In the year 1900, author Frank Baum wrote “The Wonderful Wizard of Oz,” which many believe is an analogy to our monetary system. It shouldn’t surprise you if you think about some of the elements: silver shoes and a yellow brick road (gold) leading to Oz (short for ounce, which is how gold is priced), where an all powerful leader (the President) rules in a land of illusion (ring a bell?). There’s the Wicked Witch of the East (Wall St.) and on and on. You can read about the background here, but make sure you read through the section entitled “Allusions to 19th-century America,” about half-way down the page.

As Ellen Brown writes in her book, Web of Debt

In the 1890s, politicians were still hotly debating who should create the nation’s money and what it should consist of. Should it be created by the government, with full accountability to the people? Or should it be created by private banks behind closed doors, for the banks’ own private ends?

For centuries, there’s been this ongoing discussion about how a country’s monetary system should operate. We know better than to adopt the current one, but we continually get duped by “banksters” and end up with a system that eventually divides the rich from the poor and allows a very small segment of society to take advantage of all the rest. This happens over and over again throughout history. This time, though, is the all-time “topper.” It’s going to take a long time to recover from the devastation that banksters and their enabling political partners have wreaked upon us—a long time indeed.

Central banks (in this case, the European private bank cartel) have attempted to control the world economy, effectively controlling the G7 countries. These central banks have gradually gained the upper hand by persuading each of these countries to borrow their currency requirements from these private banks rather than creating their own money, in order to “create greater international financial stability.”

However, these private banks create money just as a nation’s public bank would—out of thin air. They actually create debt—a simple entry on a spreadsheet (or more likely today, the press of a computer key). The cost to these sovereign nations is almost unspeakable. They are now all beholden to the Bank of International Settlements (in the case of the US, the Federal Reserve) as they all now own these private banks more money than they can ever pay back.

In 1694, the Bank of England (in its original charter) created the model for today’s private banking “money tree.” A circular in its stock offering stated, “The Bank hath benefit of interest on all money which it, the Bank, creates out of nothing.” This was interest charged to the government. Naturally, England’s national debt skyrocketed from $1.2 million pounds to 16 million pounds within just the next four years, due primarily to compound interest.

This is the same model that the Federal Reserve operates on today. They key in these contracts is that the principal is never paid back; the interest ends up being a constant stream back to the bank, paid for by taxpayers.

What you see happening now, particularly with Greece, is that this banking cartel is now acquiring sovereign assets. Greece is being forced to sell what it can to pay off this many tentacled financial octopus. This is the ultimate plan of the banking elite.

Here’s a summary of amounts owed by the G7 countries as of September, 2016 (data from the world debt clock).

| G7 Country | $Trillions Owed |

|---|---|

| Canada | 0.818 |

| France | 2.314 |

| Germany | 2.373 |

| United Kingdom | 2.323 |

| Italy | 2.459 |

| Japan | 8.989 |

| United States | 19.394 |

| Total | 38.668 |

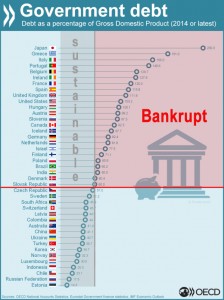

On the left is a clickable chart showing the countries in the world that are considered bankrupt. Owing over 60% of GDP puts you in the bankruptcy category.

Where “Currency” Comes From

Currency was invented as a medium of exchange—that’s its purpose. Because without it, you can have no commerce; you are forced into a barter system. In a barter system, how do you buy a car? You would have to come up with some other asset of equal worth, or a basket of assets of lessor value adding up to the price of the house. Currency should also belong to the people; it’s how a society creates markets and raises its standard of living. It’s only when governments and private banks become involved that the currency system gets destroyed.

Throughout history, we’ve seen a similar cycle play out again and again. But let’s look at a couple of recent examples so that we can understand what the ultimate, most fair system would be.

The American Colonies

We’ll start in the United States, well before confederation, in the year 1691.

Massachusetts decided to create its own paper money, because the colonists were short of silver and gold. They had to use foreign coins to conduct trade, and since they imported more than they exported, the coins were continually being trained off to England and other countries, leaving colonists without enough money for their own internal needs. The new printed currency proved so successful that other colonies eventually followed suit.

Paper money did more than make the colonies independent of the British bankers and their gold. It actually allowed the colonists to finance their local governments without taxing the people. The currency was secured not by gold or silver, but by the full faith and credit of the country as a whole.

How it worked was that a government loan office would issue paper money and lend it to residents (usually farmers) at low rates of interest. New money issued to borrowers came back to the loan office on a regular payment schedule, preventing the money supply from over inflating. The interest that was paid on the loans went into the public coffers, funding the government. In that way there was no need to tax the people, because the government received all the money it needed to function from the interest on the loans. One of the most successful loan offices was in Pennsylvania. The Pennsylvania plan showed that it was quite possible for the government to issue new money in place of taxes without inflating prices.

The Bank of North Dakota

This is how a public bank operates. There is one public bank in the United States: The Bank of North Dakota. During the “Great Recession” of 2008, it did really well:

“The state of North Dakota does not have any funding issues at all. We in fact are dealing with the largest surplus we’ve ever had.” Eric Hardemeyer, president of the Bank of North Dakota (March 2009)

The Bank of Canada

In Canada, we have a Public Bank, The Bank of Canada. From 1934 through 1974 we used a similar system to pay for WWII, the St. Lawrence Seaway, The Trans Canada Highway, the Canadian National Railway, and fund the Canadian Health System. In 1974, Prime Minister Pierre Elliott Trudeau decided to reduce the central bank to a shell and contract with European banks to secure our currency at interest. Our debt mushroomed, of course, and 80% of it is interest—currently owed to European private bankers. You’ll find the Bank of Canada story described in my video, “Take Bank Our Money, Canada!”

The US Saga Continues

President Abraham Lincoln lost his life in the pursuit of a fair and equitable monetary system. He had the government issue money during the civil war, but when he was assassinated, the bankers once again reclaimed control.

William Jennings Bryan was the Populist candidate for President in 1896 and again in 1900. He was represented by the cowardly lion in The Wonderful Wizard of Oz. His challenge was to the Morgan/Rockefeller banking cartel (The Wicked Witch of the East), which was bent on taking away the power of creating money from the people and the government.

It all culminated in the passage of the Federal Reserve act in 1913, something they achieved by misleading Bryan and other unwary Congressmen into thinking the Federal Reserve was actual “federal”—part of the government, rather than a group of twelve private banks.

What’s resulted is a system in which the Federal Reserve, like the European cartel of private banks that lends to Canada, creates money out of thin air and loans it to the United States government at interest. This obviously is a function that the government can take on itself (creating money out of thin air). All it has to do is create a public bank. In the case of the United States, this would require a change in the constitution. In Canada’s case, we just have to decide to do it.

Inflation VS. Deflation

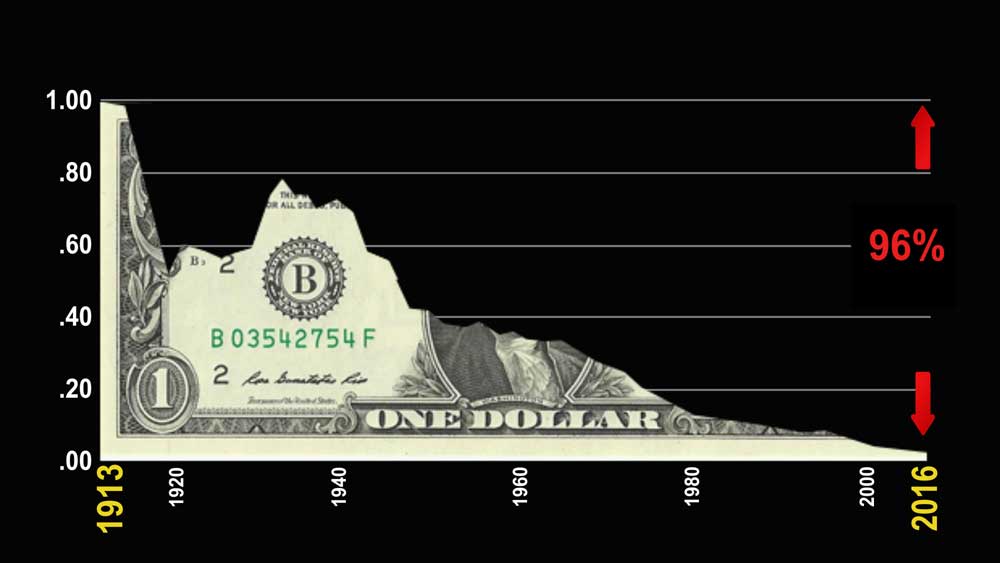

What inflation does is devalue our money. For example, since 1913, the dollar has lost 96% of its value. So, in fact, a 1913 one dollar bill is worth four cents today.

That’s why everything seems to continually get more expensive.Our money is relatively worthless. It takes more dollars every year to buy that new car, for example. Car prices continue to increase, but it’s actually our money that’s becoming worth less.

Likewise, as inflation eats away at the value of the dollar, prices for products and services rise. However, our salaries don’t rise nearly as much (if at all). Our standard of living decreases, as a result. When we attempt to keep the same standard of living, we sink into debt.

Business gets hit in a similar fashion. Costs for raw materials continue to rise. But if companies raise prices too much, they lose business. So they work on finding less expensive ways to make the same items, or cut back on quality.

While prices go up and quality goes down, your salary virtually stays the same. So you end up going further and further into debt to maintain your lifestyle.

The bottom line is that inflation destroys our economy. It makes us poorer.

So why do governments create inflation? Because they get hooked on it.

The cause is external debt—the debt created by central private banks. Because inflation causes the value of currency to decrease, governments find it much easier to repay debt. They repay it in tomorrow’s inflated dollars, which are actually worth less.

Plus, when prices go up, the GDP goes up. That’s Gross Domestic Product. That’s like the government’s salary and assets—their net worth. A higher GDP allows them to borrow more money and go further into debt. It’s a revolving, deepening cycle, which eventually meets a very bad end.

The underlying problem comes back to private banks and compounding interest. If a country’s banking system was a public banking system, there would be no interest, as it would revert back to the government, and would pay a large portion of government expenses. As a result, taxes would be lower. The government would only have to inflate as the population grows, or industry expands, and we wouldn’t have these incessant bubbles and crashes.

Tying Currency to Gold Doesn’t Work

Many believe that the answer to all our currency problems is to dismantle the current fiat system and lock the dollar to gold. This, they say, would stop runaway inflation. But inflating (creating money), is needed in moderation as the economy expands. If the dollar is tied to gold at a regulated rate, inflating is impossible. There is only so much gold available and so the economy can neither expand or contract. If the need to currency expands, the economy becomes stifled and moves into recession. People horde gold and there is less of it available in circulation. This was why Nixon uncoupled gold from the US dollar in 1971.

The issue is debt owed to private banks, along with compounding interest, which exacerbates the problem.

Until we free ourselves from the international banksters, we’ll revisit poverty each time these cycles peak. We’ll experience another revolution as our ancestors have so many times before.

As Albert Eistein is commonly thought to have said (even though he swore he did not):

“The definition on insanity is doing the same thing over and over again and expecting different results.”

We must break the cycle.

| “Once a nation parts with control of its currency and credit, it matters not who makes that nation’s laws. Usury, once in control, will wreck any nation.” |

| William Lyon Mackenzie King, Prime Minister of Canada, 1935 |

| “Let me issue and control a nation’s money, and I care not who writes its laws.” |

| Mayer Amschel Rothschild, International Banker, 1790 |

How Currency is Actually Created

In 1994 (most recent version), the Federal Reserve Bank of Chicago published “Modern Money Mechanics,” an explanation of how money is created and injected into the financial system. It’s a damning exposé of the fiat money system and how banks gradually bleed the economy to death through compounded interest. You can download the PDF here.

Natural cycles vs. Man-Made Cycles

Here we are at the top of a man-made bubble—the largest one in history. But what’s really interesting is that these man-made bubbles run in parallel with natural cycles. The climate is changing from hot to cold. At the same time, social mood is turning negative. People around the world are angry. We see mass migrations, authoritarianism, weak leaders, society breaking down, and on an on. These are the same themes that are prominent every 172 years, and to a larger extent, every 500 years.

No matter what country you live in, you will likely recognize some of the subthemes in The Wonderful Wizard of Oz. We live in a world of illusion, where governments and banksters do all they can to keep the truth from us. The herd is still under their spell, but not for very much longer …

More on these cycles in future …

_________________________

The Market this Weekend

There isn’t all that much new in the markets. I’ve been predicting the continuation of the fourth wave of the ending diagonal for several weeks now. I’m still looking for a new low.

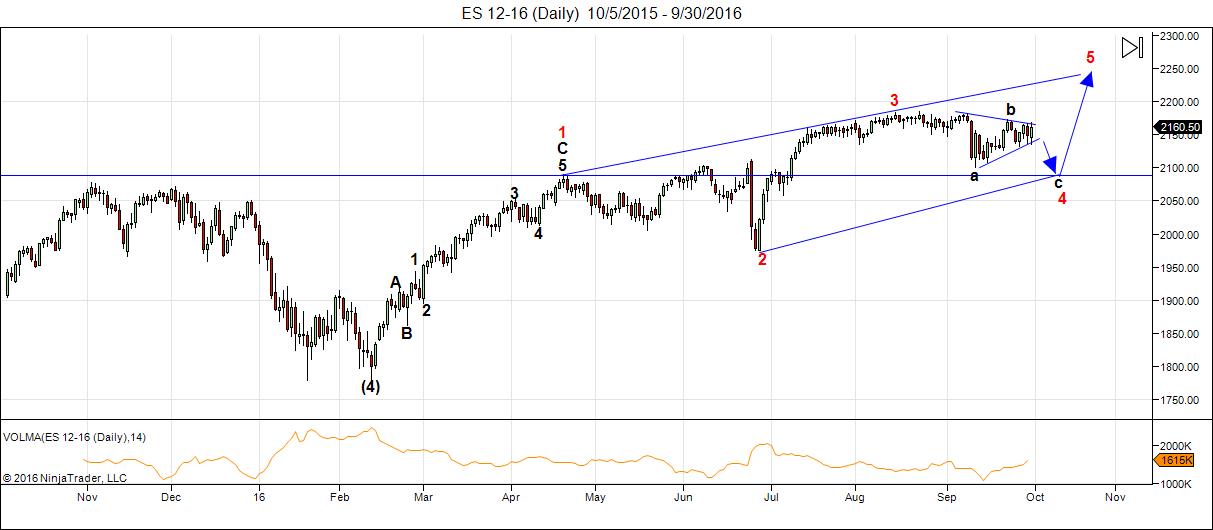

Above is the daily chart of ES (emini SPX futures). We’ve been in this fourth wave of the ending diagonal for about 2 months less a week. The second wave took 2 months plus a week, so the fourth wave should be nearing an end.

Usually the second and fourth waves in motive waves will be of similar magnitude (the fourth wave a bit longer) but in an ending diagonal, the waves get smaller as they move towards the termination, which is a fifth wave up to a new high, with a “throw-over” above the upper trendline.

Ending diagonals are triangle but they’re also motive waves. In fact, they’re the only triangle fitting under the banner of motive waves (as opposed to corrective waves). Ending diagonal are always the ending wave of the pattern.

I expect a gradual drop to below the 2100 area before a turn up in the final wave of the pattern.

Summary: This is the final fourth wave dip before the “blow-off” fifth wave and the top of the largest bubble in history. I expect a little more downside before we turn up again to head for a new all time high.

___________________________

Introducing: The Chart Show

Thursday, October 6.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis for the US market, gold, silver, oil, and major USD currency pairs.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Dear Andre,

Please keep posting! If not here, how about equityny.WordPress.com where I saw your article !!! Thanks

Andre’,

I hope you are reconsidering your stance!

It seems some people do appreciate my efforts. I’ll reconsider. Will let you know in a few days.

Thanks Andre,

You are a corner stone on this blog:

Maybe you want to share what is bothering you.

I like this blog so much because there is respect for each other so we all can become better traders.

Good luck to all.

P.s. my gut feeling is a lower high on monday and down into Okt 6.

andre,

buddy – “appreciate” is understating exactly how important your efforts and contributions are. Together we are a small, respectful, thoughtful group of like minded individuals each contributing in our own way – indeed, we are a small “family” of good critical thinking individuals. Andre, if you left, it would be akin to “losing” a valuable and loved member of the family. Personally, i want us to stick together, and continue forward. I prefer this choice rather than the alternative in which we lose you, and are forced to mourn your loss.

so, no mourning, and more contributing – let’s talk about 10/3/16, and the 115 trading day [td] cycle [or 365/116 td = 3.14 [pi]. we see it down until the middle of October – so 2 weeks?

Please do continue Andre, it will be wonderful to view your thoughts again.

Hi Peter Temple,

Thanks for Worldcyclesinstitute.com and your elliot wave analysis. Hope Andre’ continues to post. Agree with your elliot wave analysis of the next month. Have a stellar week!

Thanks Andre’….Dittos to the above!

Peter,

Great post. It will be a long road to educate people considering how they have been dumbed down (easier to indoctrinate, don’t you know). But a long journey must begin with… I mean, where else can someone go to read about the Wizard of Oz and monetary policy? I would like to add that when the Fed was originally created, it was intended to provide liquidity directly to the private sector (private borrowing). I believe this was in response to the San Fran earth quake and resulting market crash. Then I believe it was WW1 where the political establishment (not wanting a good crises to go to waste) under Woodrow Wilson effectively limited the Fed to buying government debt. This is all from memory, so forgive if I got parts wrong. In any event, it has been 120 years since the Cross of Gold speech and the progressive socialist movement began to sweep through America. That is 4 turns of the Great Chronicator -Saturn. Or 14 turns of the 8.6 year cycle. Is it time for the great experiment in coveting others assets – ‘From each according to their means to each according to their needs’ – finally going to implode down on us? As always, it’s all about time.

Thanks, Steve,

I see I forgot to add the link the actual book, which is in the public domain. I’ll go back and do that. https://americanliterature.com/author/l-frank-baum/book/the-wonderful-wizard-of-oz/summary

The education is the issue to a “herd” that has been brainwashed over a very long time … but some are starting to wake up.

Hi Peter

thanks for the post today .

Another thing you may want to consider in the future

is the annual sunspot cycle compared to GDP in the USA .

there is a historical correlation some may not be aware of yet

i assume you are .

One thing i have been aware of for a long time is that the availability

of debt drives prices higher. it doesn’t matter if it is a house or a car

or college tuition . just create financing and then push prices up .

My main concerns going forward is where to put my money.

I have come to realize we are all trapped if we have anything in a financial

institution. The house i currently own i know will decline in price yet

if i move that money into a financial institution ( if i sold it ) i am putting

myself at a huge risk once the financial melt down comes. The way property

taxes work in the state or Oregon here is the states is they raise your assessment 3 percent per year regardless of what actual home prices do.

My gut tells me that many of the states do similar things. I bought this house

in april of 2009 for 92,000 dollars and my assessment in November that year

came in at 175,000 which was an all time high!! i fought them for 2 years and

they brought it down to 132,000 . The woman who showed up told me they don’t do individual assessments , they do mass assessments so i asked her, why are you here ???? I have accepted that you just cant win with these people and unless you have more money then they do your stuck. There are ways to prevent them from raising your property taxes beyond the market value yet it is a tricky scenario and eventually the system works against you .

At the end of the day though the government is also trapped ( federal gov )

they depend on the bankers to sell the debt to keep themselves afloat.

if the banks go into default and the feds decide its OK for a bail in then our money on deposit may suddenly become 10% or 20 % less . They passed a law

which goes into effect Oct 26th where your cash in a money market account

can go below 100% so cash is not even safe in your brokers account.

The catch ? if you own usa treasuries . Obviously someone is planning for

something bad going forward . Janet Yellen stated that the fed would consider

buying stocks if congress allowed them to do so.

One last thing i think most do not see. the Congress and the Senate are next.

I’m noticing with the current up coming presidential vote. the media is all in for Hillary despite all her scandals. I am at the point where i do not believe anything

in the news anymore. its so 1 sided that its un believable.

Our society has declined to the point where anyone with morals is ridiculed.

we are supposed to be accepting of everything we don’t believe in and yet

those on the opposite side do not need to respect us for our values.

i don’t see anyway out of this other than a total collapse our of our financial

system along with a complete restructuring of our government.

For me personally, i feel the final trigger will begin with government pensions

and spread to 401 k’s and individual retirement accounts as the government

attempts and possibly succeeds in taking over the entire financial industry.

its a scary thing to think about which leads me back to:

where do i put my money so its out of the hands of financial institutions as well as out of the hands of government who just wants to ” keep me safe”

My house is a consumption item not an investment in my eyes . its value will

most likely decline yet which is worse , paying rent and seeing my money taken

or watching my houses value decline yet my cost of living stable ?

either way , property taxes will go up .

the scenario is not good from every angle .

Joe

You can always short the real estate market. Perhaps you considered that. We know real estate will drop at least 80% in value. So, you sell and buy something back in five years at 20% (or less) of its original value. You have to figure out what rent will be over a 5 year period.

Of course, if you’re in a market like Vancouver and Toronto, the percentage drop might even be more because they’re in such incredible bubbles.

The Rothschilds own the major US media, so you have to go to alternate sources, like zerohedge.com.

The other thing to consider is that in deflation, cash appreciates quite substantially. It will be the best investment there is over the next 5 years.

Joe,

I hear you and agree that we are entering a very difficult time in which the government/banks are setting it up take what they can. And I agree on all of your other points, America (and Canada) have totally lost their way, and we will probably have to crash and burn. Couple of thoughts: come on down to TX. No income or corp tax, rather property and sales tax (excludes food and some cloths). The property tax is done very reasonably (mine is way under true value). As far as where to put money, I think this is going to be a real problem. If they do any tax or bail in, velocity of money will get crushed. Not sure there is a good solution, but what about putting most cash directly into corporate stocks that pay a dividen. It would be hard to take the amount of what was invested (principle amount) and then collect the quarterly payments that could be cashed or not depending on the situation at the time. Also, similar to Peters idea of shorting RE, would a reverse mortgage have a similar effect (I’m not that familiar with them, just thinking out loud).

Steve

Joe,

Stocks are going down at least the same amount, so going for a dividend (which won’t last very long once the profit disappears) doesn’t make a lot of mathematical sense, imho.

I did a reverse mortgage and got more out of my house than I bought it for, so I’m ready to walk. You have to be over 55 (in Canada, at any rate).

Here’s the interesting thing: There’s a clause in my contract that states that I will never be liable for any more than the market value of the home, no matter what. Well ….

And when I questioned it, they told me it’s because the value of homes always increases. OK then …

Peter, I had never heard about this thing called a ‘reverse mortgage’. However based on what you’ve written I’m going to do some research on whether it is available in the UK.

WHAT A DEAL!!!

In Canada, it’s called a CHIP reverse mortgage. The generic info is here: https://en.wikipedia.org/wiki/Reverse_mortgage

Typically, if you’re over 55, you can take out up to 55% of the equity as a “loan.” The interest I pay is 5%, but it’s not due until you either sell the home or do the final check out as a mortal … lol. I’d be surprised if it’s not available in the UK.

Based on what’s happening now, I took a gamble and figured the mortgage company (it’s a bank) is going to go bankrupt and I can eventually find a nicer place in 5 years at a lot less money. So it will be interesting to see what happens. Plus I have no love of banks, so I occasionally like the screw them back.

Peter, I really appreciate your work and thank you for keeping this blog up.

90% of all people who drive into trading fail. For the 10% who know failure is not an option and seek to know all they can finding this blog and the insight of like minded individuals has been very inlighting.

Andre, It is very obvious how passionate you are about what you do and your work shows. You help a lot people figure it out and at the end of the day it’s about who we help and who we touch in life that is what truly matters I believe. Thanks for all your post it has been very helpful..

Thanks, Jody

🙂

I found research (from managers and trainers of traders) that showed 90% of men failed at trading and 60% of women. FWIW.

Thanks always Mr. Temple for publicly offering top notch analysis and facilitating lively exchange of thoughts. Thank you Andre , Valley and all for selfless sharing. Hope good karma will reward you well!

Thanks, p 🙂

Peter

I agree , dividend paying stocks not the way to go , corporate bonds is a possibility

as long as they are very strong companies . shorting the stock market along with the stock market is also an approach to consider .

as for the reverse mortgage ? i turn 55 in December and i m not sure on the specifics of reverse mortgages in the states. The property is zoned duplex yet the house is considered a single family home. i have created 1 bedroom rental

with 830 sq ft of this house which leaves me with 2400 sq ft for my living space.

with the right room mate / renter my costs go down by almost 100 %

but once they raise the property taxes i could end up with 150 a month in housing costs. this includes all utilities, mortgage payments, cable tv etc.

if i am able to do a reverse mortgage that would be money coming in that i don’t need, so id have to find a place for it.

My bias is to hold the house despite the decline .

The catch of course is having a renter that keep their job during the decline.

over a 10 year period i will re coupe all the money i have put into it .

The area here has a population of roughly 60,000 people . The immediate area

30,000 people. The crime rate is fairly low . i leave my doors unlocked and many times leave the doors open when i go to the store. I told myself when i bought this place id wait until the year 2018 before selling . so i still have a little over a year before making that decision . This is the 8th house i have owned and i have taken advantage of the tax free sales of a home twice in my life . This one though

I’ve become attached to for several reasons. Hate to say it but ill probably ride its valuation down and collect the rent as i do. hedging strategies will be put into place . at some point ill also be selling and closing out financial accounts and using that money to reduce debt on the mortgage which is really not that much

as far as i m concerned yet i will leave some debt on the table .

for those of you who have researched how home mortgages are calculated

you will see there comes a point where paying the debt down actually doesn’t

do you any good. the 1st 10 years you generally pay the bank what you borrowed , the 2nd 10 years you pay them again what you borrowed and its the last 10 years where you actually pay the debt down .

my take is to reduce debt by 7 % per year using rent money, selling off stocks

to reduce debt further . using maintenance costs to reduce income where i can

to reduce income and lower income taxes where possible. none of these things

i can do if i simply sell and then move that money into a financial institution

and hope that in 5 years my money is still there and available.

so it comes back around again . which is worse a bail in and my money taken from me and having no control, or a valuation loss on an income producing property which i have some control over and a cost of living approaching 0

( assuming the renter keeps his job and can pay the rent )

Joe

Andre and petter thanks for your viewpoints

ABC down into 10/14. AB this week. 10/7 major date. Jobreport will be disaster. Beyond 10/14 I see 10/23-ish looming. Probably the last test up. Longer term down into 2030-31. More on this later.

so andre, are you seeing a ‘corrective’ wave down in a 4 wave to overlap 1 wave for and ending diagonal like peter projects??? or are you seeing the top in place and the bear is in place and about to get rolling???

Andre,

Great to see you back….

And thanks once again….your work is much appreciated by us all!!!!

Harvey

Thanks; this helps..

So good to see you back Andre

Thanks!

Thanks Andrè!

Many thanks Andy. Love to see you back. Will wait for your more updates.

Andre’,

Wow!! First thing I did today was log-on to this site to see if you were back!! You made my day…and quite a few people’s day by sharing your exciting ideas about this market! I hope you decide to be around for awhile! Your work is very much appreciated!

Thanks Andre,

So here we go down till Okt 6/7

Good luck All.

John

10/7 will be a high, 10/5 will see a low. From 7 down into 14. That’s what I expect,

Dear Andre,

Please stay with us, you are key person for this blog. Thanks!

Thanks so the high today was only in Europe and the SP futures.

energy chart agrees

https://postimg.org/image/8mk60v077/

andre,

i am now officially confused. last week it was high to 10/3, then down to middle of oct,but in a macro sense down until march of 2017. now it is high to 10/7?? if the vibrations are constantly changing, how are you using them to predict?

Luri,

There is a difference between cycle dates and price cycles.

The trend is down but price can go against the trend. 10/6 is a very strong date. This is some ending wave. And we are down into 10/14.

Watch Thursday.

Luri,

Please understand I don’t give trading advice; I only share what I see. And I am constantly updating my system. With what I see now I could have told you last weekend 10/6 would be the day,

Understood, thanks again andre!

today’s energy chart

https://postimg.org/image/du5m7aen7/

Tom,

Remarkable; thanks for sharing.

“In the ruin of all collapsed booms is to be found the work of men who bought property at prices they knew perfectly well were fictitious, but who were willing to pay such prices simply because they knew that some still greater fool could be depended on to take the property off their hands and leave them with a profit.”

Chicago Tribune, April 1890

andre,

thanks for the clarification. so the key to any system is that it has predictive value, and so i am listening to you sharing to see if the claims of the system you use has prediction. i hope it helps you too to have questions being asked, and to hold your “feet” to the fire [so to speak] as to the dates being shared….

one question andre,

if the cycle is ‘down’ and prices are moving ‘counter trend’ to the cycle – does the down cycle “cap” or “mute” the counter trending prices to what might otherwise be larger price moves if the cycle was ‘up’?

It means that the cycle date usually gives the momentum high like in a w3. Then a w5 with divergences can come. But when that ends the move can be strong.

6/10 is a magnet. But when we turn it will be down into 10/14; no doubt in my mind. Then one last up into 10/23-24.

ahhh – soooo!!! thanks for that andre. the led lightbulb in my little ole simian brain just switched on….. :-))

The Oct. 4th energy chart clearly showed the morning dip and the trouble coming in the afternoon & end of day

https://postimg.org/image/sktvbddtr/

Thank you Peter, Andre and Tom.

This second Oct. 4th energy chart shows the second dip this morning and the pain coming

https://postimg.org/image/4jp9ytm2r/

What type of energy chart is it ?

The helpful type!

Tom, would I be right in understanding from your response to Jaze that you are willing to share your charts but not the source behind them?

I too have a number of questions but have no appetite for contrite answers.

Tom, just to be clear….neither your answer to Jaze nor your charts were ‘HELPFUL’. Your answer to Jaze was ‘off putting’ (to say the least) and your charts arrived WAAAAY TOOO LATE for anyone to take any advantage of the information that they may have provided.

If your only reason for posting these charts is to show how ‘clever’ your system is then I suspect you will get short shrift here.

Please may I suggest you read what others write here, particularly andre and valley. They provide actionable information NOT ‘I told you so’.

Best regards

Purvez

I will stop posting!

No Tom, just provide genuine answers. You DO have something of interest….hence our questions. Just not expecting ‘off the cuff’ answers.

Tom, understand your position…best to you! rotrot

rotrot, I’m intrigued by your response to Tom. It would appear that you believe that Tom’s decision to not post any more is reasonable.

I have read most of your posts and have always felt that you were someone who promoted sensible responses to posts. I would be interested to know why you found Tom’s response to Jaze a ‘sensible’ response.

I’m acutely aware that by asking this question I may be alienating you, but would like to assure you that that is not my intention.

I genuinely would like to understand why you felt Tom’s response to Jaze was appropriate…..and by extension mine wrong to criticise him.

Tom, can you post Oct. 5th, 6th… energy chart for us? We would greatly appreciate it if you could do that.

Tom, can you post Oct. 5th, 6th, 7th, 8th… energy chart for us now? We would greatly appreciate it if you could do that.

Hi Jas

send your request and e-mail address to Peter Temple and he will send it to me and I will e-mail you directly.

Just my 2 cents…Let Andre’ post what he is comfortable in posting! No pressure!

Let him share what he wants to share! My suggestion is to “fit” his ideas into your own framework and go from there!

Andre’…Thank you for posting!

I Thought this link is interesting it looks a lot like Peter’s projection.

http://static.safehaven.com/authors/gudgeon/42658_a_large.png

This is the complete link:

http://www.safehaven.com/article/42658/choppy-toppy-market-into-early-october

Hi, please may I ask if anyone is aware of why since about just before the opening till 2 hours afterwards we had nearly a 300 point gyration on the DJIA? I haven’t had a chance to investigate this yes…hence the question.

Thanks in advance for any info.

We’re trying to break through the lower trendline of the triangle and we’ve been bouncing off it. However, SPX is dropping through as I write. 🙂

This just SO reminds me of the maddening gyrations during 2008. I often thought ‘then’ that the MMs were running stops at each end. However I’m not so sure now because the HFT crowd would have eaten them alive.

Oops sorry MM = Market Makers…..(before I get told off!! LOL!!)

This is one tough crowd! 🙂

*investigate this YET. is what I meant to say.

Peter Temple, nice call for downturn this week. I also am guessing based upon PALS that low price nadir will be later this week or early next week, then I look for a real ramp up in equities into January. (PALS this week: phase – bear, distance – bear, declination – bear, seasonals – neutral, planetary – bear (post Jupiter conjunction is weak one month after ends mid October)

The following chart is what I posted on 30th Sept.

https://postimg.org/image/e4n73k0dh/

Well…..it hasn’t quite turned out like I envisaged so here is my updated version of what might be happening.

https://postimg.org/image/4bzcczgab/

Sorry Peter, for the additional hassle of ‘moderating’ my last post. I keep forgetting that 2 charts in a single post is a ‘no no’.

Apologies.

That’s OK. It just gets held up until I see it. I’m around most of today, so not much of an issue.

Seven Sentinels open article – “Black Moon Rising”

https://twitter.com/SevenSentinels/status/783393505435615232

Short term forecasts for global stock markets:

http://www.kenticehurst.com/stocks-forecasts/

Great site, thanks for link, still bearish, have been forecasting a top and a fall in to 2017 for months.

http://www.kenticehurst.com/stocks-forecasts/

A funny movie: https://www.youtube.com/watch?v=6SBVmUWFAIw

Timing is a bit tricky this week as Wallstreet is already in correction mode but Europe is motive up. 5/6/7/8 show a confluence af some long term heavy dates.

I think 6 is the strongest. Then everything is in sync and we will get some action.

This tedious topforming holds the promise of a long bearmarket,

Almost all crashes came after a lunar square. That will be 10/8. This is also a natural Gann turn date.

10/10 I have a tidal inversion. So one scenario is that we make a high on Thursday, dip into Friday; jump on the job report to start the decline next week. Next week will be a w3- like move so hold on tight.

My recent research forces me to adjust my forecast. No worries; 10/14 will be a low. Only now I think this will be just a first low. After that a retrace into 10/23-24 but then down again into a major 11/3-4 low. Then up again into 11/27 is and down into 10/12. Then possibly up again into a strong 12/31 date.

This weekend I will update my forecast into march 2017.

Thank you André!

monthly energy chart attached

tell me if we’re on the same page Andre?

sorry chart missing

https://s11.postimg.org/4m0dvu9cj/Energy_chart_Oct_7_to_Nov_6th.gif

?

Thanks Andre,

Your timing is impeccable. And timing is everything!!!!

You do great work.

Thanks,

Harvey

Andre’,

In your post at 2:51am you say…”Then up,again into 11/27 is and down into 10/12.”

Did you mean 12/10…as in December 10? Are am I missing something? Thank you in advance!

ED,

You are correct, I meant dec 10. Maybe I should avoid that confusing american date notation 😉

I can now say with certainty that this weekend is the most pivotal of the last few months. This is supported by the fact that we have confluence of a lunar square with a lunar declination extreme. Both can give major turns. So combined they are stronger. When we turn we are headed a 2017 low.

Good that you are back A!

Cheers,

W

Food for thought .

I mentioned this before yet ill mention it again .

Nothing works forever mind you .

end of qtr plus 20 days , options expiry tend to be market turns.

Jan 20th a low , april 20th a high ,July 20th a high, Aug 15 was option expiry

Tuesday Aug 23 was a swing high ( the 20th was a weekend )

Jan 20-april 20-july 20 = next turn Oct 20th . Andre has Oct 23-24th

and i have Oct 24th as the next swing high date.

The reason of this date in my work has to do the the planetary pairs

of mars and Uranus.

I have a generally bullish bias into late Oct .

another thing to consider and it fits with Peters wave count .

Oct 6 is a cycle low with an Oct 24 high using the mars Uranus pairs.

Its kind of obvious the first week of nov will be important with the elections

and from my perspective looking at the cycles it will be a mixed up affair.

the rumor mill ( martin Armstrong ) claims that if trump wins they will claim

putin rigged the election . a close race will be a Hillary win and only a landslide trump victory would go to trump ( yet be blamed on Putin hence mixed )

the outcome of the stock market should be down strongly .

So i m bearish with surprises to the downside yet between now and Oct 24th

either sideways or upwards bias.

only a few weeks to go .

the pattern is that of a narrowing triangle , the Dow still holding on to its 18125

key closing level .

anyone long a straight call or straight put is being drained financially .

Joe

Hi All,

I am not sure about all this crash talk. Having nailed the May 2015 top, I think the correction that followed is done and dusted. We are moving into the seasonally positive phase and although I can’t rule out a drop, I am more inclined to follow Peter’s S&P500 EWT chart and look for another trust up before a drop.

The link below gives a table with my previous turn dates. The chart below shows the blue vertical line tops and the red vertical potential bottoms. Next one 10th January 2017. The May 2015 top call was made in Jan 2015 and this cycle has been very good IMHO (search DJIA May 2015 Cycle High if interested) . When combined with my 17.6 year stock market cycle it has provided me with a very good roadmap for the markets. The new secular bull market is nearly upon us. More more correction ahead I think.

http://www.17yearstockmarketcycle.com/

ATB,

Kerry

ATB,

kerry,

you are indicating a “new secular bull” while peter is indicating the very last gasps and “end of a ‘cyclical’ bull”. Peter’s EW count has us thrusting up in the last A/B/C ‘blow off top’ wave 5 of a still forming ending diagonal pattern and which results in a crash of historical implications.

so i am completely supportive of Peter’s analysis. with the worst world economy of our lifetimes – with crashing world trade and other measurable indicators of depression like world wide economic activity, with real wages stagnant and falling world wide, with retiring demographics in the major world economies – how do you figure the ‘beginning of a new secular bull market” with cash flows unable to support the interest payments on 225$ trillion of on books world debt [who knows what it is off books]? do you want to discuss that a bit?

Hi Luri,

I didn’t see that Peter expects the biggest Hubble in history to burst after this wave 5. I see a correction but no more than that. We’ve had government debt bubbles before and they always get resolved the same way, they get inflated away. This one will be no different IMHO.

Retirees will get replaced with immigrants in major economies (except Japan), wealth will get passed down and the game carries on. Cheap energy and commodities will fuel the next boom.

I saw a discussion about selling houses and it makes sense now. Global stock markets have gone sideways for nearly 17 years (adjusting for inflation). We are on the cusp of a new mega bull market with real growth. I am very optimistic actually and I am increasing my exposure to the FTSE 100.

ATB,

Kerry

fair enough – although if you re-read what peter writes – he is a cycle expert. that is really all he is focused upon is the historic down cycle that is directly – the weather cycle [mini ice age] – the demographic cycle – the war cycle – social mood – is all turning down….. below is a quote from peter he wrote directly above for this weeks writings….this thing is gonna pop – and soon!

“Here we are at the top of a man-made bubble—the largest one in history. But what’s really interesting is that these man-made bubbles run in parallel with natural cycles. …..”

I am not dissing Peter, if he has figured it all out then great. I certainly haven’t. I am very interested in how natural cycles (planetary) impact cycles of optimism and pessimism, but ultimately I want to make money.

We were on the edge with the banking crisis, but central banks pulled us back. I am not a fan of them but I do think the bond bubble bursting is going to lead to a surge in equity markets and house prices.

I am a UK based investors. I have no idea what it is like on the ground in the US, but the UK is very buoyant. I agree with Joe that the US election is a key event and I have no idea what a Trump presidency would mean for anyone.

purvez

many of the same cycles present in the 2008 decline are present today

I came here today just ask everyone what they feel about triangle formations ?

im certain that the world can see the narrowing wedge .

beginning at the low near the open on sept 12th .

we had a bounce into sept 12th close.

counting all the bounces and drops to the extremes

sept 12th 1

sept 14 2

sept 22 3

sept 27 4

sept 29 5

sept 30 6

oct 4 7

oct 5 8

oct 6 9

9 waves in a triangle is rare

as is 13 waves in a triangle if this continues .

you can use letters A B C D E F G H I

The market is now at the point where you watch for the

breakout , either up or down .

today being Oct 6th, id be worried of bearish positions

on a break above the cash Dow at the 18,300 level

and id be worried about having bullish positions

on a break below 18,200 level .

18,316 and 18,116 to be specific

Joe

Kerry

if the debt just gets inflated away as you say and our politicians

would be expected to do the same things ( i know you didn’t say that )

then why as i look around the world and the establishment politicians

being voted out of office ?

also does it make common sense that at some point in time

that debt becomes a huge problem that needs to be dealt with ?

doing the same thing over and over works for a while but at some

point it reaches its head .

we are reaching the point where the returns on these policies are giving

us a diminishing return . anyone who has paid down debt knows the pain

they went through to get through it and are not about to borrow excessively

again . the aging population is not about to buy new houses or even cars

year in year out . as the aging population goes into retirement their spending habits fall . the majority of the USA population is entering that retirement phase

it will bring about a bearish outcome.

High debt, aging population makes it very difficult for economic expansion.

Money can move from 1 place to another i suppose to create a local boom

bust cycle yet its going to be very very difficult to have a world wide booming economy . in my eyes its just about physically impossible .

The bullish stock market in the usa i can see as money moves from around the world to seek a safe haven so to speak. yet the inevitable is that the money will then go back home .

negative interest rates are great as long as people are seeking a safe place for their money . but again at some point they realize they are paying for holding onto that debt and want to be rid of it .

the many many problems with our financial system world wide makes me doubt

we will see any long term boom and in fact i agree with peter completely about the coming deflation .

my only difference with peter is the when side of the equation.

You cant borrow your way out of debt and you cant print money to expand the economy when the debt just swallows what you print .

as for the seasonal bias , you are correct we are entering the seasonal bullish

period yet we have a very divided population who is about to vote for the 2 worst candidates in our history . the reaction from this vote can and very well alter that seasonal bias .

The cycles are bearish into jan 20th as well as march next year

Joe

Kerry

please keep this going and dont find my comments offensive .

why replace retirees with immigrants when you can replace them

with machines ? atm machine replaced bank tellers , we can

pay at the grocery store at a kiosk , MacDonald’s and the other fast food

places are beginning to put kiosks in . car manufacturing is automated

to a large extent . Hostess closed due to the union yet in reality went with an automated system which now produces some 85 % of their old production levels yet in going automated they now have 500 employees versus 9,000

( that is a huge decrease in the labor costs ) we pay to park using a kiosk

so no parking attendant . bringing in immigrants to fill the void ?

it sounds good yet in reality the jobs are being replaced with technology .

those that don’t have much of an education will only find it harder to find a decent paying job .

and just to add to all this . as the population becomes more and more dependent on retirement income, those who fill those jobs are paying for more and more people in retirement . Taxes would have to rise which only squeezes

the working class . squeezing the working class will cause them not to spend

and the deflationary spiral will just become like a snowball rolling down hill .

Hi Joe,

I don’t see anything offensive so don’t worry. I don’t have the answers to the questions that you pose. I am just trying to make some money on the markets. I missed the first big drop (for me) from 2000 to 2002 and the next one 2007 to 2009 and 2011, 2013, 2015…

The wheel keep on turning and I see no reason to not invest.

Here is the cycle diagram:

http://ritholtz.com/2013/11/balenthiran-cycle/

We can debate these things all day long but I don’t won’t to. I invest my money based on my views to maximise my return. I factor in I could be wrong in my risk management. That’s all we can do,

ATB,

Kerry

Kerry-

On the cycle diagram, it seems like we still have a couple of years (2018) before the bull cycle kicks in. Your comments here give off a the impression the bullish cycle is going to begin much sooner than that.

More like a year to year and half reading into a little deeper. Are you expecting more sideways movement or the cycle to begin now because of the seasonals.

Hi Ted,

I am not expecting lift off until 2018 but the low typically happens during the early part of the down phase. Like I say I haven’t got it all sussed out but I expect more sideways chop until the new secular bull starts. However this period Oct to May is seasonally good so I am bullish. I am looking to build a position on the pullback to buy and hold from 2018 to the 2035.

ATB

Kerry

Kerry-

I wanted to thank you for stirring up some thinking, interesting approach!

For the EW/technical crowd, sorry for bringing a little fundamental points into this

The most interesting thing i have found is the difference in the FTSE and S&P 500 10 year adjusted PE. FTSE 100 seems slightly under valued while the S&P 500 is very over valued. Also interesting that the bear of 1929-1946 had that early low while 1965-1982 bear had its low in the middle of the time frame. Not sure what any of this means, but interesting to think about.

The only immediate thought is typically the long term bulls start from very suppressed valuations, which 1945 and 1982 had, but we do not have now (i would consider FTSE slightly undervalued not grossly undervalued.

And of course elliot wave is great for making sure you do not turn immediately bearish when you see the 10 year cyclical pe at it’s current level.

Hi Folks! PALS suggests weak zone continue into mid week next, and then rapid rise into end of October (Lunar square major factor, thanks, Andre’). I am on board with Kerry who sees a 17.6 year bull market which is the subject of Jeff Hirsch’s Super Cycle theory. Pillars of this theory are “new tech” which tends to cluster into decade of no gain/ limited equity inflation, followed by decade or more of rapid equity inflation as “new tech” is unleashed. Thanks to Peter Temple for this wonderful site!

I agree with Kerry. Next decade will offer Super Cycle of equities inflation due to new technology which will improve goods and services (better, faster, lighter, cheaper) as Jeff Hirsch of Stock Traders Almanac has suggested. (Nano, AI, Robotics, Materials Science, Bio, etc. are all rapidly advancing)

The never ending triangle as i see it .

note the numbers on each swing and what the market did

following those point counts ( numbers )

the last subdivision if it is to even be seen would imply

a drop then strong bounce .

if that last subdivision is not seen and the market thrusts

higher then this pattern from the sept 12th low is finally

completing a counter trend bounce .

its to soon to call it .

18316 is the key level to signal the thrust

http://imgur.com/YHCbXSk

the sentiment today is uber “bullish” – 17.5 year tech cycle bullish….. is this an contrarian indicator of sentiment that coincides with “the” top?

question?? if everyone is so bullish – what is the draw to peter’s cycle analysis which indicates the soon onslaught of an historic bear??

I don’t visit this site regularly but was confused by the triangle and wanted to see Peter’s EWT count which makes sense to me. I don’t think wider sentiment is uber bullish. The recent cyclical bull market is one that few retail investors are bought into ( in the UK at least).

luri,

Sentiment is contrary to the market direction. Sentiment is so bullish because everyone’s “in” the market and they expect it to keep on heading up. The opposite happens at the bottom: Sentiment is extremely bearish at the bottom as the herd has lost a lot of money and don’t think it will ever go up again.

thanks peter.

Luri,

I visit worldcyclesinstitute.com because of the unique view of market probabilities based upon cycles. Peter Temple has a view that includes a market sell off and deflation. My view is a market buying mania and inflation. Both could happen. Going to be an interesting few years.

valley – are you “sure” about that buying mania and about the inflation? isn’t that a picture of a little poo “bear” i see hanging behind you??? come on – you can share with us, you are really a closet deflationist – we know…..!!! :-))

Luri, the inflationist mountain does not bow to the deflationist wind no matter how strong. Motel 6 was named that because when the motel chain opened $6 was the nightly rate in the 1960s. Now Motel 6 costs near $100 per night.

Valley,

History certainly doesn’t support that statement – deflation has taken over in virtually every depression.

Bank of America Says We’re Experiencing ‘Peak’ Everything and a Major Market Change Is Coming October 6, 2016 — 12:12 PM EDT

http://www.bloomberg.com/news/articles/2016-10-06/bank-of-america-says-we-re-experiencing-peak-everything-and-a-major-market-change-is-coming

Kerry

so what happens if the year 2018 is a high and not a low ?

Joe

ill check out the link later as i am a bit busy today

HI Joe,

If I am wrong I lose money. My book was published in 2013 and the cycle is the cycle, I don’t chop and change. For clarity I think the bull market will begin in 2018, so we see new all time highs and don’t look back. I am not looking for a low in 2018.

Regards,

Kerry

Rick’s Pick for Friday…worth a read!

http://us1.campaign-archive1.com/?u=822f57272edf2c46e4f77a7be&id=17c4910853&e=200f211690

The number of posts on this site is an indicator. When sentiment is quiet, the site is quiet. Now a lot of posts as sentiment is nervous. This is the vibration and you all respond. I love it. This weekend I will show what I think is going to happen. And I can say right now : more crash talk!

Hi Andre,

look at GBP/USD tonight

I saw it; the vibration is flexing it’s muscle.

andre,

might we see these ‘vibrations’ manifest themselves into an uptick in the acts of violence with the population? do these vibrations have implications on the wider nature? on the sun for example – maybe some CME bursts from a very quiet sun?? can the vibrations get a stubborn “oil” stain out of my favorite t-shirt? [that last question is for giggles only] :-))

Luri,

Everything is vibrational. So yes; when vibrations enter a down trend everything you see and know is affected. And there is no way to stop them. This is a natural law. This is quantum physics. 144 is harmonical with the speed of light. The root of 2 and 3 give PI.

Eveything is connected. 1, Pi, Phi, and the root of 1,2,3,4,5 are one system and part of ancient geometry.

Will share some more this weekend.

so i give you this quote from an FX trader in response to last night’s GBP crash.

““This is not something you would expect in a half-efficient market,” said Ulrich Leuchtmann, head of FX at Commerzbank. “We have a liquidity situation which has eroded massively over the last few years and policy makers have largely ignored it.””

as peter said yesterday – when everyone is “in” – the sentiment is very bullish. good luck on trying to find a ‘buyer’ for your paper on the way out. this is why the first move off the top of the equity will be an historic crash!! From the quote, “we have a liquidity situation which has eroded massively.” So much for FX being the most liquid markets of our distorted world…..

Luri,

Although I know you didn’t mean it , its important not to take Andre’s work lightly.

In over 40 years in the market I have understood that work in Vibration Harmonics has made for the best approach toward market and with it social mood timing.

Andre’s work is in one word sensational. His understandings although above my head are more then just a passing interest. This is the foundation for a cannon of cycle work focusing on natural occurrences and phenomena. Bravo Andre, Bravo!!!!

Harvey

thanks harvey. i support andre in his efforts. i posted below about marko rodin. it is important though to infuse all efforts with humor. humor helps with perspective. of the ocean of the ‘truth’ of all knowledge, man understands only one microscopic drop. so in lieu of full knowledge, we have humor…. :-))

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.