Booms and Busts. Both are inevitable in our current fiat-money/debt-based financial system. There’s just no getting around it. It’s a system designed to pad the wallets of the banking community to the detriment of everyone else.

| “Whoever controls the volume of money in any country is absolute master of all industry and commerce. And when you realize that the entire system is very easily controlled, one way or another by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” |

| President James Garfield, 1881. |

If you understand the concepts of inflation and deflation, that they’re a measure of the quantity and subsequent value of currency, and how our system works, then you know we have only one direction left to go – depression. That is, unless we change the system.

The system must be changed, or we’re about to witness the demise of civilization as we know it today.

The Basics of Inflation and Deflation

Inflation creates a “boom”; delation, just the opposite.

Inflation creates a “boom”; delation, just the opposite.

Inflation is an increase in the amount of currency in circulation. More money in society is good for commerce—to a point. It’s like everything else in terms of supply and demand—finding the right balance is key to a balanced economy. Left along, the market will regulate itself. However, bankers and governments both play a role of destroying both the market and our livelihoods.

Let’s take tickets to a soccer game as an example. If you build a new stadium in your city, you need to get the number of seats right for the size and interest of the community at large. If there are too few seats, the price of tickets is likely to go up, and may be prone to scalping. There’s not enough of them to fulfill demand.

However, if you build the stadium with too many seats, guess what? You’ll probably have to discount the price of the tickets to fill the stadium and may end up giving away a certain amount of them. Too many tickets reduces their value.

It’s the same with money. However, you don’t necessarily see the value of money fluctuate. There’s nobody selling a $20.00 bill at reduced rates. What happens is that the prices of products and services reflect the value of money.

If there’s lots of money in circulation (more than necessary to meet basic needs), then prices of products and services go up in price (e.g.- houses and cars). In actual fact, it’s money going down in value that causes prices to increase.

On the other hand, if people are losing jobs, and the economy is faltering, the value of money goes up—there’s not enough of it to go around. Therefore sellers of products and services have to discount their prices. There aren’t enough people with discretionary income to purchase those soccer tickets. You have to discount the price to make them affordable. That’s deflation.

The solution, of course, is to get more money in circulation. But, our monetary system makes it almost impossible to do that. After all, the government isn’t giving away money to everyone. (Well, not unless you live in one of the Nordic countries, like Sweden, Denmark, Finland, or Iceland, where they’re considering a basic income program).

To understand how money gets into the current monetary system in place in all the G7 countries, you need to understand fractional reserve banking.

Private banks (owned by private bankers) in all the G7 countries create money in their respective economies. When they create money, they’re also creating debt. To create debt, they need willing participants, like you and me, to take out loans. That how we create inflation. If there aren’t enough loans being created, the money supply deflates, and we go into deflation (a recession or depression).

The Basics of Fractional Reserve Banking – Making it REALLY Simple

We have a money system called “fractional reserve banking.” Sounds complicated, but it’s not. The government requires that private banks keep a fraction of the money they lend out in reserve. So let’s say that fraction is one tenth.

That means banks have to have on hand 10% of the money they lend out. If that sounds a little weird, that’s because it is. Actually, it’s downright crazy! It’s fraud.

Let’s say I open a bank – Peter’s bank. My slogan is “Loonie is my middle name.” Let me explain.

Let’s say I open a bank – Peter’s bank. My slogan is “Loonie is my middle name.” Let me explain.

In Canada, one dollar is in the form of a coin. It has a picture of a loon on it (even though the loon is not our national bird, it “flies wild” all over Canada—a slight nod to inflation, I suppose).

So I’m picking this slogan just so people know I’m really knowledgeable about banking (lol), and it speaks to the business of banking in general (as a double entendre).

I’ve been able to raise $10,000.00 in equity from investors and $5,000 in savings from clients. I’m going to peg $10,000 as the reserves I need and stick that in my bank vault for safe keeping.

I need a “float” (money to be used day-to-day for people who want change, to retrieve some of the deposits, etc), so I’ll go to the national treasury (in Canada, it’s actually the Bank of Canada that prints our bills and coins) and buy $5,000 worth of cash.

Nobody ever wants a lot of money, so the rule is you have to have enough cash on hand to handle day-to-day withdrawals for a period of 30 days. That’s all the amount of money a bank needs to keep on hand. With that, I’m in business! Scary, eh?

Let’s go back to the vault. There’s $10K in there and that means I can lend out $90k … because I have to keep 10% on hand. That’s the fractional reserve regulation in this case.

OK, now let’s say Fred comes in and needs a loan of $50,000.00. That’s OK because because 10% reserve banking allows me to lend out $90K, even though I only have $10K to back it up. Crazy, right? But, that’s the law.

After he’s approved, I press a computer key and guess what, $50K appears in his account! It’s double entry accounting so it’s entered as a &50K liability to Fred (that’s the money I’ve placed in his account that he owes me back at some point). On the other side of the balance sheet, I also enter $50K as a bank asset, because I expect to get paid back, so I’m allowed to call it an asset … even though there’s not actually anything there.

After he’s approved, I press a computer key and guess what, $50K appears in his account! It’s double entry accounting so it’s entered as a &50K liability to Fred (that’s the money I’ve placed in his account that he owes me back at some point). On the other side of the balance sheet, I also enter $50K as a bank asset, because I expect to get paid back, so I’m allowed to call it an asset … even though there’s not actually anything there.

And voila … I’ve created money. Fred has 50,000 digital dollars that he owes me and I have an asset of $50K. Plus I still have another $40K (sort of) that I can lend out just the same way.

My payback is the income I’m going to get in compounding interest to allow me to keep that computer key greased up and ready to go again (that’s about all I have to do for the interest income). And the longer you don’t pay me back, the more interest you owe. In fact, if I get 10% in interest, after 7 years, I will have made $50K in interest payments. Pretty good business! A good return for pushing a button on a computer and greeting you at the door with a big smile!

Now, let’s say you bought a car and that $50K goes to the dealer. The dealer puts it in his bank account and you get your car.

Now this second bank has 50K of new money in the vault, and as long as the banker keeps it in the vault in reserve, he can loan out $450,000 in loans, even though he only has $50K to back it up.

This goes on and on and you can see that the new money increases many times over, as does the debt. In fact there’s a real incentive for private bankers to increase the money supply, because they have no costs (other than overhead), it creates an asset on the balance sheet, and they’re making money in interest as they sleep. It’s an upside down pyramid scheme. The more loans, the greater the debt, the risk, and the digital money in circulation.

That’s OK as long as the debt gets paid back on an ongoing basis and more money is created. But when the economy begins to falter, well, that’s when things get a little weird.

What happens is that first, the government lowers interest rates. This causes the population to think that the money is almost free and so they go to the bank for more loans. The banks aren’t making as much interest income on each loan, and so they’re happy to compensate by issuing more loans. After all, there’s really no additional cost to them to do so.

As a result, the bubble really takes off and grows and grows and grows. Real estate prices go through the roof, mortgages increase to less and less credit-worthy people until all the players start to lose confidence that all that debt will ever get paid back. Banks stop writing mortgages and loans. In fact, money and credit become tighter and all through the economy, there’s a bit of a “shudder.”

The banks are not really all that worried, because there’s deposit insurance, after all, and not everyone wants their money all at the same time … until they do.

And what we have then is a bank run. Because deposit insurance can handle less than one percent of the problem. It’s completely inadequate.

And that’s why in 1818, 1837, 1857, 1873, 1893, 1907, and 1929, there were runs on the bank.

That’s also why you want to pay close attention to what’s happening this year in the economy. Because if there’s even the slightest indication that any of the big banks are facing issues, I’d want to be the first one in line to get the “real” money you put in in the first place.

Feeding the Spiral

The bottom line is that more money in circulation fuels inflation. Everybody’s happy in the short term, because the economy appears to growing as prices gradually rise (we’ve been brainwashed into thinking this is good), even though the irony is that it’s slowly eroding our standard of living. Our wages simply don’t keep up with rising prices.

The bottom line is that more money in circulation fuels inflation. Everybody’s happy in the short term, because the economy appears to growing as prices gradually rise (we’ve been brainwashed into thinking this is good), even though the irony is that it’s slowly eroding our standard of living. Our wages simply don’t keep up with rising prices.

We’re also paying back those loans in tomorrow’s dollars, which are gradually being reduced in value because there are more of them in circulation, which makes the debt easier to pay off. But when deflation becomes the norm, tomorrow’s money becomes scarcer and increases in value, so it becomes more and more difficult to pay back yesterday’s loans.

Once we reach a certain point of inflation, prices reach such a height that we can’t afford the products and services. The economy levels off, purchases stagnate, people start to lose jobs, mortgages become harder to pay, real estate prices level off, and we start down that long, spiralling, deflationary road. Governments, although they promise just the opposite, usually add to the dilemma, with policies that are deflationary.

Here’s a list of the things that we, as well as governments and banks, do to exacerbate the problem—to feed the deflationary spiral. Once you get into a deflationary period, the last thing you want to do it take money out of the economy (out of circulation), because that only makes the situation worse.

Paying Down Debt: Under the current system, with double entry accounting, paying down debt actually makes money disappear—it takes it out of circulation. 97% of money these days is digital (it doesn’t really exist in reality—it’s a digital entry in a computer, moved from bank to bank) and when you reduce the liability side of double entry accounting, the asset side also gets reduced by an equal amount. Banks end up losing assets, which affects their credit-worthiness. In any case, money leaves the economy. It deflationary.

Hoarding Cash: There are two sides to this coin. In an inflationary economy, the wealthy get richer and the poor get poorer. The wealthy become so rich that they have more money than they can ever spend and it just sits there idle. Because they tend to own assets that attract interest or one type or another, there’s a never-ending stream into their bank account, taking even more money out of the economy as time goes on.

On the other hand, the poor and middle class start to lose confidence in the economy and in Europe these days, they’ve already started stashing money away in basements and mattresses. This reduces the “velocity of money,” which is another way of saying there are fewer and fewer transactions taking place (there’s less money in circulation).

Fewer Loans: Banks begin to worry about the amount of money they have out in there in the economy, particularly as loans start to go bad. Businesses start to fail and mortgages start to default. Banks start to reduce the number of loans they make, further reducing the amount of money they’re creating. Creating loans (debt) is the only way we have to create more money in today’s monetary system.

Another way to inflate is to reduce taxes, but in today’s world, for all the same reasons, governments are bankrupt, and lowering taxes is the last thing they’re going to do—they need the income too badly.

Compounding Interest: Compounding interest is the core of the problem. When you pay down debt, you’re actually reducing inflation. In other words, you’re paying back new money that was created out of nothing. But when you pay back interest, you’re paying it with existing money that’s already out there in circulation. In other words, you pay back the principle you borrowed, but you have to go out into the economy and find additional, existing money to pay back the interest you owe on top of the debt. This interest is taking money directly out of the economy. It’s deflationary.

Inflation: Inflation in itself, over a long period of time, actually causes deflation. It gradually lowers the value of our money until it’s worth so little that we can’t afford to buy any “nice-to-have” items. So we stop spending except for the basics. Retail sales tank. Business start to fail. This is deflationary.

Minimum Wage: The raising of the minimal wage is what finally killed the Roman Empire. The army demanded more money because the value of the currency of that time had declined to about 5% of its original value. Increasing the wages of the army (it was so large) bankrupted the treasury.

Today, raising the minimum wage forces employers to reduce the number of employees. That’s because deflation has already decreased the number of transactions and the amount that people are willing or able to pay for products and services. Employers end up getting squeezed on both sides. The rise in unemployment becomes a bigger drain on government and the economy in general. It’s a deflationary move and it always happens in the early stages of a deflationary environment.

Increasing Taxes: The recent move to energy taxes (we have an energy tax in my province of Alberta that 63% of the population disagrees with—and, of course makes no sense from an environmental perspective) that takes money out of the economy. Governments always do the most stupid thing at the most ridiculous time.

The Sharing Economy: The “sharing economy” is both a result of deflation and leads to additional deflation. It reduces the number of transactions in the economy and the dollar amount of these transactions, both of which are deflationary.

Rise of the Value of the Reserve Currency: This is an indicator of deflation. The US dollar is the reserve currency (still) and as it increases in value, it indicates the fact that deflation is increasing. When the value of money increases, there’s less of it in the economy. Prices of assets (houses and care, for example) decrease, along with wages, and employment.

Increasing Bank Reserves: As the private banks start to experience more and more bad loans, there’s a move by central banks to require them to increase their reserve percentages. When they do that, of course it reduces money in circulation. If you reduce reserves from 10% to 15%, that extra five percent is taking out of the economy and goes into the vault where it sits there waiting for the eventual bank run.

And this is only a partial list!

This is the crazy system we’ve had in place ever since the Bank of England was formed in 1694, a system based on usury, with the Rothschild family dynasty as the core. It’s a predatory system that’s ruined the world’s economy. It’s what the upcoming revolution is all about. It’s going to get really, really nasty. These banksters play hard ball and they don’t like to lose.

| “Let me issue and control a nation’s money and I care not who writes the laws.” |

| Mayer Amschel Bauer Rothschild (1744-1812) |

Coming next week: a proposed solution.

___________________________

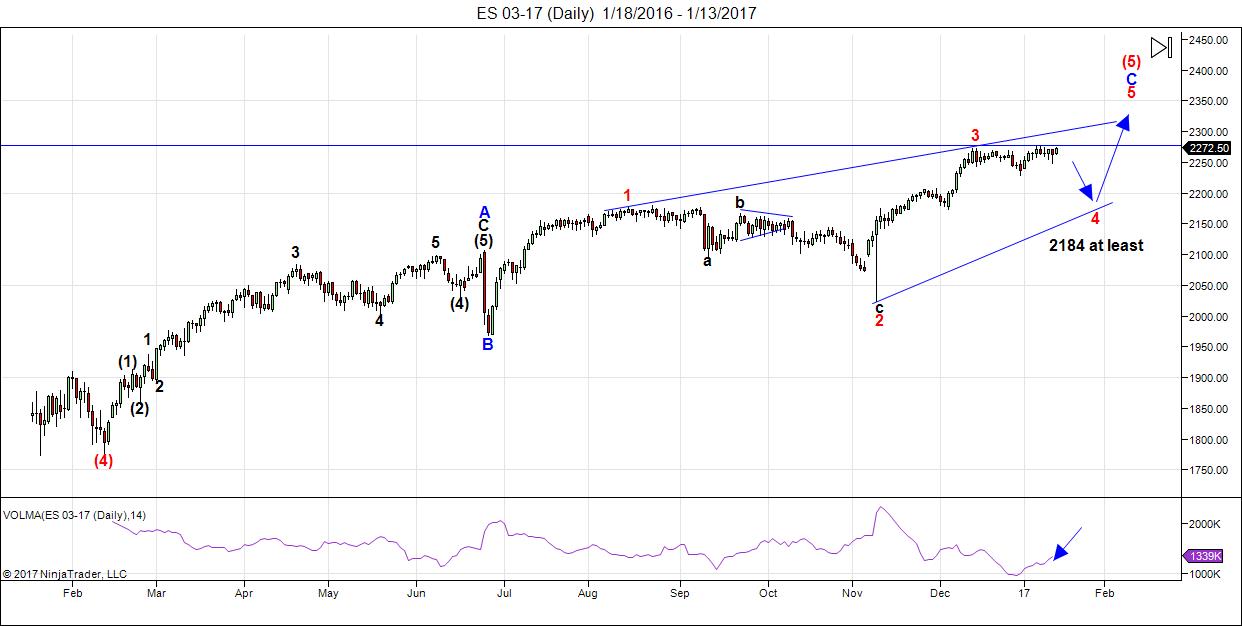

Projection for a Top

This weekend is a change in trend, from up to down. Expect the 4th wave of the ending diagonal to start on Tuesday at the open, or shortly thereafter. I count the third wave complete or almost complete with a double top in the works. USD currency pairs have now all turned as well. My “all the same market is alive and well!”

Wave three of the ending diagonal has taken 8-9 weeks, depending on whether you count the double top of the past few days. Under than scenario, I would expect the fourth and fifth wave combination to take less than that same amount of time to find it’s way to the top.

The length of the fourth wave down (and the stopping point) will determine the length of the fifth and final wave up (and the stopping point). The fifth wave of the ending diagonal cannot be longer than the third wave (about 253 points in ES).

NEXT Federal Reserve Annct: February 1, 2pm EST

______________________________

Change in Trend: Here’s the latest daily chart of ES (emini futures):

Above is the daily chart of ES. I’ve been warning my Trader’s Gold subscribers of an impending top that might not make it all the way to my preferred fibonacci ratio stopping point. That’s exactly what we have—a change in trend coming early this week.

We’re at an Andy Pancholi major turn date this weekend. For more information on Andy’s monthly cycle projections for the US indices, gold, oil, the US dollar and oil, you can go here.

Volume has picked up and I expect it to pick up even more as wave four unfolds. Wave four will unfold in three waves and needs to reach 2184 at least to stop in the area of the first wave of the ending diagonal.

Here are the rules going forward:

- Wave 3 must be shorter than wave 1 and reach a new high.

- Wave 5 must be shorter than wave 3 and reach a new high (usually it does a “throw-over”—extends above the upper trendline defined by the tops of wave 1 and 3, but it is not necessary.

- Wave 4 must be shorter than wave 2 and must drop into the area of wave 1.

- All waves must be in 3’s (zigzags).

- The trendlines of the ending diagonal must converge.

Summary: We’re beginning the fourth wave of the ending diagonal before zigzagging to the top of the largest bubble in history. The long awaited bear market is getting closer.

Good trading!

___________________________

Sign up for: The Chart Show

Thursday, January 17 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won’t find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Aaaah Peter…..such is the burden of a ‘leader’!! We DO miss your posts.

Having said that I’m too inebriated now to comprehend…..but I DO promise it will be read in detail before you are awake in Canuke land. I don’t promise to ‘comprehend’ though.

Thanks in advance.

Canuke!? CANUKE?? That’s like me calling you Brattish … which at the moment, pretty much nails it, I think, no matter what nationality you are!

Perhaps I should stop posting after a certain time in the evening!! Lol.

Haha! No, it let’s us be even intellectually for a short period.

You are a ‘GRACIOUS’ host. Many thanks.

You’re my favorite weekend read, and not only for trading. Thanks for what you’re doing. I hope we’re finally in for a ride…the best things in my life have come after shocks / crises (btw krísis = change, turning point in ancient greek…so you can’t basically change without a crisis).

This world needs to change, big time, imho. Since the market seems to influence or at least reflect the current world situation so much, I surely hope for a crisis, a big one, a 50%-ride-down-how-the-he*k-could-it-happen one 🙂

Have a great week everyone!

Alex

Thanks, Alex …

A krisis you shall have (not that I have anything to say about it).

And Purvez can’t say anything about it, cause he’s drunk and absolutely no use to me now … lol.

The first set of waves down should be 50% – don’t want miss that one.

Ahah…yep, don’t wanna miss that one for sure…let’s say I started to short a little earlier than necessary 😀 (damn…)

I probably should have clarified the entry … certainly during market hours, with a stop just above the 62% level. We’ll have to wait to see another setup.

Thanks Peter, I entered on my own, my mistake, your call was perfect!

peter,

i am well aware of the “unicorn” status of “truncation” – and that we can argue till the different shades of azure blue begin to color our faces ……..- so “IF” after 4 completes, and “IF” we get to the final wave 5 – […now peter, you best take a seat for this next sentence]……. peter – here is the next sentence……, wave 5 could..ahhh……[cough]….ummm….wave 5 “COULD TRUNCATE”!!!!! ok i said it!

OMG….peter……peter……..are you ok?? i think you must have fainted, i ‘told’ you to take a seat first…..

Can we agree, that if in the EW world of unicorn ‘truncation’ in which “it ain’t gonna happen” , that IF wave 5 just “happens” to truncate, …..can we agree to be adult about it, and can we agree to “giggle” like school girls about it, rather than the obvious canadian alternative -……………………… “tipping cows”.

yeah, so i read this book once that said all Canadians “TIP COWS” when they are upset……. what a wonderful kind and warfree world this would be if we could all just do what canadians do when they are upset, AND “tip cows” ……… Btw, i have booked Rosie O’Donnell and Oprah for 8 weeks from now “JUST IN CASE”!!!

Here is a good example

https://ewminteractive.com/truncated-fifth-wave-the-black-swan/

could happen, just be ready if the bottom of the 4th leg is broken. we are a fair way off considering this option yet.

Well, that’s a really incorrect count in the middle of a much longer wave that continued on until June, 2015. It certainly isn’t a truncation. And you can’t label a wave 1 and then a little while later higher up the ladder decide you’re going to have a wave 2 all on its own (first chart). He or she is showing a 5th wave truncation as part of a correction that actually continues up to a new high (if you were to look at longer pattern, that conveniently hasn’t been shown). Based on this chart, I wouldn’t be frequenting the site for a correct EW count. Pretty wild stuff!

Thanks for the clarification. Hard to get the truth or something that is accurate these days.

It’s never happened before in the history of the market and currencies predict just the opposite at the moment, but yup, maybe this time is different.

Luri

you made me laugh ,

My kids spent some time in eastern Oregon many many years ago .

My son told me about ” Cow Tipping”

He was 11 years old at the time and it was something the kids

did when bored.

The next few days will be important no doubt about it .

watching:

ym 19739-19732

below that 19718-19711

Mondays holiday makes Wednesday the key day .

with Jan 20th the cycle low date and option expiry along with it

ill key on price yet not going to get to excited at this point

2247.70 still matters on the ES H7.

Thank you for the update peter 🙂

5 day trin sum closed friday at 6.95

it will take a closing above 1.61 tomorrow to give a more oversold reading

10 day trin closed Friday at 1.28 still not yet above 1.40 to give an official

oversold reading, this is the highest oversold reading since the sept 26th

reading at 1.394 yet as noted before we are getting up there .

11 day trin closed friday at 1.39 and in doing so this is the most oversold

reading by this indicator since the sept 19th closing at 1.628.

Limit order to buy YM h7 19735 or better has been Placed.

Ill let the market decide .

Good Luck everyone .

( Myself included )

🙂

out at 19790 55 pt gain

limit buy at 17963 placed

Since I’d like to pretend to be a ‘culture vulture’…..I need to understand this ‘cow tipping’ thing please.

a) Does it involve money?

OR

b) A very LARGE wheelbarrow, strong muscles and a large open pit?

Please say it’s the latter as I can think of a number of them that I’d like to build up my muscles for. IT WOULD BE WORTH IT!!

Honestly, I’ve never heard of it before, but also hope it’s the latter. In any event, it will take six months to find out as cows are likely in their jammies indoors up here right now.

‘Cows in jammies’ Now ‘THAT’S’ a sight to conjure up. Molly saying to Fannie…..’is this flannel itchy or what?!’

Well, all I know is that if I had my nipples exposed for 8 hours a day in the weather we’re had here lately, I wouldn’t be giving out many favours, much less milk. And if you were thinking of tipping me into a wheelbarrow, it would be major methane production time, imho.

Hahahahaha!! I DO LURVE your sense of humour, Peter. Were you ever a ‘stand up comic’? It’s something that I’d like to do ONCE!!

…..did I just say that in an open forum? It’s a good thing my better half doesn’t lurk here!!

No, I’d thought of it once or twice. On stage comedy is way too tough! However, I was born in London, and that helps a lot … 🙂

You know the best humour is British. We come in distant second.

Yes at the moment is ‘Mock the Week’ and ‘Not the Nine o’clock News’ are the best I’ve seen in ‘live comedy’. However if you ever want to go

back in time and watch the serials then here are some of the ones I’ve loved BEST|:

‘Allo Allo’

2.4 children

Absolutely Fabulous

Oops there are a TON more but it’s probably easier to ‘google’ the following:

english popular comedy one hour tv

Fawlty Towers eh? You are showing your ‘pedigree’ my friend!! We got given a box set by our son of the ‘recently and untimely’ late Victoria Wood’s stand up routines (may even contain some of her TV serial stuff…I DO hope so), which we are eagerly waiting to view…once we can get the ‘odd hour’ together!!

There is also a more ‘intellectual’ one called QI by presenter Stephen Fry. This is guy is amazing.

The challenge is getting access to this cool stuff over here. I’ll have to do a bit of digging. I’ve just about worn out my Fawlty Towers DVD …

Thanks for the titles and google search term.

Protective stop placed at 19735

if stopped out im done for today

Cow tipping lol

what they would do is sneak up on cows at night

cows sleep standing up . they would sneak up to them

and push them over . it takes a bit of a push yet

they were able to do it .

i tend to think i may have screwed up taking this 2nd trade today

ill let it run for a bit to prove me wrong but only because

i had an earlier decent trade.

Wednesday is more important as is getting past option expiry

along with what ever comes from the trump speech .

a break below 19735 on the Dow futures leaves me to re think

what is going on .Ill move the stop up if i am able

Joe

booked it ,

$400 for the day .

im thinking something changed yet im still bullish

if the dow YM can get above 19728 i would have taken my position out

yet i think the 19840 area is now resistance of something else forming.

this B wave was to deep in my opinion .

yes the trades worked yet ill call it luck .

finished for the day .

even a continuation to just above 19904 in wave D would require

a drop back below todays lows and in doing so negates the triangle

i posted friday .

ill re think it .

Joe

typo

19828 resistance where C= A

19840 as resistance means some kind of complex

wave forming or a further sub division of this triangle .

all things asside im happy with the day so im done

Joe

Very nice trading Joe. Looks like you book ‘smallish’ profits regularly!! That’s the ‘way to go’… I too work to get 50 points a day from the DJIA. It becomes easier once you ‘focus’ on the ‘behavior of a ‘single’ index.

Nasdaq 100 concerns me with my bullish bias .

i have not dug into the pattern in detail yet looked at someone

else thoughts over the weekend and on the surface his thoughts

made sense yet as noted i have not dug into it and i am trading the dow

not the nasdaq . that said the qqq has a max pain level at 120 for option expiry

this is also the previous all time high back in the year 2000.

I hate trading in option expiry weeks .

enough of my flather lather

Joe

Hi Peter. Your waves work on ES, but 4th ED wave as drawn on SPX would be a flat, as we’ve already pushed slightly higher on SPX than where you’ve suggested the peak of ED wave 3. It was my understanding that all ED waves have to be zigzags, no? Only way I see to fix that would be another push higher to cap ED wave 3 by touching ascending TL again. What are your thoughts on ES vs SPX here? Thanks!

Hi Thomos,

It’s correct that we need to test the previous high in both SPX and ES. However, I don’t see a flat in either. I don’t post intraday in the free blog area, just daily.

I didn’t understand your comment on SPX, as I haven’t posted a chart of it. We’re not quite in wave 4 of the ending diagonal yet, but it’s next up.

Thanks, understood. Just meant that while ES ED wave 3 can be counted as complete, SPX now has a higher high– so needs another higher touch to its ascending ED TL to make its structure look correct (2295 at least by my estimate). Which would make the choppy Xmas correction the B-leg within ED wave 3. Relevant because it would extend your timeline slightly. Great post btw.

Purvez

Thanks for the compliment .

my bias is to try to position trade yet lately this hasnt

been possible , so i trade looking further out in time

yet i watch the short term and when it fails or does something

outside of what im thinking i tighten my stop .

the problem i see with day trading is its a constant amount

of work finding support and resistance and then re entering .

bottom line : ill accept what the market gives me rather than

demand a specific point gain .

Today id say the market is constructive.

minor 5 waves to the upside which yes turn into 3’s

yet only 3 waves to the downside .

advancers vs decliners slightly positive .

This continuation of a narrowing triangle through out the day

i have no opinion on . so leaving the market alone yet had

to come back and check .

im finding early morning trading a bit advantageous lately

not saying everyone should do it . i just find many of my

outside targets are getting hit in the overnight sessions rather

than in the day session .

at the moment i m not sure whether to call this days triangle

the end of something or the beginning of something .

its presently a Buy Stop in at 19785 bet with a sell stop below

what ever low forms , those type trades have not worked out

very well over the past month though , so i have no desire

to do that , despite all these swings we have yet to get any

high $tick readings or even big down $tick readings.

its a blah market .only thing good about this is you can get away

with tighter stops due to the lack of volatility

Joe

Joe, I do remember you saying you were a ‘swing’ type trader but the point I was making is that you don’t try to over reach. You take your profits and move out of the way.

I do ‘day trade’ and probably have more losing trades than winning ones as my stops are ‘tiny’. I count waves at the 5 minute level. It’s tedious work but has been very financially rewarding for me.

19750 cash dow for tomorrows key price

might be there by the close today

yet its tomorrows level.

glad i sat out ( bullish bias )

This is an interesting link about Trump :

http://www.collective-evolution.com/2017/01/17/a-completely-different-perspective-on-trumps-presidency-this-will-make-you-think/

Good luck to all.

Tomorrow is a key day based on several different time counts.

added to this on a 10 minute chart

there is 1 low to low to low count which has a turn 90 minutes before the close

and there is 2 High to high to low counts with turns 10 minutes before the close.

if we go down to the 19750 area and hold and even if we close down there

ill buy the close.

Daily chart shows 19750 as support by 7 methods.

Joe

John

Thanks for the link .

i think many of his same thoughts apply to trading as well

🙂

My Pleasure Joe,

If you are interested in psychology en human behaviour,watch this video .

Triggered by narcopaths in politics :

https://www.youtube.com/watch?v=sdq1yNcf13Q

OMG!!! Who or more importantly WHAT is this WOMAN? She is basically saying that ALMOST ALL US PEOPLE are ‘PUPPETS’ and being manipulated. Now if even one tenth of one millionth of the people in the US disagreed with that she should be WALKED OFF to the GALLOWS!! (Personally I have FAR FAR greater faith in HUMAN NATURE).

We all recognise that governments manipulate but she is stirring up CIVIC TROUBLE for her OWN AGENDA!! UGH!! That is beyond annoying.

Today’s action in the DJIA has got me thinking!! (I know, I know that’s DANGEROUS ground) but sometimes I can’t help myself. So…. is this what COULD be happening?

https://postimg.org/image/ij3o0mkh3/

That would be some sort of Expanded Beginning Diagonal….(if true).

Hmmmm!! And I was decrying someone else earlier for ‘starting trouble’. Human nature ….and all that!!

Janet Yellen, in her speech today, said, “U.S. NEAR MAX EMPLOYMENT, INFLATION MOVING TOWARD GOAL”

Full summary: http://www.zerohedge.com/news/2017-01-18/janet-yellen-explains-goals-monetary-policy-seriously-live-feed

So guess I’m living in a parallel reality, which isn’t very parallel.

I wonder if I should think about turning my charts upside down.

No need to turn anything. It’s she who is ‘upside down’…..just doesn’t know it. Sad really.

I’d much rather turn my charts upside down than her … just sayin’ ….

If you haven’t seen it, here’s a cool little article on Mr. Trump, sorry, I mean Herbert Hoover, that draws a few parallels … http://www.zerohedge.com/news/2017-01-18/trump-could-go-down-worst-president-it-will-not-be-his-fault

Peter

I’ll check out your article on Hoover .

Back in 2008 i made a trip to Iowa and went to the Hoover museum .

I watched his acceptance speech . At the time because of what he had

Done previously the consensus was Hoover could solve any problem .

In his acceptance speech he was humble and said he would do his best

My take

Yet while aware of everyone’s over confidance in him he did understand

His limits .

Obama promised the moon and trump claims he can fix it ( anything )

Neither have been humble.

Hoover was a good man but in the wrong place at the wrong time .

Purvez

You are correct , I get in then step aside when I have to .

The Jan 20 th cycle low does matter to me as does the Feb 8-11th time frame .

Since the Dow is trading sideways and I have a bullish bias

My trading has Bern focussed on only trading upward moves .

That style will change at some point I’m just not in the big bear camp just yet .

I do not use stops on entry so my focus is to be as close to key support as possible

And I give it room to swing , then I use a stop . This can be painful if the entry is bad .

Using the overnight sessions I’m very hesitant to use a stop for reasons some may question .

Several months ago I placed a stop in the overnight session and placed it in what I thought

Was a strategic spot ,yet then I watched the market turn right around seconds after the stop was placed

And watched the market make a B line for my stop then bounce straight back to were the market was before

The stop was placed . My bias is we are fighting a computer in the overnight session and it’s goal is just to swing

Back and forth to target stops. I may be wrong yet I gave up on stops because of this .

In the day session the are more market participants which gives an edge and a bit less chance or stops being targeted .

The other day I posted a triangle on the daily Dow futures . My lack of clarity of the wave D is now clear .

Today satisfies wave C of a narrowing triangle formation . I know on cash Dow this is true yet I’ll check the futures

When I’m home to confirm this , based on wave C being complete at this morning’s low , I’ll give the Dow a minimum of 4 trading days to as many as 7 trading days to complete wave D . This implies a move back above 19904 yet not to exceed 19925

On the Dow futures . This move should be an ABC move , the B wave that forms with in the ABC move will also be the target for wave E . ( wave E will be below the B wave ) once that completes New all time highs .

This is what I have Bern basing my shirt term trades on in the past few days and I’m going to stick to it as long as

It keeps working .

Cash Dow did go below the 19750 key level by 11 points ( less than 11 if I get technical ) the rejection from that 19750 level

Tells me wave C is complete and in terms of time , wave C equalled wave A , wave D will equal wave B in 4 TRADING DAYS

Yet it should be An ABC move . As I’ve Saud before I hate option expiries .

The general rule on option expiry is what ever happens on Thursday expect the opposite on Friday .

It’s a guide . Maybe and this is just a maybe . Thursday up in wave A And Fridays open down in wave B

Monday close top of D on closing basis Tuesday top then down again into wave E then new all time highs

In either a 5TH WAVE . OR we get wave 1 of a larger wave which runs into late Feb or March .

That is very tough to call at this moment .

Bottom line I’m bullish into Tuesday expecting 19904 to be touched on the Dow futures .

Get in then step away .

I own a few stocks and I cut my exposure in August last year .

My last purchase was in Jan or Feb 2015 ma.y of them I’ve owned for years .

My intention is to add either next week ( most likely ) or early Feb .

I do a lot of research before choosing which stocks to buy .

Some times it takes looking at 30-40 different stocks to get 3 candidates.

And once purchased I hold them . It’s a mix of 47 at the moment

And I’ll be looking for 15 to add .

I have a very strick approach so if they don’t pass I don’t buy .

Since late 2014 it’s been hard to find fair priced under valued high growing growth stocks .

And I’ll finish by saying this .

Valuation only works in a bull market .

In a bear market everything gets hammered .

I have seen many stocks get hit over the past year . Over all though last year

Was a very good year . Lots of 100% gains to offset the 40 % hits .

Also I reduce exposure by 1/3 once a stock doubles . The excess cash

Buys more .

I’m looking at the 23000 area on the Dow , right or wrong that’s my upside .

Things get extreme if the 23500 level gets taken out .

July – August a top or Oct a top .

By 2018 i will not own a single stock .

I may be bullish but I’m not blind and I understand very well the risks I face

On every purchase .

There is 50 % more cash in my stock account then in 2009 and what I do have

In value today of stocks owned is 3 times that of 2009 .

It’s a juggling act no doubt and it’s going to end badly

Joe

John, thanks for the Jungian link. I am a Joseph Campbell/Jung aficionado. It is really amazing how the left is becoming exactly what their shadow was projecting on everybody else. Sexist, homophobes, racists, horrifying deplorables who do not believe in the peaceful Constitutional change of power if it is not to them. Stunning. They are experts at branding others via emotion and identity politics (Trump was even better – crooked Hillary, Rosie O’Donnell). I saw it just as a horrible devisive strategy. It was so effective they apparently believe their own propaganda.

MY pleasure.

Most people are not aware what narcopath’s are capable of.

They always need the energy from other people,but they can play like wolves in sheep’sclothing and can be very dangerous.

Yesterday ,I watched this video from Richard Grannon about Trump.

He is an expert in the field.

https://www.youtube.com/watch?v=SvvDv3iBTrw&feature=em-lss

i did a test just now and it was out of curiosity

i placed a sell stop on the futures and waited a couple minutes

since futures are flat .

guess what ? may be just a coincidence but the futures ran down.

at 2 points before my stop would have been triggered i cancelled

the sell stop , futures ticked down to my sell stop level then ticked

back up . that would have become a sell stop to open ( short )

Joe, you are definitely right about ‘stops’ out of hours. In my rather ‘warped’ imagination I see computers sitting around getting bored waiting on something to pounce on!!

I try very hard not to have an open position overnight. Only if I’m ‘waaay in the money’ will I think of letting it run and then I don’t bother with stops.

I have got that strange feeling in my gut?

Big drop is coming…

Stay safe..

OMG!! I was JUST JOKING MM’s!! However ‘this’ is looking increasingly likely!!

https://postimg.org/image/ij3o0mkh3/

All of you have the ‘updated version’ of that chart on your ‘charting platforms’. Right now it’s projecting 19600- before it stops……IF it is what I’m suggesting.

You know these MM’s they like to ‘string you along’. So please beware.

I’ve had a very ‘NICE’ day today with my DJIA plays. I’m now going to try and get ‘sober’!! LOL.

Whew!! The MM’s in the last 5 minutes have read ‘my memo’…..or so it seems. REMEMBER they ‘twist and turn’ at every ‘whim’. I REALLY am ENJOYING this dance.

Jody,

If you’re still out there, please keep posting! Your stochastics settings are excellent! Thank you for sharing them a few months ago.

i was wrong about the triangle , yet i gave it a chance to prove itself.

simple ABC decline so far . No opinion on this market and i spent

today working so probably a good thing to be away for me .

interesting thought .

the trump rally from the nov 4 low on the cash Dow .

nov 4 to dec 20 was 42 trading days , using a 1.618 time retrace

we get today as the timeline .

if i use Nov 4 to the jan 6 th high and i use a very shallow 1.236

time retrace i get tomorrow .

given the ratio of time that has passed the dow has not even

retraced .236 of this rally and is very far from a .618 retrace .

something is definitely weird as i see it .

today the cash dow took out the jan 12th low yet the spx did not.

the dow also took out the dec 30th low yet the spx is still

way above it .

all i can come up with is they are shorting the Dow and buying

the spx . its a hedged trade , or at least it appears to be .

depending on how you want to look at this .

is it a bullish divergence since the spx and ndx are holding up as the Dow

falls ? or is the Dow leading the decline and forecasting more down to come ?

5 day adv decline line closed at neg 381 today , a move to neg 800

comes more times then not so yes more downside is possible .

the 10 day adv dec line closed at neg 80 which is more of a neutral reading .

neg 600 is the level that gets hit more times then not . so again more

downside potential .

the 10 trin though is giving a bullish signal .

its tough to keep my bullish bias at this juncture yet

im going to .

tomorrow is jan 20th .

this cycle low was present back in march 6th 2009

if we remember march 6th 2009 was a Friday .

march 9th 2009 was the following Monday .

March 6th was the print low and march 9th was the closing low .

if and ill just say if because i have been wrong about the dow

and its triangle .

if we see a similar theme at this cycle low .

then Monday will be the time to be a buyer .

given we are on option expiry and i adapt what i said

about doing the opposite of Thursdays market action .

then Friday will be up from the open and then Monday

id still be a buyer.

this cycle low has another piece that needs to be added to it

and ill have to look up the exact date .

it is mercury and Venus and the sun all conjunct at the same time

or very close . that is the marker for what is termed a Venus bull market.

tomorrow jan 20th mercury will be its furthest point from the sun

and will turn and start heading back towards it .

on march 3rd mercury has its sun conjunction based on my work

using a nautical almanac.

Venus reached its furthest point from the sun on jan 6th and it heading back

towards the sun .

somewhere march 18th-25th would be venus conjunct mercury and venus conjunct sun which would become the starting point of the Venus bull market.

venus bull markets last approximately 10 months and are a 20 month cycle

on average yet ill need to put in the data to get the actual dates .

the mars Uranus cycle is approximately 720-722 calendar days low to low .

the highs though are not exactly 1 yr out .

the high of DEC 2015 was the first mars Uranus cycle peak and the 2nd

peak fell in august of 2015 . this places the next peak roughly

Dec 2017- Aug 2018 and that is a very rough guess .

Late Jan 2019 should be a significant low and the first leg down

of the big bear market .

I have yet to see historically a big bear market beginning with these

2 planetary models at there cycle low points .

for these reasons i am keeping my bullish bias .

not to mention yet i will mention .

Peters wave count is that we are in a 4th wave .

If the spx and ndx beings to follow the dows lead and continue lower

then id say early to mid march is the next low point .

i have yet to accept this but i have it in mind .

if we turn up next week ill look for new all time highs .

the Dow will need to play catch up in a very big way for this

to actually happen.

No over night trading for me .

max pain on qqq mentioned before is the 120 level today’s close 122.98

its looking to me like the shorts actually lost this battle unless they were

short the dow.

not alll things have been bad mind you .

GNTX made a new all time high today .

AA alcoa is up 25 % since dec 30 2016

AEIS up close to 100 % since jan 2016

EIX Peaked in july last year and has dropped

from 78.72 to 68.44 a decline of about 18 %

if this cycle works then EIX should turn up

AT&T— T peaked in july 2016 and fell from 43.89 to 36.10

roughly 18 % decline high to low .

from the nov 14 lows at 36.10 T is up 13.6 % as of today

the recent drop from the jan 3 high at 43.03 to the recent low

at 40.24 on jan 10th was a 6.48 % drop .

i have an upside target on T at 55 so ill hold it as long as the nov lows

hold .

GE went from 60 bucks a share to 6 bucks from 2000 to 2009 .

from the 2009 lows this stock is up by a multiple of 5 and is still

down some 30 % from its 2007 highs and is also down roughly

50 % from its 2000 highs . last years high at 33 was just below

the 50 % retrace of the 2000-2009 bear market .

all things trump .

If the dollar is going to continue higher then being a multinational

company and manufacturing in the united states wont work .

Imports into the united states will be very competitive because of the

us dollar strength .

Basic materials should benefit if we actually see infrastructure spending

as well as a rebuild of out military yet who really needs ships when we have drones ??

US Steel : X peaked in 2008 at a price of 196 and fell to a low

of 6.15 in jan 2016 . despite the 2016 rally from 6.15 to 33.22 today

this stock is still down 83 % from its 2008 high over 9 years ago .

from peak to trough X fell for 91 months , 7.58 years of a bear market.

its previous Bear market from may 1993 to march 2003 lasted 118 months

almost a full 20 years despite the roaring 1990’s .

had you purchased X in may 1993 at its peak of 46 and still held it today

you have have a loss of of almost 13 dollars per share ( 28 % loss )

think about that ? down 28 % over a period of almost 24 years .

My bias has been mostly semi conductors , my reasoning is

they put them in everything or will eventually . yet even in this sector

its not all that rosy.

Diod : Peaked oct 2007 at 35 per share . after almost 10 years ( 9 Plus years )

its still down about 28 1/2 % .

good ol Microsoft .

i spent many years in Redmond Washington and i grew up in Bellevue

in dec 1999 you could have bought msft for 59.96 at the high

and now after 17 yrs you can buy it for only $2.34 more a huge gain

of 3.9 % for all that waiting ( not counting dividend )

but Bill Gates is one of those damn rich guys , i have heard his name come up

lately along with the rich 8 , buffett , gates , bezos being a few .

So i ask this simple question as we look at dow 19,732 .

where is this big stock bubble that the average investor is not even invested in ?

Maybe its not a bubble, maybe its just a bear market rally

Monthly $BKX Has 5 overlapping waves .

not sure id call it an Elliott wave count yet it is 5 overlapping waves.

this mars Uranus cycle typically ends tomorrow.

the mars Uranus conjunction though is march 2nd .

Feb 8th 11 th is another cycle based on non planetary methods .

HuH!! Is this the ‘sign of the times’?….when the NEW “potus” is signed in and there are ZERO COMMENTS here.

I guess you are all in such ‘AWE’ of the occasion. I can FULLY understand that. It is an SUCH AN ‘awe’ INSPIRING moment, eh?

Unfortunately the ‘bloke’ promised WAAAAYY MORE than he can ever deliver. Such is HUBRIS.

Well now, I warned about the unauthorized use of the word “eh” so I get to weigh in.

I’m constantly in awe of the way Wheeler’s cycles play out. Trump is the new Hoover. The situation is almost identical. We’re likely looking at reduced trade, a higher dollar, higher tariffs, major infrastructure building (somehow), a battle with the Fed likely, the market crash, of course …

Hoover was also a businessman with dealings around the world, there had been major inflation through lower interest rates, a market bubble. However, this time the problems are substantially greater. History repeats.

Peter, I DID hope you would weigh in. Sorry for the ‘unauthorised’ use of the word ‘eh’ but ever since I’ve been on this blog I seem to be using it more and more. Even my ‘better half’ said what is this ‘eh?’ thing you keep doing.

It must be subliminal because I can’t remember you ever using it in ‘polite company’ here!!

Any way I’m getting quite fond of it so ‘weigh in’ whenever you see it….which may well be quite a lot from now on or not….eh!

The more important thing I wanted to say was that the markets didn’t give a ‘firm’ reaction to the new ‘potus’ in either direction which is what I was hoping for. So I guess we are still in ‘purgatory’ land for now…..although as I write the market seems to be wanting to move higher. Probably just catching some ‘wayward stops’ left behind in the ‘potus’ inauguration euphoria.

We’re still in this interminable wave 3 in the US indices, so eventually it will top and we can get back to reality. I was expecting to see something happen, however small, as soon as somebody slapped a bible, but alas, complete quiet. Maybe cause everybody’s now on holidays (I wonder if that puts an end to the tweets for a few days.

We have a Hoover Dam looking for a “disaster” … imho.

Uhmmm in Hoover’s case it was a ‘disaster looking for a Hoover dam’….but at this time of night I’m in no state to ‘discuss’ such weighty tomes.

Eh?? Oh yeah, it’s past 11am over there. I can hear the clinking of glasses even from here.

🙂 😉 Sshhh don’t give the game away.

Hahaha! (I think most people already know … )

Oh HECK!!

I didn’t follow the inauguration, I was too busy banging my head against the wall while checking if my screen had frozen. Did he say “CHAINA”? 🙂

Probably just his New Yoik/Baston accent …

At least it’s better than nucular. 🙂

Bigly better.

Well I think I’m gonna share what I see, I’d love to hear your opinions guys, since I think you are all far more experienced than I am…so maybe you can also tell me if I just need medical attention 🙂

1. Wyckoff Distribution Schematics:

http://res.cloudinary.com/dwle9i9kd/image/upload/v1484948512/wyckoff_schematics_z6z2cd.jpg

2. SPY weekly, recognize anything?

http://res.cloudinary.com/dwle9i9kd/image/upload/v1484949004/2017-01-20_22-45-17_t5kcgh.png

3. SPY weekly, enlarged – market fractals…

http://res.cloudinary.com/dwle9i9kd/image/upload/v1484949004/2017-01-20_22-47-43bb_eeplog.png

Skippy,

I am glad they have helped you.

Another trick I use for day trading along with the stoch slow 34,5,13 setting is my EMA on a 1 minute and a 5 minute chart.

Set your EMA’s to 21,28,34 and trade the cross of the 21 and 34.

Usually what happens is in a down trend the reversal will see the candle stick pop up through the EMA then pull back to the EMA’s catch support then go. Since you should be going higher at the point the is no reason for the candle to drop back below the EMA’s if it does the trade is dead.

I have not been posting because my outlook is still the same. Although 2277 was taken out – 2282 is holding. I went back through to look at everything again and as long as SPX does not take out 2285 all the waves right now fit the rules of an ED.

Above 2285 would make EW 5 longer than EW 3 and invalidate my count.

Here are the rules:

Wave 1 is the longest wave

Wave 3 must be shorter than wave 1 and reach a new high.

Wave 5 must be shorter than wave 3 and reach a new high

Wave 4 must be shorter than wave 2 and must drop into the area of wave 1.

All waves must be in 3’s (zigzags).

The trend lines of the ending diagonal must converge.

So

EW(1) 1810 – 2111 = 301 points

EW(2) 2111- 1991 = 120 points

EW(3) 1991 – 2193 = 202 points

EW(4) 2193 – 2083 = 110 points

EW(5) 2083 – 2282 = 199 points

(Wave 1 is the longest)

(Wave 3 is shorter than 1 with a new high)

(Wave 4 dips into W1 territory and shorter than 2)

(Wave 5 makes new high and is shorter than 3)

So now we watch and if a low below 2083.79 happens it will confirm my count.

A bounce off the 2165 area look for a final leg up to end sometime in March.

i am with you jody, but now for different reasons… i have revised my thinking, as i think that we have completed a complicated D wave from the 2009 lows. the D wave is a triple zz. first one shows big picture chart. second one is the Z wave only from feb 2016 lows. keep the faith jody.

https://invst.ly/3489e

https://invst.ly/348ba

Bought seasonally strong US equities near close on Friday. Will hold until early February.

peter & the rest of the usual suspects,

here is an informative article by the billionaire Carlos Salinas Price. “Plata” is spanish for money, and the graphs have spanish words but you can see clearly the information they convey. It “CONFIRMS” and ‘SUPPORTS” that the deflation that peter has talked about has technically began 3 years ago, in 2014. Please read if you have time.

http://www.plata.com.mx/Mplata/articulos/articlesFilt.asp?fiidarticulo=304

Peter

there is many similarities to the late 20’s and hoover

one thing i noticed when i was in iowa in 2008

i was to look at real estate of all things , yet i could not move

there . in 1929 i believe it flooded in eastern iowa and the same thing

happened in 2008 just as we were starting to accelerate down .

there was another flood last year .

i have always though seen trump as the poetic president .

he puts out a best seller at the top and is in bankruptcy court at the bottom .

so i guess if that analogy holds trump take the usa into default .

many are trying to compare him to Reagan yet in 1980 we had high interest rates and that cycle has shifted . record low rates moving higher , Reagan began

the debt cycle expansion and today we are beyond able to control the debt .

im also starting to see why we can actually see dow 1000 .

this entire move from 2009 i still view as a 5th wave yet the fundamentals behind it are terrible . zero interest rates to negative rates kept governments afloat

yet no way can the usa handle 4 % rates let alone 6 or 8 which pension funds need to survive . they are beginning to restructure pension funds . the idea is to use vehicles that shift the risk from the unions to the union members .

part is being switched to annuities and part the stock market . in doing so they will kill the unions because the supposed security in being a union member was the pension . government pensions will probably go down the same route .

there is something new which kicks in in april 2017 yet last October they created rules where your broker must act in your best interest , they also said in these rules that you can lose money in a cash account ( money market account )

the catch ? if your invested in us treasuries then you wont lose a penny ?

can you believe that ? so if you have money in a money market account and it loses money you can sue your broker for not acting in your best interest . if he puts you in us treasuries then can claim on the books your account is whole yet anyone with a half a brain will realize when rates went up they lost money .

when the system blows up the gov can blame those damn bankers again

and simply take over everyone’s retirement account , pension etc.. to do what is safe and protect everyone . ( the crap story im talking ) there is what is called the government pension guarantee corp. if a pension gets taken over by the gov the max pay out is $1000 dollars a month . i know many who are counting there pension fund and looking forward to 5000-7000 a month after 30 plus years in the union . This pension is the very same one that is about to shift the defined benefit plan into annuities and stock market type investments that shift the away from the union and to the union member . the initial surge can and probably will drive stock prices higher yet after then its good night with the little guy holding the bag amd then the government coming to the rescue .

only thing is the government pensions will collapse to and will probably the first thing we start to hear about at the beginning of the decline .

trump will go down kicking and screaming trying to fix it as those against him

will stall and fight wanting it to collapse .

in truth though there is no way out .

governments always default on their debts .

once people realize they no longer have any control of their money

what ever they have left they will take out and the down will just keep on grinding lower and lower and lower for years . those who are retired are required to pull out funds each year and pay the tax of course . i would think the drop would last

at least as long as the rise . obviously stocks fall faster then they rise yet

its going to take a life time to hit the bottom and start over . college students are in debt and have no interest in buying homes , the young generator for the most part is not interested in having kids . the population shrinks , union membership shrinks and the deflationary spiral gains momentum as less and less people participate ,

at the end of the day though i ask the same questions.

where do i put my money and how do get it all out of any financial institution .

i view it as a nowhere to hide scenario .

lose everything you own in a financial institution or lose damn near all of it

by having it invested in a non liquid asset .

gold and silver may help to keep some purchasing power but then again

food or a can of soup would have the great liquidity .

i see that trump can delay the carnage for a little while yet once the cycle is

over its going to get ugly in a hurry.

ill give him a year yet that is only because of the cycles im looking at .

Joe

Good description of the future. Cash is king is the answer: By cash, I mean dollars you can feel and touch and put somewhere. You can see how governments are starting to reduce access to cash (India, Italy, for example). Cash will become rare and in deflation, it increases in value substantially, while assets and other investments decline dramatically in value.

We’re getting close enough to the top that I’m opening a bank account in the only public bank in Canada. That’s on my slate for Monday. The only one in the US is the Bank of North Dakota. I will keep enough money in it for business use, but otherwise, I’ll start to move to cash and some precious metals. I’ve got enough freeze-dried food for a year (and I’m in one of the safest cities in Canada), so I’m not expecting a good time ahead, but I think we have another year before things start to get really ugly. I can walk to fresh water, if need be.

Trump has the right ideas as to what’s going to happen, but I don’t think he has any idea as to the magnitude of the drop and devastation ahead. Neither do central bankers, who think they’re in control. I think they may end up being a hunted species by the end of all this. Once it becomes common knowledge how many countries and leaders they have annihilated over the centuries (Napoleon in France, Iraq, Libya, Syria, the thirteen US colonies, Japan (leading to WWII), Germany, Russia, etc.) because they weren’t getting paid compound interest for creating their money, the revolution will finally be in full swing.

A new post is live at: https://worldcyclesinstitute.com/state-created-and-controlled-money/

Peter

all your points taken .

i just finished putting the data together on the 30 dow stocks

fundamentals . using my basic stock pick theories here is the rough

of what i see , i still need to put this all into a spread sheet.

5 dow stocks ( no i am not considering buying any of these 4 )

5 dow stocks out of the 30 qualify on the surface as undervalued

the remaining 25 are either value traps or over priced relative to their value.

im only posting the 5 so people can see the basics of what i m talking about .

symbol:———Price———–Value——–earnings growth——-sales growth.

Unh ,———– 158.66———-220.54————-17%————————–12%

JNJ—————-114.15————-146.59————8%————————-4%

Dis—————-107.66———–129.57————8%—————not good neg 3 %

Intc————–36.94————45.44—————7%————————–9%

Csco———–30.10————35.74————-6%——————not good neg 3%

hence of the 5, 3 would be the the choice for further research.

Unh has the highest earnings growth and sales growth and has

an ideal chance to move 39 % higher ( in theory )

Dis might be under valued yet has a negative sales growth so its tossed out.

The other 25 stocks in the dow have a combination of over prices to value

negative earnings growth or negative sales growth .

Bottom line : while i do think the Dow can go higher based on a bullish cycle

it is most definitely over valued .

Goldman Sachs as an example :

price 232.20 value199.52-earning growth 7%-sales growth 21%.

if Goldman’s earnings disappoint , the first 14 % declines

could come in a single day .

chevron my last example.

price 115.60 value 70.24 earning growth neg 6 % sales growth neg 10%.

the Dow is a price weighted index . the higher priced stocks move

the dow point wise more so then the lower priced stocks .

the 6 highest weights being goldman sachs , mmm,ibm, BA, Unh .

those 6 represent 31.07 % of the dows point moves in a given day

based on today’s numbers .

Bottom line: the only way the dow can rise is because of confidence

in future earnings growth . if you trade based on the real data of today

UNH, JNJ,INTC, are the only stocks with in the dow that would be worth considering as a buy , the remaining 27 ( 90 % of the dow stocks )

should be avoided like the plague.

that is the fundamental picture i see as of today despite my calls for higher prices .

Now to put the data into a spread sheet and attempt to figure out

just how overpriced the dow is in a % number and i only use this data

as a guide . Earnings change QTR to QTR, interest rates change and everything

gets adjusted , yet as of today it does not look good.

Joe

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.