We’re headed for a long period of spiralling delation …

Inflation, according to Ludwig von Mises, is an increase in the money supply that is not offset by an increase in the need for money. It causes the value of money to decrease, which causes price increases for goods and services.

A good example of this is the current housing bubble in Canada created by next to free credit. Mortgage interest rates have never been lower and the prices of houses have never been higher.

Lets look at how we cause inflation.

Banks create money out of thin air. In actual fact, they create debt. They do this through loans. In other words, money comes into the system when banks create a loan. They simply enter the loan amount as debt in their books and you, the customer get borrowed money on the other side of the ledger. A digital entry appears in your bank account.

You pay interest on that money and both interest and the debt, when paid, go back to the bank. In any event, it’s newly “minted” (today, it’s mostly digital) money that the banks create out of thin air and then charge you for its use.

When interest rates are really low, people borrow more and bid up the price of homes. People see it as an inexpensive way to buy the home of their dreams.

Lets look “under the hood.” This increase in money in the market causes the value of money to decrease. We realize that lower value through higher prices for assets. The good thing is that as long as the inflation keeps up, you’re paying back that loan in future money, which is gradually decreasing in value. Inflation makes is easier to pay back debt (and that’s why governments like to inflate and amass large amounts of debt).

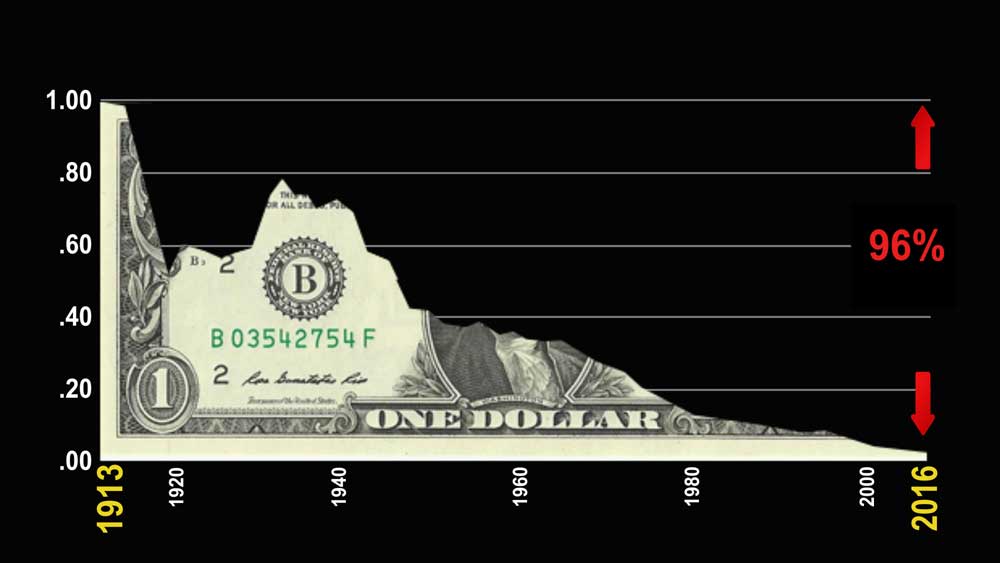

Below is a chart of the American dollar and how inflation has reduced its value by 96% over the past century.

In the chart above, you can see how inflation can been fairly consistent except for the period from about 1920 to 1936 and again around 1940.

Deflation is the opposite of inflation. In deflation, particularly in credit-based economy, which is what we have, there’s a loss of confidence in the bubble that’s been created, and a slowdown in lending (which has been an ongoing problem since 2007). This leads to less money in circulation and people start spending less and hoarding money (Europeans are somewhat ahead of the North American continent right now in this regard). The reduction in consumer spending leads to job losses, eventually company failures, even lower prices, and we end up in a deflationary spiral.

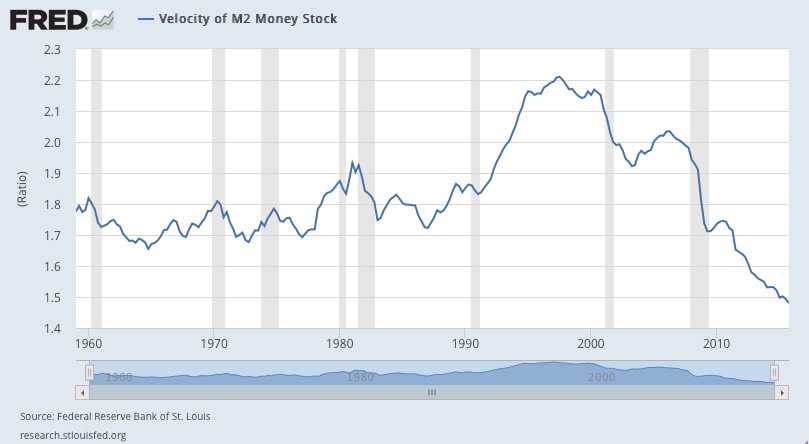

Above is a chart of the velocity of money. It comes from the Federal Reserve. This is a measure of the levels of currency available in society at a given time. You can see how the velocity of money has declined since about 1998. Incidentally, that was the warmest year on record, which I explain in by post: “Don’t Like the Climate? Wait a Cycle.” A reduction in the velocity of money marks the onset of deflation.

Lower prices for goods and services is great for consumers who have cash. But if you have lots of debt, that’s a problem. Because the real value of debt increases—less money in the system increases the value of money. So, you’re paying back those loans with money that is more costly to obtain (and is actually worth more) than when you took out the loan.

Assets like houses and cars reduce in value. The deflationary cycle in a depression picks up steam until we have a deflationary spiral that historically has reduced prices by up to 80%.

Almost all recessions and depressions in the US throughout history have been accompanied by various levels of deflation. Here are some key examples:

United States Examples of Depressions Fueled by Inflation (Ending in Deflation)

Downturn of 1819

- Inflation caused gold and silver to rise in value and along with that was an overall lack of confidence in the economy

- The price of cotton halved (the economic driver in those days) – example of deflation of an asset

- Rapidly growing credit eventually led to banks collapsing due to an overload of debt and a general economic collapse

Panic of 1837 (began in 1835)

- This was the era of substantial frontier land speculation due to easy credit

- Andrew Jackson suddenly tied bank notes to gold and silver (deflationary)

- The resulting run of bank gold and silver created a credit contraction

Downturn of 1857

- We didn’t learn the lesson in 1837—massive land speculation after 1852 reared its ugly head again

- This fueled rapid growth and speculation in railroads (easy credit)

- It resulted in major bank failures and credit contraction (deflation)

Downturn of 1873

- Chicago land values increased 500% from 1862

- Railroad expansion across the West created heavy levels of debt

- Led to a sudden stock market collapse and credit freeze, failed banks (deflation)

Downturn of 1893

- Again, substantial land speculation from an ongoing westward land boom

- It ended in a run on banks due to a sudden contraction in credit (deflation)

Great Depression of 1933

- The stock market crash began in 1929

- The depression really began with the collapse of real estate prices (1930)

- There had been wild real estate speculation during the 1920s (similar to today)

- In the 1920s, income of the wealthiest rose 75%, while the rest rose only 9%

- Deflation ran rampant from 1920 – 1936 dropping prices of real estate and the stock market by more than 85%

Recession of 1974

- The highlight of this contraction was the collapse of the US National Bank of San Diego

- Land speculation again had been the norm during the early 70s and this led to extreme levels of debt

- We experience mild deflation before Nixon unpegged the US dollar from gold (fiat money), which led to an enhanced level of inflation

Great Recession of 2007

- Sub-prime mortgages, derivatives, and banking failures.

- Extreme real estate speculation in the US. This led to even more extreme levels of debt. Between then and now, not much has changed. Our level of debt has increased, the gap between poor and wealthy is even greater, and the interest rates are so low that money is almost free, which has led to a real estate and stock market bubble.

- Since then, central banks have attempted to inflate the economy but have been unsuccessful

History tells us the road is fairly clear regarding the immediate future: Free money leads to a bubble, which leads to deflation and a depression. When a deflationary environment takes hold, gold is reduced in value. Gold will regain its value and start to increase when we return to an inflationary environment sometime down the road.

In the meantime:

Cash is king. Currency goes up in value, while prices for just about everything that’s not a necessity, go down in value. Food is a notable exception. At the same time we have a major economic collapse, we also have a major worldwide drought. This raises the scarcity of food. Expect banks to stop lending and for the current credit card scheme to end. It’s a good idea to have cash on hand in a safe place just in case banks start to fail, as they have so often in the past.

Get out of debt, because interest rates are going up. They may not go up immediately, but governments are in debt. The only way they have of solving that problem is to tax the population. Banks, if they run into problems, will raise interest rates. They’ll also start to limit credit and call in loans.

If it makes sense, sell your home and buy it back in a few years at a fraction of the current selling price. In the 1930s, homes devalued by over 80% very quickly. Many homes previously owned by the fabulously wealthy or well-to-do (who has lost everything is the stock market crash) were on the market for fire sale prices. We expect to see this scenario once again. During deflation, all assets drop dramatically in price. You can already see this in the price of oil.

Hold off on major purchases … because things are going to get a lot cheaper. As people stop buying, products go down in value. Double this with the fact that currency is going up in value and you have lower priced services and products.

Traditional investment is dead. Markets have already topped. Lower demand right across the board will lower the price of most products and services. As a result, more and more companies will land on hard times. Most bonds are also vulnerable. We’ve already heard of major cities going bankrupt. If you read your history, you’ll know that no investment is safe during a major collapse. That’s why cash is king.

Community is exceptionally important. Mend any broken relationships with family and friends. You’re going to need them. Have services that you can offer to others, to make yourself a more valuable commodity.

In reality, deflation is cathartic, and a necessary condition to heal the economy.

These are only some of the strategies you can use to defend your wealth and sure your viability during an major downturn. I hope it provides a sense of what’s to come.

So don’t get fooled by the idea that inflation is a good thing. It’s ruined the world economy. We’re awash in debt. Thank you politicians and bankers!

Deflation is good .. if you’re prepared. The train is just leaving the station …. It’s time to do some research and get ready to buck the trend.

Governments, Debt, and Banksters

The current situation with our economy is not unlike many of the previous collapses in history. But what makes this particularly scary is that we’ve created a debt bubble larger than any in history. See the recent article on Zerohedge entitled ” … Global Debt Hits a Record $152 Trillion …”

What exacerbates the problem is that sovereign debt, by and large, is owed to private banksters in Europe (or in the case of the US, to twelve private banks in the US packaged into something inappropriately named “The Federal Reserve.” It’s not federal (it’s privately owned) and it keeps no money in reserve).

These central banks create money out of thin air and then charge governments for its use. Creating money is something the government could do on its own and there would be no interest, and of course, no debt. This is something I explained in my post last week: The Wonderful Wizard of Oz.

The Market this Weekend

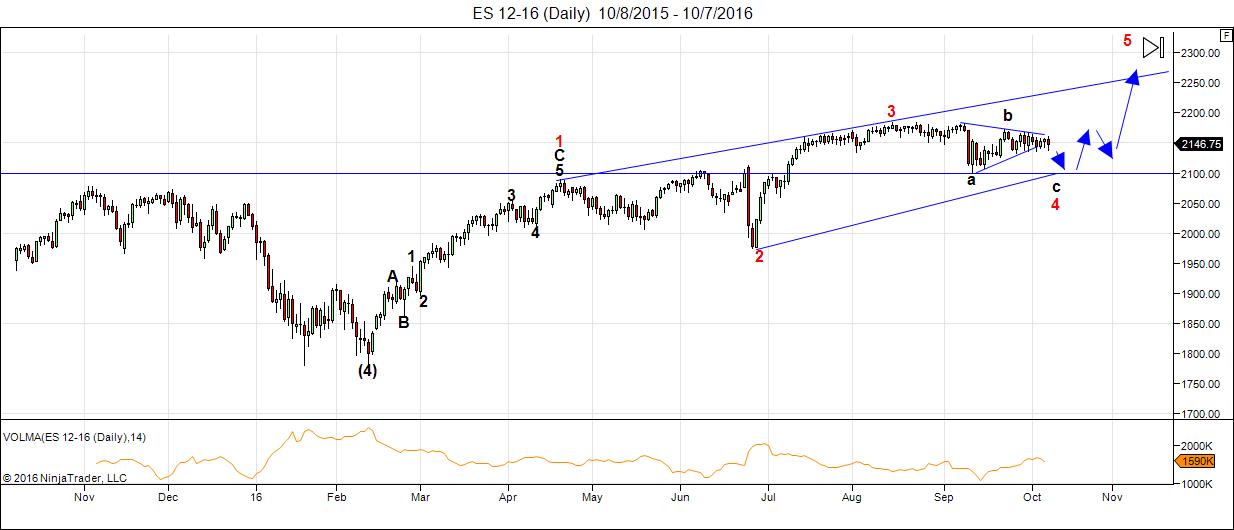

Again this week there isn’t all that much new in the markets. I’ve been predicting the continuation of the fourth wave of the ending diagonal for several weeks now. I’m still looking for a new low.

Above is the daily chart of ES (emini SPX futures). We’ve been in this fourth wave of the ending diagonal for 8 weeks. The second wave took 2 months plus a week, so the fourth wave should be nearing an end.

Usually the second and fourth waves in motive waves will be of similar magnitude (the fourth wave a bit longer) but in an ending diagonal, the waves get smaller as they move towards the termination, which is a fifth wave up to a new high, with a “throw-over” above the upper trendline. Expect the fourth wave to be slightly shorter in time.

Ending diagonals are triangles but they’re also part of motive waves. In fact, they’re the only triangle fitting under the banner of motive waves (as opposed to corrective waves). Ending diagonals are always the ending wave of the pattern.

I expect a gradual drop to about the 2100 area before a turn up in the final wave of the pattern.

Summary: This is the final fourth wave dip before the final fifth wave and the top of the largest bubble in history. I expect a little more downside before we turn up again to head for a new all time high.

___________________________

FREE This Week!: The Chart Show

Thursday, October 13.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis for the US market, gold, silver, oil, and major USD currency pairs.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

excellent post and a free webinar on Thursday, October 13…what a guy…Happy Thanksgiving! ?

Nice of you to remember the little Canadians … 🙂

Thanks, Peter Temple. Excellent explication of deflation through the decades.

It may seem like I enjoy to disagree or -worse – to think I am smarter than all of you. That is not how it is. I do have some proprietary tools that feed my expectations. The only reason I post them is so that you can see what I see. And who knows; maybe we can learn from each other.

My cycle structure is based on 2 theories.

1) Garrets 17 year musical cycle (Garret is my hero)

2) The mathematical principle that 1 (one) is the buidling block of every natural number and fundamental to ancient geometry. And as 0 (zero) is nothing, 10 and 100 are as vibratory as 1.

So I think we have a 100 year cycle. And half of it is 50 (remember music; half the string is new octave).

As it happens 3 times 17 is 50/51. So 2 theories align. I don’t think this is a coincidence. What does this tell me?

A price-time anlaysis reveals that the 1932 low was very fundamental (and connected with the 1906 high; not 1929).

From the 1932 low we count 50 years into the 1982 low (almost to the month!). Within the 50 year we see 2 divisions : 25/25 and 34/16.

So 25 year up from 1982 is 2007. And 34 years up from 1982 is 2016. Both highs simply explained from the 50 year cycle. But it leaves me with one devastating conclusion : all that is left is a 2032 low.

Armstrong gives the peak in real estate in 2007 and sees a low in 2032. And I doubt he uses the same cycles I do.

One challenge with the cycle structure is that we have several series of cycles running all at the same time. 1929 was 50 years after the 1879 bearmarket low and thus came from a different serie than 1932. The 1932 low came 25 year after the major 1906 high. From a 103 high we declined 61,8 dollars into the 1932 low. The 1929 high was in between and distorts this picture, but it was a different cycle.

Two times 34 from 1906 gave the 1974 low. And another 34 years gave a 2008 low.

At least now you can see why I am so bearish. Whether I am right or wrong 😉

Will share some more this weekend.

Cheers.

Hi Andre,

I have connected all of the tops, panics, corrections in one cycle series for the DJIA. This twitter link shows the full 17.6 year stock market cycle diagram from my book “The 17.6 Year Stock Market Cycle, Connecting the Panics from 1929, 1987, 2000 and 2007”:

https://mobile.twitter.com/17_6YrStockCyc/status/565982465479942145

Of course the Balenthiran Cycle is actually 35.2 years in length (bull and bear). Between 1906 and 1974 there were massive bull markets peaking in 1929 and 1966. 2009 + 35.2 = 2044 which would be a low. I predict the Dow will reach 100,000 by 2035 before that crash.

Fred Harrison has written an excellent book on property cycles (Boom, Bust,…) where he nailed the top on 2007 and the bottom in 2011 (UK market).

Have a good weekend,

Kerry

p.s.

One conclusion I draw from the above is that central bankers don’t control the market. The vibrations created the need for some additional juice to push this thing into 2016. And the banks delivered and they called it quantative easing. But they are slaves to the rithm. Once the cycles turn down there is no QE 5,6,7 or 8 that can stop this.

Hi Peter/Andre/All,

I have read all of Deweys cycle books and many other cycles book but have never come across William Garrett, so thanks for that. I have found his Pdf book which subdivides his cycles much as I have done. He has a 17 month cycle which I will research and I have a 17.6 weeks cycle which has been very effective.

Garrett book is here, I haven’t read it yet as I just found it.

http://www.forexfactory.com/attachment.php?attachmentid=1262333&d=1377638791

Regards,

Kerry

As 5 is a vibrational number 5 times 17 (85) is aswell.

85 years from the 1929 high gives 9/3/2014. 34 years from the 1982 low gives 8/12/16. This midpoint between those two dates is 8/23/15,

So the august 2015 low was simply the market recognizing these cycles and testing the midpoint. The 2014 was 7 years from 2007 is nice.

Between 2014 and 2016 the market is stuck between 2 very significant dates. But it couldn’t go down before aug 2016.

So, if 2016 why now? The moon and Saturn are connected as they share the same vibration. The moon does 29,5 days and Saturn 29,5 years; the same vibration.

When the sun squares the nodes we get moon wobbles. When Satrun squares the nodes we get? Happens every 7.5-ish years. Will happen this weekend. And 144 days from the major 5/19 low is 10/10/16.

Kerry; I don’t claim I’m right and I don’t say you’re wrong. I enjoy this discussion with you and hope some day we will be able to fuse all ideas into one.

André,

Can we expect some real downside action this week?

Untill now the plunge protection team is still succeeding to hold the line.

Thanks..

John,

I really think so. Something heavy is turning this weekend. There is a reason the market didn’t tank and it is not the PPT. These same reasons argue the turn is upon us Monday/Tuesday by the latest, And then down into a December low.

I realize this is different from what Peter said. This has nothing to do with disrespect; it is just what my own indicators are telling me.

Hahaha! I love this ‘plunge protection team’ thingy, whahahaha. Nice one John! 🙂 If I didn’t know better, I would say, ‘yeah, it is the PPT AGAIN!!!’. 😉

Cheers,

W

A cycle presented by Peter Eliades of 33 years is interesting. It predicted a high for Aug 2015 which still has some validity – NYA and Trannies. That top corresponds with the 1929 and 1965 tops and others that capped the mkt for 15 to 20 years. He traced it all the way back to 1802. The really interesting aspect was from the major lows of 1974 plus 33 = 2007, 1970 + 33 = 2003, and 1982 + 33 = 2015. I love cycles but always remember what Richard Russell said about them, where do they go when you put money on them?

One other book I read this week is “Geometry of Markets’ by Bryce T. Gilmore. I loved it. Read this quote:

“In nature, especially music, certain vibrations are pleasing to the ear. These vibrations when explained using mathematical terms relate directly to ancient geometry. The square roots of 1,2 and 5 can be found in all things. My research work using these same ratios in markets has enlightened me to an approach of analysis that has such accurate predictive qualities, it is second to none”.

I will have more on Gilmore this weekend.

Stan Harley who writes a cycles newsletter, puts great importance on the square root of 5. Dividing Fib numbers by the sq root of 5 gives major octaves like 89/sqr5 =39.8 and 377/sqr5 = 84.3 etc.

30000 times E (Eulers constant) – or 30 degrees – from the NYSE birthdate gave 8/25/15, just 2 days after the vibrational midpoint. One could argue august 2015 shoud have been a high. Maybe that is why we got a tripple top into july 20. And then a swift decline so start a rally again.

Looks like the market inverted for one more push up.

I could add that 14 times 144=……..2016! This makes 2016 one of the most vibrational years in our lifetime. That 14 adds up to 5 makes it all extra special.

10/15 is 288 days (twice144) from jan 1st. If this is not a magnet I go crazy.

http://www.zerohedge.com/news/2016-10-04/warning-bond-markets-are-signaling-something-massive-coming

http://www.phoenixcapitalmarketing.com/roundtwo.pdf?inf_contact_key=0497b1c83202df2ff3ee6a60cfb2d0ad0f42ede164911fd001eb0e8bdee3345c

“Here’s a looksie at all double inside weeks in the S&P 500 over the past 20 years.”

Sentiment Trader – October 7, 2016

https://twitter.com/sentimentrader/status/784512611853357056

the mcclellan summation for the nyse has just fallen below 500. Normally that is a support area in an uptrend. This breakdown usually leads to a sharp market drop.

The pattern looks a lot like August 2015 if we we see such a drop again?

http://www.marketwatch.com/investing/index/NYA/charts?symb=NYA&countrycode=US&time=9&startdate=1%2F4%2F1999&enddate=10%2F8%2F2016&freq=1&compidx=none&compind=none&comptemptext=Enter+Symbol%28s%29&comp=none&uf=7168&ma=1&maval=50&lf=1&lf2=4&lf3=0&type=2&size=2&style=1013

https://worldcyclesinstitute.com/the-wonderful-wizard-of-oz/#comment-12081

Goethe said : ‘Geometry is frozen music’. Once you understand geometry and music are really the same, you start to see the real vibrations.

Looking into geometry you soon realize there is more than fibo ratio’s. I found another ratio that – when used with square of nine – is mind boggling.

Suddenly I can see why 10/11 is such a major date. And not just because it is 9 years after 10/11/2007.

In this square of nine 10/11 will be 3 revs from 1/19/16. This was a major low. And 1/19 was 180 degrees from 8/24/15.

6 revs from 8/24/15 brings 12/3/16. This will be a low.

From 10/11 into 12/3 is 180 degrees.

10/28-29 is a very significant date and possibly the high Peter expects. Will it be an ATH? It is Sunday; I don’t want to argue. But after the end of this month it will be down seriously. I hope we can agree on that.

Cheers,

André

Quote : The content of our experience results from an immaterial, abstract, geometric architecture which is composed of harmonic waves of energy, nodes of relationality, melodic forms springing forth from the eternal realm of geometric proportion.

Combining Carolan and Gilmore we created a new spiral calendar that I will call the Gilmore spiral.

This GS gives 10/9 on the may 15 high and 10/11 on the 8/15 high. So this confirms 10/9-11 is a major vibration. 80 years ago Mercury turned direct on 10/10.

10/10 will be 64 weeks from 20/7/15

10/10 will be 36 weeks from 2/1/16

10/11 will be 49 weeks from 11/3/15

All were highs. Gann said squared numbers are the cause of turns in the market. 10/10 will be 144 days from the 5/19 low. 12 is the strongest number we have. For this reason Nicolai Tesla published his map of multiplication 12/12/1912. So 144 is the strongest timer we have, both in calendar days as in market days.

And this happens when Saturn squares the nodes and the 27,5 and 29,5 lunar cycles synchronize with square/declination this weekend and full moon at perigee next weekend. This will start a new 103 days cycle, 1/4th of the full moon cycle.

Yes, I think next week will be down. Watch the news.

andre,

are you nervous? i takes big kahuna’s to make predictions based upon a system, but it takes bigger kahuna’s to put it in a public forum for public acknowledgement and scrutiny.

i am cheering from the sidelines for the follow through for a hard downside move. although the fat little white haired lady, [who should invest in a lady’s razor – check that upper lip] named yellin may have another intention. And intention is a vibration too…..

Luri,

Not nervous. Yellen can’t stop this. A turn is long overdue. This builds up tension. And that tension will be released. Everything is drawn to the center of gravity. There is no escaping.

andre,

the money manager – michael pento – agrees with you. he is on the record stating that the “membrane” of the markets have been stretched far beyond its capacity,…… btw, so is chris carolan also paralleling your key dates?

The classic spiral calendar gives 10/7-9-11, so fully consistent with the Gilmore spiral.

André, can’t thank you enough!

P

My pleasure 😉

Can we please bring Tom back to posting his energy charts. Both his monthly and daily charts have been very accurate and extremely helpful! Tom is definitely a very important added value to this exceptional blog. Thank you

I concur; Tom, many people appreciate your contribution. Certainly me!

andre – another point of interest in parallel to your work……

check this out – it is from a jewish scholar …..

” The Yuval (Jubilee) ends on Yom ha Kippur (Day of Atonement), which is on October 11th at sundown, not on October 2nd, which is Rosh Hashanah. The Shemitah always ends on Yom ha Teruah (Day of Trumpets), Yom ha Din (Day of Judgement) and Rosh Hashanah (Head Year), which are all on the same day, but not the Jubilee. It ends ten days later after the ten days of awe.”

Luri,

Thanks. I have 10 and 11 as strong dates. Could be we see a high and low on Monday and the last leg up into Tuesday, 10/11 would be 106 trading days from the 5/10 high. But 10/10 is 180 degrees on 1/20. As 1/20 was a low; 180 degrees should be a high. But again; we could see 2 highs with a low in between.

Thanks for thinking with me 😉

what can i say “A”, i can feel your vibrations!!! :-))

PALS this week:

Rising tides fast and high into Full Moon (very bullish)

Pre Full Moon Friday (very bullish from Tuesday)

Post South Declination (bullish)

Pre Perigee (very bullish)

Seasonals: bearish Monday Tuesday, bullish from there

Planets: Uranus opposition on about the Full Moon could be bearish

Summary: Will trade from short side into Tuesday, and will trade bullish into Friday.

I’m really confused about what they said. Can anyone help me? This week and next week are bullish or bearish?

Hi Jas,

PALS is a fruit salad of different indicators, moon phase, declination, distance, seasonal etc.. Because Mon and Tues are more bearish than rest of week, and I am guessing selling isn’t over, I will be looking to short Mon and Tues. After Tues, market could continue to sell, but because PALS is mostly bullish, I will be in cash or look to go long.

Valley, thank you1

old school trading theories

sell Rosh Hashanah

buy Yom Kippur

Andre I love your passion

I still favor a high Oct 20 th yet my turn date is Oct 24 th

Kerry

simple question , what if the year 2018 is a high and not a low as

your work implies ?

I’m sticking to y work Fridays lows are my line in the sand

if the market proves me wrong so be it .

I’m looking for a surge upwards into Oct 20 th yet I’m not

looking for new highs ,

after Oct 24 th the market should drop

Jan 20 th is where I see the bottom

yet a higher low in March 2017

Oct 2017 into the year 2018 the peak

then the real bear market begins .

the congress and the Senate are next

the up coming election is just the starting point

good luck everyone

Joe

Another old school theory that worked great in the late 60’s to early 80’s was market good for two years into the election, and bad 2 years after the election.

With all the zig zag 3 moves it really looks like a A,B,C,D,E and E has over shot like it does and the turn down should start shortly…. This has been the craziest sideways market I have seen in the 8 years I have been trading.. Wow!

Agree. 🙂

We Normally Wouldn’t Share This Unusual Chart With You – S&P 500 (SPX)

Bottarelli Research, October 10, 2016

http://www.bottarelliresearch.com/charts/2016/10/10/normally-wouldnt-share-unusual-chart

Now, for something completely different. For ESZ6, based on the vibrations of colors, for several weeks we have been having a difficult crashing below color frequency support (minor) at 2141+/-2; and there is resistance 2171+/-2 which the market doesn’t even want to consider at this point; and the recent battle line seems to be at the mid-point of major support/Resistance (2218 & 2094) or 2156+/-2. Levels to watch.

Steve

andre,

fat white potato dumpling with a hairy upper lip [yellin] 1

vibrations 0

it is 10/11 and it looks like prices continue to consolidate rather than reverse.

Just wait and see. It should be a matter of hours now.

Andre’,

Again “thank you” for sharing your insights! To me…When you are calling a change in the market’s direction in time period that spans 100 years…the words “exact and precise” do not enter my mind! Pulling for your analysis! And who is keeping score?

Looking forward to your next post!!

oh ma gawd ED

i kept score!

scores vibrate ED….they ‘vibrate’. [sob]

ok – ok i admit it, i am the evil scorekeeper……. [sob]

:-)) …..

no worries andre,

i am cheering here….its either ‘price’ reversal and the stone starts rolling down the mountain, or its ‘back to the drawing board’ – either way, i am here cheering for you to continue refining your system!!!

I appreciate your understanding. I keep innovating all the time.

Have found new things I can post about this weekend. But it all confirms we are close to a long awaited turn in the markets.

In a sideways market like THIS one has been there are bound to be MANY different Elliott Wave counts. So I’ll like to add mine into the ring.

https://postimg.org/image/fg95d21zp/

Good Luck to All

Sorry SHOULD have said this is a DJIA count. I keep forgetting that most here follow the S&P and it’s derivatives.

GO Andre !!! hand tough!!

andre,

we are dropping as per your predictions/system. 1st test, for us to drop to 2100 area to watch for price reaction. if we bounce hard from there – peter’s ED looks good – and in “play”…..

2nd test, if we smash through the 2100 level, then the brexit bounce area of 1990-ish becomes focus…..

if the boulder keeps rolling down the mountain after breaching those key levels – then your system would have achieved both “veritas” and “gravitas”…. and THAT achievement deserves the making of “ANDRE’S VIBRATION” t-shirts…..

something to consider…

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2016/10/08/20161010_1987.jpg

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2016/09/28/20160928_19873.jpg

Finally took out vibrational support of 2141+/-2 on ES, should be short term resistance. Lets see if it finds vibrational support at 2125+/-2 (25%of the major support/resistance of 2094/2218). What kind of fight does ES have in it?

Steve

I see a potential reversal tomorrow. My vedic timing gives a low. In that case we are dealing with an inversion and will the high come next weekend.

andre,

reversal? from what? we only dropped 20+ points. there is no short term direction of trend – we are sideways – neutral for the last month. we need to have some kind of short term trend established before we can have a reversal.

get me them vedics on the phone. we need to talk – sicilian style!

Good call, Andre’. I concur that Tuesday’s sell off may be short term low.

Good call andre

Today’s drop now makes the rise from Sept 27 to Oct 10

a simple A B C rally .

my issue though still considers the low from Sept 12-14th .

we now have sept 12th-14th to sept 22 which was also

an A B C move .

The Sept 27th low is now the key support , the pattern is no long a triangle .

because the market has changed from what i was following i must

take today as a bearish signal yet stop trading until i have re evaluated

what is happening . there is only 1 possible bullish outcome short term

the move is ABC X ( the X wave being the sept 27th low )

the move from Sept 27th to oct 10 being ABC ( A ) and today’s drop

another B wave .

That said , im not trading until i see the market prove itself .

Oct 20th-24 being a high is very important to my work cyclically .

Joe

Joe, I agree Tuesday’s drop went a bit too low to allow the bullish triangle to be still valid. Of course the bearish version remains both valid and completed so we get a thrust downwards now.

I have about 2117 on the SPX as a target for the wave 4 of this large ending diagonal to wrap up, assuming the wave 5 of this last motive subwave move down is the same as wave 3. (2167.11-2138.98 was wave 3.) this would create a low just below the 9/12/2016 low. Then blow off top time!

ted,

as i understand, as a rule, for an ending diagonal pattern to be such, wave 4 MUST overlap wave 1, otherwise it is some other pattern, which if you are looking at this move as the end of a wave 4 it has to go below 2100 to overlap wave 1.

1.618 of wave 3 would get us right to 2100, which then overlaps wave 1 and has us bounce off a round number, so that certainly is reasonable as well.

Wave 1 on SPX was 2111. The 2100 in Peter’s diagram is for ES.

yes, i just realized i was talking ES not cash…..so yes 2011 ish….on cash

this current drop is beginning to look impulsive

the overnight trading action on the DEC Dow futures

has come up to satisfy a wave 4 , if this holds true

then new lows are coming to complete a 5 wave downward structure

from Mondays highs .

This implies today’s lows matter in order to confirm the short term wave formation from Monday. how that fits into the larger picture remains to be seen.

peters wave count i completely understand and not arguing here .

the Dow and SP 500 do not have the same patterns which is my mistake .

Joe

as stated prior

im not trading until the market proves itself .

my main issue is the oct 20th 24th date really must be a

high . swing high lower or higher high doesn’t matter

just a high .

we we do see a 5 wave short term pattern in the Dow from Mondays high

that fails to take out the Sept lows ( on the dow ) then the pattern will become

more complex

or we may end up with a divergence between the spx and the Dow .

as an example .

the Dow held above its Sept 27th low today yet the spx did not .

that in itself is a divergence .

im sitting back and observing until the picture clears .

oct 20th – 24th to me is very important .

Joe

The sox index ( semiconductors ) are also giving mixed signals

with its wave count .

peter if you could touch on this index in your chart show i think it could

be very educational with this present market .

the question i ask is simple .

the wave structure from early august as well as mid September

is now all overlapping which is indicating a wave near completion .

i have not dug deep enough to label every wave .

looking at the sox from the sept 12 lows

you can see 1 2 3 4 5 drop then 1 2 3 4 5 then drop ( todays lows )

this can also be counted

1 2 3 a b c 1 2 3 a b c into today

aug 3 low plus 27 trade days sept 12 low plus 27 trade days =wed oct 19th <—

the oct 20th 24th dates are beginning to show up .

6 trading days is not to long to wait for me 🙂

good luck everyone

Joe

Just for the record I believe that we have start a wave 3 to the downside and 1920 is the target.

When the last crash started 07-08 futures we be up and we would open up then start to crash by lunch each day and finish the day lower. It would sucker people into buying as it looked like we were going up then drop them on their heads.

Good luck all.

jody – i am interested, wave 3 of what? what is your bigger count?

Luri, Using VIX and Inverted VIX (SVXY or XIV) to help guide my count. I believe the top is in. This is were Peter and I differ a bit. I do understand that we certain could bounce if this is a EW (C) of Wave 4.

My issue is the support line coming off the 2-11-16 low connecting the Brexit low and then the Sept. lows. We have already broke the support and I am watching this leg down as a EW(3).

So 8-15-16 as a Top – 8-23-16 Double top confirmed – then down to 9-12-16 was EW(1) – then up to 9-22-16 EW(2) and now we are in EW(3).

I try to always have at least 2 counts so I am not caught off guard..

1,2,3 can also be A,B,C

jody – thank you, very interesting count. i am still waiting on confirmation if the top is ‘in’. that will happen when my ‘black box’of analytics confirm by turning bearish at the weekly level. currently they are indicating neutral. my EW count is extremely bearish also, but until the top is confirmed, i sit back and wait – and crack a few jokes…..

Everything Mercury did 80 years ago is relevant (Bayer rule).

The high should have been 9/4 when the Venus indicator turned down with Jupiter, But 9/4 80 years ago a new mercury max cycle started. And that runs into 10/16. This is also a crashdate. So If we go up again into the weekend this is not because the trend is up. Next week should – finally – get volatile.

The full moon next weekend is conjunct Uranus. 120 degrees from the galactic center and at perigee. Would not be surprised to see a vulcanic eruption or earth quake. Could this be the big one?

http://www.youtube.com/watch?v=n06pzojDDlI

Earthquake u say?

could be the big one indeed: http://www.youtube.com/watch?v=n06pzojDDlI

https://astrologyforganntraders.wordpress.com/2016/10/12/the-balance-is-overturned/

Cowan says the root of 2 is more important than 1.618. One root 2 years from 5/20/15 is 10/17/16. This should be a massive vibration.

Last weekend I explained the significance of the 8/24 low (midpoint major cycles). Mastertiming on this date gives 10/16. Very significant. This is the anniversary of the oct 2014 low. Only this time it will be a high.

Seeing all this I get more bearish by the minute.

Andre’,

Thanks again for the update! What do you “read” to get a tiny bit of knowledge on the things that you do? Have viewed Olga’s site but with not even the slightest understanding of things she talks about it is over my head! Who is Cowan that you mention!

I remember October 19, 1987 as if were yesterday. So yes I am a very senior citizen.

Any guidance would be appreciated! If I need a background in physics…then I am out! Ha I did take out a 6 month subscription to Arch Crawford’s work! Just searching for something that will educate me a little!

This weekend i’ll do a more elaborate analysis.

andre, i could accidently get the rear band of my man thong caught in the escalators of Loblaws and DIE a horrible and painful and embarassing death before this weekend. Life is rife with ‘risk’…. i could meet my maker and NEVER have had the opportunity to know what your were going to post on this upcoming weekend. could you live with yourself andre??? could you live with that burden?

:-))

Ed,

There is not one thing to read, or 2, or 3,… But its a good place to start. Start somewhere, anywhere that you might find interesting, and continue in that vein – forever. When I first started, I was very confused, thought it was of no value, went down many worthless paths,… But even those paths that I saw no value, I later found out were critical, I just needed to build a stronger base elsewhere. BTW, you do not need physics or math beyond junior high school, or what they knew 5,000 years ago. I still don’t know anything, but I know more and I feel satisfied but hungry. It really is personnel research, for personnel satisfaction. These days I am researching Sarvato Bhadra Chakra. Didn’t even know what it was 2 months ago. It doesn’t matter where you start. Here are some thoughts (they are all related): Elliot Wave basics (just follow this site, join the Gold section, read Peters writings on patterns), determine the difference between Vedic and Tropical, understand the frequencies of light and sound (everything vibrates), (if really challenging think about light, gravity, electricity). Cowan has a site (his books are expensive), why is a circle=cycle=Pi=anything on cycles, sacred geometry, why is speed change important (how do you feel in a high speed elevator at various points in time or on a roller coaster?), do planets really go backwards and why would that be important, … There are so many rabbit holes you can go down. Finally, DO NOT dismiss the ancients as having out dated information, they had much we can use. After all, they spent 1,000’s of years trying to understand war/peace/prices/timing…. Use the internet, follow your intuition and don’t give up. Good luck.

Thanks Steve!!

today yet probably tomorrow i m going to look for a low .

this is only if the 18002-17950 level holds on the cash Dow .

Tomorrow would be ideal .

there is a confluence of price and time yet if that lower level

fails ( 17948.97 on close ) this market can tank .

if yesterdays low were the low then ill be watching the 18500-18515 level

into Oct 20 – 24th to take a longer term bearish position .

the 18002 level is more important then the 17950 level .

no trades until tomorrow at the earliest .

something is a miss as far as i can tell and i think the pattern

is a simple A B C decline .( Labeled A ) the rally if it unfolds as i think

would be labeled B then wave C down

oct 20-24th high nov 14th low ( minor high Nov 7th )

nov 25-dec 2 high dec 12-13th low ( lower high lower low )

dec 22-29th high jan 20th low ( lower high lower low )

Jan 20th Key low big bounce then drop

Feb 3rd the market should start turning up and trending

March 2 a possible higher low yet the Jan lows should hold .

Short term indicators are oversold , my bias is upwards

despite the larger downtrend .

Joe

18221 is key resistance for today

getting much above there and closing above there

tips the odds that a bottom has been seen .

touching that level is a bit above an ideal wave 4 yet

id give it benefit of doubt if the market stalls near that level .

an ideal 4th wave would land into the 18191-18211 range

nuff for now

Joe

Ed,

Follow on to your question above. Re Cowan: one of his more important concepts is PTV (Price Time Vector), the squaring of price and time to generate related moves, where there is a trade off between price and time, but must be related. Which can be expressed as a(2nd)+b(2nd)=c(2nd) or a(sq)+b(sq)=c(sq). Equations are hard to do on an iPad! Now read some George Bayer books like George Wollsten. Also his pentagon or 72deg.

Steve

Steve, thanks again!

GM andré,

your comment on September 25 looks right on the money, hence no inversion?

“Time-price-vector calculations confirm 9/28 is the day. 10/6 the strongest date in between. This might be a low. Then up into 10/9-10 and down into 10/14. This date is very strong and confirmed by multiple sources.”

On October 9 you shared, “Yes, I think next week will be down. Watch the news.” And we’ve just got bad trade data from China. Amazing!

P

Thanks.

No, not a real inversion. But 10/17 is a magnet. So market may keep chopping around untl 10/17 is hit. This comes from some new things I found. Will tell you more about this. But – as far as I can see – 9/4 was the last serious high and we are consolidating in time before we are allowed to let go.

Thank you sir.

Andre, thank you for your posts. You think 10/17 will be up or down?

I expect it to be a high.

Thanks!

Next weekend I will be traveling, so no time to post. Maybe Monday.

Bradley. F. Cowan is one of the best analysts I know. I read several books he wrote. Cowan confirms my 17 year cycle and says it is a Uranus cycle. As the moon is connected with Saturn, Earth is connected with Uranus. The distance from the sun is times 19 and mass is times 4. 19 is the root of 361; or one full circle in the square of nine.

10/16 earth will be conjunct Uranus and that will start a new cycle.

Cowan found the time-price vector what is really Pythagoras’ theorem. The TPV must give multiples of 12. Ray Tomes found that harmonics center around 12; the same as Tesla said.

The nasdaq did – from the 2009 low into the 9/22/16 high almost exactly 34 times 144 in the square of nine. We all know what 34 is. 9/22 was also the midpoint of the 1974 prices cycle and Lillith 60 degrees to the node. And it was 18 days from 9/4. Another 18 days brought 10/10; another high in S&P.

Cowan found the pentagonical timing as there are 5 times 17 years in one Uranus cycle. 3 times 17 is 4 times 13 and this is the 52 year cycle Gann spoke about.

Bryce Gilford created the Gilford number series that helped me creatd the Gilform spirals. This does not only give dates but also cycles. One Gilford cycle exactly connects the 2009 low with 9/4/16, This was a major turn. 2 more cycles – or 15 year- will bring us into 2031.

So much to tell and so little time. Read Cowan,Gilford and Garret to see they all say the same.

Have a nice weekend.

André

ANDRE,

SERIOUSLY – be careful traveling. we need you back in one piece!

One more thing about the Gilmore cycle. It is the F20, or maybe I should call it G20. It is 2740 days. And this is exactly 9 times 144. As 9 is the last number; it ‘ends’ something.

Make that 19 times 144.

Andre

your timing has been spot on lately

the one thing i have not studied over the years is wd gann to any

real in depth . i have seen others work yet nothing in depth like you have

been posting , i think this next year ill dig into it further and add it

to my other work which i still have oct 20-24th as a high .

the wave count from Monday to me is 5 waves down and the dow

futures hit 17913 which is a dead on hit . this should bring the cash dow

down to 18002 near or on the open . so it makes sense that we should see a bounce. how far back upwards though is still open for debate .

the drop from oct 11 high can now be considered an a b c decline.

i do not expect new all time highs yet it is possible .

enjoy your travels

Joe

then again :

a further break down would be a 3rd of a 3rd to the downside or sorts .

just keeping my mind open for what comes next

Joe

it will be interesting if the dow can close at 18112 today .

if it hits 18002 we will have 2 equal point moves down from

oct 11 high

if it closes at 18112 we will have 2 equal closes in terms of point

moves down close to close.

today will be an interesting day .

for me ill be looking for upside yet im not overly bullish

come oct 24 im expecting a stronger decline to unfold .

even if this is an abc move from the sept lows .

the upside will be limited to just a poke above the oct 11 high .

Joe

correction

the market will be limited to just a poke above the sept 22 high .

hence no dow 18500 only dow 18450 roughly .

obviously today’s trading has not begun in the cash market

yet as i see it today will be important .

a close at 18112 is all im expecting .

18002 will be key .

measuring the time from the top to top to measure time from the low to low .

sept 22 to oct 10 top to top .

sept 27 to today .

its a balanced move in terms of price and time .

it doesn’t always work but it fits very nicely .

Joe

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.