Last week, I rolled out a blog post explaining how private domestic banksters create money out of thin air. The central bank cartel (in Europe) does it exactly the same way. They create an equal amount of debt when they create money and they do it by pressing a computer key. For that privilege, we allow them to charge our governments compounding interest, which our governments pay back by taxing us (which takes existing money out of circulation).

Last week, I rolled out a blog post explaining how private domestic banksters create money out of thin air. The central bank cartel (in Europe) does it exactly the same way. They create an equal amount of debt when they create money and they do it by pressing a computer key. For that privilege, we allow them to charge our governments compounding interest, which our governments pay back by taxing us (which takes existing money out of circulation).

I also explained that inflation and deflation are a result of the amount of money in circulation and that paying down debt to bankers of any stripe reduces debt, but also reduces the amount of money in circulation. Banks create digital money out of nothing, but under our current system, when that digital money gets returned to the banks, it disappears back into nothingness. Through double entry accounting, liabilities will remain equal and, as liabilities are reduced, so are assets.

So banks both domestically and internationally have full control over our economic viability. When they exercise their total financial control, you have results like we’re seeing in Greece. For non-payment to European central banks, these vultures go after the sovereignty of the country. Greece has had to auction off their airports to interests in Germany recently. Many more assets within Greece are being lined up for the same fate, but Greek politicians are currently trying valiantly to slow down the process. This has been the game plan all along—to financially send us back to feudalism.

“The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert by secret agreements arrived at in frequent private meetings and conferences.”

— Quote from Caroll Quigley’s Tragedy and Hope

The process began in earnest with the formation of the Bank of England in 1694, giving the Rothschild family (and friends) a legal method of using usury to subjugate the world. In 1946, the Bank of England was nationalized; in 1998, it became independent from the government. However, it gets its money from floating bonds to the private market. As a member of the European banking cartel (Bank of International Settlements), bonds that are not subscribed are gobbled up by this central bank of central banks. Like all the other G7 countries, money is created outside the country. Rather than created internally, it’s borrowed at compound interest.

This is what the current revolution is all about, except that “the herd” hasn’t woken up to this fact, yet.

But let’s look at the solution, in terms of a banking system that would solve virtually all of our problems. It’s called “The Chicago Plan” and presented to the US Congress in 1912 by Professor Irving Fisher, but through trickery lost out to Rothschild-influenced Federal Reserve System, made up of twelve private banks that act very much like the Bank of England. The Federal Reserve System was voted in the following year, in 1913.

The same year the Federal Reserve was formed, the 1913 national income tax act was ratified in the US. From Wikipedia:

“The first Income tax in the United States was implemented with the Revenue Act of 1861 by Abraham Lincoln during the Civil War. In 1895 the Supreme Court ruled that the U.S. federal income tax on interest income, dividend income and rental income was unconstitutional, because it was a direct tax. The Pollock decision was overruled by the ratification of the Sixteenth Amendment to the United States Constitution in 1913”

The Chicago Plan

The Chicago Plan was written as a six page memorandum. In 2012, the International Monetary Fund put out a paper that updated the original plan, The Chicago Plan Revisited, by bringing it up-to-date with today’s monetary system

The basic idea is that banks should be required to have full coverage for money they lend; this is called 100% reserve banking, which would replace the fractional reserve banking system.

Under this proposal, banks would no longer be allowed to create new money in the form of credit in connection with their lending activities. Instead, the government-owned central bank of the country should be solely responsible for all the creation of all forms of money, not just paper money and coins.

There are four great advantages in state controlled issuance of money compared with the private money creating activity of the banks:

- increased control with the fluctuations of the market so that exaggerated booms and slumps are prevented

- increased financial stability due to the likely elimination of the risk of bank runs

- a dramatic reduction of public debt

- a great potential for minimizing private debt

The most important feature of the Chicago model is that the banks would be obliged to back up deposits 100 percent with credits issued by the government. This means that they would not be allowed to create their own new credits which, in turn, are made into deposits (along with the same amount of debt).

This government credit, which is an asset for the government and a debt for the banks, would, from a government perspective, be used for redeeming the interest-bearing government bonds that the banks own (which is an asset for them). In the next step, the banks would credit the government credit as well as the assets from private deposits and holdings of government bonds. In other words, the debt owed to the government would be cancelled out by assets from deposits and governments bonds.

In this way, the national debt owned by the private sector would be eliminated and all deposits, which today lack backing, would be fully backed up. Proponents argue that all this would be possible with the aforementioned government credit. The process would be concluded by the banks adapting to a lower official cash demand by lowering the amount of their own capital.

Other Countries and Sovereign Money

Canada: Until 1974, The Bank of Canada created Canada’s money. Unfortunately, that year, Prime Minister, Pierre Elliott Trudeau (father of our current Prime Minister—yes, the US does not have a monopoly on dynasties) made the decision on his own to ignore our constitution, contract the BIS to create our money, and charge us interest for it, which is paid back to these private bankers through taxes collected from citizens.

Canada: Until 1974, The Bank of Canada created Canada’s money. Unfortunately, that year, Prime Minister, Pierre Elliott Trudeau (father of our current Prime Minister—yes, the US does not have a monopoly on dynasties) made the decision on his own to ignore our constitution, contract the BIS to create our money, and charge us interest for it, which is paid back to these private bankers through taxes collected from citizens.

From the time that the Bank of Canada was created as one of the world’s only public banks (creating its own money for the country), Canadians were able to pay for two wars, the St. Lawrence Seaway, the Trans-Canada highway, the Canadian National Railway, and much more. And contrary to common arguments about governments unnecessarily inflating, there was no above normal inflation over that entire period. In fact, our inflation chart mirrored that of the US during the same period, when the Federal Reserve was in full control of the US money supply.

There is a lawsuit currently being undertaken by a private group, the COMER Group, to demand that the Government of Canada adhere to our constitution and revert back to using the Bank of Canada as our public bank, based on our constitution. It has now reached the Supreme Court level.

Australia: In 1912, the Commonwealth Bank of Australia was founded with £10,000 from the government. It operated as a state bank, and for the next twelve years, Australia enjoyed one of the greatest eras of prosperity in its history. It sparked a huge infrastructure program, with the construction of dams, the great Transcontinental Railroad, electricity power plants, gasworks, harbours, roads, and tramways. World War I cost Australia $700 million, which was financed as non-interest bearing debt.

However, in 1924, Prime Minister Bruce privatized the bank and borrowed £230 million from the Bank of England, and by 1927, the federal and state debt had reached £1 billion. In 1947, Australia joined the International Bank of Settlements and now it, too, is not in control of its economic prosperity.

Napoleon: When Napoleon came to power in 1799, his first act was to establish the Banque de France. It replaced the fifteen mainly Jewish private banking houses which has been charging extremely high rates of interest on loans to the French crown, which was causing the government to allocate over 50% of its resources to paying interest.

In taking over the ownership of the banking system and the printing and issuing of money, Napoleon make the franc the most stable currency in Europe. It completely shut out the Rothschild family from France’s economy. As has been proven over and over again, when this group is shut out from the money making and government control business, they react negatively.

“England under the direction of her international bankers, proceeded to bankroll Austria, Prussian, Russia, Spain, and Sweden and duly declared war on France,” A History of Central Banking, Stephen Mitford Goodson.

Libya: In 1969, when Mu’ammar Muhammad al-Qathafi took control of Libya, he kept the central bank as the creator of money for Libya and did not allow foreign banks to operate. Financing of government infrastructure was free of interest and the country had no foreign debt.

Beggars and homeless people didn’t exist, electricity was free, as was health care and education (in fact, students were paid a salary). The literacy rate was 82%. With the exception of Benghazi and its environs, he had the support of 90% of the people. He also constructed the Great Man-Made River, which supplies fresh water daily to the cities of Tripoli, Sirte, and Benghazi. The total cost of the project was financed without a single foreign loan. Well, we know what eventually happened.

Iceland: After their bankruptcy of a few years ago, the government of Iceland has come up with a plan for monetary reform based on the Chicago Plan, but also incorporating several elements from other developments. The plan centers on the idea of replacing the current system of private creation of money by banks by a system where only the government is authorized to issue “Sovereign Money.” The economy has fully recovered and is doing very well.

Here’s an article from “World Finance,” which goes into greater depth.

The Solution

The solution, of course, is that governments need to create their own public banks (owned by the people) that create their own money, which represents the equity of the commonwealth rather than debt. Opponents of governments having a monopoly on the creation of their own money is that such a system would be highly inflationary. There is very little in the history of ancient societies and Western civilization to support this view.

Here’s a link to a PDF outlining the experiment of Guernsey, which created its own interest-free money.

| “Let me issue and control a nation’s money and I care not who writes the laws.” |

| Mayer Amschel Bauer Rothschild (1744-1812) founder of the private International Banking House of Rothschild. |

___________________________

Projection for a Top

The US market continues to frustrate. We seem to be in suspended animation. However, periods of inactivity always lead to spans of volatility. We’re very close to a change in trend.

Wave three of the ending diagonal has taken 11 weeks, counting the double top of the past few days. Under than scenario, I would expect the fourth and fifth wave combination to take less than that same amount of time to find its way to the top.

The length of the fourth wave down (and the stopping point) will determine the length of the fifth and final wave up (and the stopping point). The fifth wave of the ending diagonal cannot be longer than the third wave (about 253 points in ES).

NEXT Federal Reserve Annct: February 1, 2pm EST

______________________________

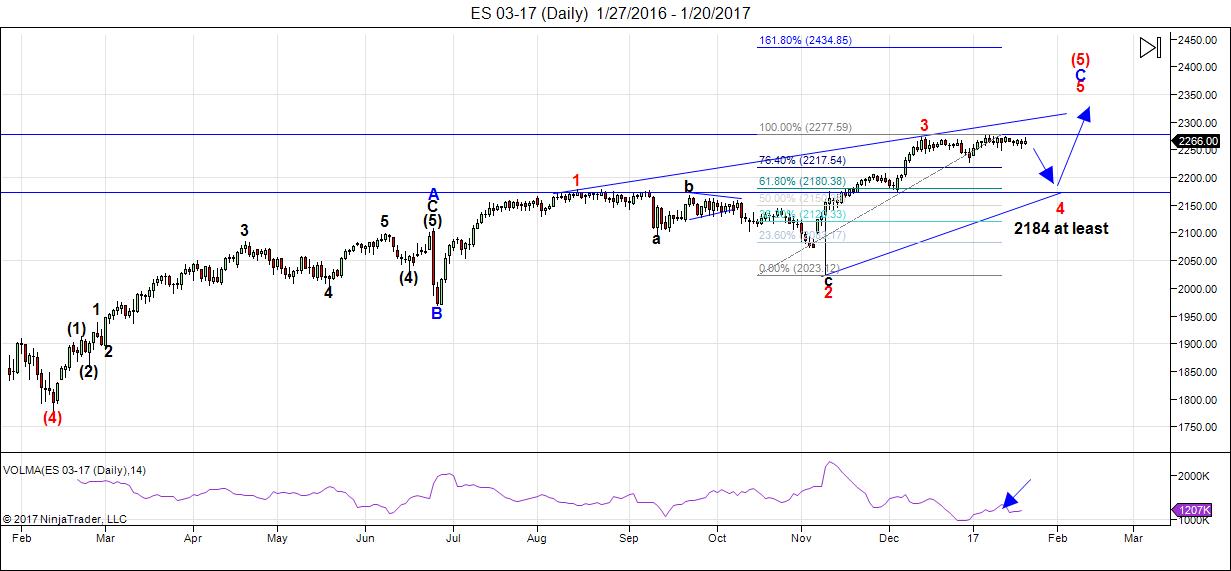

Change in Trend Coming: Here’s the latest daily chart of ES (emini futures):

Above is the daily chart of ES. I’ve been warning my Trader’s Gold subscribers of an impending top that might not make it all the way to my preferred fibonacci ratio stopping point. That’s exactly what we have—a change in trend that I thought was going to happen last week. However, we’ve gone sideways for almost two weeks now.

We did nearly the same thing at the top of the first wave. This time, however, we clearly have 3 waves down so far, and that required a retrace to the top (in ES, this is at about 2277). ES and SPX have struggling so long to reach the double top that I’m expecting a dramatic drop through the fourth wave.

USD currency pairs (and the US dollar, of course) have already turned and are in countertrend moves, to varying degrees of progress. They will need to finish these moves before turning one final time to complete their ending waves. They will all finish their bull markets are the same time, a time we can now measure in weeks.

Volume has picked up and I expect it to pick up even more as wave four unfolds. Wave four will unfold in three waves and needs to reach 2184 at least to stop in the area of the first wave of the ending diagonal.

Here are the rules going forward:

- Wave 3 must be shorter than wave 1 and reach a new high.

- Wave 5 must be shorter than wave 3 and reach a new high (usually it does a “throw-over”—extends above the upper trendline defined by the tops of wave 1 and 3, but it is not necessary.

- Wave 4 must be shorter than wave 2 and must drop into the area of wave 1.

- All waves must be in 3’s (zigzags).

- The trendlines of the ending diagonal must converge.

Summary: We’re beginning the fourth wave of the ending diagonal before zigzagging to the top of the largest bubble in history. The long awaited bear market is getting closer.

Good trading!

___________________________

Sign up for: The Chart Show

Thursday, January 26 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won’t find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Peter

Very good post today .

I am not familiar with the Chicago plan so pardon

if my comments are out of line ( if they are )

So lets say governments around the world do adopt

this plan and ill assume if they do it will be at a moment

of panic ( im not sure at this point )

would you expect that with a stable money supply that

growth would basically be flat ????

If so , then i would assume we get the rest so to speak

price collapse then we flat line .

would that then remove speculation for the most part ?

my own thoughts would be a money supply tied to the

rate of population growth or something similar to that .

You peaked my interest and i will take the time to think

of this further .

thanks for the post

Joe

There are a variety of theories as to what to peg the money supply to. It wouldn’t be gold or silver and they don’t fluctuate in quantity and you need a money system that can grow as you need it to. Ellen Brown’s great books (although I can’t find the entry right now) suggested CPI or a basket of commodities within that country.

Taxes need to stay in place (although they could be much lower) as a means of cooling down an overheated economy) and there’s also talk of a base income, which is what some Scandinavian countries are talking about testing. There has to be a way of regulating the supply to the level of goods and services.

correction

i meant to say .

we get the reset ( not rest )

There is a bearish count tonight that puts ES in a bearish triangle, which if broken to the downside, would put us into the larger fourth wave down.

USD currency pairs seem to be turning with the London open.

luri, I very much liked your 2 charts in the previous post. Thx

Peter an exceedingly thought provoking post, as always. Many thanks. I do however believe that the criteria for the volume of money created by a State Bank needs to be independent of Politicians otherwise their profligacy will increase. A clear ‘formula’ based rule is required so that the volume cannot be manipulated to fit ‘someones’ purpose. The difficulty of course is defining that elusive ‘formula’. I’ll have to buy a bigger thinking cap.

purvez,

‘HOW DARE YOU SAY “NICE” THINGS ABOUT ME, INFRONT OF MY FACE, AND BEHIND MY BACK!!!”

I mean, i don’t go saying nice things about ..”YOU”….behind your back!! this is just another example of the degeneration of society, the same kind of degenerate behaviour that lead to the collapse of the Roman Empire…..

whoooa, i am glad that FIRST i had that cup of that ‘no-name’ calming time tea [it was on 50% sale at the store this weekend – “NO_NAME CALMING TIME TEA” [i am hoping to generate some kind of advertising revenue at the same time i chastise you purvez!]

now in future, please refrain from nice and kind comments….who knows what kind of riff raff that sort of comment will attract into the forum section….we must be selective you know……

luri, I DID THINK LONG AND HARD……before I complimented you. I KNEW you would be PLEASED!! Although now that I think about it IT WASN’T YOU AT ALL. It was your chart I was complimenting!! So THERE!! Are you back to being your ‘grumpy ol’ self again’? Hope you are back in your comfort zone!! I will think even longer and harder next time. This one took a whole 2 minutes. Next one under 2 seconds!!

I for one am very glad to have your sense of humour here. Yes I know humour is ‘spelt incorrectly’ according to American English but it’s not according to ‘English english’.

‘NOT’ complemented….complementing. Me and my butter fingers.

Ok for those in ‘the know’ it clearly is ‘that’ time of the evening for me.

‘Complemented’ was the RIGHT tense. Sorry I’m going to sign out now before any more serious ‘gaffs’ occur…..like….. ahem ‘Canuke’.

B-U-T-T-E-R?? did you say “BUTTER” purvez??……[you mean the newly introduced “NO – NAME BUTTER – ……”NO NAME BUTTER” ……”The butter that tastes almost like butter but just better – NO NAME! — you mean THAT butter purvez?

Thanks. What’s ironic is that the BIS insists that central banks of member countries are independent of their governments. No, I wouldn’t change that. In Canada, ours is, but thankfully we have the constitution, which tells us that politicians can’t give away our sovereignty. We’ll see how that turns out …

Do you like some good Dutch humor..

All of Europe is laughing about it…. It is so great so fantastic …..just watch it… skip the dutch in the beginning…

http://www.dumpert.nl/mediabase/7016679/f3d20832/even_voorstellen_aan_trump.html

OMG john,

i was innocently eating a jumbo dill pickle dipped in honey, and was watching your video…..

let’s just say, i snort laughed at the WRONG time, and pickle juice descended out my nose!!

do you know what pickle juice in your nose feels like JOHN???? ….hmmm….DO YOU??….let me tell you something john – “IT BURN’S JOHN…….it buurrrrrnnnn’s!”

ahh thank you for that….thanks

:-))

I actually have more empathy for the pickle …

but that’s just me.

🙂

“gasp” —- really peter, ……”THE PICKLE”……….the pickle?? the humanity of it all!!

‘sigh’ – just another sign of deteriorating social ‘mores’……. and with it, economic/social collapse…….. am i wrong here?……… anyone, anyone…Bueller?? ….anyone……

aha … feeling a bit trumpish, are we?

Sorry for that Luri, I hope you feel better by now…

We still do not believe what is happening but it is what is..

Good Luck..

By the way Mahendra was spot on with his prediction that the market will go sideways from Dec 21 and now he says the market has topped last week and we will see a big drop…We will face a bearmarket for the comming years with Trump..

My dates are bottom on Jan 26/27,up till Feb 1 after that all hell breaks loose till Feb 9.

http://www.mahendraprophecy.com/latest-news.php?id=1108

no worries john,

except all is good – “UNTIL SOMEONE GETS THEIR EYE POKED OUT”! just remember that one young man, as you are GROUNDED in your room for a week!! and NO COMPUTER!

:-))

Hi Peter,

I’m waiting for a good entry point into gold, are we going to see a pull back from here? Just wondering what your thoughts are regarding gold? Thanks so much,

Corrine

Corrine,

I can’t really give you much more on gold, as it’s not fair to my Trader’s Gold group, but there’s a two week free trial now, so you could sign up for that. There’s absolutely no obligation, but you can only do it once. You can go to the Trader’s Gold page (link in the sidebar) for more info.

Peter,

Ok fair enough, will do. Thank you.

Corrine

Has Andre’ been posting anything lately?

Can geo-engineering effect the climate cycles on the earth? I have read that geo-engineering has been going on for close to 70 years.

Thank you.

linda,

Hasn’t nature itself been geo engineering from the beginning – long before man showed up? According to the geologic record, ice core samples, there has been epochs were the earth has belched up the most toxic mixes of sulfurs [acids], etc into the atmosphere – and still we have ‘ the climate cycles’ . It seems to me that cycles are cycles because they ‘encompass’ all variables [including man’s puny attempts at controlling the uncontrollable] and still the cycles continue and produce predictable sine waves.

well i happen to support Velikovsky’s assertion that our current arrangement of our solar system is relatively recent, ie, 5,000 years recent. He portended that before that time, earth was under the influence and plasma field of Saturn. [Saturn being a brown dwarf star]. We were protected by the field from the radiation of space, and the planet as a result was completely warm and tropical, including the poles, otherwise called the ‘golden age’. We had 2 suns.

Something happened to rip apart that orbital arrangement, to the configuration we have today. If so, the climate cycles would be such that it is only now settling into this new arrangement with our current sun…..

:-))

Linda,

I don’t think so. It hasn’t seemed to have changed anything on a grand scale. We still have floods, forest fires, and the extreme weather that was predicted in the 1940s. It will start to die down in the next few years as it gets colder and less wet. We’re at a cusp (like spring and fall) between two different climate systems. A typical climate cycle is 25 years and then 100 years and then 172 years, etc. 515 and 1030 years are the large cycles that change civilizations.

I take it you’ve watched my Global Cooling video on the main page of the site …

I need a magnify glass to see todays price range. Snooooze

Magnifying glass.

Ted were you ‘really’ wishing for a large move? Hope it went in the direction that you were ‘wishing’ for today!!

🙂 it did, i was looking for a better entry for going short. Have put 3 batches of 207 spy puts on. Done adding to the position ready for fourth wave. But at the moment i technically have a losing position. hopefully we hit 2277 es soon and reverse.

I just want this 4th and fifth wave to get over and done with. Granted I should be carefully with that i wish for when this bear market starts.

Congrats Ted for trading ‘what you wanted’. It came true. No ‘other’ feeling compares to that.

G’luck with ALL other trades in the same way.

Thanks Purvez, still looking for wave 4 to really get started to truly claim this as a good trade. Lets hope that 1/24 turn data mentioned by John was it.

Well, just look at JPY

Well nicola2910.

We are entering your dates,I think tomorrow.

Raj is getting exited.

January 7, 2017, 5:55 pm

I did the math on his next swing high.. I get 01/23 or 24 .. give a day or 2 either way

I am watching also ….n

Thanks,

I will keep you informed if I receive a new update from him.

John , If this happens, I will take no credit for this , I only counted his 47 T.D. chart , It would be Raj ‘s win or lose , but it is interesting to watch , any comments ?? …n

Thats oke,

I appreciate your effort but it is interesting to watch what will happen,tomorrow is also Mahendra’s day

Saturn in sagittarius for 30 months,it should be bad for Trump he wrote

Good luck..

John.

Hai Nicola,

My best guess the top was yesterday (Raj) if I understand him correctly.

So what will be his bottom date is the next interesting point..

John..

Hi Peter, I tried to sign-up for the Traders’ Gold free trial, but it redirected me to the homepage (no sign-up form). Then I cried. Then I’m writing here right now :))

For anyone else trying to sign up, there’s a workaround now to the glitch we found today that we’re still working on. Just go to the Trader’s Gold page, click on the Free Trial button and it takes you to a brand new page. It’ll do for now. We’re continuing to work on the longer-term fix.

New highs

Now just need to Dow to keep moving

So far the mars Uranus cycle is working in a similar fashion to the 2009 lows

Next up is the Venus Sun mercury Sun conjunction to give the markets

The boost , March 2 is where that begins yet late March is where we should

See the excelkeratiin higher , May 19th is a cycle low .

July August an important time Fran for a potential high yet October is the better time to get short .

End of quarter plus 20 days was Jan 20th .

Next is April 20 then July 20 then Oct 20th .

Joe

Joe I don’t think I can make it there alive (October), both emotionally and financially. Please tell those planets to move faster 😉 – like mid-February faster…

Linda

I’m not familiar with geo engineering but I’m very familiar with

The sun spot cycle .I think sometimes we ( myself included ) over think

Climate cycles ( not to mention economic cycles )

In the end though we muff accept what ever the cycle is that is laid out

In front of us . I try to analyse something and then be able to sell myself

On what I think the outcome will be .

As an example how would you explain to a 3 year old what is happening today ?

From a 3 year olds point of view it’s cold out . Pretty simple thought process .

I suppose if we took bare land and measured the average tempurature

We would get an average temp . If we then built housing and office space

On that land and turned on the heaters to warm up the buildings we would then expect

To see a higher average temp . So I can see how man could have warmed the air space

In some minor way just by development of cities . But if I look at the sun spot cycle

I can also see we go through global warming and cooling periods and these periods in time

Take years and as Peter has pointed out these years can become decades or multi decades .

If I had the choice I’d prefer more global warming yet I know that is not what to expect .

Joe

Alex

Only trade using money you can afford to lose .

Being patiant is extremely hard in practice and I suffer

The consequences every time I rush into a trade when I speculate .

Another thing I’ve found is over trading will kill you at some point

The simplest approaches usually work best for me .

I try to focus on only one market at a time .

With individual stocks I watch various sectors

With index trading I watch the nya the sox ndx spx oex

Transports the utilities and the Dow yet my main focus is

On the DOW . Many focus on the spx , I used to do that but over time

I changed my view to the Dow because for me I had to make a choice

On where to get historical data for my research and the Dow had the longest

Historical data from which I could create very long term historical indicators .

I’m in the very early stages of taking my spreadsheets ( excel ) and inputting

My formulas into a computer software and from there being able to use these

Formulas on a real time basis instead of a closing basis .

My point to all this is , we must look at the stock market as a never ending chess game

And in order to stay in the game you need to understand as many angles as

You can in order to persevere . I have taken many of people’s theories of the years

And back tested them and found they don’t hold up over the long term on a consistant

Basis . Some of these theories are formulas and they have to be adjusted

And or thrown out . The few that have held up I have kept yet the process

Never ends . It takes a long time and a lot of effort to put it together yet for me

I’m at the point where I’m realizing I need more computer power and the ability

To take it all from excel spread sheet form to computer software form .

From there I’ll find myself doing much more research . As an example

Just because a 1000 day indicator has worked over 100 years does that mean

The same formula will work on a 1000 minute chart ? Or a 1000 hour chart ?

There is way to much time involved to input 1 minute data manually day to day

70 % of trading activity is now computerized trading . If we do not understand

How these computeres move the market we will find ourselves at a disadvantage

That does not mean you can’t make money trading manually it does mean

Though that to be successful you need to be on top of the market .

As for Elliott wave theory , I have yet to find an Elliott wave software

That gives true wave counts . Those software programs can make money

But I have yet to find accurate wave counts from them that satisfy me enough

To buy one .

I have looked at Elliott wave patterns in many things including my own spending

Habits to the sun spot cycle to of course the stock market .

Elliott wave has proven in self to me and is as consistant it helping me

Understand nature’s patterns , my own spending patterns , you could

Even plot web site hits and use a wave count .

But….. I chose to manually plot wave counts

Bottom line : you will make it to October yet financially or emotionally

You will have to chose where your priorities lay.

You can flip a car and double your money , or trade options on the stock

Market or work a 60 hour week , all could create a profit or a loss .

Truth be told : I shorted the stock market in 1997 and again in 1998 and again

In 1999 and then in mid 2000 bought heavily in the Jan 2004 puts .

All told ? Even though I made money in some of those time frames .

The losses over all were outragious . In 2003 I changed my entire trading stradegy

By creating my own formulas and focusing on what I thought instead of depending

On someone else’s view , 2004 to 2009 great improvements , 2009 into 2014

Great results , 2014 to date decent to ok . My stradegies are now changing

And because of these planned changes I’m not speculating nearly as much as I used to .

I figure I have around a year of programming ( I’m allowing for it ) and then

I’ll be back to trading more aggressively .

Point is we will always have a train coming into the station you can buy

The 9 am ticket or the 910 ticket or buy the ticket 2 days from now at 4 am .

The trains comes every 5 minutes and runs all year .

No one should ever feel rushed to trade or should you feel angry you missed the move .

Sideways markets kick your butt more times then not .

Catching a move is my goal and to hold it as long as possible and not get caught up

In the very short term .

If I’m going to catch the train from San Francisco to new York

I don’t want to stop and spend a day in north Dakota and then take a taxi

To Idaho and get back on the train to new York .

Anyways

You will survive

Joe

Joe Thanks for the in depth description of your trading. There’s always another perspective which makes it all interesting.

So, to be clear, you’re waiting till October for the correction/bear to begin ?

Eric

To be clear yes I’m waiting untill October

Yet as I’ve mention before , I’m also going

To see what the market looks like I’m the July August

Period .

Keep in mind I’m also only begining to transfer

My formulas from excel spreadsheets to a computer

So I can use many of my daily or weekly or monthly

Or 36 day inductors in real time . Getting all that

Together is going to take me a lot of time to get together .

Also lets say you shorted the stock market at the very

Top on Oct 11 2007 ( date from memory so I’d check that )

Say you sold that top short and held throughout which means

Either long term options or a short position in an etf which

Ties up capital for margin or you used futures which you

Had to roll over on each expiry .

The question being how long did you sit on those positions

Before the market finally went into free fall ?

You could have sat out untill may June 2008 and done

Extremely well ,

June 2008 to Nov 2008 was a huge drop

Jan 2009 to late Feb early March another big drop .

So being late to the short side still paid off extremly

Well .

Bear markets are about fear of loss and it takes

Time for people to really panic .

The first 5 – 10% won’t shake out long term investors .

Yet you see weakness over a period of a few months

And people start to worry , they stop buying and

And sit on the fense. You get the first and second waves

The wave 2 bounce fails . The news starts scaring you

Then the market begins to decline and you go to your

Broker or call him and he/she somehow convinces

You to hold off and be patiant . Then the market declines

Further and begins testing that first wave low . You call

Up angry and sell a portion yet not everything .

The market bounces a little then flatlines and you question

Those sales yet your still nervous . The market drops further

Breaking to new lows and you sell again .

Then another big bounce again so you question your selling

It happens over and over .

Or you have people who learned about margin , they traded

A hot stock on margin and made a lot of money . That first

Drop brings a margin call and turns 300,000 into

90,000 . This type guy leverages back up trying to get his

Money back convinced the bull market will bail him out

Again , he is scared to death and has yet to explain to his wife

What has happened . This type guy is usually a small business

Owner who does ok income wise . His account jumps to

120,000 on the bounce and he covers with the intent

Of buying the next dip . The next drop comes he leverages

Up again and the market crashes . His 120,000 is now

30,000.

You are correct , we all have different views .

The explaination I told you I watched happen yet it was

450,000 and the guy wiped himself out . The entire

Account .

Another guy was long 600,000 in the tech sector in 2001

He sold his chiropractor business going into January

2000 put it all in ( 600,000 total ) he took a 2 month trip

To Mexico and came home in April 2000 to one hell of a

surprise . That didn’t wipe him out but it crushed him

Financially .

I personally had a bull call spread on 20,000 ounce of silver

In the early 1990’s the trade was working and it hit my target

Yet me being the genious I was ( not ) called the broker

And sold the long calls and told him I’d call back later

To cover the short calls . Silver held up during the day

And I thought I should exit so I don’t expose myself

Overnight . I called the broker and he said silver closed

3 minutes ago . Me with a 5,000 gain and feel confident

Said no biggy I’ll exit in the morning . Well that night

The news came out that Warren Buffett had cornered

The silver market . You can imagine my hell being short

20,000 ounces of silver . I traded silver futures like a mad

Man for 4 days because I could not buy back those

Call options using a limit order and the rule of thumb

Is never ever use a market order in a new York market

Let alone a fast market . In the end my 5000 gain

Turned into a 500 dollar loss . To this day that is the

Best 500 dollar loss I have ever had. I learned first

Hand what fear feels like . At the worst of it I was

Down 40,000 . Get your head handed to you and you

Understand fear . If you understand fear then you

Understand a bear market .

So I wait

Jeez … what chapter are we on? 🙂

Peter Does todays action negate wave 4 or is it still coming ? Thanks

Hi Eric,

Today’s action was predicted. There’s always a wave 4, so I’m not sure I fully understand the question perhaps. Today we hit my target.

Another question- what what the target that you predicted for wave three to end? Nenner research had called for an SPX top at 2882.

2294. The rest tomorrow in the Chart Show.

Eric

The short story is

Yes

The long story I wrote yet not sure if it will post .

Joe

Hi Peter:

Hope to see you at the webinar tomorrow GW

Do you still see an ED in SPX, and if you do, the rule of wave four returning to wave one territory means a much bigger decline after these new all time highs. I am having difficulty seeing a three wave zig-zag in this latest move up. Any thoughts would be appreciated. Thanks!

That was chapter 2 -3 highlights

Chapter 1 was very fun 🙂

I figured why not post a few nightmares that moved me .

Those are the worsts .

Chapters 4 through 12 much more positive yet

Probably won’t ever get published .

Joe

Congrats to Joe and Valley on their ‘bullish’ calls. Next stop 2300!!

Thanks, Purvez! =) Year of Rooster (2017) second best year of the 12 year cycle.

I don’t know as I would take bullish comfort if it is a 12 year cycle, Valley. If so, then prior years of the Rooster would have been 1981 (minus 9.2%), 1969 (minus 15%), and 1957 (minus 12.8%)…

However, 1945 and 1933 had 100% return combined which skews the rooster year data. Rooster, Dog (2018), Pig (2019) going back 8 cycles have averaged 10% per year or a total of 240% for the 24 years combined.

It is still the Fire Monkey Year. Fire Rooster year starts January 28, 2017. Last year the monkey year began Feb. 8 and retest of Jan. 20th low was 3 business days later. Three business days from January 28, 2017 is February 1. It would be interesting to see if Feb. 1st will be the top for the 3rd wave.

Good point! That would be symmetrical.

Just some Gann stuff…

Low on 3/9/2009 = 666.79

3 x 666.79 = 2000

3/9/2009 + 2000 = 2/11/2017

Cash Dow has short term support at 19890

short term resistance at 20125

longer term support at 19156 into march 7th yet i have doubts march 7 is a low .

if the Dow fails near present levels though we could see a decline into early

march then a choppy market into March 28th and then another big leg higher

which would complete by June 30th-july 21st .

Feb 11th shows up as a turn date , high or low im not sure .

Daily dow chart only 3 waves up at this point and id rather see 5 .

Im bullish yet have mixed picture im looking at and need to think through

Joe

Todays is looking like some sort of high has formed

to what degreee i dont know .

the dow stalled just below 20125

sox has stalled

value line index stalled

oex looks to be stalling

nya stalling .

utilities showing some strength

im not sure how to read this at the moment.

Maybe this is just a minor wave 3 high from the

jan 19th low .

im undecided on the very short term

Joe

Joe, today is looking to me like a ‘correction’ in an onward ‘bullshit’ wave. (I always knew I’d make this ‘innocent’ mistake once it was past a ‘certain’ time in the evening.)…. I meant ‘bullish’

So I’m still expecting another wave higher (ad infinitum if Yelling is to be believed).

I now have a completely different trading strategy. Each day I look to see where the ‘highs’ have been and then I take a ‘teeeny tiny’ scout short down. If that get’s violated then ‘hey’ I’ve lost a ‘teeeny tiny’ amount. (Although emotionally painful it is financially bearable).

My main reason for change of strategy from trying to gain 50 points each day is because I can’t BEAR to go long any more even though I ‘know’ it will yield my 50!! This market is in some ‘unknown’ stratosphere which I don’t understand.

So I’ve surrendered to ONLY SHORTING until my money runs out in ……. 2133.386 as per my trusty Excel calculator. That number by the way is the DATE and not the S&P.

Those ‘awake’ will have realised that ‘that’ date is beyond my current body’s exhaustion point. So ….I DON’T CARE anymore!! HAHA!!

Purvez

I would love to be in your shoes 🙂

No worries for the next 116 years is a wonderful thing .

im shooting from the hip here yet it is now late January

if you take the high of the week of :

feb 23 2015 to the low in the week of feb 8 2016

you get a time period of 50 weeks high to low

and adding 50 weeks to that low you get this week .

from the week of jan 18th 2016 to week of april 18 2018

you have the 1st wave ,

wave 2 ended the week of june 27 2016

from june 27 2016 to dat we have been in a 3rd wave .

wave i of 3 began the week of june 27 and ended the week of

July 18 2016 ( notice the end of qtr plus 20 theme so far ? )

wave ii of iii of 3 ended the week of oct 31 2016

the wave iii of 3 peak looks like it ended the week of

dec 5th 2016 and the wave iv low which was very shallow

must have ended the week of dec 26 2016

then we went into a minor wave v of this wave 3

minor wave i lasted 2 weeks into the week of jan 9th

minor wave ii lasted 2 weeks into the week of Jan 23

which is this week .

The alternate and there is always an alternate

is we have been in a minor wave v of wave 3

from the week of dec 26th low .

under that scenerio and a recap

wave i of 3 lasted 4 weeks

wave ii of 3 lasted 15 weeks

wave iii of 3 lasted 6 weeks

and this wave v of 3 would be counted

as lasting 4 weeks if it was to end this week .

Regardless of what i think the market will do short

term , i still see this as a peak in a 3rd wave

which requires a wave 4 then 5 before it can be counted

as complete .

wave 1 lasted 13 weeks

wave 2 lasted 10 weeks ( 10/13 =.769 , not an exact square root of .618 but close enough )

this wave 3 has so far lasted 30 weeks into this week

wave 1 at 13 weeks times 2.618 would equal 34 weeks which would target late feb

if that actually played out .

13 times 2.382 would imply a high next week ( 13*2.382=30.966 )

in either case

both wave 3 of 3 as well as wave iii of 3 have been relatively weak .

Bottom line:

this week is the first week i see as a potential for an important top

yet i do not see a completed wave so ill keep the bullish bias .

from the next low ( when it comes ) ill look for a 5th wave move

and from that top which i have mention already the several dates

ill look to take a bearish stance .

Joe

Look at the monthly nasdaq composite chart

$compq

from the low in feb 2016 you can see 5 clear waves up

wave 3 barely put in more points than wave 1

and this 5th wave is weaker still if its a 5th wave .

so if i was to be taking a bearish stance as many here

are looking for i would be looking at the nasdaq or nasdaq stocks

Lastly

another oddity

compare the ndx ( nasdaq 100 ) to the qqq

they don’t match yet they should

the move up on the monthly chart of qqq

aug 2015 to dec 2015

and the move from

feb 2016 to today

almost the exact same point move

yet .

the first leg up lasted 4 months

and this last leg up lasted an entire year ( 3 times longer for almost the exact same point gain )

either the ndx needs to drop or the qqq needs to extend higher .

todays high was with in 3 ticks of an exact equal point move .

so to sum it up

todays highs should matter yet ill consider it the top of a wave 4 not a major top

and i have no intent to take any bearish positions

Done

Top of a wave 3 ( correction )

Good night 🙂

march 115 qqq put might be a consideration as a hedge

a day trade mentality says when you break below the prior days low

you look for a test of that prior days low .

in the bigger picture the same thing can be said on a break below

the prior years low you would there for look for the possibility of a test of

the prior years low , it does not always work on the years basis yet

that is the thought process behind it .

Damn typos

a break below the prior days high you look for a test of that prior days low

a break below the prior years high you allow for a test of that prior years low

nuff

bed time

I think we need to hit that upper trendline to complete wave 3 before we turn, thought it should be pretty sharp… my guess is we hit on Wednesday or thursday next week with the fed.

This is a “WTF” moment. RUT chart – which never made a new high, showing the pattern to be complete has registered a Balance of Power reading that is ‘off the charts’. Anything below 0 indicates selling is happening. What this is suggesting is a HUGE amount of selling is occurring in an otherwise “pinned” end of month market.

WOW! https://invst.ly/35ncs

Idk Luri. /TF to me looks like a bull flag.

so, just after the feb 2016 low, if you look at the BOP [balance of power] you see a large ‘spike’ up in an otherwise sideways trending market at that time. it was saying that HUGE buying was coming in, and giving you indication of much higher prices.

at the time of the UP spike, the RUT was consolidating between 1050-1100. The UP spike gave you a heads up that ‘much” higher prices were coming. So this is telling me the same information, except in the “opposite” direction. MUCH lower prices are coming our way.

the april 2016 excessive spike ‘UP’ in the BOP told you to BTFD.

with today’s ‘DOWN’ spike in the BOP it is telling you to STFR. [sell the f’ng rip]

Luri….it’s VERY LATE AT NIGHT in the UK ……BUT even I know (despite the late hour) that it is NOT ‘HUGE’.

IT’S ‘YUUUUGE’. Didn’t your school ever teach you ANYTHING?!?.

No…neither did mine.

purvez,

your comment was bulky, and overused , it was a’cliche’, it lacked definition, and there was a heavy ‘fruity’ aftertaste that lingered on the palate.

your comment also had smokey overtones, very similar to the way gordon ramsey prepares burnt toast, and in the immortal words of the great peter temple – [AND I QUOTE] “I actually have more empathy for the pickle …but that’s just me.”

otherwise – thank you – THANK YOU so much for your comment. :-))

Luri

Out of curiosity have you looked at that indicator

Going back 10 years ? 20 years ?

To see if those down spiked have shown up before and

What happened ?

Not knowing the details in what that indicator measures

Or how it works I don’t know the meaning yet obviously

You do. It would be interesting to see it’s moves in mid as well as late 2007 and mid 2008

Also back in early 2001 to get a better grasp on the meaning of that selling pressure

On a historical basis

Joe

Thanks for sharing 🙂

Luri

I think this us the formula

The calculation is: Balance of Power = (Close price – Open price) / (High price – Low price) The resulting value can be smoothed by a moving average

You might also try along with the historical process

Using a 20 day simple moving average to see

If that indicator shows and extremes on a yearly

Basis .

My guess is the market moved in such a way that

Skewed the indicator yet I’m not saying anything

Other than that .

Some times it happens is all .

You should know next week what the WTF

Means though .

Joe

joe,

thanks for the comment. Yeah, i am aware how BOP is derived. BOP is no general oscillator and lagging indicator showing divergences…. once mastered – it becomes an effective leading indicator. the friday signal will manifest itself over weeks, it is a signal for the future…….so look to the future in terms of multiple of weeks.

if you have it, you should play with it……..

Analysis.

The problem with cycles is that there are many of them and they all seem to work.

The most fundamental are the vibrational/music cycles (17 year). Next come the natural cycles.

The sun is the center of our solar sytem and features an 11 year cycle. This is sunspot cycle and varies between (roughly) 10 -12 years. The 1998 dec high was significant as it was 66 (6 times 11) from the 1932 low. Torque confirms this was significant. 17 years from dec 1998 comes dec 2015. Carolan saw this as a long term cycle due to the full moon at solstice. And torque gave a high 12/28/15. 17 months from this day brings late may 2017 for a low.

Next come the sun-moon-earth cycles, the basis for the delta system. 90 metonic years from the 1929 high gives 12/28/16. This is a very significant timing.

We also have numerology cycles (50-100 years). Adjusted for inflation, 1966 was the all time high. 50 years later we have 2/9/16. This should have been a high. But the market made a low 2 days later as the 90 metonic year cycle was up into december. So the 50 year cycle needed an extention. So we add 1 metonic year to 2/9/16 and we get 1/28/17.

Combined this says :

– 17 month on dec 2015 is down

– 90 metonic years on 1929 is down

– this weekend the extended 50 year turns down.

1/30 may be the 2017 high. a low by the end of may is likely due to the 17 month cycle. A high in september 2017 would be 88 years (8 times 11) from the 1929 high and lilith trine the north node). This will cause massive financial panic and god knows what else (ww3?).

The high tides give extremes Monday/Tuesday and the low tides Thursday and Friday). Tuesday we have a tidal inversion. Volatility will increase nex week. 1/2 is the crashangle on NDQ. 2/3 will be a high and cayse a crash into the lunar eclipse. Guess the jobreport will disappoint big time. With low economic growth and car inventory at record levels The Donald needs a miracle. A trade-war with Mexico will increase the cost of living in the US. This will not create jobs.

Merriman says 2017 will bring the ‘big reset’. Think he is right.

So, markets have been flat most of the last year and certainly this month. My analysis is one way to explain this. And changes are 1/30 it will all be over.

I have more on the delta system. If you like I can tell some more on this tomorrow.

Have a nice weekend; next week should be interesting.

Typo; chances are…

Thanks Andre

If I understand your comments are you looking for a market high on January 30th and then down to a low at the end of May 2017? Any indication of the low point for the S&P at the end of May?

Thanks

Andre’…a couple of questions for clarity.

You have identified potential highs on 1/28/17 a Saturday…1/30/2017 could be the

2017 year high…So the high is potentially next week! No guarantees! Ha

You write 1/2 is crash angle on NDQ…Is that Nasdaq? Then you say 2/3 will be a high and “cayse”…Do you mean “cause” a crash into lunar eclipse?

In your humble opinion…We reach a high between 1/28/17 and 2/3/2017, right?

Then down into late May! Does Merriman place a date in 2017 for the “Big reset”?

Thanks

Ed,

You are right. NDQ is nasdaq and I expect a major high next week with 1/2 as the most likely date. And 2/3 will be a high with a swift decline into 2-10 – for starters.

But 1/28 is a system date; so the strongest this month. 2/3 will be a retrace within a downtrend. Will show the metonic timing tomorrow. This will show some support into 1/31.

I think Merriman also points to the fall of 2017.

The lunar year – or the hebrew calendar – starts with the new moon in Pisces.

In 1929 the high came 2160 degrees in the lunar year.

In 1987 the high came 2160 degrees in the lunar year.

So 9/3 and 8/25 may look different in the solar calendar, in the lunar calendar they are the same. This is what Carolan explains in his book. But there is more to this. Why 1987? The 2007 high came 2520 degrees in the lunar year; 400 degrees further.

The 1932 low came at 1490 degrees and the 2009 low at 113.

When we look at 1490 degrees in 2015 we see 7/20. So this high was a sensitive degree on 1932. This is one reason why the market didn’t decline 5/20 and we saw the crash in august; after the major 7/20 date.

This analysis makes me believe we see sensitive degrees in the lunar year or anniversaries. 1490 degrees in 2017 gives 6/27 and 2160 degrees gives 8/21. 2520 degrees (2007) gives 9/19. I think all these dates are relevant.

2/1 will be 95 % in the lunar year that started 3/2/16. The 11/4 low was 70 %. So it seems those dates are sensitive.

Now I see it; 25% from 11/4 is 2/1. 25% is 90 degrees. 2/1 crashdate.

2/1 is the Fed announcement. Could be a 1/2 increase to set the markets down?

Any thoughts?

John,

This weekend will be a high, so Monday will be down. Tuesday will be a low and Tuesday/Wednesday we turn down again. 2/2 will be a low and 2/3 a last test up. After next week a bit more volatility; a w3 type of wave. 2/26 will be a high again and 2/22-23 a low. 3/3 will be a low on 11/4 (1440 degrees) so late february another high.

Oops; 2/1 way more important than I thought. The party is over. The feds will spark a recession. Want a date for the low? Try 8/13/2022.

I am not joking; this is hard core Gann timing.

Thanks a lot andré. On Jan 6 you said, “Upagrahas gives a nodal Parivesha 1/21. 1/31 a Saturn indrachaapa. Again; very different system but these dates are unavoidable.”

So the high this weekend may spill over into 1/31 – 2/1 high it seems!

andre,

so 12/12/16 was the high for the RUT. Was this a date of significance?… are your turn dates being respected by indexes other than the DOW and SPX??

P

1/31 we have a saturn Indrachaapa. It could be some Upagraha’s are more special than others. Next comes a moon Dhuma, 2/7-8.

Why are not U counting the waves as 1 -2- i -ii -iii in place of A of 1- B of 1- 1-2-3. Is there any elliot wave guideline to distinguish them. I have seen some count it that way.

I am new to this post. But I have read some of your earlier posts now where you mentioned that 2000 and 2007 had impulsive tops but since this was a supercycle top so you are expecting an ED.

Andre

I find your work amazing and your dates

keep hitting mine yet from a way different process

im posting this only for a reference and because it dove tales

yet this is by no means based on anything planetary

it is just a statistical what if based on historical percentage

movements in the dow .

Tuesday is an important date .

id say dow short term wave 4 may be over or close to it

from the recent Jan 19th low if this model has any accuracy

behind it .

while a Tuesday low makes sense im beginning to think it may be a high .

my other model points much much higher .

early to mid march is the next important cycle period

yet this next week would clear up several issues in this bull bear debate.

until i see what the market actually does this should be viewed

as only a guide

looks like 20130 is now the key level and this level can be taken out

in the short term yet a break back below it would be a must if

this idealized % model has any meaning at the moment .

http://imgur.com/cL4RYzX

The old adage

so goes the 1st 5 days of January so goes the month of January

so goes the month of January so goes the year .

The above chart says something different yet that doesn’t mean

many wont adobe this attitude and get bullish .

the next high past this June 30th date . targets august

then we get October which is beginning to look more and more

like a low and not a high yet i cant rule it out as a high at this point

only because we have many months to go .

A drop now isn’t even proven at this point yet if i see a sideways

move develop over this next month then id be on guard

for the march low as this chart implies .

19980 would be the key support to watch on the cash dow .

breaking below that starts to make this model projection

more likely . and the 20130 level is the key resistance .

its beginning to get interesting

( i am not a die hard bull )

Joe

Note :

i moved the support up from 19890 a few days ago

to 19980 . not a typo .

Joe

INDU trend trade system…significant negative divergence…could drop like a rock post FOMC…?

https://twitter.com/allerotrot/status/825443337377193984

Metonic years.

In the delta system, metonic years are the strongest and should give pattern repetition. As I said before; I calculate with degrees in the sun-moon elongation and not with time. A matonic year = 12 times 360 degrees.

Looking back in this timing I get 11 dates between 1/27 and 1/31. Think about this. Over a period of almost 11 years, the metonic years give a range of 3 trading days.

Of this 11 years, 3 give a low and 8 give a high, suggesting the trend is down, with some support 1/30 and 1/31. After 1/31 support is gone.

In 1929 the lunar year started 3/11. In 2017 it will start 2/26, This is a difference of 13 days, 2/11/1929 the dow made a high, 2/11 minus 13 days = 1/29. This should be a high. This is hebrew timing.

Carolan writes about how the 717 moons connect panics. This cycle gave a high 1/20, a low 1/30 and a high 2/1.

The 666 lunation cycle is 54 solar years or Kondratieff. The 444 or 36 years (squared number!) gives a high 1/31. This is a Hurst cycle, and a trine in the number of the beast.

40 years is also a cycle. And 4/10/78 we saw a high. That would be 1/31 ( and it was a significant high.

My Gann-Delta system assumes 360 lunations is one cycle. This would be 30 lunar years and is used in vedic astrology.

60 degrees gives a high 2/1, 90 degrees a high 1/29, 270 degrees a high 2/1 300 degrees a high 1/31, 360 degrees a high 1/29.

See how all kinds of delta timers all point to this weekend being very pivotal?

And could it be coincidence that the 50 year cycle on the 1966 high + 1 metonic year (being a repetition of the all time high when adjusted for inflation) gives a historic high 1/28?

HC mercury in Saggitarius should be bullish for gold. 2/1 HC mercury in saggitarius.

Can’t help it; can’t shake off this bearish feeling.

Last one; Gilmore weeks. A Gilmore week is 1,272 regular weeks. 3067 GW’s from the 2007 high gives 2/1. 2091 GW’s from the 1966 high gives 1/30, 1414 GW’s from the 1982 low gives 1/30. 21506 GW’s from 10/12/1492 gives 1/31.

Everything I see marks this weekend. We will see a black swan of some sorts.

andre

quick question

you noted you use the sun for your timing .

i have seen that work .

you mentioned chris carolan and the moon

there is a difference

he says if we were to have a calendar year based on the moon

we would have a 13 month year and not 12 ( if my memory is correct )

your 360 degree year i am not questioning mind you .

the question would be this :

is a 360 degree year 365 days or is it really something else ?

it is obvious you have spent a lot of time looking at gann’s work

Feb 3-10th shows up in my timing work

feb 8-11th shows up in other methods .

early march to late march seems to be an end to something

and the beginning of another cycle .

my main reasons for keeping a bullish bias in the larger picture

though is the mars Uranus cycle and the Venus mercury sun relationship.

those 2 scenarios are now bottoming .

mars uranus has ended yet the conjunction is march 2

the venus mercury sun conjunct is in march .

each year i work on next years planetary model and at the moment

my data ends mid march so i have plenty of inputting to do before i can

same much on the rest of this year .

could there be a 13 month year and could that be 360 degrees ?

Have you ever looked into that ?

Joe

Joe; The delta system features the metonic year and that is 12 lunations. 360 degrees can be anything. My Gann-delta system uses lunations and metonic years.

I have never seen a 13 month year; so I haven’t looked at that.

There is a 378 day cycle caused by sun/saturn. This close to 13 lunations, but not the same. sun-jupiter has a 399 day cycle.

last thought thinking of puetz and carolan.

this year has no puetz window

we get the lunar eclipse this year 1st and the

solar eclipse becomes a stand alone eclipse .

the puetz window uses the solar eclipse and

then the lunar eclipse follows .

looking at carolans 58 year panic cycle if i cut that in

half and used 29 years as a half cycle

1929 1958 1987 and 2016 .

also i see posts of 1966 being the top and i understand

the Elliott wave thought process behind it . yet 1966 was

not the print high in the Dow .

Jan feb 1966 was a top and the dow fell in an ABC drop

into may 1970 , then we had an ABC move to a new

high into Jan 1973 ( price wise that was the high )

The bear market from 1966 to August 1982 was a series

of bull and bear markets which i label as

ABC x ABCDE

the Jan 1973 high was the top of an X wave and the Price high .

1966-1972 = 6 yrs ( 6-7 yr top to top )

plus 6-7 yrs = 1978-1979 low ( 1978 was a low )

plus 6-7 yrs = 1984-1985 low ( 1984 was a wave 2 low )

that is just keeping it simple .

1919 was an inflationary high

adding 12 yrs 3 months to 12 yrs 8 month targets the july

1932 low

using the 1937 high march 1937 was the high as was aug 1937

12 years 3 months to 12 years 8 months from those highs

you will find the 1949 high ( going from memory yet you will find it )

the march 2000 high as well as the sept high in 2000

targeted the nov low in 2012 .

gann said 5 years high to low as well as 5 years low to high

also 10 years high to high as well as 10 years low to low

nov 2012 plus 5 years = nov 2017 ( thats why i allow for oct 2017 as

a high even though im beginning to call it a low )

george lindsay

7 years low to low followed by 8 years low to high

also 15 low to high

these are guides .

oct 2002 as well as march 2003 fall into this

2002 plu 7 yrs = 2009 low to low

2009 plus 8 years = 2017

2002 plus 15 yrs = 2017

oct 1987 low to the oct 2002 low was 15 years

adding 15 years to oct 2002 is oct 2017

a monthly Low to Low to High count

this is also 10 years from the oct 2007 high

this is also 5 years from the nov 2012 cycle low .

now comes the mars uranus cycle which is now

bottomed and the venus sun mercury cycle which

is bottoming .

all of this combined leaves me with a bullish bias for

now .

yet im not a die hard bull .

everything ends this year and all turn bearish come 2018

the benner business cycle peaks in the year 2018 and

then points lower for a few years .

thats my work wrapped up as short and simple as i can make it

Joe

i meant to say you will find the 1949 low

the rest stands for larger timing thoughts

Joe,

Carolan says that october panics only come when 2,5 years before there was a new moon close to the vernal equinox. In 2015 the new moon was exactly on the vernal equinox. So 926 days later we should see a panic.

This is also the year that lillith is 120 degrees to the node. According to McMinn this is the cause of panics.

Third, Gann said there is a 10 year cycle. From the october high in 2007 this brings 2017.

These 3 methode are within 3 weeks in the fall of 2017.

So I think this year will bring panic. If we have a W3 down in the fall then a high now is likely. With a low by the end of may a high by the end of september is also likely.

Just my thoughts.

Well surely Trump (and I’m politically agnostic) is working hard in favor of the “expected black swan”. Everybody was waiting for some sort of polished version of what we saw during the elections (as usually happens). Instead we have ourselves (in all its comedic value) a bigger, faster stronger version 😀 in 24 hours trade war with Mexico and geo-political tensions with China and Iran…

I’m really starting to love the guy for his amazing resemblance to my favorite cartoon character, Eric Cartman…

A new post is live at: https://worldcyclesinstitute.com/assessing-our-political-and-social-progress/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.