Probability and Elliott Wave

At the risk of beating a dead horse to within an inch of its life, let me once again touch on the core of the Elliott Wave Principle.

“Without Elliott, there appear to be an infinite number of possibilities for market action. What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott’s highly specific rules reduce the number of valid alternatives to a minimum. Among those, the best interpretation, sometimes called the “preferred count,” is the one that satisfies the largest number of guidelines.” — Elliott Wave Principle, Frost and Prechter

My philosophy on providing guidance on the market is not to provide several possible counts, but to provide the most probable count, with an indication, where possible, of when (or where price-wise) the count would be incorrect. Because, as a trader, how can you possibly trade multiple counts? If I were to tell you that either the market is “going up or down,” or that there are several possible outcomes for the current situation, without taking a stand as to what is the most probable, this would be worthless information to a trader. I am a trader, contrary to many analysts out there who pretend to know EW.

I analyse over ten assets five days a week (ES, NQ, SPX, NDX, US Dollar, TLT, gold, WTI oil, EURUSD, AUDUSD, GBPUSD, USDCAD, USDJPY). You cannot make an accurate prediction in this market without looking at all these assets every day.

Let’s look at the most recent case that I got “blasted” for:

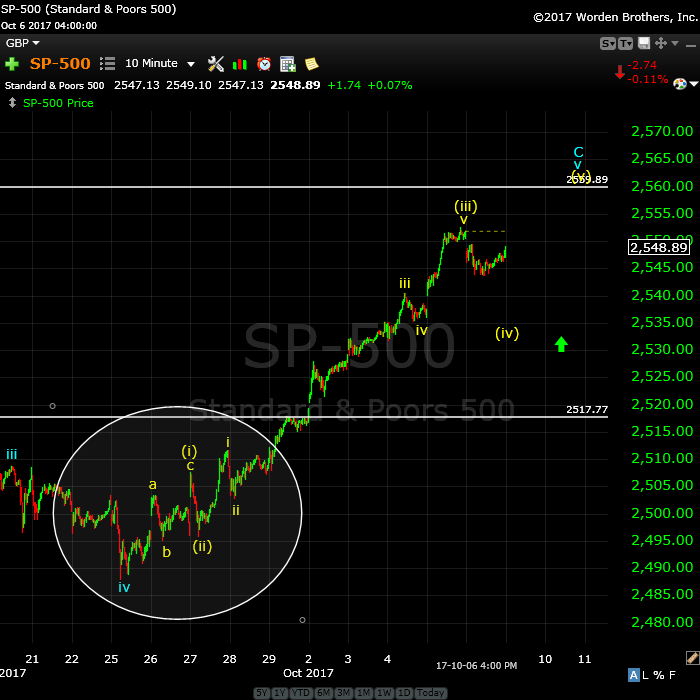

Above is the 10 minute chart of the SP500, showing the most recent wave up.

The circle on the above chart contains the set of corrective waves that identified the entire wave up as corrective, right off the bat. Wave (i) can only be classified as part of a corrective wave (it’s in three waves). It looks like a zigzag; it is certainly not a motive wave (I’ve labelled it as an abc wave, but also as the first wave of the larger sequence). What follows is a wave in 5 waves (not complete yet) that ends where we are today. This would suggest that this entire sequence is corrective, in fact, a zigzag.

At the point at which I had a “preferred count” of an ending diagonal, after seeing the first set of corrective waves, there would be two options going forward (know that we’re in a fifth wave):

- We’re forming an ending diagonal, as all waves in an ending diagonal have to be zigzags (and NQ has been in an ending diagonal for the past two months)

- The wave up would become an ABC corrective wave and remain so right to the top. Because my larger count identifies this final wave up from about 2485 as being an ending fifth of fifth wave, this would be an anomaly (as we’ve never seen this structure as a final wave of a cycle plus degree wave sequence). On the other hand, the entire pattern up from 2009 is corrective.

I chose what I considered the higher probability outcome, which was the ending diagonal. However, I cautioned that if the price action exceeded 2517, then the ending diagonal would “break” and another option would be most likely. At the point that we slightly exceeded that level, I called the ending diagonal pattern dead (the horizontal line shows what would have been top of wave 3 of the ending diagonal, which is where I negated it). I believe that was the prudent, responsible thing to do, and certainly follows the core principle behind Elliott Wave.

The Elliott Wave Principle is exceptional in its ability to tell you when you’re wrong. However, opinions seemed to be that I erred somehow. Perhaps it’s because I’m not spineless and will take a position on a most probable wave count. Others won’t. However, I’ll put my success ratio up against anybody out there. Anybody.

I have little respect for those who offer opinions on my counts with absolutely no logic, evidence, or a chart to explain their position. These opinions are, as far as I’m concerned, completely worthless. Keep them to yourself. However, if you want to dispute a call and have a valid EW explanation as to why it’s in dispute, this I will entertain. The rest is noise.

NB: I am not good at suffering fools.

_____________________

The entire wave up from Feb, 11, 2016 is a corrective wave. In fact, the entire wave up from the 2009 low is a corrective wave … a B wave. Here’s the “personality” of the B wave from the Elliott Wave Principle”:

“B waves are phonies. They are sucker plays, bull traps, speculators’ paradise, orgies of add-lotter mentality or expressions of dumb institutional complacency (or both). They often involve a focus on a narrow list of stocks, are often “unconfirmed” by other averages, are rarely technically strong, and are virtually always doomed to complete retracement by wave C. If the analyst can easily say to himself, “There is something wrong with this market,” chances are it’s a B wave.”

A “B” wave has to be a corrective wave, by definition. A “C” wave will follow the top of this “B” wave, and it’s projected that the DOW will end under 3K. Based upon cycles and history (and even present economic fundamentals), this shouldn’t be any great surprise.

“Those who do not remember the past are condemned to repeat it.” — George Santayana

Gold Mining

Above is the daily chart of gold, with green arrows to show my successful calls. The final two calls have yet to play out. This shows how the Elliott Wave Principle provides a highly predictable tool (in the right hands) to help you make money in a difficult market. These are the calls I make for gold in my Trader’s Gold service.

All of the waves after January, 2016 are corrective. Yet there have been analysts calling for a rise into infinity. That’s simply impossible without “clearing the deck” by going to a new low. Analysts make errors because they don’t stay objective, simply don’t understand EW, or can’t recognize patterns (even the simple difference between a wave in ‘5’ and one in ‘3.’

If we’re going to get a wave up to the high 1500s, then we’ll need to bottom and begin again, and that’s exactly what the wave structure is telling us is going to happen. Look for the 1100 area as the top in the US market. It is likely to become a volatile market as this plays out.

Trade what you see, not what you think.

_______________________

The Market This Week

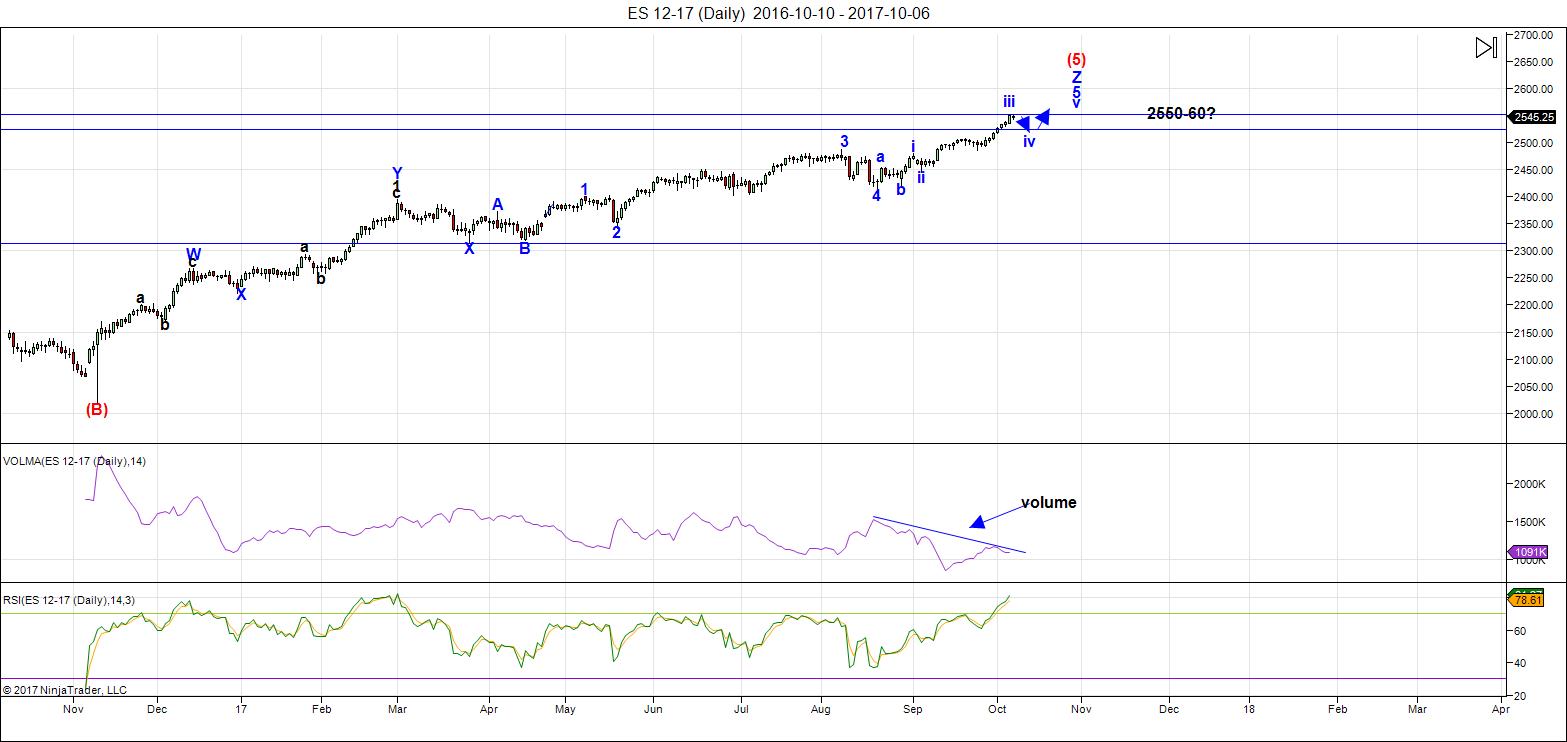

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

This past week ended up with a "blow-off-type" wave up in ES/SPX to new highs, while virtually everything else "sat."

The wave up appears to be yet another corrective wave (a zigzag) and it that's a case, there are at least a couple of ways to label it. However, the prognosis is the same. A final fourth wave is in progress, with the final fifth wave on deck. Look for gold, oil, the currency pairs, and a lot of other assets to follow.

The projection for the fourth wave low is approx. 2530. The level it settles at will go a long way in determining the final high. It will be limited by the fact that NQNDX is in an ending diagonal. The fifth wave of an ending diagonal cannot be longer than the third wave, so the Nasdaq side of the equation could be considered a "marker" for the top.

Volume: Note that for some time now, volume has been expanding with selling, and drops considerably when the market heads back up. This is yet another signal of the larger, impending top. Volume should increase during this fourth wave down. It will drop off suddenly towards the top of the final fifth wave top.

Summary: The final wave five in ES, NQ, and SPX is in progress. The subwaves are calling for a continuation of final smaller fourth wave down to the 2530 area and then a final rally to the top (to at least 2550). The top will be limited by the ending diagonal in NQ.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Wednesday, October 18 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

TOM,

Please post your energy charts.

Peter,

Thanks for the post , appreciate your effort and we understand its next to impossible to be right all the time in any market.

Question – Why do you think we have such a small 4 th wave. If it only reaches 2530..thats around 20/25 points from thursday High of 2552.

Because that’s what the wave structure dictates. It could come down one fib level lower, but that’s not my preference.

Peter

MY last post as it has merit to everything i wrote prior to this.

James mars diagram compared to today .

this cycle of Jupiter Uranus from oposition to 0 to plus 60 degrees is the next trend

which was also the 1921 1929 top in the dow based on just this jupiter uranus cycle

which began sept 28 2017 ….. we have now begun the next 8 year cycle which is a very long cycle in my opinion even though there is longer cycles .

so this cycle may have to do with a cooling cycle yet it remains to be seen

it may effect weather or stock prices or social mood , what ever it is though

begins now ( sept 28 2017 ) and lasts about 8 years ….

we have begun the longer term cycle lasting 8 years from now basically

then shorter term ect…. this is where all of the cycles conjunct so to speak

nothing more to say

Joe,

Peter T and Andre’ seem to be in agreement that a “top” is at hand. Are you

saying that a new 8 year cycle based on the Juniper Uranus cycle began on

September 28th and is a down cycle? I am confused…Sorry, I do not understand enough to even ask a question.

i wont update this again until january .

this is a ” TextBook Pattern ” based on

the mars Uranus cycle as i understand it .

i credit this work that i do to raymond merriman

and arch crawfod , it was i believe both of them that

did the back sudies that i read . so for what it is worth

it is the text book pattern if this market is going to turn down

then the window is opening . there have been many declines

based on this pattern and its had its failures as well .

yet like other plantary models moon cycles ect…

you can also see inversions or just plane and simple

it just doesn’t work . Then it wont be what this textbook

cycle does in which case something else is going on , sideways market

or who knows what . Yet to be textbook these are the major swings ..

the market should be feeling heavy in January…

Warning , this is my research based on the work i found which was done

by arch crawford and i believe raymond merriman as well .,

Nobody is advertising this cycle yet that is fine with me .

my general notes in one chart .

red is the dow blue is the cycle .

https://imgur.com/hxrl6vH

Last chart until January . this part of the this then that

scenario . if we are turning down then how many different

planetary pairs in effect over this time . the more the better

dates for now no a question you can see the rough time line

which dove tails with the other chart above .

andre spoke of may , im seeing april 4th , yet it should

be a steeper than normal decline in which case the chart scaling

is not correct yet not the overall move . you never know how

strong of a decline you will get or if you will get one you only know

you have a cluster of many different cycles all coming due in dec

and dec 12th 13th will be a focal point for me .

that said this is my template and fits with everything else

a top is at hand indeed >>>:)

just need to see how this plays out.

thanks peter for allowing me to post .

ill keep it to once a month chart wise yet

my opinion or notes ill try to keep down to a minimum .

this is it for a bit …

the models are either correct or they are not

no more thinking since my home work is complete

timing wise ..

now for the indicators, monthly weekly daily ect .

if this then that . right or wrong yet this is it .

to many cycles all coming together .

https://imgur.com/xtrviIZ

Joe,

Thanks for sharing! Myself and many others on this site appreciate your contribution!

Ed,

In answer to your email: Let me state once again that since I’ve added higher security to the site, I’m having issues with regular commenters being sent to moderation. I’m attempting to come up with a solution, but at the moment it is entirely out of my control. It’s either that or risking additional attacks and the site going down.

I’m here generally during the day at some point, so the delay is usually a few hours at the most.

Peter T,

I had no idea of attacks on your site. No disrespect meant by my question.

No issue there. It’s difficult to communicate with you, as you know, due to the email issue with aol.

Peter

i understand the security as well as the delays etc..

my last graph to show a quote ” failure which fortunately

i called for ” overall the pattern was very accurate until

the cycle high date which would have ideally been a high to low

scenario into oct 16-17th i think the chart shows . this would

be the momentum turn based on this . the cycle inverted

im still focused on oct 19th yet as noted prior

these all fit together.

i can be wrong .

the example of cycles work until they don’t ,

that doesn’t change the fact that this cycle is coming to an end .

https://imgur.com/OCSUB3y

now im really done

ED

thank you yet it is up to the market to prove or disprove

any cycles.

this is the last for a while and i question this but it is in my notes

so ill assume it relates to chris carolans spiral calandar which does

not always tie together with the puetz window . two different approaches.

just the end of another cycle

https://imgur.com/z7nGfKo

Ok peter ill stop

yet this is a large sample of everything i have been looking at

and im excited .

this last chart has been amended so many times that i consider

it just a rough draft yet is based on the 1924-1929 cycle .

like i said edited several times over the years so

not going to make any huge claims . just wrapping it all up

let the market prove itself

Thank You Peter 🙂

this final move if it does come should be sluggish and possible

sideways and just choppy up and down motion as i see it .

https://imgur.com/1wVcGD5

I think you’re right about the final wave. The Nasdaq doesn’t have that far to go to the upside.

happy thanksgiving peter!!!!

in reflection and in gratitude, i give thanks to you “PETER” – [boss]….., and of course i give thanks to each of you “OTHER” kindred spirits that also graze on the grasslands of EW and fibonacci – and cycles…………….

“And the prayer, which my mouth is too full to express,

Swells my heart that thy shadow may never be less,

That the days of thy lot may be lengthened below,

And the fame of thy worth like a pumpkin-vine grow…

best luri////

You, my friend, are exceptionally kind! Thanks for remembering!

🙂

We should have a top wedged in between the two Thanksgivings. Kind of a turkey sandwich, which is certainly what this market feels like now …

Pass the cranberry sauce and the gravy……this turkey is about to get carved!!

Mind offering up your address?

Of course Peter…if you can make it to Toronto…we’ll feed you!!….but I’m afraid that there will only be bones left to pick after the really big turkeys are done!

Ah … just like the market.

LoL Peet! ??

Pete

Thanks for your devotion to EW. Have received a lot out of your tutoring. Let those wanker comments pass to the keeper. You seemed a little stressed about them. Don’t be, it their issue.

Can you put up that AUD/USD chart with your plan on it again please. Can’t seem to find it.

I have no recollection of posting a chart of AUDUSD. Are you referring to something else?

Actually I think it was in a video. I will find it.

https://www.youtube.com/watch?time_continue=6&v=vBmJwRUqfzU

Pete – wondering if you could update this video. Your view looks pretty good especially re the USD.

Ahhh … OK, I get it. Nothing much has changed, actually. But it probably makes sense to update it, since I put us at the top. Good idea. Towards the weekend.

🙂

That is one helluva a B wave! The move from 2000 to 2009 was a beautiful ABC. I had originally thought it was an ABC A like you. However, it now appears 2009 was a bottom like 1974-1982, and 1932. 2016 was almost as good a bottom technically as 2009. A 500 year top should be euphoria squared. People still hate this market.

I hear that “people still hate this market,” but I fail to see that “hate” in any of the sentiment data I follow. Do you have any citations that objectify that hate. The latest data on household participation in the market is at its highest level in 65 years with the exception of the very end of the 1999-2000 madness… I also take exception to the 2009 market bottom (and especially the 2016 bottom) being anything like 1932, 1974, or 1982. By any reasonable valuation measurement yardstick, the 2009 bottom was nowhere near the other three. I’m not a P/E guy, but those other three lows showed both P/E ratios in single digits and index dividend yields over 6%. Now those were market bottoms! 2009 was simply a resting point between extreme market madness. One man’s opinion 🙂

I watch CNBC, why? They all virtually say mkt overvalued! Three major technical indicators gave major bottom indicators in 2003, 2009, and 2015-6. Investors Intelligence bullish sentiment below 30%. S&P 500 put/call .6 or below. Large spike in VIX. Oh yes, Coppock gave a buy. Those type of readings are good for 3-5 years. What most people seem to miss is that the late 2015 early 2016 was a major bottom very close to 2009 extremes despite small price drop. Its relative high low verifies the strength of this mkt. So the hate was Feb 2016. That hate lasts for 5 years until it has turned to total love. Right now the bull/bear ratio is 4, euphoric? Maybe, but those type of top reading rarely call tops, maybe corrections after they have gone up more than that correction will be. My cyclic stuff says up until 2022 before a lengthy, 1 yr, correction. At the top, there will be a general mania and a specific mania, say Bitcoins. I just do not see anything like that now. I asked several friends lately, what they think of Bitcoin, never even heard of it. It is like the NASDAQ IN 1990. This man’s insight.

I’m with you Kent, 2009 and 2016 were major lows. Up and away in this new 17.6 year secular bull market imho.

test

Awfully quite in here.

Peter

Last one , the weekly dow chart over the past 2 years and its comparison

to 1927-1929 i think …. anyways it has worked out very well up until

the top . my point is we are in an extension in my opinion and based on history

and other measures a reversal is near by . in other words , back to the crash

of 1929 or 1987 or 1997 ? those dates should become highs . ( very close )

from the august 25 2017 we began the extension in my opinion . based on history the dates are roughed in .

https://imgur.com/p0OFCbb

To add to this timing measure i use a weekly oscillator.

the year 2016 was also an extension when comparing the 1932 to 1973 high

the 1974 low became the next starting point . we have now extended and exceeded the previous percentage point move .

https://imgur.com/0aayzrW

so in short we are both completing a short term inversion we are also competing a longer term inversion .

this starts coming together right now . so its a no brainier if we are going

into a reversal or not .

Last to wrap up where i began .

indicators :

this is just 1

this is my own version of an oscillator .

it began as a back test of other methods and then i edited it

and added to it until i liked it .

i cant explain how its formatted yet here is 5 years of history .

This run to the upside has been no different than other rally’s .

all i can say is , there is room for higher prices yet based on

this indicator we are what ill say is overbought enough on a weekly

basis . momentum is now going to weaken or it has already begun

to weaken .

5 weeks off a low to a high leaves a couple months yet we will see.

https://imgur.com/gBp6K59

5 weeks off a low leaves 2 weeks which is this week and next.

last chart for a long long time .

its the bigger picure zoomed in from 2014 to date .

it is the weekly dow chart where 1 week = +1 or -1

and the accumulate . 0 being the 2009 low .

label this chart how ever you wish yet it is worth a look at .

and weekly oscillator is acceptably overbought .

plus a couple weeks .

https://imgur.com/vEnTcgX

Peter

If i could ask you for your opinion on this charts Elliott wave count ??

My gut says buy sooner than later and the wave count leaves me a bit paused .

https://imgur.com/TehsYVU

Joe,

You didn’t give me enough to go on so I looked it up. It’s basing, but I’d want to see one wave up and a second down but it looks like the wave up on a daily chart is in 3.

Peter,

We keep going higher, Any change in your thought, Do you think we already had 4th wave down, I was thinking atleast 20/30 point down.

By the way , Mahendra sharma has turn date from oct 12th , as per him goes down from here.

In the most recent post in ES, I was expecting a drop to 2530, which was only another 10 points, but nothing more. The full story of the present pattern was in today’s Chart Show.

HAHAHAHAHAHA….Mahendra Sharma…..if you follow his advice you’ll be bankrupt in no time! He has a good track record which he is about to completely ruin by his own admission when the market does not crash 20% by end of October. Maybe I’ll eat my words but oh boy is using the position of Jupiter relative to Uranus to determine the stock market makes little sense to me!

with all due respect “qwert” – i think it takes courage to publicly “predict” outcomes. it takes courage to “assume” this kind of ‘reputational’ risk / i respect mahendra for this, and his belief in his “system”.

To “deride” from the shadows is “riskless” and is, if i may go so far as to say “easy.” are you “easy” qwert?

Luri I just feel the manner he advertises his predictions is misleading and can lead a newbie to make big losses if they dont know what they are doing. There is no 100% probability of anything yet he makes it sound like there is. Peter on the other hand gives us his best EW count but never has said he is going to be right without fail.

no worries qwert,

there are no “losses” that exist. When one makes a “choice” …….. learning is the outcome of said “choice”………. how can one possibly “lose” by learning????

rather than ………[“the truth”]…….. but “knowing” the truth – shall set you free……………

Agree with you, Iuri.

Just for fun, this is what everybody will do when the system is completely rigged:

http://nypost.com/2017/10/11/airport-stops-29-passengers-smuggling-gold-in-their-rectums/

https://www.youtube.com/watch?v=YFtHjV4c4uw

Jupiter to Uranus? They are not even close to being anywhere on the same degree of the Zodiac (Jupiter just changed signs, is now close to 1° Scorpio. Uranus is ~27° Aries). When planets are at the same degree, you get important angles like conjuntions, trines, and sextiles. Hard aspects like squares and oppositions are likely to cause trend reversals.

Yes, there are astrological relationships to the market. I’ve been studying the 1987 top along with a few others. Price & other planets need to be considered. The outer (slow moving) have the biggest effect, but the faster moving inner planets help with the timing.

As far as harmonic lines go (different than astrological relationships) Uranus sits at 2547 and Jupiter is at 2713. If price were to fall below 2520, Jupiter & Uranus are not even close. The next nearest line would be Neptune at 2502.

Notice how when it broke 2502 to the upside it rocketed to 2544? Yea, there is some merit to this, but not on its own. You need the technical analysis to go with it.

Mike I made up the reference to Jupiter and Uranus. Was just having a go at astrology predicting stock prices but I understand many use astrology when it comes to investing so that was not a fair comment. Also I guess the 12th was not a turn date! Surprise surprise. I guess there are still 12 trading days for the S&P to fall to 2000 as he predicted. For the record my prediction is a mild pullback to maybe 2500 or just below and rally into early November. My position is long S&P and looking to add on a pullback. Stoploss at 2450. That’s my view out there so no-one can complain I comment from the shadows but yes I don’t have a reputation to lose like Mahendra and he does have strong faith in his system so he isn’t making wild predictions. I guess it really is up to investors who follow him to take appropriate measures to contain risk.

NOT AN ENDORSEMENT

Mahendra Sharma | October 6, 2017

“Market will fall from 12 October…or around this date”

https://www.mahendraprophecy.com/latest-news.php?id=1154

Because it’s Friday the 13th after.

Ou-ou-ou…

Long UNG at 6.51

Long Weat at 6.34

Both positions bought today and admittedly i think im

premature with those purchases .

My reasoning is that these may go counter trend to stocks.

if so they will act as a hedge yet they are not a true hedge .

Im betting on the weather getting colder , the seasonal s in

natural gas should be looked at .

That said these are longer term positions on wheat and nat gas .

Friday the 13th stats per month. Check out October. https://www.stocktradersalmanac.com/LandingPages/Friday_13th.aspx

I think we have a pretty good chance of a top being in today in the US indices. I will need confirmation with a second wave.

peter — “REALLY?”….i was chewing on a cheese and pickle sandwich, and almost choked on the “pickle” part…….

i know you are taking your ques from the nasdaq – but the ES has been looking very “ending diagonal” wedgy on the 15 minute time frame.

does anyone want a half eaten cheese and pickle sandwich?

https://invst.ly/5fb1y

Pass on the sammy. No, I look at everything and yes, SP had a small ed at the top, so did NQ and ES. I haven’t looked at your favourite index yet, though.

peter,

yes, i am unsure, but i think on the 15 minute time frame, the RUT seems to have had a small ED which looks to have topped on 10/9 – a few days earlier……

https://invst.ly/5fb-p

Not quite done yet (after my analysis).

Liz

it looks like you showing oct 13th

i have a low due oct 14th and a high due oct 19th yet

im with peter that we may have topped out today yet

my timing models say be patient until dec 12-14th ( ill give it a day

on either side of dec 13th ).

ended up flat on the day for my entry … yet it is a longer term though

so im ok with a bit of a draw down if one comes .

its to soon for me to take a bearish position in the dow or spx as i see it

with timing allowing for higher prices yet this market is considered acceptably

overbought so im not going to call for higher prices even though im allowing for them .

oct 14th to oct 19th is the potential swing period upwards im concerned

about .

Peter, Joe thank you for the tips.

Going with the theme ‘years ending in 7’, swing high,

1987 – Oct 14,

1997 – Oct. 7,

2007 – Oct. 11. But ok, Joe, you’re looking for a swing low 10/14 but for now, I’m looking for one 16th or 17th.

Peter G

Just something to consider .

this is a long term indicators based on the dow monthly chart

and assumes that the dow closes right where it is today which

obviously wont happen yet it is a reference to where the market

stands today compared to the last 43 years .

Note: oversold levels at the 2009 lows .

ill say i agree as well as disagree with you .

keep ion mind this is a slow oscillator

https://imgur.com/wZ0ORyR

Joe, I have great respect for your market insight, but to me the plot you show is more like an oscillator or rate of change indicator. In that respect, there is little question the 2009 low ranks with the best of them if we seek oversold extremes. After all, it was the greatest percentage decline in the history of US markets, except for the 1929-1932 crash and, in fact, if you use a simple oscillator measurement like a 14 period monthly RSI, the 2009 bottom was the most oversold extreme in the history of the DJIA. Here’s the big “but,” however. Past market master, Edson Gould, (he made some remarkable market calls) always claimed the best valuation indicator historically is the dividend yield on the major indexes. At extremes of undervaluation, those yields almost invariably go to at least 5% and sometimes 6% or higher (almost 17%! at the 1932 low). He considered any index yield of under 3% as overvalued. At the 2009 bottom, the indexes barely reached normal valuation (~3.65% over the past 90 years) as opposed to oversold. The current dividend yield on the S&P 500 is 1.96%. Historically, index dividend yields under 2% are not only very rare (except for the past 2 decades), but they invariable lead to 10 year compound returns in the territory of 0% or less. Why all this fundamental mumbo-jumbo. Because we have not seen a historically undervalued market in 35 years. If you believe in cycles, you know one is coming, you just don’t know when. I hope this clarifies my perception that 2009 (not to mention 2016!) were nothing like 1932, 1974, or 1982. My belief is we will see dividend yields over 5-6% within 4 years. That implies a decline of 60% if dividends remain the same. That, of course, would be very unlikely, so the decline is scheduled to be much greater than that!

Liz

the open on the 16th is open for debate yet i tend to expect it to

be a high . oct 19th i have also said i thought would be a high .

Oct 14th is a key day for me as a low of sorts .

Oct 19th to Nov 7th id like to see as a high oct 19 low nov 7

then up into dec 1st

yet from dec 1st to dec 13th im leaving open for direction

my preference is both are some sort of high’s yet im not

going to swear by it . Jan 2 2018 im leaving open as a turn.

hence dec 1st to jan 2 is where i just start focusing more

on shorter and shorter term indicators .

Not a technical signal yet i wonder if speculators will wait to sell

hoping for a tax break ? either way dec 12-14th is my main date

im focused on despite the mars Uranus cycle high due dec 1st .

longer term bias is downward for the next year .

that’s all i give it for now .

shorter term basis will be an april may low in 2018 which agrees andre

completely . after april may 2018 ill adjust my timing based on its accuracy.

essentially im considering now to may 2018 as the larger reversal swing .

yet the dec 1 through to jan 2 is where i decide on when to take the bearish

trade into may ( may or june options depending ) yet covering in mid april .

My initial take today was to begining following through with my larger term

market thoughts which are speculative

Keep in mind oct 14th is Saturday and im calling it a low of sorts.

im also considering the open oct 16th on the open a high or sorts

and considering oct 19th a high with nov 7 low .

oct 14 being sat 15th Sunday and 16th on open implies a gap up

open on monday morning 17th is Tuesday and 19th Thursday .

for me ill see how next week looks .

oddball weather in new york .

note the record low for this date is back in 1987 .

i use this to because i find the records are well maintained

http://www.cnyweather.com/

First freeze dates based

on link above you can click through the menu

http://www.cnyweather.com/wxfreeze.php

My take on the astrological vectors is that the Sun Jupiter conjunction on Oct 26 is the peak energy driving the equities. That day also sees Saturn change signs in the sidereal zodiac. That releases a two years-long malevolent grasp between Saturn in Scorpio and the Dragon’s Tail (lunar nodal axis, karmic control point) Ketu in Capricorn. They are in each other’s signs till Oct 26. The impact of Saturn with Ketu is smoke, illusion, fakeness. The last time the node shifted signs saw the biggest one day move in months on 8-17. This time because the Sun and Jup agree there should be a trend change, we can start an actual wave four type pullback. Not the end of the trend, but at least a short term 100 pt or so drawdown into Thanksgiving and after. just my humble opinion.

Peter G

i use price oscillators

ill agree with you on valuations and dividends .

stocks in my opinion were near fair value in 2014

yet dividend yields have gone straight down the tube for

many stocks ( almost all ).

a couple records set last week on the weather front and yes

i m looking for confirmation to my colder than normal

weather outlook along with a collapse in sunspots which have now

shown 4 consecutive 0 sunspot days ( not a trend by any means )

https://weather.com/storms/winter/news/rockies-snow-montana-colorado-wyoming-early-october-2017

Havre, Montana, had seen 13 inches of heavy, wet snow as of late Tuesday afternoon, which set a new record for heaviest two-day October snowfall total at the Havre City-County Airport. The previous two-day October record was 12.6 inches, which was set in 1898. Due to power outages, further investigation will be needed to determine if any daily records were broken in Havre.

Whitemare

Points taken

thanks 🙂

Having just read several articles from martin Armstrong blog

i have a few concerns .

I have the ut most respect for Armstrong and have read his posts

for for the past decade roughly .

he states money flows will go back into the us dollar this next year

which i can accept ( a dollar rally ) yet he also feels that this time is truly

different and the money flows will spill into us equity markets driving stock prices

higher .

I just cannot rationally make out how this will happen using technical analysis.

If all the money around the world pours into us equities then wouldn’t trade effectively stop ?

Ill give him the respect he is due yet i seriously question a bull market next year.

If this time is truly different then maybe we should be expecting a warm winter

lol

so peter,

you were indeed correct by saying “not yet done by my analysis”….

we overthrew the wedging pattern on the 15 minute time frame on the ES this morning.

what say you?

https://invst.ly/5f-xo

Looks like a go this morning to me, but I’m worried about what you’ll do to “Friday the 13th” in prose for the next month or so. 🙂

And the movie will never sell because nobody will believe it … we’ll see.

But then … reality TV in the White House … so par for the course, perhaps.

ok – “peter”…… CALM DOWN….for the love of god, “c-a-l-m down”…….. – and step away from the toast!!!

….there is no “movie” peter,,,,,,, and peter, there is no “prose”……… just calmly sit down, and let us inject you with this tiny needle……it will help you “relaaax”……

:-))))

https://invst.ly/5g0tj

yes, that be the pattern.

I just placed a short on QQQ just in case Freddy Kreuger decides to put it in a blender. 🙂

hahaha!

10/16 is a major date and will start a 270 day cycle down into the 10.000 pi count on 1932 low, 7/11/18.

10/25 strong date an will be tested. So basically 10/16 is a system high but 10/20 will be an inversion low to create an inverted high 10/25. After 10/25 thibgs will speed up. A Violent wave down will start early 2018 (w3) into the 5/2/18 low. This is a 4 month decline.

Next week 16 high, 17 low, 18 high, 20 low. In 1929 10/18 was a panic day.

Monday the sun changes mansion and wednesday Mars.

10/25 will bring capitulation with a first low 10/30. 10/16 – 10/30 is one cycle, so ABC down.

We are in a first leg down into july 2018. Likely just the first leg in a much longer cycle down into 2020.

Cheers,

André

Cheers/thanks!

energy chart for next week attached

just press the zoom button at the top of the page

https://postimg.org/image/816pdsquln/

One problem with analyzing SNP is that the dollar index is manipulated/affected by the dollar/yen carrytrade. A dollar will allways be a dollar. But if we want the ‘real’ value of SNP we should divide the SNP by the dollar index.

When we do this and calculate torque, the composite Garret gives a significant high 10/17 with a significant low 11/2. Above I said 10/18 was a panic day in 1929, but it was 10/17.

Never done this analysis before, so a bit experimental. The composite Garret on Vix gives a low 10/17, Problem with vix is that we don’t have volume so we can’t calculate torque. Still, 10/17 seems remarkable.

P.s. This analysis was not complete. Including longer term cycles the high was 10/13., with a down trend into 10/26.

Again, a bit experimental. But if true, pressure down already mounting. We’ll see.

Would volume on the vix futures work for you?

With volume i can calculate torque. And for Garret timing we need that, Garret says price is a liar; we need torque, So volume on VIx would help but I can’t find it.

The link for the current active VIX futures contract follows. Many of the charting programs will create a continuous contract based on relative open interest so you can get a steady volume number. Also, it’s possible VXX or XIV etf volumes might be reasonable proxies (i.e., using VIX prices and etf volumes for the calculation). I happen to like torque, but haven’t tested it on VIX strategies.

http://www.cboe.com/delayedquote/futures-quotes?ticker=VIX/V7

Just a followup on the weekly chart .

This may appear to be something more then it is not .

this is not really an overlay , what it is is an example of

the puetz cycle as well as chris carolans work based on the moon .

I use these overlays though because they repeat more often then not

and until they fail which i doubt they will , ill continue to use them .

the firt chart being what kept me long into august and the aftermath

of a potential crash which failed . ( it inverted )

weekly charts :

you have to admit it was very spot on for the most part until

august .

https://imgur.com/ChojjEX

on this second chart i inverted the dow , this means as you see the blue

bars falling it is the dow rally upwards . ( note scaling on the left )

Note the timing : oct 16th open , oct 16 17th .

this is based on calendar research and is 55 hours prior to the new moon.

note the 2nd date marked, the week of dec 1 . this lines up with the mars

uranus cycle . to sum it up . if this is going to work going forward then we should

see a sizable pullback begin next week ( monday open – Tuesday calendar research work , Thursday oct 19th the crash of 1987 30 year anniversary date

and the mars Uranus sub cycle high . while this is longer term it is short term

thoughts ( watch bitcoin for grins to see if it tops out and also begin watching

for trend changes in other assets begin)

https://imgur.com/h5BuRvh

Tom

Interesting energy chart you posted .

thanks 🙂

Andre

I see the oct 17th date you mentioned .

For me this week is where the pieces start falling into place.

I doubt ill make any position trades this week yet if i see

anything worthwhile to trade short term with dow futures

ill take it on an intraday basis only and probably not until

Thursday or Friday

Peter G

this is the why i agree with you that the 2009 lows

we not oversold enough .

This is just another oscillator and i leave it alone

and just update it from time to time .

its based on the dow weekly charts and goes back

to the 1942-1943 lows . just historical perspective is all

my issue with the stock market is we have not seen any

bearish divergence show up in this which leaves open

the door, new all time highs following the lows in 2018-2019.

Just food for thought .

keeping to my bearish bias though for now ( longer term )

https://imgur.com/r0J5Db2

https://weather.com/news/americas-5-coldest-cities?pageno=2#/6

Reference stations for further research .

#5: Caribou, Maine

Average annual temperature: 39.7 degrees

Subzero days/year: 41 days

All-time record low: -41 degrees

Average last freeze: May 15

Average first freeze: September 24

#4: Jackson, Wyoming

Average annual temperature: 39.4 degrees

Subzero days/year: 41 days

All-time record low: -50 degrees

Average last freeze: July 10

Average first freeze: August 16

#3: Gunnison, Colorado

Average annual temperature: 38.1 degrees

Subzero days/year: 59 days

All-time record low: -47 degrees

Average last freeze: June 24

Average first freeze: September 5

#2: International Falls, Minnesota

Average annual temperature: 37.8 degrees

Subzero days/year: 58 days

All-time record low: -55 degrees

Average last freeze: May 26

Average first freeze: September 15

#1: Barrow, Alaska

Average annual temperature: 11.7 degrees

Subzero days/year: 160 days

All-time record low: -56 degrees

Average last subzero low: April 23

Average first subzero low: November 4

Last link for those interested in trading grains this next year .

http://www.agrinews-pubs.com/markets/boucher-headed-to-drought-in/article_54d615bc-a394-11e7-8514-aff1c6bd0833.html

The spiral calendar gives a strong 10/15, 10/18, 10/20, 10/25 and 10/30.

Tidal inversions 17, 18 and 20. As 16 will be a high the tidal iversion 10/17 will be a low. From 10/17 up so the tidal inversion 10/18 will give a high. Then down into 10/20, so the tidal inversion 10/20 will bring a low. 10/18 very strong; be prepared.

Peter

there is a man named ed fix who wrote an article in 2011

explaining the sunspot cycle . his model looks fairly accurate

from what i saw . a google search : ed fix sunspot model

will lead you to his work yet i have not actually found his work

in his words so tough to get into it at this point .

other articles though focusing on global cooling beginning

beginning now basically and running into 2053 .

it brings me back your quote of dr wheeler and the 8 year cycle

which i questioned yet it stood out to me after seeing the recent

sunspot spike ( back in sept i think ).

My dalton minimum overlay is still spot on for October yet the proof

will be as we get through nov and dec and run into next year .

I think ill learn alot over the next few years in regards to sunspots

as well as global cooling .

At the moment just taking it in and wanting to thank you for

your research into dr wheelers work .

if the ed fix model is correct we peak in the next sunspot cycle

in 2020 then head back lower and the cooling trend accelerates .

on another note robert prechter wrote an article on the sunspot cycle

and the stock market several years ago in which he showed stock prices

tend to turn higher just before solar minimum .

if we did reach solar minimum ( which i have doubts yet can accept being wrong )

if would help to explain this rally if it manages to continue .

its all coming to a head as i see it so we should know soon enough .

anyways thanks

A new post is live at: https://worldcyclesinstitute.com/gravity-always-wins-in-the-end/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.