In the year 1900, author Frank Baum wrote “The Wonderful Wizard of Oz,” which many believe is an analogy to our monetary system. It shouldn’t surprise you if you think about some of the elements: silver shoes and a yellow brick road (gold) leading to Oz (short for ounce, which is how gold is priced), where an all powerful leader (the President) rules in a land of illusion (ring a bell?). There’s the Wicked Witch of the East (Wall St.) and on and on. You can read about the background here, but make sure you read through the section entitled “Allusions to 19th-century America,” about half-way down the page.

As Ellen Brown writes in her book, Web of Debt

In the 1890s, politicians were still hotly debating who should create the nation’s money and what it should consist of. Should it be created by the government, with full accountability to the people? Or should it be created by private banks behind closed doors, for the banks’ own private ends?

For centuries, there’s been this ongoing discussion about how a country’s monetary system should operate. We know better than to adopt the current one, but we continually get duped by “banksters” and end up with a system that eventually divides the rich from the poor and allows a very small segment of society to take advantage of all the rest. This happens over and over again throughout history. This time, though, is the all-time “topper.” It’s going to take a long time to recover from the devastation that banksters and their enabling political partners have wreaked upon us—a long time indeed.

Central banks (in this case, the European private bank cartel) have attempted to control the world economy, effectively controlling the G7 countries. These central banks have gradually gained the upper hand by persuading each of these countries to borrow their currency requirements from these private banks rather than creating their own money, in order to “create greater international financial stability.”

However, these private banks create money just as a nation’s public bank would—out of thin air. They actually create debt—a simple entry on a spreadsheet (or more likely today, the press of a computer key). The cost to these sovereign nations is almost unspeakable. They are now all beholden to the Bank of International Settlements (in the case of the US, the Federal Reserve) as they all now own these private banks more money than they can ever pay back.

In 1694, the Bank of England (in its original charter) created the model for today’s private banking “money tree.” A circular in its stock offering stated, “The Bank hath benefit of interest on all money which it, the Bank, creates out of nothing.” This was interest charged to the government. Naturally, England’s national debt skyrocketed from $1.2 million pounds to 16 million pounds within just the next four years, due primarily to compound interest.

This is the same model that the Federal Reserve operates on today. They key in these contracts is that the principal is never paid back; the interest ends up being a constant stream back to the bank, paid for by taxpayers.

What you see happening now, particularly with Greece, is that this banking cartel is now acquiring sovereign assets. Greece is being forced to sell what it can to pay off this many tentacled financial octopus. This is the ultimate plan of the banking elite.

Here’s a summary of amounts owed by the G7 countries as of September, 2016 (data from the world debt clock).

| G7 Country | $Trillions Owed |

|---|---|

| Canada | 0.818 |

| France | 2.314 |

| Germany | 2.373 |

| United Kingdom | 2.323 |

| Italy | 2.459 |

| Japan | 8.989 |

| United States | 19.394 |

| Total | 38.668 |

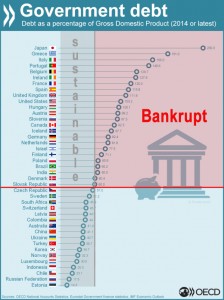

On the left is a clickable chart showing the countries in the world that are considered bankrupt. Owing over 60% of GDP puts you in the bankruptcy category.

Where “Currency” Comes From

Currency was invented as a medium of exchange—that’s its purpose. Because without it, you can have no commerce; you are forced into a barter system. In a barter system, how do you buy a car? You would have to come up with some other asset of equal worth, or a basket of assets of lessor value adding up to the price of the house. Currency should also belong to the people; it’s how a society creates markets and raises its standard of living. It’s only when governments and private banks become involved that the currency system gets destroyed.

Throughout history, we’ve seen a similar cycle play out again and again. But let’s look at a couple of recent examples so that we can understand what the ultimate, most fair system would be.

The American Colonies

We’ll start in the United States, well before confederation, in the year 1691.

Massachusetts decided to create its own paper money, because the colonists were short of silver and gold. They had to use foreign coins to conduct trade, and since they imported more than they exported, the coins were continually being trained off to England and other countries, leaving colonists without enough money for their own internal needs. The new printed currency proved so successful that other colonies eventually followed suit.

Paper money did more than make the colonies independent of the British bankers and their gold. It actually allowed the colonists to finance their local governments without taxing the people. The currency was secured not by gold or silver, but by the full faith and credit of the country as a whole.

How it worked was that a government loan office would issue paper money and lend it to residents (usually farmers) at low rates of interest. New money issued to borrowers came back to the loan office on a regular payment schedule, preventing the money supply from over inflating. The interest that was paid on the loans went into the public coffers, funding the government. In that way there was no need to tax the people, because the government received all the money it needed to function from the interest on the loans. One of the most successful loan offices was in Pennsylvania. The Pennsylvania plan showed that it was quite possible for the government to issue new money in place of taxes without inflating prices.

The Bank of North Dakota

This is how a public bank operates. There is one public bank in the United States: The Bank of North Dakota. During the “Great Recession” of 2008, it did really well:

“The state of North Dakota does not have any funding issues at all. We in fact are dealing with the largest surplus we’ve ever had.” Eric Hardemeyer, president of the Bank of North Dakota (March 2009)

The Bank of Canada

In Canada, we have a Public Bank, The Bank of Canada. From 1934 through 1974 we used a similar system to pay for WWII, the St. Lawrence Seaway, The Trans Canada Highway, the Canadian National Railway, and fund the Canadian Health System. In 1974, Prime Minister Pierre Elliott Trudeau decided to reduce the central bank to a shell and contract with European banks to secure our currency at interest. Our debt mushroomed, of course, and 80% of it is interest—currently owed to European private bankers. You’ll find the Bank of Canada story described in my video, “Take Bank Our Money, Canada!”

The US Saga Continues

President Abraham Lincoln lost his life in the pursuit of a fair and equitable monetary system. He had the government issue money during the civil war, but when he was assassinated, the bankers once again reclaimed control.

William Jennings Bryan was the Populist candidate for President in 1896 and again in 1900. He was represented by the cowardly lion in The Wonderful Wizard of Oz. His challenge was to the Morgan/Rockefeller banking cartel (The Wicked Witch of the East), which was bent on taking away the power of creating money from the people and the government.

It all culminated in the passage of the Federal Reserve act in 1913, something they achieved by misleading Bryan and other unwary Congressmen into thinking the Federal Reserve was actual “federal”—part of the government, rather than a group of twelve private banks.

What’s resulted is a system in which the Federal Reserve, like the European cartel of private banks that lends to Canada, creates money out of thin air and loans it to the United States government at interest. This obviously is a function that the government can take on itself (creating money out of thin air). All it has to do is create a public bank. In the case of the United States, this would require a change in the constitution. In Canada’s case, we just have to decide to do it.

Inflation VS. Deflation

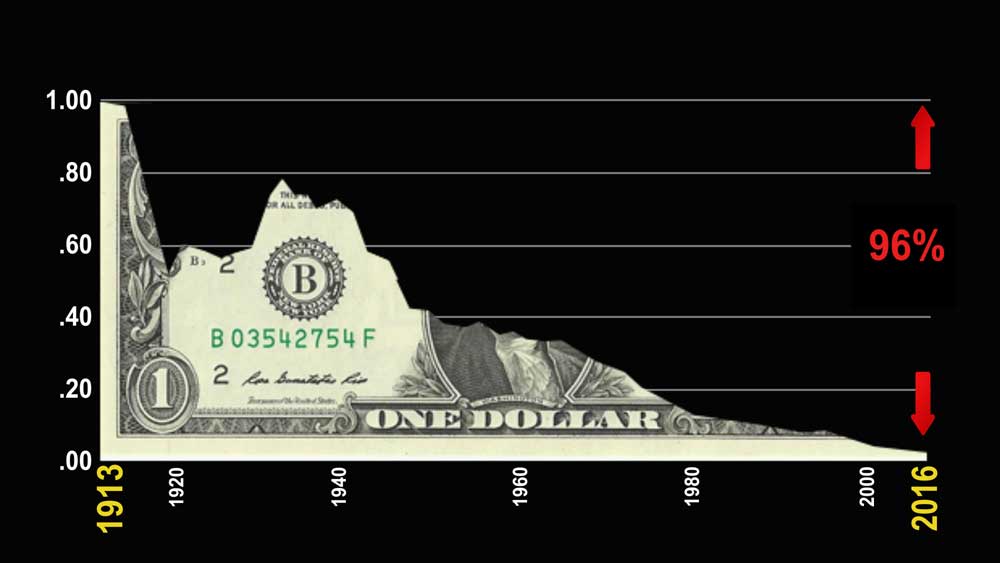

What inflation does is devalue our money. For example, since 1913, the dollar has lost 96% of its value. So, in fact, a 1913 one dollar bill is worth four cents today.

That’s why everything seems to continually get more expensive.Our money is relatively worthless. It takes more dollars every year to buy that new car, for example. Car prices continue to increase, but it’s actually our money that’s becoming worth less.

Likewise, as inflation eats away at the value of the dollar, prices for products and services rise. However, our salaries don’t rise nearly as much (if at all). Our standard of living decreases, as a result. When we attempt to keep the same standard of living, we sink into debt.

Business gets hit in a similar fashion. Costs for raw materials continue to rise. But if companies raise prices too much, they lose business. So they work on finding less expensive ways to make the same items, or cut back on quality.

While prices go up and quality goes down, your salary virtually stays the same. So you end up going further and further into debt to maintain your lifestyle.

The bottom line is that inflation destroys our economy. It makes us poorer.

So why do governments create inflation? Because they get hooked on it.

The cause is external debt—the debt created by central private banks. Because inflation causes the value of currency to decrease, governments find it much easier to repay debt. They repay it in tomorrow’s inflated dollars, which are actually worth less.

Plus, when prices go up, the GDP goes up. That’s Gross Domestic Product. That’s like the government’s salary and assets—their net worth. A higher GDP allows them to borrow more money and go further into debt. It’s a revolving, deepening cycle, which eventually meets a very bad end.

The underlying problem comes back to private banks and compounding interest. If a country’s banking system was a public banking system, there would be no interest, as it would revert back to the government, and would pay a large portion of government expenses. As a result, taxes would be lower. The government would only have to inflate as the population grows, or industry expands, and we wouldn’t have these incessant bubbles and crashes.

Tying Currency to Gold Doesn’t Work

Many believe that the answer to all our currency problems is to dismantle the current fiat system and lock the dollar to gold. This, they say, would stop runaway inflation. But inflating (creating money), is needed in moderation as the economy expands. If the dollar is tied to gold at a regulated rate, inflating is impossible. There is only so much gold available and so the economy can neither expand or contract. If the need to currency expands, the economy becomes stifled and moves into recession. People horde gold and there is less of it available in circulation. This was why Nixon uncoupled gold from the US dollar in 1971.

The issue is debt owed to private banks, along with compounding interest, which exacerbates the problem.

Until we free ourselves from the international banksters, we’ll revisit poverty each time these cycles peak. We’ll experience another revolution as our ancestors have so many times before.

As Albert Eistein is commonly thought to have said (even though he swore he did not):

“The definition on insanity is doing the same thing over and over again and expecting different results.”

We must break the cycle.

| “Once a nation parts with control of its currency and credit, it matters not who makes that nation’s laws. Usury, once in control, will wreck any nation.” |

| William Lyon Mackenzie King, Prime Minister of Canada, 1935 |

| “Let me issue and control a nation’s money, and I care not who writes its laws.” |

| Mayer Amschel Rothschild, International Banker, 1790 |

How Currency is Actually Created

In 1994 (most recent version), the Federal Reserve Bank of Chicago published “Modern Money Mechanics,” an explanation of how money is created and injected into the financial system. It’s a damning exposé of the fiat money system and how banks gradually bleed the economy to death through compounded interest. You can download the PDF here.

Natural cycles vs. Man-Made Cycles

Here we are at the top of a man-made bubble—the largest one in history. But what’s really interesting is that these man-made bubbles run in parallel with natural cycles. The climate is changing from hot to cold. At the same time, social mood is turning negative. People around the world are angry. We see mass migrations, authoritarianism, weak leaders, society breaking down, and on an on. These are the same themes that are prominent every 172 years, and to a larger extent, every 500 years.

No matter what country you live in, you will likely recognize some of the subthemes in The Wonderful Wizard of Oz. We live in a world of illusion, where governments and banksters do all they can to keep the truth from us. The herd is still under their spell, but not for very much longer …

More on these cycles in future …

_________________________

The Market this Weekend

There isn’t all that much new in the markets. I’ve been predicting the continuation of the fourth wave of the ending diagonal for several weeks now. I’m still looking for a new low.

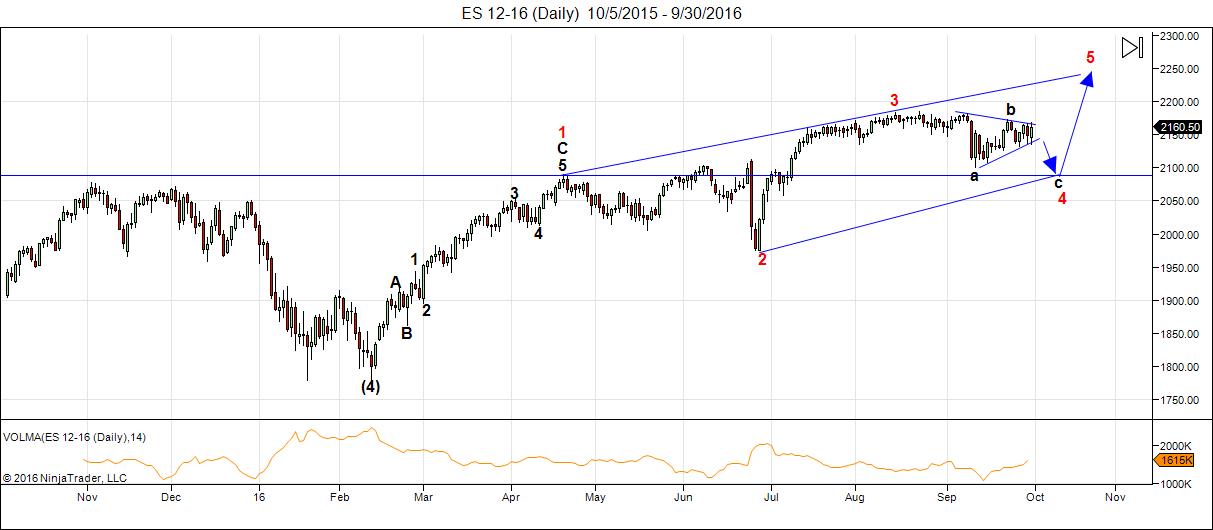

Above is the daily chart of ES (emini SPX futures). We’ve been in this fourth wave of the ending diagonal for about 2 months less a week. The second wave took 2 months plus a week, so the fourth wave should be nearing an end.

Usually the second and fourth waves in motive waves will be of similar magnitude (the fourth wave a bit longer) but in an ending diagonal, the waves get smaller as they move towards the termination, which is a fifth wave up to a new high, with a “throw-over” above the upper trendline.

Ending diagonals are triangle but they’re also motive waves. In fact, they’re the only triangle fitting under the banner of motive waves (as opposed to corrective waves). Ending diagonal are always the ending wave of the pattern.

I expect a gradual drop to below the 2100 area before a turn up in the final wave of the pattern.

Summary: This is the final fourth wave dip before the “blow-off” fifth wave and the top of the largest bubble in history. I expect a little more downside before we turn up again to head for a new all time high.

___________________________

Introducing: The Chart Show

Thursday, October 6.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis for the US market, gold, silver, oil, and major USD currency pairs.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

andre,

marko rodin – the genius who created his own branch of mathematics [vortex mathematics] – deconstructed the fibonnaci sequences to show that in fact it represents “an electric circuit”. His mathematics recognizes the numbers “themselves” as the ‘building material – the ‘lattice structure’ and underpinning geometry of the universe.

And so your vibrations are “bang on” !

The job report missed expectations. Last weekend I predicted this. This is how vibrations work; the only trick is to find them. I found some new techniques that I will share this weekend.

And thanks for all the praise although it is not needed. When people appreciate what I write I am happy.

Dear Andre,

I look forward to reading your weekend report ! Thanks.

Andre, are we still expecting down until the 14th?

Well, that would certainly be odd. Because I’ve been predicting a leg down to about ES 2100 since August 27, been posting a chart to that effect every week, and even posted a video on it. André told me I was wrong on September 25.

However, my prediction has not wavered in all that time.

What, am I suddenly right again? 🙂

https://worldcyclesinstitute.com/the-next-prophet/#comment-11758

“Just for the sake of argument I would like to present an alternative scenario. This is just what comes from my own analysis and is in no way meant to challenge the analysis above.”

I sit back … amused. A lot of back and forth to get to the same place …

peter,

ahhh – no respect – no respect…..I tell ya I get no respect from anyone. I bought a cemetary plot. This guy said, “There goes the neighborhood!” …..I tell ya when I fly, I don’t get no respect. I took one of those cheap flights, no frills. I finished eatin’ and had to do the dishes. And I tell ya I got no confidence in the pilot. When he makes a left turn he puts his hand out. :-]]

Peter, I have been in the lower camp too.. I am actually seeing a possible bigger drop than what you are looking for.. All the sideways movement for so long says to me that the big money is trying to exit the market but the lack of volume and interest to buy stocks from the heard is taking longer than expect for them to exit the market. It looks like 1 big rounded top to me.

One poster had mentioned “The new secular bull market is nearly upon us”

This is very confusing to me because trend-lines are one of the basics we learn when we first start trading. The other thing we learn is to look at the larger time-frames first.

On the monthly chart connecting the 2007 High to the Nov 2014 high monthly candle we can clearly see that trend-line has been repeatably tested and proven to be the rejection point. Then if we take the March 2009 low and connect it to the Aug. 2011 low and bring it up, there is no mistaken we are in a raising wedge. Raising wedges are terminal structures. When that bottom trend-line is breached and closed below then pops up to test the underneath and fails its lights out. The measured move or target is the bottom to a little past the bottom of the triangle so below SPX 666.

It will be a 3 way move down. Larger picture 1929 Crash was the EW(2) crash then March 2000 to March 2009 was a EW(4) A,B,C and now when we finish the 5 what comes next? A,B,C correction – and its target? In the zone of where EW(4) finished.

Hopefully folks took your advise and started to stock pile food and water. Its going to get nasty and going to be the worse drop in history..

Yeah, but we’re not done yet. We have to get to a new high. Three waves down retraces.

Plus, it’s a contracting triangle, which always, always, always (in a fourth wave position) signals one more wave before a reversal.

jody,

i see what you see.

here is yet another possibility for the $indu http://invst.ly/2j5-w

Peter, I totally understand but what I am struggling with as I agree with you is the fact that the Dow does have a 5 wave structure up from Jan 2016 lows. Brexit appears to be the end of EW(4).

If we take the 2-11-16 SPX low and connect it to the Brexit low and bring it up to the 9-12-16 low we can see clear support. If we do move lower we will have breached that support and in fact we are doing that right now as we speak. I trade what I see – not what I know – and I know we are suppose to pop back up but I see something different.. So I will anticipate a final leg up to new highs but will wait until it shows the reversal until then I will remain bearish.

I appreciate your insight and knowledge.. Thanks again for all that you do!

Well, that may be true. However, in the DOW’s case, the wave structure low is on August 24, a 3 wave move up. So the wave structure up in the DOW couldn’t be more obvious—it’s in 3 waves. You can’t start a motive wave segment in the middle of a wave structure and simply disregard the first wave. So that’s where you have to start your count … at August 24, 2015.

That doesn’t have a lot to do with the ending diagonal, other than the fact that you can’t have an ending wave up in 3 unless it’s a triangle of some sort, and the only triangle in a fifth wave scenario is an ending diagonal.

Them’s just the EW rules, like ’em or not.

Today’s lows are now the key level .

The triangle thrust to the upside will be confirmed

on a break above today’s high at 18319.73 on the cash Dow.

Monday should be interesting as well as the entire week.

Joe

Today’s lows are considered the fake out .

note the labeling on the chart .

i am using numbers to keep it simple .

yet we saw the same fake out back in September .

bottom line today’s lows are now key there is no

more allowances .

Next week would therefor be bullish if this is to be

correct .

http://imgur.com/12o1ajh

5 waves down and 3 waves up so far and the wave up is to 62%. That’s enough for me today, back to my writing … 🙂

Oh … and it’s a bearish triangle.

Joe, The 5 min chart reads todays low does not hold…

The 5 down 3 up is what I am seeing as well.. that tells me there is more downside to come and we take out today’s low on Monday..

we will know soon enough .

my point is today’s lows must hold if we are going to see a bullish outcome.

a break above today’s highs next week implies ( to me ) a continuation

( thrust ) upwards .

once the thrusts completes ? ill be back to looking for more downside .

until we see next weeks action its to soon to say we break or not

either up or down .

i have become more and more short term focused with my trading

yet longer term focused in terms of the trend .

i bailed a bit early today with upside trades .

i don’t expect today’s highs to be broken today and i do expect

a fade down into the close .

The chart i posted though dove tails with what i posted yesterday .

The market so far has done what i expected and until i m proven

wrong by the market i expect today’s lows to hold and i m expecting

today’s highs to be broken .

The market will prove me right or wrong .

i dont see 5 waves down today

i see an A triangle B followed by a 3 wave decline in wave C.

end of qtr plus 20 days is Oct 20th , my turn date is oct 24

andre has oct 23-24th for a swing high .

we both may not agree on the finer details yet both of us

see a low next year .

my dates are jan 20th the low yet a higher low in march

andre is calling for the low in march .

overall i agree with his work .

its only the details of it all that i see differently .

Next will will tell the tail .

Enjoy your weekend 🙂

hanging out with kids this weekend and

ill be back late Sunday .

computer being shut down until then

Joe

Thanks Joe..

FYI.. A H&S formed on the 5 min chart with a strong break of the neckline at the end of the day..

Prediction – Trump kills it Sunday night and the market tanks Monday 😀

Have a great weekend!

New post live: https://worldcyclesinstitute.com/deflation-throughout-history/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.