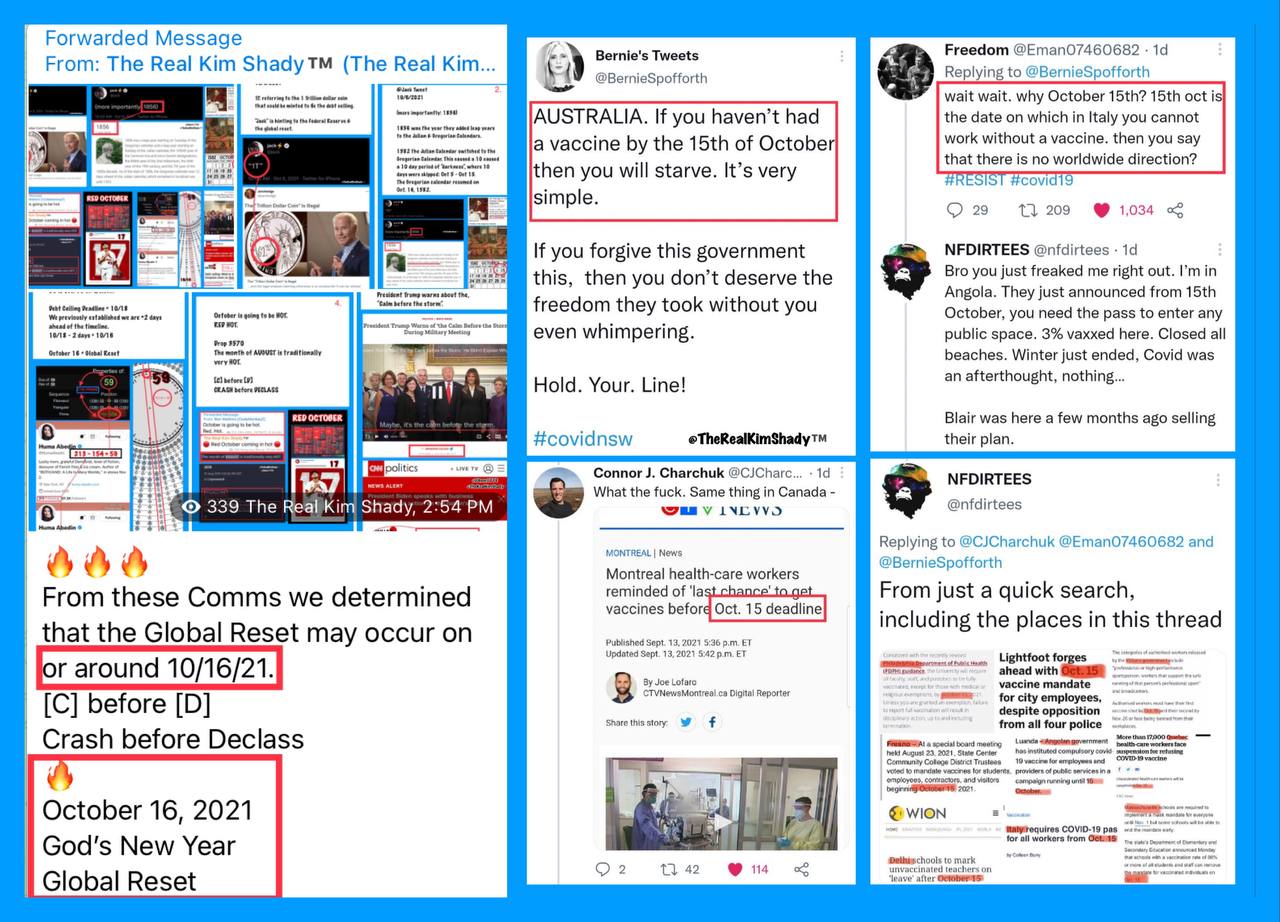

There are now many references to the start of the Julian Calendar on October 16, and along with that, clips that suggest may contracts are going to end on that day. I’ve seen a lot of information (not all of it have I “unpacked yet” (I had a busy week) of the Golden Jubilee happening on October 16, this coming Saturday.

I think we’re finally going to see that dam in China come down this Tuesday and if so, the dominoes will really start falling for the remainder of this week.

When is EBS? Not sure, but it certainly can’t be far off. President Trump has a rally in Iowa tonight which may bring some clarity to unfolding events. Military is positioned all over the world. I know in my city (Calgary), City of Calgary work crews and Enmax (our city energy company) have been out all over the city working on electrical “issues.” Is this foreshadowing Telsa free energy coming in?

Queen Romana has been warning about EBS and martial law all week long, as well as what’s coming up in the future. She tends to share more than other prominent figures and I tend to get a lot of information from her. In short, I believe this will be a very important and enlightening week.

Above, some “intel” in a “drop” that suggests “God’s New Year” (October 16) is going to be extremely important.

On the market side, we’re more or less at a top. All asset classes I cover are hours away from a potential top. I’m thinking Tuesday, but that depends on what happens over this weekend. I’d like to see an event unfold that will give us some momentum to the downside.

It’s also been stated many times that “the crash” will be before DECLAS (which is declassification of government documents withheld from us). And once the dam comes down, things are going to happen very quickly.

Have a great weekend. Be stocked up, of course. Enjoy the show because it’s certainly been ramping up even more this past week!

I expect Tuesday is going to be important.

_____________________

We’re currently in THE STORM. This should result in a number of big events that are still in the works (some have already happened, or are in progress):

- WW3 Scare Event. Nuke Sirens: This appears to be an event that the US military is going to stage at the White House. Israel is in a “staged” war with the Palestinian Authority (“Israel will be last” and the buildings that are “going down” and imploding, meaning they’re pre-wired with explosives). Big announcement about Iran coming.

- Changing over to Tesla Free Energy (this will require power to go off in the Continental US — not sure if it will affect the rest of the world)

- 34 satanic buildings & dams bombed — I think some of these buildings have already been taken out. They appear to be part of an energy grid system that has keep the natural energy of the Earth suppressed — much more on this to come

- Breaking of the 3 Gorges Dam in China. This dam sits above Wuhan and the plan is that the water from the break will destroy the Wuhan lab, which has a link to US Big Pharma, and will be the beginning of the end for them. Bitcoin Servers turned off (99.5% of Crypto gone China Coins) — this involves the dismantling of 24 nuclear reactors under the dam that provide the electricity for Bitcoin. There’s a Chinese satellite that’s supposed to come crashing down to Earth and it’s likely this is going to be cover for the breaking of the 3 Gorges Dam.

- Martial Law — for the ten days dubbed “ten days of darkness.” Actually, it should be called “ten days to the light!” It will be the Great Awakening as we see round the clock video that explains most of what’s been going on the last 5 years to overthrow what’s been going on for two thousand years! — the Illuminati.

- AND, of course …. GESARA

They’ve recently said, “You’re watching a movie, but it’s coming to an end.”

We’re already in “The Great Awakening” part of the process, but THE STORM continues (flooding, arrests, audits …). There’s so much going on that’s not obvious to the general public.

There’s also muchmore to come and so much you’re likely not going to believe at face value. I think it’s going to take a long time for everyone to cast off the lies we’ve been living under all our lives.

The market this weekend is in what you could call “a dead cat bounce.” The direction is definitely down., The near future looks like it will be a lucrative one, no matter the timing of the “great reveal!”

What Price Gold?

I want to address the relationship of gold to the US Dollar, and equate it with inflation/deflation. So many people don’t understand the movement of this commodity and how it relates to inflation. So many economists also don’t understand it. The key is to avoid listening to anyone with a vested interest in owning gold.All these people are biased (at least, the ones I’ve listened to, which isn’t in the recent past. I try to avoid them! If you believe there’s corruption within society, it’s pretty much a “given” that you’re going to find a rats-nest full of it in the financial industry, particularly having to do with gold.)

I want to address the relationship of gold to the US Dollar, and equate it with inflation/deflation. So many people don’t understand the movement of this commodity and how it relates to inflation. So many economists also don’t understand it. The key is to avoid listening to anyone with a vested interest in owning gold.All these people are biased (at least, the ones I’ve listened to, which isn’t in the recent past. I try to avoid them! If you believe there’s corruption within society, it’s pretty much a “given” that you’re going to find a rats-nest full of it in the financial industry, particularly having to do with gold.)

While I’ve been saying for some time that gold is going down in price (which has proven correct), so many pundits have been calling to gold to go up to $10,000, or even higher. That’s absolutely crazy! It can’t happen in a deflationary environment, which is what we’re in (although mild, so far) and where we’re going with the new currency that’s being introduced.

Here’s a short video on where gold is going, with an equally short explanation as to why. For my video on deflation itself, go to the Deflation tab.

To summarize:

- Gold is currently priced in US dollars. As I write this, the price of and ounce of gold is 1,757 USD. It’s at a relative high.

- The price of gold moves in the opposite direction from the valueof the dollar. For example, if the value of a dollar has been inflated away, so that the dollar is only a fraction of its original value a hundred years ago, the price of gold rises. As the dollar becomes next to worthless, the price of gold skyrockets. That was much the situation in 2012 and recently, in 2020. However, technically, gold is topping out. The price of gold will move lower over the longer term (we appear to have one more test of the high to come, perhaps before the end of 2021.

- With the new currency coming in (QFS — the name for now), the idea is to go back to 1950s/1970s prices. That’s deflationary. To do that, they’re going to peg gold the dollar at a level that won’t change appreciably over time. This will provide stability for the value of the dollar. Let’s say they peg gold at $50 per QFS dollar. That means the price of gold will be closer to $50.00, similar to the 1970s when it was at $43.00 (for an ounce of gold).

- Right now, gold is at 1,757 USD per ounce of gold. That’s highly inflationary. We don’t want to keep it there. It has to go lower. The key is that when the dollar has value ($50 buys an ounce of gold), gold will not be expensive. Right now, it takes 1757 dollars to buy one ounce of gold. So, the dollar itself has very little value. It’s almost worthless. Therefore, the direction of gold is to the downside.

__________________________

Enjoy the Awakening!

_____________________________

Know the Past. See the Future

_____________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

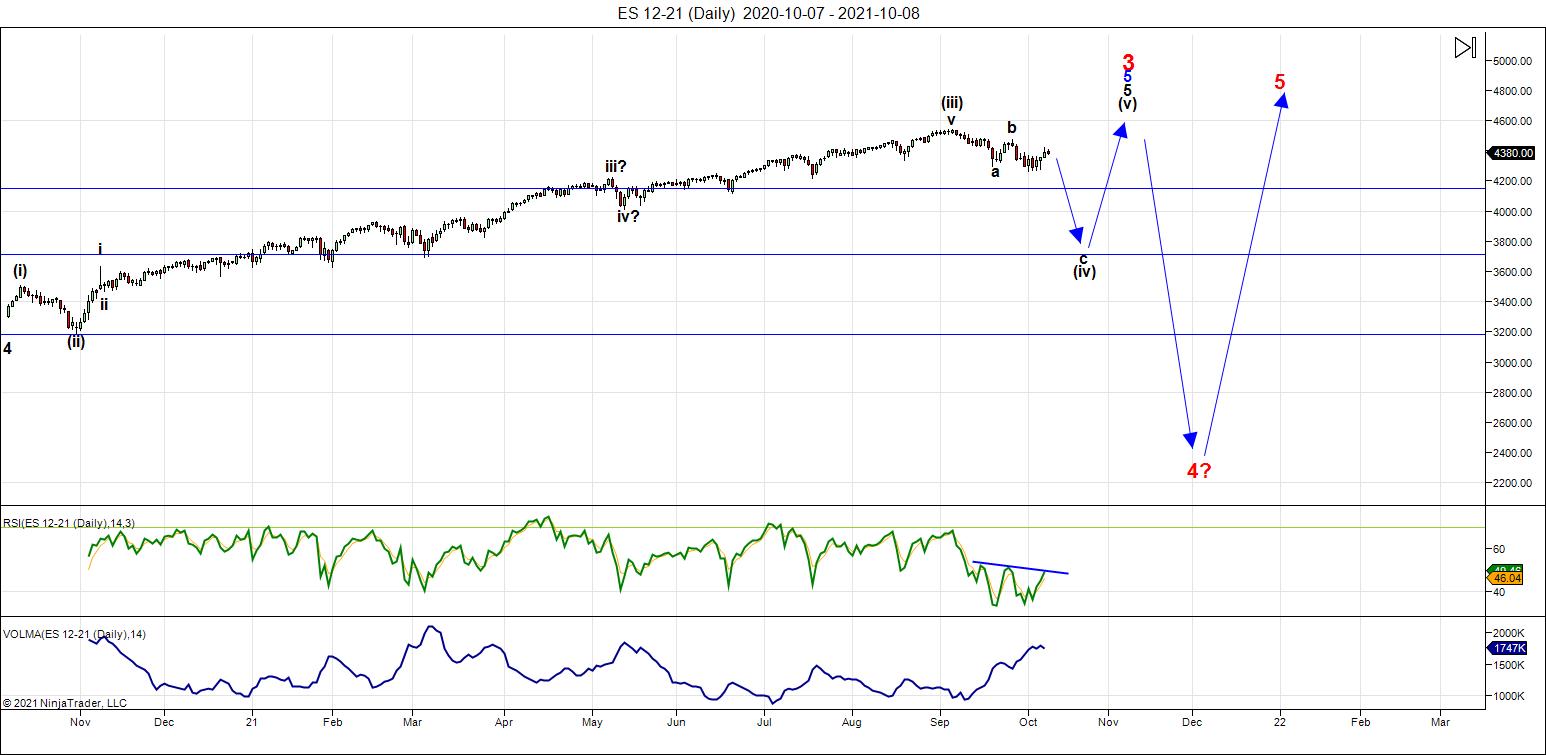

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The corrective fourth wave down continues. As of this past week, we've now retraced 62% of the first wave of the C wave down. I'm expecting an imminent turn back down to complete the C wave, which looks like it may unfold in 5 waves. Progress is slow, primarily because the entire market has to get positioned for the turn. That includes US futures, oil, gold, silver, and USD currency pairs.

They all have waves of different lengths and so there's a constant "back-stepping" of some asset classes to accommodate the classes with the longer distances to cover (think currency pairs). It ends up with periods where trading is difficult to not viable (risk-prone), to period where everything moves all at once. It's feast or famine in this market, and has been for quite some time.

Along with this tribulation is the fact that natural forces, like the moon, haven't been having their usual influence, so you can't depend on them to turn the market. The major top we're at (top of the third of a large C wave up from March, 2020) seems to be constantly waiting for a signal, most likely a major mood-changer from the largest covert military operation in history.

What's going on behind the scenes comes to us from snippets of information that must be decoded. All these snippets give you are expected events, never hard dates. As Trump has said many times, they will never give out dates that the enemy can use to formulate an offence, or even a defence. It's all kept tightly under wraps; few know the exact schedule.

That said, we know we're at "the EVENT" and this week, we're going to see many more lies exposed. Many, many deaths and resignations have happened over the past couple of weeks. The WWIII fake scenario is building. We're still expecting to see a big dam break, which will start the dominoes falling.

Nothing can stop what is coming!

October 15/16 are important dates, with rumours exploding about a Golden Jubilee. Stay tuned.

All asset classes this weekend are very near my targets for a turn. There are signs this weekend may be volatile in terms of intel. Trump has a big rally tonight in Iowa.

___________________________

Summary: We're in the a corrective fourth wave of a large C wave up, as part of what appears to be a broadening top formation on a daily chart. Expect more downside over the next couple of weeks. The A wave down of the fourth is complete, as is the first and second wave of the C wave down, leaving a lot more downside to come.

The covert military operation that's been in action the past five years is also coming to an end. With that phase of operations ending, we have ahead of us continued weakness that will parallel the Great Awakening over the next few weeks. We appear to be tracing out a zigzag pattern to the downside, with a probable drop of at least a further 600 points

Following tha weakness, we'll have a final 5th wave up to a new high before we experience a large drop of close to 2000 points, targeting an area under 2100 in SPX.

Once we've reached an area below 2100, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.