Bombshell of the Century?

Bombshell of the Century?

There is so much news coming out this weekend, it’s difficult to keep up with it all. We seem to be following the same playbook as I’ve described in my Cycles of History videos that focus in on at the turn of the century in England around 1600.

As I’ve said many times before, the truth always comes out at the tops of these 1,000 year cycles (to a lesser extent at 172 and 500 year cycle tops). This week, you’re going to get a firehose full of information that most people will find absolutely shocking and will start to define the new direction for the future, not only in the US, but worldwide. Stay alert on January 6.

Merry, Old, Elizabethan England

Merry, Old, Elizabethan England

During the reign of Elizabeth I (1588-1603), inflation was at an all-time high. The rate of interest merchants paid once again crept up to 33% per annum.

There was a high level of corruption throughout the empire and all during Elizabeth’s reign, palace intrigue remained rampant. Following is a brief description of the social environment:

“Obedience to higher powers was its watchword. It was in many ways deeply conservative and authoritarian society, which penalised those who did not think and act as government decreed that they should.” — The Story of Britain, Roy Strong

Elizabeth’s cousin, Mary, Queen of Scots, had fled Scotland in 1568 and was living in England. She was next in line to the English throne if Elizabeth bore no offspring (she did not). Over the ensuing years, Mary was involved in numerous plots to overthrow Elizabeth. These plots involved others — the Duke of Norfolk and the Earls of Northumberland and Westmorland. for example.

After yet another plot involving Philip II, the king of Spain, Elizabeth had Mary executed in 1587. Spain at that time was a world power, but a failing one, as it had gone through a number of bankruptcies. By 1588, Spain was clearly in decline financially. At cycle tops, outbreaks of wars generally fail, and this one was no exception. They tend to be final outbursts from empires that are failing themselves.

In 1588, Philip organized the Spanish Armada to attack England. It was a complete disaster. England and Spain met in battle twice over the next few days, but Spain was forced to sail northward and ended up losing over 11,000 men when they continued, in extremely cold weather, into the North Sea and around the British Isles.

Once the battle was done, Elizabeth gave what is revered as the greatest speech of her reign, but is was falsely promoted as given at the height of battle. It was not. Propaganda is thick at the tops of warm wet cycles.

A year later, the English Armada was mounted to attack Spain, but it was even more of a disaster than the Spanish version the year before. The winners always get to write the history, and at this point, Spain was sinking fast. Few know about this final skirmish.

In 1591, the weather turned wet and cold. European peasants watched helplessly as their crops rotted in the meadows. English historian W.G. Hoskins observed, “the 1594 harvest was bad; 1595 was even worse; 1596 was a disaster; 1597 was bad, too.”

A major economic collapse occurred in the period from 1610 to 1622 all across Europe. During the entire period from 1551 through 1650, peace prevailed throughout the European continent in only a single year, 1610. in 1618, the Thirty Years War broke out, a civil war that devastated Europe, lasting until 1648. By this time, the world was entrenched in the Maunder Minimum, or “Little Ice Age.” We’re expecting a similar cold-dry period over the next 500 years.

As the financial situation across Europe devolved, “Needy governments resorted to all the usual forms of fiscal folly. Some tried deficit financing on a large scale. Others systematically debased their coinage. Many tried to wring more taxes from sullen an resentful populations. The result was an age of revolutions in virtually all European states.” — The Great Wave, David Hackett Fischer

It sounds very much like the situation we’re in today.

The Road Forward

This week in the United States promises to be one for the record books. The level of corruption over the last 60 plus years has now surpassed the similar level at the top of the Roman Empire. We have more debt than we’ve ever had on Earth, and the US is being attacked from within and without. It’s almost a perfect match the waning years of Queen Elizabeth. President Trump has detractors all around him. It’s all going to come to a head, I believe on January 6. The traitors will be exposed.

Here are some highlights of what’s to come:

Monday, the decision on the fate (extradition to the US) of Julian Assange is to be revealed by the courts in the UK. I expect he’ll be pardoned by President Trump.

Tuesday is the Georgia run-off election for the two seats that will determine what party controls the US Senate. There are lots of late speculation as to whether this election will be fraudulent, or not.

Wednesday will be the day that both houses of Congress will meet to count and debate the electoral votes of the November 3 election. As I write this, there are over 140 members of the house that will contest the vote, and over a dozen senators. You must have one member from each house to contest (in writing) the results of individual states. There are six contested states, with the addition of New Mexico, that also has two slates of electors.

Contested states will be subject to up to two hours of debate for each, which may result in a rather long, drawn-out debate lasting beyond Jan. 6. Rumours are that both Nancy Pelosi and Mitch McConnell are attempting to derail the vote. Both have well-documented ties to the Chinese Communist Party. The obstruction is becoming more and more blatant and open.

The Vice-President, Mike Pence has a colored history in terms of loyalty and there’s some question as to which side of the fence he’s on and what power he will display in terms of deciding the electoral outcome. As President of the Senate, he presides over the counting of the votes on January 6.

We’re expecting at least a million patriots in the streets of Washington DC on January 6, to witness the counting of the votes in Congress. At the same time, the Mayor of D.C., Muriel Bowser, is attempting to close all hotels and restaurants in DC on January 6. Hard to make this stuff up!

Trump is threatening to unleash a large contingent of damning information on the election and the levels of fraud across the government and courts. He has the power of the Sept. 12, 2018 executive order in his back pocket, which allows for the arrest of anyone aiding and abetting foreign interference in the a US election and the seizure assets of these entities (eg – main stream media, tech giants).

Here’s what else is coming out:

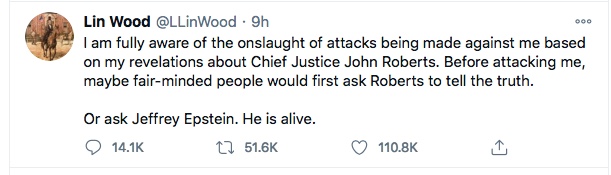

Lin Wood, the Georgia attorney in the fight with Sidney Powell has been tweeting over the last 24 hours, or so, that Jeffrey Epstein is alive. I’ve researched this possibility and believe is has a relatively high probability of being true.

I have heard through reliable sources that there are 220,000 indictments for treason and related charges sitting in the wings.

There was an executive order (#S3418 declared on January 1 by Trump) that allegedly activates FEMA camps for the housing of the potential traitors, when and if arrested. NOTE: I have been unable to locate this order online.

On December 16, 2020, Donald Trump also extended an executive order 13818 for an entire year. This relates to anyone who is guilty of human rights abuses.

So, January 6 is ramping up to be one for the history books.

The Longer Term Picture

I don’t, at this point, see how the world is not going to devolve into civil wars. History dictates that civil wars will indeed break out, in time. I would also expect a revolution and eventually, a financial meltdown, which I believe will begin at the end of 2021, or early 2022. History repeats and seems headed down the same old path of the past.

However, the final outcome will be a good one. The next year should provide a better idea of timing and severity of the eventual turn down. It will also result in a new, far fairer financial system, political system, and equality and prosperity for all. Gain always seems to come with a large amount of pain.

__________________________________

AAPL

Above is two chart of AAPL as at the end of the day on Friday.

We appear to be tracing out an ending diagonal, which now requires a fourth wave down. We may still see a test of the high as most assets are turning together. In any event the next big move will be to the downside with a target slightly below 120.

We could also have traced out an A wave down. In that case, we should test 136 (a 62% retrace level) before more weakness to that 120 level.

Then we’ll be looking for a fifth wave up to a new high.

Know the Past. See the Future

_______________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

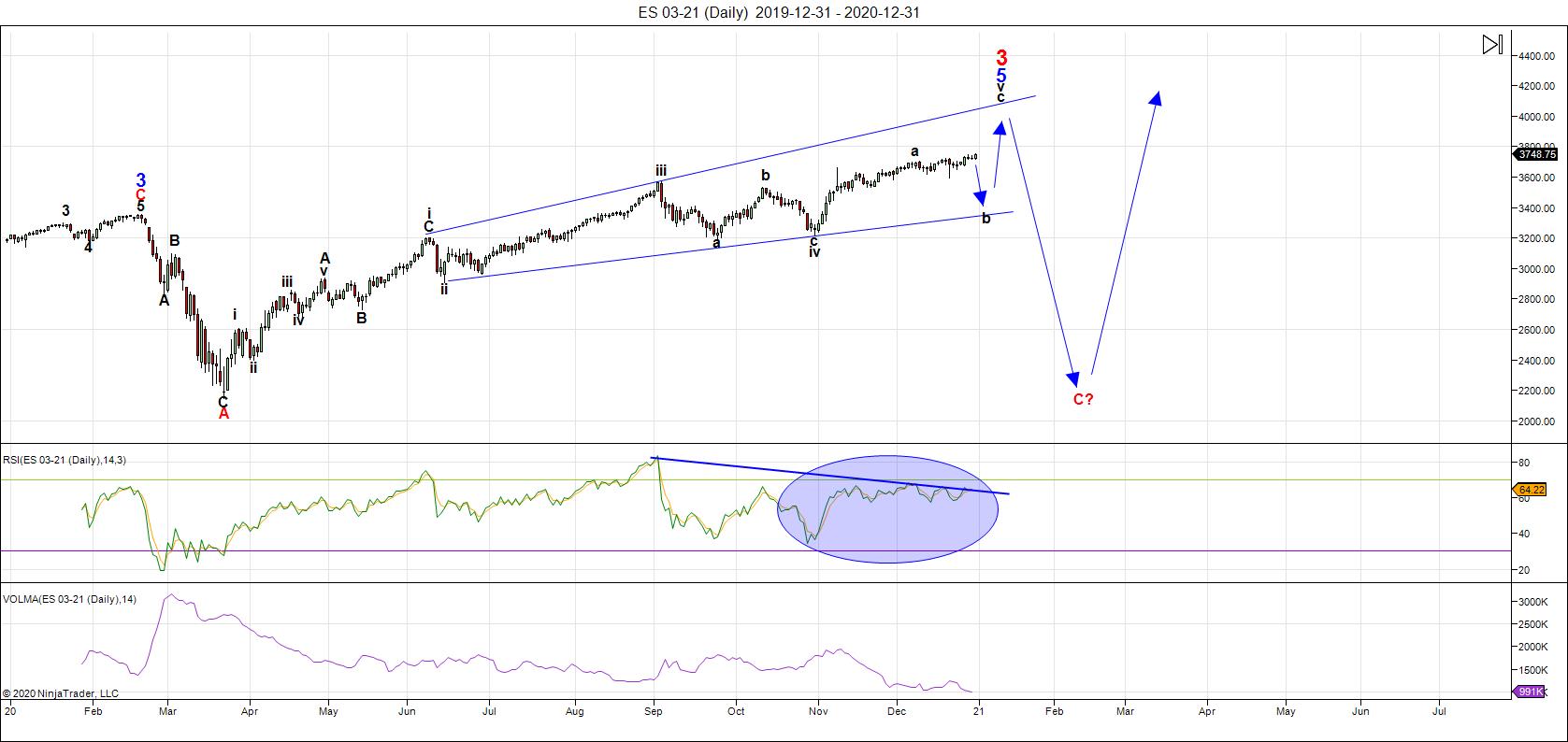

Above is the daily chart of ES (click to enlarge, as with any of my charts).

As I said last week here, we've been waiting for a turn now for weeks. It requires a new high at, or slightly above, the current high. The RSI at the bottom of the chart (with the blue ellipses also signals weakness).

On Friday, we had a small rally across the indices, which is part of a final fifth wave of a five wave, almost sideways, rally that has been ongoing since mid-November. I consider the count of the top of this zigzag up from November second to be almost complete, other than for a new high.

I believe the time-target now is Tuesday or Wednesday of this coming week. We had a full moon on the weekend the influence of which should be waning as we move into the new week.

The Georgia runoff for two Senate seats is on Tuesday and the electors "show-down" in both houses of the US Congress is Wednesday. There is a labor report on Friday.

Currency pairs, US market indices, oil, gold, silver and some international exchanges should all turn at the same time.

The lower indicator on the above chart is volume and you can see it's exceptionally low, so overall, it's still a dangerous market. We're near a top, so the influence of bulls and bears is evening out.

So, the best thing to do is be patient, and if you must be in the market, keep your risk low. The current target for the interim high is now slightly above 3760. While there were options regarding possible patterns in ES, it seems now that we're in a large ending diagonal (in the final fifth wave up).

So, we continue to wait; the direction is still up, for not for much longer.

Brexit is now complete, but the stimulus package may, or may not be. It could have some effect on the market, depending on whether it gets voted in, or not.

The expected B wave down may be quite deep, as NQ requires a fourth wave of an ending diagonal to trace out at the same time. In any case, the B wave down will be in three waves and will result in a large final C wave up to finish the rally up from March of this year.

___________________________

Summary: The ending expanding diagonal pattern is playing out on the daily chart. We're in the final fifth wave, having completed the A wave and still waiting for a turn down into a B wave.

Most other US market indices have similar patterns. Diagonals are ending patterns and warn of an impending, dramatic trend change after they're complete. This puts us in the final stages of this rally up from March of this year.

The resulting trend change will target an area under 2100 in SPX, and will likely be a combination pattern and, as such, may contain zigzags, flats, and possibly a triangle or ending diagonal at the bottom. However, I'm leaning towards a series of zigzags, which are corrective waves, and will likely come down fast.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

______________________________________

Comments on this entry are closed.