The Road Ahead

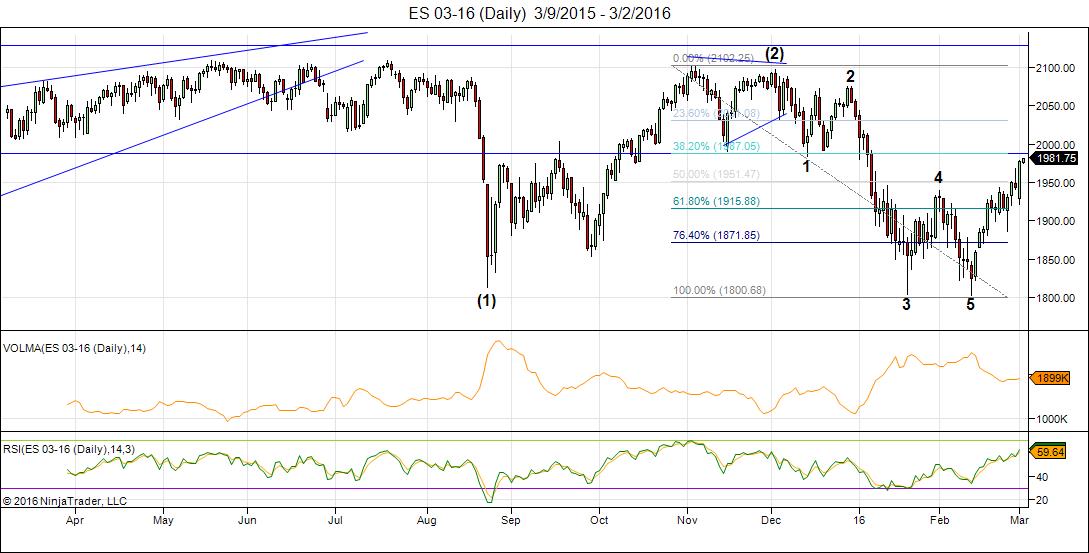

Above is a 3 day chart of the SP500 showing the road ahead. This would be the third wave of the first (of the third) down. You can can see the first and second wave marked. We’re beginning the third wave down.

_____________________

Update Friday, March 4, 9 AM EST (before open)

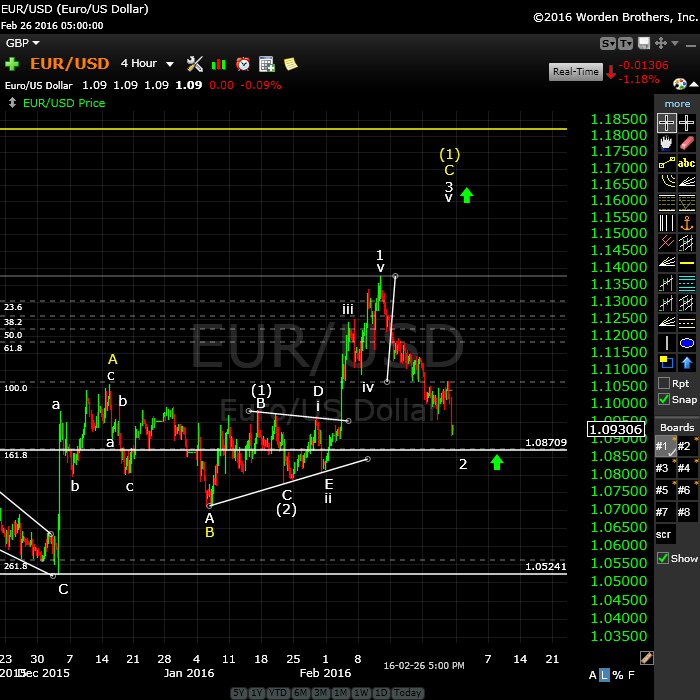

This is exactly what I was expecting. Eur/usd turned yesterday. It has now done one motive wave up in 5 waves and with the labor report, retraced 62% in 2nd wave. It’s poised to head up in a third wave.

Futures popped to a new high. For “pioneers,” I would wait for futures to either do a 62% retrace or a double top (more likely). Cash has to now get to the target and I’d expect that to happen shortly after the open. Then it should be down, down, down in both cash and futures.

USD/CAD should also head up from here.

_______________________

First Wave Down – What to Watch For

Tonight we’re dangerously close to a top of a second wave (in some cases, a 4th wave).

Let’s look at the SP500. When we turn over, we should drop like a stone. A good index to look at in terms of what motive looks like is IWM – perfectly formed motive waves.

The first wave down will be in 5 waves and will likely drop to about 1890 SPX (previous 4th wave). After that, we should get a second wave that will retrace in 3 waves to about 1958 (62%). That’s the preferred EW entry point. So don’t feel you have to rush in. There’ll be a much better opportunity at the second wave level than at the top and the risk is substantially reduced.

______________________________

Targets

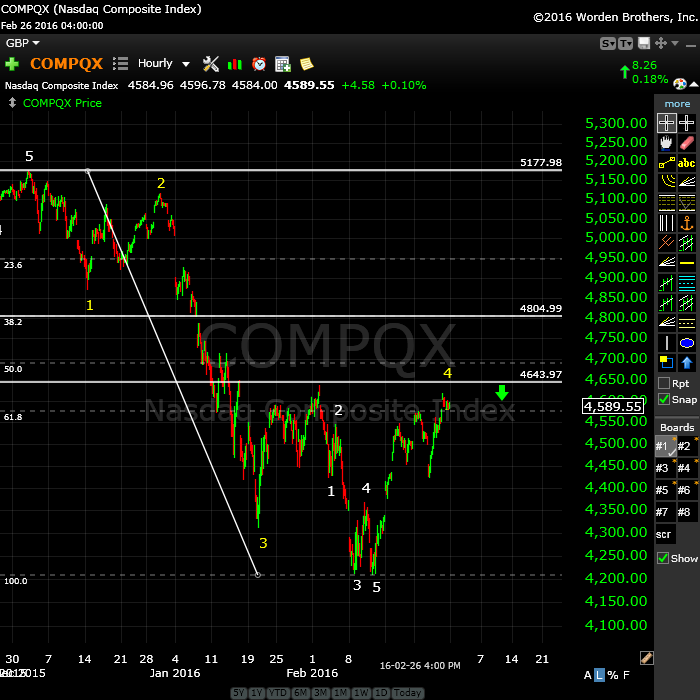

Here are the targets for the major indices as I see them. We’re on our way in SP to a second wave (62% retrace) while NDX seems to be focused on a 4th wave. Both turnovers lead to dramatic drops.

Keep in mind that they all have to get to their targets. The more bullish assets may exceed them, but the stragglers are the ones to watch. I’m projecting Friday morning as a most probable turn date. There’s a labor report due out an hour before market open.

ES: 1988

NQ: ~4367 (revised as it’s a fourth wave)

SPX: 2000

DOW: 17,005

SPY: 200

IWM: 110.19 (IWM tonight is at the 38% retrace level of the entire wave down). I’m not sure why that is, but it could be the turnover level for this index—we’ll figure out the numbering later.

NYSE: 10,000

GDOW: 2244

This is a corrective wave we’re in. There is nowhere else to go but down (after it gets this rally out of its system). As they might say in some US election campaigns … there’s is no path to a new high.

____________________________

Update Wednesday, March 2, 730 am EST

Here’s the daily chart of ES (SPX futures) I happened to “back out” the ES chart to a daily and found that it’s the best daily chart of all of them because it has a really clear picture of where we are. We’ve completed a full motive wave down (again the 5th wave is short and overlapping—could be an ending diagonal, but in any case, suggests this is a fourth wave). The large retrace we’re at the top of has now retraced almost 62% to 1984. However, the 62% market is at 1988, so this is not technically a second wave although exceptionally close.

The other thing that happened is that there was a bit of a “rejection” at 1984 and I’m sure this has to do with the fact that the bottom of the first wave is at 1983.50. So we’ve retraced into the area of the first wave but only by 50%.

This is important because if we retrace into the first wave, this wave up can no longer be a 4th wave; it has to be a second wave and that would mean a third is to come. So it still makes it questionable as to what wave we’re in. Perhaps we’ll get a better idea this morning.

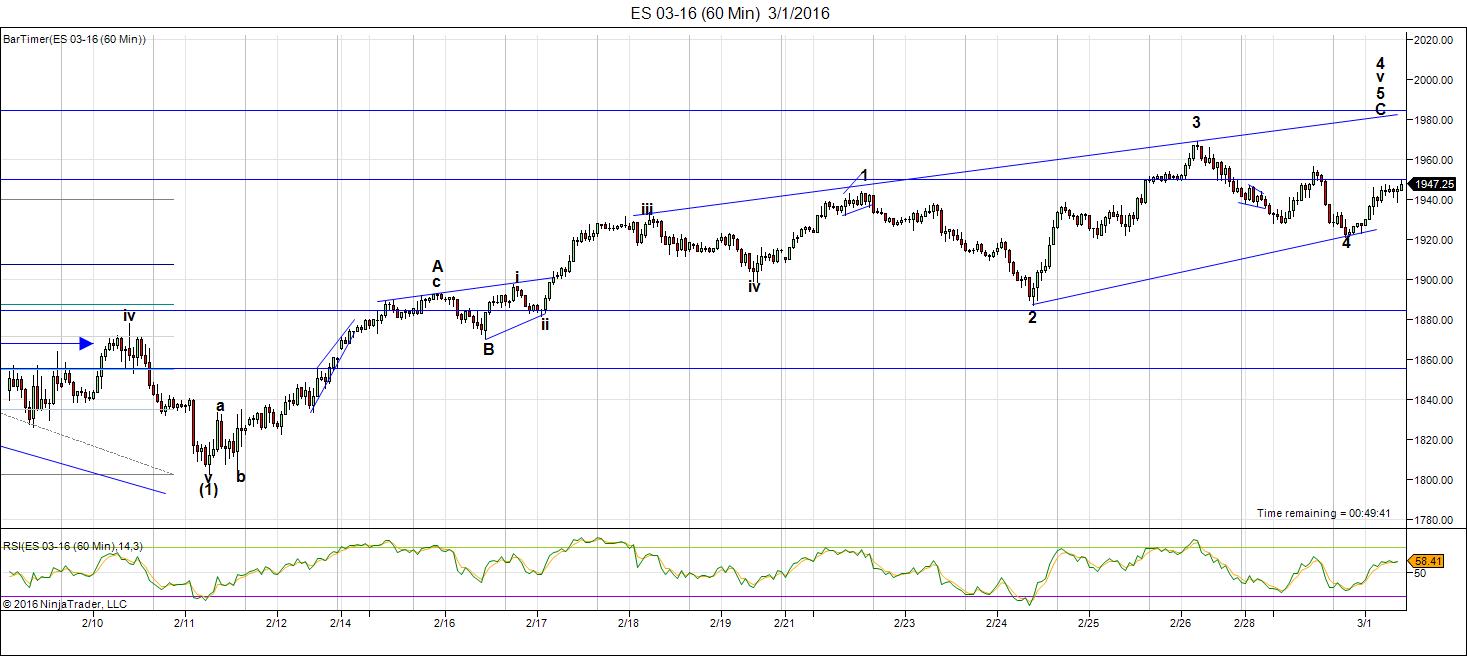

Above is the 60 minute chart of ES showing what we accomplished overnight. You can see the large ending diagonal. We appear to have done a small 4th wave in the last few hours and are poised to do the fifth wave up. Because of the nature of ending diagonals, I have no firm upside target. We should at least meet the upper trendline and usually we’d exceed it.

The DOW appears to have another small leg to go to hit the upper trendline. I also note that eur/usd may have bottomed (it still could spike down one last time while equities spike up, but it’s close to a bottom, nonetheless). USDCAD looks like it has one more spike down to go.

Note that I had a cycle turn date yesterday and there’s a stronger one of March 5, which is Friday. So there are a few options in terms of what happens next short term and I’m afraid I can’t offer much more insight than this.

If you’re looking for a stop entry, it would be just below the fourth wave, slightly below the previous high, at about 1967 ES.

Good luck!

__________________________

Update Tuesday, March 1, 12:15, EST

The 15 minute chart of the SP500. Now I’m seeing ending diagonals forming on all the cash indices (as well as futures). I don’t have upside targets for these as they generally exceed the upper trendline (they do a “throw-over) and end sharply. They can immediately retrace to the bottom of the pattern (in this case 1890 or so).

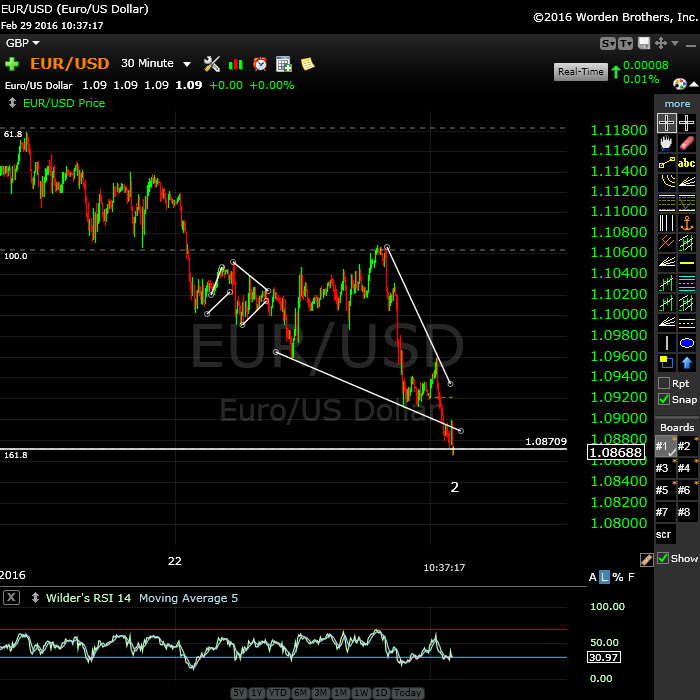

And here’s a chart of the euro (3o min) with it’s incredibly sharp ending diagonal that’s virtually at an end and just over the measure target (horizontal line).

_______________________

Update Tuesday, March 1, 10:15, EST

Above is the 60 minute chart of the final leg of ES. I am still counting one more leg up to go in an ending diagonal. The first wave down from 3 looks motive (the closer you get to a top, the more motive waves tend to look), but has a B and C leg down after it, which makes it a 3. There is an outside possibility, that we could just correct to the top of the B wave and create a double pronged wave 2 and head down. I think that a much smaller possibility as I don’t see another obvious option for the ending diagonal.

Currencies appear to be bottoming.

____________________________

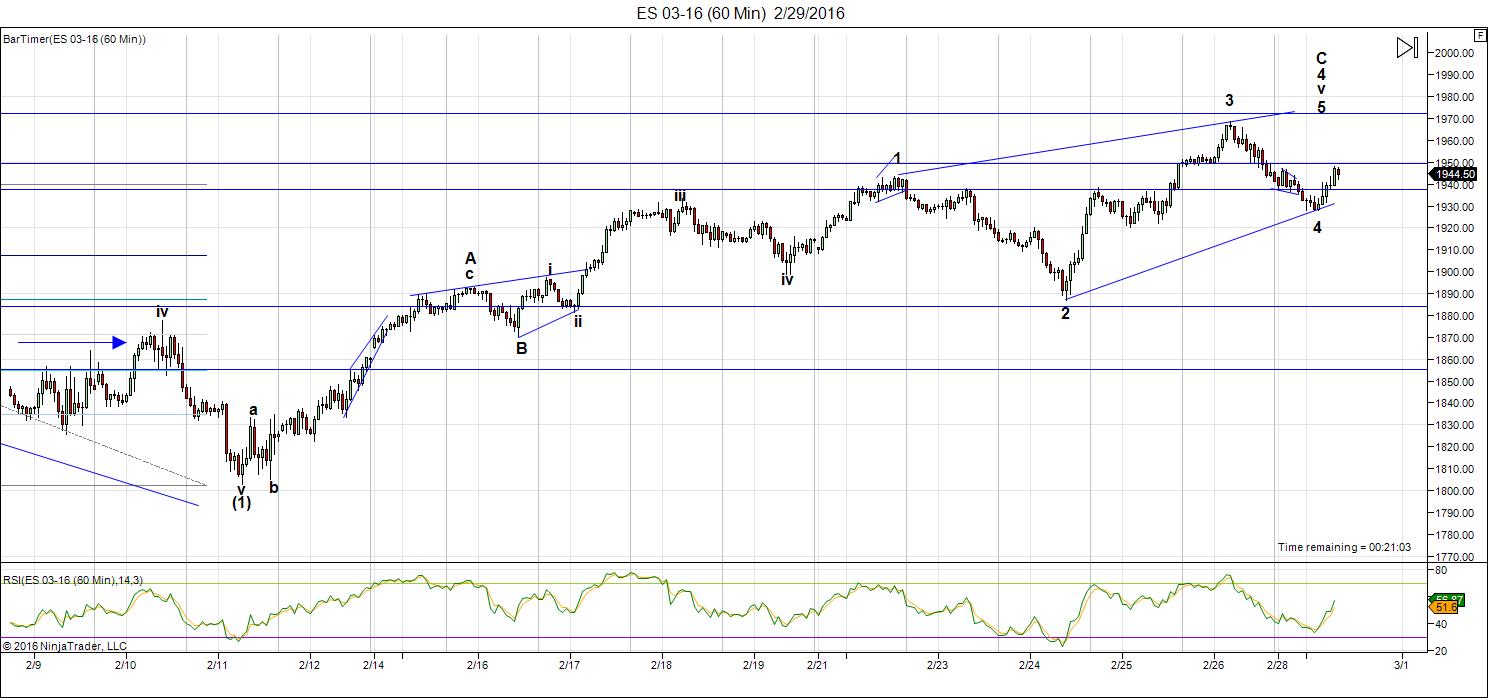

Update Monday After the Close, Feb 29

Above is the 10 minute chart of the SP500. We have a corrective (ABC) wave up in 3 waves. The C wave shows 5 waves almost complete. The horizontal line at 1935.72 is at the 38% level, which is a common retrace level for a 4th wave retrace. We’ve come down in a very clear 3 waves. Watch for a turnover if we reach a new high first thing tomorrow.

I now have a cycle turn date for both March 1 and March 4 for equities.

_____________________________

Update Monday at the Open, Feb 29

This continues to be the most brutal market I’ve ever seen (mostly in futures and currencies, like the euro).

Futures overnight completed an ending diagonal to the downside (as part of a wave 4 leg down) and now are completing what appears to be an ongoing ending diagonal to the upside. Above is the 60 minute chart of ES (emini SPX futures) showing the large ending diagonal. These things keep appearing at just about every wave end and it makes this market extremely difficult to call and trade. Be really careful. I expect a new top here but I don’t have an upside target, as ending diagonals stop when they want to and do a dramatic reversal. You just have to look at the euro from last night at about 3am EST to see the sharp reversal (below).

This last wave up should be in three waves. We are close to a major top.

Above is the 30 minute chart of the eurusd. It’s at the projected target I noted in my the video on the weekend.and putting in yet another ending diagonal. It also finished a smaller ending diagonal to the upside overnight and you can see the sharp reversal just above 1.096. I think we’ll see one more small spike up within the trendlines before a final leg down to a new low. Then everything should reverse.

SPX; My projection for the SPX hasn’t really changed. It appears to be in a final fourth wave. It’s come down so far in 3 waves, which means it should retrace to the top. It may come down a little further before it heads up.

___________________________

Original Post (Saturday, Feb 27)

Governments and Our Money—A Really Terrible Cocktail

Well, the G20 concluded and absolutely nothing happened, not that I was expecting anything. You can read about it in zerohedge. The market was likely expecting a lot, but now cycles have taken over, the mood worldwide has turned decidedly sour, and central banks are simply out of ammunition.

It’s absolutely scary when governments get their hands on our money, as they’ve had outright since 1971. Inflation has been rampant right across the world and now, of course we have the largest debt bubble in history on our hands. It will unravel in its own time (over the next 5 years or so), but it will do it in a predictable manner in the major markets … and Elliott Wave manner, with motive waves down for the first leg, then a large B wave, and a final drop to the bottom.

Governments have now destroyed our currencies, are in the midst of currency wars, and have no idea of the damage they are doing to international relations, which will eventually lead to another world war, even though its happened over and over again in history … yawn.

Can we do anything to stop it? Likely not, but we can take steps to get out of the road and ensure that those around us stay safe and sound while our politicians act like “children let loose.” I think the opportunity is to use this new resource (the internet) to help educate all those who want to learn the truth and perhaps the truth will win out.

I would also like to have some long term affect on the banksters continually stealing from us.

If you want to know more, this past week I happened across the very best explanation of the international monetary system, its history with gold, and how governments inflating for their own ends have destroyed our future. The world is in one hell of a mess.

It’s free, only about 130 pages, an easy read and from the Mises Institute. It’s entitled “What Has Government Done to Our Money?” I’ll add the link to the appropriate spot in the forum.

Global Cooling

If you missed my interview on FXStreet with Dale Pinkert, it’s here (and in the forum). He ended up calling it “Global Cooling,” although I had no idea we were headed in that direction.

The Gap

If you were with me in November of last year when we were watching the NYSE and GDOW trying the reach a 62% retrace level, you may remember my comments about all the major indices having to eventually reach their targets before they turn down en masse. Here we are again.

We’re so close to a turn down, but there are still some stragglers. The Nasdaq has not quite tested the previous 4th wave high. Neither has GDOW. IWM is just shy of the 38% retrace level (cents away), but yet we’re not going to turn until they get there. So stand by. It won’t be much longer.

For over a week now, I’ve been advocating we’re headed for a fourth wave top in the US indices and that the SP500 is about to drop 300 points. This is still my position. The count continues to support it. In fact, the entire market (currencies, gold, etc.) is supporting it. I look at a lot of charts when I do my work and, as I stated in a comment Friday (and have been saying since last fall), the markets are all moving as one. That being the case, it takes them longer to turn (because ‘the whole world’ has to turn) and head in the opposite direction at the same time. This is what I believe we’re witnessing now.

Full moons always elevate the psyche and this week, we certainly saw that in the blog. Let’s just keep our eye on the ball. EW analysis works. I’ve never seen it fail.

Summary

Here are the indices that are at the top of what appears to be wave 4: NQ, ES, YM, SP500, IWM, NDX, Nasdaq Comp, RUA, DOW, SPY, NYSE, GDOW, DIA … to name a few. Currencies appear to be at inflection points.

Stocks at the top of retraces: FB, AMZN, NFLX (wave 4), IBM, BLK

AAPL is in wave 4 of 3 with a long way down yet to go. So is GS (good!) There seem to be a lot of stocks in a third or 4th of the third at the moment.

Timing of the turn: I note that we have had a major turn at the beginning of every month since September of last year. Wave 4 came down in two weeks and it’s rallied to this point for the past two weeks. The time factors should be similar. We’ve completed 5 waves up in the most recent wave. 5 waves denotes a wave end and a trend change.

My Availability

With that in mind, I will answer blog queries if they ask reasonable questions and don’t make me guess what asset you’re talking about, or suggest that I go and do some work looking up old information. I’m here to help understand the market, and more than that, have a dialogue about the larger implications of the meltdown we’re in (on the world, and you) in general. That’s what the forum is for, in particular.

I’m more than willing to give of my time and knowledge in understanding Elliott Waves and how cycles affect all aspects of our lives, but quite frankly, I get tired of the comments suggesting I have no idea what I’m talking about. Save them.

I will likely be available less frequently during market hours, as my book is getting further behind and I must get it finished. Distractions must be put on the shelf for the moment. I will answer what I can after hours.

That you Wouter for stepping in and attempting to bring back some sanity while I reviewed some charts.

The video this weekend focuses on the tiny gap that still exists between our target in some indices and where we left off Friday. I’ll also post a couple of pertinent charts below.

Here’s a video overview of the market as at Saturaday, February 27:

Market Report for Feb 29 |

_______________________________

Here are some pertinent charts relating to “the gap.”

Above is the one hour chart of the Nasdaq. You can see that the 4th wave (yellow) is sitting just below the previous fourth wave high. It’s one of the “stragglers” I was talking about. It has the straddle the gap. I expect it to get there sometime early this week. The downside target once it gets there is 3611.

Above is a 2 hour chart of the NDX (largest 100 stocks in the Nasdaq). It has a very clear motive wave down from the top of the market. It shows that we’re completing wave 4 and should head into wave 5 down shortly. We need to reach the previous high just above 4300.

Above is the 4 hour chart of the Nasdaq. The horizontal line at 1.08709 is the 62% retracement level, which would represent wave 2. You can see the existing gap. We need to get to the 62% line at least before turning up into a third wave of the C wave up.

Above I’ve drilled down to the 30 minute chart of the SP500, so that you can see the wave structure. The final wave up is in five waves (subwaves) and a larger 5th wave up to a new high is needed to finish off this wave. If we measure wave 1 of that C wave, 1.618 right now takes us to a double top with the existing wave 3 high on the chart. The horizontal line at the top of the chart represents the 62% retracement level.

The downside target for wave 5 is 1620.

Good trading.

Gold and Silver are performing as I mentioned back in November…

Fun to see this unfold! I can’t wait to see the public reaction to a $5.00 up day in silver.

A post I made elsewhere…

This move in gold and silver right now is remarkable. PM’s were real strong this morning (3/4/2016) and when the stock market opened up gold and silver lost all of their strong gains and gold even went from up $20 to down $5.00. Then the market reversed to the downside and gold and silver climbed right back to the previous highs.

Here is what is interesting. Are we right now arriving at the point Martin Armstrong mentioned? That is the “slingshot” move in US equities because of the global flight to quality. Why is it that the stock market reversed strongly from down to up and instead of getting weak “again”, the metals are accelerating even higher.

Surprisingly bitcoin is languishing at $419…

There is so much more happening right now with China / currency / Korea and nukes / bank derivate awareness, etc.

Amazing..

Peter,

ES now around 2005

First target around 2010 , I do not think that will stop the rise for long ,

Next target around 2033 , which I feel will be the TOP

AZ

You might be right AZ, I think we need a final push on Monday. 😉

Cheers,

W

We have a very possible 5 waves down in ES, YM, and SPX. The wave lengths looks correct. However, I think it’s 3 down in NQ and it didn’t quite make the previous. So we should either have a final trip up to the top, or a turnover at the 62% mark.

Yeah, that pretty well nails it. ES should come down to 1994 before the retrace, I think.

Sorry, 1984 on ES – the the bottom of the previous wave up.

Unless this is not a first wave, but it’s looking good to me.

I don’t know what this rally wave is. It could be wave 2 but I expected a longer first wave down. The wave down looks motive this rally looks corrective.

Now I’m thoroughly confused. Not what I expected. The bounce now could be motive. Being a Friday afternoon makes it even more confusing. Maybe we have to do a double top. I can’t see us completing a third wave down on Sunday as that would leave a large gap. So I’ll wait to see what happens next.

I have been keeping an eye on eur/usd and while it’s done one motive wave up and a valid second wave, the wave up after that is in three waves. So my thought is (has been all day) that eur/usd has to correct that 3 wave move, which would mean that future would likely have a wave up at the same time.

The wave down in equities and futures looks motive, although the final wave is in three waves (the typical ending diagonal we see so often). I don’t think we’re quite finished topping, even though everything seems set up for a third wave down. This is the strangest market (the influence of the dollar seems to pop up again and again).

Thank you Peter. Maybe, we’ll have a manic Monday to the downside then turnaround Tues afternoon.

LizH,

That’s what I’m thinking. We’re poised to drop but there’s something holding us up. Disappointing as I was expecting follow-through. It started off so well. And we’ve had a triangle which forecasts a wave end and trend change. The resulting wave out of the triangle was just the right length and in 5 waves. The wave down is motive (except perhaps for the end, but that’s debatable). And everything retraced close to 62% (although that wave looks motive, so might be leading to end ending wave – a double top).

Seems logical to me. We’ll have to wait to see if the market thinks so. Also the cycle turn is on the Saturday, not really today.

I’ll do a new video on the weekend but may not have a lot to add.

have a change-in-trend on March 5/March 6 (this weekend)…daily charts for SPX, NDX, IWM, & VIX all signaled a change-in-trend today…the next change-in-trend is March 15/March 16…Monday could be interesting…

Yeah, virtually the same as me. No follow-through, so hopefully Sunday will clean up the mess in currencies so we can move on. 🙂

http://ibankcoin.com/bluestar/2016/

Hi Peter

my plan in a nut shell

Selling short the dow ( all based on cash price index )

selling short by 10 am tuesday pacific time .

208 minutes after the cash open tuesday to be as exact as possible ( id be careful yet that is the timing to look for a reversal down )

5 day adv decline line turned down today as the dow closed up ( bearish )

10 day adv decline line is still moving up , a sell signal will be given once

the 10 day adv decline line turns down with an up close on the dow ( probably mondays close )

the 10 trin has completed a 5 waves move and is now in the latter stages of an A B C

counter trend move as the dow is making a high ( the 10 day trin also close to giving a repeat sell signal )

the dow price range 17013-17218 range is key with an extreme i doubt at 17306.50

todays high at 17062.38 was just a few points below the equal point of from the

the aug lows last year to the sept highs last year . in a perfect world the 17066.11 level would have been hit by Tuesday ( thats extremely close for a time price match )

17 trading days aug-sept 2015 , the same measured from the feb 11 2016 low targets tuesday march 8th . and equal price time decline would be 991.06 points

down from what ever swing high comes. ( todays high satisfied price yet tuesday

10 am is still the target swing high date and time point )

using 17100 as a simple price point minus 991 points targets 16109 on the cash

dow . even if there is more bearish potential that is an extremely good downside

trade ( if the market just does what it did before when in this cycle last time )

bottom line : a high is due march 8th on the solar eclipse , the indicators are overbought and beginning to turn down . price is being satisfied at this time

and a down turn is now expected . the march 23rd cycle low date plus as much as 2 days is all that can be called for at this time .

a move from roughly 17100 down to the low 16000’s level is a fair trade .

breaking 16165 is targeted .

once we reach the march 23rd date i will re evaluate the indicators and most likely

be looking for a bottom with a trade able rally to begin from below 16165 yet probably closer to 16000.

Joe

Thank you for sharing Joe Im looking forward what the future will have in store for us..eu

Cheers.

Ty for the info Joe! Sounds good. 😉

Cheers,

W

Just to clarify my comments back on Jan 20th

my target prices noted above are based on what

i have seen take place since jan 20th 2016 .

I now have reason to doubt that we see new lows

in the dow below the recent lows and that the low 16000’s will be tested and hold

the wave labeling is a more complicated 3 wave move to the upside which

will end its momentum phase in late april ( march 23 low late april high )

the updates above and my original thoughts below which are still possible

even if i now tend to doubt it .

Typos left in on the below notes

Joe January 19, 2016, 9:42 pm

My Jan 20 th date is here 🙂

The question me now becomes the Jan 23 full moon and

Mercury turning direct Jan 25th . If the produces a pop

This the upside It gives clues that the full moon lunar eclipse

Can be a low in March 8th I believe .

That said th puetz Window opens the first week of February

My assumption at this point is the stock market is in

A bottoming process and if so the downside momentum

Is on the verge of ending .

Joe

the obvious errors in my notes are this :

march 8th is the solar eclipse

that makes the lunar eclipse march 23 a LOW

and inverted crash cycle

time will tell

Sorry peter

im consolidating my published notes from your site .

last of my notes

and its my way of staying grounded

the question is did the dow do what it should have and has it

followed the thoughts before hand

jan 20 last notes

Joe January 20, 2016, 2:06 pm

So Far this jan 20th turn date is showing some promise which is good

for me because it is a new method based on head and shoulders top formations i only recently discovered.

That said jan 23-25th ( the full moon and mercury turning direct is next )

what i need to see is a series of 1’s and 2’s which needs to look like

1 2 i ii , this could take until early feb to as late as march 23rd .

but the main thing is i need to see the counts .

today’s reversal as good as it looks is only 1 day .

if i see the 1 2 i ii set up then i would make the case for new all time highs

if i don’t see the set up then something else is taking place .

once this rally takes hold it is going to take a while due to these oversold readings .

the potential is a bounce in a weekly wave 4 into march 8 then down to new lows into march 23rd . either way i think we saw some sort of momentum low today .

Joe

Tuesday we will see earth conjunct Jupiter (helio). After the Venus-Jupiter conjunction this brings the strongest tidal pull on the sun. This is positive for markets. It’s just one of the forces; not dominant but it helps. Remember that the august 2015 low was 2 days from the 180 Earth-Jupiter opposition; 8/26.

Anyway: from Tuesday on we will be heading for an opposition again; the help will be gone. My tidal station gave a low (=high for markets) 3/2 in low tide 2, 3/3 in both high tides and 3/4 in lowtide 1. So from 3/2, gravity is growing stronger. Now all tides are up (=markets down) into at least 3/9 (low tide 1). As the latest tide turns 3/11, the tides predict a low between 3/9-11.

Price angle timing gives a range of dates between 3/1 and 3/6 with a stong emphasis on 3/1 and 3/6. It is remarkable how different indices give different timing. Dow jones gives 3/1, Nikkei give 3/3-5 and Dax gives 3/6. Only S&P gives 2 3/7 dates but the rest stays on 3/6 or earlier.

I calculated this timing purely on price. See how it confirms gravity?

We can clearly see the market was showing heavy divergencies this week, with the positive forces that I see terminating this weekend. Yesterday I showed 3/5 is a major 1929 date. So all the prices on every index were coded with this date. There is order in the universe.

Next week markets must go down. I can explain why it didn’t happen last week. But I run out of explanations for next week. The dive into 3/23 (low) can start.

Cheers,

André

Master timing is a different technique. It takes the dates of turns, and calculates the difference with the vernal equinox to get the time angle. This timing gave the strongest cluster 3/1 (consistent with the price angles on Dow Jones) and a second cluster 3/5.

Time is price and price is time.

Another way to look is to assume significant turns give signifcant angles. S&P on the 5/20 high gives 3/4. Nikkei on the 2007 high gives 3/3.

The square root method is yet another different technique that can be used on price and time difference. Let’s assume that we made one cyles from the 2011 low into the 2015 high. Calculating the number of days between the turns and using the square root method this cycle gives 3/5 on 180 degrees. The S&P 2000 high price gives – using square roots – 3/4 on 180 degrees. The low-low cycle from the oct14 low to the august15 low gives 3/6 on 90 degrees, The Nikkei 2015 high gives 3/5 on 0 degrees; so should be a high. The Dax 2015 high price gives 3/3 on 90 degrees, The NYSE 2011 low gives 3/6 on 225 degrees. So you can see that no matter what you look at, the same dates keep coming back. When you see this you can assume these are the real vibrations,

Cool stuff as always André, ty! So without my knowledge of astro, my 5-6 March dates and therefore 4/7 turndate wasn’t that bad. 🙂

@Joe, we will go lower, I agree totally with Peet and cannot see us NOT going lower as you said… 😉 Still thanks for sharing your thoughts. 🙂

Have a great weekend everybody!

W

recognize that it isn’t always productive or desirable to post links to other blogs…however, the number of astro related posts prompted me to reconsider…Ray Merriman made an interesting post for the week of March 7…

http://new.mmacycles.com/index.php?route=blog/article&category_id=1&article_id=66

New post: https://worldcyclesinstitute.com/down-for-the-count/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.