The World Runs on Math

I’ve always maintained that “the stock market is a mathematical representation of the mood of society.”

I know this from my work in cycles, extensive research over fifteen years in that area, and my time as executive director of The Foundation for the Study of Cycles, founded by “the father of cycles,” Edward R. Dewey in the 1940s.

The stock market itself moves in cycles; it moves in a predictable pattern of five wave to denote a trend and three waves for corrections. The wave lengths adhere to fibonacci ratios, primarily the golden mean (1.618). The market moves through the same corrective patterns (triangle, flats, and zigzags) over and over and over again. It’s as if it was programmed.

So, where does this predictable movement come from? Well, it’s a bit of a secret, but if you were to take the distances between the planets in our solar system and average them, you’d find that they come to 1.618.

The Universe, and hence our world, runs on math.

When the market’s at a high, the social mood is positive, when at a low, just the opposite is true. We’re at a high now and very soon, we’re going to see a turn to the downside that will end in a precipitous drop. The mood will turn decidedly negative.

Last March, the “pandemic” appeared, and along with it, an irrational fear. It turns out that this COVID monster is more like a mouse, less dangerous than the flu (do you research and you’ll easily find that out).

Last March, the “pandemic” appeared, and along with it, an irrational fear. It turns out that this COVID monster is more like a mouse, less dangerous than the flu (do you research and you’ll easily find that out).

I knew instantly when it appeared that something wasn’t right, because all other outbreaks of viral diseases through history have happened when the market was at a low, when people are depressed, when social mood is negative. I said so on this site.

I also experienced it myself last March. I’ve never worn a mask. That particular technology insults my intelligence. But then, I know it’s a scam. Cycles alone tell me that. We should expect tyranny at the top of the cycle … and we sure got it!

Sure enough, this dark plot by the Cabal to take over the world was behind it all. I didn’t know it at the time, and I didn’t know how deep the history and depravity ran. I certainly do now and I’ll be starting a new video series shortly on consciousvitality.com where I’ll have a larger voice and be able to talk about everything I know about cycles, history, and how it all repeats in predictable time frames. I hope you’ll watch and share, because we need to get the word out.

There are many similar speakers you may realize that are carried on that site. I already have one video there.

Back to markets.

We’re at a stock market high, but this market high is a B wave. According to Bob Prechter (who wrote “The Elliott Wave Principle,” we’re not supposed to have a B wave at the top of a market. Well, we do! Interestingly, Ralph Elliott, who discovered this science thought otherwise. As it turns out, Prechter’s book has many other errors within, all of which I’ve exposed in other posts. I you find them, you’ll become a very much better analyst. But I’ve got 35,000 hours with EW in the market, and it takes at least half of that to really understand it.

This B wave has a personality and Bob did get that right:

“B waves are phonies. They are sucker players, bull traps, speculators’ paradise, orgies of odd-lotter mentality, or expressions of dumb institutional complacency (or both). If the analyst can’t easily say to himself, ”There is something wrong with this market,” chances are it’s a B wave.” — Elliott Wave Principle

The pundits have been complaining about this market for a couple of years (I’ve been complaining about this wave up from March — the most difficult I’ve even had o dea with). Just take a moment to think: Even though we’re at a stock market price high, does it feel right? Nope. It’s a very strange time, particularly if you don’t’ know anything about cycles. Cycles tell you what’s going on, It’s the bigger picture.

As I’ve said, we’re going to see a top to this market very soon, and then we’re going to see the SP500 drop 2,000 points, the DOW 10,000 points. The mood, because it’s not really at a “typical” high, is going to turn decidedly negative. People are going to get fed up.

If you know what’s going on in the world, if you’ve watched “Fall of the Cabal” and are “awake,” you know there are good times ahead … eventually. But, even though we’re going to see a new financial system, for example, you don’t just flip that switch and expect things to go on as normal. We’re going to see a depression and deflation, because Mother Nature is in charge. Haha … man continues to think he’s all powerful, but if you’ve been around as long as I have, you know it’s not nice to fool Mother Nature.

It’s not only not nice, but you can’t do it. Mother Nature is in charge. She controls the climate and through electromagnetic waves, much of what else goes on here on Earth.

How this all relates to the market is that we see a lot of pundits at the top making decisions based upon emotion. They’re predicting hyperinflation — and, since we’re already at the top of an inflationary cycle, so do economists. After all, they’re not taught about cycles. As a result, they’re always predicting “more of the same,” depending upon the trend. The trend is up so the DOW at 100,000 seems like “a thing” to them.

Gold bugs are predicting gold at 20,000, but gold is going to go down. They’re predicting the US dollar is doing to drop in value (the same thing the price going up relative to other currencies), but that’s not going to happen either. Every depression in the history of man has been deflationary.

So, I laughed when a couple of weeks ago, “silver up into the stratosphere” was the call all across the main stream media. It’s wasn’t my call. I predicted down and, guess what — that’s what it’s doing.

So, don’t listen to main stream media. In fact, if news of the market hits the main stream media, you can bet it going to turn in the other direction. That’s the norm. It’s because everybody making that bet has a financial interest in it happening and they’re either emotionally bullish (social mood is up) or, when at a low, they’re bearish (social mood is negative). When either happens in the extreme, the market turns. Count on it! It’s a simple indicator that will tell you where we’re going.

This negativity that will come with this large market drop is going to wake people up. That’s a good thing! They’re going to start pushing back on the tyranny. We’re already seeing in happen in countries like France where very large crowds are turning on police.

The US is under military control and there a very large cleanup going on of the Cabal members and the treasonous characters in the US. There are also the perpetrators of crimes against humanity, like Bill Gates, Dr. Fauci, and the many, many pedophiles that have been praying on children in the most vile and horrendous ways imaginable.

These one thousand year cycle tops always expose the truth. They root out the corruption, but we’ve never seen corruption this vast on Earth or to such depths.

All good in the end, but along the road, this may end of in civil war, no matter the attempt to avoid it. That’s what history tells me.

In any event, we’re on the verge of a major revolution and it will eventually change life for the better, certainly for generations to come. It’s also a dangerous time: Make sure you don’t take the vaccine and are around to enjoy this new, promised world. The vaccine is a biological weapon designed to reduce the population. That much is very clear.

My move to doing more videos is an attempt to get the word out about what’s REALLY going on. People are mostly asleep in this country (Canada), but hopefully, the several of us that are continuing to speak out can make a little dent in the situation … for the better!

It’s an exciting time to be alive, but it’s also a dangerous one. You can do a lot to help by standing your ground and spreading the word. The faster all this gets out, the better. People are power. Information is power. People who know the truth will destroy any government’s attempt to take away our freedom.

The good news is that the war has actually already been won. What you’re seeing is fear by the other side. I think that as the market drops over the next couple of months and the real story comes out, it’s going to be a very volatile period. My knowledge of cycles and how the market reflects social mood tells me that.

It’s important you prepare and be wary. Everybody of every colour and way of life needs to stay safe during this transition. It will be an amazing new world that lies ahead, but achieving ultimate freedom always requires a fight.

Never give up when it comes to freedom.

Know the Past. See the Future

_____________________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

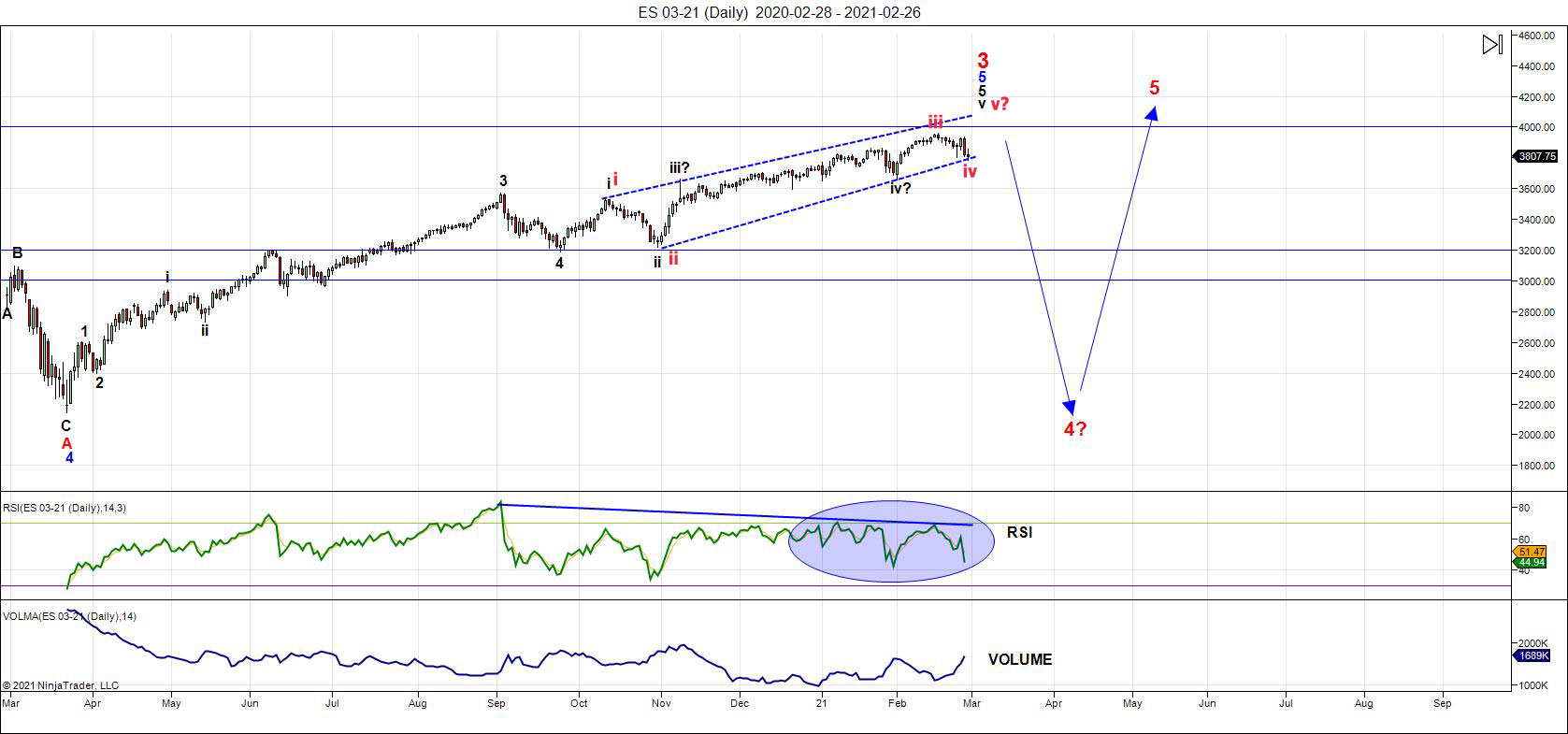

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Well, I thought the fourth wave down that we've achieved over the past couple of weeks would give a clear indication of the structure of this very strange final wave up that's been playing out for the past four months (since the bottom of black wave ii).

There is no change to the prognosis. We have one more wave up to a new high before a large collapse.

I see tonight (Saturday) as I write, that Congress has passed the COVID stimulus bill, which should full inflation in the US Dollar, sending it down and the US indices up.

Although I've placed dotted lines to show the channel in terms of what might constitute an ending pattern, all common structures have problems.

- Ending diagonal. It can't be because it's not the correct structure. The third wave does not touch the upper trendline.

- Ending expanding diagonal. It can't be this either because the trendlines converge. In expanding diagonals, they must converge.

- A simple five waves up. This is also having problems. The first wave up (wave red i) is in three waves. The first subwave of the third wave (the first up would be where black iii is located, intersects with the fourth subwave of the third, which would be where black wave iv is located. This two issues makes the wave up corrective.

In normal circumstances, you have two choices for a final wave. They're either impulsive waves, which this isn't, or they're an ending pattern (a triangle, or a diagonal of some sort). We seem to have neither.

This is a great indication of why this wave up from March of last year has been so difficult. Corrective waves are always difficult, because the pattern is never quite "right."

In this case, it has one more issue in that normal fibonacci measurements don't work. Boy, I'll be glad when this wave is over. It's truly been a year of Hell. In all my years analyzing the market using Elliott Wave, I've never seen a wave behave like this one has.

Now, I suspect the reason for this weirdness is the fact that all asset classes and indices are moving in tandem, BUT the Nasdaq side of the equation has traced out an impulsive wave to the upside, which the NYSE side has been corrective all the way, but they're reached final high (well, almost) together!

In the SP500, we seem to have traced out an ending expanding diagonal. If that's the case, and in this market, I need it confirmed with a new high (!), I'd be expecting a high slightly above 4000. This is not a market I trust, so we'll see what happens.

The good thing is that we have ending patterns in other assets — in oil and DAX, for example. Oil has an ending diagonal forming and that provides a cap on the that particular asset class, which should indicate a top across the board.

___________________________

Summary: We're getting close to a final high from this rally from March, 2020. The wave structure appears to be a corrective pattern in five waves.

Most other US market indices on the NYSE side have similar patterns. This puts us in the final stages of this rally up from March of last year.

The resulting trend change will target an area under 2100 in SPX, and will likely be a combination pattern and, as such, may contain zigzags, flats, and possibly a triangle or ending diagonal at the bottom. However, I'm leaning towards a series of zigzags, which are corrective waves, and will likely come down fast.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.