Update Friday morning, June 17, ~10AM EST

Above is a 3 minute chart of SP500 this morning. It’s not a typically motive wave, but rather an A wave with 5 subwaves. I’ve drawn on lines that show where the retrace might go down to. The wave is short in terms of meeting the previous 4th. So there are options. If this wave doesn’t retrace any lower, it may simply continue up.

You can see that the subwaves are not clean motive waves. In fact, the last wave up is in 3 waves. This configuration could also be a 1-2, 1-2 pattern, which would mean we’re in a third wave up at the moment.

Above is the 15 minute chart of USDCAD showing the motive looking wave it’s traced out overnight. I’m expecting it to reverse at ~1.2830 and retrace in a second wave to ~1.290. This may have some bearing on what ES and SPX do next.

___________________________

Update Thursday night, June 16, ~6:30PM EST

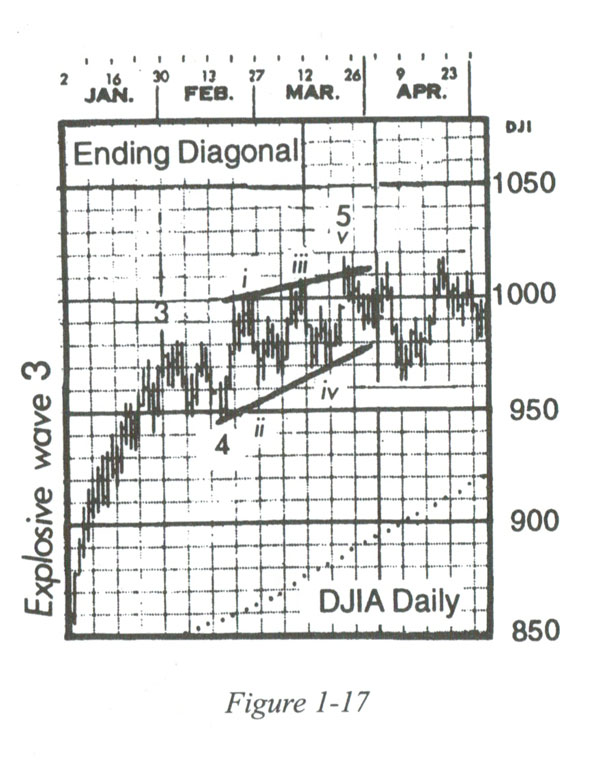

Above is the 2 hour chart of the SP500 after today’s action. I’ve had to back out the chart after today’s action to get a handle of the triangle that’s forming. I had to actually hit the textbook to “see it.” Ending diagonals aren’t always that obvious. In any event, you’ll find the text book version just below here.

Today, we trashed the expanding ending diagonal option by dropping beneath the lower trendline of the pattern I had posted.

I’ve relabelled the larger wave slightly, making a larger wave 4 into wave ii and starting the ending diagonal a little earlier. You can see the similarities to the textbook version below. The waves are all in 3’s (a requirement of an ending diagonal, which is a triangle) and so a triangle of some sort has always made the most sense. Plus a correction can’t end a wave sequence. It has to be a five wave move or a triangle. This is the pattern that for now seems to fit the bill. We would have to hold the wave iv low, however.

There’s an alternative in that wave ii may need to be labelled as wave 4 and that would put us only at the bottom of the second wave of the ending diagonal.

Above is the textbook version of an ending diagonal from The Elliott Wave Principle book—4th edition (page 38). You can see the similarities in terms of what the market has traced out in the SP500 so far today. The problem with the book version is that the 4th wave should not be part of the ending diagonal and they’ve improperly extended the lower trendline to include the bottom of wave 4. The ending diagonal is actually only the five waves (1-v) that make up the ending diagonal itself.

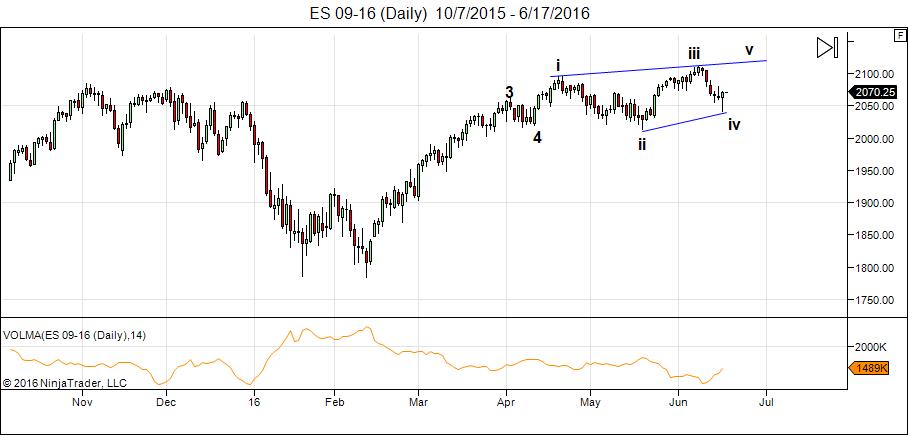

Above is a daily chart of ES (emini SPX futures) showing much the same pattern.

ALTERNATE – LIKELY THE VALID VERSION

Above is the same chart of the SP500 at the top of the post. However, this is more likely to be the path of this ending diagonal. It’s actually the same path I drew out earlier in the week. In this case, we’re in the very early stages.

_______________________________

Original Post: Sunday, June 12

Here we are at the top of wave two. It doesn’t mean we’re done, but we’re almost there. Many of the major indices have hit my target. However, the pattern is not complete. The “fifth” wave (or more properly, the C wave), is in three waves. As a result, it has only one option—to form an ending diagonal, which is what I believe is taking shape tonight.

It’s difficult to project a final path, as the pattern is just starting to unfold, but it’s looking to me as if we’re going to trace out a converging ending diagonal, rather than one that’s expanding. In any event, I’ve provided a chart with the projected waves drawn in. We’re possibly just days away from a top.

We have a much anticipated Fed announcement on Wednesday, which should disappoint, and of course, the Brexit announcement on the 23rd of June (next week.)

In regards to the upcoming possible cycle turns, Andy Pancholi has provided a great little video, which you can watch here: Andy Pancholi Special Report.

To purchase Andy’s high-end cycles report, click here. Andy is 99.9% accurate on major cycles turns and using his turn dates with my Elliottwave projections is really the holy grail in trading. You won’t often go wrong in timing the market.

In this weekend’s video report, I take another look at the bigger picture with the NYSE, because it’s crazy to look at the sub-indices in isolation (the DOW, SP500, RUT, futures, etc.). They all have to do more or less the same thing and the NYSE is the ultimate determiner of market direction. Actually, it’s the US dollar that’s the real ultimate determinant of market direction, but within the stock market, the NYSE is the largest cap index (in the world, actually) and so it’s the one you have to pay attention to.

As I’ve mentioned here over and over again, the currencies and US market are becoming more and more tightly aligned. They’re all moving together as debt is being deleveraged. If you’re good at seeing patterns and mentally manipulating them, you can easily see them aligning and this helps you forecast the market moves.

It certainly won’t always be this way forever, but they’ve been moving closer and closer into alignment for the past couple of years. Now the moves are almost identical, from a technical analysis perspective.

Bottom line: The final high for the SP500 should be at or slightly above 2116. I’m looking at the June 16 (the next Federal Reserve announcement) as perhaps being the catalyst for a top. WE also have Brexit on June 23. I’ll repost the charts for the larger third wave down we’re expecting in the forum later tonight or tomorrow.

______________________________

Here’s a video overview of the market for Tuesday, June 13, 2016:

Market Report for June13, 2016 |

_______________________________

The Charts Going into Monday

The US indices appear to be tracing out an ending diagonal. The cash and futures markets seem to be more or less in sync.

Above is the 60 minute chart of ES showing most of the large wave up (from May 19) and the projection for the ending diagonal. I had projected a drop to below the previous, most recent fourth wave (at 2083) but it looks like that’s all we’re going to get. I would want to see this wave drop at least a tick below the previous two waves down to 2083. If it makes a new low, that would bolster the wave 2 prediction in an unfolding converging ending diagonal.

Ending diagonals end in a throw-over (they exceed the upper trendline), but they don’t project a final target.

The above chart is at ~ 12:30AM EST. You can see how we’re almost at the 2083 level, so I would expect a drop to a similar level on the open by SPX and most likely a turn up sometime tomorrow morning.

The Alternate – An Expanding Ending Diagonal

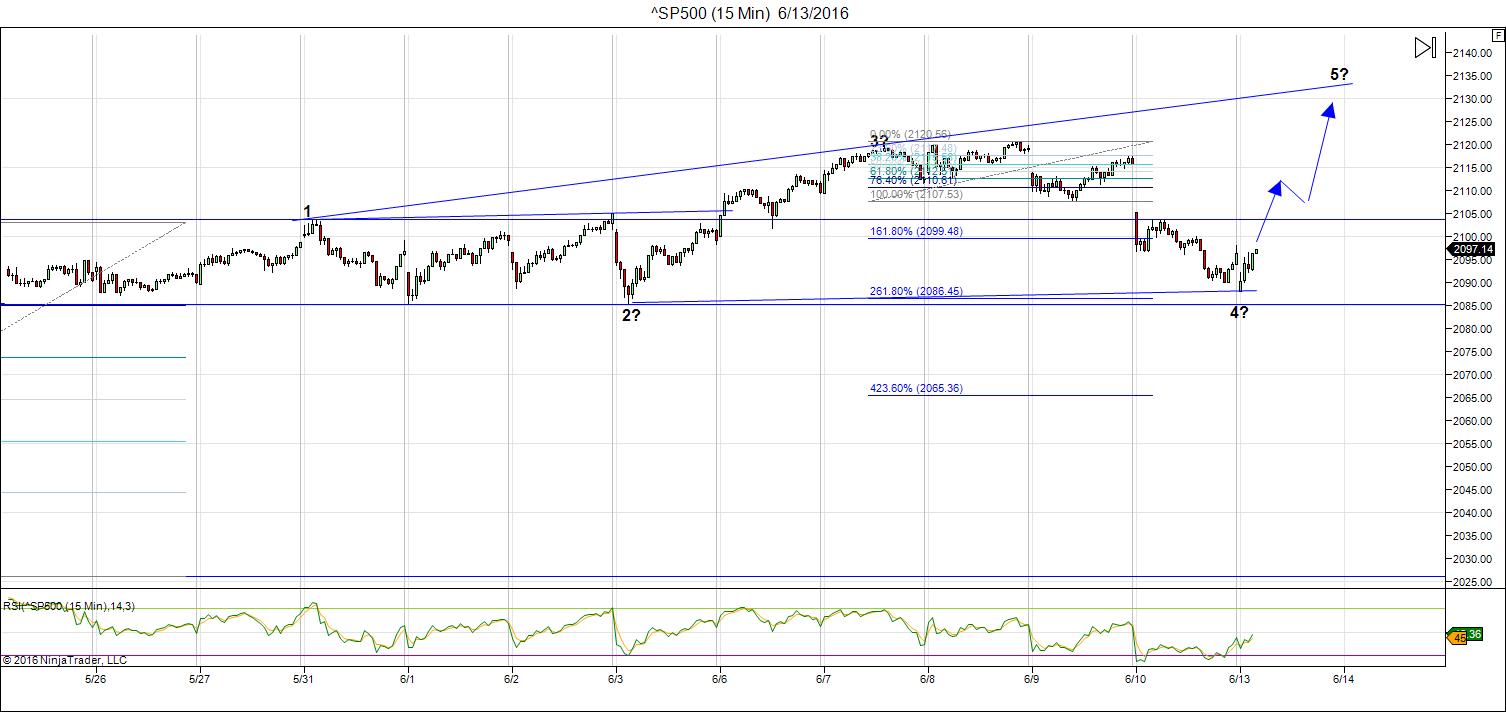

Above is a 15 minute chart of the SP500 at 10:30 AM EST, Monday, June 13. After watching the opening and see that neither the futures or SPX went to a new low, this puts the expanding version of the diagonal front and center. So I’ve drawn in the projected path. It’s not a lot different than the converging ending diagonal in terms of where it’s headed.

The outcome is the same, the look of the pattern is slightly different. The trendlines expand.

Above is the daily chart of NYSE (the largest cap index in the world) and the one we really need to pay attention to for the US market. It’s showing a very obvious 2nd wave pattern, with the most recent wave up being clearly corrective. We’re in the ending wave of the pattern and have reached the previous high at ~10648, as projected.

The next major move down is a very large 3rd wave. All we need to do now is finish up the final pattern (an ending diagonal expected here, too.

Above is a 4 hour chart of SPX. This has a similar look to the NYSE, although more elevated. I’m expecting to see a top to this second wave somewhere above 2116.

Above is the 15 minute chart of the SP500, showing a projected ending diagonal similar to ES. This isn’t much more to say about this chart, since is should more or less follow the path and timing of ES. I’ve added a projected path for an converging ending diagonal, which is what I believe is starting to trace out. It’s early yet, but I’ll update the chart as the week progresses.

I’ve added a fibonacci retracement tool, which gives a projection for the end of this wave down (2?) at ~2084. It should drop slightly below the previous two shorter waves down to this same level. I don’t expect the SPX to reach up to a new all time high. However, it may get very close.

Above is the 2 hour chart of USDCAD.

I cover off what’s happened recently with this currency in the video. In this chart, you can see us heading up to my projection of Friday last. The extension of the A wave of this fourth wave correction, puts the top of this move up at ~1.28407. Close to that point, we should turn down in a fifth wave to a double bottom at ~1.24579. After that, we’ll turn up in a very large fifth wave, which will eventually take up to a new high for USDCAD.

Here’s the daily hour chart of EURUSD showing the “4th wave” of the major corrective pattern we’ve been in since March, 2014. We’re in the final stages of a bearish triangle formation, with one more leg up after we finish this leg down.

The EURUSD, as well as other USD currency pairs, completely changed direction with the most recent labor report On Friday, June 3. As I explain in the video, we had a failed triangle the day before and this led to a “truncation,” or shortened pattern from what I was expecting. As a result, I shortened the width of the triangle. We’ll see if we follow through, based on this change.

In order to do so, we need to turn up from the point that we’re currently at (~1.12536), to complete the E wave of this pattern. If we continue down, then we will need to widen out the triangle. However, USDCAD seems to be supporting a turn up in EURUSD right about here.

There are two fibonacci measurements you can do to determine the c wave target (E Wave end point). They both give the number ~1.161 as the turn point for the E wave top.

EURUSD should turn down after finishing the E wave in tandem with the US equities.

Above is the hourly chart of the USDJPY, which I’ve been stalking for the past week or so. It’s finished one wave down (in five waves) for an A wave. I had originally expected a 62% retrace due to the original shape of the first three waves down. But again, the June 3 labor report changed that situation. It looks to me that the C wave tracing out now should drop to approximately 103.22130, before turning up in a large 5th wave.

Above is the daily chart of XGLD (gold). It continues to follow the path I laid out at the beginning of 2016. We should turn down here to complete a C wave, taking us close to 1136, before turning back up for a larger C wave to about 1600.

________________________

First Wave Down – What to Watch For

This weekend we’re dangerously close to a top of a second wave (in the fifth of the fifth, with an ending diagonal pattern).

What we’re looking for to confirm a turn is a motive wave down in 5 waves at small degree. After that, we should get a second wave that will retrace up in 3 waves about 62%. That’s the preferred EW entry point. So don’t feel you have to rush in. There’ll be a much better opportunity at the second wave level than at the top and the risk is substantially reduced.

__________________________

History: The 1929 crash

I think it’s important to look at 1929 and the wave structure (above and below), which was the same as 2007—to a point. I will show the 2007 crash below in the “What If” section.

The wave structure of the 1929 crash was in 3 waves overall. There were 5 waves down from the top (the A wave) and then a very large B wave retrace. The final C wave down was a stair-step affair and lasted over 2 years.

Let’s look a little close at the timing of the 1929 crash because the similarities to today are uncanny.

The market peaked on September 3, 1929 and then it took 2 months for the crash to actually happen (to reach the bottom of wave 5 of the A wave). The larger crash which we always hear about began on October 23, 1929. Then there was that large B wave, which lasted 5 and a half months and finally (which I explain a little further in the cycles section below), the C wave which went on for more than 2 years. This might be the scenario we’re looking at going forward.

Thanks Peter,

Excellent analysis.

Thanks I with you….!!!…nick

Thanks

Because we didn’t drop down to a new low this morning, I’ve added the alternate expanding ending diagonal to the post. It doesn’t change all that much at this point. The result will be the same and the path at this point is very similar. It’s the second chart down from the video—a new SPX chart.

Highest Vix since March 10th. I would imagine this spike and the 2085 support should be the short term low and springboard us to the top of wave 2.

Hi Peter – Just wanting to ask if there is anyway you could possibly concede that the wave 2 top has been put in? Even as a remote possibility? I greatly respect your Elliott Wave acumen. I am still holding out from going short and waiting for a better entrance, but getting nervous.

The preferred entrance re: EW is at the top of a second wave (62% retrace), so even if the count were wrong, you don’t want to enter here. You want to wait for 5 motive waves down (which we don’t have) and then 3 waves up in a second wave, and a turn down from that point.

Nothing has changed so far today in my count. I was expecting a new low in the major indices and we finally have it, although it’s taken all day to achieve it. Both versions of the ending diagonal carry equal weight now.

Peter, rut , nya, transport, spx all made high and also spx 2116 you were looking for,

Hi, I don’t understand your comment above that “The final high for the SP500 should be at or slightly above 2116.” The S&P already closed at 2119.12 on June 9th. Doesn’t that count?

It counts as a good first step. The pattern has to complete, as well. Then we need 5 waves down and three up to signal a trend change. Don’t have it yet.

And, of course, one index hitting a target does not make a top, as I’ve stated a few times. They all have to get there (and exhibit the above behaviour.)

this is so strange, vix is 20, and spx only 2085 don’t know what is going on

Three new charts up top.

The most important organ in the Body as far as the Stock Market is concerned is the guts the head ! Any one acquire the know how for analyzing stocks.

Peter Lynch

What is Mr Lynch saying. Before pulling the trigger on your next trade, check your gut. (solar Plexus) Do you feel calm and relaxed in your body? Go a head and pull the trigger. Or do you feel a ping in you gut? Does your solarplexes feel tight? Step a way from the computer. Yes it takes practice, but yet one can learn to profit handsomely in the markets.

All the best every one.

The most important organ in the Body as far as the Stock Market is concerned is the guts NOT the head ! Any one acquire the know how for analyzing stocks.

Peter Lynch

With all due respect, Dave, my 40+ years of market analysis and trading indicate just the opposite. The best trades and analysis have always come when your brain tells you to pull the trigger but your gut is scared as hell to do it.

Thank you for your reply Peter. When you say your gut is scared, I would say your emotions are scared. Their is a huge difference between feeling scared emotionally with the head vs the gut. Peter Lynch would beg to differ with you and he was one of the best stock pickers their were. The old CEO of General Electric Jack Welch would also agree with Peter Lynch. He often talked about,how an employee would present him with an out of the box idea for the company. He mentioned how his mind response was absolutely no to the idea at first. After further review of the idea, his gut would say go for it. In his books, he often mentions how he goes with his gut rather than his emotions ( head ) He truly was a visionary of his time. Peter, their is a very settle difference between the mind and the gut feeling. If the idea does not stick for you Peter, no problem. All the best to you.

Good summary Peter. Excellent analysis. Thank you.

Hi Valley – Love your comments and analysis. What are you seeing in addition to Peters update? I know you posted last week you were bearish for the next 2 weeks. Just wondering if you see a possible rally in here going into Fed day?

Hi Aaron1, I was long a single VXX call this morning and doubled my money, after commissions I made $80.00 when I sold it.

PALS is mixed this week with phase suggesting up trend beginning mid week, lunar distance negative all week, declination positive Monday to Wednesday, negative Thursday and Friday, tides reversing to rise mode on Thursday for ten days. So, as price is selling off and Brexit is next Thursday which has market concerned, I will wait to trade again until after Brexit.

I think we may get further selling this week, and then next week Brexit week may surprise to upside as people have sold the rumor, and may buy the news.

Peter, I believe selling will continue into and past Fed meeting reaching bottom Friday late in the day. Occasionally Fed meetings cause selling rather than buying. Then, next week into Brexit and beyond, a rally back to 2200. This is my best guess. Brexit may act as the hopeful event this month, and Fed meeting may not offer a reason to rally.

Valley,

I’ll go half-way with you on that. I have a turn date over the next couple of days and I think it’s a bottom (based on what we’re doing now). I’m looking to Brexit. We’ll see what happens.

Mr. Lynch…Does sentiment figure into your analysis? Just read this morning that investors are heavily invested in the “inverse SPX ETF”…In others words “short”. The chart which accompanied the article indicated we were at a level that should result in a rally. Perhaps that plays perfectly into your analysis! I would be very interested in any comment you might set forth!

Peter, 2200 spx calls are back everywhere

Should have typed “Mr. Temple”…Sorry!

Eddie,

In terms of being near an overall top, yes. For today’s call, it’s all about the pattern.

Is the ending diagonal still in play? Markets heading South fast and the projected turn date is the 15th. How will the market get to 2116 by tomorrow? That’s 2.4% higher.

Peter, pushing 2064 s and p, how far can this move drop and not disrupt anything. Thanks TAJ

TAJ,

It looks much better to me now than it did last night. If you recall, I’ve been looking for a larger correction for quite some time, and now we’ve got it. We’ve also got the DOW participating (YM particularly looks good), which we didn’t have last night. I’d be looking for a turn here. Euro and dollar look like they’re turning, although still in early stages.

The megaphone, which is the look of an expanding diagonal looks very good at the moment.

SnP broke significant support at 2078

significant technical damage, unless it regains support back over 2080

time will tell…..

http://invst.ly/1w2uw

I’m afraid I don’t see any technical damage, so you’d need to explain that to me. Dropping through an arbitrary trendline is not technical damage.

Got it, thanks TAJ

SP500 appears to be finding support at the 62% retrace level of the large wave up from May 19, which is fairly typical.

Peter, rut etc are not falling with this correction

My charts show RUT has fallen, more like a fourth wave than an ending diagonal.

Today is a little turn in the bradley till June 18 so maybe the big boys want to turn things up into Opex.?

Hi John – Is there a site that you follow for the Bradley turn dates?

http://time-price-research-astrofin.blogspot.nl/2015/11/geocentric-and-heliocentric-bradley.html

Succes.

I posted a revised SP500 chart at the top of the post.

thanks Peter, I know you were looking for 2116, so now it is higher than that may be 2130 or so

Peter – If we see SP500 back at 2016, you will “officially” be the Man! I have not seen anyone seriously calling for that. I sure hope you are right. At that point, you could have serious bragging rights as far as I am concerned.

I’m getting used to being alone, so that’s ok. 🙂

We still have to get there, though. Timing is never what I think it will be, however.

Peter

You are not alone … you are gradually coming closer to my target of 2134 … and if we get there … then we might ( we might ) get to my next target of 2160 :-))

AZ

Yeah, I haven’t forgotten about you or your number. I’ll buy 2134, but not 2160. That would mean everything would need to go to a new high. 🙂 I can’t see that.

Either way, we will be a lot older then, the way things are going …

K index dial has moved to 6 and solar storm in progress (solar ham.com). Geomagnetic disturbances seem to have a slight negative bias on stock market.

Remember the Fed Announcement at 2:15 EST. My concern is that we could likely see a lot of volatility and being a fairly equal (bulls vs bears) market and jittery, along with today being a major cycle turn date, it wouldn’t surprise me to see us drop back to where we started this leg up. It could also just form a B wave.

Don’t know … but be careful around that time today. Other than that, the direction remains up.

Peter,

SPX has just retraced 38% of the wave down.

So, we’ll see now if your alternative scenario may be played out.

Currencies are acting strangely, too, so that adds to my anxiety about this move up in indices being the “real one.”

Or (and I think you’re alluding to this), there’s the outside chance that this could be a fourth wave leading to a fifth wave down, but the wave lengths and structure don’t seem to support that scenario.

Peter ,

I think you are right , SPX need to go one more wave down before heads up toward the high.

I have 2045 – 2048 as strong support

AZ

No, it had better not go down there, or your high has no chance.

Anything below SPX 2064 puts us into a potential fifth wave and negates the ending diagonal.

Don’t forget, it’s an OPEX week.

There are options for 1 trillion dollars to roll over

SPX still fighting to get above ‘my arbitrary’ trend line (support line for presumed W2)

http://invst.ly/1wcab

The Fed announcement was a yawner. I would expect a correction here in SPX/ES and the like (a second wave of the A wave probably) and then a slow continuation up.

Currencies should do likewise.

I’ll post a futures chart later tonight or tomorrow morning once we see some movement. I would like to see ES drop to a double bottom at about 2064 before turning around and continuing back up. It doesn’t have to, but it would double confirm the large wave down from ~2120 as a “3.”

Currencies still have a bit of work to do before they turn and this supports a small move lower in ES.

Nothing has changed with my ending diagonal projection.

Thanks Peter and all! 6/15 6 pm pt

🙂

I posted a new chart of ES at 11:15 PM Eastern time.

Thanks peter

Dave

Id have to say i agree with you .

before making a trade i go with my gut but i also check my emotions .

i tend to over analyze and dig into the internals of the market .

then everything lines up the market is typically at an extreme .

In which case my emotions are on the nervous side my gut says

the turn is here or close by and my gut says its time to look for a trend change.

like you said , after further review they ( lynch or ) tended to go with it .

What ive learned though is to check me ego out the door and accept that the

market will trend up or down but the internals of the market will trend in a range.

watching the internals is the most important thing to do .

the 17000-16890 range in the dow is the key support that im watching into

the end of June .

updating data this morning so no opinion as of yet .

Joe

Thanks Joe,

Until now you made very precies calls I m curious how this one will play out.

What helps me a lot is to sit down and do a 20 minute meditation when possible in the forrest while listening to the birds after that my mind is much more clear from disturbing emotions.

I think brexit will no happen but it is a close call.

Good luck to all.

In your opinion…Have we gone to far below 2064 to keep the ending diagonal on the table? If we need more time to know that answer that is fine. I am a neophyte on my understanding of EW…Thank you!

No. We just travelled along the trendline.

The futures roll-over changed the target by ten points, so it only exceeded my target by 3 points.

Eddie,

If we break through the lower trendline, then something else is happening. I posted the latest ES chart. Same thing with EURUSD. If it breaks the triangle, it will change everything. Yesterday/today is a major cycles turn date, so I expect we should turn here or shortly thereafter.

The cash dow 144 day 2 % trading band :

resistance 17808

Mid point 17364 ( turning down )

support 16908

Indicators: short and medium term ( Overbought and Bearish )

Very Long Term ( 2 – 3 years data , Oversold yet not at an extreme, BULLISH )

Longer Term 5 plus years , Topping

Bottom Line : This Market had its momentum peak back in 2014 The price high

in 2015 still counts best as a B wave of sorts .

The 16890 Price level on the dow Remains Key support at this Juncture .

Breaking below that level and accelerating down would make the case

that a long term Bear market has begun .

Breaking below 16890 and then turning back up and going above 17202

would imply it was all noise and the bull market would re establish itself .

The LOW due January 20th 2017 may become a higher low from what ever

low is produced later this year ( im not finished with my work )

Jan 20 and march 2017 are cycle lows of different degrees .

From a wave perspective best guess today ?

This is a very tough call to make for me .

wave 3 Peaked in July 2014 ( im including indicators which show a momentum high )

a running sideways triangle began at that juncture .

Wave A B C ( labeled ( A ) ) Ended in august 2015

Wave ( B ) has ended ( april 2016 )

We are now beginning wave ( C )

There are many problems with a call for this to be a continuation of a triangle formation .

This problem stems from the fact that the low in Feb 2016 was a closing low

as well as the fact that the print low in Feb 2016 was very close to the low in

Jan 2016 . Triangle formations as i understand them are very simple yet must

form in a specific pattern. Each B wave must overlap , this fact alone would

imply the Feb 2016 print low on the dow must be broken and yet the jan 20 low

on the dow must hold . ( spx a different story )

If this was to happen the dow will Not have the ” Right Look ” and therefore while

the technical back drop of a Triangle would be considered correct i have to now

consider a wave C down which will break the Jan And Feb 2016 Lows .

Its not what i would like to see given my longer term bullish cycles from Jan 2017

to Jan 2018 .

What now must be considered ( breaking Below 16890 and failing to break back above 17202 )

The potential is you are correct peter , If so we are in the early stages of Wave 1

down which would bottom in Jan 20 2017 then make a high low in march 2017

and wave 2 would be complete in Jan 2018 . I don’t like that idea but it is now something i must begin to consider .

More work to be done on my longer term charts .

( The Above all Based on Daily chart data only )

Joe

SPX is now around 2052 … not far away from my target of 2045 – 2048 .

I fell price will stop around that level and start moving up.

Now my count comes into question, which may bring in the alternate I mentioned on the weekend. However, we don’t have 5 waves down at the moment. We would have to drop further, as this last wave is not complete. If we drop to 2030 SPX, then we will arguably have a first wave down. We will then have to retrace 62% in a second wave to confirm it (to about 2086 SPX).

Peter

If SPX drop to 2030 , and we have 5 waves down , then does this means the TOP was in on 8th June according to your count ?

AZ

I would love for this to be a first wave down in the indices, but I’m having a problem accounting for the subwaves. It doesn’t fit a motive wave structure so far. Neither futures nor cash are helping that situation. I can’t get a clean motive count. So we’re going to have to let this play out to see if we’ve actually changed trend. The DOW in particular would have to be logged as a truncation if we have.

From my point of view nothing has changed yet , and SPX should still be going up to at least 2134 .

I agree, but the count is the question for me. And you were right about the drop—good call.

We’re perhaps working on a triangle. I’m in and out today, so will have to get a better look tonight.

A quick look around the indices suggests we’re in a regular triangle and not an ending diagonal. Same results. I’ll get a better look tonight. If it is, it will signal the end of the larger wave up is close at hand. However, it will draw out the ending of this saga quite a big longer.

BIG PICTURE

1940-1930 key support on cash spx .

How it gets there i have no idea

its just a key level.

looking at a chart of all the index’s added together

the market as a whole failed to get above its nov 2015 highs

( Dow + Tran + NYA + SPX + oex + ndx + sox ) =

the monthly chart can be considered a wave 1 upwards but

its way to early to call for that . we touched the 10 month moving

average this morning . a break down looks eminent

april high a lower low in may and a higher low reversal down in june

this looks to be implying.

the april and June highs will be key levels going forward

if the monthly chart proves correct a wave 2 scenario is playing out

which probably means the spx makes a higher low then the feb lows

maybe the NYA holds up . The dow though remains a concern as

mentioned earlier .

No Matter what , June 13 was a key day and the market turned down .

the next high is due august 1-3rd and everything cycle wise points lower

from that date .

Bottom line : this may turn out ugly but we are only into the beginning point

Im done for the week

Joe

correction

april high , lower low lower high in may and a higher high in june below the april high and a reversal down in june

Hi Peter, what are your thoughts on classical support vs resistance levels in traditional technical trading versus elliot wave patterns?

I don’t understand the question. They both work together.

You just made me laugh Peet… Laugh of the day! 🙂

I like your ‘I don’t understand the question response’. >< You are smart enough to understand what we rookies mean to ask you, but still you say that shitty line of yours, whaha, HERO. 🙂

Cheers to you my friend,

W

Sorry for the confusion, but not for giving Whazzup a laugh of the day. After all, laughter is good medicine for the soul, even at my expense. What I meant to say is that historically, technical analysis uses pure history of data which could be days, weeks, or months to draw their support or resistance. With EW or the graphs you have, you do incorporate it as well but using fibonnaci numbers. That was the part that was throwing me. I’m new to your website and EW so I aware, my questions are likely dumb or watered down. Thanks

Jemba,

Cheers to you as well and many thanks! 😉

All I can tell you that Fibonacci = EW and EW = Fibonacci… The standard support and resistance that you find in the charts, are often at Fibonacci levels. So what is their worth? I think you have to thank Fibonacci because that is giving the support and resistance! 😉

Greetings,

W

Maybe this helps. Seriously, I didn’t know how to answer the question as it really wasn’t specific enough. Fibonacci levels run all through the market. They’re the primary levels in EW that influence where waves start and stop. Traditional resistance and support levels often coincide with them.

Jemba,

I saw this after I answered Whazzup. Since fibonacci levels determine wave lengths, they often become support and resistance, so you can think of it as a way to relate they levels to each other, as they often coincide (are the same thing).

Thanks guys. This helps.

Sorry to people that might feel offended by the following: in other words Jemba: people that love TA (hey there must be support/resistance because we have been there before and we do touch this diagonal line blablabla), have not looked far enough to see that nature rules everything and not TA which is arbitrary. Sometimes it works, and sometimes it doenst, but nature WORKS ALWAYS or let’s say IS ALWAYS AT WORK! 😉

You should watch some short movies that Peter made, AWESOME STUFF about nature! 🙂 Best teacher you can have/find in this area and a brilliant and nice guy, therefore I call him friend!

Cheers,

W

Peter,

this wave up in SPX from 2050 looks motive enough ?

Yes. I missed the turn this morning, so I’m waiting to see a retrace, but yes, a motive looking wave up.

The wave down is clearly corrective.

There’s a lot I don’t like about this wave up, though. I don’t like the fact that we have a spike bottom. The wave lengths are also not correct. We’ve done 5 waves up in futures but we haven’t stopped at a meaningful level. We’ve retraced 62% from the previous 4th wave, which in my mind suggests we’re going back down. And we’ve lost all momentum. We’ll have to see what happens here.

Looking much better. I’d like to see ES get to 2080 and then do a 3 wave retrace 62%.

All the waves up in futures look corrective to me. The first wave up in YM and NQ is a 3.

Ok, Peter,

you have got your 2080 in ES and the retrace after.

Dimitri,

In ES, I show we’ve only hit 2075. This retrace is shallow and looks like a fourth wave (or b wave). If I measure the wave, it should be a 4th wave, with a larger retrace at 2090 (I’m not sure which spike is the previous 4th, but the measurement seems to indicate the one at 2090.

First waves typically turn at the previous 4th and we’re not there yet, either in ES or currencies, which are all moving together. The turn in CAD will be 1.283 and then we’ll get a second wave, so at the moment, that’s my indicator for a turn.

I’ll put up an ES chart shortly.

USDCAD is tracing out a lovely first wave down (which has been “spot on” in terms of measurements).

ES seems to be tracing out 5 waves, but not motive. The 4th, if that’s what it is, is overly large.

NQ has dropped down quite far, while ES is still in a shallow retrace. It’s odd to see them out of sync like this.

ES has now traced out 5 waves down (a wave), so I expect there’ll be a b and c wave down to follow.

Sorry, I meant SP500 has traced out 5 waves down in what might be an A wave.

In SPX, the wave up could also be an abc wave up, which is really what it looks like to me and could retrace back down to the start. Based on what currencies are doing, I would be concerned about that being the higher probability. Currencies look like they’ll retrace here at least a second wave.

ES has retraced 62% of the whole wave up from yesterday low

If it drops below that, then it’ll likely drop to a double bottom. That’s where NQ is and we still have a lot of correction to go in currencies.

USDCAD is taking off nicely in its correction and ES hasn’t moved, so my opinion is changing. For what it’s worth, I think it will turn at 62%. NQ however, went to the previous low.

I just posted a revision to the ending diagonal pattern from earlier today, changing it from the expanding version to a converging pattern, based on today’s action.

Peet!

Cool stuff, thanks man! How do you see the AEX? Because we went lower with the downmove now than we did @ April 5 (April 7 for US markets).

Cheers,

W

I think we talked about this wave down in AEX. It’s in a flag at the moment, so it should head up shortly, I think.

Right now everything is extremely difficult to predict. I’ve never seen a market like this. It sits for an hour and then shoots up or down and then sits again. VIX is all over the place. Currencies are almost impossible to trade. The best thing is to wait until we top. It’s got a volume issue.

I posted charts of SPX and USDCAD

Made a bit buying VXX puts yesterday and selling today. Bought 2 AAPL calls 96, expire 6/24, cost $1.17. Counting on market rallying next week into Brexit.

Hey Valley why don’t you buy some tulip (aex) calls they will jump next week (lol).

Good weekend to all.

We’re certainly into summer doldrums. While the US indices are slower than molasses, there are opportunities in currencies (especially EUR and CAD).

I expect ES and SPX to drop to a double bottom here (2040 ES). The wave up was a 3, so it should retrace. We’re also not half-way through the correction in EURUSD (and other US currency pairs) and they should be affected by it.

Oil has dropped but looks to be in 3 waves, so should retrace. Gold still hasn’t corrected properly. It looks like XGLD has completed an expanded ending diagonal. I see so many waves ends with three spikes in them.

I’ll put together a video probably Saturday evening. I’ll be out of town next week so not available during the day, but will comment in the evenings.

After bottoming here, I’m expecting US indices to head up in an ending diagonal. I don’t have an end date in mind.

New post live: https://worldcyclesinstitute.com/summer-sideways/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.