A New Mini-Cycle Emerges

A New Mini-Cycle Emerges

More and more, the real truth is starting to come out about this virus and the numbers are supporting my article of a few weeks ago, which Facebook initially flagged as “controversial content,” but when I asked for reconsideration, they relented and let me boost its reach (which they refused to do the first time).

YouTube has come out against allowing ANY controversial videos on the subject. And Twitter … you wouldn’t stand a chance on THAT platform! Freedom of speech is under attack across the liberal online media outlets.

The BBC posted an article last week giving some data on the low mortality rates of the coronavirus. And Governor Cuomo of New York has come out and said that the death rate is actually much, much lower than originally thought. The truth will find a way!

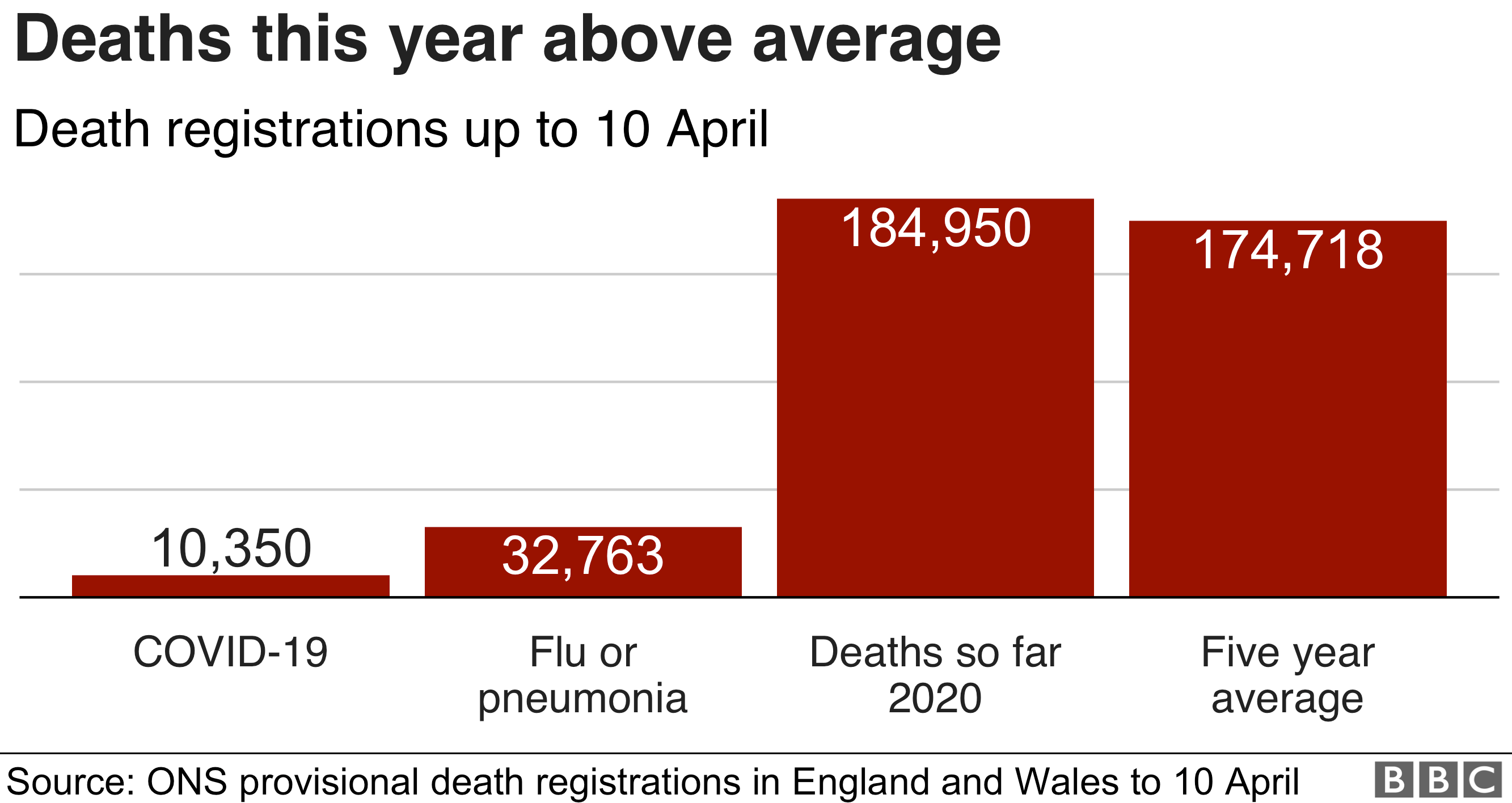

The above chart is from a recent BBC article. They concluded that “the number of deaths from flu and pneumonia – at more than 32,000 – is three times higher than the total number of coronavirus deaths this year.”

Here’s a compilation of several studies: The Real COVID-19 Mortality Rate Is 25-60x Less Than Governments, Media Claim. The summary:

The current actions of politicians in a number of countries are difficult to explain with anything other than incompetence or deliberate actions to achieve their personal/clan political ambitions or promote interests of external actors.

And another one here, from ER doctors!

It’s going to be interesting to see how governments explain away this rather ridiculous, over-the-top response to a new flu virus.

I had it about three weeks ago. It was the mildest flu I’ve ever had, and I’m Crohn’s disease sufferer! (the flu usually hits me harder than most) I had the usual seasonal flu in January, and it lasted a month and a half (I found it difficult to defeat!). The corona virus, on the other hand, lasted maybe a week, and for much of the time, I didn’t know I even had it.

Social distancing is, of course, a joke. Most doctors will tell you that. You would need to actually sneeze or cough on someone to even have a chance of spreading it. \

The correct government response would be to pay attention to those most at risk, the way we might for seasonal flu, not shut down the world economy! The figures show that his bug mostly affects those over 70 years of age, with over 90% of deaths in people with multiple pre-existing conditions.

There’s going to be a revolution, as I’ve been predicting, and this government/media response has done nothing but shorten the timeframe as to when it begins.

It’s certainly going to be interesting to see how they spin their draconian response, because the economy is never going to recover. The Spin Cycle: a new mini-cycle is about to begin. It’s not likely to be successful, as social mood has turned fearful overall — for the long term.

Debt is the real issue, but it’s been “papered over” with the virus fear. So, while the general population may be appeased for a few months, but won’t last. And then the Spin Cycle will rise again … once the market tops for good, most likely in 2021. And that’s then things will turn ugly.

Corruption at the Top

There’s a famous line from Apocalypse Now (1978), where Robert Duvall as Lieutenant Colonel Bill Kilgore says, “I love the smell of napalm in the morning.”

There’s a famous line from Apocalypse Now (1978), where Robert Duvall as Lieutenant Colonel Bill Kilgore says, “I love the smell of napalm in the morning.”

It’s a sarcastic remark. Napalm, used extensively in Vietnam, burns at a constant 5,000 degrees F and destroys everything it touches. In the Vietnam war, many simply became psychologically immune to the horror.

Dr. Raymond H. Wheeler, who I cite often found that 500 year warm/dry cycle tops were rife with corruption and palace intrigue. Near the top of the Roman Empire, the authoritarian, Caesar, was murdered by his senators, for example. Corruption and civil war continued for many, many decades afterwards, as the empire self destructed.

I’m currently writing a blog post on the end of the English Empire (coinciding with the reign of Queen Elizabeth I, who died in 1603), which ushered in the end of feudalism. Corruption was rampant all through her reign, much of it centred around her chief rival, Mary, Queen of Scots.

Corruption really ramped up much earlier, during the reign of Henry VIII (1509-1547). But the warmest, driest part of that period was during Elizabeth I’s reign. There were ongoing plots against her by those in power closest to her.

Towards the end of her reign, England experienced periods of extreme poverty, pandemics, volatile weather that destroyed crops and resulted in widespread hunger, along with inflation that destroyed the value of money. There were restrictions on free speech and what could be put into print; books had to be approved by the government. There were high levels of government propaganda as many (not only in England) were on the verge of collapsing.

Civil wars went on for many years after her reign, not only in England, but across Europe.

In short, the collapse of medieval England is a model for what’s going on today, as is the demise of the Roman Empire.

We’re seeing corruption everywhere. Most of the time, you can follow the money trail to discover the source. We’ve had Climategate, Russiagate, Ukraingate, the Mueller witch hunt, and now the corona virus. Buried in there was the murder of Epstein the pedophile, obviously to protect the elite. We had the MeToo movement, which helped expose sexual predation amongst actors, on-air personalities, and the elite (which had been going on “undercover” for many years). There’s been 9/11, Uranium One, Benghazi, the Iraq war, Syria, Libya …. the list goes on and on.

I love the smell of corruption in the morning.

After all, it’s all around us.

The bottom line: expect extreme corruption at 500 year cycles tops. However, also expect all of this corruption to eventually come out into the open, in time. It may take a major civil war to help get it all “out there,” but civil war and revolutions have historically come after the top of the 500 year cycle (the top was in 2007).

During the coming downturn, which I expect to last at least 50 years, many of the most corrupt will be exposed. At the same time, there will be a move away from tyranny, fascism, authoritarianism and a gradual move towards democracy, which we certainly don’t have now.

A new world awaits, but it’s going to take a whole lot of pain to get there.

In the meantime, it’s time to prepare for economic winter, more pandemics, food shortages, civil war, and the loss of many government services.

We have about a year and a half to prepare. To that end, I’m working this month on launching a “Thrive Academy” monthly newsletter, along with videos and other information that will help you understand the forces at play over the next few years. Most of what I know comes from the study of history, Dr. Wheeler’s ground-breaking work, and from other luminaries from the late 19th century right up through today.

We do indeed live in interesting times, but we’ve only scratched the surface, when it comes to tough times.

Know the Past. See the Future

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The wave down from the 3400 area appears to be a double zigzag (the subwaves are difficult to label with certainly). At the bottom of the last zigzag, an ending diagonal traced out. That ended the main down-leg for the short term.

The wave count of the extremely complex set of corrective waves up in the US indices (including ES) has become clearer this week. It appears that we're in a final ending diagonal (an alternative count would suggest fives waves up). In either case, I suspect we're reaching for the 62% retrace level of the double zigzag down from the 3400 area.

There's also a timing consideration. It looks now like the top will coincide with the next Federal Reserve announcement, slated for Wednesday, April 29 (not certain, but it's a rather obvious target at this point).

There's a lot of manipulation going on (the Federal Reserve is doing whatever it can to prop up the market with more debt — a very stupid idea) and you and I will pay for it in the end.

It is making the market much more bullish than I ever would have thought; however, the Laws of Nature (one of Elliott's original books) always play out, and even though the wave structure can be complex, it doesn't break (at least, not yet ...)

We're near the top of a complex C wave of an ABC correction to the upside. I was expecting a top last week but ending diagonals and triangles always prolong the topping process, so here we still are, going sideways. Note that the NYSE (the "mother exchange") also requires a top to zero of the corrective waves to the downside. Other indices are in the same boat.

When we top, I'm expecting another set of zigzags (there are other options, but I think less probable) down to a new low. The wave to come may be just as long as the original wave down from 3400. If not, it will be close.

Also, it's reasonable to expect a time span that's about the same as the first leg down, which took a total of 23 market days to complete. This brings us to the early to the first week of June timeframe.

___________________________

Summary: We appear to be in a "combination" fourth wave, and have traced out double zigzags (two of three possible patterns in a "combination") to the downside so far, along with an ABC correction that has almost reached the 62% retrace area. We're waiting to begin the third pattern to complete the large fourth wave drop. Another zigzag down seems to be the most probable outcome.

Measurements are targeting the area in the 1800s, although there are other options that target a bit higher. The timeframe has moved to late May to early June for a final low.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

_________________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil) right down to hourly charts (and even 5 minutes, when required).

______________________________________

Upcoming Webinar — May 12, 2020

It's free! Click here for more information and to sign up.