Friday, during market hours -- chart updates

Here’s the 5 minute chart of the SP500 so you can see where we’re at. We’re in the final 5th wave of a motive wave up. 5 waves spell the end, but it’s not quite complete until we rally back up to this morning’s top. All the subwaves measure correctly. We remain patient.

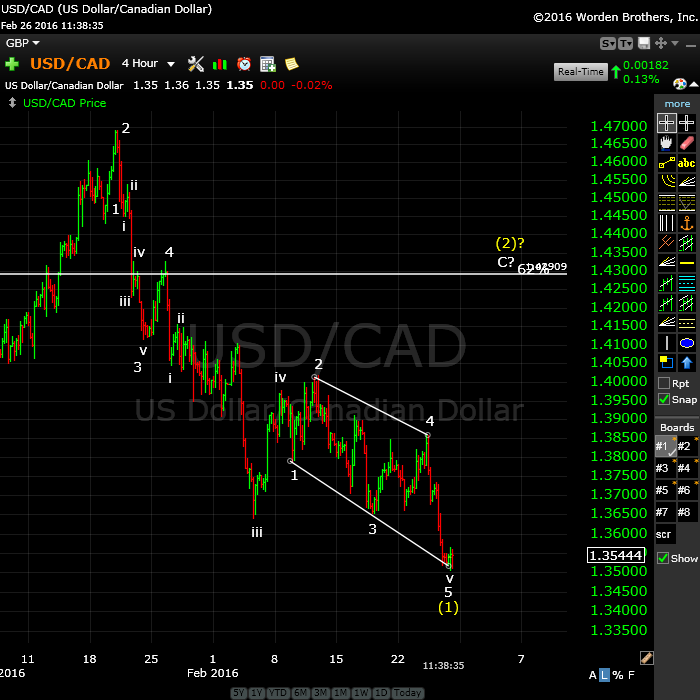

As a comment on this market, here’s 4 hour chart of USDCAD showing the inflection point we’re at, very much like the one for EURUSD. This currency pair should turn up to complete a second wave. Strange motive configuration (it’s actually countertrend) but it works.

________________________

Update Friday, Feb 26, Before the Bell

We’re at the projected target. I expect a double top this morning and we may see an opening gap reversal in the cash indices. Eur/usd has come back to what I also expect will be a double bottom. The EW preferred entry point is after 5 waves down at small degree and three waves up (a second wave). Good luck.

_______________________

Update Thursday, 1:40PM EST

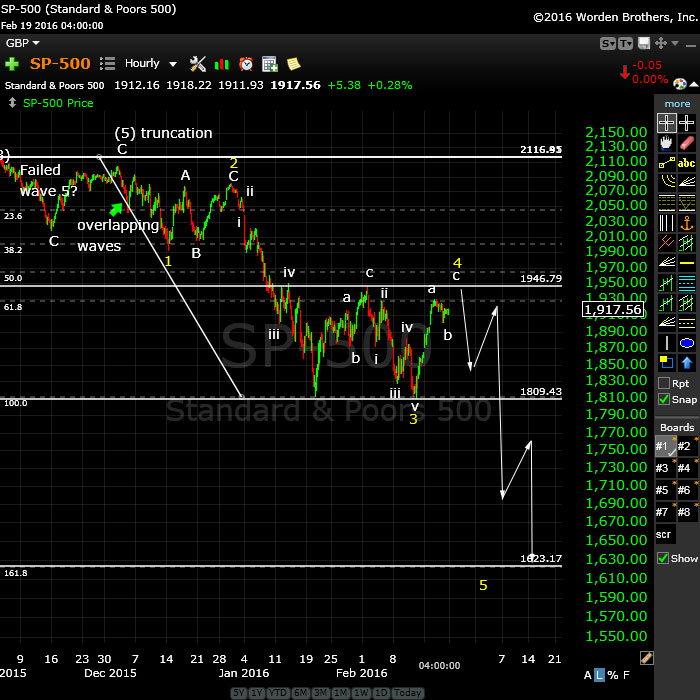

This 60 minute chart of ES is at approx. 3:15 EST, just before close. Because of today’s wave up, which has turned into a “3” in futures, the overall pattern has turned into an ending expanding diagonal. Extremely bearish pattern.

Above is a 10 minute chart of the SP500 (updated at market close)—showing the motive subwaves leading to a top after the fifth wave. The 3rd wave up was exactly 1.618X the first wave and if the fifth wave continues to its full length (1.618 X the first wave, as well), the target will be about 1960/1. It may not necessarily make it that far. I’ve renumbered the subwaves to more adequately match the underlying wave structure.

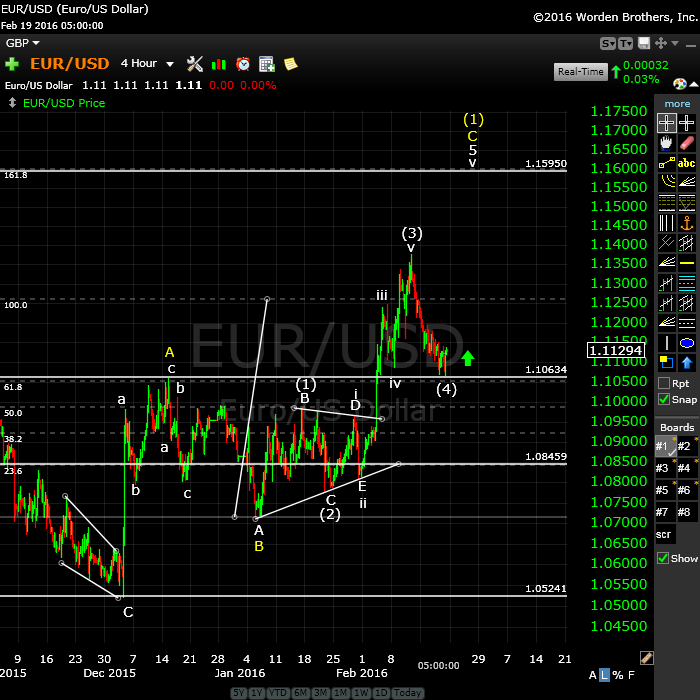

On the other side of the coin, eur/usd seems to have turned and is possibly completing the second wave after a motive first wave up. They should all turn more or less together.

__________________________

Update Wednesday Night, Feb. 24

As I write this tonight, we appear to be in wave 4 of this 5th wave up. If we retrace 38% and the final wave up is 1.618 the length of wave 1, the top measures to about 1955 ES. As far as SPX goes, based on the fourth wave ending at about 1925, I’m projecting a top of about 1961 (the fifth wave at 1.618 X the first).

_____________________________

Update Tuesday, Feb 23, After the Bell

Above is the 30 minute chart of ES. This chart shows what I’m seeing in the futures markets and in the Nasdaq. The SPX and DOW are slightly different and may just be setting up for a top at the previous 4th wave high. All these ending waves are in 3s and this suggests the ending diagonal, which would head up in three waves with a likely overthrow past the trendline to a new high. They result in a dramatic turndown.

This should turn over tomorrow (likely) in the long-awaited fifth wave down of the much larger first wave from Dec 31.

___________________________

Update Feb 22 Before the Bell.

Above is the one hour chart of ES (SPX futures). Watch for a turnover this morning at the previous 4th wave high. All the cash indices, as well as futures, would have to make that previous high, so don’t get in too early. There is still the possibility that we go higher. However, we’re within the cycle turn forecast and have just about met the price target.

Note: The Nasdaq may not need to reach a new high as it’s the only one of the indices that could be considered to have completed 5 waves down.

Also eurusd is has reached its objective.

The safest entry point is after 5 waves down at small degree (a very small first wave and then a second wave of 3 waves up to about 62%).

____________________________

Original Post: First waves of a sequence are interesting animals. Few “wavers” get them right. That’s because there’s no written mention (that I’ve found) of the fact that they’re different than the rest of the motive waves in a sequence. They’re often mistaken for waves “in 3,” because without a careful and thorough look (right down to the one minute level), they look like an ABC corrective wave. They certainly have the same overall measurements. But … they’re in 5 waves.

You won’t find a mention of them in the Elliott Wave Principle book. But they’re real. I’ve watched them form over and over and over again during my 20K hours of watching the market.

First waves come in two parts. You get a set of five waves down (in a bear market), but they’re not quite complete. The five waves don’t measure out properly to each other in terms of their expected fibonacci ratios. It’s the fifth wave that’s the problem; it’s usually too short. That’s your clue.

That’s what we appear to have here. I’m expecting the other shoe to drop this week … to give us the fifth wave down to complete the first wave.

A complete motive wave to a “waver” is the holy grail. Because it tells you the trend has changed and that you can expect three more larger waves in the same direction, at least. And they’ll be highly predictable waves, because they always follow the same pattern. It’s only the first wave that’s the devil to get right.

My major cycle date is the second part of this week. I’m expecting to see us tag the previous 4th wave high and roll over into a fifth wave. That fifth wave should drop 300 points in the SP500 and over 2500 points in the DOW.

It won’t quite wake up the sleeping herd. It may give them a bit of a jolt, but they’ll go back to the party, because the second wave that follows is going to come right back up to where we are now and everyone will breathe a sigh of relief. Everyone but us.

Here’s a video overview of the market as at Monday, February 21:

Market Report for Feb 21 |

_______________________________

I’m providing only two charts tonight because the video pretty well says it all and the markets are all moving as one, so more charts really don’t add anything to the forecast. I will be putting long term charts in the Forum this weekend, so if you want access to those, you’ll need to join. The Forum is here.

Above is the one hour chart of the SP500. The primary count shows us topping at the previous 4th wave high (about 1946-50). There is an alternative that will see us going a bit higher, to the 62% level, but that’s not my expectation at this point. That would be second wave, but I think the first wave needs to finish its work first.

Watch for another small leg down Sunday/Monday in futures and cash to at least the 38% retrace level before heading up to finish the current C wave. I cover this in the video.

The fifth wave of the first will drop substantially (and fairly quickly) to the 1620 (at least), before we get a second wave that will retrace right back to where we are now.

Above is the 4 hour chart of the eur/usd. It’s interesting that it’s an exact reflection of the US equities at this point. I also place it in a 4th wave. With the euro, as with equities, there’s the option of a second wave retrace. In that case the euro would drop to the 1.08459 region before turning up in earnest. The chance for that to happen will be when the equities trace up to the previous 4th this week. Otherwise, expect the euro to sit here a little longer.

The eurusd is in a countertrend (corrective) wave and I expect it to rise in the medium term, and for the dollar to head down. The longer term prognosis is the for the dollar to rise, but not until it at least retraces 38% of the previous large wave up, which it has not yet done. The euro is in the same boat, but in the opposite direction

Profitable trading!

The Forum

This weekend, I expect to flesh out the forum. You can join now. There’s a link to the sign up page in the menu at the top of the Forum page. I will create more signup links on the weekend. You can only post if you’re a member.

___________________________

History: The 1929 crash

I posted the 1929 chart a few months ago and now’s the time to bring it back to the forefront. I would expect a similar path moving forward.

I think it’s important to look at 1929 and the wave structure (above and below), which was the same as 2007—to a point.

The wave structure of the 1929 crash was in 3 waves overall. There were 5 waves down from the top (the A wave) and then a very large B wave retrace. The final C wave down was a stair-step affair and lasted over 2 years.

In our current situation, we’ve had wave one down that’s lasted three months (May, 20, 2015 through Aug. 24). Then we had wave 2 up, which lasted from Aug. 24 through Dec 31, 2015 (approx. 4 months). I would expect the wave 3 sequence down (all the waves—the A wave) to last approx. 3 months. Next is the fourth wave (B wave), which should be at least 6 months, I think and then the final C wave to the bottom, which will likely last a couple of years.

Let’s look a little close at the timing of the 1929 crash because the similarities to today are uncanny.

The market peaked on September 3, 1929 and then it took 2 months for the crash to actually happen (to reach the bottom of wave 5 of the A wave). The larger crash which we always hear about began on October 23, 1929. Then there was that large B wave, which lasted 5 and a half months and finally, the C wave which went on for more than 2 years. This might be the scenario we’re looking at going forward.

Clear stuff Peet! I am fan of Gann but you have seen it correctly and I had the same feeling because the move down wasn’t ‘oké’… GG Peet! 😉 Now let’s see where we end up. 🙂

W

It is a pitty that Joe is not around at the moment but pay attention to this comment Jan 15.

It is still valid so next top around March 8..

Joe January 15, 2016, 11:13 am

Hi Peter

Looks like some sort of bottom is in place

yet this may be just another very minor wave 4 bounce .

The advance decline ratio today showed bullish divergence at the low

and by the time i finally got it together we started bouncing and i missed the low

The spx i still favor 1848 being hit yet everything else has hit the targets .

the sox diverged , the dow is diverging , the nasdaq 100 diverged

the nasdaq Comp has the overlaps in place for a potential triangle

the banking sector $bkx has 2 almost perfectly equal moves down from the may highs . the only thing left is timing this massacre .

market is closed monday ( short day ? ) that leaves tuesday the 19th-jan 20 ?

The next time frame to me will be the puetz window which begins 20-25 trading days before the solar eclipes ( solar eclipse march 9th ) that leaves feb 3rd-10th

for the starting point . so will the next full moon be a low ? if so id give bias to

a lunar eclipse low on march 23rd which implies and upward crash phase

its not as strong as the fall cycle but will be worth paying attention to when we get

there. if the new moon on feb 8 forms some type of Low and the new moon on march 9 forms some type of High ( new moon to new moon ) then the full moon

on march 23rd should be the low ( higher or lower doesn’t matter )

the cycle ends april 16th-25th.on the other hand if the feb 8 new moon becomes a high of sorts then we see a choppy down trend into the march 9th solar eclipse

then a bounce into march 23rd lunar eclipse would set up the crash cycle

and the cycle still ends yet with a low april 16th-25th .

Given the oversold status of the market and taking last yrs cycle into account

my bias is we see a low of sorts in the feb 3rd-10th time frame with a high

towards the end of april . Way to early to call this yet the parameters do not change .

Joe

Peter,

the waves up look quite motive.

The issue is that gold and euro have decoupled from the equites.

Again, I don’t know what asset you’re commenting on (in terms of something looking motive).

I’ve never thought gold was coupled with equities. Unless you’re talking very small degree on the euro, I don’t see a decoupling. Euro is at a bottom. You always get slight variations at tops and bottoms. They don’t tend to end exactly together. The euro tends to lead equities in my recent experience, which I’ve stated previously. I haven’t seen any change.

I’ve posted a chart of ES.

New highs in DOW, SPX, ES, YM. I expect the Nasdaq to test the previous 4th wave high. Tomorrow should be interesting. I updated the SPX chart to the close.

Hi Peter ,

I just like to congratulate you , and say well done on calling a new top yesterday , it did happen today .

Regards

AZ

Well, let’s thank Mr. Elliott. I like to think that I’m properly using the tool he spent his entire life on discovering and developing. 🙂

Well done Peter sold my shorts this morning and went long

Good for you! Shorts coming round again, though … we’ll watch for a setup in the morning.

Peter-

Unclear on one part, on SPX, do you have a preferred target of ~1961, upper trendline of the expanding diagonal or just roughly when the NASDAQ tests its previous 4th wave high?

Ted,

In SPX, it appears to be a fifth wave up, so my target is 1961 (the subwaves measure correctly and the structure is motive). ES and other futures seem to be diagonals, mostly due to the extra time overnight they have to form their waves, of course. So, I don’t have good targets for them because they can overthrow. However, they’ll all turn together. I also think the euro will turn more or less in sync.

DOW target is 16,750—same structure as SPX.

Peter

Yes , you are using the tool properly … but please do not get frustrated with yourself if you get it wrong sometimes … we are all humans and do get things wrong sometimes … even my hero Mr. Gann did :-))

AZ

Not frustrated at all. I’m not perfect, but I have a very good record with it. The market can frustrate, but I’m not frustrated with EW. I do get frustrated by all the skeptics, though, and the people out there that use it improperly.

Thanks for all the hard work, I will sell my longs tommorow or at the latest Tuesday.

But I will not be surprised if we hang on till March 8 or 10 like the prediction of Joe.

I remember how frustrating things were in Oktober when the rally continued for more then a month.

Amen! GN to all!

W

Peter,

I refer always to SnP.

When you see the waves up motive and the waves down mostly corrective doesn’t it suggest that the trend should may be turn up ?

I ask this because I stay in shorts

I’m afraid I’m too busy to mark that down, so if you want a reply, you’ll have to tell me.

To your question: Yes. But I am completely missing your point.

The quality of a forecast does not depend on the actual outcome.

I said that 2/21 was a major date; and it was. So basically the trend is down and the market is simply waiting for the weekend. A few points higher high is meaningless. I stay bearish and prepare for a volatile week.

Maybe some more detail this weekend. Enjoy the ride while it lasts; time is allmost up.

André

I live by different standards:

“By the work one knows the workmen”

Jean De La Fontaine

well we busted up through that inverted H & S neckline. Dare I suggest that it could go a lot higher???

this morning, heading for the 62% retrace? suggesting that W1 may be complete and heading to a start of W3? But at what level?

http://invst.ly/160qm

To everyone since I need to get a few things of my chest so just hear me out for a few minutes:

Peet will update the count every weekend and lucky for us, even within the week!

And in all honesty, if his count is still that we are topping in wave C from 1.4 or 2.A eventhough it goes higher now, it is pointless to doubt him. Of course Peter will consider all options since he is the one with 20K hours of EW time (and to be honest, I know NOBODY that is better than this Canadian dude), so he has his reasons to say that it is corrective or not. Surely we need to think for ourselves, but please people, PATIENCE! Use the information that Peet gives us, and make up your own mind… And sure, Peet is a human being and can make minor errors here and there, just like us all, but to question a count every day is pointless especially when it is very clear that the market is a F*CK*NG B**TCH that makes no sense for weeks… The bigger picture will tell us if it is 1.4, 2.A or 1 up and look who got the bigger picture by its balls… Yeah, PEET! This weekend we know more and knowing Peter, he will enlighten us later this day as well even though his time is limited as he has told us through the lines a few times before. 😉 So what I am trying to say, when I see him commenting that he doesn’t know why he his teaching EW, that sucks and is something we don’t want. Let’s keep him stimulated and don’t come up with stuff that he has been saying for weeks. Please people, READ WHAT HE SAYS, and if you don’t get it, get the EW book and start reading yourself first.

Cheers to all, just my 2 cents, no hard feelings/offense to anybody! Just trying to show you how I would feel if people would question me or come up with stuff without having 20K EW hours and not even read what I am really tring to show you, while I am sincerely trying to help others for ZERO, JUST BECAUSE I CAN AND LIKE TO! Now let’s get back on topic and let’s see what happens. If you ask me, jojo up and down till beginning of March. 😉 The perfect market to make us all crazy, good for daytraders with some big balls though… 🙂

@André, keep the important dates coming! I agree with the 20/21 being significant and a bit higher now doesn’t mean shit. Still all corrective the way it looks… 😉 In 2 months people will know that Peet is right in his EW and you and I know our timing through dates (I do it a little different from you but I often get to the same conclusions) is alright. 🙂

@All, the forum is live, use it to share if you please! 🙂

W

Ah … full moons are fun! Thx.

And yes, I’m going to back off for a while. I find this daily grind tedious (per my comment on skeptics …)

I posted a couple of lines at the top of the post. We’re at the target.

Downside target is still 1620.

Whazzup, thank you for posting this. I completely agree with your points, and especially that Peter has been very, very generous in sharing his knowledge and making regular update posts and answering questions. For these, I am very grateful, and especially for his very high quality weekend videos.

NO YOU MUST BE WRONG PETER! I BELIEVE IT WILL BE 1580! 🙂

Take some rest and hope to see you back soon! 😉

Cheers to you my friend,

W

Just wanted to say for myself (one who’s lost in the haze, trying to learn) that your kindness to share your knowledge and experience every week and most days is a GOD send.

Thank you

Yes Indeed!

Getting this stuff perfect is impossible.

To consistently have an edge is all one can ask for.

Below 1948 ES would be a good start. Below 1939 SPX would be even better (previous 4th). At this point, this could still be a 4th wave with a double top to come.

Peter,

You’re the best! Proof is Whazzup’s post. But I don’t mind some asking clarification for the count because I myself am trying to learn EW. Andre mentioned the 26th before and I’m wondering if we fade the day. All the best everyone!

I don’t have confidence in the count either way at the moment. The euro is obviously not finished dropping (it’s in a corrective wave down and indices have been moving counter). However, indices are not moving up. If we’re doing an ending 5th wave in SPX, it should be in 5 waves, but the wave up so far is in 3. So it continues to hold back on clues. Futures are in what look like ending diagonals, so 3’s are OK. It’s an incredibly tough market to call at the moment.

We bounced at ES 1948, of course.

What makes this market so incredibly difficult right now, in my opinion, is the fact that everything is moving in tandem due to the worldwide deleveraging. The dollar is in charge, but now equities have coupled with it.

So turns take a long time and the waves have to move in their correct lengths, ratios, etc. but there are times when we appear to have to wait for currencies, or equities to line up properly so everything moves again in the new direction. I think we’re waiting for the euro & dollar to get to where they need to before we turn.

I know this might sound a little strange, but I’ve been seeing everything move closer and closer into alignment for about 2 years now. To my knowledge, this has never happened before (this is the “all the same market” theory Prechter forecast some years ago).

eur/usd is in a rather strange triangle at the moment but might have to drop to about 1.086 (not very far from here) before turning (that’s about a 62% retrace of the entire move up from the bottom to the recent top).

The wave down in SPX is not motive. So it’s a bit of a waiting game, but we seem to be at or near a large inflection point. Andy Pancholi’s cycle turn is Feb 23-26 (euro extends it to 26th) and he has them all turning in that time period. He’s very accurate and in fact, I updated his accuracy chart on the Market Report page about two days ago. So I would be patient and we’ll see what happens here.

I just posted a chart of USDCAD to show some of the stuff I’m seeing out there. eurusd has a somewhat similar looking end diagonal.

SPX and futures have just come down to a double bottom, which reinforces the count of 3 down, so we need to properly top. Patience.

Then take a look at some of the big guys, like FB, AMZN, AAPL, NFLX and think whether they look like they’re going up.

UP UP UP SKY IS THE LIMIT! 🙂 No seriously, they will fall harder than the rest 100% sure of that!

And thank you for mentioning all markets aligning to move in tandem, very interesting!!!

This market remains crazy until we top and finally can drop to the 15xx or 16xx level!

Cheers,

W

I dropped in for a minute to add a 5 min chart of the SP500 so you can see the count. We’ll likely wander around the top until the euro gets moving and finishes off its wave. I don’t expect anything more out of today. I’m looking forward to Monday.

Me too Peet, me too! 🙂

The moon at apogee is positive for markets at lunat gravity is low. The moon at a square with the sun is positive as solar gravity is low. As 1+1=2, a Lunar quarter at apogee is the best of both worlds. Apogee is 2/27 and last quarter is 3/1. You can see the dates are drifting apart, indicating the best is behind us. We are now heading into a period where the new and full moon are heading for apogee/perigee. This is the worst of both worlds. And this is just the moon.

2/26 is a date I mentiond earlier. It is just stonger than I anticipated. And 2/28 we have a price-angle timing on Nasdaq. This technique is stronger than anticipated. It works by using the 2015 high price, taking the angle of this price, add that to the vernal equinox and then apply tradional Gann timing. You could say this gives shadow-dates; dates when the market could have/should have turned but didn’t.

Anyway, as I said yesterday, 2/21 was a major date. So the market had to deal with several strong and long term timers this week. I mentioned the tidal inversions Wednesday and Thursday and this gave a one day retrace. Friday was flat as we are heading towards the edge of the cliff.

Next stop is an extremely sensitive period : 3/15-18. Think 3/16 is the strongest but we may see a little overshoot as volatility will spike.

Other dates I gave persist; so I expect a low 3/4, then a test of 3/9 and then panic into 3/16-17.

I just can’t see it any other way. Next weeks should be fun. Tomorrow I’ll give some details about the roadmap after mid March.

Cheers,

André

3/9 is a Solar Eclipse, and then the significant Puetz March 24 Full Moon eclipse also is in the general area of the Equinox March 19 and the Saturn retrograde station March 25; these all are game changers

New post live. https://worldcyclesinstitute.com/closing-the-gap/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.