Reflections and What’s to Come

The intentional car bombing in Nashville on Christmas morning is most likely a sign — a warning by the forces of evil that are likely getting scared; the intelligence I’m getting is that the tide is turning, but it isn’t going to be necessarily obvious on the surface.

The US is in a cyber war, with China and others as the instigators. It’s obvious now that the virus was planned (it was always obvious to me, because it came at the wrong time in the cycle) and that the “bad guys” used it as an excuse to “steal the US election.”

What is also clear is that this was expected by “the good guys,” and that the Declaration of Sept 12, 2018 was setting up a trap of sorts, and we’re smack-dab in the middle of it as the the end of the year plays out.

Events don’t change the market direction; however, financial events do. We have a stimulus package waiting in the wings with Nancy Pelosi calling for a vote on Monday. At the same time, we have a market that is very slowly coming to an interim top. I suspect both events will happen at the same time and it may be this coming week, even though it’s another short one.

There’s also Brexit, which appears to be complete, if you believe reports, but we haven’t seen anything from the market yet. As I’m uncertain of the status as I write this, I don’t know whether we’re going to see it reflected in the market (currencies would be the place to see a reaction, if there’s going to be one).

There are rumours out there that there’s going to be a very large ‘data dump’ very soon in the U.S., which will provide some devastating information on the Deep State. There’s also a lot of talk about civil war, the Insurrection Act, military action, and possible political and judicial moves having to do with the election outcome.

The corrupt ones (and there are many in today’s world) are getting scared. The world is slowly waking up to what’s been going on for decades across the world. “The people” always have the power, and when they’re upset, you’d better not be standing in their way. Next year will bring this battle between good and evil to a head.

So, enjoy the holidays and the relative quiet, although it may not last all that long. We’re going to be back into the thick of it come the first week of January, with January 6, being a very good indication of what the road may be going forward.

I expect we’re going to see some real volatility in the markets over the next month or so. I say that because technical analysis tells me this. We’ve been sitting in sideways waves for weeks now and we’re very slowly reaching a major inflection point.

On a larger scale, the globe is starting to get colder overall, and that tends to make people wake up. Turning down into a colder, dryer climate always results in turmoil and chaos. I hope we avoid civil war, but history tells me otherwise.

It’s a time to hope for the best and prepare for the worst. That being said, the future, the way I see it, is looking very bright. This is a major turning point in history. It takes years to get where it’s going, but it will be well worth the wait, particularly for the younger generation.

Best to all over the holidays!

The Sound of Silence

This song, one of the most beautiful ever, was written by Paul Simon and recorded in 1964. Later, its title was change to “The Sounds of Silence.”

This song, one of the most beautiful ever, was written by Paul Simon and recorded in 1964. Later, its title was change to “The Sounds of Silence.”

It was recorded 3 months after the Kennedy assassination, when I was 13 years old and living in New York, on Long Island. That period was “the best of times” and “the worst of times” as Dickens once said. It was about halfway through a “golden age” in music. We have one of these golden ages every hundred years. You can think of the great classical composers in the early 1800s as another one.

Three years later, in 1967, my family moved back to Canada, and the next year, I spent almost half a year in hospital, missed my graduation, and had a tough time getting into university, as a result.

But I fell in love with the early Bee Gees recordings and learned to play guitar. Music became a very big part of my life.

That long period in hospital at 17 was a traumatic experience. I grew up very quickly; I’d learned to “fight,” and, after two years, ended up getting into university on the road to becoming a television writer/producer/director, which I’ve done now for about 45 years.

Good things often come from adversity. My medical challenges helped me convince my mother to lend me her ’66 blue Mustang and head with two friends and my sister to Woodstock in the later summer of ’69. It was the best of times; it was the worst of times.

That experience was iconic and made me a bit of a rebel, over time. I was never part of “the herd,” as a result.

Music is a very powerful force, given to us, I believe, by Mother Nature. It springs from the lower numbers of the fibonacci sequence (3, 5, 8), and the golden mean (.618) comes from the average of the ratio of the distance of the planets of our solar system from each other.

This holiday season this year is a brief period of silence in a larger cacophony of noise, much of it propaganda, that masks what’s really going on in the world. As has happened many times before in history, we’re heading into an even more disruptive period over the next ten years or so. It will be a test of our resolve to keep our freedom. The tough times should make us cherish what we have, and give us the strength to carry on.

This is one of the most important lessons I take from natural cycles. This you have to remember: It will all turn out better in the end. The world will be a better place for your loved ones and children. It’s going to take some pain to get there, but as I’ve learned time and again, the periods of pain make us appreciate what we have.

“What has been will be again, what has been done will be done again;

there is nothing new under the sun.” — Ecclesiastes 1:9

At this time of year, music and memories help me to remember those times and how the human spirit is every resilient and adaptive. “The people” will come together and win out over the current tyranny. We always have, we always will.

So, take some time to listen to your favourite music and reflect back on your strengths and what you’ve achieved. The greater challenges may yet be ahead of us. Together, we’ll forge a new world, a more democratic one, and one that’s far better than the one we’re leaving behind.

Have a wonderful holiday!

Now, back to reality …

The Strange Case of Dr. Fauci and Mr. “Hide”

Here’s a very short video of Dr. Fauci getting vaccinated and then talking about the experience the next day. Notice anything at all odd?

Which arm is the sore one, again, Dr, Fauci?

I’ve railed against these vaccines, which are more than a little bit suspect. There has never been a vaccine effective against SARS (and it’s been around for a very long time), but we can suddenly create one in under a year? The performance above should tell you all you need to know.

______________________

We’re at a major turning point in history.

“Current events show that another world convulsion is occurring second only to

“Current events show that another world convulsion is occurring second only to

(1) the emergence of rational thought in the sixth century BC,

(2) the fall of Rome and other ancient civilizations in the 5th-century and the beginning of the medieval world based on feudalism, and

(3) the final collapse of the Middle Ages in the 15th-century.

(4) The current convulsion is comparable to the birth of Christianity in the first century and to the birth of the modern nation as a feudal principality in the ninth and 10 centuries.

All of these reorganizations of society were marked by spurts in the evolution of democratic institutions.” — Dr. Raymond H. Wheeler, Ph.D

Christmas Advisory (an update):

Late this week, a meeting at the White House ended in a decision to postpone any action by the military until every attempt has been made to let the US Constitution play out (which would result in a decision that would give Donald Trump a second term, due to the extraordinary fraud in the November 3 election

That doesn’t mean there won’t be a major campaign to remove the corrupted parties from society; it will still happen, but on an extended timetable.

Until then, it will likely remain quiet. January 6 will be the next big milestone, in that case.

Know the Past. See the Future

_____________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

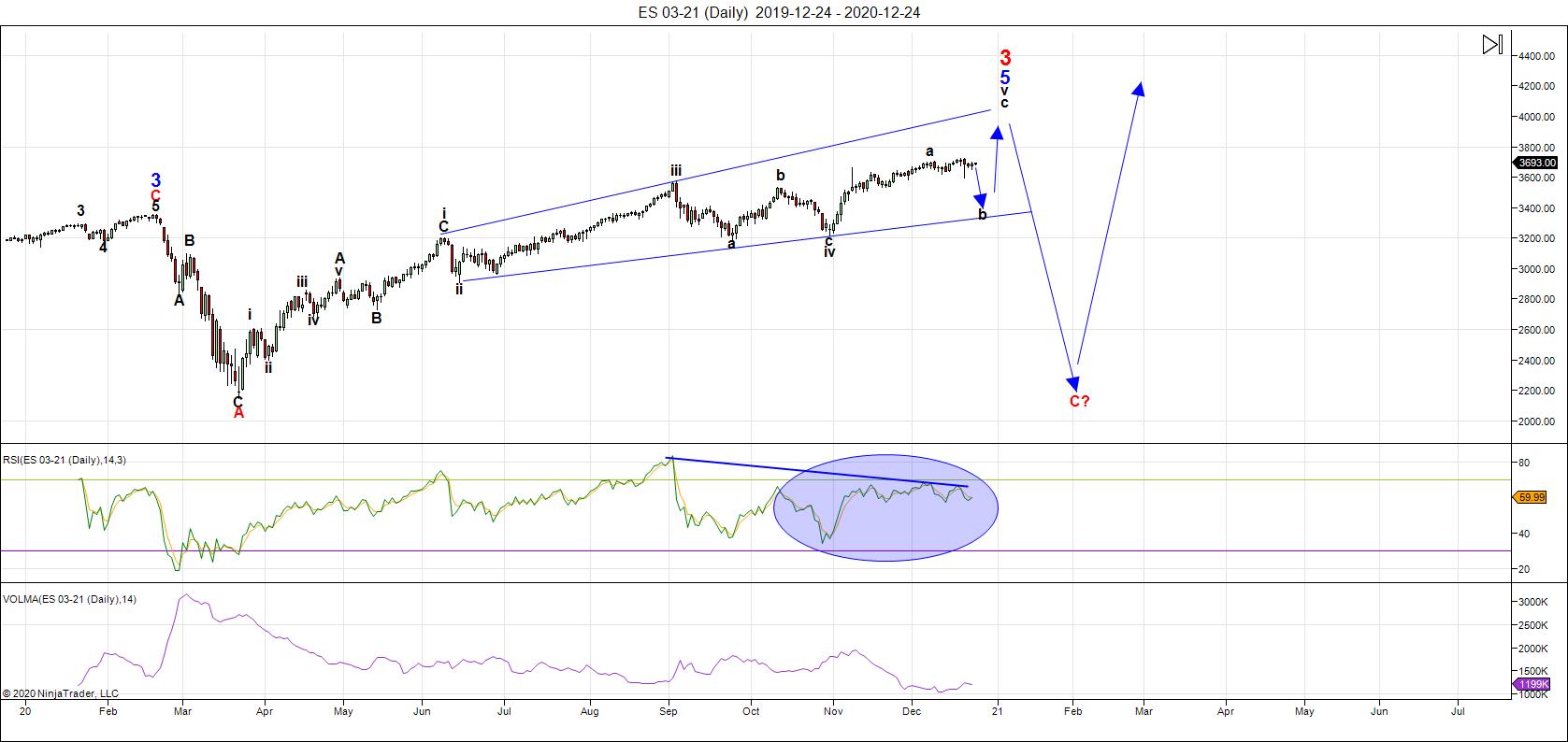

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The plethora of ending diagonals at the current top tells me the market is very weak. We've been waiting for a turn now for weeks. It requires a new high at, or slightly above, the current high. The RSI at the bottom of the chart (with the blue ellipses also signals weakness).

The challenges with timing this market are many. All asset classes are moving in tandem, so they all have to top at the same (a bit like herding cats — they won't turn until all of them get to their individual targets). The usual market cycles influenced by the solar system aren't working as they normally would. Many asset classes are tracing out ending patterns of one type or another and trading ending patterns is extremely difficult, as fibonacci ratios are unreliable within diagonals.

The lower indicator is volume and you can see it's exceptionally low, so overall, it's a very dangerous market.

So, the best thing to do is be patient, and if you must be in the market, keep your risk low. The current target for the interim high is in the area of 3725, but there a two possible patterns in ES, so we could exceed that level, but not by much. In fact, on the hourly chart of ES, there've been two ending expanding diagonals and a regular ending diagonal (in a row!), which I've never seen before, in such close proximity.

So, we wait.

There's also lots of news in the wings. Brexit goes on and on, but it sounds this weekend like a deal might have been completed. Up and down we go with the stimulus package — still not done. Both of these are potential market movers and were expected weeks ago.

The B wave down may be quite deep, as NQ requires a fourth wave of an ending diagonal to trace out at the same time. In any case, the B wave down will be in three waves and will result in a large final C wave up to finish the rally up from March of this year.

___________________________

Summary: The ending expanding diagonal pattern is playing out on the daily chart. We're in the final fifth wave, having completed the A wave and still waiting for a turn down into a B wave.

The SP500 also appears to be in an ending expanding diagonal. Most other US market indices have similar patterns. Diagonals are ending patterns and warn of an impending, dramatic trend change after they're complete. This puts us in the final stages of this rally up from March of this year.

The resulting trend change will target an area under 2100 in SPX, and will likely be a combination pattern and, as such, may contain zigzags, flats, and possibly a triangle or ending diagonal at the bottom. However, I'm leaning towards a series of zigzags, which are corrective waves, and will likely come down fast.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

______________________________________