In this blog over the past couple of months, I’ve written about the impending revolution, which I refer to as the “Great Financial Revolution.” This topping cycle is the result of both a natural rhythm, a 516 year revolutionary cycle that has negatively affected society since the beginning of recorded history and before, and a man-made cycle, which parallels the natural cycle. The man-made cycle is one of boom and bust, inflation and deflation.

As we traverse the cusp of this 500 year cycle high, you’re seeing an underlying sore starting to break wide open. Populist leaders are arising around the world to challenge the New World Order (otherwise known as globalization). Migration is sending hordes of people fleeing from their homelands and creating friction across Europe and elsewhere. Authoritarianism is springing up everywhere. Our every move is being recorded by governments without bound, freedoms are being restricted with terrorism as an excuse, and “fake news,” (which used to be called propaganda is the mainstream news of the day for the bulk of the population).

We’re starting to see riots springing up around the world as deflation takes hold and economies start to break down. Vast numbers of people are out of work, starting to go hungry, and their dreams are being dashed. This is a natural phenomenon that takes place every 172 years to a lesser degree and every 516, where we see the ends of societies. An similar 500 cycle marked the top of the Roman Empire in 100 AD.

There’s a harmonic relationship between these cycles—multiples of three—as there are with the lessor major cycles or 6.3, 19, and 57 years. You simply need to access history to see the same patterns unfold at the cycle milestones. Climate, interestingly enough is an indicator of these impending cycles turns.

Central Bankers Conspire

From the early 1900s, a group of central bankers, the true “elite” of the world, the Rothschild family being at the core, have been conspiring to create one shared financial system, with a vision to subjugate countries around the world to the dictates of this global cartel, housed within the Bank of International Settlements.

From the early 1900s, a group of central bankers, the true “elite” of the world, the Rothschild family being at the core, have been conspiring to create one shared financial system, with a vision to subjugate countries around the world to the dictates of this global cartel, housed within the Bank of International Settlements.

Carroll Quigley, mentor to Bill Clinton and member of the Council on Foreign Relations, is often quoted with open admissions to the general scheme:

“The powers of financial capitalism had (a) far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland; a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank… sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.” – Carroll Quigley, Tragedy And Hope

There are only a few countries that still exist outside this financial tentacle: Syria, Iran, North Korea, and Cuba. These are the vilified nations of the world.

Europe was an early trial version of this New World Order (a group of countries with one central bank and one currency), but you can see it starting to self-destruct. Britain leaving was the second tear in the financial fabric that binds them together, after Greece, which still seems to be in self-denial. But it won’t be long until it leaves, as well. Other countries are beginning to see the end in sight.

This week, there’s an article in zerohedge.com about Russia and its preparations to leave the cartel. This is great article, which lays out the challenges associated with a break of this magnitude. The problem with going up against the cartel, of course, is the threat of being “excommunicated” from the global financial system, which governs trade, currency exchanges, and the ability to carry on business country to country, based on the reserve currency (which is also losing its position of dominance).

A History of Economic Destruction

More than that is the threat of war, or even destruction of a country’s economy. You just have to read history to see the path of destruction brought about around the world over the last few hundred years. Every country that works to create its own system of money-creation outside of the central banker system of usury has been destroyed.

I’ve written about the Bank of England and attacks on Napoleon, eventually toppling his government and the French independent banking system, which had created an expanding economy devoid of deflation and the interest payments that cause it. There were the thirteen colonies of the United States and the constant fight to keep this vile system out of the country, which was an “off-and-on” process until a group of unscrupulous bankers misrepresented a bill before Congress in 1913 and created the Federal Reserve.

I’ve written about the Bank of England and attacks on Napoleon, eventually toppling his government and the French independent banking system, which had created an expanding economy devoid of deflation and the interest payments that cause it. There were the thirteen colonies of the United States and the constant fight to keep this vile system out of the country, which was an “off-and-on” process until a group of unscrupulous bankers misrepresented a bill before Congress in 1913 and created the Federal Reserve.

There was Germany at the beginning of World War II, a war Hitler did not start. Poland was much more the aggressor in 1939, with atrocities against 1.5 million Germans living in Poland. Hitler tried to negotiate a settlement. However, on the orders of international bankers, at least 28 attempts at a settlement were all refused.

Germany’s independent monetary system let them wage war and almost win it against the allied powers. The was due to the nationalization of the Reichsbank in 1939, which gave Hitler total control over the monetary system of Germany, with no outside interest payments. They created their own money and a very vibrant economy.

At the same time, Italy had its own banking system under Mussolini. There was Russia just before the Russian Revolution in 1917, which sprang up for the same nefarious reason and ruined another vibrant economy. More recently Libya was attacked for the same reason. Syria is still under attack. Japan was forced into World War II for similar reasons (it still has a central bank that it still uses to some extent, even though Japan is within the BIS fold. Iraq also got off the financial cartel bandwagon and paid the price (but in this instance, it was more a matter of trying to work outside the reserve currency—the US dollar).

“Let me issue and control a nation’s money and I care not who writes the laws.”

—Mayer Amschel Bauer Rothschild (1744-1812), founder of the private International Banking House of Rothschild.

The Case of Canada

Canada is in an unique position. That’s because we have the only public central bank in the block of G8 countries; the ability to create our own money is “baked into” our constitution. All the other G8 countries, if they have a central bank, have private ones. Take, for example, the Federal Reserve. It consists of twelve private banks controlled by shareholders who are obviously interested in making money from creating digital money (out of thin air, mind you) lending it, and charging compounding interest over time.

The argument of the BIS is that having a European central bank loan sovereign countries their money will somehow create greater stability throughout the global financial system. Well, what about 2008? How stable was that?

The second argument is that having countries create their own money independently creates inflation. however, from 1938 through 1974, when Canada created its own interest-free money, our inflation was actually lower than the average of 15 OECD countries

Canada’s debt is staggering … and it’s getting worse. But we can change the status quo. We can take back the power to create our own money, stolen from us in 1974.

| “Once a nation parts with control of its currency and credit, it matters not who makes the nation’s laws. Usury, once in control, will wreck a nation. Until the control of currency and credit is restored to government and recognized as its most conspicuous and sacred responsibility, all talk of the sovereignty of Parliament and democracy is idle and futile.” |

| Canadian Prime Minister William Lyon Mackenzie King (1921-30, 1935-48) |

Here’s the background:

Canada has a public bank, the Bank of Canada. It was founded in 1934 (due to the hard times of the depression). In the Canadian constitution, it’s allowed to lend money at no interest to municipal, provincial, and federal governments for education, health, housing, and other social services. And it could loan money at low interest for other projects. Any interest, of course, would be paid back to the government. In other words, to taxpayers. To us.

Canada has a public bank, the Bank of Canada. It was founded in 1934 (due to the hard times of the depression). In the Canadian constitution, it’s allowed to lend money at no interest to municipal, provincial, and federal governments for education, health, housing, and other social services. And it could loan money at low interest for other projects. Any interest, of course, would be paid back to the government. In other words, to taxpayers. To us.

From confederation to 1974, Canadians were able to pay for two wars, the St. Lawrence Seaway, the Trans-Canada highway, the Canadian National Railway, and much more. The bank actually made money for the government. That’s because we created and printed our own money.

In 1974, Prime Minister Pierre Elliott Trudeau made the decision to stop using the Bank of Canada for our money, and instead borrow it from a private bank outside of Canada (the Bank for International Settlements in Switzerland) and pay interest to that private bank! Obviously that’s not in the interest of the Canadian people (but I’m sure a threat from the cartel went along with the decision).

To give you an idea as to how bad things are here (after all, economists promote our banking system as one of the most stable in the world, here’s what happened during the Great Recession of 2008 (that the government of Canada and the Bank of Canada have continually lied about):

- Canadian taxpayers gave three national Canadian banks $60 billion (Obama gave US banks $800 billion).

- Taxpayers assumed the toxic debts of $160 billion of CMHC (Canadian Mortgage and Housing Corporation) mortgages

None of these new money injections created inflation, so why would creating money in a public bank create inflation?

By 2012, we’d paid interest to private banks of over $1.17 trillion, which is almost as much as our entire annual gross national product during that period! That amount of money leaving the country and going to private bankers in Europe causes deflation. In other words, it contracts the amount of money available in the Canadian economy.

It’s been estimated that if we’d stayed with the Bank of Canada as our public bank, we’d now have a surplus of $13 billion. That would lower taxes and bring us a higher standard of living through continued funding of all our social programs.

Now we can’t even afford to maintain infrastructure—like bridges and roads. Our health system is on life support. Social programs are getting cut. All because of these huge interest payments … to a private bank!

What’s even worse is that in 1991, our chartered banks lobbied the government to remove the regulations regarding reserve minimums in our commercial banks. So effectively, they’re not required to keep reserves. Once the stock market crashes and our housing bubble bursts (the largest real estate bubble in world history), the banks are not going to be a place to find your money. It will be long gone.

And, on top of that, Canada has recently sold all its gold. So if you’re thinking of migrating to this country, I’d think about the developing financial situation here—particularly since our economy is so heavily based on the value of oil and gas, which are both heading down to historic lows.

The Outrage is Beginning to Gain Strength

The COMER Group is currently heading to the Supreme Court of Canada to force the government (by law) to do the proper thing. This small independent group of citizens is represented by constitutional trial lawyer Rocco Galati, who has a record of bringing lawsuits against the government of Canada and winning. We need a groundswell of public opinion to help make sure they’re successful. Find more information on the lawsuit progress at comer.org.

Former National Minister of Defence, the Hon. Paul Hellyer (who is 93) has, in mid-March, 2017, written an excellent, open letter to the Canadian Minister of Finance, the Hon. Bill Morneau (PDF here), demanding that he adhere to the Canadian constitution and return to having the Bank create money for Canadians, the way we did during the most economically vibrant time in our history, the period from 1938 to 1974. It’s an excellent letter and is accompanied by a plan on how to effect this change with minimal disruption to our financial system.

It’s the only way we’ll be able to fund social security and our medical system when the market crashes later this year.

Prime Minister Justin Trudeau simply has to instruct Parliament to follow our constitution, or call a referendum.

If you’re a Canadian, please sign my online petition** to get the government of Canada to stop spending our money needlessly by paying interest to a private bank, when we could create our own money at no interest, as our constitution provides. I‘ll send this petition directly to Prime Minister Justin Trudeau and Finance Minister Bill Morneau and demand change.

In Canada, as in other sovereign countries around the world, we need to get control of our money and start using the Bank of Canada to create it, as our constitution mandates.

** Please sign my petition here: https://www.change.org/p/justin-trudeau-take-back-our-money-canada

The Bottom Line

All the major countries of the world have economically strangled by this European banking cartel. For example in 1974 – 2013, Canada paid 1.17 trillion dollars to these private European bankers. That was almost as much as a single year of our gross national product. That amount of money leaving the country brings on deflation.

Here’s how the system of gaining monetary control of countries works:

- These bankers begin by persuading countries to sign up with the BIS, which then lends them funds at compound interest. These funds are created out of thin air. It’s not existing money, so it’s the same system as these countries could undertake themselves, interest free.

- The BIS does not allow no-interest loans by the national government to provincial governments (or sub-states) for infrastructure projects or other social programs, so all of these additional expenses are also subject to loans with compound interest.

- Over time, the economy starts to suffer, social programs are cut, infrastructure begins to fail. Eventually the government has taxes the citizens to the maximum amount and cannot pay the interest, which keeps compounding.

- Central banks (as in the case of Greece) then suggest that the government sells off assets. This is what has happened with Greece. Their airports have recently been sold, for example. The country is being looted.

- Eventually, the bankers own everything in site and have total control over these countries. The ultimate vision is one currency and eventually one government, all controlled by these central bankers.

However, we’re starting to see the cracks.

- Brexit is leaving the Eurozone. Spain and Italy are on the financial ropes and other European countries are considering leaving.

- Russia is obviously considering a break from the international banking system and it will be interesting to watch their relationship with Iran and other countries who are not on the system.

- Canada has a legitimate claim on our own central bank and monetary system. In fact, it’s in our constitution. The noise is starting to rise.

- In the US, there have been calls for an audit of the Fed. The US is about to hit the debt ceiling by early fall.

The timing for all of this is this year and the timing for a market top is this year. Let’s see what happens.

________________________

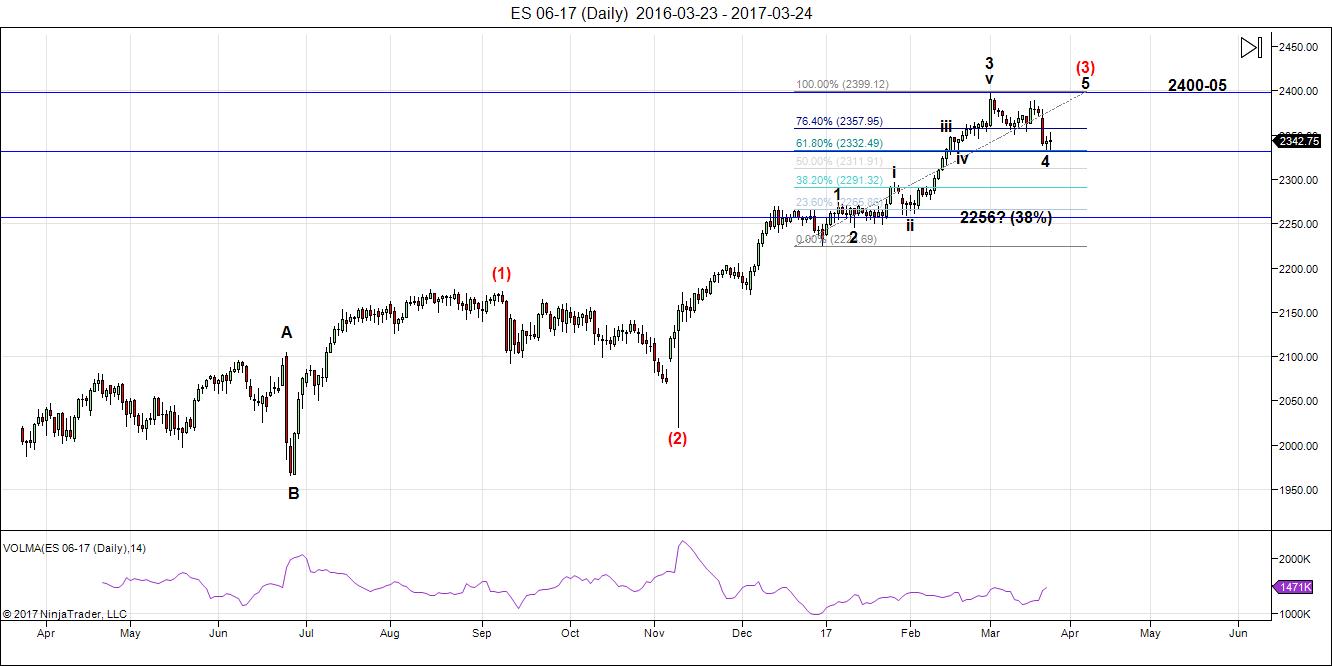

Here’s the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge). The big question this weekend is “What wave are we in—the fourth of the third wave or a larger fourth wave of the entire C wave structure up from about 2006 in the SP500 from the turn in early July, 2016?”

As I write this, I’m expecting a further drop in the current wave in ES, with an open lower in SPX perhaps Monday. However, this drop may not be enough to signal which fourth wave we’re in—the fourth of the third or the larger fourth wave.

In any event, both situations require a rally. If we’re in a larger fourth wave, the rally will likely retrace only 62% before we get a larger C wave down to a new low. The eventual target for a larger wave 4 is 2256, but there are also options for patterns that may not reach that level.

If this is wave 4 of 3, then we’ll head back to the top.

Summary: We’re at an inflection point. We’re either still in wave 4 of 3, or we’re near the end of the A wave of an ABC drop into a larger 4th wave. We should have a good idea which it is early this week.

After completing the larger fourth wave, we’ll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

_______________________

Sign up for: The Chart Show

Thursday, March 30 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won’t find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Futures making the case for a larger fourth wave underway. I am expecting the A leg to complete Monday followed by a B wave bull trap…

Peter,

From what I am reading the U.S. will hit its “debt ceiling” by Memorial Day, May 29th. That is quite a bit sooner than the “early fall” that you mention above. Any thoughts on that?

Ed,

There was an article on this in the last few days and I can’t remember exactly where …. zerohedge, I think. They can pull some accounting tricks to extend the “run” was the thinking but September was about as long as it would go. All this is somewhat speculative, of course. My projection for a top is extending out to September, so it’s a bit of a guess (or maybe a lot of a guess).

Hi,

According to thefiscaltimes.com they can use accounting methods to delay the debt ceiling until around mid Aug to early September.

Vince

Thanks, Vince,

That’s similar to what I read. And we have the American Eclipse Aug 21, so it’s shaping up to be an interesting fall (the double entendre is on purpose).

And Oktober is also Andy’s important month interesting

The astrologer … is also very bearish in that time frame.

The entire Federal government has been thoroughly corrupted by the creature that previously occupied the White House. In keeping with the notorious mendacity of Mr. Obuma, most of what the bloated bureaucracy puts out is nothing but a tissue of lies. With the sharp decline in tax revenues of late, God only knows from where and from whom they have stolen to maintain the illusion of solvency. The unatural price action in VIX has convinced me personally that there has been a co-ordinated and deliberate attempt to suppress volatlity so masking the true level of risk in financial markets. I suspect we have not even scratched the surface of the depth of criminality in the Washington clan. Bubbles don’t bleed, they burst…!

Without having to resort to wider conspiracies, Verne volatility has been suppressed, it’s a technical fact. Some funds’ algos just automatically buy when volatility is in the red – no questions asked, so it’s an excellent way to keep the market up for the cheap without having to actually buy the indexes when you know they’re about to implode. Other levers as you would have noticed include credit, oil and the dollar. They’re slowly being crushed, one by one…when there will be no levers left, you know what happens next 😉

https://worldcyclesinstitute.com/usury-comes-to-america/#comment-15840

Yep!

What if Mahendra was finally right claiming the top is in.

All analytics predict the new highs after some consolidation.

No worry, all gonna be “uuuge” and “bigly”.

I also sometimes feel he may be right. A top always comes when no one is expecting it even as the most remote possibility. A 5 wave count can always be found in hindsight. Sid Norris of elliotwavepredictions.com has a 5 wave count indicating a peak as a possibility. Moreover retail investors step at the end of the upmove creating euphoria just when the momentum is maximum.

That has been a nagging concern of mine TBH. Everybody, and I mean grandmas included, have been calling for a final fifth wave up. It was not until a few weeks ago that I could find even one person who so much as hinted that the last runaway leg up could be it, despite the historic level of mania and complacency. I have always wondered about that as I have a hard time trying to imagine how market action could get any more reckless than what we saw with the recent “Trump Rally”, which as you will recall, began from already overbought conditions!

Just keep in mind that this is a 500 year rally .. the ultimate “show.”

I pretend a 500 year bear market for compensation 🙂

Verne,

this rally has been not only Trump but also Brexit, Itexit, terror attacks, Fed tightening, bond bloodbath, etc.

So, don’t look for any logic.

It may easy take another few hundreds points up before the crack any moment when the market suddenly discover that “The King is naked”

Every man, his dog and his grandma in the world “know” that the stocks all over the world are in the fifth wave. ETFs all over the world saw record inflows from retail investors last month. Every country index is headed north and every person knows it.

Decidedly NOT the situation. Optimism is generally at record highs.

Daily Sentiment Index for SP futures sits at 92% bulls. Last week, the Investor’s Advisory Survey registered the highest percentage of bulls in 30 years.

SPX @ 2338 looking for the bounce to be over about here.

SPX above 2345 I will move from Bearish to neutral and will be in all cash.

Started a short position @ 12:15pm EST

Looks like PPT buying ES.

Should wait to break this ascending support mounting from the low of 16:05 candle

I like to start building a position before the break so I have a good cost average. Sometimes it breaks so quick it does not allow you to get in.

We just got your break – lets see if it picks up steam..

Jody,

it’s emotional to build position before the break.

You would louse nothing to open it after the break.

Jody obviously has learned that lowering your cost average also lets you take profits sooner. That is exactly the way I like to enter my trades as well. I know I have done it right if I am taking profits when folk are just starting to jump in… 😀

I limit my loss which was 2345

By getting in early allows me to exit early into the strength of the break.

Anyone can call it after it happens:)

Yep. They are buying like there is no tomorrow. Something very contrived about the move off the bottom. The VIX move also does not look right. I don’t still see capitulation from the amazing level of complacency.

Broken now

There is a reverse H&S on the UVXY

If it breaks above $19.90 we should see $24.00 pretty quick..

With all the short interest on UVXY it should fuel the VIX rally if we do in fact break that $19.90 level.

Once it breaks it might pull back in to test the neckline before going.. That could be a good entry for those waiting to see.

Imho… 🙂

Yep! The banksters are desperately trying to short volatility as it forces long positions to unwind as VIX rises, and limits capital available to try to arrest the decline. I think we are going to hit an inflection point soon because of the historic degree of suppression we have seen for so many months. It is amusing to watch them try…

Verne This comeback from the depths pattern has been going on for ever. I agree with you (and posted a week ago) that everyone is expecting the same thing.

They (whoever “they” are) will do whatever it takes to take as many hostages as possible. fwiw I don’t believe it turns out the way we expect. There will be a black swan before the final curtain.

The SPX does appear to be forming a falling wedge.. I covered and will wait to see what tomorrow brings..

We might get that wave up after all..

One interesting thing is the small caps..

Looking at the IWM on a monthly chart we have a outside reversal engulfing candle forming.

Of course we have to wait until Friday to see how we finish up but that candle usually forms at the end of a run.

Also the same thing happening with the DJT (transports).

I know I am the only one in the universe saying we have seen the top and it is signs like this as well as SPX W(1) off the 2009 lows and this current move off the 2016 lows being a quality in length with each other that are drawing me to this conclusion. I am still keeping my eye out for an upward move but all signs for me point to the turn has happened.

Regardless using the daily EMA 8 & 21 on the SPX as your guide as long as we are below them momentum is lost and until we recapture them and break above I will continue to look for short opportunities.

Snall caps and tech both put in monster bearish engulfing candles last Tuesday and you would not know it by looking at where they are still trading. Amazing. I think the bottom is about to fall out from under both. Northman Trader in a video recently pointed out how many technology stocks were uncharacteristically trading light years away from their daily 5 day ema and have been doing so for some time. I don’t think most folk recognize the remarkable extremes we still are seeing in this market. I think contrary to popular opinion, they are about to be reminded that RTM (mean reversal) is not dead…delayed, but not dead by a long shot!

Peter, you mention the 500 year rally early today…Do you have something that you have written that you can refer me to? I do not recall you having said or written about that! Very interesting!

I’ve written extensively about the 500 year cycle and that there’s a financial collapse at each 500 year cycle top. There’s also a crash at the 172 cycle tops (3 of those in a 516 year cycle). I have a chart around somewhere. I’ll look today. I’m not sure if it’s posted in the forum or not.

SP500 Wave Three Down – Peter Temple’s Forecast, June 19, 2016

“Here’s the projection for wave 3 down from current levels. This is based purely on fibonacci wavelengths. I’m projecting the third wave at 2.618 X the length of the first wave down. Then we’ll have a 4th wave that should retrace 38% of the length from the all time high (which will be about the level of the previous smaller 4th (of the third)) and a final larger fifth wave to a bottom. More to come after that (a B wave).

It’s important to note the support levels on the wave up to the left. Rather than hitting my targets, we’ll probably drift a little bit lower to the next support level in each case. The final wave 5 low may be closer to 1158.”

obviously this forecast needs to be revised based on the revised wave count…

Ed,

I’ve uploaded the 500 year chart at this url: https://worldcyclesinstitute.com/forum/long-term-charts/500-year-dow-prices/#p186

1929 – 1932…”a series of bear flags all the way down”

http://tinyurl.com/nybz78b

Hi Peter:

I have been reading your latest post over and over again as each time I learn something interesting. On my last read through I was struck by the countries you mentioned outside the banking cartel. That little fact goes a long way toward explaining the wanton bloodshed and destruction of nations that sadly must be laid at the doorstep of the US and other Western nations joining them in their war mongering. All for filthy lucre!! We are going to pay mightily for our blood and money lust I am afraid. How can we not?? ?

And then there’s Islam, which doesn’t allow usury, or interest—a religion that’s a “problem.”

I truly admire the perspective on the purposes and proper use of money. I deplore the sanctioned violence by some of its adherents. I do have to say though, considering what we have been learning of late about the depth of depravity of what appears to be quite a large number of our political leaders, not only in the US but across the Western world, their disgust is entirely understandable. I doubt few Americans are aware of the depths of outright wickedness being perpetrated by their leaders. So sad. There is now in the rumour mill, which obviously I cannot repeat here, some absolutely shocking news that explains the mealy-mouth conduct of FBI leadership the last several months in the face of spectacularly criminal conduct. How can some of these people appear in public and say the things they do with a straight face is mind-numbing. It betrays in my view, what is beyond contempt for the observing public. It must be the fluoride in the water…!

“There is now in the rumour mill…some absolutely shocking news that explains the mealy-mouth conduct of FBI leadership the last several months”

please post a link

I was actually listening to an insider being interviewed and he was reminding everyone that few people get to positions of power in Washington who cannot be controlled. The way you control people is by keeping a dossier on their darkest secrets. It is fascinating to me that Obuma picked Comey to head the FBI. The conventional wisdom was that here was a man of the utmost integrity know for standing up to White House Counsel Gonzales when he tried to get AG Ashcroft to authorize warrantless wire tapping from his hospital bed. Made a nice story did it not? Well folks, I hate to break it to ya but that was all the biggest pile of horse manure intended merely for public consumption and to preseent Comey in the best possible light. It seems few remember his brother did the taxes for the corrupt Clinton Foundation, and that he himself was on the board of one the most criminal and corrupt banks doing business today HSBC. They implicated in every possible kind of criminal wrong doing from laundering drug money to child sex trafficking. They also forget that Comey’s law firm represented the Clintons during their White Water scandal, and also Sandy Berger when that cretin was caught stealing incriminating document from the National Archives by hiding them in his socks and underwear – what a despicable creep! Integrity my hiny. The man is bought and paid for, plain and simple. The thing that this insider said that really startled me was when being pressed to disclose what they could possibly have on Comey steadfastly refused to do so, but then in a parting cryptic quip, wondered what kind of pizza he liked. Nuff said!

“listening to an insider”…really…pray tell how one verifies an “insider”…

the following is for the record…

– the Gonzales/Card/Ashcroft/Comey/Mueller matter is fact not a “pile of horse manure”

– Comey is a man of integrity

– Comey may not be an effective leader

– pizzagate is total BS

from someone who knows the facts…

I would listen to rotrot on this, knowing what I know about his background.

We are coming into resistance between here and SPX 2357

If the SPX can get above 2357 then I will turn bullish as long as it holds that level

but I am looking for SPX to start selling off again here in this zone.

Lets see:)

It seems the market is still on hope and should melt up until Friday (window dressing)

overall direction is still down – end of quarter window dressing not withstanding.

RUT short term – https://invst.ly/3k8lp

Hope you are right.

I still keep my shorts

Using the MacD on the 60 min chart and the 0 (zero) line as a guide when the red and green lines are above the histogram and zero line that is a bullish sign and they tend to stay above. When the drop below they tend to stay below in a down cycle and pull to the zero line then drop.

We are below the zero line and i do believe that SPX 2357ish area will provide a ton of resistance. We are coming into it now..

agreed.

🙂

Both lines are over the histogram and the zero line

Well I’m looking at ES chart.

May be SPX is different

I look at the S&P

On a 5 min S&P looks like we are wrapping up a 5-3-5 move and are in a rising wedge. We could have a little overshoot..

If we blast threw this area then I would have to believe the small 4 wave is over and we are heading to 2400+ (not my preferred outlook)

We are at an inflection point right now.. We will know really soon..

We do have some seasonal bullishness the next few days but I think it will be short lived. I think the corrective move up will co-incide with the upcoming correction in the precious metals – hopefully short and sweet!

Not removing them properly sometimes leads to electrocution! 🙂 🙂 🙂

An ‘exercise’ in DJIA wave counting….to stop the boredom.

https://postimg.org/image/whrqsk4kr/

Please someone provide a better alternative. Thanks in advance.

https://invst.ly/3k9ae

Luri, I can always rely on you to put a ‘smile’ on my face. I DO like the i count at the bottom right…..it holds so MUCH POTENTIAL!!

I can look forward to more of my ‘teeny tiny’ positions gaining foot holds. (Today’s action killed a number of them…..but when there is a war on you have to expect casualties!!)

Did I not say THANKS?!…. sorry THANKS VERY MUCH….for the smile on my face.

Energy chart looking good so far

https://s4.postimg.org/igm04kl31/March_27_to_31_energy_stream.png

Tom,

As a follow on to our discussion of last week regarding, ‘does the market remember or know the energy that occurs when the market is closed?’ The action on Sunday night and Monday morning seems to confirm your intuition (if I understand your comments correctly). Over the weekend the Energy Stream peaked (was higher) compared to the close on Friday, and when the market opened on Sunday night the Energy Stream was at a higher absolute level than on Friday close. However, the energy level was declining rapidly from its peak, and would continue to do so into Monday open. So, a very tentative observation (based on one weekend!) is that it is the rate of change of the Energy Stream (second order derivative, whatever…) and the length of time of that change when the market opens that is important to the market. It doesn’t care what was going on when it was closed.

Correct! it does not care

the streams are natural forces that affect humans and humans buy and sell stocks. The streams and the markets are not directly connected but indirectly connected because of humans buy and selling stocks.

Might you tell us a bit about what the energy stream is based on? looks very interesting

Although we did close slightly above the 8/21 EMA there is a big Pendant on the SPX Daily that was rejected as it tried to come back into the bottom side and with the major dump on the S&P in the last 5 mins of the day I would still be looking lower. Tomorrow it should resolve..

“major dump on the S&P last few minutes” That made me laugh. More like minor profit taking……. Though I’m also waiting for a drop.

No quite sure what your looking @ but ave 5min vol all day was 763.207k

The last 5 mins 6.352 M that’s minor.. lol!

Jody, it is best to ignore some posts! Most everyone knew what you meant!

Thx Ed.

Kinda like rodents departing a sinking ship methinks…

Not rats Verne. More like surfers just riding the wave. ?♀️

THE MAIN reason that I like ‘lurking’ on this site is the sheer ‘gentleness’ of the participants. Well DONE to Verne for that explanation to Eric.

People if you have any doubts about the ‘JOY’ of participating on this site then I would recommend a day or two at Dan Eric’s site to fully appreciate what our host provides us.

haha … until the host has a bad day … or reaches an age when he can’t remember what this site is for, or where he is (not that there are any signs cropping up … at least, I can’t remember any).

Yup, it’s a great group here. It’s all about staying positive. After all, trading is tough enough, particularly in these brutal markets.

Hahahahaha!!! ……Not forgetting our HOST’S sense of humour of course!!

LURVE IT!!

No reason to be rude. I wasn’t to you and merely stated the obvious. That being the PRICE did not drop (last 5 minutes) much relative to the days movement. Furthermore (to everyone’s insult) last minute volume and price changes DO NOT forecast the next days market moves.

Never been called a rat before. Thanks

Furthermore, Jody, your whole post was about PRICE. Go back and look it up. Cheers

My apologies Eric. That comment was not at all meant to refer to you or anything you said. I just meant that folk exiting the market probably sensed that it was going to do down. Poor metaphor.

Nicely summed up Liz. LOL

Watching today’s low.

If we take 2352.94 out selling should pick up..

Jody,

I think nothing to wait this week.

Investors do nothing. Those who wanted to take profit have done it last week.

The rest are just waiting the end of the quarter.

Nobody wants to be the last to hold the bag.

Only specs looking to squeeze the shorts and chasing the stops.

Retail investors and trend chasers still all in. Commercials still holding record short positions. Something’s gotta give…! 🙂

dimitri,

you speak as though the equity markets resemble “anything” close to a “real” market place. it is all an illusion. All the green and red candles are predetermined to give the impression that prices are random. The grid to control prices are ‘derivative’ in nature, and virtually free of cost to the participants – see gold/silver paper market as example.

red pill/blue pill —- :-))

hey dimitri, is it true, that Moscow has deep underground bunkers for the protection of the population in the event of nuclear war??

luri

“hey dimitri, is it true, that Moscow has deep underground bunkers for the protection of the population in the event of nuclear war??”

HUH?!? Did you really say that?

1. How do you know that dimitri is from Russia?

2. Even if he is why would you assume he has knowledge of the question that you just asked?

3. Were you trying to demean him? I SINCERELY SINCERLY HOPE NOT.

Looking forward to hearing from you. I’m sure Dimitri is as well.

P.S. The rest of your questions to Dimitri were all legit and to the point hence my surprise at the last one?

Dimitri let that kot out of the bag a while ago. Russia it is. C’mon, keep up over there … lol.

purvez,

http://www.pravdareport.com/russia/politics/30-09-2016/135749-moscow_nuclear_war-0/

purvez,

hmm…..so do the words……”barking” , ……….”wrong”……. AND…..”tree”………have meaning for you?? :-))

Hi Luri,

yes, there are many bunkers in Moscow with a lot of vodka and smart girls.

Personally I prefer for escape a lonely Greek island somewhere far from the big cities.

Dimitri – haha……how smart are the girls?? I mean can they make good and accurate charts for the SPX too??? This is important!

Remember, if the market crashes soon – we get the vodka at either Dr. Живаго, or Шаляпин or maybe we buy a really good bottle at Елисеевский

yes, i agree with you, the best place to be is on a quiet greek island away from all the craziness!!

Tom, thank you for your generous posting of the energy graphs.

Looks tentatively like a possible top in upside next week 4/6 timeframe.

Does that sound about right?

WTF??? Fractal much? algos cannot be creative!

large fractal https://invst.ly/3kip3

small fractal https://invst.ly/3kiri

have been utilizing a system of pivot dates…on March 3 some of the readers/posters here were provided with critically important (in my view) information with a best guess for a ‘high’ on March 22 or 29 followed by a selloff and ‘low’ in May…the months of April and May could be particularly volatile…the pivot dates will not be posted on this board or any other public message board…

https://worldcyclesinstitute.com/relax-it-always-happens-like-this/#comment-16150

rotrot, are you referring to Andre’s post?

Hi Rotrot,

any news from Mahendra?

He prices now his 2017 book for 795 bacs.

I wonder if he is still thinking that SnP will not exceed significantly 2400.

Correct, but most important the negative astro cycles start mid next week going into mid may 2017 with a rebound into mid July 17 followed by a crash cycle into end of october followed by a year end rally.

Cheers,Jaze

very kind of you Jaze!

Thank you for the update Jaze. Please be aware of Mahendras past record. I subscribed to him APPROX 8 years ago. If I had taken all his recommendations and implemented his trading strategies, I would have lost my home and dog. Yes, he has been correct at times. But I would not exclusively rely on his recommendations. Use your own trading strategies and inner instincts. If your own ideas line up with Mahendras, go for it. As always, cut your losses quickly and move on to trade for another day. All the best everyone. Please note, this was for any newbies who are not familiar with Mahendra.

Hi Dave, many thanks for your thoughts. You are absolutely right. Any method should always be a complementary tool to the own system one feels comfortable to trade. I must admit that I follow Mahendra the last 3 years with his yearly prediction on positive and negative cycles and the performance has been outstanding since 2014. His monthly newsletter is too expensive for the content he is delivering.

Best, Jaze

Thanks Jaze.

Is it Mahendra cycles that you are talking about ?

Yes

Mahendra says bear market to start on 8th April in his website alert.

not reflected in Mahendra’s free website alerts…is that subscription info?

https://www.mahendraprophecy.com/login-lifetime-members.php?url=latest-news.php?id=1122

it is important to note that Mahendra’s original post on Sunday, 26 March 2017 did not mention Monday as the day of the low…the original post read, “Short term positive trend in Market, dollar and metals will start from…but…”

the original post was edited after the Monday low was confirmed…

See the rolling title at the top of the webpage with the Alert title in red color

https://www.mahendraprophecy.com/login-lifetime-members.php?url=latest-news.php?id=1122

Check out the rolling text inthe link you have mentioned.

gotcha…thanks!

https://www.youtube.com/watch?v=spePtR0Z5CE

Interesting.

Thanks for sharing.

Andre’,

Any thoughts would be appreciated!

http://thesovereigninvestor.com/exclusives/billionaires-bet-big-market-crash-reason-shocking/

Hi Nick,

Raj is back maybe you have read it already:

A new Flash crash cycle for June/July.

I see an important top April 6-8 after that a decline into May, Volatile recovery and afterwards Kaboem.. (after first week of July)

John.

http://timeandcycles.blogspot.nl/

John : thanks for up date ,I had his 47 TD cycle for April 3 , he had it on 03 /27 /17

{The 47 TD and 94 TD Cycle has a 3/27 Low+/-} so he picked 4 days ago for a low .

I have a April 3 or 4 for a top , and i go along more with you.! Raj is more confusing

to me than ever , ….Nick , Thanks

Thanks John

I had his 47 TD cycle at 04/3 /17 He put it on

(The 47 TD and 94 TD Cycle has a 3/27 Low+/-}

4 days ago , I have a top on 0/4 / 05 , more in line with you.

RAJ is more confusing than ever . Thanks John ….Nick

“At times the FC Cycle skips a beat, out of the last 12, 8 (67%) were direct hits and 4 (33%) were misses”

Thanks

I hope we see a low on Monday/Tuesday bought some puts on the dutch stock exchange.

“I see an important top April 6-8 after that a decline into May, Volatile recovery and afterwards Kaboem.. (after first week of July)”

John, is that your forecast or are you attributing it to ‘Raj’…thanks…

It’s a combination what I think..

ok – RED ALERT – maybe/ sorta.

so the short term final broadening topping pattern of the RUT has an ALTERNATIVE count now. this ALT is the basis for the Sirens screaming.

Based on ‘truncation’ expectations [i know, i know….calm down…..i know…. – and if you find the need to “kick” me, please mind the sweater as it is new], this ALT count is super interesting. ……..so this move this week could be a “d” wave OR it could be a super sneaky truncated 5th………….. so you all know what i am going to say next…………..”BE WARNED!”

https://invst.ly/3l2-9

How did we do this week?

other than a slight inversion on Monday the overall pattern looks good!

https://s30.postimg.org/b294oiq29/March_27_to_31_energy_stream.png

Thks Tom, for your contribution.

Tom, thank you for your generous posting of the energy graphs.

Looks tentatively like a possible top in upside next week 4/6 timeframe.

Does that sound about right?

I posted a monthly chart last week

Yes, that was what I was referencing. Does that projection still work? I dont know if your data is static or changing, which is the reason for the question since 5-7 days have elapsed since then.

http://tinyurl.com/l3qk85s

Thanks Tom ,

looks very accurate we should see a low on monday .

http://www.cnbc.com/2017/03/31/mysterious-trader-known-as-50-cent-bets-millions-on-volatility-spike.html

P.s.

Will do some more in the weekend but can tell you upfront my own analysis points to 4/6 as a major high, the down into 4/14, up 4/25 and down 5/5. Have reasons to believe 6/30 -ish will bring the low.

Energy chart for next week shows a 4/6 high also

https://s11.postimg.org/h7br42fsj/April_3_to_7_energy_stream.gif

Tom, I love it. Funny thing is that I see Monday a high, based on trading day count on 5/20/15,

Tuesday a mercury vibration and Wednesday and Thursday highs.

I said before I have no clue how you create this, but you must be doing something right 😉

6 very strong date. 4/1 also. Will give details this weekend.

Oke low on Tuesday…that would be Bearseye

Dear Tom, could you be so kind and add me to your mailing list? You offered this possibility in the past. Thank you! magnetar at seznam.cz

3/29 was a turn in some Multi month cycles. The planetary A index made a high 3/28. That is bearish. But the index goes down into 4/6 and that is bullish. So ar we up? I am not sure, It’s more like we can’t start the sell of before 4/6.

4/6 is a very strong date that comes from multiple sources.

Hebrew timing on 5/20/15 gives a high 4/2 and the day count 4/3. The A-index goes up from Sunday into Monday so Monday looks bearisch. But then the index goes down again so a low by Tuesday – or Monday late – is supported by the A-index. A proprietary timing system gave a strong low Friday 31, a high and a low on Tuesday and highs for Wednesday and Thursday. Tom’s chart confirms. So a choppy start of the day will end into a serious decline later this week. A low around 4/15 (is Saturday so 14 or 17) is expected. Then a high around 4/25,

4/25 comes from multiple sources. Hebrew timing on the significant 5/20/15 high give a high 4/28. But 5/20 was a Monday, so the real turn could have been in the weekend before. This could give 4/26 which would be one trading day from 4/25. I think it will be 25 but the 5/20 high confirms 4/25 will be a high.

Then a significant low 5/4, a test up into 5/10-11 and down again into 5/16-18,

The larger cycle is down into 6/30 or early july. Then we will be up into the fatal september time frame. In august the significant solar eclipse and in september lillith on 120 degrees from Rahu. This period of the year looks very stressfull and God knows what will happen then. Some predict world war 3. I can’t confirm that. But that 2017 will close below the levels we see now is extremely likely. But hey, what’s new.

For now : next week will be very significant. It could be the start of Peter’s W4.

Was browsing around at some other chartists “long” term charts.

here is one from atilla at xtrends- it goes back to 1929/30 low. I thought some here might find it interesting. he posted it in Feb, and since then the market has hit his top range indicated on march 1st. thoughts anyone?

https://pbs.twimg.com/media/C5yPM3fUoAA5S4Z.jpg

The chart itself doesn’t give any evidence that the market should turn down at this level and not just continue to melt up.

dimitri,

fair enough, i can understand your sentiment – although i am challenged to think of ‘any’ chart that gives the absolute info to tell us when markets absolutely end and turn.

For me, i think what he is showing is that the trendlines that goes back almost 100 years, have a type of ‘gravitas’ [from the market testing and retesting] that the market cannot just overlook the trendline, and disregard it.

also, within the almost 100 year trendline there is a discernible 1/2/3/4/5 count, and usually the 5th wave makes new highs to test/retest the “middle of the channel”.

I can appreciate trend lines on a daily time frame being disregarded by the market, and overthrown, but on a quarterly time frame – i think the history of prices and time holds weight, and is ‘remembered’ by the market.

We shall see. We are an important 8 fib years from the last low.

Actually, from an EW perspective, there are four things that tell us the opposite, and we missed my turn target by one point. But I’ll share some of that this weekend. There is one thing that gives the market an outside chance of continuing up, but I wouldn’t count on it.

OMG peter,

your post is akin to an “end of the season” cliffhanger – much like {ok, i am dating myself here},…….much like — “WHO SHOT J.R. EWING”!? [anyone here remember that cliffhanger from Dallas? it was the 1980’s if i recall correctly]……

Peter, i always eat my dessert first, as an insurance policy against the “ending of the world”!!!! What if the life ends on the planet over the next 24 hours, and we never got to read about “the four things” from an EW perspective………??

May be “Who Framed Roger Rabbit ?”

luri,

Is this kind of a reverse “Catch 22?” If you remember JR as in “who shot?” (1980), you likely remember Joseph Heller and his 1961 book. OK, well maybe not …

Catch-22 starts as a set of paradoxical requirements whereby airmen mentally unfit to fly did not have to do so, but could not actually be excused.

So, now, I’m realizing this is an extraordinary exercise in mental dexterity, but it occurs to me that if the world ends in 24 hours (and you’re on it, which is likely in question to begin with), then your ability to use the information (not to mention your actual interest in it at that point), will likely be overshadowed by whoever is ticking you off, wherever you are (dressed in red or white, a result of the direction of your own personal trajectory).

But in the meantime, if there’s some amount of anxiety based on the threat of me not making your end of mortality schedule, let me temper it slightly with the thought that it will also end taxes.

But getting back to Catch 22. You are not to be excused from reading my post even if the Earth ends in the next 24 hours. Nobody has given you permission, TSA has not patted you down, and therefore you are not confirmed to travel, no matter what happens. Because that’s the political system we live in (to various degrees, depending on the country).

peter –

i will type only “one” word to describe your last comment – although i would suggest you assume the “crash” position………

……..here is the ONE word……are you ready?……..here it comes…..i am gonna type it now……. [cough]……[sniffle]………..

…………hey, wait a minute, peter, is “genius” spelled with two “n'”s? “gennius”……. :-))

ok forget ‘genius’……my one word is……drum roll please – “buttah”! Your comment is like “buttah”……… and now, with all this talk about food – let’s go get some lunch!

That one thing IMO is QE4 (which is probably likely after the next 10% drop, since the Fed is now basing monetary policy on the market and not economics at this point). Wont sustain the upside, but i’ll be the last shot in the arm.

https://twitter.com/xtrends/status/837050796512538624

“…The next one will be a life-changing market with a final stop @ $SPX 430”

thanks rotrot,

i am a novice looking through twitter, and i never saw those replies…..so glad you know the ropes!!!

Thanks Rotrot , the authors perspective is some what a doom and gloom scenario. I have seen many of his writings over the years. From what I have read, he has been a bear for many years. If I ever get to meet him, the first question I would ask is where is the money going to go? Bonds , I doublt very much. If we have a major crisis in the markets , bonds stocks. I would rather be in stocks with some money in a money market. Either way we shall find out, within the next few years. All the best every one

When stock markets fall they can do so under their own weight even with very little volume. Money need not go anywhere. It is just that a stock $100 today will have buyers only for only $80 dollars tomorrow. So in effect money has not gone anywhere but only buyers dry up. And once there are no buyers prices further fall (domino effect) and continue to do so till buyers come in at an attractive level.

So stock markets can fall on very low outflow of money. Your notion that money has to move out seems misplaced. I think Peter can clarify if what I feel is right.

I highly suggest you re read my comment. My main point, is I would rather be in stocks and money market than bonds when we have a major crisis. The 1930 s many countries a round the world did not honor their debt. Investors lost their investments being in bonds. I highly suggest you read Armstrongs blog and Peters past writings of the 1920s-1930s. As for my own accounts, when ever I make money I take a percentage of my winnings into a money market which will be used to buy gold coins once we pierce 1000.00.

Let me put it this way.

You buy a stock for $100 dollars to sell it for $101 tomorrow.Its value is actually dependent not on the price you paid but what the buyer tomorrow feels it is. Tomorrow there are buyers only for $80 and hence you are forced to sell it at $80. Stock crashed 20% with only your volume due to lack of buyers and no money has gone anywhere. So market will move up only as long a s buyers (Dumb money) keeps coming in.

Your comment, dumb money keeps coming in. This reminds me of the comments during during the 2009 as the markets kept on climbing the wall of worry.

When I meant dumb money , I mean the money that comes when the stock is overvalued and the smart money goes out. No stock goes up forever. It goes up till it is overvalued (Overvaluation is due to dumd money which comes in only to ride the tail end of the rally when wall of worry goes away). Stock markets lead the economy. At the top everything looks perfect just before the fall OR when everything is perfect and everyone is in ,the fall begins . Stock markets always climb wall of worry.

https://www.facebook.com/MIDRussia/videos/1008139769285464/

This is official page of Russian US embassy.

For those who don’t speak Russian just go directly to the second 0.30′

hahaaaa!!!!……ok forgive my russian – but here goes —– Отлично. Это сообщение весело! У русских есть абсолютно лучшее чувство юмора !! отлично

Glad I went back to view some of this week’s posts! Stumbled some really terrific posts by Thomas T, and rotrot…those posts were dated April 1st buy were. Ixed in with the March 30th posts.

Be sure and view those posts if you happened to miss them!

ALERT TO ALL!….

there was a Bradley long term 100/100 power “turn date” on 3/20/2017. The big candle down happened on 3/21!! Did the market just quietly turn?

BTW, there was a Bradley 100/100 turn date on Feb 11th 2016, exactly where the market bottomed and turned last year………

does anyone have any cycle type ‘color’ to add to this Bradley turndate??

anyone…..anyone…..Bueller?? ……anyone?

http://us8.campaign-archive1.com/?u=17b47d962aafbd817571b1659&id=56e3dd2154&e=0bfb839d54

Luri,

I know that Bradley did not have this in mind, but FWIW, on both of the above dates the Lunar Nodes went from normal motion (Rx) to adverse motion (Direct). On April 3 (tomorrow) the nodes go adverse motion again for the rest of the week.

I do not have the time right now, although it is certainly worth looking at, but Bradley looked at specific planetary relationships including Declination.

Steve

A new post is live at: https://worldcyclesinstitute.com/predictions-revisited/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.