The Fight for Our Freedom

The Fight for Our Freedom

I began about seven years ago with a site entitled “Outside the Crowd.” I eventually abandoned it because I didn’t think anyone would “get it.” It probably makes more sense to have that website today.

It was all about contrarianism, which I consider critical thinking at cycle tops. It’s OK to think like the crowd in the middle of a trend, but at tops and bottoms, the crowd is always wrong.

“At the extremes, the herd is always wrong. One should not under estimate its capacity for stupidity.”— The Secret Life of Real Estate, Phil Anderson,

The Secret Life of Real Estate is an excellent book, by the way, about the 18.5 year real estate cycle and its history in the United States. You can find it on my recommended book page.

It’s also exceptionally important to adhere to contrarianism (to some degree) outside the markets. As I look around at what’s going on in the world, it’s clear the herd has completely bought into the Orwellian narrative that incarceration is good. They’re wandering around with masks on, clearly traumatized, with apparently no ability to think for themselves.

Meanwhile, more and more science is coming out (study after study) that the supposed pandemic was over in April, that masks offer no protection at all, that PCR tests are completely useless and don’t tell you anything at all, and that deaths in everything but the coronavirus are dramatically down. That, of course, tells you what we already know — many deaths are falsely be attributed to something that is no more deadly than seasons flu.

I, on the other hand, don’t own a mask, don’t look at any main stream media sites (ever!), and have done the research to know that this whole pandemic exercise is a complete fraud — an exercise in tyranny, which always takes place at 172, 500, and 1000 year cycle tops. At these cycle tops, you have to expect fraud to the highest degree — that’s what history tells us.

And I don’t Google anything anymore; I use DuckDuckGo.

The US is in an international cyber war (and to a certain extent, so are we). There’s a move by China, the elites and oligarchs of the World Economic Forum, and the central bankers, who created this mess in the first place (by duping and corrupting politicians around the world). Revolutions at these major tops are always about money. Governments always end up bankrupt, and rather than admit to the problem, leaders to to hide the problem by taking complete control.

The world is bankrupt and there’s no easy way out. A world currency is not the answer, as we know from the failed attempt in the European Union. There will be civil wars, chaos, and a revolution. I don’t see how it can be avoided, even with a debt jubilee, or dismantling of the Federal Reserve. I don’t see how stability in the financial system can be maintained with the social divisions and levels of fraud that exist around the world. Usually, it means starting over.

So, we have this world level conspiracy to subject us all to socialism, or communism, or worse; that’s obvious to me.

The guy in the way of this conspiracy is Donald Trump, of course, and it’s getting more and more obvious that’s he and his administration have set a trap. “Draining the swap” was not some idle phrase to fire up an electorate; there are real teeth behind it and I have little double you’re going to see some dramatic action within the next month, or two.

We know that the Dominion servers in Germany (in a CIA facility) have been seized and therefore, the US government has all the data to lock up a whole bunch of people, which also seems to be in the works. Rep. Louie Gohmert (R-TX) explained the raid on German servers in a video online. We have information that lives were lost in the raid, and that Gina Haspel, the current head of the CIA was at the location, and was arrested.

On September 12, 2018, Trump created an executive order that set up a National Emergency relating to the upcoming election and any related fraud. It’s very powerful in its wording and information I’m getting on the web is that the response to treasonous acts related to the election is already underway.

I don’t think it’s any coincidence that Mark Esper was fired at the head of the Department of Defence, replaced by Chris Miller as Acting Defence Minister on November 9, 2020 and that special operations were raised to the same level as other military forces, with direct reporting to the President of the United States.

We’re seeing other personnel changes at high levels and troops being brought home.

During the past two weeks, there have been huge numbers of US military planes in the air. There are reports of millions of dollars of work having been completed at Gitmo.

On December 2, 2020, Donald Trump delivered what he said was his “most important speech ever.” It was short, but I think it’s worthy of being paid attention to.

The speech by Donald Trump was apparently important in that it referenced words used in the Emergency Declaration of 2018 and may well have set a high level response in motion.

Now, I don’t have any real proof of the reaction that’s to come, which amounts to the arrests of all the perpetrators of this enormous crime against the United States, but there’s lots of detail to be found all over the internet. From my perspective, the events i’ve described above are becoming more difficult to ignore.

As a market analyst, I need to know what’s going on in the world, as these major events can affect the market. This last statement is really a misnomer. The way the market moves actually tells me what might happen.

I know we have a major top coming soon that will drop the SP500 over 2000 points. I also know that in 2021 (mostly likely), we’re going to see the final top of this 500 year rally. These market moves typically dictate the severity of events … at least, they can.

So, I present this information here that, for the moment, you may be very skeptical of. I have a degree of skepticism at the moment, but the leaks and events leading up to what I’m seeing today are becoming more and more difficult to ignore.

This is all outside the main stream thinking, but that’s where I come from. I have what I think is a healthy cynicism for anything the herd thinks is the true narrative of today.

As I often say about the market: “Trade what you see, not what you think.” I’m seeing a lot of hints that there’s something very big going on.

Now, to the market.

A Stretched Market

The market is stretched and looks like it’s very close to a correction. However, my short-term confidence in the market as a whole is low this weekend, due to Friday’s action. I want to see what happens on the weekend and where we’re positioned Monday morning.

On Friday, ES continued up past my projected top, but only by a few points. However, for a good part of the day, currencies corrected, as expected. It was a day in which many assets I cover were moving in directions inconsistent with established expectations — in relationship to each other, that is.

As a result, I’m cautious about short-term calls this weekend. There are a number of reasons to be cautious at this time:

- We’re getting near the end of a trend right across the market. When that happens, you can usually expect more volatility and shorter-term moves can be difficult to predict.

- Across the market, we’re mostly in ending patterns (diagonals and triangles), which have few rules in terms of movement, so I’ve been operating on a higher degree of “guesswork,” which is now becoming even more dicey. The overall direction is clear; it’s the daily movements and timing of turns that’s more problematic.

- Volume is low, and that leads to volatility.

- Some indices have patterns that can be counted more than one way (IWM is a good example).

As a result, the action over the weekend into Monday will be important. I’m expecting a turn down in the US indices. But I need to see it. Fibonacci measurements tell me we’re at an inflection point and the count for the waves up in the US indices is “full.”

We have a Fed meeting announcement coming on December 16 and a full eclipse of the Sun on December 14, which is also a major election date. As well, as these important milestones, we have lots of news at the moment and expectations are for some major announcements over the next month, or so.

“May you always live in interesting times.” — Anonymous

___________________________

NYSE – Ending Diagonal

Above is 2 hour chart of NYSE showing us a very large ending diagonal. In fact, there are two of them!

The entire wave up from March, 2020 is corrective, telling us it must completely retrace to the bottom. It also means all the waves up in the sub-indices are also corrective.

In the above chart, you’re seeing the top of the wave up from March which has traced out an ending pattern, a large ending diagonal (signified by the blue numerical labels). When the entire pattern is complete, the trend will change to the downside.

It appears we’re also tracing out a smaller ending diagonal right at the top (yellow 1,2,3,4,5). If so, I now put us at the top of the third wave of that ending diagonal, with a wave expected imminently to the downside targeting the lower trendline at yellow 4.

There are no real rules within ending diagonals, other than the subwaves are zigzags, which are corrective three-wave patterns. Fibonacci measurements don’t necessarily work, so it’s impossible to know how long the waves will be. However, with the fifth wave, you know (in this case) that it needs to at least reach the upper trendline and may do what we call a “throw-over” (reaching even higher). There’s a “cap” on the throw-over since the fifth wave cannot be longer than the third wave.

We’re currently near the top of the third wave, which has to be in three waves (it’s always the longest wave of the sequence). We’re expecting a fourth wave down to the lower trendline and then a fifth wave up to a final high.

The time factor is the questionable element. Elliott wave does not have a timing component to it. I’m expecting an all time new high which could go as high as the 14,700 level. That final wave will end the rally up from March.

IWM — Russell 2000

Above is the 2 hour chart of IWM (the Russell 2000).

There are two possible counts for this index.

Either IWM is stretched at the top of the third wave of an ending diagonal, and expecting a large wave down to the lower trendline, or it’s at the top of a third wave, expecting a fourth wave down to (mostly likely) the area of the previous blue 4th, at about 165. At this writing, I don’t know which it is. If an ending diagonal, we’d need to drop to the white horizontal line at 159.32 in order to intersect with the first wave up, which is required for an ending diagonal.

All the other NYSE-related indices appear to be in ending patterns, so that might give the ending diagonal an edge in terms of probability. Other than that, I’m on the fence as to which of the two patterns will play out. In any event, I’m expecting a good-sized correction very soon.

The next major move will be to the downside, and based on futures, the turn is expected within the next few days.

What’s important about the chart above is that the configuration is looking for a fourth wave down, which gives me an order of magnitude for all the other C waves down that I’m anticipating. All the indices appear to need large waves to the downside before we get a final fifth wave up to a new high.

Know the Past. See the Future

_____________________________

Free Webinar Playback: Elliott Wave Basics

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

If you’re new to the Elliott Wave Principle, or even fairly comfortable with it, this webinar will give you a solid introduction and comprehensive understanding of the difference between trending and counter-trend waves, the various patterns for both types of wave patterns, and a good overview of how fibonacci ratios determine trade targets.

This is link to the YouTube playback video, allowing you to review, stop and start, etc.

____________________________

Want some truth?

My new site now has several extensive newsletters in place. Videos now explain the banking system and deflation, and I’ve provided lists of what to do and what the start collecting in preparation for the eventual downturn, which will last for decades. The focus of my new site is now to retain your wealth, plan for deflationary times, and stay healthy in the process. I’m also debunk a lot of the propaganda out there. It’s important to know what’s REALLY happening in the world today. This has all been predicted and we know how it’s going to play out. Getting to the real truth, based on history, is what I do, inside the market and out.

To sign up, visit my new site here.

All the Same Market.

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re in the midst of deleveraging the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2017. Over the past three years, their movements have been moving closer and closer together and one, and now they’re in lock-step, with the major turns happening at about the same time.

it’s challenging because often times currency pairs are waiting for equities to turn, and other times, it’s the opposite. The other frustrating thing is that in between the major turns, there are no major trades; they’re all, for the most part day-trades. That’s certainly the case in corrections, where you very often have several possible targets for the end of the correction.

We’re now close to a turn in the US indices, currency pairs, oil, and even gold. Elliott wave does not have a reliable timing aspect, but it looks like we should see a top very soon.

_________________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

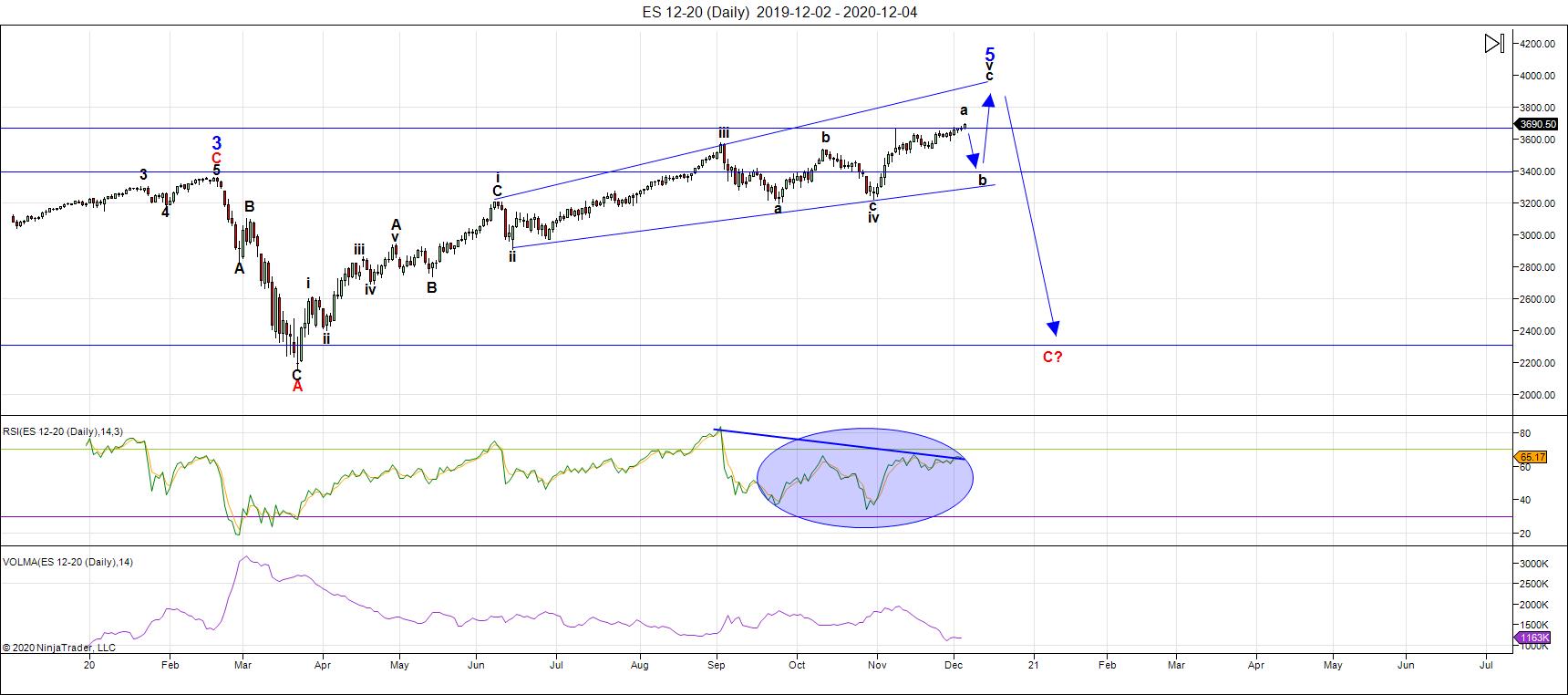

Above is the daily chart of ES (click to enlarge, as with any of my charts).

ES, the SP500, and the DOW all appear to be tracing out ending expanding diagonals. You can see regular ending diagonal patterns in NYSE, NDX, and NQ appear to be in normal ending diagonals.

This weekend, ES looks to be on the verge of a turn down into a relatively major correction. On Friday, I'd called for a correction in currencies, which seems to have begun, but I'm skeptical that it's the correction that will accompany the expected large correction in the US indices. Everything appeared out-of-whack on Friday, which various assets classes moving against each other.

As of the end of the day on Friday, neither ES nor NQ has quite met their targets, although they're only points away.

This weekend will be key in determining what happens at the beginning of the coming week. If we get the expected turn, there could be news to accompany it.

While I expected to see a turn this past week, the market continues to move at a snail's pace and so everything this weekend is "stretched."

While events don't change patterns, they can dictate turns and it seems that we're at the mercy of the ups and downs of the US election to determine the timing of the next turn.

___________________________

Summary: It's an incredibly difficult, exhausted market getting close to a top, which I now think will happen sometime within the next month (or two). The market may top with the announcement of the winner of the US election but it's difficult to say when that will be.

The SP500 is in an ending expanding diagonal. Other US market indices have similar patterns. Diagonals are ending patterns and warn of an impending, dramatic trend change after they're complete. This puts us in the final stages of this rally up from March of this year.

The resulting trend change will target an area under 2100 in SPX, and will likely be a combination pattern and, as such, may contain zigzags, flats, and possibly a triangle or ending diagonal at the bottom. However, I'm leaning towards a series of zigzags, which are corrective waves, and will likely come down fast.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

______________________________________