A Challenging Market Overall

The wait continues while the bankers play.

Central banks were hard at work this week — the Federal Reserve with its ongoing monetizing of debt and on Thursday, the European Central Bank injecting another lump in QE into the system.

It will all prove to be too little, too late.

And then there was the labor report. Well, we’ll see longer term if that piece of work holds up (I see a big adjustment coming up at some point).

My work this weekend tells me we’re not done with this top. I’d been hoping the Moon and eclipse, along with the labor report might help us achieve a turn. I haven’t given up on that scenario; however, with a Federal Reserve announcement due this coming Wednesday afternoon, and the state of the sub-waves, my bias is that we’re going to stay elevated for a few more days.

In the meantime, of course, I get the usual emails that tell me I’m wrong and the market is going to new highs. By “the market,” most of these emails tell me it consists of the SP500 only. Most people don’t look at anything else, which, in the current scenario, is a blueprint for failure.

So, I put together another “big picture” video (it’s short) just below to give you the scenario between the NDX and SP500 that is causing this extreme rally. Whenever we get these extraordinary events, it typically sends me back to do my homework to make sure I haven’t forgotten where we are. It may keep the emails at bay for another 24 hours …

The other thing I should point out is that people are talking about a V shaped recovery (no such thing, in my experience), the pundits are talking in the news about this market continuing up, and Donald Trump is touting the unbelievable numbers as gospel. Right … there were 345 new businesses created during the lockdown!

And what would “reality” be without Peter Schiff telling up gold is going into the stratosphere sometime soon. Keep your eye on the ball, and lock out all the crap — that’s my mantra at the present time.

All good contrarian signs that a top is near.

_______________________________

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

US Indices Big Picture Review

US Indices Update June 2020 |

_______________________________

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now very close to a turn in the US indices, currency pairs, and oil. Gold looks like it’s still on hold a little longer. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top within days.

Know the Past. See the Future

_________________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

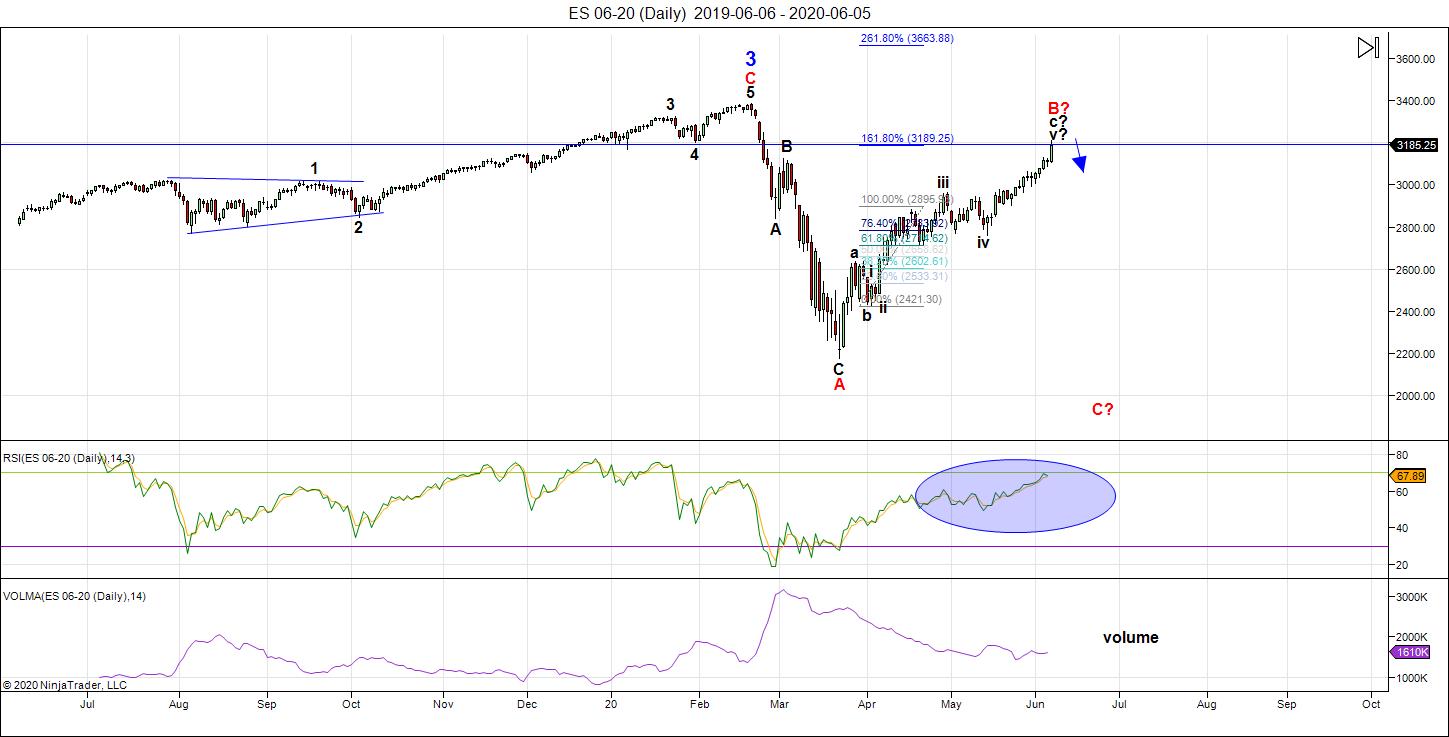

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last week, we were in what I referred to as "the last leg" of this rally, a fifth wave. That wave, because the market is fractal, has five subwaves. The final fifth wave ended up being somewhat of a "blow-off wave," rallying 100 points. It was unexpected, as I was seeing signs of weakness across several asset classes.

The bulk of that rise was due to the US labor report on Friday morning, a report that, based on recent circumstances, made no sense at all. 345 new businesses created during the lockdown? C'mon.

While the US futures and cash indices rallied, other asset classes were much quieter.

On Thursday, the ECB injected another round of QE into the system and EURUSD shot up (which US futures moved to the downside). On Friday, the opposite occurred — weakness in currencies, while we had a rally in futures. It's a dangerous topping process, this one.

The good news it that now ES is up against a measured fibonacci level, which (finally), gives a more reliable indicator that a turn is near. The C wave up of the correction in ES is 1.618 X the length of the A wave, a typical length for a C wave on the verge of turning.

The SP500 also now sports a fibonacci relattionship, but it's a bit more complex, and not nearly as obvious.

On top of that, the count of the final fifth wave in ES is full. Now, it's a case of waiting for confirmation of a turn, and that will be across multiple asset classes and international exchanges.

There's a Federal Reserve meeting announcement out Wednesday and that could keep the market elevated into the middle of the week.

As I stated last week: There's a lot of manipulation going on (the Federal Reserve is doing whatever it can to prop up the market with more debt — a very stupid idea, and you and I will pay for it in the end. Inflation through the extraordinary "printing" of debt has had its affect on the market overall. However, the problem is simply too humongous (the dollar is worldwide) and the Fed will fail. We're getting close to seeing the result, which will be spiralling deflation.

___________________________

Summary: We appear to be in a "combination" fourth wave down from the 3400 area. After the first set of zigzags down, we've retraced well over 62% of the distance from the top. We've been sitting in this corrective ABC retrace for two and a half months. However, we're sitting at a potential topping level.

Once we top, another set of zigzags down seems to be the most probable outcome for the journey to a new low, but it's early to be sure of the pattern.

Look for a new low below 2100: There are several possible measured objectives below that point. The timeframe has moved to July timeframe (speculative), perhaps, for a final fourth wave low.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

_________________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil) right down to hourly charts (and even 5 minutes, when required).

______________________________________