Update Thursday, April 22, Before the Open

Sometimes you just need to sleep on things to think through what could be happening … (chart updated ~12:30PM EST)

Above is the 60 minute chart of ES (emini SPX futures). I’ve completely re-labelled this wave and I’ll tell you why. The circled area has always been the area of contention, because it sports an abc pattern. However wave 1 was in 5 waves. Wave (i) looks like three waves, though. I’ve labelled it as a 1-2,1-2 pattern, as a result (that wave in 3 is still an issue, however).

I’ve labelled the entire wave up as a third wave within a larger five waves, because each of the major waves look like they’re in 5 waves and labelled this way, there is no overlap. However, it’s unusual for wave (ii) to be lower than wave 2 (in the circle). Usually the third wave is fully within the confines of the larger wave enclosing it, but in this case, it has fallen slightly below it.

This would make the final pattern we’re in probably a triangle. This works for timing due to the fact that we don’t have a cycle turn until April 28/29 (right after the fat lady Yellen sings). A triangle warns of only one final wave up after it’s over and that wave up is usually about the same height as the triangle itself. My target for SPX is still 2116/7.

This seems to me to be the most logical labelling of this wave at the moment.

Above is the 30 minute chart of the SP500 showing the final set of waves. The structure and wave measurements project a target top of just over 2116.

I’ve relabelled the chart as I have with ES. However, this chart is much more normal in wave structure.

We get this by measuring the first wave (yellow 1) which in this case is an abc wave. The third wave (yellow 3) should be 1.618 X wave 1. It is exactly. Wave 5 should also be 1.618 X wave 1. The red line is at 2116.02.

2116 is also the previous wave 2 high. At the end of todays’ session, the wave structure looks like it needs one more subwave for high.

During today’s session:

- the VIX hit a new low of 12.50

- put/call ratio is .776, the lowest in 2 years

- volume continues to tank and had been moving steadily lower since Feb 11.

- 5 day sentiment is at 83.4%, higher than even the market high on May 20, 2015

These are all attributes of a market in the final stages of a second wave, ready for a trend change.

________________________

Update Tuesday, April 19, Before the Open

Futures headed up to almost finish the ending diagonal. It’s not quite finished because we have 3 waves down.

We look to be at the level I had forecast in the video—the previous second wave top. For the SP500, that would be at 2116. For the DOW, about 18,137 (by my chart).

If so, I would expect a reversal with one more small rally close to the open. We’ll be looking for five waves down.

If you look at futures, you can clearly see the 3 waves up, with each A and C leg comprised of 5 waves.

USDCAD is right at my target ready for a turn. EURUSD is clearly in a triangle and should start heading down relatively soon (likely with a first wave down in the indices).

_______________________

Update Monday, April 18, ~ 10AM EST

Top Tick Time: Today we really are looking for the top tick. We’re in the final leg of the fifth wave. The waves in the indices should go up in 3 waves. We’ve arguably finished the A and B wave and are working on the C wave.

We need to reach a new high above the upper sloping trendline of the ending diagonal. The top will be a sudden turn. Then we’ll be looking for 5 waves down. Finally, three waves up in a second wave will confirm the change in trend. More on that at the very bottom of the post.

_______________________

The Second Coming refers to the top of this second wave, which is slowly inching it’s way to a double top.

But The Second Coming is also a poem written by Yeats in 1919 in the aftermath of the First World War.

“Yeats incorporates his ideas on the gyre—a historical cycle of about 2000 years. He first published this idea in his writing ‘a vision’ which predicted the expected anarchy that would be released around 2000 years after the birth of Christ. The gyre suggests the image of a world spinning outwardly such that it cannot recall its own origin. These anxieties are closely tied to the traumas of a continent at war, and the rise of industrialism and militarism on a global scale.” … cycles yet again.

This 2nd wave is almost over. The next cycle turn date is the end of April for just about everything. This is a MAJOR turn date (the middle of the month was a more minor turn date and gave us the start of the final subwave wave up).

We were expecting some sort of geopolitical (or financial) event towards the end of the week. We got Doha and some other events.

- The Doha oil talks ended without agreement, as expected. We already knew oil is in an ending diagonal and hasn’t hit the bottom yet, so this meeting falls right in line with expectations.

- Japan had two major earthquakes, one after another.

- We’ve got Brazil’s President in the midst of an impeachment vote.

It certainly isn’t boring!

Events don’t affect the market to any great degree, of course. Social mood affects the market (it’s a mathematical projection of the social mood of the masses); human cause events as a result of their mood.

In terms of the market, the dollar controls the market and it’s coming to a major turning point. Watch it closely for the signal of a turn down in equities. (More on this in the video).

The direction of US equities is still up. But not for that much longer.

We’re still in the the final fifth wave of the C wave. The structure of the move up in the SP500 is questionable. I’m going with the start of an ending diagonal, as I explain in the chart below and in the video. While we may see a spike in the indices in this fifth of fifth wave (the throw-over), it should be short-lived and I would expect a dramatic turn down, with waves that should revert to the beginning of the ending diagonal relatively quickly. I don’t have an upside target for the SP500.

The short story is that equities and currencies all seem to be heading for the same top tick (or pip) all together!

As I mentioned last week, the VIX has flashed a sell signal for equities, so a turn down is imminent.

There’s a lot of information in this post to digest. I hope I’ve made it clear what I’m expecting. I’ve been saying for some time that the markets are all moving in tandem as one (due to deleveraging debt worldwide) and I see everything lining up for the turn. I actually pointed this out last September.

I’m casting my attention towards month end now.

______________________________

Here’s a video overview of the market for Monday, April 18, 2016:

Market Report for April17 |

_______________________________

Futures Sunday: Above is the 60 minute chart for ES (emini SPX futures). You can see that we opened lower—at just slightly below the 2.618 retrace level (the extension of the first wave down) that I mentioned in comments on Friday. This now lets me draw an ending diagonal with overlapping waves (finally!). It’s now clear where we’re going …. up to a new high. I was clear before, but the pattern was in question.

We still could top on Monday—we’ll have to see how rapidly this market moves to a new high.

Here’s the 60 min chart of NQ. Same structure. You’ll find YM is almost exactly the same, except the 4th wave happened at a slightly different time.

Above is the 4 hour chart of NYSE. I keep a fairly close eye on this index as it’s by far the largest in the world (in terms on capitalization). We are at the top of an ABC corrective wave (a bit more to go). I’m expecting at least a test of the yellow (B) level before the turn down.

Above is a two hour chart of IWM (Russell 2000). It’s traced out a very obvious ending diagonal and just has the throw-over to complete. This is a small caps stock base and should give a pretty good indication of what’s happening overall.

Above is the 4 hour chart of the SP500, showing the possible double 2nd wave top waiting to trace out. This would negate the “truncation” and create a spectacular EW textbook set up for a huge third wave down.

Second waves have few restrictions. The key rule is that they can not retrace to the previous top. They should retrace between 62 and 100% (but cannot hit the 100% retrace level).

It’s typical in a bear market for second waves to trace out a double prong (and ABC wave down in this case and a 5 wave structure up). The five wave structure, however, is not motive (subwaves won’t necessarily all be in “legal” 5 wave motive configurations).

Above is the 10 minute chart of the SP500, so I can focus in on the wave structure of this final wave up. From the fourth wave bottom, we have a wave up in 5 waves. There is no overlap, so this suggests a simple 5 wave ending wave. However, none of the subwaves are in 5’s. They’re all in 3’s. Now, if you look at the most recent wave up (wave i on the right), you’ll find it’s also in 3.

These threes lead me to believe that we’re looking at wave 1 of an ending diagonal complete and that we’re working on the third wave up. OR … we’re going into a normal third wave, that interestingly enough (based on the length of the first wave) projects at top at 2120 (1.618 X the first wave), which is exactly the previous higher degree 2nd wave top (see my next chart below).

If this is an ending diagonal, this final wave will go up in three waves to a top and turn. If it’s a normal 5 wave ending wave, it will go up in 5 waves, of course.

Above is the 15 minute chart of the DOW. It’s similar to all the other indices, as it should be. Don’t be surprised to see the double pronged 2nd wave make it to the previous wave 2 level.

Note that just about everywhere I look at individual stocks, we’re in huge second and fourth waves spikes. This whole market is about to turn.

A Major Inflection Point: Above is the weekly chart of USDCAD. I have been following this for some time, and called the bottom of the third wave, expecting a retrace (although unsure as to how deep it would be).

The larger pattern is an ABC corrective wave, but the C wave is in 5 waves. We are completing the 5th wave of this pattern (an ending diagonal), which should reach the 38% retrace level (shown by the bottom white line) before turning back up.

Once it turns and heads up, it will head up in a fifth wave to a new high, a very lucrative trade. The euro, Australian dollar, dollar, and Canadian dollar are at similar major inflection points.

A Major Inflection Point: Here’s the daily chart of EURUSD showing the major corrective pattern from the low of March, 2104. I have been advocating for some time for a retrace to at least the 38% level, and I’m entertaining the possibility that we’re finally going to get there. Although I’ve been able to anticipate and call all the major turns, it was two weeks ago that the white C wave we’re in now turned decidedly corrective, as well. However, this current C wave should continue up to either the previous high (yellow A) or touch the 38% line and then turn down. Note that at that point, the white C wave would be exactly 1.618 X the white A wave.

On the chart, I’ve labelled my preferred top as (4)?. But I’ve also labelled yellow 2 (in case we don’t make the 38% level).

There is also the possibility of this being a triangle. Considering what’s happening Sunday night, the triangle may be the highest probability active pattern.

The eventual turn (at any level) should send up down into a very large 5th wave. It should turn in tandem with the US equities.

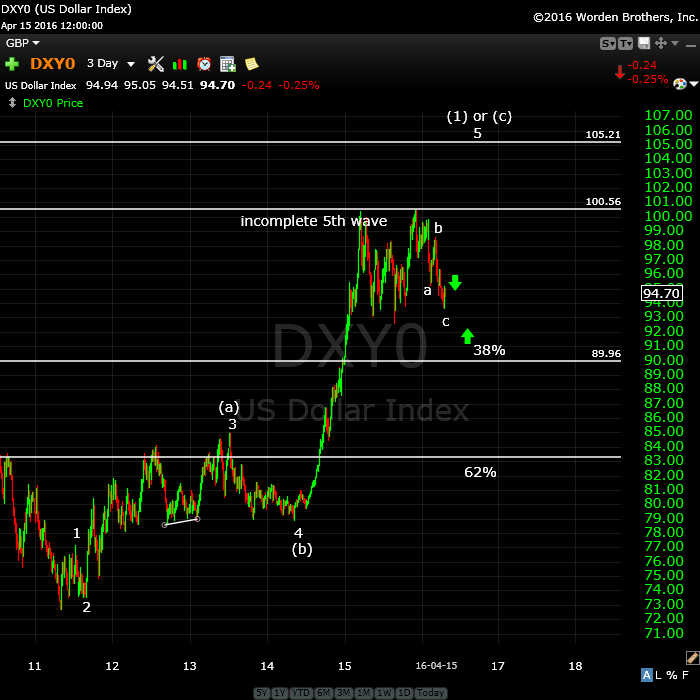

The US dollar (this is a 3 day chart) should do the same thing but in the opposite direction (up). I’m up in the air right now about the structure of this wave. Although in 5 waves, it looks more corrective to me than motive.

Short term, however, we’re heading up (after a pending double bottom). More in the video.

Above is the daily chart of GDOW (Global DOW) showing the current count. It looks to me like we’re tracing out a second wave after an ABC lower part of the wave. I think we have one more small leg up. This wave has stopped at the the 23.6% retrace level (or 76.4%) from the bottom of the wave (as forecast). Whether it will stop here or not is the question. If not, it will likely retrace tot he wave (2) level.

I do not see a path to a new high for GDOW and, in my opinion, this strongly lowers the probability of a new high for the main US indices.

________________________

First Wave Down – What to Watch For

This weekend we’re dangerously close to a top of a second wave (in the fifth of the fifth, with an ending diagonal pattern).

What we’re looking for to confirm a turn is a motive wave down in 5 waves.

Because we have an ending diagonal, the first wave will likely drop to the previous fourth, which is also the beginning of the ending diagonal pattern (~2022). After that, we should get a second wave that will retrace in 3 waves about 62%. That’s the preferred EW entry point. So don’t feel you have to rush in. There’ll be a much better opportunity at the second wave level than at the top and the risk is substantially reduced.

__________________________

peter, i think the dow hit your target level already???

Yeah, I think it went a little above it.

Bought SPY at 209.10, will sell at close today if profit or open tomorrow as FM days often open up.

We’re now back to the previous fourth wave, so we should turn around here and then head up to a new high. How long is a guess.

Thank You

Peter

Is your 60 min charted posted this morning still valid ?

AZ

Analogy:

The flash crash May 2010

What do we have in common

Bullish sentiment

Low put buying

Mercurius retograde started April 18

full moon April 28

The bearparty started two days before the full moon and the first drop ended May 7.

It is a wild card but possible

http://www.ispyetf.com/view_article.php?slug=Despite_Crazy_Run_and_New_Highs%2C_Immediate_Flash_C&ID=114#7lCR8GvgkQXU1EUd.97

Hello John,

Your April-May 2010 analogy is interesting. April 8, 2010 printed the 2nd lowest low for the month of April while April 7, 2016 is so far the low for the month of April.

Right now, I’m testing a hypothesis that matches the weak days of 4/7-11/16 with the weak days 11/11-13/16. Both 4/12/16 and 11/16/15 were the pivot days. Today is supposed to be 11/30/16.

If you align 4/7/16 to 11/11/15 and 4/8/10 as all day 1, it’s interesting that the pivot high were 4/26/10 and 12/2/15. The latter 2 dates are day 13. April 25, 2016 is supposed to be day 13.

11/11/15 = day 1

12/2/15 = day 13

4/8/10 = day 1

4/26/10 = day 13

4/7/16 = day 1

4/25/16 = day 13 = Peter’s ES HI?

I’m sorry for the typo. I meant 2015 for all November dates.

potential of an expanding ending diagonal as long as prices stay at current levels?

No, but we’re still in the larger ending diagonal. This is still the fifth wave.

To your point (and Purvez a couple of days ago), now I don’t think we’re in a larger ending diagonal. I think it’s just a fifth wave up. What this last little pattern is is what’s troubling me. It might actually be a small expanding ending diagonal. I want to think about it for a bit. But I’ll post it after the close.

I posted a chart of ES re-labelled with some comments.

And SPX is there now, too.

chart in the post, that is.

looks like a small parallel channel and this is small iv?? we just hit the bottom of the channel on the spx…[channel from dates of 4/8 to today}

if i=v on channel looks like 2114 – or exactly your target peter….

I still have 2117, I think, but close enough. That seems to me where we’re going.

Ouch! GOOG.

http://www.marketwatch.com/investing/Stock/GOOG?countrycode=US

Some sympathy dives from the other FANG stocks as well.

Not only GOOG.

MSFT too as well.

But that doesn’t matter while the oil is up

Futures are likely to drop lower tonight. NQ could even be a first wave down (which I mentioned a couple of days ago. So be careful. In other futures and cash, so far we have three waves down.

I would not want to be long in a market like this. We’re too close to the top.

At what price in ES would you abandon the thought of seeing a new print high and believe the top had already occurred?

At 2077, the C wave down is 2.618 X the length of the A wave. That’s about where we are. So right about here. But we should turn up, because the A wave is not in five waves, so this wave is not motive as far as I can tell.

If I’m wrong, the thing to watch for is a 38% retracement of the full wave down (a fourth wave) and then a turn down into a fifth wave. But I think this is low probability.

Obama in Saudi tomorrow. Fed meeting next Tuesday begins. If there is a large sell off, it should retrace by Tuesday mid day.

PALS has bottom next Wednesday, Thursday; but Fed meeting often acts as market stabilizer, so sell off will probably be muted until after Fed meeting. My guess:

Friday: close at 2050

Monday: close at 2020

Tuesday: 2035

Wed: 2050

Thursday: 2070

Friday: 2100

Morning Valley,

No issue with your timing. I too think we’ll turn in a week. However, we should start up from here (based on the structure this morning) and put everyone to sleep along the way perhaps. I’m guessing your numbers relate to ES and if so, I would put the top around 2110. That’s my EW 2 cents.

Hi Peter,

PALS indicates weakness today, and until Wednesday of next week. Market is not budging to down side. Oh well, keeping my short position modest.

We’re still bottoming. Futures are all up in 3, so they should retrace. Euro still has to hit its target. All is looking as expected. We’ll take our time heading up to a new high. But down (perhaps to test the lows from today) for the remainder of the day, I expect.

I think we may get a bit more downside this morning before turning up and if we do in NQ, there’s a chance it might be “done” which would be odd, since cash on the Nasdaq side is in a completely different place.

Looking again at NQ (slowly waking up – lol), it’s down in 3, so it too will need to reach for the top again.

New ES chart posted. I think we’re starting to form a triangle and that will likely span a week. It’s the very early stages.

I would peg the bottom of this drop right about here. NQ has come down to the previous 4th wave. ES has come down to the lower trendline of the triangle I drew.

NQ and Nasdaq still look like they’re down in 3 waves, so this sets up the final wave up. I was expecting a further drop in NQ to a more appropriate level. The C wave is now 1.618 X the length of the A wave.

For anyone wanting to follow the “lack of action,” we’re waiting for eur/usd to fall a couple more points to 1.119 before everything turns back up again. Slow, slow bottoming. That’s the point the abc pattern down will be 1.618 X the length of the A wave down.

peter,

in a big picture sense, i was expecting more “fireworks”. overall, this is supposed to be a “C” wave down of [large] cycle degree. i was imagining that the “weight” of the cycle down would be such that would make it very hard for waves to fully complete. instead every squiggle [especially to the upside] is completed fully. why?

I don’t know what you mean by C wave down and that waves don’t complete. Waves always complete (otherwise, it wouldn’t be much of a “principle”). I put us in the second wave up (of an A wave of a very much larger C wave). We still have to complete that second wave. Sounds like you have a different count.

sorry, i meant the BIG count – with the May 2015 high being the “potential” end to primary B wave up, with a primary? C wave down to come. so far it looks like we have 1? of C down, with the ABC of 2 of C up almost complete….. my question was one concerning the primary C wave down in general – it seems that we have been topping for 2 years now…..

OK, so we’re on the same page. And yes, we’ve been topping for 2 years, if you consider the NYSE.

The only difference is that your primary B up, I call the 5th wave of an expanding ending diagonal.

So … waves always complete … and so they’re predictable.

yes, i know you are correct peter, i am being “impatient”, and as a result “frustrated” as i want to see social mood [and thus the markets] really shift to the negative…. but it seems social mood stays elevated…. hey where can i see a “BIG” cycle/super cycle chart of your count?? i was looking over the site but maybe i missed it..

thanks as always…..this is a great forum….

Well, I can’t help you with the frustrating part … lol. It comes with the territory. There’ll be big picture charts in past posts and videos. But I’ll tell you what, I’ll put one in the forum this weekend and let you know where it is. It’s also time to re-mount my 1929 charts and likely do another wave 3 target chart. I’ll let you know when they’re up and where. 🙂

Today has been particularly frustrating, as nothing is moving. However, I sure saw that coming, based on the euro. Talking with Andy P. today (cycles report at the bottom on the post), who is 99% accurate on cycles turns, we’re looking at April 28 as the turnover date, the day after the fat lady sings. Couldn’t be more perfect timing. Until then, molasses …

UVXY 14.70 low last April 19th held so bought some calls after close. I hope to hold it until May or Jun.

New post: https://worldcyclesinstitute.com/the-ultimate-cycle-turn/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.