All the Same Market

Gradually over the past year or so (since I first mentioned it), the USD currency pairs, the US dollar, the US indices, bonds, and gold have become more and more closely aligned. With the potential top in place in oil, all assets with any relationship to the reserve currency are now moving towards a final top. You can even look at the DAX and see the same phenomenon taking shape. We have a few more weeks left in this market and then the bear market begins in earnest.

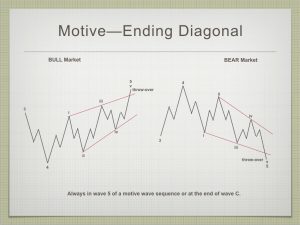

Ending diagonals are appearing all over the place. They’re considered relatively rare, but in this market, they’re certainly not. We have them unfolding in both ES and NQ (emini-futures) as well as their cash counterparts. It’s becoming more probable a top is in place, from an Elliott Wave perspective, with all these ending diagonals showing up. They are very weak fifth waves.

We had three ending diagonals in a row—a triple three of ending diagonals (an historic first, as far as I can make out) on a 10 minute chart of the SP500. That more than suggests a top is in place for the third wave of the ending diagonal.

From the top so far, we appear to be setting up a flat to the downside. This is a 3-3-5 configuration, the two three-wavers now complete. This would mean that the C wave down is up next and it should trace out in 5 waves to the downside.

Following is a full description of the larger ending diagonal, more than half-way to completion in NQ/NDX/SPX/ES.

Ending Diagonals

Ending diagonals are notoriously difficult to trade. There are a number of reasons for this. The biggest is that all the waves are in threes and the upper and lower boundaries don’t get defined until the 3th wave (upper in a bull market) and 4th waves (lower). So, you don’t actually know you’re in one until the fourth wave of the ending diagonal is in place.

Ending diagonals are notoriously difficult to trade. There are a number of reasons for this. The biggest is that all the waves are in threes and the upper and lower boundaries don’t get defined until the 3th wave (upper in a bull market) and 4th waves (lower). So, you don’t actually know you’re in one until the fourth wave of the ending diagonal is in place.

The sub-waves will be in three waves (zigzags), which makes analysis difficult, volume gets lower as the ending diagonal traces out, and the final wave will likely complete a throw-over (exceeds the upper trendline in a bull market).

Rules (these are “hard” rules; they cannot be broken):

- A diagonal triangle always subdivides into five waves.

- An ending diagonal always appears as wave 5 of an impulse or wave C of a zigzag or flat.

- Waves 1, 2,3, 4 and 5 of an ending diagonal always subdivide into zigzags.

- Wave 2 never goes beyond the start of wave 1.

- Wave 3 always goes beyond the end of wave 1.

- Wave 4 never moves beyond the start of wave 3.

- Wave 4 always ends within the price territory of wave 1.

- Going forward in time, a line connecting the ends of waves 2 and 4 converges with a line connecting the ends of waves 1 and 3.

- In the contracting variety, wave 3 is always shorter than wave 1, wave 4 is always shorter than wave 2, and wave 5 is always shorter than wave 3.

_______________________________

A Word of Caution (the Coles notes version)

We’re starting to get close to a major market top. We’re seeing some volatility in terms of large swings in currencies, gold, and oil particularly.

There could be quite a bit of volatility at the top. Nobody’s seen a 500 year top, so we don’t have a lot to go on.

Volume is light, which means that almost everyone is “in” on the long side and smugly enjoying their profits, believing this market is going to continue on for a whole lot longer. Of course, a lot more are “out.” It’s amazing how many hedge funds have folded as they simply haven’t been able to make any money (and are unsure of where the market is going). In any event, that takes a lot of money out of the market.

We have a lot of financial “cracks” developing. Amazon just set themselves up for a gigantic short by over-leveraging and buy out Whole Foods. Toys “R” Us looks like it’s finally going down for the final count. I expect Elon Musk to crash and burn: After all, none of these electric cars have sold in great quantities. They’re mostly government subsidized (certainly in Musk’s case) so it’s only a matter of time before it all falls to dust.

We’ve had many retail bankruptcies recently and this foreshadows a much greater problem. Insurance companies are getting quite scared, as there’s a lot of fraud out there, not to mention Houston, Florida, and Equifax. Who’s next? It’s going to be a wild ride over the next few years.

It’s going to get a lot worse before it gets better. Start getting prepared for a decades-long “winter.”

_________________________________

The Market This Week

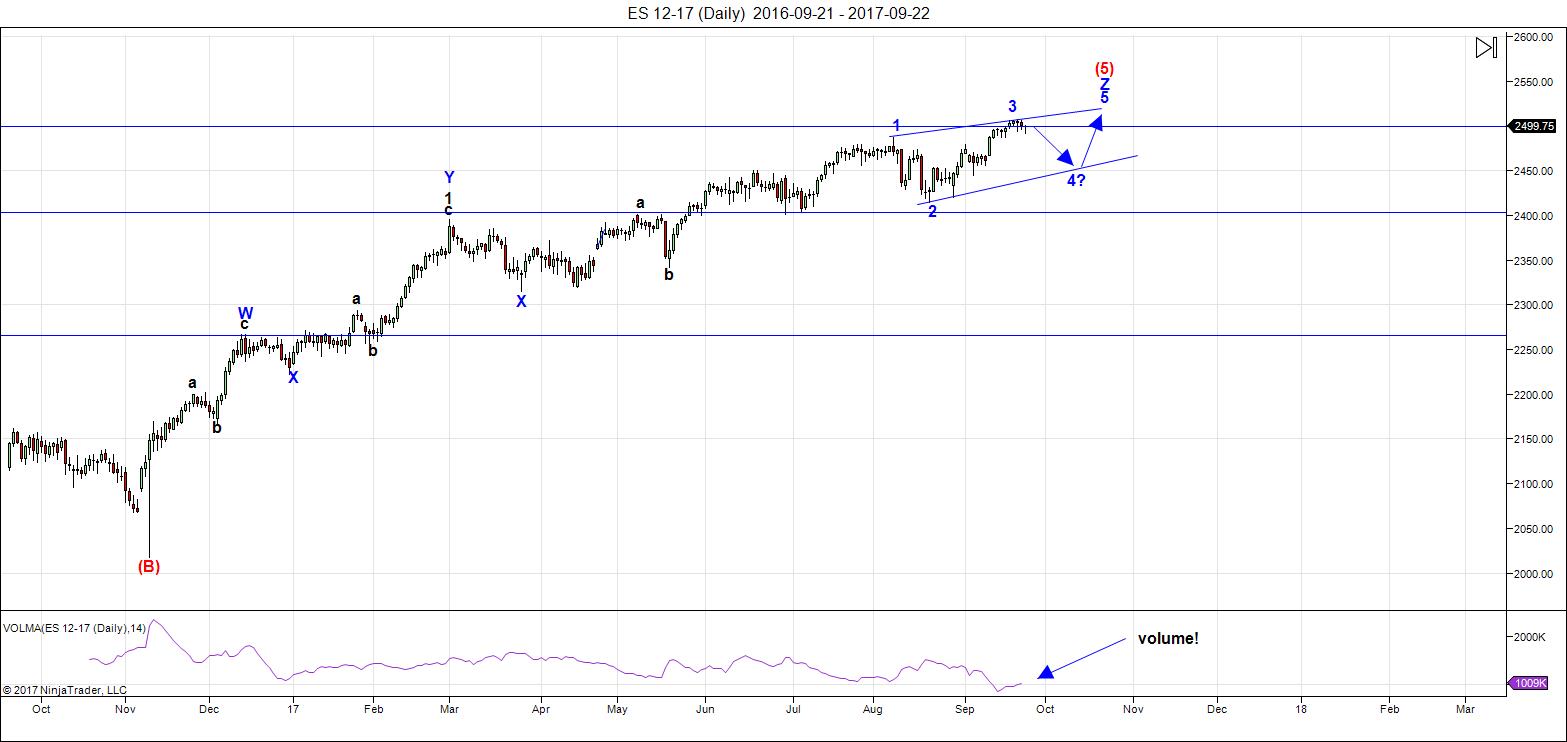

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

This past week, the third wave of the ending diagonal in ES appears to have topped and that puts us in the fourth wave. There are at least a couple of options for the wave down, but we could be setting up a flat, which would mean five waves down is the next move. We arguably have 5 waves down in ES already, which could be part of a small flat (which may continue to a larger one), or we may end up creating a different pattern. The overall pattern in wave E should be a zigzag.

There is a lower probability chance that the second wave that traced out on Friday could test the previous high at around 25089, but I believe the higher probability move is down from around 2501.50.

NQ (Nasdaq futures) turned down on September 1, so it's been heading down for three weeks now, and has further to go.

Volume: Note that volume now expands with selling, but drops considerably when the market heads back up. This is yet another signal of the larger, impending top. Volume should increase during this fourth wave down. It will drop off suddenly towards the final fifth wave top.

Summary: The final wave five (an ending diagonal) in ES, NQ, and SPX is in progress. Look for wave E to head down to the 2445 area before a final fifth of fifth wave up to a new high to complete the 500 year bull market).

______________________________________

Sign up for: The Chart Show

Wednesday, October 4 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Joe,

We are approaching one of your cycle resolutions…the the post 6 weeks of the solar eclipse. Your time window for that resolution is September 28 to October 8.

I have a question for you…My recollection is that Dow 22,496 was a level you are watching, is that accurate?

DJI 22,496 very close to 1.618 fib for 2000 lows and 2007 highs….I am thinking we are gong to hit exactly 22,500.00 and reverse hard at a 500 year top. It would be most interesting if we fall away from SPX 2500 and we see it lag DJI on the final wave up with SPX making a double top at around 2500.00!

Thanks Peter.

Valley whats your take ..do you think we go higher to 2510/20 and then short it.

Hi Bill,

I am taking a rest from trading unless we see some sizable sell off as I am still bullish after middle/late October. As Verne has suggested there seems to be deep pockets that chase market higher each time a sell off occurs.

Staying short from last Thursday. All the best every one.

Will exit wed to go back long into early Oct.

Peter,

I’ll never get tired of saying thank you to your blog!

I know you said no ending diagonal pattern in BABA unlike BIDU

but my short worked today.

https://worldcyclesinstitute.com/mother-nature-always-wins/#comment-21753

LizH,

You’re welcome. When you asked me on 9/15, there wasn’t. There is on a 15 min chart now. You don’t necessarily know it’s an ED until the fourth wave is in place. The fourth wasn’t in place until the 18th (and the third, as well – same day).

Ahhh, ok Peter. I appreciate you pointing out my error.

Not your error. It just wasn’t formed. It looks like the final wave up was 5 waves and the small 5th wave became and ending diagonal. It would have had the same result. It looks like the entire market is correcting at the same time …

I have no idea who this is ( above) not Dave from Vancouver.

https://www.youtube.com/watch?v=a2aGIT7bV68

Red dog, thank you for the video. He has an amzn “if-things-really-get-ugly” 845 price target. There was an after hours flash crash last May 24, 2017 in some stocks. Among them amzn from 980 to 850.

Yes Amzn looks very ugly. Not sure how Pete see’s it but you would have to think its days are over. AAPL looks worse.

Randy is a very skilled chartist, one of the best I have seen. Thanks for the link!

I said about a month ago I thought AMZN was headed for the dustbin because they’ve leveraged themselves to the hilt. However, the wave down is corrective, so it still has one more high. The top of this market is going to be a candy store. So many stocks are poised to top at the same time.

Yep. The purchase of Whole Foods was the final nail in the coffin. As if that was not enough, then came the hubris signal of the announcement of brand spanking new headquarters….

https://invst.ly/59hmt

RUT is clear. wave c = 1.618 of wave a @ 1465″ish”….. [which just happens to be where the breech of the upper trendline is located]………. high of today 1462….. …BE WARNED!!!

Did you mean to say….”Be Varned!!”, Fraulein ? 🙂

LOL…..that’s only funny verne – “until someones eye gets poked out”……!!! BE VARNED!

I’m wearing my glasses as I ask this: “What are we being varned about?” … a C wave?

ahhh …. peter, peter……….”p.e.t.e.r”………”grasshopper”………, it is more than a final “c” wave – it is the “return of real risk”. ……… “wear clean undies, because you just never know when you will be in an accident!!! ” – remember as a child, those motherly words of advise???…. well – BE WARNED! – its TIME to reach for the clean undies again……………

but … but … a C wave retraces, so that means a new high.

little g-hopper (not be confused with “little rocket man,” but we just might be related (be varned)).

boss – i agree. we will continue to make new highs in RUT till we break over that upper trendline of the ending expanding diagonal……….. but we are REAL close to that break………..

methinks the RUT was the “risk on” index on the way up, and will be the “risk off” index on the way down – topping first……..

RUT is setting up an ending diagonal, so it’s in sync with SPX. It’s exactly the same pattern. I think we’re all going to party at the top together.

I would settle for being “Verned”.

🙂

Oh yeah! 😀

Party party??! Where?! ??

Peet! Holland on your agenda soon?

Cheers,

W

There is something truly spooky about the way the banksters are expending enormous amounts of capital to keep SPX pinned to the 2500 pivot…unbelievable!

Releasing my short’s from last Thursday. es 2495 11.00 am today Took the long route around. Good for only 7 points, Going long into Friday . All the best every one.

i would be a seller of the RUT at these levels…..

https://invst.ly/59vcb

Massively short IWM as of today’s close. Smooching underside of previously broken trend line, now very likely strong resistance.

Piled into UUP puts on nice doji above upper B band, same for XLF. These trades should all return easy triples over the next 30 days! 🙂

I was quite surprised by the new ATH in SPX although I was expecting it for DJT.

Looking like lots of blow-off moves today. Cheerio! 🙂

Went all-in short via Oct 20 SPY 247 puts @.97 today. Would like to hold till the October expiration based on:

-Peter’s ew 4 (then perahps 5 into the year end?)

-Andre’s down forecast into October

-passage of the Jupiter/Uranus opposition on September 27 (h/t Mr. Merriman)

Maybe I am a day or two early. just hope I am not a week early 🙂

5:12 pm et

oh I forgot to mention Tom’s dream (I am serious). Thanks Tom.

Ed

Yes we are coming into the end of the cycle .

I have been out of touch market wise so not going to state

A Dow price level . Had I mentioned that level prior then I’ll

Accept it yet at the moment I don’t recall , ( I’ll need to look it up )

Math wise though I was watching a 2.2 times retrace from the 2007 highs

To the 2009 lows as well as the 1.618 times the 2002 lows to the 2007 highs

Plus the 2009 lows . I use the 1.618 and 2.2 as well as 3.2 extensions which are not

Considered the norm ( 2.2 and 3.2 anyways ) yet they work for me .

Also on wave counts I use the bottom to top of wave 1 and

Measure 1.618, 2.38-2.854, then 3.618 5.618 8.618 13.618 etc….

Note that while I don’t mention the 2.618 it does sit between 2.382 and 2.854 .

Dave «———-*

I have managed to get myself a few extra days pay and will be in Portland Oct 1st

So it is looking like I’ll be there Oct 4 th for sure yet you may be traveling and getting

Situated so maybe Oct 5 th ???? Lunch .

Between work or hanging out with my daughter and having some what free rain from

Office I think that works .

Going to have lousy phone reception for another day .

I can post an email addy on here if ok with Peter ( it’s one I don’t use yet have from an old phone )

Joe

The fifth, sounds great for lunch Joe.

Wow. Looking around at different blogs, I seem to be on the wrong side of a positive trade for tomorrow. Still long.

Peter

I’m winging it here yet looking at your chart and with the benefit of hindsight yet no detailed updated data

I see your 3 ending diagonal s and with today’s New high in the spx can the entire wave from your starting

Point of the first ending diagonal be an ending diagonal or its own ?

Ending diagonal wave 1 ending diagonal wave 3 ? And today being the 4th ending diagonal in a row ( not shown on your chat )

Hence ending diagonal wave 5 ? Yet the entire pattern being 5 waves ending diagonal with each subdivision being their own

Ending diagonal s ???

Like I said I’m winging it yet …… That’s what comes to mind

A bit cooler along the coast as we travel north .

Joe

Price action looks very similar to July 6 to August 8. If that is what is unfolding, we don’t get a turn until Monday….

Verne, Monday is my turn day on my model. But than again, what do I Know.

I will be sliding in some shorts Friday for Monday.

In case anyone wants to buy into IYT tomorrow, I’m thinking it might just have formed a bearish shark pattern today with BC leg stopping at 113% of OX leg.

http://www.profitf.com/articles/forex-education/harmonic-pattern-shark/

Sunspot group rotating around toward earth (solar ham.com) will be earth facing in about two days. K index is up to 6 which is elevated.

Valley,

What are the implications of your post?

Elevated geomagnetic levels result in greater levels of energy on earth’s surface and atmosphere. The implications for markets are unclear, some suggesting market rises after, and some suggesting market declines.

With all the recent attacks on the site, I’ve had to harden it to repel them and I’m noticing that some of my regular commenters are having their comments sent to moderation. Gradually, I will get you into a whitelist, which should arrest that issue.

So if your comment doesn’t show up right away, I will get to it as soon as I can and make it live and then add you to the list, which should make the next one show up without my involvement.

Peter, are you meaning you are having cyber attacks on this site? Is there anything we should be aware of just in case?

No, it’s fairly normal these days. I just had to add a bit more security software and lock out a couple of ip addresses in the US.

But thanks for your concern.

Today is an odd day ( Sept 28 th ) I forget the opposition yet it represents tension .

As we move away from today the tension technically should ease .

The mars Uranus cycle I have finished re calculating and it shows a low today and a turn upwards

From Oct 14 th . Which won’t last very long but can be a strong move .

Dec 1, is the opposition . I’m not finished putting all the pieces together which include

Carolan research , mercury retrogrades , puetz Windows as well as the Venus mercury Sun aspects .

From what I have to work with though . Keep this in mind .

Sept 28 and Oct 14 are technically lows from mars Uranus only . Oct 19 th is a high .

Nov 7 th is a seasonal low and is also shown as a low based on mars Uranus only with

A Dec 1 high .

The present mars Uranus cycle on the surface looks similar to 1999-2001 .

I have not yet looked back further in history to find this similar relationship .

My plan is to take this to the next level yet at the moment I only know what

I have stated above . The mars Uranus cycle low is Jan 4 2019 . That is over a year from now .

Short term bias is bullish until proven wrong .

Long term bias is topping to bearish for the next year .

One step at a time .

Dave

I’ll plan on the 5 th .

Hitting send while I have a minute .

Better reception in the next day

Peter, I come here for your analysis only. The rest is mumbo jumbo.

I sincerely hope you are right because the financial markets need a reset

Due to all the manipulation. You say you see the market differently.

I admire your conviction that we are going to start a bear market when

Almost everyone else is saying we are in a long term bull market for the

next decade. At what point or spx price level will you have to reconsider?

Surely there must be some point.

It looks like SPX won’t get above 2550.

Thank You.

methinks the “hidden hands” of market rigging will pin this market till end of third quarter. That said, I will go out on a limb, and say the RUT will top first, and weeks later the rest of the indexes will top…..

https://invst.ly/5a8cz

Interesting wave numbering in the diagonal – hard to make out five distinct waves as presented…

verne,

this is the “broadening top” of a “broadening top” that i have been charting since 2014, and posting here for some time……

if you chug a bottle of good aged rum – i am sure you will begin to see those “waves” you desire……

https://invst.ly/5a98r

hmmm….bad chart shot above……..maybe this one is better…..

https://invst.ly/5a9b0

I did recently pick up a bottle of Bacardi Oakheart spiced rum to add a dash of daring to my home made pina colada! No one else likes that much excitement and insist on having theirs “Virgin” 🙂

Not an expanding diagonal. The pattern is incorrect, imho. I make it the top of wave 3, just like everything else. There’s no valid wave 4.

no worries boss – henceforth i will call it a “broadening topping pattern” – which would make it ‘non’ EW pattern…….

I have to say I continue to shake my head in amazement at all the confident pronouncements of how healthy this bull market is. Here is a recent summary from Lowry’s:

“In summary, based on the recent performances of

breadth, Supply and Demand, the bull market shows few

signs of faltering. Rather, given ongoing signs of long-term

strength, any short term pullback that might occur in the

weeks ahead should serve primarily as a buying opportunity.”

I guess everything depends on how they define “short term”….!

That is what I thought. One thing I have learned from Peter is to look carefully at the sub-waves. Of course not every technically valid pattern will confirm to EW rules. For example, I will consider a rising wedge to be bearish even if it does not meet all the rules for an ending diagonal.

Taking 2/3 of my longs from 2095 level from yesterday. Good enough to pay for Joes lunch. I will leave one on base for now. Depending on market action Friday, I will be going short into Monday. All the best every one.

Sold the 1/3 position. I wanted to wait until tomorrow, but I have to get ready for my conference next week.

Unless we see a big plunge in futures overnight, they will certainly ramp things up into the weekend so your long trade is probably still safe. I am holding SPY 249 and 249.5 calls as hedges expiring this weekend and plan on unloading tomorrow.

I am personally, looking for one more new high late next week to finally clean out the bears ( Tuesday – Thursday )

Yep. I sure looks like we have yet to make a turn. I think a larger fourth wave would be expected to decisively take out the important pivots of 2500 and 2470 on the initial move down. Hesitation around pivots in my experience has been a reliable tell that the bulls are still in control and the upward move is not yet complete. I am still looking for a fall of 2470 to be fully convinced the downturn has arrived. Hopefully futures will confirm or dismiss my theory this evening….

IWM making a new 52 week high today on substantially lower volume; the extremes and divergences continue – ongoing overbought stochastics, upper penetration of the B band. Never seen anything quite like it…not good!

The longer a reversion to the mean is delayed, the more violent is tends to be when it does occur….

The SPX reminds me of George Foreman fighting Ali in the 8th round…

Interesting analogy. We are witnessing the power of central banks largese.

I am impressed that they have managed to negate the seasonal declines typical of the months of May and September, historically the weakest month. Either we are about to see the mother of all mean reversion moves in the markets, or we will have to concede that the central banks are more muscular than we gave them credit for!

Yes sir! Obviously big losses occurred whenever I was fully short. Plus I am concerned that the ES closed above 2506 today. But I’d like to stay put and see where the market will be around Oct. 20. No pain, no gain 😉

If ES takes out 2509.25 overnight we could be in for several more days of more upside…

Got it thanks Verne!

Some alarm bells are really starting to go off in my head about this market to be honest. Despite all appearances to the contrary, no one and nothing can abrogate the law of mean reversion. It is an immutable law of Nature, like Entropy. My trading strategy was to anticipate a correction of some sort in September, which is after all historically the weakest month of the year. I got positioned over a month ago with October bearish call spreads but the market has continued relentlessly higher and here we are at just at about the end of September with no correction in sight. While I hedged my short position with SPX calls expiring tomorrow, it is beginning to look as if this year the month of September will buck its historical bearish tradition. My expectation of a final joy ride in a fifth wave up was strongly predicated on some kind of correction this month. I think the fact that we have not had one is ominous. I have been of the opinion that a continuation of the market extremes we have been seeing these many months with no corrective relief would not ultimately issue in a correction but in a collapse. I would often somewhat jokingly refer to what appears to be the banksters morbid fear of even the mildest correction possibly turning into something more sinister. Heading into the month of October with well over a year of not one single 5% or more correction, a ten year cycle year ending in Seven, and Nine Hindenburg Omens on the clock, one cannot help but wonder. Every single impulsive in this market for months on end has been arrested with relentless deep pockets buying- every single one!

Few wave counts consider this to be the case, but it seems to me personally that each day we go without a meaningful correction in this market, that argues for our being in a final wave up, with what is to come next far more than just a correction.

The market has confounded many a savvy observer over these many months and clearly no of us has a crystal ball. Nevertheless, the red flags abound, and despite the drumbeat of bullishness now being driven by the new DOW theory confirmation, something seems rotten in Denmark…!

I was really looking forward to that final fifth wave up…

ok verne,

before you read on – mix up one of those hard core pina coladas – relaxation will be needed…..

ok – here it is – Tuesday October 10, 2017 is my “lotto” pick numbers for the date of said collapse…….. stay with my on this one verne ………..why this date??

black tuesday was October 29 , 1929………. october = 10 month or 10 or [1+0=1]

the 29th = 29 or [2+9=11]

omg i hit submit before i finished……..

1929 = [1+9=10] or 1 and [2+9=11] or 11 so, what we had was a 111:111 in the date of the crash back then…….

so will this be Black Tuesday the modern version? October 10, 2017

october = 10 or [1+0=1] and the 10th is also [1+0=1] and 2017 is [2+0+1+7=10] which is also [1+0=1]…….so we have a perfect 111 in the date…….

so do you see why i had you mix up a pina colada verne!!! :-))

the RUT is in “blow off top” stage – there is no other way to describe the price behavior, and the absolute size of the monthly candle…..food for thought …….

GULP! Glad I had that ready! 🙂

Hello Luri, I also have the Monday the 9th into first part of the morning of the 10th as the next vulnerable date for the markets to tank. NO, I am not going out on the limb to say this will a 1929 style crash. As we know from a Ew perpective this will not be the case. I am on record, to say no more than a 12% correction. For the bears point of view, I hope I am wrong. Again to be perfectly clear. The 9th 10th is the next vulnerable dates for some kind of wave down. It maybe a case of testing the 2470 level or possibly more. Either way, we are in full agreement for some kind of down draft. Looking at my model, it should start from Sunday night trading hours. All the best Luri.

The 12% correction does not mean the dates of Oct 9 10th But the over all market correction for the next several weeks.

Not sure if anyone uses IG.COM platform to trade but a request has just come through asking for nationality and passport number. Seems very dodgy.

“Please verify your nationality by 1 December 2017”. Then it goes on to get your PP No.

Are they expecting something that we don’t know. (skeptic coming out)

Some thing is up, for down the road. Interesting times a head.

Dave

So i replied and asked if this was a con. Check this out.

Thanks for your email.

Please note that this is a new requirement base on the Markets in Financial Instruments Directive (MiFID) which is a new framework of European Union Legislation for investment intermediaries. I understand that this is private information, but we do need to collect them to fulfill our obligations. We’ll be much appreciated for your cooperation in this matter.

If you have any further queries please do not hesitate to contact us. Alternatively, please visit the IG Community where you can share ideas, knowledge and experience with other like-minded traders.

Regards,

Can you believe this. Now someone in Australia is being governed by some Clown in the EU.

Some thing smells fishy.

Bob Farrell’s Rule #10…

“When all the experts and forecasts agree… Something else is going to happen.”

For several years I have thought we were at such a point.

energy stream update

https://s26.postimg.org/9ocj1d2kp/sept_25_to_oct_17_energy_stream.gif

Thks Tom. It looks very close to what I have communicated in earlier comments.

I am becoming more and more convinced that we are wasting our time looking at the usual market metrics They are for the most part broken. Plain and simple.

I have never seen a market throw off as many bearish signals as this one the past twelve months yet continue to march higher. The fact is that the banksters are in full control of price action in the market for now and we will not see normal price movement until they loose it. The signals I believe are real in that they depict a market that is weak (literally years of declining volume!) and rising on fumes and prodigious bankster cash dumps. I do not believe we are going to see a market turn during the regular session as they simply buy every single impulsive decline. What I expect to happen to trigger a mean reversion in the market is some kind of exogenous shock and I expect it to evidence itself in the futures market, When I see them fail to arrest and reverse impulsive declines in futures, we will know the end is near, but not before – so this game could go on until the black swan flies….

I tend to agree with you Verne. For now, I am just going to act like a algo and take what ever crumbs the market will give me.

10 +19+2017= 10. 10. 10.

What happened Oct 19 1987 ?

Food for thought ol luri 🙂

My bias as mentioned the other day is it is a high .

The rest of the dates posted above .

Dave

Joeb6058 @ Gmail . Com

Just sent you a e mail Joe.

In my system 10/3 triggers a multiyear cycle down. Will expand on this in the weekend.

10/2 the trouble starts. 30 years ago we had the high 10/2 and we have Mars at 16.6 degrees. 10/4 we have Venus at Aphelion and 10/8 Mars at perihelion. 10/4 vedic Mercury is exalted (top) and 10/30 Vedic Venus debilitated (low).

The planetary cycles give this. jupiter and saturn are bearish and the Sun turned down 9/22. Mercury, Venus and Mars are still up. Mercury in to 10/5, Venus into 10/17 and Mars into 10/30. When mars turns down the first significant low will come 5/2/18 when the Sun breaks out of its channel,

10/16-17 will be a low. For the end of October I have 2 scenario’s. Venus gives a low and Mars a high. 10/23 strong date. So after the 10/16 low we could see a high end of October. But this will be within the longterm down trend.

10/5 will be a high. So I expect 10/3 high, 10/4 low, 10/5 high, 10/8 low.

10/11 is significant as it is 10 years after the 2007 intraday high on SNP and it is 1000 PI from 3/6/2009. Think 10/11 – 10/16 wil be a very significant down move.

The 40 year cycle gives the high 10/3 as does the solunar model (19 year). 17 week cycles give the high 10/2. So 10/2-3 the high, test on 5, down into 8, test on 11 and down into 16.

In short, longterm 10/3 marks the spot. During october some last sort term cycles run out of gas. Volatility will pick up next week. The swings wil get wilder. 10/3 will bring some panic. Once we are past 10/3 the trend down is irreversable.

Next few days will bring some disturbing news. Wonder what it will be 😉

Hi Andre. I am curious about why you think the bearish signals your system gave for September did not pan out. This is not meant as a criticism for as iI mrntioned,this has been happening for some time with other merics. The most clear recent example being the hanging man SPX candle that was “confirmed” by a subsequent bearish candle. As we saw, we went on to a new ATH! Just wondered what you thought might explain it.

Been working on a new system that brings new insights, Had I seen this before I could have you that October would be more significant than september.

And I did say 10/3 would bring clarity.

This weekend I will give some arguments for my current expectations.

Thx! 🙂

Andre’,

Thank You for the update!

Thks Andre’

the energy streams are showing an ugly October

https://ibb.co/j7ZRyw

Tom. Very impressive. Both of us seem to be in syink for the 1st hàlf of the month. One of us have our models inverted for the 2nd half. Some thing to be aware of. Thks

Some further thoughts Tom. We have option expiry week into your bottom, which is usually on the positive side. New moon on the 19th. Usually Full moon to new moon is positive. Of course that is not always the case. Hopefully sharp shooting Peter, will be able to give us some help from the 14th to give us some indication with EW. It is interesting from my model I have the 19th as a high and 24th as a slightly higher high. You have the 19th as a slightly higher high than the 24th. I am certainly willing to be wrong and act accordingly to get the most out this market. All the best

inversions can happen from one week to the next , so you have to be careful

I have been reading Chris Vermeulen’s last few articles on Safehaven and I feel kind of sorry for him. He keeps touting the predictive models he uses butt last four dates he called for volatility spikes the spikes were a no-show. He is certainly right in thinking that the volatility suppression has been extreme, but the fact is that it has remained so for quite some time. We have not had a true volatility capitulation spike in well over a year, something I have never before witnessed. The short trades will eventually unwind, but is quite evident that when and where is anybody’s guess. October should be interesting.

For the mystics among you… Ian Thijm is a confirmed cycles guy (Raj) who is pretty good. He has been talking recently about The 9 Days of Mother Divine potential Crash Cycle. See his Wednesday, September 20 comment on his public blog at http://timeandcycles.blogspot.com/ Although he says the details of the Mother Divine crash cycle are reserved for subscribers, I don’t think it is unfair or unethical for me to cite a public link from 2010 where he wrote about it in detail: http://timeandcycles.blogspot.com/2010/10/9-days-of-mother-divine-and-potential.html Today is the 9th day of Mother Divine. If it fits the pattern, it could be a secondary high before a crash. You might say it can’t be a secondary high because we hit new all-time highs yesterday…yes, on the S&P but look at the Dow.. today could indeed be a secondary high on the Dow as it failed to confirm yesterday’s new all-time high on the S&P. That’s “Raj’s” stuff. Now, draw a trendline from either the S&P cash high on December 29, 2014 or Feb 25, 2015 through the spike high on August 8, 2017. They should almost exactly overlap, confirming the potential importance of the line. That line was actually very slightly pierced on 9-18 and reached exactly on 9-20. Today it is between 2512-2513 on the cash. I would say if that is reached today it would be a low risk short on the futures with a stop just a couple of points higher. You should be able to sniff out that something important could well occur within the next few weeks!!! The one disturbing factor militating against this being an important top is the damn a-d line which hit another all-time-high yesterday. Oh well!

Hey peter…… “boss”……. i was listening to SGT report, and David Dubyne was being interviewed. At the 41min. point of that interview – Dubyne referenced you specifically – “peter temple”. so great was that reference – “gee” – i was so a proud “mom” hearing that – that is, if mom was a middle aged “man” with facial hair, a deep voice and shortly cropped hair…… …….. here is the url to the interview….

https://www.youtube.com/watch?v=v90Z54Sg8Gg

Thanks for the link Luri and the 111-111 idea.

But Joe mentioned 10/19/1987 to negate your thesis?

But 1987 = 25 –> 2+5 = 7. It’s neither a 1 nor an 11 so…

I’ll be looking out for indicators for a possible mini crash on 10/10/2017.

Perhaps save the big crash for 11-11-2018 (2+1+8=11) ?

or 1/11/2018? 1/29/2018?

no worries Liz – my pleasure. ……..as for the 111 “thingy” – well it only works intellectually – only if you have been “drinking”, for some extended period of hours……..

i was specifically looking for a “tuesday” for the 111….as you know 10/1/2017 is also 111, but it lands on a sunday…….. maybe we get sandwiched in between 10/1/2017 AND 10/10/2017 for some market fun — although i do like your suggested dates in 2018…… ! …and remember, health and laughter, family and community are real – the markets – “not so much”!

oh yeah liz – the “why” as to Tuesday – well i consider Saturday is the last day of the week – so sunday is the first day of the new week. that would make Tuesday the 3rd day……and as you know 3 = 1+1+1 or 111…..that is why Black Tuesday 10/29/1929 – it was really 111:111:111 – go figure….!

My last post for a while. I need to take some time off. I am sure a few of you will be happy. LOL I am going to slide in some shorts for Monday. Slide back into longs till Thursday. Fully expecting a bear trap from the 11th into the 19th. The 19th is Joes day. I have a Double top on the 19th and the 24th. I fully expect Mr Market to slay the rest of the bears by the 24th. Bottom line, The bears are going to be feeling a lot of pain. Good luck to every one.

The 9th possibly the 10th will set the bear trap before Mr Market ramps up the markets to new highs.

Looks like Nasdaq Comp shot above the top line of wedge today. Now looking for an impulsive decline below lower wedge boundary to signal that’s all she wrote!

Gann used 2 ‘mastercharts’; the square of nine and the square of 12.

In the square of nine 1057 is at 225 degrees. If a month is 30,4375 days, then 1057 months on the 1929 high gives 10/3/17.

The square of 12 is 144. Gan’s great cycle is 144 squared, Within 144 we find points of resistance. One of these points is 131. Adding 131 times 144 to the 1966 high gives 10/3/17,

2 mastercharts on 2 major highs give the same date. This is what kept the market going. A 90 degrees move brings us into 2020 and the next resistance in the great cycle 2019,

One challenge in forecasting is that international markets are not (always) in sync.

9/20 was a major date and should have been a high. DJIA gave the highest close that date. Since 9/20 DJIA is flat (-0,04%), In the same period the DAX did +2%,

The yoga cycle gives 9/20 and 10/16. The midpoint is 10/3, So it really seems Wallstreet obeyed 9/20 while Europe targets the midpoint. Big move can only come when all markets are in sync. Ergo; for a decent forecast we need to analyze both European and American markets. The us markets won’t go down when Europe is up.

Everything I see pints to 10/3. And then we have basically one cycle down into 10/16. This will be a low.

As I said yesterday; the end of the month is less clear. My Mars cycle gives 10/30 a high but vedic Venus is debilitated at the same date.

When Mars turns we are down into 5/2/18 as a first low.

The composite Garret timing on Dow and SNP give the high 10/2 when Mars is at 16,6 degrees (+150). Eurostoxx gives the high 10/4 when Mercury is exalted.

BR 7 (venus and Mars at aphelion/perihelion) gves 10/4 and 10/8. Please note Venus and Mars have very different cycles, so when they converge whe have an exeptional situation. 10/9 Mercury 80 years ago new sign (Bayer rule).

Tidal inversions is a timing system unlike anything else. These inversions come 9/30, 10/5, 10/8, 10/13. 10/17-18, 10/20 and 10/29. 10/17-18 the inversion lasts 2 days. This indicates this is a major turn period. The venus cycle gives an inversion 10/17. And 10/29 is a sunday so 10/30 is the date; same as the Mars cycle.

In short. 10/3 Is the strongest day of the year. And a fundamental change in trend. Even if the market goes for a high by the end of the month, the trend stays down.

The 30 year cycle gives the high 10/2. The 40 year 10/3. Composite 17 10/2, composite 19 (delta) 10/3.

Lumber gives a low 10/2, a high 10/11 and a low 10/16. 10/11 very significant. So I expect some consolidation with a bearish bias into 10/11. But from 10/11 down into 10/16 should be volatile move.

Quote from Yellen :

“My colleagues and I may have misjudged the strength of the labor market,” Yellen announced on Tuesday, adding that they’d also misjudged “the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation.”

I other words; they don’t have a clue but manage trillions of dollars. I would find this humor if it wasn’t so sad. Would you enter a bus knowing the driver is blind? I’ll walk.

Cheers,

André

The one thing that has consistently worked for me lately is watching price action around contested pivots. Lately it has beeb the one in the 2070-2080 price area. When it was decisively broken to the downside a few weeks back I knew a short side trade was in order. Upon its recent recapture I suspected the bears were in trouble and that indeed turned out to be the case. It has been very obvious for many months now that contests around these pivots are almost always won by the bulls. The way you know that you have a decline that truly signals a trend change is that these pivots are taken out back and summarily shot, so to speak. Any resistance will at best be a brief back-test of the pivot which is usually forcefully rejected intra-day. A protracted battle means the bears have already lost. You will know we have a genuine new downtrend when 2470 falls like a ton of bricks. Until then, I would keep dry powder…

Peter g

Thanks for the link , I’ll dig into that and see if I can learn something .

Andre

Thank you for your thoughts

Your may 2018 low caught my eye yet for different reasons than you .

I don’t have all my pieces of the puzzle together for next year but

Here is what I’m considering and briefly why .

The present mars Uranus cycle we are entering has a similar pattern to it

As the 1999-2001 cycle did ( on the surface ) so my initial thought was

Are we going to see a mini crash into April 2018 ? ( very rough thought )

If so it would be similar to the crash from March – April 2000 .

I can’t at this point back that up because I have not put it all together yet

But from my point of view it will be worth further research once I’m home

And can commit more time to prove or disprove the idea .

Also just more speculation at this point .

The year 2000 was basically a sideways trend for the most part in the Dow despite

The crash in the nasdaq .

We had an April low in 2000 then a low in Sept 2001 which aligned with the mars Uranus crash cycle .

Then the bounce and further decline into the July and Oct 2002 lows .

My speculation at this point ( no cycle work done yet I intend to dig deep on this )

Is that we may see a similar development take place . A possible April may 2018 low similar

To the year 2000 a bounce then another low into Jan 2019 which is similar to the Sept 2001,low

Then a bounce and a further decline into late 2020 or early 2021,which is similar to the July and Oct 2002 lows

Which may include March 2021 . At this point it’s just an outline yet I’ll continue to put the puzzle together

Cycle wise and planetary wise and see how much it all fits or not .

My point to it all is this decline fits together and also dove tails with the benner business cycle then

We have a much longer bearish cycle than most anyone expects yet it will not be a straight down affair

So if it all holds true there will be good trades to be made both bullish and bearish .

A ton of money to be made or lost if one fails to be objective or keeps an open minded view point .

The trend though should be decidedly down and for many individual stocks it should be extremely

Negative .

Just a ramble at this point .

Joe

Thanks Joe; seems we agree,

Andre’ and Joe,

Thanks for your insight! Both posts were excellent reads.

Every Saturday I get free email on my inbox from JLyons Fund Mgt…Always interesting. Today’s email focused on the VIX…more specifically the…

…Non-Commercial Speculators’ Net Position in the VIX Futures…

…a quote “just 5 years ago, the largest ever net-short position for Non-Commercial Speculators in the VIX was around 30,000 contracts.” By comparison this past week the Net-Position VIX of that group spiked to a record of more than 170,000 contracts.

The shorting of volatility is now, and has been for some time a theatre of the absurd. There are other ways in which volatilty has been artificially suppressed to mask true value at risk and permit algos and risk managers to continue to lever up on long trades in this market. The current situation is going to make the unwind of LTCM look like chump change. The strange and sad irony is that the banks have already made arrangements to seize depositors’ money to cover their reckless bets. I remain long volatility. It is the biggest one way bet you will see in your life time.

The one caveat is that the trade has to be structured to possibly withstand some short term pain as the insanity could continue a while. Few people are aware that John Paulson was seriously under water for quite some time before his famous housing bubble short turned in to the greatest trade in recent memory.

In my humble opinion, the madness we are seeing with respect to distorted volatility metrics presents an oppotunity equal to the one Paulson exploited. Few will take advantage.

Verne,

The Non-Commercial Vix Position is a “Net Short” a 170,000 contracts. As I re-read my post…I did not do a good job of making that clear. I appreciate your comments on this insanity!

Arguably the most crowded trade in the history of markets…

Wave 3 not quite done yet, IMO. You’ll get steam rolled if you try to get in front of this.

Not quite, but it is close. Lots of bearish divergences everywhere. Not too early to get positioned imho… 😉

Fully agree !

Fully agree Dan.

yes, I think we are still in a smaller degree iii with a smaller iv and v left to go before we get to a bigger wave 4 correction. Again, just my opinion.

Hopefully wave 4 down early next week. Oct 9th 10th

A new blog post is live at: https://worldcyclesinstitute.com/one-market-two-waves-one-trade/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.