Last week, I concentrated on relaying the story of how the Rothschild family got into “the big leagues” financially by funding both sides in the Battle of Waterloo and gaining personally from the information they were privy to more than twenty-four hours before anyone else.

This week we’ll explore how usury ended up in the United States in the 1800s and next week, how it became the basis for the Federal Reserve. It’s a story of intrigue, deception, ruthlessness, and greed.

The Monster Travels to the “New World”

When the American colonies were originally settled, beginning in the early 1600s, they were founded under mercantilism. The mercantile system of the British Empire stipulated that commerce and growth within these early settlements was for the enrichment of Britain. Trade by the colonies with other empires was forbidden, taxation would originate from the motherland, and money would be created in Britain and “loaned” to the colonies with interest. The Royal Navy, which dominated the seas, was easily able to both protect its merchants and police international trade.

When the American colonies were originally settled, beginning in the early 1600s, they were founded under mercantilism. The mercantile system of the British Empire stipulated that commerce and growth within these early settlements was for the enrichment of Britain. Trade by the colonies with other empires was forbidden, taxation would originate from the motherland, and money would be created in Britain and “loaned” to the colonies with interest. The Royal Navy, which dominated the seas, was easily able to both protect its merchants and police international trade.

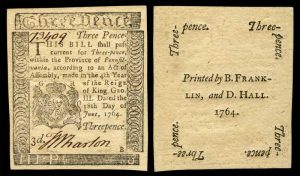

In 1691, Massachusetts began to create its own money, called Colonial Scrip. It resulted in controlled growth, an inflation-free environment, and no taxes. Other colonies followed with slightly different models and less success at keeping inflation at bay.

It was not until three years later that the Bank of England was founded, in 1694. It was founded on the principle of fractional reserve banking and compounding interest—the model for the banking system we have worldwide today.

In 1763, Benjamin Franklin, from Pennsylvania, visited London. He was apparently shocked to see the poverty and squalid conditions of most of the population. Asked to explain how the colonies were doing so well, he replied:

“In the colonies, we issue our own money. It is called Colonial Scrip. We issue it in proportion to the demands of trade and industry to make the products pass easily from the producers to the consumers. In this manner, creating for ourselves our own money, we control its purchasing power, and we have no interest to pay anyone.” Benjamin Franklin, A History of Central Banking, Stephen Milford Goodson.

That was a mistake—for Ben to be so open about their monetary successes.

Franklin’s way of creating money for the colonies was viciously opposed by English bankers. After all, the entrenched method in Britain was to borrow money from bankers at interest. A year later, King George III issued a bill that severely restricted the right of the colonies to issue their own currency.

It didn’t take long for the economy of the colonies to collapse and within a year, half the population were unemployed and destitute. They had been forced to pay taxes to England in silver or gold, and since they had no mines, they went into debt to do so. This was a deflationary environment and it was the primary cause of the American Revolution which, of course, led to a complete break from England in 1776.

The First American Currency War

The colonials now found themselves at war with no money with which to pay for it. A Continental Congress met and decided to issue $200 million in Continental Currency (or scrip). It certainly spurred the economy, but flooding the marketplace with currency only works for a while; it ultimately leads to inflation, which severely lowers the value of the money in circulation.

“By the end of the war, the scrip had been devalued so much that it was essentially worthless; but it still evoked the wonder and admiration of foreign observers, because it allowed the colonists to do something they had never done before. They succeeded in financing the war against a major power, with virtually no”hard” currency of their own; and they did it without taxing the people.” —Ellen Brown, Web of Debt

“Without taxing the people” is a misnomer, because inflation is a tax. Your money reduces in value so, in fact, prices of assets, products, and services rise, GDP rises, but your salary doesn’t increase, and the cost of living goes up. Eventually, to retain your lifestyle, you end up in debt.

Just to “hurry up” the inflationary effect, the British Government weighed in with one of their favourite “old tricks”:

“The Bank of England quickly responded. Hundreds of workmen were recruited and soon millions of dollars worth of counterfeit banknotes were rolling off the printing presses and being shipped to New York. The continental dollar retained much of its purchasing power during the first two years of its issuance, but once the English counterfeit banknotes started to increase in circulation, its value so soon fell away and by 1781, was worth only 2.5 cents.”—A History of Central Banking, Stephen Mitford Goodson

From the destruction of the Continental dollar came the expression, “Not worth a Continental.”

The English had a habit of using counterfeiting as a weapon to attack their enemies. They did the same thing to France during the French Revolutionary Wars (1792-97) with the assignat, which was the currency of the French Revolution. They flooded the country with counterfeit paper fiat money. This was a key reason for Napoleon taking complete control of the banking system when he came to power.

The First American Banks—Private and Lucrative

Even before the colonies had drafted a constitution, they had their first bank (The Bank of North America, founded in 1781, during the war), modelled after the Bank of England. That meant it was based on fractional reserve banking with fiat money. The private bank was riddled with fraud and, because of this, its charter was allowed to expire after two years, in 1783.

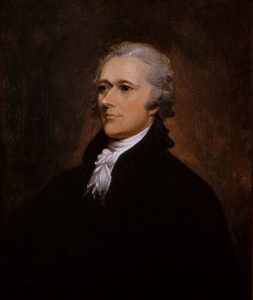

The next bank idea came from Secretary of the Treasury, Alexander Hamilton. His plan was to found a private bank that would create money and lend most of it to the government. It would keep the ability to create money out of the hands of politicians. Thomas Jefferson vehemently opposed the plan and fought to the point that the rift ended up creating the two political parties in existence today. Hamilton won the argument and in 1791, the First Bank of the United States was established with a twenty year mandate.

The argument of private bankers for keeping money creation away from governments is that they will cause hyperinflation. However, that’s been disproven over and over again.

The First Bank of the United States didn’t turn out much better than the Bank of North America. The Rothschild family ended up being the major investor which gave then power both financially and politically. The bank’s main purpose was to lend money to the government at interest and within the first five years, it had helped inflate the economy by 42%.

“By the end of 1795, the Bank had lent $6 million to government or 60% of its capital. As the bank was allegedly concerned about the stability of government finances, it demanded partial repayment of this loan. The government did not have the funds available and was therefore forced to sell its shareholding in the bank between the years 1796 and 1802. By means of this cunning ruse , the bank became 100% privately owned, of which 75% of the shares were held by foreigners.”—A History of Central Banking, Stephen Milford Goodson

In 1811, the bank’s charter came up for renewal. Former president Thomas Jefferson violently opposed renewal. It was a hard-fought battle that went on for days in Congress. It was close: Renewal was defeated by one vote in the House, and one vote in the Senate.

“When the principal shareholder of the First Bank of the United States, Mayer Amschel Rothschild heard about the deep dissension regarding a renewal of the bank’s charter, he flew into a rage and declared that, “Either the application for renewal of the charter is granted, or the United States will find itself involved in a most disastrous war.”—A History of Central Banking, Stephen Milford Goodson

“Let me issue and control a nation’s money, and I care not

who writes the laws”—Amschel Rothschild

In 1809, Spencer Perceval became Prime Minister of England. During this period, England was in a war with France, both sides financed, of course, by the Rothschilds. After the vote in the US to decommission the bank, Nathan Rothschild put tremendous pressure on Perceval to declare war on the US. Perceval was already tied up financially in the war with France and refused.

On May 11, 1812, Perceval arrived at the House of Commons for a debate and vote. He was assassinated in the lobby by John Bellingham, with a shady past and possible ties to the Rothschilds. Within the year, the US and Britain were at war—the War of 1812—which was completely unnecessary.

The Second Bank of the United States

The Second Bank of the United States was set up in 1816 and it was 80% privately owned. In 1822, President James Monroe appointed Nicholas Biddle president of the bank. Biddle was the point man to James de Rothschild, who was the bank’s principal investor.

“The charter required the Bank to raise a minimum of $7 million dollars in specie (gold and silver), but even in its second year of operation, its specie never rose above $2.5 million. Once again, the monetary and political scientist had carved out their profitable nieces, and the gullible taxpayer, his head filled with sweet visions of start quote banking reform, ‘was left to pick up the tab.'”—The Creature from Jekyll Island, G. Edward Griffin

America was about to be introduced to her first boom-bust cycle.

“In 1818, the Bank suddenly began to tighten its requirements for new loans and to call in as many of the old loans as possible. The contraction of the money supply was justified to the public then exactly as it is justified today. It was necessary, they said, ‘to put the brakes on inflation.’ The fact that this was the same inflation in the bank account to create in the first place, seems to of gone unnoticed.”—Creature from Jekyll Island, G. Edward Griffin

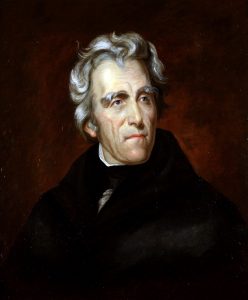

The depression of 1819-21, in which the bank was able to buy up assets at depressed prices rose the ire of Andrew Jackson, head of the Democratic party. In his election campaign of 1832 for President, he declared that “the monster must perish” and ran his entire campaign on “Andrew Jackson – No Bank.”

“Notwithstanding a failed assassination attempt on January 30, 1835 by a presumed Rothschild agent, Richard Lawrence; when a 20 year charter of the Second Bank of the United States came up for renewal in 1836, Jackson collapsed the bank by withdrawing all government deposits. He promptly repaid the National Debt in its entirety, leaving a surplus of 50 million in the treasury.”—A History of Central Banking, Stephen Milford Goodson

In 1837, the Second Bank of the United States was no more. Jackson had beaten the bank. He had also survived an assassination attempt. Luckily, both the assassin’s shots missed him. He was one of few to tangle with the banking cabal and live to tell about it.

America was in the middle of a boom, due to the fact that the Bank had increased the money supply through loans by 84% through fractional reserve banking (in other words, debt). But when the Bank disappeared, the money disappeared, because that money wasn’t backed by anything. It was called the Panic of 1837; deflation roared in, as it always does in these situations.

Men were put out of work, homes and savings were lost. Many other banks also went bankrupt, with their owners walking away with what was left. The depositor were left holding the empty bag, as usual. Thirty-two Massachusetts banks collapsed between 1837 and 1844.

For the next 77 years, the economy got along without a central bank.

President Lincoln and Greenbacks

The American Civil War was a clash between the economic interests of the North and South. The issue of slavery was raised as a way to get people to fight, but was secondary to the main issue of the economy.

The American Civil War was a clash between the economic interests of the North and South. The issue of slavery was raised as a way to get people to fight, but was secondary to the main issue of the economy.

In 1861, the expenses of the federal government were $67 million. After the first year of combat, they were $475 million. Taxes would only cover about 11% and government war bonds would cover about half the needed amount.

In 1862, Congress authorized the Treasury to print $150 million worth of bills of credit and put them into circulation as money to pay government expenses. They were printed with green ink and became known as “greenbacks.” By the end of the war, $432 million in greenbacks had been printed.

The impetus for the creation of fiat money (greenbacks) to pay for the cost of the civil war originated in Congress, but President Abraham Lincoln was a very enthusiastic supporter:

“It would appear that Lincoln objected to having the government pay interest to the banks for money they create out of nothing when the government can create money out of nothing just as easily and not pay interest on it.”—The Creature from Jekyll Island, G. Edward Griffin

The National Banking Act

On February, 25, 1963, Congress passed the National Bank Act, which established a new system of nationally-chartered banks. This was a whole new system that was to set the country on a course to perpetual debt.

The system was based on the government issuing bonds. The national bank would pay for these bonds, but they didn’t keep the bonds; they gave them back to the Treasury. The Treasury then exchanged the bonds for an equal amount of US Bank Notes with the bank’s name on them. So the banks still owned the bonds and received interest on them, but also had the money from the government that they could then lend out at interest.

The banks were required to keep about 12% on hand as reserves to prevent a bank run (which of course, would happen anyway, if everyone wanted their money at the same time). This then, was just a slight variation on the exact same system we have today: fractional reserve banking.

The way the money got into the economy was through loans. So, as I explained in my post on how banks create money out of nothing, it would put the country into perpetual debt:

“Rarely has economic circumstances manage more successfully to confound the most prudent in economic foresight. In numerous years following the war the federal government ran and heavy surplus. It could not pay off its debt, retire its securities, because to do so met there would be no bonds to back the national bank notes to pay off the debt was to destroy the money supply.”—John Kenneth Galbraith, The Creature from Jekyll Island, G. Edward Griffin

While all this went on, in the background lurked the Rothschilds and other central-banker-types. They would await their opportunity, which would come around again in 1913. They were obviously upset not to have a piece of the American money pie.

“Lincoln’s defiance of Lionel de Rothschild and his uncle James resulted in his assassination on the night of April 15, 1965 by John Wilkes Booth at the behest of the Rothschilds local agent named Rothberg.”—A History of Central Banking, Stephen Milford Goodson

President Garfield Speaks the Truth

The bank runs of the second half of the 19th century made President James Garfield so angry that he issued a statement on March 4, 1881:

“Whosoever controls the volume of money in any country is absolute master of all industry and commerce … And when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.”—A History of Central Banking, Stephen Milford Goodson

Two weeks after his made that statement, President Garfield was gunned down by Charles J. Guiteau, who apparently was ticked off at not having received a diplomatic posting.

“At his trial, the hidden hand of Rothschild was revealed when Guiteau claimed that ‘important men in Europe put him up to the task, and had promised to protect him if he were caught.'”—A History of Central Banking, Stephen Milford Goodson

The Bottom Line

It should be relatively clear now that this cabal of central bankers will stop at nothing to gain control of the economy of countries around the world through usury. Under the auspices of creating financial stability worldwide they contract with governments to supply the money for their citizens, money they create out of thin air, and charge compounding interest for that privilege.

It should be relatively clear now that this cabal of central bankers will stop at nothing to gain control of the economy of countries around the world through usury. Under the auspices of creating financial stability worldwide they contract with governments to supply the money for their citizens, money they create out of thin air, and charge compounding interest for that privilege.

In fact, if pressed, any central banker would have to admit that they have no real need to get paid back the principle of the loan, but rather that they are happy to have the principle sit idle, as long as they are paid the interest, which is their income.

Since the principle equals the amount of debt created at the time of the loan, it is really just an accounting entry (the asset equals the liability). When the principle is paid back, both the “money” and the debt disappear from the double entry accounting sheet at the same time. The money disappears as quickly as it was created. But since the debt side of the equation is recorded on the books as an asset, the bank loses the “value” on the asset side of the equation if the debt is repaid. This is without a doubt accounting “trickery.” It’s simply fraud.

“Fraud,” defined in Black’s Law Dictionary is ” a false representation of a matter of fact, whether by words or by conduct, by false or misleading allegations, or by concealment of that which should have been disclosed, which deceives and is intended to deceive another so that he shall act upon it to his legal injury.”

But what’s worse is that by creating loans, which create the flow of money into the economy, they create inflation. Creating loans is their job and they’re paid handsomely through interest to do that job. However, inflation is the obvious by-product.

Banks are incentivized to create as many loans as they can, each one increasing their income (through the interest paid to them) with no cost (other than the labour to keep the books) and no downside … until the economy starts to suffer, the loans start to default, banks start to restrict credit, which in turn reduces the money in the economy.

A contributing factor is that when inflation reaches a certain level, the money of a society has been debased to such an extent that it substantially raises the cost of living, major purchases become unaffordable, and the economy starts to contract. We move into deflation, banks pull loans, and people lose their assets and their livelihoods. Banks get baled out and the taxpayers foot the bill. What a system we’ve created!

In Canada, we’re suing our government to get back our public central bank, the Bank of Canada, which has a contract with the Bank of International Settlements (yes, the same cabal of banksters) to create our money for us (from nothing) and charge us interest for it. We used to do that for ourselves. The story is a similar one all over the world.

Today we’ve created the largest inflationary bubble in history. The downside, of course, will be a deflationary spiral so devastating to be virtually unimaginable by the almost anyone on Earth. It’s a man-made cycle that repeats over and over again with some amount of regularity.

Next Week: The Federal Reserve and the 1929 Collapse

___________________

The Market

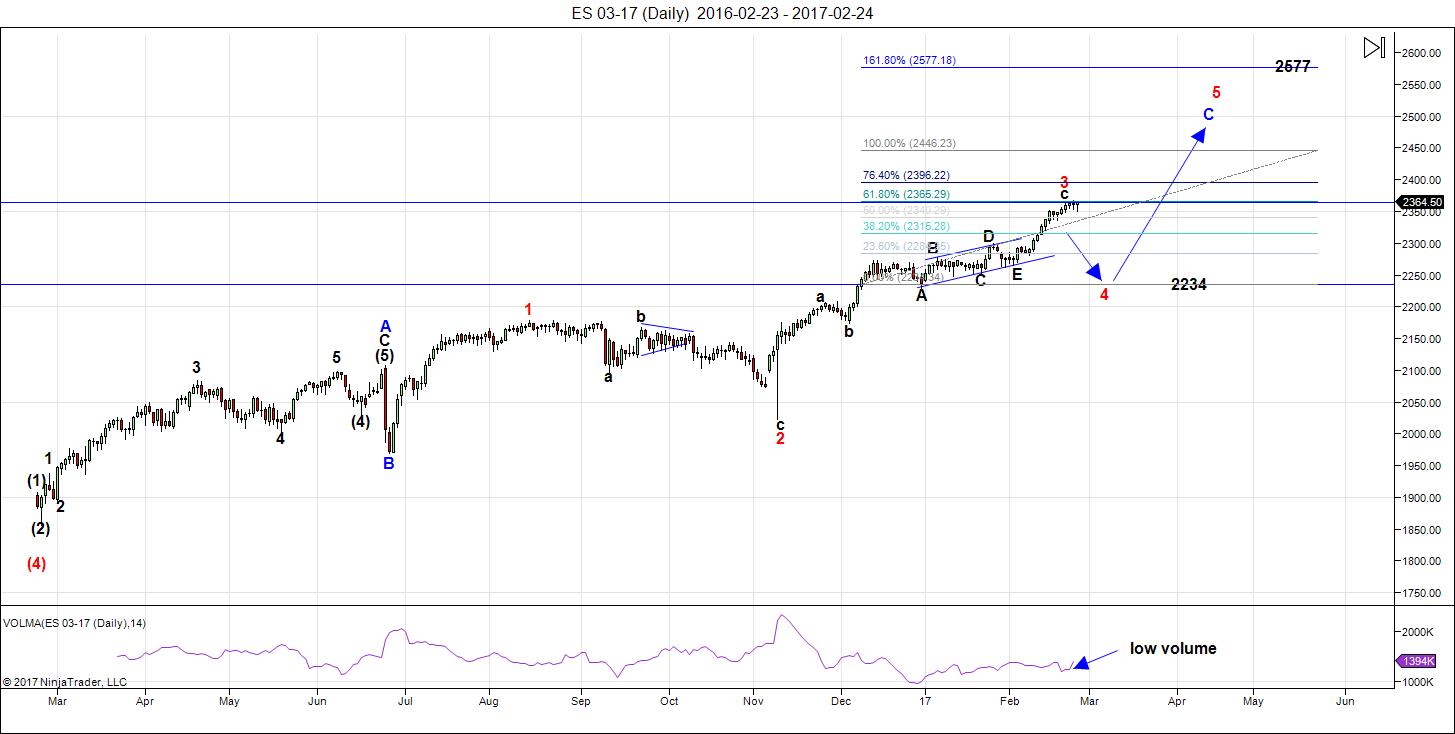

Here’s the latest daily chart of ES (emini futures)

Above is the daily chart of ES. The full wave up looks to be like a triple three (a combination wave) which is at completion.

The final pattern of the triple three is now labelled as a very rare running triangle with a final motive wave as the final thrust wave. This would be the top of wave red 3. In high degree wave structures, the thrust out of a triangle can be a blow-off wave, and that certainly seems to be what we got.

There was a very obvious, large ending diagonal in ES. Note also that the volume is extremely low, which is bearish.

What is obvious at the end of the week is that in ES (not in any other indices that I see, although I could have missed a sub index), the third wave up at 2365 is exactly 1.618 X the length of the first wave, which is the typical length relationship between those two waves.

None of the other indices (SPX, RUT, IWM, etc) have that relationship and are much shorter (except for the DOW, which is longer). This tells me two things:

- the waves are compressing, as they very often do in a final sequence, and

- the market is starting to get a little sicker as we move forward.

ES reaching that milestone also gives me confidence that my wave count is correct.

Currency pairs are, for the most part in sync to where they should be in relationship to a pending final blow-ff sequence.

The 4th wave will come down in three waves. After we finish the A and B waves, we should be able to project an end to the C wave of the 4th wave. Once we finish the fourth wave , we’ll get a final blow-off wave.

Here are the path predictions going forward:

- Wave 4 will come down in 3 waves with any of the corrective patterns possibly in play.

- Wave 5 is likely to be an ending diagonal. In any event, it will be in 5 waves (not motive).

Summary: We’re at the top of wave 3 of the final 5 wave pattern, ready to turn down into four with one more very small wave up to a new high. I expect all major US indices to turn this week. The larger wave (4) should come down in 3 waves.

After completing the fourth wave, we’ll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

_______________________

Sign up for: The Chart Show

Thursday, March 2 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won’t find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Thanks Peter ….Nick

🙂

Why do you feel that wave 4 and wave 5 will complete in less than a month each?

Is there principle of alternation in time also? Since wave 2 took 3 months, you are expecting wave 4 to be quick? Wave 3 has also taken almost 3 months so far.

Or is it astrology?

Amit,

Good question! I had meant to delete that line and simply missed it. I’m starting to thing we’ll see September, but I haven’t had time to really think much about it. EW doesn’t time well and major cycles have been calling for a top for a while. At this point, it’s very much a guessing game.

I have read quite a few comments suggesting the fifth wave up is going to be some kind of blow-off move but I am starting to have my doubts. We are already seeing levels of mania and market extremes not seen in literally decades. The DOW trading over 2000 points away from its 200 dma. Most interesting, very few observers think we are close to a top and some are throwing out some target numbers that are positively ludicrous. The fact of the matter is the BLS has been giving us completely bogus numbers for years now and the US economy has been contracting for months and could well be close to recession if not already there. The shallower the upcoming correction, the shorter the fifth wave up will be. If this bull is going to last for additional months, this move down is going to have to be sharp and deep enough to dispel a lot of the current ebullience. I personally get the sense that the banksters are all in and will fight desperately to limit any downside momentum, which argues for a shallow move down, then one last gasp death rattle upward. We shall see.

Verne,

I personally think we’re going to get an ending diagonal for a fifth wave, because I count this entire sequence up as corrective. If so, that would support your theory. Most indices on the SP side are starting to compress.

Interestingly enough, Ellliot describes an ending diagonal as the wave that develops during an impending trend change that is being resisted. They could not prevent it in bonds, they will not be able to in equities…

Verne,

the problem for me is that everybody is now aware of this.

http://www.zerohedge.com/news/2017-02-25/goldman-perplexed-relentless-bull-market

And the top usually happens unexpectedly for the most of

It could be that your own awareness of the situation, and resultant inclination to seek out confirming viewpoints might influence your perception that “Everyone” is aware of this. The reason I say this is because if everyone is indeed aware as you claim, they are certainly not behaving as though they were. The DOW has closed up for eleven straight days, the longest such streak of new highs in 30 years(1987); we are seeing a remarkable number of upside gaps which means the masses are buying heedlessly at the ask-this is manic behaviour; VIX remains at historic lows, and DSI has registered better than 90% bulls for four straight days, another record. It seems to me everyone is behaving strangely if they believe a top is near.

Verne,

you are right.

The problem is that all these warnings you can find at Bloomberg, Marketwatch etc.

GS, JPM, BoAML and others advise their clients that the downside risk is much higher than the upside.

But the market continues to climb The Wall of Worry.

The jabbering in all the media outlets are probably politically motivated. When was the last time during previous seven years did you hear these clowns talking about risk in the market? My suspicion is that they are trying to talk down the market for political reasons. Having said that, their subterfuge does not in any way obviate the fact that there are very serious risks in the market. Earnings are what they were in 2011, so you do the math when you look at current evaluations. The problem for us is that we cannot know when this thing is going to implode, but implode it will. All bubbles eventually burst, no exceptions. I recently read that markets need to decline 50% to return to historical P.Es. I suspect that they will, and when they eventually do, it’s going to be far faster than most folk expect, but that is just one man’s opinion….

http://www.bbc.co.uk/news/business-39095430

Hopefully this guy is dead wrong.

Peter

Excellent update !

There is something that i am only begining to contemplate

So please excuse my potential errors on the subject of food.

I realize the outcome will be deflationary overall with the economy .

It is generally accepted that under the extreme nightmare scenerio

That food would be the ultimate thing we would all need to survive .

In the United states there is approximately enough food in grocery stores

To cover everyone for 2 weeks . We are going into a global cooling period

And I would assume since almost if not all crops use genetically altered seeds

There is a risk that farmers could use the wrong seed and end up with

Either a decreased yield or an outright crop failure due to colder weather

Or simply a freeze . The politicians may turn to a cashless society to prevent

A run on the banks yet that would do nothing to prevent a run on the grocery stores .

This past crop cycle on wheat farmers lost Money. The cost of producing wheat

Is now higher than the price they receive . I think it’s worth researching this in more detail

And over this next year I intend to do so. Historically the sun spot cycle

Has had periods of high grain prices with high sunspots ( drought conditions )

As well as high grain prices do to cool conditions . The United states has benifited

By being the world reserve currency which has kept our food prices relatively low

Compared to other nations . In some countries food costs are closer to 40% of

Gross income yet here in the USA it’s probably closer to 10% on average .

( I’m guessing )

As I continue to follow the present sunspot cycle and it’s correlation

To the Dalton minimum as well as the potential pi cycle to the freeze in 1709

I think the risk of crop failures should be considered which could cause a run

On food at the grocery store and possibly a spike in grain prices .

Bread lines all over again .

On the other side of this , I guess food costs only relative high and incomes

No where to be seen .

Lastly I’d say a spike in food prices and a run the grocery stores yet government

Intervention by creating price controls and yes a collapse of the financial

System all over .

Many many angles to consider how the process unfolds .

If the present sunspot cycles continues to correlate with the Dalton

Minimum then after October this year the sun dies off and there

Will be no sunspots for the most part until late 2019 early 2020

Which implies all of 2018 and almost all of 2019 colder than most realize .

It snowed in southern Oregon a couple days ago which is a very rare event .

It hardly snows down there any time of year let alone late Feb .

Thank you for your history lessons , I appreciate all of them

Joe

Thanks, Joe,

And don’t forget transportation. When people don’t get paid, transportation lines tend to break down.

I’ve been advocating a supply of freeze dried food and you’ll find a bit of info on that in the forum.

Thanks peter

Always appreciated.

Wave 4 please hurry up and happen.

Regards,

Phil

Already new highs. 2365 broken. Just a little higher (oh my).

Verne

You make some good points .

The Dow being up for 11 straight days is a 30 year record ?

I’d have to look that up as well as compare it to historical weekly ups

As well as monthly ups.

The Dow being only 1 I Dec though I’d question the significance since other indexs have

Not had the same streak.

The gap ups are implying it’s a 3rd wave .

For those who have sat in bonds they could be buying stocks

The other thing to cinsuder is we are seeing shirt covering and not

Real stock buying .

The difference would imply shirts driving prices up yet no

Sellers taking profits . Under that scenerio no drops .

Short the highs and cover on new highs .

You need real stock buyers to have profit takers .

Another thing I see in the works is changes to defined benefit plans

Pensions are being changed as we speak and the changes are not

What I consider good , once these plans get changed there will be more

Money directed to corporate bonds as well as the stock market .

Define benefit plans leave the employer on the hook for any shortfalls

Switching the plans to vap or sip plans switch the risk from the pension as well

As company to the employee . This will remove any further risk for the employer

Dear Peter,

Critical Juncture

I have been following your site from the days it was “born” and I admire your knowledge and persistence .

We are now at critical juncture so I choose the time to check with you on a particular EW count on SPX

MM/DD/YY (L/H) low or high

03/06/00 L – 04/26/00 H (1) of V

04/26/00H – 10/04/11 L (2) of V

10/04/11L – 05/20/15 H. (3) of V

05/20/15H- 02/11/16L. (4) of V

Sub waves of 2016 Now in wave 5 of V

02/11 L- 04/20 H sub wave 1

04/20 H -06/27 L sub wave 2

Within sub wave 3

06/27 L- 08/15 H mini sub 1

08/15L – 11/04 L. mini sub 2

11/04- now mini sub 3 of 3 of V

If this holds true we are going into mini 4 of 3 of 5 of V

Then we have 4 of 5 and the final 5 of 5 to come before it ends.

Pls feel free to invalidate this counting as I am open to criticism .

By the way we are entering North node of Leo this year.( nothing to do with EW)

Thank you in advance.

Vince

Vincent,

Afraid I don’t have the time to go through your numbers, but you’re correct your assumption of where we are … into wave 4.

Old post and and old link

Nothing has changed in regards to the oex

http://imgur.com/9MIZbGc

Still room to run higher as noted before

Compare the charts

http://www.google.com/finance?q=INDEXSP:SP100&sa=X&ved=0ahUKEwifmdzJ1K_SAhVM5GMKHQxODTwQowEICzAA

This may be interesting

http://www.safehaven.com/article/43785/major-stock-trend-turn-coming-in-march

Basically, between now and 2070, between here and SPY 580, we may have a bear market, IF the FED allows it. In the meantime, up we go, cmon, it’s not like it’s real money! God bless ‘merica

…just a little higher…

As much as this market has tried the patience of those waiting for a trend change, if you know what to look for, it is doing something that it normally does not do for traders, and that is telling you what is coming next. The way the market is telegraphing this, and it has been doing so persistently over the last week or two, is flashing divergences with price and VIX. About a week or so ago we had very strong divergence as both price and VIX moved smartly higher. The was another kind of divergence today that I have never seen, and that was both VIX and its inverse ETF XIV rising in price, another token of completely broken and disjointed markets. No one should be too surprised by what is coming; at least I hope not after all this suggestive prelude….Caveat Emptor!

Thanks Verne for keeping the dialogue going!

Verne,

you can add gold to the list

Speaking of Gold, I recently read that JPM has now taken delivery of Silver equal to their considerable short position. They have been doing this quietly for the past year, and as soon as I read that I thought that we could see another smack down as they continue their accumulation at cheaper prices. Voila!

The funny thing though is that it looks like some serious money is stepping in to buy the dips. The Chinese perhaps? The miners have really plunged relative to the price of the metals and they look to me like a great buying opportunity.

Where is everyone? LizH, Luri, Purvez, Jody, Joe, rotrot, Valley…????

…and Dimitri…Everyone is missing Andre’! Wishing him God’s speed!!

Hi Ed!

“I think what people are missing is this date, March 15th 2017. That’s the day that this debt ceiling holiday that Obama and Boehner put together right before the last election in October of 2015. That holiday expires. The debt ceiling will freeze in at $20 trillion. It will then be law. It will be a hard stop. The Treasury will have roughly $200 billion in cash. We are burning cash at a $75 billion a month rate. By summer, they will be out of cash. Then we will be in the mother of all debt ceiling crises. Everything will grind to a halt. I think we will have a government shutdown. There will not be Obama Care repeal and replace. There will be no tax cut. There will be no infrastructure stimulus. There will be just one giant fiscal bloodbath over a debt ceiling that has to be increased and no one wants to vote for.”

David Stockman

Dimitri,

Does David Stockman say why the markets are not responding to the March 15th “debt ceiling” expiration? Thanks!

At least not yet!

No, but there has already been so many debt ceilings and every time they increased it. So, market is sure that it will be fixed in some manner.

Great point!!!

Peter

I had not thought of transportation being broken down because of not being paid

Yet I will from here in out .

What I had thought of was transportation breaking down because of weather ?

Freezing weather or lots of snow would also slow or stop shipments .

Ed

I work in the ocean towing industry and I’m presently back at work .

We’re leaving from the Columbia river ( Oregon ) for Honolulu early thursday morning .

For the record my bigger interest is gaining as much insight to this global cooling trend

And thinking through ways to profit by it . It is a definable trend .

Peter has been calling for a 4th wave ONCE this 3rd wave ends and the we get a 5 th wave

This takes time to complete .

Wave 3 needs to peak wave 4 needs to bottom then wave 5 needs to peak

After all that we need to see either wave 1 or A down followed by wave B or 2 up

Before taking a longer term bearish position that we can just hold .

Think that through .

4 5 a b , that means 4 additional swings before grabbing the bull by the horns .

Additionally : someone recently pointed out the Dow being 2000 points above

It’s 200 day moving average . To really quantify that as an extreme I think looking

At it in percentages . What would that mean historically ?

Sox or spx ndx or Dow . What has been the highest extreme percent wise above

The 200 dma or say the 200 dma above the 90 dma percent extremes etc

If you look at individual stocks or even commodities or stock indexes and you

Use percent moves versus points . More times then not you can find price targets

That nail key levels more consistantly then just using points .

Take us steel as an example , the symbol is X . You can always find a 3 wave move

Labeled A B C , your not always going to find 5 waves in large moves . 5 waves

Are easier in many ways yet the larger picture might be 12345 a abc b then 12345.

The larger count being ABC . Take the percent drop in A and minus that percent

From B to target C.

180 to 90 as an example is a 50% drop if wave B went to 135 that would be a 50% rise

A further drop to 72 1/2 another 50% drop etc… The drop from 180 to 72 1/2 is another

Percent drop which would be used following the rally from 72 1/2 to what ever that high would

Be.

What I’m getting at is don’t just use point moves, use both percentages and points

The Dow rising from 20,000 to 21,000 is only a 5 % move .

GE is right now trading just under 30 per share , yet it peaked at 60 +-

Point being ge needs to rise 100% to reach its prior all time high

Yet presently it is at the 50% Mark of its prior high.

Ge bottomed at 6 bucks in 2009 and is up percentage wise

A multiple of 5 times that 6 dollar low .

No projections here yet had the Dow risen 5 times the 6400 +- low it

Would be over 30,000 right now .

So which is more over priced ? The Dow or ge ?

Look at bac or nvda .

Fair value on the Dow is around 18,000 so I’ll agree it’s over priced

My point though is as the numbers stretch use percentages for

Your guidelines . It’s more accurate as well as more consistant .

I’ll be gone for most of March getting to Honolulu and

Then I’ll be there for only a day or two before heading back.

It’s a 2400 Mile transit .

Lastly, I have stated using valuations work well during a bull market

Yet fail miserably during a bear market . That won’t ever change .

I’m discovering something new to this though .

I have used a simple formula during this bull market that has served

Me well. To keep it simple I looked for high sales growth and high earnings growth

And minimum 40% undervalued stocks . I cannot find that today .

Here is what I’m begining to think and it’s just a thought .

As the market drops in a bear market earnings drop and valuations

Go down with the lower trend . Yet near the lows ( cycle lows )

You will find value , ( under valued stocks )

So as example only using today’s Dow valued at 18,000 and not considering

Tomorrows mark down as what would happen in a down trend .

The Dow would be a buy based on my parameters in the 11,000 area .

Assuming the Dow rises further to 28000 as just an example yet earnings continue

To weaken and growth slows and the Dow valuation drops to say 17000 .

Then id take 40 percent off the 17,000 level which would imply roughly 10,000

As the level to buy ( finding 40% under valued stocks was easy prior to 2015 .)

What I’m getting at is while using valuations to buy stocks in a bear market

Is foolish , using valuations near bear market bottoms is incredibly profitable .

Reverse engineering the process is something I have never heard of yet

I am going to pay attention to this a few years down the road .

Think of what I just explained and use the 28,000 to 10,000 example

Even if just made up numbers . An 18000 point drop from 28000

Would be just over a 50 % decline .

It’s a whole new thought process on using fundemental analyisis .

No one wants to buy fair value so don’t target fair value

Target 40% below fair value at a minimum .

Doing that at a cycle low is powerful .

So how low can the Dow fall ?

A lot !

Don’t worry about getting the top tick .

Good luck everyone

As always Joe, very informative. Thks.

Long term energy chart attached

https://s4.postimg.org/kghurw5zx/energy_chart_Feb_21_to_March_21.gif

Thanks, Tom!

I find this rather amazing. 🙂

Thanks Tom ,

How was the perfomance in Feb.

Thanks.

Tom thanks. Looks like down to march 13. Up to 18. And then 23

Your energy chart is doing great spot on so far…

I wonder what April will bring?

Good luck.

John.

Ed,

I have to admit – watching this market is like watching a horror flick.

You know the one – where you think the monster is dead but it keeps on coming back!

Its like Jason from Friday the 13th.

I have been studying to see where we might turn. When the last place I thought was a top was taken out I went back to the drawing board. What I came up with was this.

SPX 666 was the start of this long move off the 2009 lows – the first 5 wave sequence topped at 1219.

So 553 points

add 553 pts to 1810 gives us SPX 2363

If W1 equals W5 then we are at the top now.and the week of March 2 2009 is when the recovery started. We are 3 days away from that which will be 8 yrs.

I am loading up UVXY and watching for SPX to take out last weeks lows @ 2352..

Thank You!!

Jason is still there. Look at the dollar 🙁

Alex,

I peek at the dollar once and awhile.. it’s hard to know exactly where the top will be W5 can go 1.618 of W1. I bought more UVXY this morning and will continue to cost average in as the market rises. Nothing goes up forever.

The dollar should be topping right now, putting a brake on the indexes. Ideally we start going down today or (more probably) tomorrow. The problem is the market doesn’t respect out opinion (such a b*tch! lol)

My site was down for a couple of hours. Very odd. Seems to be OK now.

There’s / was a global problem due to an Amazon Cloud service outage 🙂

No it was not. It was the Russians that did it. LOL

LOOOOL

No, this was an internal issue on my site and I’m not on Amazon. However, happened at same time, so maybe a page I refreshed accessed something externally about that time, because it sure messed up the site for a few hours in an area it took me a while to come around to as the problem.

I love (30%) hate (120%) relationship with technology .. lol.

In case the market sells off like 11/8/2016 pre-open during/after Trump’s speech tonight (http://insider.foxnews.com/2017/02/28/lineup-watch-pres-trumps-address-congress-tonight-fox-news), I think dip buyers will come in if ES hits 2336 which were the lows made on Feb 16 & 17. Also, tomorrow is the first trading day of March which usually closes higher than the open. http://jeffhirsch.tumblr.com/post/140229633308/march-first-trading-day-only-slightly-bullish. So, if short, be quick if market gets the huge fade before or at open. That said I am wary of March 2nd.

Since we touched on years ending with seven, March 1, 2007 had a positive close but the close price was lower than previous day. A lower low printed on 3/5 then a little bounce followed by a slightly lower low on 3/15/07.

If ES overnight session has hardly any reaction after Trump speech and ES has a higher low at tomorrow’s first hour open than today’s low with a hammer candle combined with a bullish SVXY I’m not going to be surprised if it hits 2376-80.

It’s fading on the upside…

Well, it went past my 2380 target so might as well shoot for 2400. ?

USD and Gold have inverted.

May be the top is somewhere here.

The dollar is doing its best to give a wink to the indexes, but at this point I’m afraid the driver is drunk, blind and a fool. Exactly like I would like to be when I look at my account.

Every time the choo choo train idles and backs up a bit, it picks up buyers giddy for La La Land.

Weekly RSI for SPX has never been higher since 2004.

The algos really stretch the rubber.

Is this still wave 3? Does it have an invalidation limit on the upside or we can go endlessly?

While Kuroda is permitted to devalue JPY and buy US stocks

Andre, I read about the loss of your beloved mother in the last post and want to extend my deepest condolences.

Regardless of age losing a parent is traumatic but fond memories of joyous times together is a healer.

Who knows right? But usually before a trend reverses it accelerates to get those who don’t know – in the market.

They feel “OMG” I am missing out! Hop in then it reverses. Then they think as it goes the other way – its ok it will resume I can sit in, it will pay off.. lol

Volume is really low..

Each time UVXY dropped below $20.25 today I bought..

This is one of the largest short positions I have ever had and will hold.

JODY – you are a good brave man! this is the BIG short! :-))

https://invst.ly/3d6ao

the price reversal needs to ‘gap up’ and reverse on HUGE volume, and end the day much lower. that will begin the crash. so we could see a ‘gap up’ again tomorrow…… and continue to gap up, until we get the price reversal.

prices must continue to gap up from here on in. they are unable to “correct” in the blow off phase. We could see another 100 – 150 pts or more in ‘gap ups’ of the spx in price over the next few weeks until we get the price reversal. No one knows when the reversal will come – [except of course for the rigging Rothchilds owned central banks]

I have a stop loss in @ UVXY $15 but looking to cash @ UVXY $35

So 1/3 risk/reward average cost $20 per.

We are really close..

jody,

an overlay.

https://invst.ly/3d6o0

Iuri I love the chart but 150 pts it’s blow-off for sure, of my account to be precise. Please lower the number lol

What a beautiful sight! This was exactly the kind of manic move up I was hoping we would see. Look at that massive divergence between index prices and the inverse futures VIX ETF SVXY which topped back on February 15 at 135.54

Every single EW analyst I know is calling this a third wave up. I am going to respectfully suggest that it cannot get any more manic and irrationally exuberant than what we are seeing. It would be most interesting to see if any one has a count that sees a final top unfolding. I think there are some good reasons to believe that we could be seeing just that. Patiently waiting…. 🙂

That would make sense Verne as it would catch out all EW who would miss out on the big short as they still expect more upside! Time will tell!

I know at least 2 EW analyst counting this a wave 5…I guess that’s the problem (and beauty) with EW, they’re really subjective…those 2 guys are recognized as top of the field, Peter-caliber (yes, that’s now a recognized standard :), not talking about some StockTwit user personal blog.

I don’t have a single EW target for this wave (III or V who knows) that hasn’t been heavily revised on the upside over and over. My best guess (and the hard evidence) is that nobody on this earth really knows what’s happening, at least not without recurring to ranges so broad that are impossible to trade unless you’re Warren Buffet or just interested on it for philosophical purposes.

Hello people I’m back from my Cape Verde jaunt with a decidedly different colour. It’s the melatonin in me that goes ‘WHOOPEEE’ some SUN at last!!

If anyone here gets a chance to go there then I would heartily recommend it….only just not in the middle of February. …….The sun was hot but the wind had an ‘icy’ feeling to it which made sun tanning easier but shiveringly cold when the sun decided to rest behind a cloud.

I see nothing much has changed since I left other than the markets moving ever higher.

I have to give a ‘shout out’ to Joe in that respect and latterly to poor suffering Alex who have both started predicting higher. Joe of course has been suggesting higher for quite a while and Alex recently.

My holiday saved me a few ‘coppers’ which extends my time ‘to expire’ by about 10 days.

Whilst on holiday by a quirk I ended up reading the following book:

https://postimg.org/image/dx0h3jdn5/

It’s a potted history of the US around 1927 and thereafter covering the major stuff happening then e.g. Aviation, Baseball, Prohibition and it’s close cousin Crime and of course the lead up to the Market Crash.

In there the author describes the markets (and I’m paraphrasing here) as being on thin air with each person buying hoping that there will be ‘another’ to buy at a high price. Given that this was in 1927/8 it was just before the Great Depression.

Sound familiar to our circumstances today to anyone?

Although I DON’T get a penny out if it I would VERY MUCH recommend reading the book if you ever get a chance. The author is a meticulous researcher and has a very humorous turn of phrase.

purvez welcome back. please crash the market. please.

SVXY was skeptical of today’s mega rally in the indices…l?ks like there could be some selling tomorrow…?

https://twitter.com/allerotrot/status/837056933873975296

Apparently the passage of Jupiter/Uranus opposition happens tomorrow March 2. Last time it happened was 12/26. So let’s see if this thing can hammer down the markets for the next 3 days. Warning: nothing goes down on a straight line. Well, except panw yesterday after hours and today.

https://www.youtube.com/watch?v=VmEtGnnZLE8

welcome to crazy 🙂

No comments as to the wave count .

Just details on this next cycle to kick in .

The term is a Venus bull market .

This link gives the dates .

Some times though when then cycle begins

You will see an initial drop folllowing mercury

Conjunct the sun. Other than that it is bullish.

Also when Venus and mercury are retrograde together

You will see a market or sector ( can be gold, commodities

Or the dollar or stocks ) some sector will go nuts

To the upside . If you notice , Venus is about to go retrograde

Also you will find that towards the end of Venus retrograde

Period , mercury will turn retrograde , and this will be happening

In a Venus bull cycle .

Point being : be careful .

That said , the oex is entering the target area I had for June

Yet it is only March . Much more upside is available yet my price target

As I see it is being satisfied right now.

None of this rally is based on fundementals , it is based on lunacy

That said it will rise higher despite any drop that comes .

The real question is when is the ultimate top ?

The pecking order

Big money = Dow

Hedge funds /institutions = spx

Little guy= nasdaq .

Follow the leaders , both the sectors as well as the individual stocks .

It’s looking a bit cloudy , it’s chilly , there is a storm coming

Yet it’s still a ways out

See you all in a month

https://www.google.com/amp/s/astrobutterfly.com/2017/02/27/astrology-of-march-2017-happy-new-astrological-year/amp/

https://invst.ly/3deq9

so i drew this blow off top into the parabolic move yesterday.

here is a close up. https://invst.ly/3der1

methinks if we lose the top and bottom elliptic support lines – to expect large moves to occur to the downside.

So jody, i am looking for that break, and i think your positions are good. Alex, you too!

of course i still think this is a “bull trap” and still have the 3PDH pattern on top the pile of charts.

https://invst.ly/3deti

3PDH pattern has some time constraints. Have you checked it out?

Amit,

I separate Lindsey’s “idealized” version from today’s reality. In Lindsey’s day the markets were never dominated by CTA’s – algo’s trading at microwave speeds on a single worldwide platform across every asset class. That change separates the idealized version from today’s reality – so the time constraints must be given a very wide birth.

It really is amazing how many otherwise intelligent people have started to talk about a perpetual bull market, that we are in the middle of a third wave and on our way to an eventual DOW 40,000.00!!!!

I think we are in a small degree fourth and have one more push…

took out one elliptic support….

https://invst.ly/3dfuv

“Where did Steve Bannon get his worldview? From my book.” – Neil Howe, February 24, 2017

interesting/insightful article

http://tinyurl.com/z8dyaen

He’s lying. The book he gets his worldview from was written in Germany in the mid 1900s…lol

Just a warning we may have a mini-V wave starting here into tomorrow, don’t get killed now 🙂

It’s always entertaining to see folk busily trying to determine what and when the market is going to do what it does next. The fact of the matter is that if you pay close attention the market generally will tell you both things. We have had over the past several weeks a series of gaps up at the open – more than i can ever remember seeing. These kinds of successive gaps happen primarily in one of two circumstances- start of an extended bull run, or the end of one. I will let the reader decide what it is we are seeing in the current price action. The simple fact is, the first clear evidence that a reversal has arrived will be the decisive filling of the most recent gap from yesterday. If that happens it will obviously have to be considered an exhaustion gap. The rapidity with which subsequent open gaps are filled should provide a great clue as to whether we are in a substantial correction, or that’s all she wrote. I like to keep it simple!

Do you have a list of all the gaps?

Indeed. They are pretty easy to spot. Just pull up a daily chart of the indices and they are all pretty obvious. The most recent one is at 2364.64 from Tuesday’s close.

verne,

on the 30 min [spx] for example, there are 7 unfilled gap up’s from jan 24th. beginning at the 2260 ish level.

on the daily, there are 9 unfilled gap up’s just from election night from the 2080ish level.

from the feb 11th 2016 low, you can add another 3 more unfilled gap up’s from the 1860 level.

Yep. I don’t recall ever seeing so many in such s short span. This is manic behaviour, it seems to me like1929…the charts from then and now overlaid suggest we go a bit higher…

I prefer markets fade a bit towards end of day. No 3:30 pm ramp so we can open lower tomorrow and buy the dip for opex pinning.

Hereeeeeeeeesy! No dip buying allowed here…only selling or selling heavily…lol

We should have more days like this. Thank you CAT, thank you Sessions.

Here it comes, our daily bears slugfest…

ah ok. It’s just Trump saying “Bigly, Huge, we’ll win so much we’ll get tired of saying ultra-bigly”…guys, we live in extraordinary times…bigly…

lol – Big League

Wow! DJI down triple digits, and closing just at about the day’s lows no less, and VIX deeply in the red at almost -6.0%. This in my view speaks to the pernicious effect of central bankster pumping in totally distorting any semblance of risk perception in these markets. This is suggesting to me that we have quite a ways down to go to dispel the current levels of optimism. Stochastics and RSI just starting to roll over. Not a single analyst I know thinks that we have an at least interim top – not one! They all consider the upward structure incomplete. I’m quite curious to see just what Mr Market has to say about that. Quite curious indeed.

My working thesis is that the banksters are absolutely terrified of even the slightest decline in the markets, and if they are not succeeding in reflexively buying it out of the red, it is not for lack of trying, no disrespect to EW theory. The implications are ominous…

verne,

my take of a ‘red’ vix, and red spx is as follows. Rather than use the “vix” for protection of long positions against sudden down moves in an upward trending market [example of this is 9 trading days of green spx and green vix – which means higher prices to come], when the market reaches some hidden consensus of ‘overbought’, then the underlying “long” position is sold off, and with it the ‘vix’ protection for that position.

So you get a scenario of red index, and red vix. When the underlying position is sold, that is a clear indicator of real selling which begets more selling.

Interesting. Since VIX (supposedly) represents a put call ratio, the decline could also theoretically be explained as simply far more calls than puts being bought, something you generally do not observe in a declining market. It is a BTFD mentality on steroids. The crowd is absolutely convinced that any and all declines present an opportunity to go long. So far they have been right!

Luri,

I know who is selling the US stocks. Those ……………..

who need money to buy SNAP

Lol

SNAP 24 to 28! ?

At some point, a really nice short. lol.

The move from 27 to 29.44 looks like an ending diagonal but I jumped at 28. 🙁

**jumped ship

Too dangerous to short SNAP right here

I tried to short SNAP but they are not leading out shares. So you only buy lol.

Hey Guys – first time posting here, but I did a study and found all the unfilled gaps since the bull market began Mar 2009 (as of 2/16/17). Cheers!

http://imgur.com/a/QHQwU

my target is 676 lol

Snap CEO “We’ll never monetize, told ya ah…don’t say I didn’t told ya…” => TSLA valuations

Drop da bomb…drop da bomb…granny drop da bomb…

Did you hear that??? wait yes I heard it!!

Fat lady is singing!! lolol

This market is really making no sense..

Someone is lying.. Either S&P or UVXY.. Guess we will see.

I covered all my shorts for a small gain and will re-approach it next week, just not comfortable after today’s action..

Have a great weekend..

Buy them back …now

UVXY above $21.50 I will..

I am not comfortable with UVXY down $1.30 and SPX only up 1pt.

Something is fishy with today’s action.. To many conflicting signals..

Jody,

ES/SPX have not topped yet. One wave to go. I’ll talk to this a bit on the weekend.

Too bad…

The period from 3/5-8 is strong. Large moves – if they come- come after the lunar square. 3/5 is first quarter. 3/5 we also see Saturn enter a bearish dasha. And will stay there deep into 2018.

The 1440 cycle gave a low 3/3 and gives a high 3/8. The low tides give a high Monday and the high tides on wednesday. 3/7 is also a strong date and will likely cause a low Tuesday.

So it really seems the market is topping. And next week should really shake things up a bit. 3/10 also strong so will be tested before a plunge into 3/15. 3/15 we have a BR15. 3/2 was BR36 and 3/4 BR17.

In my system 2/1 was the real high. 49 days is a Gann cycle. 49 days from 2/1 is 3/22, 3/22 should be a high. Hence 3/15 a low as will be 3/29. 3/29 is a 1440 low.

The lunar declination cycle causes wet and dry periods. This cycle turned in 2011 and the midpoint – 2020- should bring a dry period. If wet=warm and dry=cold we are really in a down trend. On a larger scale 2011 should have been a high but was inverted. So the ‘bullmarket’ basically was an inversion. If inversions take 5-6 years, a bearmarket should much longer. 2032 – 100 years from 1932 – is still an option.

Anyway : I agree with Peter; one more leg up into wednesday before we head into a 3/15 low. 3/22 a very strong date and some stronger down move.

Tuesday Sun conjunct Mercury; will give the low.

Enjoy the weekend.

I was encouraged to find your post this morning! We have missed you and your comments. I would like to get some clarification…If you are up to it.

You were looking for a test of the “midpoint” of the 1440 cycle on February 25th… which was surrounded by other dates spread between February 22nd and February 28th. You mentioned February 24th was to be “dark day” per Olga Morales. So here we are in early March…

My question is…Are you still looking for the “59 days down into late April”? I believe that on a shorter term basis you were looking for the market to initially cycle down into March 7th…Has the market’s strength surprised you? Have the tides altered the March 7th low into a March 8th high? Just attempting to understand.

When you use the word “strong” does that mean “up” or does it mean “strong influences” could be either “up or down”?

To summarize…a “top” is still trying to form. If we see a move to the downside…it could last into “late April”!

Probably too many questions…for that I apologize! Not seeking trading or investment advice. Thanks in advance!

Sorry, been busy cleaning out my mothers house for the sale.

Your questions: I meant to say I expect a high early next week. Vedic Saturn enters a bearish mansion 3/5 and Saturn is conjunct the galactic center 3/8. This is also bearish. So Saturn alone confirms the 5-8 window.

My outlook for the year is that I expect a panic cycle in the fall. So we need a low before that. Strongest dates are 4/25 and 5/28. My preference goes to the last.

For March the strongest dates are 8/15/22 and 29. I explained above why I think 22 will be a high. If 8 is a high (1440 delta says so) then 15 and 29 are lows.

The market is definitely forming a long range top. Think 22 will be a more significant high than 8. But 8 will be a high.

6 is strong as it is a midpoint in squared number timing on 2011 and it is a yoga velocity extreme (next 22). Also see a jewish dasha 6. (will explain later).

So Monday high, Tuesday low and Wednesday high again.

Hope this helps.

Today I was thinking of that song : I lost that bullish feeling, oh oh that bullish feeling, I lost that bullish feeling and now it’s gone, gone gone etc. Or am I confused?

Glad to see you are back in the saddle, Andre’. Much appreciated.

Thank you Andre…… Nick

NYAD: Weekly -464.00…Monthly -269.00…healthy market?

http://stockcharts.com/school/doku.php?st=advance+decline&id=chart_school:technical_indicators:advance_decline_indi

Formerly reliable market metrics. like volume, breadth, rsi swing failures and a host of others have failed for years now to provide meaningful information about market direction. It is quite amusing how analysts keep citing them in a futile attempt to tell us what the market is or is not going to do. One would think after so many years of being wrong they would have given it up.

We are seeing unprecedented central bank intervention in markets and whether we admit it or not, it has been a game changer. We all know how it I going to end, but we need to stop pretending that we know when…

I am not sure why this happens, but very often just before volatility explodes, it takes what appears to be a completely irrational spike down. This makes sense as you expect a climax of optimism prior to the tuto. It is possible,as Peter points out that we have one more wave up. It is also possible that we are seeing a second wave spike in optimism, very typical at the onset of a new downward trend.

Are you still thinking that it seems to be too many people looking for that 4th wave down followed by a 5th wave to final high? I wish Peter could come up with an alternate count that would allow for that!

Yes. Many people looking for a wave 4 down a wave 5 final high.

This does make an interesting read.

http://www.safehaven.com/article/43836/important-stock-market-top

As I have been opining for several years: based upon Chinese Zodiac (Rooster, Dog, Pig next three years), new tech renaissance (M.E.R.I.T.-Materials, Energy, Robotics, I/T, and Transportation; MERIT is acronym for this renaissance, and the lack of a economic expansion cycle for several decades, and the dynamic duo of Tax Reform and Regulation Reform; I believe we see upward bias in equities for next decade.

You will certainly not be unique in your conviction that perpetual bull markets are now possible, whatever your reasons…. 🙂

Verne,

Are you still thinking that it seems to be many people looking for a 4th wave then a final 5th wave to finish this move off? I am because the best EW guy that I ever have known always said “that if everyone has the same count…it is wrong!”

Unfortunately he is no longer with us for me to ask his thoughts.

Verne,

Should have said in previous post…”I am cautious of that EW count because…”

I have seen a few more counts lately that are showing a completed impulse up as an alternate to another fourth down before a final fifth up. This would mean we are now in a second wave ahead of a steep decline commencing on Monday. We will know if that is incorrect by Sunday evening I expect. I am now mostly looking at movement inside the parabolic curve to gauge what is likely to happen and I think there is room for a move a little higher. The line in the sand for me though is Tuesday’s open gap. This remains a feral and dangerous market as we have seen numerous bearish signs reversed by bankster brute force, not to long ago a clear island reversal. It is possible that we could see that gap from Tuesday filled and still go on to new highs as the bansksters continue to go “all in”. In a strange kind of way, their continued interference would almost be a welcome scenario as it would mean that once the market does start its decline, it would be prima facie evidence that they are out of bullets, all the nonsensical talk about a never-ending bull market notwithstanding. 🙂

That is what I tried to convey last week stating…..” if this is the great crash we’re looking at, would it not be conceivable that they fooled EVERYONE thinking we have more time ? ”

I believe fooling most of the people for most of the money is what the bankers are all about. They are the one’s manipulating for their gain. They will profit from this crash and destroy what’s left of the middle class.

Someone who has profitable trades on all but 3 days in four years will know when “time is up”. That is really what we’re looking for. Not a number or level but WHEN.

Yeah, I have noticed that most commentaters are bullish for next few years. Even though I long to be contrarian, I can’t short this market until every computer, portable electronic device, and household has graphene enhanced functionality; robots are completely running fast food restaurants; and all new cars are running on hydrogen or something like it. These are the memes/themes that have multiyear bull market written all over them.

Those things are no match for the bond market, which dwarfs the equities markets. I have always contended that the thing that will end the euphoria is rising interest rates. You can lie about corporate earnings in the fact of rising global bond defaults for only so long. Rising interest rates is a noose from which the banksters cannot escape…I am not even going to mention derivatives…!

SPX v VIX

https://twitter.com/bamabroker/status/838141291523371008

https://twitter.com/bamabroker/status/838141718558048257

https://twitter.com/bamabroker/status/838141890776219649

https://twitter.com/bamabroker/status/838142132519063552

Verne, Eric and Valley…Thanks for your comments and views! Very thought provoking!!

About the tides.

This week all tides give a high. The low tides give Monday/Tuesday and the high tides Wednesday and Friday. This says Monday is the strongest day and the trend grows weaker as of Tuesday. The sunspot indicator is up into 3/11.

This all indicates next week is very important. As longterm cycles are down the upside this week is limited. The 1440 cycle gives a high Wednesday and seems to sense what the tides are doing.

In short, after next weekend everything is down. This week will give the high with increasing pressure down in the second half. Wednesday is a strong day and will be down. Friday will be tested but will likely bring a lower high.

Venus turns retro for 6 weeks.

McHugh says the stock market is vulnerable and could be about to roll over. I tend to agree 😉

The historical DJ table gives with the nodal moon 3/2 as strongest day and with shadow dates 3/5. Master timing gives 3/6, This confirms something is brewing.

As I think 2/1 was the real high, the downtrend will persist once this thing turns, If my 2/1 is confirmed this same tool gives a low august 2022.

This all is based on the 1942 low that I consider to be the most significant. The 1929-1942 time-price-vector gives 3/29 and 4/25, These will be major dates.

In 1942 Mars changed sign 3/8 and mercury elongation was max 3/8.

This confirms the 1440 timing and the tides. Garret vibrations on the 5/20/15 high give 3/8.

The sqrrt on price technique on 1942 says 3/7 is 45 degrees. One cycle back was 5/19/15. We all know what happened then.

1987 is 30 years ago. When we adjust for the hebrew calendar, 1987 gives a high 8, a low 14, a high 22 and a low 28. In 1929 3/8 was a high.

I think 2/1 was the high. Let’s assume this fits with the 1929 high. This is an adjustment of 214 days. Now we see a high 3/10 and a low 3/29,

So 8 and 10 a high and 28/29 a low.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.