The Final Drop Begins

The Final Drop Begins

This past week was a brutal one and highlights the weakest aspect of Elliott Wave — the ability to target the ends of corrective wave patterns.

Impulsive waves are easy. All the waves in an impulsive wave pattern have strict fibonacci relationships to each other. They seldom vary much.

However, corrective waves have five possibilities, but the full wavelength of the correction almost always has a fibonacci ratio that relates to the first A wave of the correction. The challenge becomes figuring out what that A wave is.

Here are the options:

- the A wave 1.618 extension

- the A wave 2.618 extension

- wave A = wave C

- wave C = 1.618 X wave A

- wave C = 2.618 X wave A

It is EXTREMELY RARE that the relationship of wave C to wave A will exceed 2.618.

Corrective Example (AUDUSD)

Above is the hourly chart of AUDUSD showing a corrective wave up from the bottom at approx. 0.550.

There are two A waves shown on the screen. There’s a large yellow A wave and a smaller blue a wave. I have always found that the smaller a wave measurement is the most accurate, but very often, both measurements will yield close the same result.

In this case, this huge correction has already surpassed the 1.618 fibonacci relationships and we’re left with the 2.618 levels. Note that it is very rare that you’ll get a correction that goes beyond the 2.618 correction ratio.

The first possible target was the 2.618 extension of the a wave. This level was at 0.625 roughly, shown by the yellow horizontal line on the chart. However, after stopping at that level, we eventually rose above it. If it does so, the probability is very high that the entire correction will target the next major fibonacci ratio. This next “higher” ratio is the A wave relationship to the C wave.

In this case, you measure the blue (smaller) a wave and then place the bottom of your fibonacci tool on the blue b wave bottom (hard to see on this chart, but it’s just above where I’ve place the b. Measuring from here using the full 2.618 measurement targets 0.641. This is most likely the turn point for a wave that will completely retrace (likely in five waves) down to a new low, at least to the 0.550 level.

Know the Past. See the Future

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

______________________________

US Market Snapshot (based on end-of-week wave structure)

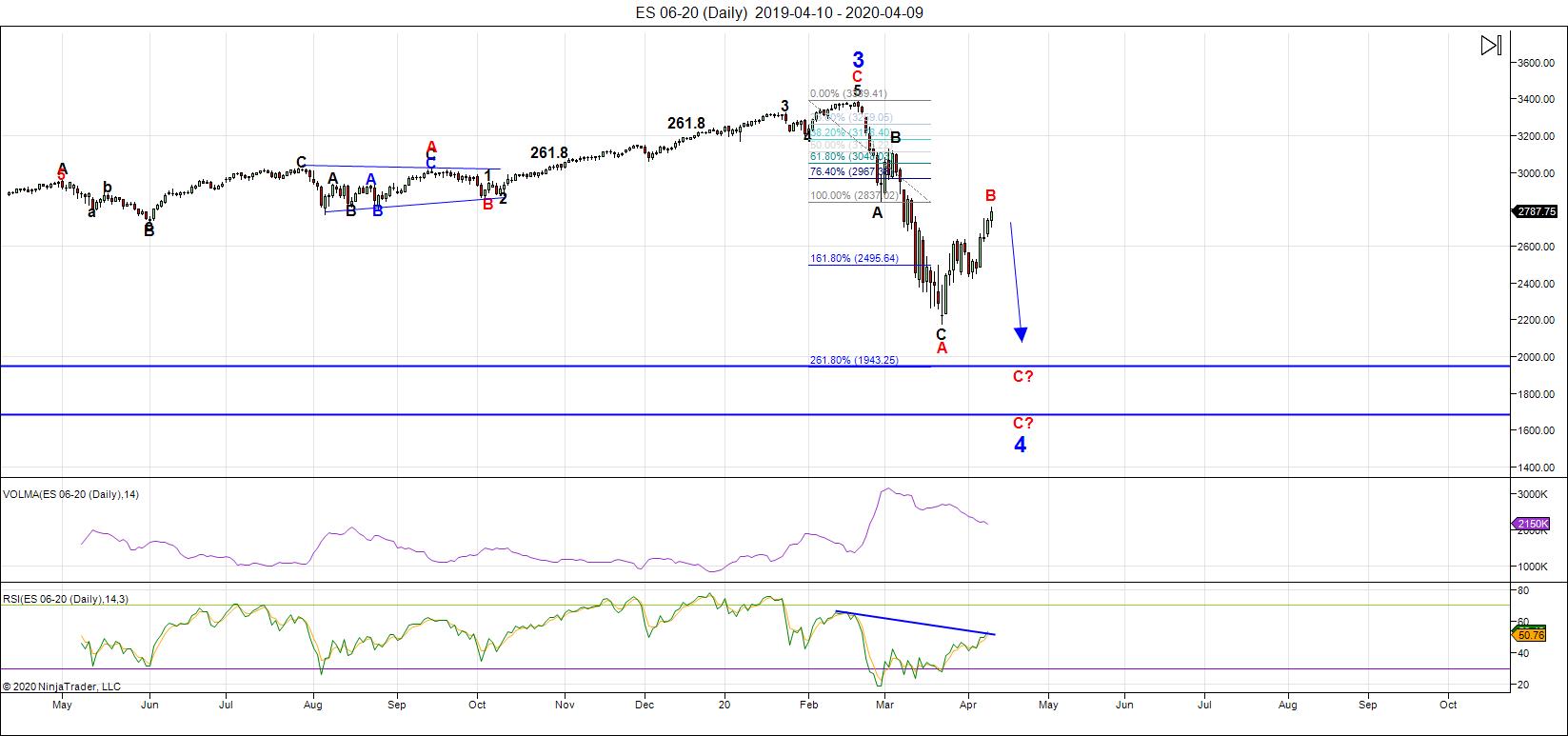

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The wave down from the 3400 area appears to be a double zigzag (the subwaves are difficult to label with certainly). At the bottom of the last zigzag, an ending diagonal traced out. That ended the main down-leg for the short term.

This week saw and unexpected C wave rally up to complete a large expected B wave. The visual look of the wave structure is as important as measurements. In this case, the red B wave on the chart had to be larger that the previous smaller black B wave; it had to give the appearance that the entire wave down from the 3400 area is an ABC wave.

It appeared that wave was in place on the Friday before the last weekend report. However, the market shot up during Trump's Sunday press conference and kept going. While the (obviously) corrective ABC wave up to the 2640 area did measure closely to two waves (A=C) of equal length, it became obvious that the market needed more correction time.

This weekend looks like the full correction is complete, with a 5 wave move up in the C wave. As a result, early this week, we're looking for most probably another zigzag down to the final bottom. There's a reasonable chance that the expected C wave down will be as long in length as the current ABC wave down from 3400. In that case, we'll be targeting the 1800s for a final C wave low.

Also, it's reasonable to expect a time span that's about the same as the first leg down, which took a total of 23 market days to complete. This brings us to the early to mid-May timeframe.

___________________________

Summary: We appear to be in a combination fourth wave, and have traced out double zigzags to the downside. We're beginning the third pattern to complete the large fourth wave drop. Another zigzag down appears to be the plan.

Measurements are targeting the area in the 1800s, although there are other options that target a bit higher. The timeframe may be targeting early to mid-May for a final low.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

_________________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil) right down to hourly charts (and even 5 minutes, when required).

______________________________________

Webinar Coming Very Soon

Click on the above image to expand. It was a busy week, More info to come this week. First date for the webinar is April 30.