The Up and Downs of Fourth Waves

The Up and Downs of Fourth Waves

Up and down, back and forth. That’s the nature of fourth waves, particularly in a corrective pattern, which is what the NYSE is in, along with all its sub-indices.

And sure enough, this particular fourth wave is proving to be one of the most difficult to predict ever (although we’ve done exceptionally well, particularly when considering the work of all the Elliott “pretenders.”

And just when everyone thinks we’re headed for the exits, we turn around and head in the other direction. That direction this weekend is pointing up.

Fourth waves are the pattens I dislike the most, and for the most part, do not like to trade them. That’s because they’re the final countertrend pattern before a trend change; bulls and bears at this point are relatively evenly-matched.

Fourth waves in corrective patterns are typically very “wide” (this wave has taken almost an entire year to trace out its sideways pattern, for example). But the final wave out of these types of structures is relatively swift. It will be to the upside and reach a rather paltry new high before reversing into a new trend to the downside — a trend that will last at least five years and be devastating to our economy and way of life worldwide.

If you want to try to figure out a time frame, you should look to the NDX. The structure here is impulsive overall (up from 2009) and so when this fourth wave is complete, we’ll get a final wave up to a new high (in five waves) that will more reflect the length of the fourth wave.

The fourth wave of NDX will have taken 3 months to trace out its pattern, which looks like it may end in the first week of January. A similar wave to the upside (in time) would take us into March. Whenever that top materializes, it will be the absolute end of this 500 year rally.

_________________________

Elliott Wave Basics

There are two types of Elliott wave patterns:

- Motive (or impulsive waves) which are “trend” waves.

- Corrective waves, which are “counter trend” waves.

Motive waves contain five distinct waves that move the market forward in a trend. Counter trend waves are in 3 waves and simply correct the trend.

All these patterns move at what we call multiple degrees of trend (in other words, the market is fractal, meaning there are smaller series of waves that move in the same patterns within the larger patterns). The keys to analyzing Elliott waves is being able to recognize the patterns and the “degree” of trend (or countertrend) that you’re working within.

Impulsive (motive) waves move in very distinct and reliable patterns of five waves. Subwaves of motive waves measure out to specific lengths (fibonacci ratios) very accurately. Motive waves are the easiest waves to trade. You find them in a trending market.

Waves 1, 3, and 5 of a motive wave pattern each contain 5 impulsive subwaves. Waves 2 and 4 are countertrend waves and move in 3 waves.

Countertrend waves move in 3 waves and always retrace to their start eventually. Counrtertrend (corrective waves) are typically in patterns — for example, a triangle, flat, or zigzag. Waves within those patterns can be difficult to predict, but the patterns themselves are very predictable.

Fibonacci ratios run all through the market. They determine the lengths of waves and provide entry and exit points. These measurements are really accurate in trending markets, but more difficult to identify in corrective markets (we’ve been in a corrective market in all the asset classes I cover since 2009).

To use Elliott wave analysis accurately, you must be able to recognize the difference between a trend wave (motive) and a countertrend wave (corrective). There’s very much more to proper Elliott wave analysis, but this gives you the basics.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

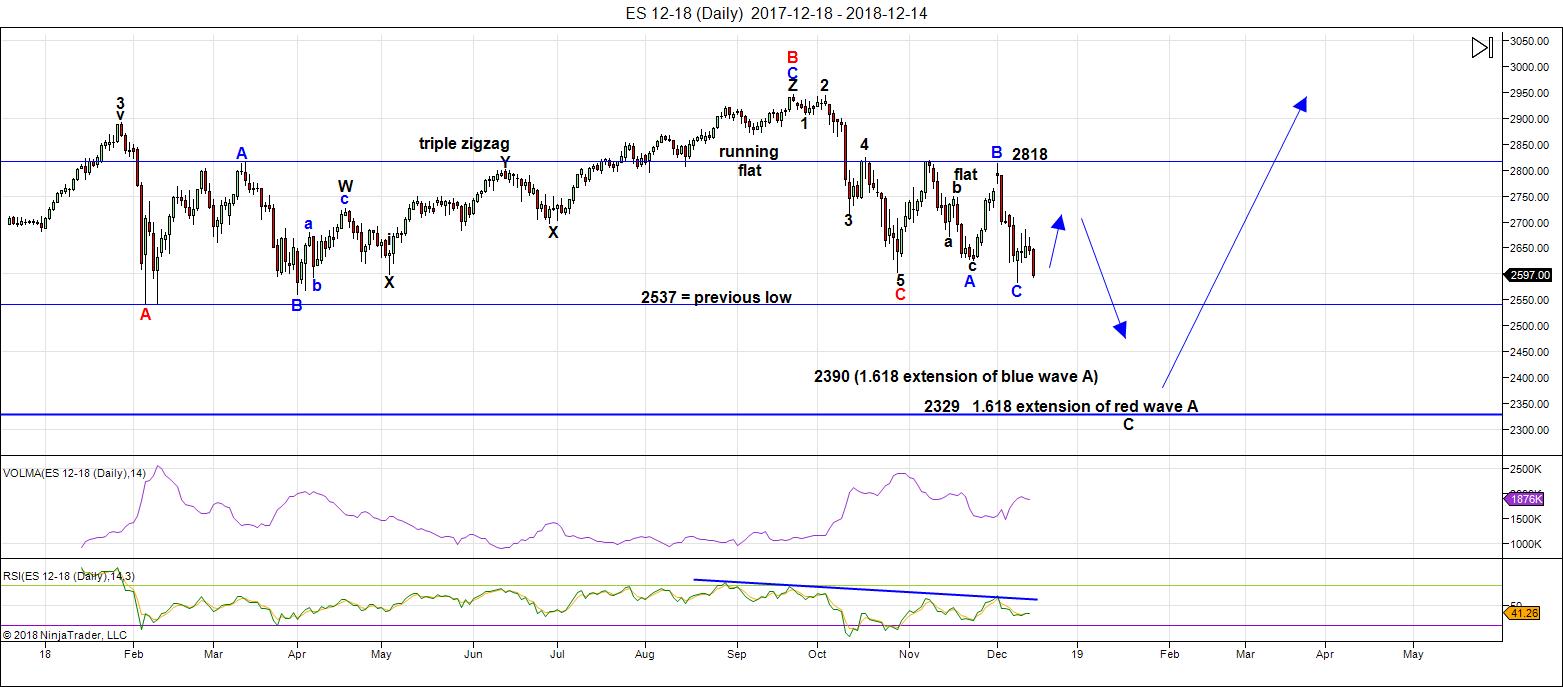

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last weekend, I called for a rally to the 2710 area, before a drop to a new low. We got the rally early in the week, but it didn't make it all the way to the target, keeling over at the top of an all-day ending diagonal on Wednesday, something I warned about at the time; it was a pretty obvious pattern and affected both ES and NQ.

On Thursday evening, I called for more bearishness, which we got right through to the end of the day on Friday. But, as I said on Wednesday evening, the wave to the downside is corrective and will eventually retrace.

We did not drop to a new low, so the direction is still to the upside. Expect a rally starting either Sunday or Monday to last the week. Then it's down to our target, and looking like it will take out any chance of a Santa Clause rally.

Last weekend, I also pointed out the fact that the NQ/NDX "pair" are tracing out a relatively large triangle, with only the E wave to go. That seemingly will be an excellent "marker" for the eventual turn down in ES. If we break the lower trendline of the triangle however, something else is going on.

Likewise, if the SP500 breaks 2534, something else is going on. A double bottom there does not change the prognosis.

The height of the rally in ES will be the question for the week. There's a chance that we're in a contracting triangle and we may only get to the 2665 area. However, based upon the required rally by NQ my preference is for a larger rally, to break above the 2710 target from last weekend.

If that's the case, the final pattern to the downside in ES could either be the C wave of another flat or a zigzag. Either one will end up with a dramatic drop, resulting in a high degree of market fear.

As I've been saying, these large fourth waves consist of multiple patterns (what we call combination waves). Both ES and NQ developed a large running flat from the drop in January of this year. That was the first pattern.

The second pattern differs in ES and NQ. ES has traced out a flat and NQ has traced out a contracting triangle. Triangles, as part of a combination, are always the final pattern. So, I'd expect a fairly deep fifth wave out of the triangle to a new low in NQ.

Summary: I'm looking for a rally this weekend that may test or exceed the 2710 area.

Once we have a new high, we're looking for a dramatic drop to an area under 2400 ... at least.

Once we bottom in this large fourth wave, we'll be looking for one more final wave up to a new high. That fifth wave up to a new high will be the end of the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, December 19 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Wow!

Just think about it. We are seeing 500 point down days in DJIIA with corrective waves.

The final C wave (or 3) down is going to be quite something. A thousand points in one session seems not out of the question.

Considering the incredble market complacency in view of current market downside risk, thaf is exactly what it is going to take to jolt folk out of their stupor!

Exited remaining short trades. Looking for VIX confirmation of an interim bottom, or negation of positive divergences and acceleration of the move lower. Very interesting market indeed!!

Watch the indicators to make a Low on Monday (now 2572) and a High on the 19th and then like u huge yoyo up and down. There is a lot of panic the next few days.

http://www.prognoseus500.nl/

I sure is looking to me like this correction is just about done.

I am nibbling on long trades on developing hammer reversal. RUT already printed a green candle. Will the other indices follow?

What a chaotic market! This churn is almost impossible to trade!

I have not yet initiated any long trades yet. It is starting to look like wave C is ongoing. If wave C were to be a zigzag, then I can see the first ABC finishing around 2450-2475 (A = C) area followed by a nasty and quick rally.

Yep. No doubt the larger C or 3 down underway.

Begining to look like 2450’ish is do able

Peter’s targets of 2390-2329 are still worth keeping

Your eyes on .

Todays drop fits the script as mentioned on Friday .

There are now only 3 turn dates. Jan 4-6 th being 1st of

Importance .

My guess is that the market will be showing some extreme

Oversold readings by then .

My indicators use the 1928 to date time frames and I’m only

Interested in the readings of major lows.

Weekly chart is becoming more important to me at this juncture

Yet the daily chart is included at is the monthly . All indicators

Should bottom together ( my work ) hence daily and weekly will

Become a Friday/Monday affair for me .

Jan 4th is a Friday ( mars Uranus cycle low ) Jan 6 is the solar eclipse

and as per the puetz cycle it should be a low of sorts .

Jan 4 a Friday and Jan 6 a Monday .

Hence daily and weekly occilators I’ll focus on more and more

Over the next few weeks .

I’d mention the 14 day rsi below 27 is somewhat of a rare event .

Find the extremes in the indicators you use and keep them in mind

Is all I can suggest .

Enjoy the week everyone .

no longs yet here but just been trading blips in tvix..good day for that one today

it was a wait and see kind of day

It has been my experience that when investors are anticipating a support level to hold i.e. the February lows…If that support is violated “lookout below”. A crash of sorts.

That is obviously a basic observation! Could we tag Peter T’s 2329 level before we bounce?

Peter G, if you are still out there…Do you have any thoughts you would like to share?

I would say if the Demo’s don’t give Trump his money for the wall by Friday then Pete’s bottom target will get hit if not wiped out.

https://www.news.com.au/finance/work/leaders/americans-terrified-over-looming-government-shutdown/news-story/6db41833c82db4cc70c13770c1029fb9

interesting that #ES_F on Feb 9 low was @ 2530.25 & today’s $SPX day low/52wk low = 2530.54

wished I looked at the #ES_F earlier this a.m. instead of waiting til after markets closed. also wished I looked up your site this weekend. the 2529 would have alerted me.

LOL… sorry — MISREAD your blog, Peter — its 2329 — NOT 2529 !!!!!! LOLOL

been up since 3 a.m. PT and tweeted like a village idiot — the $SPX Feb & Dec data and ONLY #ES_F Dec data and NOT Feb data — otherwise I would have been on RED alert !!

& with that g’nite .. need a long sleep

The only time I can watch network TV ia when I am travelling.

I am looking at CNBC this morning and they are flashing on the screen “Dow Implied Opening”.

The number is twice the futures print. HUH???

Do people really buy this propaganda B.S.?

This week’s Chart Show I’m dubbing “The Carnage Special,” because after our bounce is over, look out. You don’t want to miss it.

Yep! I think the Fat Lady has been just clearing her throat…😁

Hi there,

the indicators are up untill tomorrow EU opening and US opening. Then it starts..

The panic is showing. I think Bradley’s 19th is perfect. It is the High and then the decline. First the YO-YO on the rest of the 19th ending in and very LOW then up on the 20th to make the last up for the rest on the decline.

watch http://www.prognoseus500.nl/

be carefull this is the worst time to trade

re you expecting the markets to top on Dec 19 and bottom at the Bradley turn Jan 18? Declining for a month?

Hi Aaron.

Could be. Bradley shows the possibility. I must wait and see what the other indicators do in that period.

sorry I forgot that we first have to decline in to 2547-2550 and then up (I Think)

The 10y TRIN has started moving up towards an oversold reading. A few more panic sessions will get us to 1.50. Wednesdays are busy for me, but I will have to make time tomorrow for the chart show.

Closed another round of spectacular short trades today. VIX did not confirm the phony morning ramp so I scaled in short on the way up and added quite a bit on the green VIX print. Took profits at the afternoon lows as I anticipated the ambush of the newly arrived shorts. It unfolded like clock-work.

Hard to believe some folk don’t think market price can be, and in fact is routinely manipulated to steal traders’ capital!

I can only surmise they don’t do very much actual trading.

I appreciate your asking for my current thoughts, Ed, and I will give you a few right now. We are at a fascinating market juncture. All would do well to read this erudite and comprehensive article on Dow Theory (and a few other items).

https://rambus1.com/author/coons/ Like so many good market principles, Dow Theory is poorly explained and even more poorly interpreted by most practitioners. The fellow who wrote this does an excellent job explaining the intricacies of the theory and he concludes that on Friday, December 14, a primary bear trend was signaled by the Dow Theory for the first time in 11 years. He makes a fun comparison with the 1929 signal which was generated on October 23, 1929. For those of you weak on market history, the 1929 crash began just a few days after the primary bear signal. Does that stand a chance of happening here? Well, it would surely break a lot of patterns and rules if it did. We are now in the most bullish seasonal 3 weeks of the whole market year from around December 15 to around January 6 (every year!). On the other hand, although Peter T may take me to the back of the class and make me stick my hand out for a good whipping with a ruler for what I’m going to say, my very amateur Elliott wave sense tells me we could be at or very close to a 3rd of a 3rd to the downside. My last post was on the exact high day of December 3 where I noted a few technical factors that pointed towards a possible top that day. Interestingly, we have now seen the opposite set up on the Bollinger Bands VIX indicator. VIX is now ABOVE the upper BB and a move back down inside the bands would theoretically generate a short term buy signal. Because so many other momentum indicators, RSI, MACD, and others are fully oversold, such a short term buy would not be a surprise. I would ask you, however, to also be prepared for what sometimes happens when the VIX moves above the upper BB. You sometimes get an acceleration upwards as the VIX remains above the BBs for several days as the market suffers an opposite-effect waterfall decline. Those are the possibilities as I see them. Someone commented on the TRIN MAs finally getting oversold and indeed the argument can be made that the current 10d MA at 1.32 qualifies as enough oversold in a bull market to mark a bottom. The problem arises in that the days where there has been strong selling almost all seem to have small single day TRINs implying no urgent selling. For example, Monday’s 500 pt Dow decline and 403/2628 advance decline numbers was accompanied by a TRIN of .98!! Even today, the 5 day TRIN is a neutral to slightly overbought .99!! You can criticize and make fun of the archaic Dow Theory all you want, but I would respectfully recommend you not ignore it, even if there is a short-term rally from here.

Thanks Peter G.

Here is a consideration that speaks to potential contra-indicator market price action.

During bull markets, price can and often does, negate bearish siignals. The exact opposie is true during bear markets.

It is impossible to consistently trade any market if you are wrong about the main trend.

Take a look for example, at candlesticks with long shadows coming after at least several days of prior downward movement. Until last month, every single time they ocurred marked the end of a correction, with price higher one week later. Go and check. Demonstrating predictive power is how a thesis moves from scientific “theory”, to “law”.

The current situation with VIX trading above its upper B band, under this theory, would clearly be expected to have a different outcome if we are indeed in a bear market.

Haha!

Are the banksters going to let me cash in those calls I picked up yesterday in anticipation of this phony ramp?

Amazing is it not?

Are we to assume the gangsters want us to think there will be no rate hike today? Lol!

Good luck wid dat!

Looks to me like the fleecing of the hapless BTFD cohort continues.

Boy is that a slow group.

They refuse to give up their beloved FANG stocks…never mind the blighted landscape!

I also have a huge VIX bull 23/24 put credit spread expiring this morning. I had stopped holding those into expiration as the criminals at the exchanges would spike VIX down every Wednesday to push profitable put spreads into the money for a few seconds right at liquidation and literally steal traders’ capital. It became so blatant traders sued the bastards, and the practice ceased. I heard all kinds of idiot explanations for those spikes that had nothing at all to do with the real reason they were happening.

Look at the VIX 1 min chart. The neanderthals are still trying to spike it lower! Lol!

Peter G,

Thank You for sharing your thoughts! Always insightful and appreciated!

Can it be a flash crash? if you watch the bold red line and we make a serious LOW around the end of the US day. And go up as a rocket around the opening of the EU market.

Be carefull I only predict what my indicators tell me 🙂

FOMC days are very volatile. A 2-3% move that gets reversed would be very normal. But it can happen the other way too. I do not have a good way of forecasting one day moves. I heave initiated some longs (mainly on the back of oversold readings and FOMC today). In case it pops, I will likely switch back to short. The market can always continue lower from oversold readings, but it would be a lot easier if there was a nasty pop before.

Longs on the back of FOMC today, Vivek? Did you know that SPX has been down 6 of the past 6 Fed announcement days? By the way, here is a fun stat. As you may have noted in my post above, there was a Dow Theory primary bear market signal last Friday, December 14. I also noted the primary bear signal given on October 23, 1929. Here is a fun stat. The October 23, 1929 close on the DJIA the day of the primary bear signal was not surpassed again until just short of a quarter century later, in 1954. Think we will wait until 2043 until we see 24,000 on the DJIA again?? 🙂

All very good points Peter G. I have been covering my shorts on declines and trying to trade small longs simply because of how painful it has been trying to short this market (maybe its needed to make sure very few people are fully short when things implode). If we actually get a decline past 2475 with higher momentum than what we had in the last couple of days, then it will your outcome – these levels will not be seen for many many years. I try to catch 5-7% moves (as I have a much better track record there). I am going into the event long SPY along with 252 puts to flip me to short in case this market implodes post press conference. All these are minute issues compared to the ones you are bringing up, which is much bigger picture and I agree with you there (and indeed have learnt a few things from yours and Joe’s posts).

Well…! I managed to survive the expiration with my VIX spread profits intact. He!he!

I guess the market makers do not like getting sued over their flagrant cheating!

Anyone knows why weekly VIX option chains no longer showing up in the list of what is available?

Ready to reload! ☺

Are we seeing yet another buy-the-rumor, sell-the-news scenario?

Peter G

you made a lot of good points which I agree with .

That said I will note something I watch for in regards to the 10 day trin .

This doesn’t always work yet it is worth watching . I look for a 6 trade day high to high on it . The 5 day trin has seen buying action as the 10 day continued higher .

Today is has turned down . Time wise we are now into what I termed above a few days ago as a sluggish pause .

For me the cash dow can test the 24370-24513 level . above those levels tell me something is wrong . this rally ( pause phase ) should only last for 4 trade days .

The full moon should produce a high of sorts . this full moon surrounds the winter solstice .

the solar eclipse and the mars Uranus cycle Jan 4-6th will be important .

I still favor it as a low and im not convinced the puetz cycle which your very aware of will work this year . that all said the market continues to follow the crash cycle .

I am seeing oversold readings from various indicators . the 5 day and 10 day advance decline lines , the 10 day trin as I see it im still not sure of , the 14 day rsi

has a little room left .

For now im sticking with this as the sluggish pause .

the 24370-24513 levels are my main gauge at this point .

The 15 lesser weighted stocks in the dow have finally broken below their oct lows

yet are still above their july lows . It is the 16 higher weighted stocks in the dow where most of this decline has come from .

while I do remain bearish ( despite this rally/pause stage ) ill note something else .

The cash dow weekly chart :

Week of jan 22 high to week of april 2 low . an A B C decline ( not same as spx )

week of oct 1 high to week of dec 17 .

look at that correlation in terms of price and time .

Both declines have been basically the same .

Ill say this, Maybe we have an oversold market with the ability to rally yet we are in a cycle that says lower prices still probable.

Tax loss selling into year end, the new administration concerns , Brexit and the EU are the news/fluff . the cycles dominate and the market bottoms next year .

Gold still has another 100 bucks in it to the upside . the gold stocks , xau and hui have not moved all that much from where I went long on sept 14th .

That’s all I have to add for the next week.

lets see how this up coming Tuesday market action is .

some kind of high and then sideways action.

we are closer to the end of this bearish cycle than most realize in terms of time then most realize

Peter T – I used to be able to see replays of the Chart Show once I got re-directed to a site. Somehow it did not work this time. Would it be possible for you to send me a link for the Chart Show in an email and I can try again.

Wow – this market is having a tough time managing even the smallest of bounces.

Great Chart Show Peter T – made it a great trading day for me today !! Covered 50% of the shorts I had set today morning on the back of Peter’s call. Seems like this full moon tomorrow will be a very big deal.

covered all short positions

will wait for the weekend to dig into the internals of the market.

I covered all the shorts as well. Tomorrow is a big unknown with multiple option expiry dates and full moon.

Joe – Are you still looking at the Jan 4 Solar eclipse as an important turn date ?

I have 3 cash dow downside projections

the levels being 21847.80, 21657.41 and 21560.23 .

the 21560.23 is the key as I see it .

Todays drop which poked below 22729.52 and then turned back above it

will give a buy signal ( short term ) on a close above 23075.17

there is still more downside action coming in my opinion yet …..

this present minor cycle should have produced more of a pause / rally

which so far has failed to show up .

the Jan 4-6th time frame as a cycle low has been my thinking for a very long time

as is the jan 20th date .

Covered my short positions only and at this point I have no intention to take any bullish trades .

Ill decide this weekend .

there is a top to top to bottom count which hits on dec 28th . mars Uranus cycle low due jan 4 and the lunar eclipse due jan 6th .

this places the dec 28-jan 6th time period as important .

the jan 4-6th dates are very important .

The NYA is sitting about right in the middle between its C = A and where C = 1.618 * A . Im not a middle of the road type trader so I must allow for more weakness on the NYA .

It is worth noting that the NYA is Both good for market timing as well as price projections and fib retracements for major lows .

it has served me well over the decades so ill continue to follow it .

No comments from me until Sunday at the earliest .

Staying flat on spec trades .

enjoy your weekend and holidays everyone

Cash dow closing below 22729.52 technically is a bearish close with its next projections towards the lower levels noted above .

I am staying flat and will dig further over the weekend yet …. a bearish close is a bearish close.

thanks for the info vivek I had forgotten about option expiry .

ill look at maxpain on spx and see what that shows .

im out of here : ) its been a great ride down yet ….. part of this was a hedge and part spec . covering my shorts leaves me net long by default .

Peter T

I sent you an email to your inquires email addy.

subject being 1 oscillator to consider on cash Dow.

I hope you find it informational .

Happy holidays

Joe

And I replied already. You should have an email. Thanks!

Lots of 3 wave moves since the bottom yesterday. Another 40 point swing day in SPX coming up !!

NYAD yearly has gone negative (-3271 as of today’s market close)…it doesn’t happen very often…the last two times were in 1996 and 2007…

Thank you Peter T. for the target call on this wave down.

I was able to trade it with near PERFECTION!

Now for the bounce, then once more into the breach!

Have a great week-end everyone! :-))

Looks like we have an ED in the works here, so yes, one more up and one more big down.

Happy Holidays Everyone..Santa brought us some good trading! Thanks Santa :))

A new weekend blog post is live at: https://worldcyclesinstitute.com/a-dramatic-ending-to-a-sideways-year/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.