SCOTUS On Deck

For the next couple of weeks, it’s more or less the SCOTUS show, with at least five election fraud lawsuit confirmed on the docket.

I’m expecting weakness in the market as the process unfolds, whatever the outcome of the trials.

Sydney Powell (on Friday, Feb. 19: “For all interested in the status of cases set for conference today at SCOTUS, today [Friday, Feb 19] was just a meeting for the Justices to discuss issues and cases. We expect any orders to come out Monday [Feb. 22] and any opinions that might be ready to be announced on Thursday [Feb 25]. Thank you for watching these issues. And regardless of what the Court decides on cases pending now or next week from the pre-January 6 cases we filed, we are NOT DONE.”

Three states are up for review starting February 19, with a further two states up for review beginning February 26 (this coming Friday). There are no other potential market-moving events that I’m aware of during the coming week.

It’s not a coincidence I don’t think that these two “sessions” end on Thursday, March 3rd. The next day, March 4, promises a major event on the grounds of the White House, along with some major announcements. March 4 is the day when, historically, before 1871 (when the United States was a true republic) the first eighteen presidents were inaugurated. Let’s see what happens on the fourth!

Other than that, the information on the current cyber war has been untrustworthy, as both sides (white and black hats) continue to weave their propaganda-based narratives. It’s for the corrupt to continue to pretend that all is well, while it’s advantageous for the “good guys” (the US army) to pretend to be weak in order to “draw out” the corruption amongst the political class and elites in the business world.

It’s happening! Take, for example, the recent speech by the Senate Minority Leader Mitch McConnell, seemingly out-of-the-blue, after the Trump win in the impeachment trial. He voted to acquit the President and then turned around and made scathing comments about Trump’s character, and more.

He is now being asked to step down by his republican colleagues; his political career is probably over. But then, his path forward in life also appears clouded, as he’s complicit in treasonable acts, which will soon all come out into the public arena.

We’re seeing cracks in the political black hat narrative, as Governor Andrew Cuomo is now under federal investigation for the COVID-19 debacle involving nursing home deaths. The latest is that his brother, Chris Cuomo, is no longer allowed to interview his governor brother on his prime time CNN show.

Last weekend, I showed the video that revealed what was really going on during the Capitol incursion on January 6th. In my write-up, I suggested that Ashli Babbitt was probably not dead, even though in the video you can see her (with a suggested neck bullet injury) being carried head first down the stairs. Never mind that you never move a body from a crime scene until it has been fully vetted by the police!

Here’s a brief story following up in that issue.

Also note that the New York Times this week put out a very quite update of a previous article that had declared that an officer on scene during the “riot” had died from being hit by a fire extinguisher. The latest article has now told us that there was no fire extinguisher and that the office had not died.

If you had any thoughts that there was truth in reporting by main stream media, this event, on its own, should clear up that misconception!

The ongoing saga continues. As I’ve said before, nothing these days is what it seems. The “fog of war” is very much alive and well, and so are a few other folks!

Another Bill Gates Documentary (as if you needed one more)

If you value your health, make sure you watch it!

Future Prospects

One thousand year cycle tops project dramatic change, change that affect entire civilizations; that’s what history tells us.

“The current convulsion is comparable to the birth of Christianity in the first century and to the birth of the modern nation as a feudal principality in the ninth and tenth centuries. All of these reorganizations of society were marked by spurts bin the evolution of democratic institutions.” — Dr. Raymond H. Wheeler, Ph.D

Approximately 400 years ago, the Rothschild family was behind the formulation of our current system based on debt, with the founding of the Bank of England in 1694. It’s led to a world owned and regulated by central bankers, centred at the Bank of International Settlements. We are working on breaking free from that system.

We currently have the largest stock market inflationary (debt) bubble in history; we’re at the top of a 500 year market cycle. In Elliott Wave terms, we’re beyond the final fifth wave, in a “rogue” B wave that has been fuelled by the injection of extreme levels of debt by corrupt central bankers. Bubbles always burst — this one is getting very close to doing so.

Something obviously has to “give,” and there’s a collective interest in changing the system before the system completely collapses. However, the history of the stock market, along with current market structure, dictates that man is unlikely to avoid the ravages of Mother Nature, who takes down the stock market at regular intervals (as the history of cycles has proven over and over again).

The new world we’re moving into will see a major shift in the world power structure over the next several hundred years (from the West to the East); however, the goal now is to rid the world of the satanists, pedophiles, and social predators (the Illuminati and their minions) that have a financial chain around all our necks (debt slavery).

The transition is one that will at times be shocking, difficult financially, and fraught with uncertainty. However, the end result will be much much better life for all, one that will be fairer and make life much more joyful. A tall order, I know, but that’s the goal. Hopefully, it will be a bloodless transition (like the Glorious Revolution), but no guarantees in that department.

NOTE: I can’t vouch for the validity of what follows under the title of NESARA GESARA because the underlying documents have been under seal for decades. However, this information is flowing out from a multitude of source, so I believe the information is at least directionally correct.

Here’s a list of what is percolating behind the scenes in the development of a system that isn’t yet implemented, but should be over the next few years, probably in stages.

- New Financial System (NESARA is the proposed system. You can read more about it here.

- New Legal System. Our current legal system is corrupt and governments have become involved in the court system. It requires a complete overhaul or root out the political and financial influencers.

- New Health System (Medbeds, etc.) Med Beds are apparently real, but as I haven’t seen one in operation, I can’t vouch for the techology. However, it’s the end of the corrupt pharmaceutical industry we’re now imprisoned by.

- New Energy System (Nikolai Tesla). Tesla’s ground-breaking work on energy was suppressed (and stolen from him), but it’s about to come out into the open again, promising much lower cost, more efficient energy for all.

- UFOs are apparently real, now admitted by the US Military, which obviously has implications for life on Earth over the longer term

- Religion — ridding the Earth of Satanists and pedophilia is a major thrust right now and I can say with certainty that many have been arrested. With the US Military in control in the US and leading the battle through Special Operations forces, tribunals are a certainty and over the next few months, we’re expecting to see more information out on this aspect of the ending of the “Deep State” that so many leaders have warned about.

- Social — as the cold-dry cycle takes hold, democracy and freedom rise. This has been true since the beginning of human history

- Political — the Deep State/Illuminati/Cabal has been “running” the world for centuries. Illuminati control has now been damaged and the current cyber war is destined to end if altogether. View the Fall of the Cabal.

- TODAY we’re in the middle of a cyber war — the Battle for Your Mind. Propaganda is everywhere, as it always has been at the tops of these cycles. Even Rome at its height experienced extreme levels of propaganda.

The thing I do know is that historically governments have been dismal failures in trying to implement any type of financial strategy on a grand scale. Mother Nature is the influencer of the stock market; it’s fool’s quest to think you’re going to outsmart her. Economists never consider the human psyche in their predictions (or the influence of the Universe) and are therefore almost always wrong.

It’s the same in almost any field of endeavour. An example is climate. it runs in cycles and is caused by the interaction of the Sun and our solar system. To think you can change the climate or even influence it to any great degree is delusional (knowing what I know from my knowledge of natural cycles throughout history).

_______________________________

AAPL

Above is two hour chart of AAPL as at the end of the day on Friday. The short-term direction is down.

Above is two hour chart of AAPL as at the end of the day on Friday. The short-term direction is down.

This weekend, we’ve reached my target on the downside, even though we appear to have a wave down still to materialize in the US indices. I expect the next major move up to begin, but it’s always the best idea to wait for a first wave up in five waves and then a second wave retrace of at least 62% before considering a bottom is in place.

The current target for the top of the fifth wave measures to about 173.00.

I we get more downside in AAPL, then we’ll have to reconsider the current wave structure. A drop below 125.39 would potentially create an ending diagonal situation, which would change the already stated potential upside target. This is the last AAPL chart I’ll be posting for the foreseeable future.

Know the Past. See the Future

_____________________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

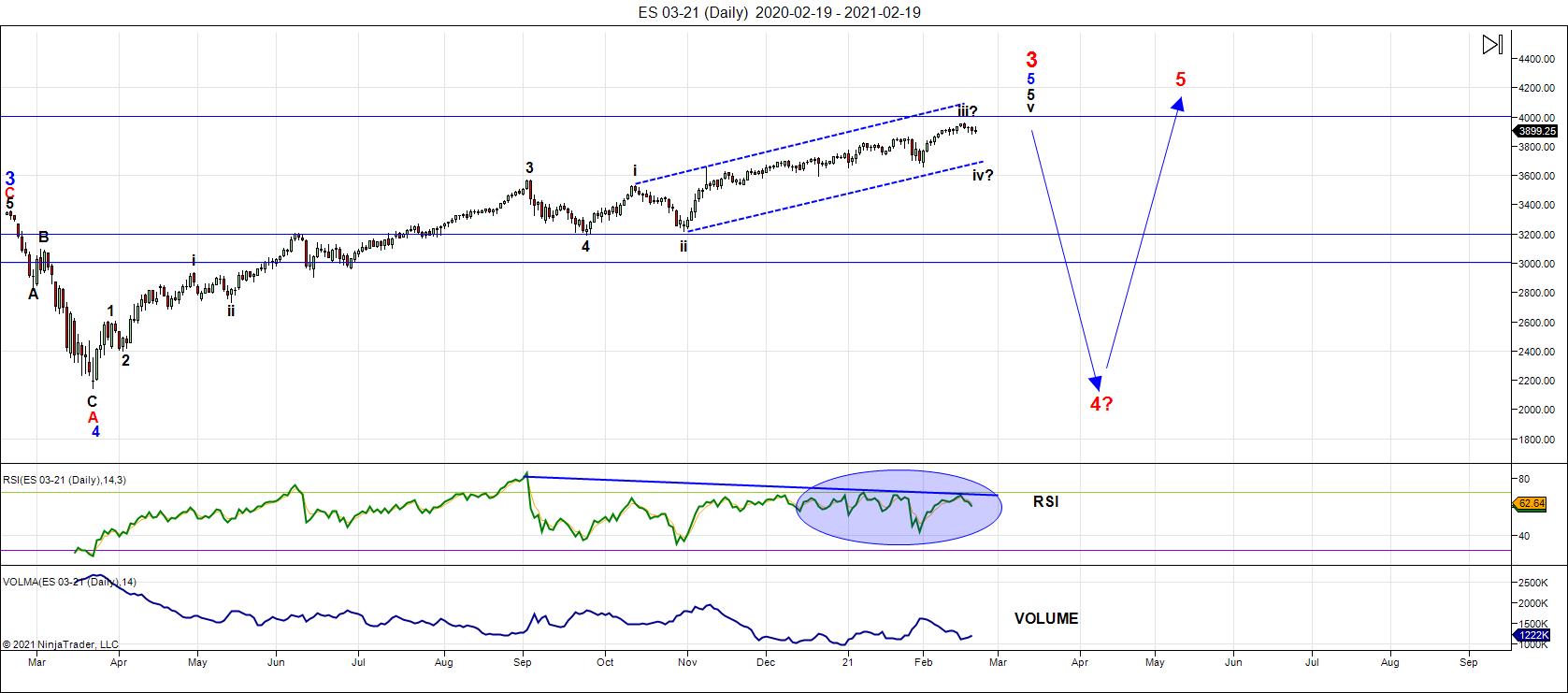

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

I've cleaned up the chart above to show the structure as a typical five waves up, although it's not. It's a corrective wave that looks like it's a series of zigzags. In any event, it's an odd substructure and measures as corrective.

There is no change to the prognosis.

I do not think we're in a diagonal. NDX has a similar pattern (everything is moving in tandem and has been for the past three years or so) but is motive and measures as motive. It's been a very difficult market on the NYSE side and for the last couple of months, has been more or less sideways.

We're still in a situation where I'm expecting a wave down (call it a 4th wave, or B wave) and one more wave up to a new high before a larger correction to the downside.

Friday was the beginning of the Supreme Court (of the United States) deliberation of the election fraud lawsuits from the five swing states. They're all on the docket and I expect some indication on Monday and further communication from Supr

There are multiple possible targets on the downside for the weakness over perhaps the next couple of weeks, but not to a new low below the lower trendline. The trendlines do not denote a pattern; they're there to identify the channel.

___________________________

Summary: We're getting close to a final high from this rally from March, 2020. The wave structure appears to be a corrective pattern in five waves.

Most other US market indices have similar patterns. This puts us in the final stages of this rally up from March of last year.

The resulting trend change will target an area under 2100 in SPX, and will likely be a combination pattern and, as such, may contain zigzags, flats, and possibly a triangle or ending diagonal at the bottom. However, I'm leaning towards a series of zigzags, which are corrective waves, and will likely come down fast.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.