Waiting for the Second Wave

Last weekend, I called for a turn to the downside for SPX. We now have a first wave in place (and a second wave almost complete). I very often “sit out” the first wave.

That’s because if you don’t have a target for it (and no idea where it’s going), in a corrective market situation, it’s difficult to count sub-waves. This market is also deteriorating rapidly, so wave structures often aren’t clear. The other important issue is that we seem to have been in an ending expanding diagonal for the past few months and the sub-waves in diagonals are always in zigzags, which can be very difficult to analyze.

The first wave down is corrective and doesn’t measure properly; it looks like a zigzag (a 5-3-5 wave configuration). Elliott wave methodology requires that you wait for the second wave (in this case, the corrective wave to the upside), which almost always will retrace at least 62%. This particular wave up is well above that level and will probably fill the gap in the SP500. Then, it will turn down to trace out a much longer wave down.

The “master set-up” in a fourth wave correction in a bull market is to short the second wave. Even though you’ve avoided the first wave (there’s a lot of risk playing it just in case it isn’t one and retraces on you), once it’s in place, you can play the second wave up because you have a target of a fibonacci 62% retrace.

Shorting the second wave top lowers your risk and in this case, you only miss about the first 25-30% of the first part of the wave — a very acceptable trade-off. I can’t tell you how many times I’ve attempted to play the first wave down and got out way too early. You generally have to watch every tick!

The other issue in this particular situation is that ES topped overnight and the SP500 topped after the open. After the SP500 bottomed, ES put in an additional wave down overnight, but the SP500 didn’t. I’ve seen this happen only once before. The cash and futures waves don’t match; they’re different lengths1

The problem here arises when you attempt to set an upside fibonacci target for the second wave. You end up with different targets for the SP500 and ES. In this case, there’s a gap in the SP500 and it usually gets filled, so that, to a large extent, mitigates the problem. Then again, this is a VERY rare situation.

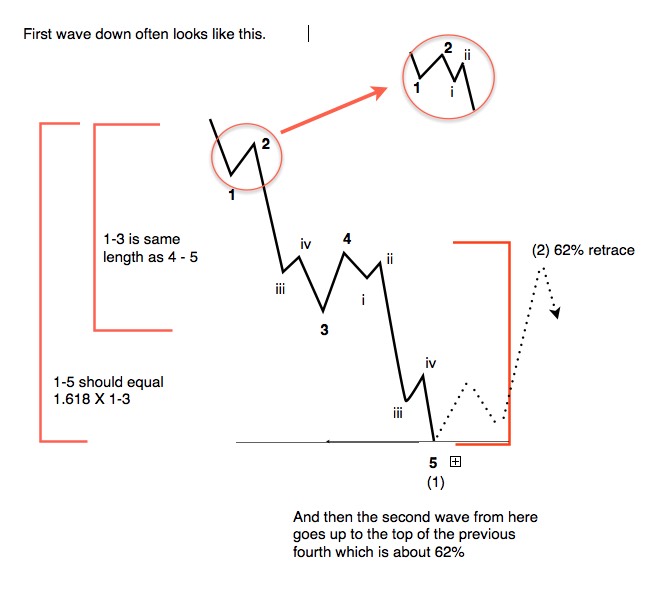

So, here’s an explanation of a typical motive first wave down. Most often, they’ll look like the diagram.

First waves of a new sequence typically different in their configuration that a normal motive wave in 5 waves. They’re hard to discern, as all the waves need to be present and some of them need to hit specific fibonacci targets. If they don’t, you’re looking at an ABC wave that’s going to retrace right back up to the top.

From a “big picture” perspective, you can break this first wave down into two major waves.There’s a wave that comprises the 1-3 subwaves and then another wave of equal length that captures the waves 4 through 5. Of course, there are subwaves along the way. The 5th wave down (from 4 to 5 on in the diagram must have 5 subwaves).

The third wave also must have 5 subwaves (I’ve included an inset circle to show the small wave i and ii of the third wave, as these can be quite small). Wave i should also have 5 subwaves in an impulsive situation (not necessary in a corrective one), and they may be too small to analyze properly. (all in all, there are lots of challenges playing a first wave).

IMPORTANT NOTE IN AN IMPULSIVE FIRST WAVE: Wave 4 needs to retrace to at least the 38% retrace level of the wave down so far (measured from the very top to the bottom of the third wave). That’s a big clue that there’s another portion of the wave down still to go and that you’re in an impulsive wave.

The first wave should bottom at a previous 4th wave (of the final wave up in the opposite direction). [This did not happen this time, which is more of a sign of the larget pattern we’re leaving being an ending diagonal — they have few rules for their subwaves. In almost all other cases, the first wave will target the previous fourth wave of one lesser degree, as part of the final wave up to the top.]

In general, once the first wave down is complete, look for a second wave up in three waves to at least 62%. Wait for the turn at the top. This is the least risk entry for a short from an Elliottwave perspective — the preferred Elliott wave master setup. The third wave down will be at least 1.618 times the length of the first wave down. Voila … you’ve reduced your risk substantially.

No change to the Revolution Movie … so far.

There’s A LOT going on tonight, Saturday, the 15th. We only have the BIG EVENT left to go and it’s expected to happen very rapidly when it triggers. I see trains in Australia are shutting down and if we see airports shut down on Sunday, that would be a signal that something big lies ahead. I’ve been expecting the current turn down to start the “Great Awakening” video playback. We’ll see if this is it.

Just in: Cyclones have all but destroyed much of Wuhan, China. Hmmm.

The “Big Event” is up next:

- WW3 Scare Event. Nuke Sirens: This appears to be an event that the US military is going to stage at the White House. Israel is in a “staged” war with the Palestinian Authority (“Israel will be last” and the buildings that are “going down” and imploding, meaning they’re pre-wired with explosives). Big announcement about Iran coming.

- Changing over to Tesla Free Energy (this will require power to go off in the Continental US — not sure if it will affect the rest of the world)

- 34 satanic buildings & dams bombed — I think some of these buildings have already been taken out. They appear to be part of an energy grid system that has keep the natural energy of the Earth suppressed — much more on this to come

- Breaking of the 3 Gorges Dam in China. This dam sits above Wuhan and the plan is that the water from the break will destroy the Wuhan lab, which has a link to US Big Pharma, and will be the beginning of the end for them. Bitcoin Servers turned off (99.5% of Crypto gone China Coins) — this involves the dismantling of 24 nuclear reactors under the dam that provide the electricity for Bitcoin. There’s a Chinese satellite that’s supposed to come crashing down to Earth and it’s likely this is going to be cover for the breaking of the 3 Gorges Dam.

- Marshall Law — for the ten days dubbed “ten days of darkness.” Actually, it should be called “ten days to the light!” It will be the Great Awakening as we see round the clock video that explains most of what’s been going on the last 5 years to overthrow what’s been going on for two thousand years! — the Illuminati.

All this remains to be proven, but we’re very close to what they are calling “The Big Event).

Enjoy the SHOW!

_____________________________

Know the Past. See the Future

_____________________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

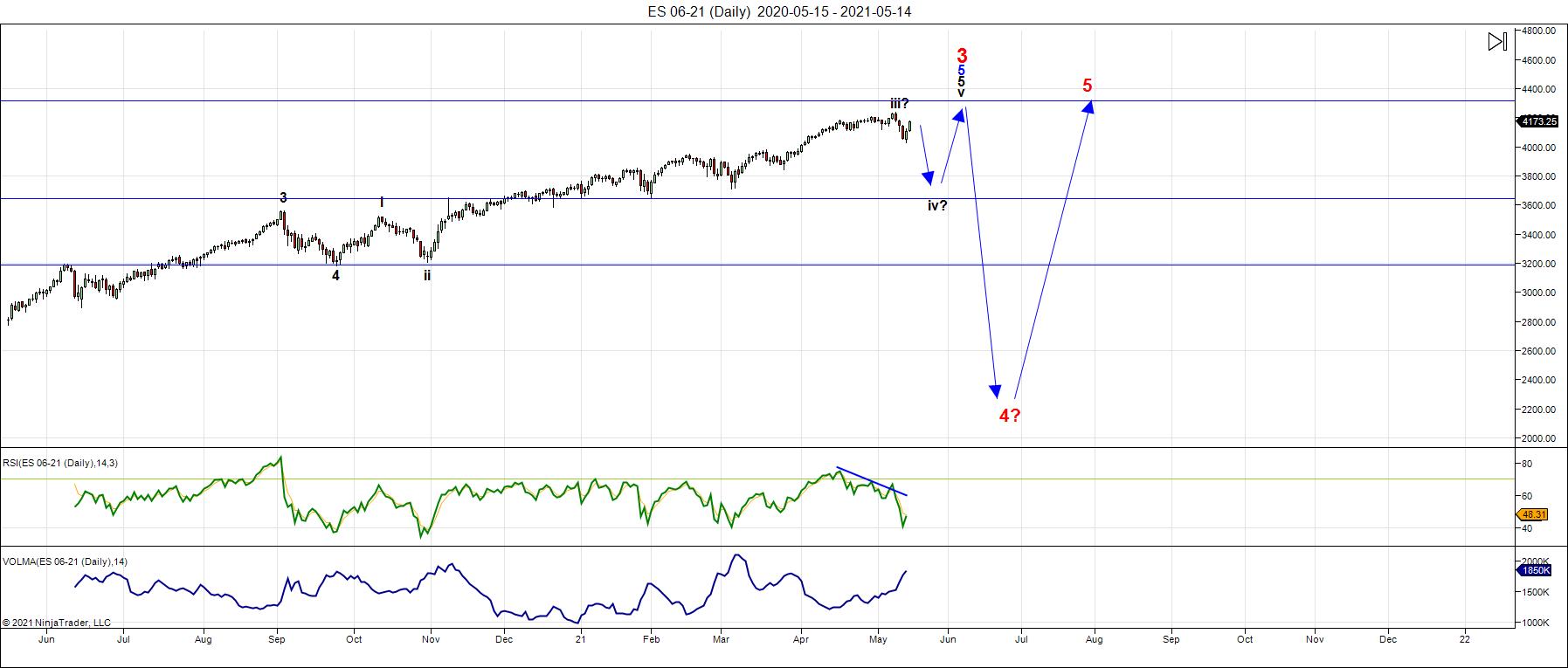

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last weekend, I called for a turn to the downside — into the long awaited fourth wave. The title for my Trader's Gold blog post was, "Down We Go!" and sure enough, down we went. I'm predicting another turn down in the first couple of days of the coming week, I've also been expecting a big event in the real world coincide with this turndown. Well, we'll see what happens, but in any event, I expect it to be a big week.

Today (Saturday, May 15), a lot of intelligence is coming up, much of it hidden history about relationships on both the dark and light sides in this epic revolution that is going on behind the scenes. I've been predicting a revolution for fifteen years now, predicted by cycles and the work of Dr. Raymond H. Wheeler, who I've written about extensively in these pages (and in video).

We're at a pivotal period, moving from an old world that is dying into a new world of freedom as you've never experienced in your lifetime.

There are ending patters of one kind or another all over this market, in various asset classes, and even in international exchanges. It's not the top of the market, but it's an important high. We have one more wave up after we experience the current weakness.

The current ending patterns have made this market extremely difficult to trade. At times, it's been difficult to analyze, as well, requiring hours each night to stay on top of. But if you understand Mr. Elliott's work, you can do well in thick and thin.

It also requires you to know when to be in and when to be out. The low risk set-up don't appear that often, but when they do, they're golden. Paying attention to second wave set-ups like the one we have now the the way to lower risk and increase profitability. But, like any business, you have to spend many years to understand it from the ground up in order to be successful.

The road forward in the real world hasn't changed. The timing is always the issue. As well, there is more deception in the news than ever before (perhaps in history). You're watching a movie and you have the overall script that I posted last week. The end is near. Nothing can stop the climax that's coming.

___________________________

Summary: We're heading down in the expected fourth wave. The wave structure up from March, 2020 is a corrective pattern which appears to be a zigzag. This wav down is also expected to be a zigzag.

After about a 4-500 point drop, we'll have a final 5th wave up to a slight new high to go before we experience a large drop of close to 2000 points, targeting an area under 2100 in SPX.

Once we've completed the larger fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.