Update Dec 18 1PM EST

My argument for a truncation

This is the 3 minute chart of the SP500. (updated as at 1:30PM EST)

Truncations are extremely rare but I’m leaning more to that possibility after looking at the cash indices today. It’s a major turn date and we have a very motive wave up yesterday (a full five waves). This could be the ending wave and it’s short of the target.

Today we are looking at a motive wave down. I count five waves in a typical first wave pattern. If this is correct, we would now have to rally to the 62% mark and then turn over into a third wave. Right now (as per this chart, the fifth wave down is 1.618 X the first three waves, which is a typical relationship.

Caution here as the futures are not necessarily as motive-looking as cash at the moment.

We watch carefully.

________________________

Update Dec 16, After the Bell

Here’s my count at the end of the day in the SP500 (2 min chart). Looks to me like we’ve done one motive wave up of the fifth. I would expect a retrace in a second and then a larger 3rd wave before the final 4th/5th.

___________________________

Update: Dec. 15, 2015 After the Bell

Above is the 3o minute chart of the SP500. We have the start of the fifth wave up, a motive-looking wave which has likely finished the first three waves up. I would expect a fifth of fifth wave up from here to a new high (a fifth wave requires at least one tick above the previous wave 3 high to complete). Once five waves are done (and they are! … almost, anyway), the trend will change to down.

The top is actually 2116.48 (not the amount shown).

The Fed announcement should be on Wednesday at 2:00 EST. It’s likely to be volatile (not the statement, the market … haha). Janet Yellen herself is scheduled to speak at 2:30PM.

Above is the 2 hour chart of eur/usd. We have now created a 5 wave motive sequence and I would not expect the retrace to get below the 62% level (marked with a horizontal line that reads the reciprocal of 38.2 on the left – approx. 1.07293) before heading back up again.

GLD. I may be wrong on the wave up from the end of the leading diagonal. The problem in reading the wave is that it’s got a great big gap right where the fourth wave might be. It looks like 3 waves up, but it might be 5. It keeps bouncing off 101.41, suggesting that it might be done with its downward motion.

_________________________

Original post from Dec 13:

Bottom line: The fourth wave of the C wave of a regular flat should be complete, which now leaves us with the final wave up (in five waves) to go. Target date for the turn: Dec 17/18. The next turn will be a major turn down into an extreme bear market. I’ve posted a longer term chart for the DOW showing the expected wave structure for the drop.

The turn will depend upon us finishing off 5 waves up. It is likely to be very volatile around the Fed announcement on Wednesday, the 16th.

Changes Coming

When I began this blog in April of this year, I had projected a Sunday blog post only. That’s because I’m a swing trader rather than a day trader. I wait for the big moves that I can stay in for days or weeks, rather than spending all my time watching moving charts.

However, due to an underlying personality flaw (I like to help people 🙂 ), I’ve been pulled into the community and ended up posting much more often. The time involved in developing each post can sometimes run to 6 hours, or more. Obviously, I can’t sustain that kind of time commitment for a free blog. Although fun to participate, I find the intraday comments distracting to my other work, which includes speaking and writing a book on how to profit from deflation, (among other tasks). I simply cannot be around during the day to field comments.

On top of that, my objective is so have a site that provides a wealth of information in a wide range of areas having to do with cycles (how the Universe and in particular, electromagnetic waves affect all of us and “make us crazy”). Trading by cycles and Elliottwaves is only a small part of a very much bigger picture.

For example, we’re heading into what will likely be a 500 year drought and mini-ice age. Concerns about food and water, income, investments, health, and life in general will be much more of a concern than ever before. It’s that bigger picture that I want to play a part in, due to over 35 years in communication and television, and over 8 years in cycles research and a big long in mastering Elliott wave analysis. (Politicians running around the world spending our money trying to change the temperature simply makes me crazy! The population needs to have their egos taken down a notch; we need to educate people about not only finance, but how the world really works.)

As a result, I’m launching a forum this month that will allow comments, and pictures, etc that will allow for a repository of information from not just me, but all of you, on self preservation and opportunities (as well as trading) over the coming years. You will likely need to be logged in to participate. My hope is a for a site based on truth and reality that can help people make sense of a world gone mad.

I will continue these posts for the remainder of the month (they’ll start to morph into video posts) and provide details of my upcoming newsletter, trading service, and general site subscription, as they become available. I’ll need to gauge the interest in a four times a week, video-based trading service to see it it’s a viable option. I’ll be posting a survey within the next week or so.

I want to thank you all for being a part of the start of this site and hope you’ll stick around to become even more involved in the site as it evolves.

Here is a 2 hour chart of the entire corrective wave in the SP500 from Aug. 24 of this year. It’s been very apparent for a very long time that we’re completing the C wave of a regular flat (also the larger wave 2 of a bear market trending wave sequence). A flat is a 3-3-5 combination. This final C wave up then must be a wave in 5. As a result, we should expect five waves up to complete the pattern. I’ve drawn my expectation for the pattern on the chart.

I have maintained right from the start (in August) that we completed one wave down from the May 21 top and that this ABC wave up from Aug. 24 is a corrective wave that is not slated for a new high. I still maintain that position. That’s because the A wave is very definitely in 3 waves. To be an ending wave (to make a new high), the A wave would have to be 5 waves (Elliott motive waves are fractal – all subwaves must be in 5 waves. Otherwise, it’s a corrective wave).

It will be important to take a measurement of the first wave up when it’s complete to be able to extend that measurement for a confirmation of the final C wave top at 2116.48 SPX. I will post the result here during the coming week.

Record so Far (since April, 2015):

Here’s a short list of how I’ve done so far in accuracy with what has been an extremely difficult wave pattern to navigate and predict (I’ll refer to the SP500 chart above in these points). You can find all these points in the post archives.

- Called the top of the market on May 21, primarily using the NYSE top.

- Successfully predicted all the twists and turns of the first wave down (although I missed trading the third wave of the first – to Aug 24 – due to being out of town with a crashed hard drive … argh!)

- Successfully predicted the twists and turns of the A wave right through to calling the top on Sept 18 (in an ending diagonal), which corresponded with a Fed announcement.

- Successfully called the B wave when all around me questioned that call (some will remember the missing second wave and my insistence that it much be there for that wave to be motive). This was a three wave move down.

- Successfully called the turn right at the end of September (Sept 29) that led to the C wave up. Called the entire countertrend move as a second wave, rather than a 4th wave at about that time.

- Successfully called wave 2 of the C wave intraday.

- Successfully called the top of wave 3 on November 4. The wave down from there was a challenge, due to Prechter’s write-up of a leading diagonal pattern in his book. I no longer believe a leading diagonal pattern actually exists (!)

- Called the bottom of that first wave down intraday (the original 4th wave).

- We’ll see how my present call works out, which is a wave up starting on Monday, December 14 to test the previous high of 2116.48 (SP500).

So … a pretty good record all around, I think.

Here’s an hourly chart of ES (emini futures – SPX). I’m expecting the current wave down to bottom at about 2000, which would complete the (double) 4th wave of the larger C wave up. The next step is for a turn up into a 5 wave ending wave to 2110 (I’ve shown the projected path up on the chart).

Here’s the 2 hour chart of the NYSE. It’s completed 3 waves down, which means they must completely retrace. Now, here’s where the question arises:

It’s difficult to tell whether the first wave down is motive or not (in 5 waves or 3). So, the next wave up will either retrace to the top of the B wave to create a second wave, or it will retrace back to the previous high (approx. 10,645), for a double top to complete wave 2. In either case, the wave down after the top will be a protracted third wave (see the DOW chart below next).

Here’s a look at my longer-term projection for the DOW (monthly chart). This is where I find Elliott wave amazing, equally with how fibonacci ratios act as guides to the future.

The longer-term prognosis is for a corrective wave (an ABC, 3 wave sequence) down to the previous fourth wave. The previous fourth wave was in 1974 at approximately $570.00. When you do the appropriate EW fibonacci measurements, you find that it leads us right to that spot.

Let’s take a look at what I mean: The A wave down (starting hopefully later this week) should take us in 5 waves to approx. 10,240. this length it 2.618 X the length the first wave down (not marked) from May 21. This measured move stops right at the previous 4th wave up, coincidently enough. Then we should have a B wave retrace of 38% at least, which should last over 6 months (at least the length of the second wave we’ve just completed) before a final C wave down of 1.618 X the length of the A wave. Again, that takes us right to the previous 4th wave from 1974 (a life changing move, no matter whether you’re trading or not!).

US currencies are moving countertrend to the US equities. Here’s a 2 hour chart of the EUR/USD. I’ve referred to this phenomenon as “All the same market,” which Bob Prechter coined a long time ago.

Now, last week, I thought that the huge move up from the ending diagonal was a first wave and that we’d complete the fifth wave up, but we didn’t. The first wave should have terminated at the previous fourth wave, but it came up short and the final wave was in three waves.

So, what we have here is a three wave move (ABC on the chart). If correct, it should completely retrace. Although I’ve drawn in the 62% retrace line, I’m expecting the euro to retrace right back down to the bottom to complete a double bottom (probably in line with the US equities C wave top) before turning up in a first wave of a very large countertrend, longer-term move.

Let’s look at GLD, which mirrors gold. Here’s a daily chart of GLD showing the ending diagonal and a move up. A closer look at the move up shows it to be in three wave, so I’m expecting one more drop before we turn and head up in a much larger counter-trend rise which should be a counter move that aligns with the expected drop in US equities.

Here’s a closer look at GLD (the 15 minute chart). I’ve labelled the abc move up on the chart. I would expect either a double bottom (in tandem with the top in US equities) or a throw over – a move below the line in a final ending diagonal capitulation move.

Cycles

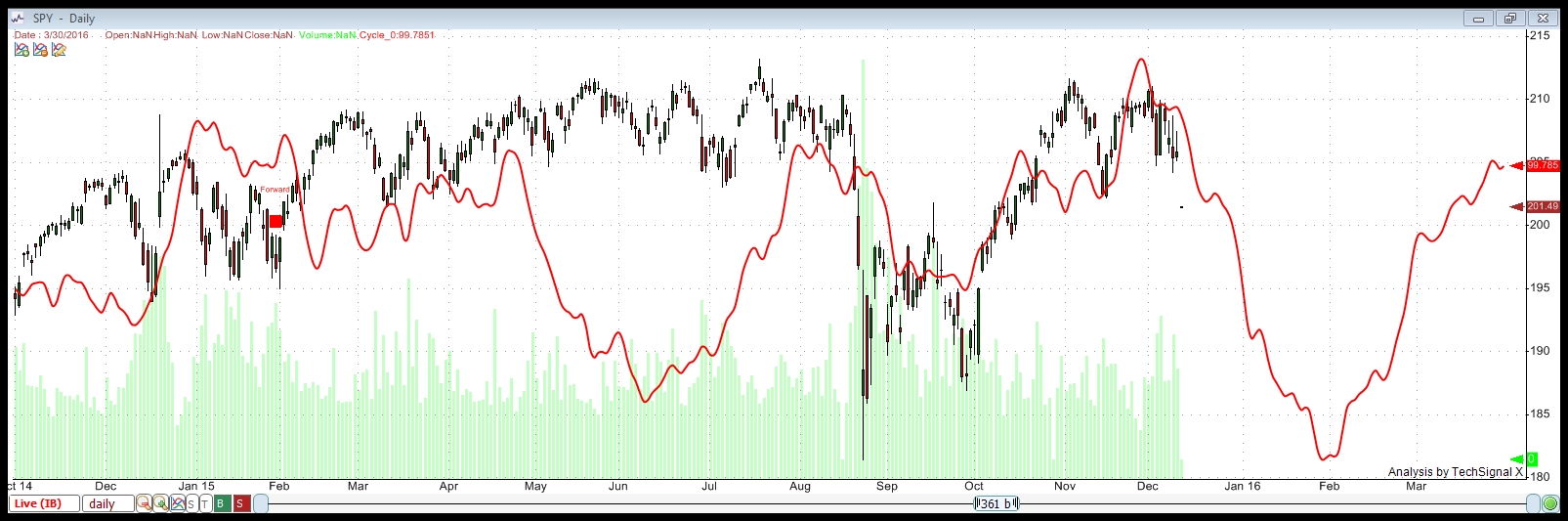

I haven’t run a cycles analysis with the TechSignal software as I’ve been finding it unreliable. I’ve run it again this weekend, but have slid the phase of the resulting analysis to more properly align with where we are now. This has a projected bottom of the third (or fifth) wave of this next major move down at the beginning of February which, considering the timing of the first wave down from May 21 (3 months), might be a bit short.

Wave 3 should come down faster, but I wouldn’t expect it to drop in one month as opposed the three for the first wave.

I will be relying heavily on the turn dates of Andy Pancholi going forward for the upcoming paid service, as he’s hit almost every key cycle turn throughout the year. Information about his monthly newsletter is here. I will be updating the charts on his sales page this month so show the accuracy of his service. Andy’s been forcasting cycles turns his entire life (and he’s not a young guy!). I know him personally and can attest to the accuracy of his projections – best I’ve even come across!

The Question of Seasonal Bias

The Decennial Cycle (chart below) that’s tossed around without a lot of thought is not a “cycle” in the true sense of the word. It a short-term phenomenon, or pattern, perhaps. It’s interesting that most charts only go back a few decades to make the case for a continuing pattern.

The chart above goes right back to 1805 so you can see the issue I have with this phenomenon being anything other than a short-term pattern. 2005, in fact was ‘flat’ or negative, depending on who you listen to. So far this year, the NYSE is down one percent. I find the reference to the “decennial cycle” lacking in any kind of credibility.

You’ll find the article to this chart here.

In terms of seasonal bias, Santa Claus and end of year seasonal rallies show even a spottier performance. On the other hand, as a contrarian, I would much rather see rabid optimism in the market, as we have now. In my way of thinking, it sets up the perfect scenario.

Above you’ll find a snapshot of market breadth, which continues to implode. This is from a zerohedge blog post.

Now on to cycles:

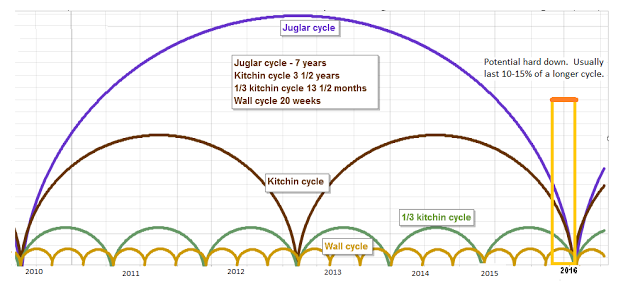

Here’s a chart of the Juglar, Kitchin, and Wall cycles which are harmonic. They’re forecasting a turn near the end of 2015 or very early 2016. More specifically, they point to the January/February time period as a bottom.

You can find this chart and a full explanation at http://swingcycles.blogspot.ca.

This is a similar chart of the recent past. You’ll see the end October/beginning of November forecasting a major top. In fact, we topped in wave 3 of C on November 4—a direct hit.

Andy Pancholi’s “Market Timing Report” forecasts December 18 as a major turn point for the month. I highly recommend it for its accuracy. You can find it here.

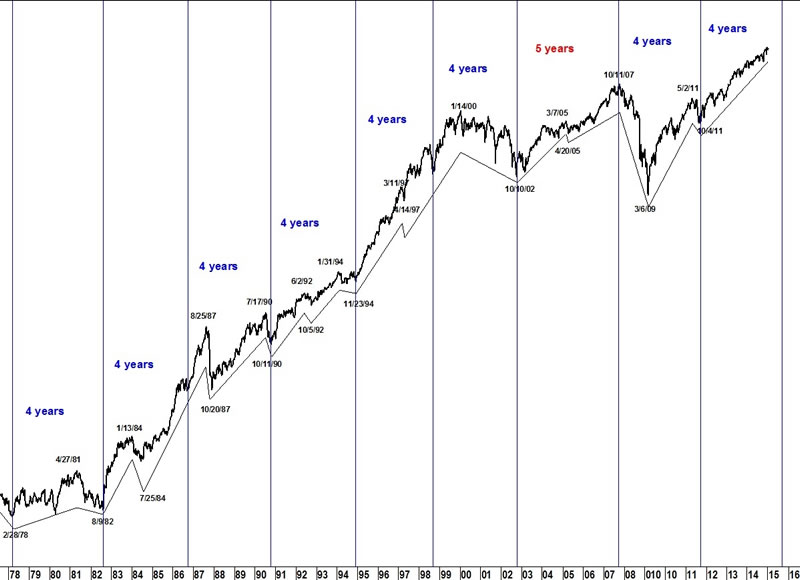

On a longer-term basis, here’s a look (above) at the 4 year cycle on the DOW. This cycles forecast looks to the end of 2015 for the turn. You can see how long-term and persistent this cycle is.

I was asked a couple of weeks ago about the broadening market topping pattern (well-known market topping pattern—not Elliott Wave related), so decided to include it here.

Above is the larger broadening top of the NYSE in a 9 day chart going back to 1999. This would be called an “ending expanding diagonal” in EW terms. It’s an extremely bearish pattern and seem to be failing in the final stages.

It’s interesting to me to note the difference in the NYSE as opposed to the SPX (lower blue chart). It speaks to the breadth of the market. It tells me the buying is concentrated in the big cap stocks.

Above, we can see this same pattern on a short term scale in the final wave of the larger topping pattern. We have what appears to be a failing e wave in the NYSE 2 day chart.

There’s also a non-confirmation here, as well. with the SPX chart. This suggests the rally is narrow on even a short term-basis, with most of the buying in the big cap stocks.

DOW Theory (Transports and Industrials Non-Confirmation)

I haven’t brought up the Dow Transports non- confirmation for a while, but it’s been busy at work setting up for the next drop. The Transports Index (DJ-20) is tracing out a typical fourth wave (above), with the Industrial Index finishing off the 2nd wave (below). Both are setting up for a turn down in tandem. You can find background on the DOW Theory here.

For more confirmation, you can visit this article on the Baltic Dry Freight Index. Scary stuff!

Good trading!

Hi peter

I to am more of a longer term swing trader so i understand where your coming from .

My question tonight is more of a long wave question .

Im Going to go on limb here with my question with a few assumptions.

the peak in 2000 was the top of wave 3 ?

If this is true then ill take this a bit further then ask my question as it has been

a question i’ve asked myself for the past 13 years .

based on Elliott wave theory once wave 5 is complete you look for a move back

to the previous 4th wave of 1 lessor degree .

of the impulsive waves 1 3 and 5 , wave 3 is usually the longest and the strongest .

wave 5’s tend to be weak fundamentally and technically .

waves 2 and 4 tend to alternate , if wave 2 is complex then you would look for a simple

wave 4 . if wave 2 is simple you tend to look for a complex 4 .

wave 2 must not break below the bottom and wave 4 must not break into the

territory of wave 1 .

2nd waves many times have worse fundamentals then the actual bottom .

wave 4 tends to decline back into the territory of the previous 4th wave yet

also tends to be a .382 retracement of waves 1 through 3

Can you agree so far ? i’m still working towards my question .

If this is a very long term B wave and the top of wave 3 was the 2000 top

at 11750 on the dow , wave A lasting 9 years roughly and this wave B

now well into its 6th year and working on its 7th .

MY Question : there is 2

a drop from 11750 to 1000 would be a 91 % decline in the very big picture .

how does a 91 % decline fit into the basic tenants of Elliot wave theory

and still be considered a 4th wave ?

Question 2 :

while there are many reasons to mark the year 2000 as the peak

given the extremes the world governments have taken to keep this party alive

is there not a case to be made that the 2009 low was a 4th wave and this

move up is actually a final 5th wave ?

Joe

Hi Joe,

1. I don’t know where you’re getting the 91% figure from—you didn’t say. Remember, this is a correction of super cycle degree and is correcting 5 waves up from the 1700s (I don’t have a chart handy right now to give you a specific date. Since it’s five waves up, this should be a second wave, rather than a fourth. 1929 was a similar drop percentage-wise and was a second wave. I don’t know where they start the typical DOW chart, but I’m sure it doesn’t go back that far.

2. The DOW top is a broadening top (non-EW) or expanding ending diagonal (EW). The final wave is clearly in 3 waves, so it could not be a motive wave. It is corrective.

My Vision is that 2000 was a W3 top. After that 2 scenarios. One being that we saw a running flat into 2009. In other words, the 2007 high was a wave B top.

The other scenario is that 2003 was the low.

Either way, 2015 marked a high, we’ll be down into 2018 a last leg up into 2020 when the real trouble may come.

Cheers,

André

Thanks for your input Andre

My work does not show 2015 as a high , it shows late 2017-2018 as a high .

and that is why i am asking the question i am asking .

2019-2020 is a low yet i think that can extend into 2023 even before any real rally shows up .

but that is not what i am here asking about ,

my question is specific to Elliott wave theory not timing .

Joe

Peter!

I can only agree with you that you have done a terrific job with your blog! Thank you for all your energy and patience with us. 🙂 I would do the same if I were you, focus on the core and not on 30 comments a day in your blog. 😉

That being said, I am looking forward to the forum since it would be cool to exchange charts with the others here! And I guess you will not have to post so much than anymore so that you can focus on your book and studies!

Cheers to you Peet!

Wouter

The forum will provide a last depository for info, as well, so that more learning could take place, I think. There have been some really good comments here and they’re now buried in the posts, which doesn’t make them readily available. In a forum, they would be.

I won’t be posting as much on EW (likely just a Sunday video post with an additional visual or two. But I will be able to do more general videos and posts.

Thanks, Wouter. 🙂

Peter

I would like to be one of your first subscribers in any type of site you plan to launch .

I also like to wish you all the best of luck in achieving your short and long plans .

You have been of great help to me and maybe to others .

Regards

AZ

Thanks AZ,

Thanks for the kind endorsement. I’m not going anywhere, though … haha. I hope the videos will be more helpful because I can explain and show things much easier than in text. And it cuts down my time. So more effective overall I think. Hope to have an example a bit later this week.

minor 5 waves up ?

If this is to me, I don’t know what it means.

Hi peter

I actually did explain how i came up with a 91 % decline .

if wave 3 in the year 2000 at 11750 was the peak of a 3rd wave

and this was a B wave upwards and not a 5th then yes it would only be 3 waves up .

your target is pointing towards the 1000 price area on the dow .

11750 to 1000 would be a 91 percent decline .

so a drop down that far ( as prechter has called for forever ) in my opinion would not be a 4th wave ( my assumptions being your inline with prechters wave count ). this would imply that the peak in 2000 would not be a 3rd wave followed by this being a B wave .

so to me it implies more subdivisions higher to complete a final 5th wave up .

since as you note there is only 3 waves up so far i would expect waves 4 and 5 to complete

before the larger decline to unfold .

The most recent wave up in 3 will forever be a wave in 3 because there is no valid second wave. A wave 4 and 5 up won’t change that fact. It is what it is. And, as I said in my post, the first wave of the current flat we’re finishing is in 3 waves. So even if we get a fifth wave that goes to a new high, it won’t change the count. So there are multiple reasons why the larger wave from 2009 is not a motive fifth wave.

I agreed with you that the projected drop would not be a fourth wave; it would be a second wave (no matter what happens at the top).

On your percentage then, I’m guessing you’re measuring from zero on the DOW. My point still stands-that the chart you’re using is only a partial representation of the entire supercycle wave. The start of the entire US supercycle starts in 1789. However, the chart I’m using daily only goes back to 1915 (or so-can’t quite make it out).

So the point is 91% as an indication of magnitude only relates to the final set of 5 waves up (from about 1910), not the entire supercycle from 1789. This wave down corrects the entire thing. It’s kind of uncharted territory, as we’ve never had a debt bubble this large.

Peter., a Question please…Are you saying that we will have a 5 wave up by Thur. or Friday or Monday and the turn will be a start of wave 3 down, a last chance top , and a kick off for

the larger bear wave down. I was with you when you called the big ATH in this market earlier this year. So is this it??? Just few words answer will do. Your friend… Nick Timpa..

Hi Nick,

That’s the theory, yes. Unless something changes, that’s what I’m expecting. 🙂

It will become more obvious as to what will happen as this final set of waves unfold.

Thanks Peter, I am out of the market. I am braced for what is coming.I feel so sad for all the pain that is coming, The people that will be crushed , the pain is already here, as i live in a oil producing state, many friends and relatives are out of work, business is slow,and it has barely started. I have been in many bear markets, and recessions and did well, but it is not a happy time. God bless you for helping these people,Hope you come out of this ok.

Thank you and all of you on this blog.God bless America……Nick

Nick,

I’m in Calgary and it’s much the same here, although not as bad yet as your description. Yes, it’s going to be tough for a whole bunch of people who don’t deserve it.

I guess if I want a gopro camera, I’d better get one soon. Stock now $16.50 and these are motive-looking waves … From a high of about $98.50!

You haven’t lost your sense of humor Peet… 😛

Whahaha! GOPRO MAN GO PRO!

Cheers,

W

Hi Peter

thanks for the info .

what you said makes sense to me

Joe

phew! … haha.

Hi Peter,

this levitation of US market is really frustrating.

But I hope you will not give up like John Hampton did.

Your opinion is very helpful for me even if I do not always agree with it.

The best format would be the weekly post with general overview of the market and brief daily conclusion on the daily development in ES and Eur/Usd after the close of the market.

Whatever You decide I want to continue to hear from You.

My best regards

Dmitri,

Not to worry. I’m not giving up. It’s exactly as I stated. I just need to get my time down to a reasonable amount for the free blog part as I have other aspirations.

And speaking of the euro, it looks like eur/usd right now is finally getting 5 waves up put together. Frustrating, yes.

And ES, too (difficult to figure out).

Tough markets. I think it’s lack of volume, for the most part.

Thanks Peter,

It would be amazing to see if the SP will hit 2016 again with everybody bullish again.

Let´s see where we are at the end of the week?

From an EW perspective, it has to.

Excuse 2116

Peter,

do you find this wave up in SPX motive?

I don’t see any second wave. It goes like a steam-roller without significant retraces.

Absolutely. But this is still the first wave, I think. In SPX, it will likely end closer to 2067. I’m out of the office right now, so best I can do at the moment. Then we should get a second wave (perhaps tonight in ES).

Dmitri,

Now that I’m back … there are either 5 waves up or almost 5 up. We might need one more small wave up to get there, as per my previous comment. It looks more like we might be done as momentum seems to have drifted away. The next major move should be down to about a 62% retrace for a second wave.

Or this could be a fourth wave setting up, as the fifth wave of the first is very short … it might just be the fifth of the third. Weird things happen so close to a top (in terms of wave lengths, so I’m not positive as to the degree of that final small wave up.

Hi peter

Cash dow on a 13 minute bar chart to me has 3 clean waves up

for the dec 14 lows .

Not sure about this being a 4th wave or not yet it looks like one ?

if so 17440 is my key support ( 17453-17431 range )

wave 5 up may be early morning tomorrow is this holds true .

Something im noticing lately when i watch the advance decline line .

the buy side ( advancing stocks ) doesn’t move that much .

the downside though does . it appears to me right now that

watching the decliners as well as the advancers helps but

focusing on the ebb and flow of the decliners is most helpful .

Joe

Joe,

Looks like a fourth … We may have done all of the third and going into a fourth now. That final small wave seems too short to be a fifth wave to me. We’ll have to see if this next wave down retraces 38% or 62%. The DOW is a lot higher relative to SPX …

In any event, we need to make it to the previous top, I just don’t know what wave down we’re heading into. It will likely tell us the balance of the path, though.

The third wave on both the DOW and SP500 is exactly 1.618 X the first, so this would lead me to think this is a normal full wave up and that we should have a retrace to the previous fourth before a 5th wave up, also 1.618 X the first. It might then extend with the Fed announcement. There are options here and futures are slightly different than cash in terms of the wave structure.

Peter,

What is your focus the price or the time tabel you mentioned Dec 17/18 in case the top (2116) has not been reached?

There isn’t one. This is a fifth wave. A fifth wave must reach a new high at least one tick above the third wave high. Otherwise, it’s a truncated wave which, as I’ve explained before, is extremely rare.

I updated an SP500 chart at the top of the post with my latest count.

Peter,

FOMC is on Wednesday

Oh, yeah … you’re right! Thanks, Dmitri.

Hi Peter

I dont expect you to comment about this but i wanted to comment on

the stock DIOD . the monthly chart from 2007 to date .

i have found a handful of these type situations over the years and i watch them

because it teaches me corrective waves over years .

you may find that interesting from an Elliot wave point of view .

MYGN is another yet not near as clean .

AA is a great example of the before and after .

all multi year Monthly charts .

Joe

I just wrote a note on GLD before the open about it maybe being finished the downward spiral and sure enough it’s up a buck at the open. So that suggests the wave up from 100.53 was indeed in 5 waves. It should continue up, I think.

Hi Peter

The cash dow can be counted as 5 waves up

yet the dow Ym futures can be counted as a triple 3 .

focusing on the cash index , a .382 time retracement target 203 est for a low

taking the top of yesterdays high and measuring from this mornings high

it target 137 est as a top to top to bottom count .

with the volatility most likely to be around this fed statement im going to lower

my buy point lower than i would normally 17339-17259 on the cash dow

for the moment im going to consider this a B wave untill the wave clears up

and im sitting out of this decline .

this will be an interesting day .

Joe

With the DOW, what you have there is a really well formed wave 1,2,3 and 4. Looks like we’ve done the first of the fifth and we’re in the second wave. Just like the other indices and futures.

Peter,

does that mean that you count the first of the fifth from 1994 to 2060 SPX and should retrace to 2020 SPX ?

Dmitri,

I’d count the first of the fifth from 2041.52. The fourth has to come back to tag the previous fourth, which it didn’t quite do (but that’s OK, it’s still a fourth)—the bottom of the first starts at the bottom of the fourth. Top you have is correct. So the second, which we seem to be in now should be about ready to turn up on a third wave of the fifth.

If you’re in ES, you can see the 5 waves up of the first wave of the fifth (60 min chart).

Ok, you mean 1st of the 5th of the 5th.

So, SPX shouldn’t go under 2041 now.

Correct.

SPX ended up doing another fourth wave, so the count really hasn’t changed, so far. Still pretty volatile.

In fact, in the DOW, if you measure the length of the first three waves and you measure the length from the bottom of the fourth wave up to the previous top, you’ll find they’re just about the same length 🙂

So, all the indices have waves that are shaping up as 5 wave ending waves. Nothing like telegraphing a top … haha.

I don’t know what everyone thought, but I expected a bit more volatility out of today.

However, we continue on.

US indices in fifth of fifth of fifth and euro/dollar heading down to a second wave retrace. The big turn isn’t that far off. Perhaps tomorrow or Friday …. we’ll see.

Peter

SPX is now around 2075 , so there is still more about 40 – 45 points to go ..Correct ?

Regards

AZ

Gotta get to the top … yup. Eyeballing it, that looks about right.

SP500 has now got itself in a position where the first three waves will equal the final fifth wave to end up right at the target.

Well, volatility will come with OPEX

I count 5 waves up in the 5th in ES, so we may be a second wave here before we continue up some more.

Did you want to say “the fourth” ?

No. After the first wave of the fifth comes the second wave, then third … etc.

Not sure what you mean …

This fifth wave is not long enough yet that we’d be at the fourth, I don’t think. Perhaps, but it would mean a very extended final wave.

Excellent calls Peter. Friday afternoon has a Moon setup for a turn……. finale of 5?

Thanks. The only thing is that this looks “textbook” so far, which always scares the heck out of me …. 🙂

I’m guessing we’re going to have five full waves up within this final wave, which might take us into Friday. My preferred turn date is Friday, so that would work out just right (scary).

I thought we have finished the 5.5.1 SPX at 2060 and just now the 5.5.3 at 2077

I posted a quick chart at the top there with my count at the end of the day for the SPX.

There are options at this point. Not saying my count is necessarily correct, but that’s what I think is happening, based on the distance we still have to go.

It seems that wave i is overlapping with wave iv

Not on the SPX. I don’t know if you’re referring to another chart … or another 4 and 1 …

Friday as a turn date? Than we think alike Peet! My Gann system tells me Dec 18th as well! 🙂

Cheers,

W

Yeah, it’s in the blog post.

The night retracement in ES was rather shallow.

May be you should change i and ii for 1 and 2.

There is another possibility to place i and ii between 2 and iii at 3 min chart.

In this case SPX has finished 1, 2 and 3 yesterday and ES has retraced 38% of the 3 and is in 5th now

If this is the case ES may be finished the wave i of the 5th and according to its length of 16 points the wave v should finish at your target

Well Peter,

you should have more reason than me.

Just this wave down looks a little bit motive for the 2nd

Depends on what index you look at. Not motive, but it could be a 2nd or 4th. Still going up.

This will be a double wave 4 in futures, I think. They did 3 waves up from the end of the third wave, so that needs to correct. They should come down to the previous 4th.

Not sure about SPX and DOW. This would make the most sense to me as wave 2 but everything seems out-of-sync. SPX is lagging badly, so we’ll have to see what happens. Nasdaq might also be wave 2.

This last wave up is not something I would be trading as it’s on its last legs …

Looking at the SPX and DOW, the other thing this could be for them is a double second wave. Often when there is something wrong with the previous wave (for example, I’m now seeing that the third wave of the fifth up in the SPX yesterday was only in three waves), it will correct back to the wave before it and start over.

If this is correct, that means we have a first wave and we have a third, fourth, fifth of fifth still to do on those two indices. We seem to be stopping at the previous second wave on them.

While it goes down it’s Ok for me.

You know I stay in shorts. I’ve sold some in 2000-2020 area and recharged yesterday at the close.

I don’t know since when the tightening has become bullish. Especially in today environment.

For me Yellen speech yesterday was hawkish enough.

So, I consider any upside to be fake. The only question every time is how far may it go.

It may be also rolling the positions in advance before tomorrow OPEX.

1.1 trillion of the options is a big piece

Smart to stay in shorts at this point.

Well, we’re all back in sync. It looks like cash and futures indices completed a fourth wave (again). We still have one more wave up to go.

Yes Peter,

I think this market will break down suddenly without opportunity to get in

The odds of that happening before the fifth wave achieves its target are, of course, EXTREMELY thin.

We’ll see tomorrow.

Any way I’ll not get out of the train at 2000 the third time

Hi Peter

I get what your saying about the double 4th yet what im noticing when counting this as a 3 wave structure i come up with a variable ( outside the box thinking )

the 60 minute cash dow chart can be counted as 1 2 3 expanding triangle 4 into the fed statement then 5 up with today being wave 2 .

the same can be said though when counting this as a potential A B C formation

1 2 3 A into dec 15th open , then a very large expanding triangle B wave which is

near complete if the cash dow gaps down tomorrow morning to below 17483.68

( the fed reaction low ) .

if i count it as 5 up and look for a .618 retracement that implies 17391.16 as the .618 retrace of the entire move up .

taking today decline ( 60 minute cash dow chart .

a b c it looks like c will equal a near 17419.69

17419-17391 would be support for either wave 2 or and expanding triangle wave B

wave A from the lows to the high was 17138.47 to 17592.12 or 453.65 pts up .

adding 453.65 points to what ever low shows up tomorrow morning ?

17419-17391 as a reference plus 453.65 targets wave C on Friday

in the range of 17845-17872. breaking above that range would imply its a 3rd wave

a failure in that range id suspect the run up this week was just another 3 wave move

of this sideways corrective wave pattern .

Lastly .

looking at the expanding triangle further and the 60 minute cash dow again .

there is a top to top to bottom count which would imply a gap down near the open

followed by a swing to the upside .

the open dec 15 as the start point plus 7 hours = the high on the open the 16th of dec

plus 7 hours is tomorrows open ( 1st hour of trading ).

the dow futures look complete for this corrective wave yet the cash dow really would look better with a gap down tomorrow .

additionally the weekly close only chart of the Dow ideally should close near the high

for the week , so a run up Friday would be the ideal situation for a top and while this can be debated ill label it Wave D .

Joe

PETER, have you ever considered the thought that 2000 was the top of a fifth wave extension of giant wave 3. IF so, then what the market has done since is fairly normal. PS—in 1873 and 1929 new high tech and drugs led the market up. Also 2000, and now social media and biotech. In 2007-08 the averages(wave 2) peaked about 7 months from the top. Now about 7 months from May. ——–Could the averages be doing a 3-3-5???

Roger,

I’m having trouble figuring out the first part of this comment. Got that you’re talking about the year 2000, rather than price. Yes, it’s the top of a third wave extended of a fifth. I don’t find anything abnormal about it, so not sure of the point.

Your flat you mention … no, not at the top. As I’ve said, the final wave up from 2009 is in 3 waves and always will be. If it’s the pattern we’re currently in, yes, it’s a flat (3-3-5) in the indices.

Peter–The last two days of gain have been engulfed to the downside?? Gary (Denver)

You’re finding something abnormal that I’m obviously not seeing … Not sure what the question is/means …

We did a second wave in futures (after one full wave up). We’ll have to see where cash opens tomorrow but might be in the same place. Currently a fourth wave.

Futures should expect a large third wave up tomorrow, I think.

One note that I think they group may want to watch for is the likelihood of a golden cross being triggered in the next day or two. Though most likely not relevant to Elliot Wave Analysis, that trigger may cause enough technical buying to push us to the top of wave 2. Combined with the bullish seasonality and the distance to 2116, I think wave 2 tops out sometime between 12/22 and 12/30. 50 DMA is at 2061.537 200 DMA is at 2062.03. For the Golden Cross not happen, the selling needs to keep us below 2020 for a couple of days at least, but based on the heavy put option expiration today, the contrarian view would be bullish.

Thanks, Ted.

I don’t have any other major turn dates until January. There won’t be enough volume to get us going until then is my guess. Doesn’t look like a lot will happen today. Volume this week has been non-existant.

Unless this morning’s wave drops to a new low, it looks like a second wave. Expecting a third, although I’d be surprised if it went to full length.

Peter –

“Expecting a third, although I’d be surprised if it went to full length”

are you giving up on 2116?

No. In the SPX, for example, if wave 3 went to full length, it would go to 2161,

I proffered that according to conventional contrarian Wall St. Wisdom (oxymoronic) what the markets should do going into the rate hike announcement.

The stock market should decline. It declined to the 14th and then rallied.

The $ should rise. No, it declined

Gold should decline. Essentially correct.

Interest rates should rise 10 year declined to the 11th. 3 mo bills did rise all of Dec.

The concept is they would sell or buy the news. If they did, they are actually doing that a few day before the news.

Today must be pure hell for those guys who write put options .

If this market drops to the previous low (SPX at 1995), there would be a really good argument for a truncation, because this wave down is motive.

If we drop to that previous low, then we would need a retrace of 62% of that wave (second wave) and a turn down to solidly make the case for a final turnover.

I’ve been looking at the overall structure and the C wave is getting a very heavy top to it which is starting to make the 5 up theory questionable. Let’s see what happens over the next few hours.

Important update chart at the top of the post!

Based on the possibility this is a first wave down, I would want to see one more small wave down to the previous low. The fifth wave looks not quite complete. Then a retrace probably Sunday/Mondayish before a wave 3 down.

Hi peter

today this market looks flat out ugly .

ill admit this is a stretch .

the ym h6 futures must hold above 16991 in my opinion or this entire structure

is screaming bearish .

the only possible bullish count i see is that we are now at point E

this implies the dec 14 low at 17053 low holds which at this point i have no

confidence in .

long and nervous with a stop in place

ill let the market decide

Joe

Well, the more I look at currencies, the other indices, and futures, the more I see truncation. CAD hit my long time target of 1.4 this morning and immediately bounced. eur/usd seems to have turned back up. I can’t find anything that supports a bullish move other than a retrace.

i wonder if trend line support from Sept will hold???

http://invst.ly/oo2m

Unlikely in my view. I think we’re doing an ending diagonal in SPX. We should get to the previous low below 2000. In 3 waves. Euro/dollar looks to be in the third wave up already—have to see more to be sure.

Everything is performing nicely!

Peter–Transports have taken out the August lows. Gary (Denver)

http://stockcharts.com/h-sc/ui?s=%24TRAN&p=D&yr=2&mn=0&dy=0&id=p08490514158

We’ll let the day play out and if we finish off the way I suspect, it’ll be time to call a top in this corrective maze. 🙂

The expectation being selling into the close?

Yes, and Monday to finish up. Futures might complete the bottom on the weekend and then we head up on Monday. I have no options for a count that is bullish. In fact, I really have no options but the truncation one, at this point.

That means we continue down a little further to complete wave 1, then bounce into two. The top of two is the optimum EW point to enter. Wave 3 should be at least 1.6 times the length of this first wave down.

We just completed 3 waves up in the 1 min ES chart, so the direction is still down.

And the euro is in wave 3 with a long, long way up to go.

Actually, this first wave in the euro will correct soon, so you want to wait for a second wave retrace before getting on board.

Peter—Please be careful on the EURO. What I can say is a set up is nearly in place for a huge move to the downside (euro) which will literally be one of the most unexpected outcomes in all of market history. Gold bugs and dollar bears are likely to get the surprise of their trading lives. Gary (Denver)

We’ll also have to rewrite Elliott wave then, as so far, it’s down in 3 waves. So it will have to go back up to the top and start over again. It can go down a little from here, but not to a new low, as that would require 5 waves.

I rode it all the way down, but I’m out until it re-establishes itself.

What technical analysis are you using for your prediction?

Now that I look closer, my count actually brings it down to 1.073 before the third wave kicks in (62% retrace level). I’ll share a chart on the weekend. All the US currency pairs have been moving counter to the market for months, so I’d be surprised to see that change.

Let me be one of the first to call “Top!” There really isn’t any alternative.

We have a bit more to finish up on this first wave.

I’ll put together a blog post on the weekend and may do a video. The game has finally changed. A motive trend (where we’re headed) is so much easier to predict! 🙂

Good call peter

i cant see any bullish set up on the spx or the dow as of the close .

ill dig further on the weekend . look forward to your posts

Gary i to am interested in the set up your seeing in the euro .

Joe

We’re not done this wave. The DOW should get to 17,888 before a bounce. I’ll check my measurements on Saturday …

Thanks for all the comments. I have learned so much in such a short time. I still have a long way to go. This is just a great place to be considering the turmoil that lies ahead. I feel fortunate to have found this site. Thank you Peter for the hard work and willingness

to share. When your ready, where do I sign up.

Robert

Thanks for the kind words, Robert. Much more to come from me, I think. We’re just getting started …

The trend has been down for some time but markets kept going thanks to zirp. But in all their whisdom, the FED decided it was enough and switched off the lights to end the party.

On Wednesday we had the vedic sun at 240 degrees and a host of other gann/astro timers. Last weekend I said the trend for this week was down. So the market went to test the 16th, to end the week lower.

The Christmas period will bering a massive reversal down. 12/25/15 was given by Carolan years ago (in his book) and Gann timing confirms this timing. As does astro. HC venus will be conjunct Mars, conjunct the north node and square the galactic center. Mercury is opposite mars,venus and the north node, square the galactic center and earth. 12/18 the sun is conjunct the galactic center and square the north node with the moon opposite the north node.

See? Everything aligns with the node and the GC, Sun, moon, mars, venus, mercury.

This is rare. Very rare. And it happens when Uranus turns direct (to tighten the square with Pluto again) and Pluto gives a shadow date as Saturn will do Sunday. Ah yes, the winter solstice. 12/25 the nodes max north at a local extreme.

I expect a pull back into Christmas with the slide starting the first trading day after. 2/17 strongest date I have now for first target.

Cheers,

André

For clarity I should add that the astro pattern I painted above can only exist when the nodes are square the galactic center. As the nodes have an 18,6 year cycle a square takes more than 4,5 years. And all the trading planets – including sun/moon – energize this square. And the sun makes a 45 degree angle with the death and destruction midpoint. See Olga Morales for details. And to top it off a full moon.

Just hope we won’t see a disaster in the real world

The interplanetary magnetic field is caused by the tidal pull on the surface of the sun. Jupiter and Venus give the strongest pull, especially when the are conjunct, like on 12/18. A strong pull is associated with a high (positive for markets). So this gave some fuel to keep levitated. But that ended last week.

Funny how things get clearer when you write it down. Take a look look at the HC zodiac; won’t see this for a long time to come. Jupiter,venus and mars conjunct in Leo, with the north node on the doorstep (1:19 virgo). Leo is a fire sign; brings a lot of energy. The conjunction is opposite Neptune that is conjunct mercury in aquarius. Pluto is opposite Sirius; the star of Bethlehem. And the full moon is opposite the galactic center that squares the nodes. With a lingering Jupiter/ saturn square and Uranus / Pluto square, with pluto square midheaven and Saturn conjunct the ascendant.

With Saturn neutral (square) and Uranus far and weak, the sun will move relative to the bary center.

The fact alone that Jupiter, Mars and Venu are conjunct opposite Neptune is a rare alignment. And a full moon opposite the galactic center is also extremely rare. Both at the same time. These are strange days indeed.

The shmita planning (http://areyouready.co.za/2014-2016-shmita-year) gave 9/23 as the start of the “final prophecy”. 12/23 will be square this date. Coincidence?

Yah André,

would be also nice to know what does think Goldman Sachs about all this.

Peter-does this kind of sum it up?

realizing end of 3.1 indeterminate, yet

3.2 and 3.3 are guestimates, IF 3.1 is done, which it may not be.

http://invst.ly/osu9

Well, you’re right on the direction, but your numbering needs some work. There are some options here in terms of the upcoming corrective wave. It could be a 4 (38%) or a 2 (62%) but I haven’t had a chance to look at the charts in detail to see if there are any clues as to which it will be. The length of the first wave determines all the rest. So the key is the next move.

I’m going to attempt a video later today to explain where we are and the short term options.

Peter

thank you for the updates along with the message board etc .

Andre thank you for your insight .

ive spent most of today putting several cycles together and ill dig into your thoughts

tomorrow .

A Drop into Christmas does make sense yet im seeing a few other things that i have not

yet completely gotten in order .

Mondays market action will give me more clues

in the mean time ill look at your thoughts in regards to :

Jupiter, Mars and Venu are conjunct opposite Neptune is a rare alignment

My question is to myself , what happens when those planets move away from each other

and when was it when the spread began to narrow so to speak along with their narrowing spread beginning in relationship to Neptune.

Joe

Joe,

I said I expect a pull up into Chrismas; not drop down. The drop will come, when most people will be taken by surprise.

Thanks andre

from what im looking at 16960 tuesday is key date price for a low .

i also went through 80 years of data on just the month of dec researching

the supposed santa rally . the rule of thumb is the last 5 days of the year plus

the first 2 of the next year .

the averages of those 80 years turns up on the 21st of dec yet also shows a low

on dec 15 . nothing is perfect yet its something based on history .

for its Monday’s price action more so near the open then the overall day .

a gap up on the open would be similar to the price action back in dec 1929

a low on tuesday is another Fibonacci type turn date

tuesday dec 22 minus 13 trade days dec 3 low minus 13 trade days nov 13 low minus 13 trade days oct 27 low

tuesday dec 22 minus 21 trade days nov 20 high minus 21 trade days oct 22 low

tuesday dec 22 minus 34 trade days nov 3 high minus 34 trad days sept 16 close high

taking the average point losses in terms of duration and distance traveled , the drop from dec 9 would target tuesday near 16960 , the average bounce would send the Dow back towards 17600 .

short term some of my indicators are oversold yet not extreme

the 10 trin closed friday at 1.30 , the rule of thumb on that is a close above 1.40 is oversold

and a move above 1.40 followed by a close back below 1.40 gives a buy signal .

its somewhat oversold yet no signal being generated at this time .

the 20 day oscillator is in a similar position , its oversold and yet not extreme .

10 day adv dec line into an oversold reading yet nothing extreme and the 5 day adv dec line not even close to oversold . so there is still room for lower prices yet id be hesitant to take a bearish positions , the 5 day trin sum closed Friday at 7.39

in bull markets that is an oversold reading , in bear markets the 5 day trin sum reaches

9. so again a time to pause i guess would be my thinking .

bottom line : the market is oversold yet that in itself is no reason to buy , many times you can get very deep sell offs with the market oversold .

Tuesday is my key day and 17960 my price level im watching on the cash Dow as support.

if we see a gap up Monday then ill follow the general theme of the 1929 1930 rally

and look for higher prices into April may .

the dow has a .382 price retracement level from the aug lows to the nov highs

at 16981 and the 50 % retrace from the sept low to nov high is at 16960

for me this would be a normal 4th wave retracement into the 16960-16981 price range

yet to satisfy me that this is a 4th wave the market must turn higher come Wednesday

with the Fibonacci turn date tuesday dec 22 being the key date.

going further , the dec 15 fib date failed to hold its low , this makes the dec 15 high a key resistance going forward . 17627 will be resistance ( if taken out a more bullish picture)

Home work is finished, its now up to the market to give the answers .

the market is Never wrong .

Joe

A new post: https://worldcyclesinstitute.com/the-game-has-changed/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.