Down into October?

Down into October?

Timing of the coming drop in the stock market across the world in certainly interesting. It could not come at a worse time for the current US administration.

Late in the week, we saw a dramatic downturn in a fourth wave, which confirmed my count, and gives us a very clear path to the coming trend change. There is one more smallish wave to a new high to result in a change of trend.

Market volatility does not bode well for the incumbent in an election year. It looks like we’re going to see a market drop across the US indices (and across exchanges around the world) targeting the Halloween period, mask, or no mask!

Timing for the trend change is not something Elliott Wave gives me, so we have to rely on a new high to give us the signal. Oil, although in the early stages, appears to have topped, as it has pierced the lower trendline of its ending diagonal.

DAX appears to have a new high still to go, and currency pairs are following the US dollar index, which still needs one more low (it created a corrective wave up on Friday, and then turned back down).

In the “real world” (or maybe “unreal world” would be a better term), riots are continuing in the US, but the more telling situation is in other countries. People are rebelling against the ridiculous draconian lockdowns. This past week saw the largest demonstration in Germany’s history, and a very large one in the United Kingdom.

Australia had the first stages of a revolt in Melbourne this weekend. Dictator Dan, as he’s called, the premier of the state of Victoria has doubled down and threatened more fines if people don’t stay at home (other than a few hours allowed outside) and wear their masks whenever outside. He’s also considering another year of the same. My bet is that it’s not going to happen (not that he won’t try).

He’s going to have a revolution on his hands and it won’t be pretty. In fact, when you consider where the market is going, with a likely bottom in October near the US election, you can expect major uprisings all over the world. The mood is about to turn a lot more negative.

The truth about this rather mild flu bug is coming out from many different sources now and as that information becomes more pervasive, expect a complete loss of credibility for governments around the world. It will not be the desired outcome for the central bankers and their plans for a New World Order.

However, the market will still continue on its path. This is going to be a prolonged process, but the coming drop will turn the population much more negative, and likely less willing to conform to these ridiculous, unconstitutional lockdown laws.

And watch out for those rather hurried vaccines. The UN has had to admit that The Gates Foundation is funding a vaccine that’s causing children to be paralyzed.

Elsewhere, the heat is getting turned up on Google, which, with other tech social media giants, is trying to muzzle the truth (this always happens at major cycle tops, although the propaganda power they have is greater than at any time in history). There’s an anti-trust law suit in the wings and US Attorney General Barr is reportedly trying to get it in the works before the election.

At the same time, there’s the promise of the Durham probe into the attempted “soft coup” in the US resolving to at least lay down some indictments in the month of September.

In Canada, we have a corrupt Prime Minister who has shut down parliament to hide his malfeasance and is now apparently planning to spend many billions more in attempt to stay in power. He has named a new finance minister, Chrystia Freeland, who knows nothing about finance, but has strong ties to George Soros (and is a Rhodes Scholar — a program that has ties to the New World Order (a single world government for all), socialism, and long-held beliefs in eugenics). Word has it that Trudeau is contemplating an international monetary loan to expand on the unprecedented billions he has spent during his time in office. This country is bankrupt, morally and economically, as are so many others.

From the writings of Dr. Raymond H. Wheeler, PhD:

“The sixth century BC, the first AD, the fifth AD, and the 10thand 15thwere all natural turning points in history, marked each time by the decline and fall of civilizations the world over and the birth of a new era. In each case these centuries terminated 500 year cycles in long range weather trends.

The six century BC, the fifth AD, and the 15thmarked a end of the still longer cycle, on the order of 1000 years. These sentries were characterized by exceptionally profound reorganizations and revolutions in the civilizations of the world.

Current events show that another world convulsion is occurring second only to:

-

- the emergence of rational thought in the sixth century BC,

- the fall of Rome and other ancient civilizations in the 5th-century and the beginning of the medieval world based on feudalism, and

- the final collapse of the Middle Ages in the 15th-century.

The current convulsion is comparable to the birth of Christianity in the first century and to the birth of the modern nation as a feudal principality in the ninth and 10 centuries.”

Know the Past. See the Future

_______________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has two extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening out there! Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

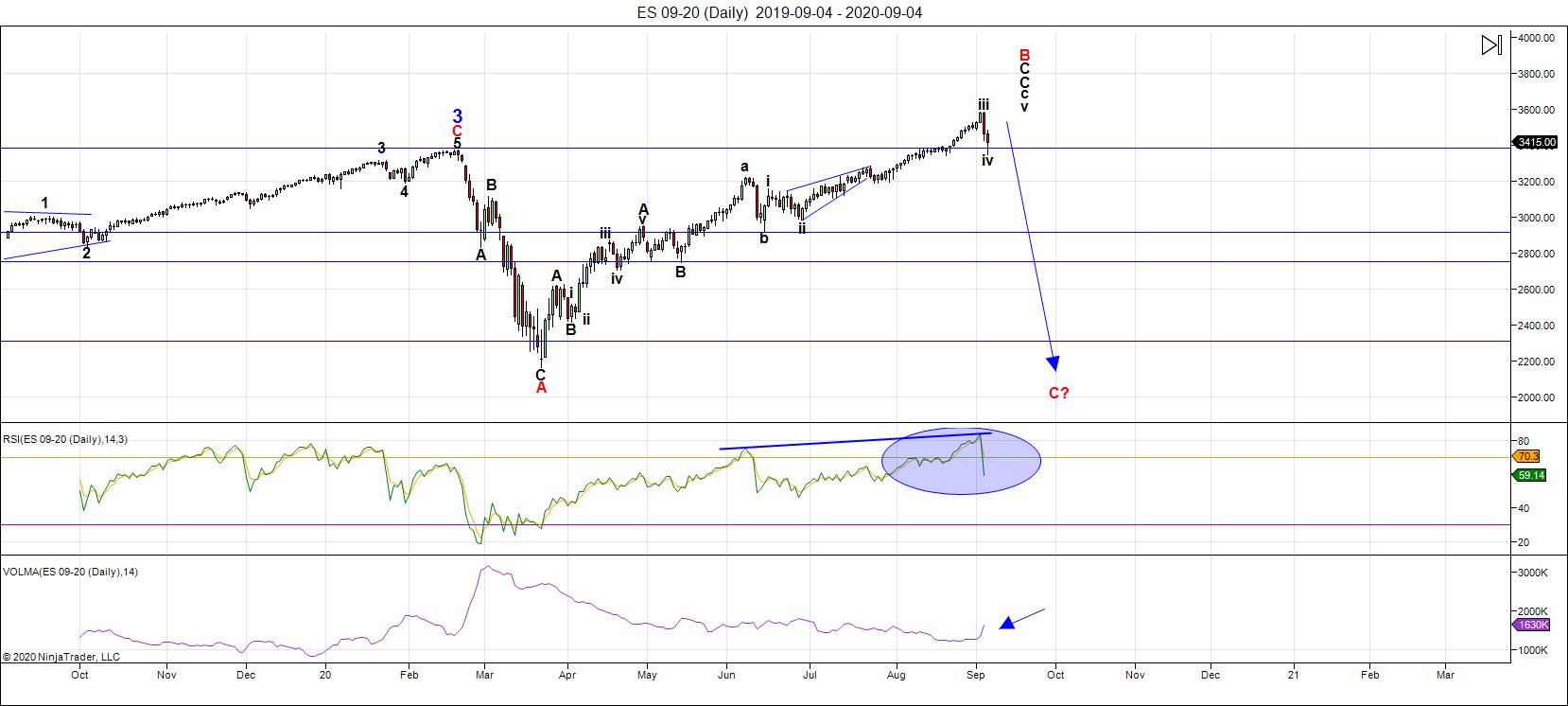

Above is the daily chart of ES (click to enlarge, as with any of my charts).

This week gave us the final fourth wave (of the fifth) of this five month rally. A big picture look at the US indices and NYSE exchange show a very sick market, as many of these assets have different counts from the rest.

The NYSE exchange shows very clearly a corrective B wave up, ready to complete a fifth wave up of the C wave, which will lead within the next week to another crash to a new low. The various indices are in different patterns, which is an anomaly certainly, but support that this wave up from 2009 is a corrective B wave.

OEX (the SP100), the Russell 3000, and the SP500 are all at new all time highs. The NYSE, the Russell 2000, and the DOW have not made it to new highs. It's a failing market and a situation with a degree of non-confirmations that I've never seen before, either in real time, or in historical charts.

On Thursday of this week, we dropped in a fourth wave, which I warned might see a bit more downside in ES, because the wave in the SP500 was a bit short. On Friday, we dropped in another leg down to the previous fourth wave, before turning back up at about 10:45 EST. The waves up aren't clearly impulsive, but we're in a corrective wave overall, so that is not out-of-line with expectations.

On the daily chart, we now have RSI divergence that should continue as such as this final wave reaches to a new high.

I put us at the end of the day on Friday in the third wave up, with expectations of a minimal new all time high in ES. Then the trend will change.

DXY (the US Dollar Index) continues to be in an ending diagonal and I'm expecting a new now here before the trend changes to the upside.

Some other currency pairs also appear to have traced out ending diagonals and are in the final wave.

West Texas Intermediate Oil appears to have topped and broken slightly below its ending diagonal.

The major tech stocks are showing very obvious signs of topping (the tops of third waves). The entire market is moving together and will drop together. This includes many international exchanges.

The Labor Day long weekend is upon us, so markets are closed on Monday. However, futures should continue their rise over the weekend. I would expect a top within days.

The timing of this is interesting, of course, because the projected bottom of this wave down is potentially targeting the election, or close to it. I expect a rather rapid descent, rivalling the previous corrective wave down that began in February of this year.

___________________________

Summary: It's an exhausted market about to top.

We appear to be in a kind of broadening top formation (not an EW pattern). Other US market indices have completely different patterns, which is the sign of a very sick market, and one in the final stages of centuries-old rally, and a corrective B wave up from 2009.

We dropped in a corrective fourth wave late this week, which projects one final high to go.

The coming descent should be a fourth similar to the previous one, with a target under 2100 in SPX, and will likely be a combination pattern and, as such, may contain zigzags, flats, and possibly a triangle or ending diagonal at the bottom. However, I lean towards another series of zigzags, which are corrective waves.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

______________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil) right down to hourly charts (and even 5 minutes, when required).

______________________________________