Steve Bannon as this revolution’s Thomas Cromwell?

I’ve consistently written about the world being on the cusp of major revolution that will bring about change that will be unimaginable to most. In fact, I was relatively sure that because of this cycle turn, we would see Donald Trump win the election.

I’ve consistently written about the world being on the cusp of major revolution that will bring about change that will be unimaginable to most. In fact, I was relatively sure that because of this cycle turn, we would see Donald Trump win the election.

My work researching cycles often focuses on the writings and extensive data left by Dr. Raymond Wheeler, who concentrated most of his life of drawing parallels between world events and climate change He had a PhD in psychology and the traits that he attributed to the top of this cycle strongly suggested that Trump would win.

There’s a “war” going on behind the scenes between the globalists (the international banking elites) and everyman – the serfs of the twenty-first century. Today’s serfs are the middle class primarily, who have lost the standard of living they have spent most of their lives building up. They are living off credit cards, are losing their jobs, and certainly losing hope. Once again, it’s the people against the elitists, the establishment, the money lenders. This has happened over and over again in history.

“It has been well known and documented for decades that the push for globalism is a deliberate and focused effort on the part of a select “elite;” international financiers, central bankers, political leaders and the numerous members of exclusive think tanks. They often openly admit their goals for total globalization in their own publications, perhaps believing that the uneducated commoners would never read them anyway.” – Carroll Quigley, Tragedy And Hope

This revolution is a financial revolution, just like all the other major five hundred year revolutions were. In fact, you can go back to Bible for the story of Jesus and the moneylenders to get a sense of how this underlying theme re-introduces itself about every 500 years.

History doesn’t repeat exactly, but it rhymes. What we’re seeing today, with the “populist” vote gaining power around the world has happened before, but in perhaps a different manner, often with bloodshed. With Brexit, with the rise of Le Pen in France, the financial subjugation of Greece, the election of Donald Trump, the riots beginning again in cities across the US, the financial problems coming to a head in Italy—all of these events are warnings of an international financial upheaval ahead.

In many of my posts, I’ve talked about the 515 year cycle. As Steve Puetz writes in “The Unified Cycle Theory,”

“This cycle greatly impacts social organization. New civilizations generally form 200 to 300* years before its theoretical peaks. Conversely, Dominant civilizations tend to decline, then collapse, in the 100 to 300 years following its peaks.”

* It’s interesting to note that the United States was 231 years old at the current top (Wheeler’s climate top).

I differ with Steve slightly on the specific dates of the 515 year cycle tops (we differ by one 172 sub-cycle). I tend to align the 515 year cycle with Dr. Wheeler’s climate cycle tops, while Steve places them one 172 year cycle later. In the big scheme of things, it doesn’t really matter all that much, but in the table below, I’ve listed the two dates for each major 515 year cycle top.

| The Major Cycle Tops (A.D.) | ||

|---|---|---|

| Cycle # | Wheeler | Puetz |

| 1 | 54 BC | 118 |

| 2 | 461 | 630 |

| 3 | 976 | 1148 |

| 4 | 1492 | 1664 |

| 5 | 2007 | 2179 |

What prompted me to take a closer look at this cycle top was the recent interview with Steve Bannon, who’s touted as the brains behind the Trump presidency.

Steve Bannon (1953 – )

Bannon’s position in the new administration is apparently, “chief strategist and senior counselor.” He’s been considered the mastermind behind the recent campaign and Trump’s messaging.

Bannon’s position in the new administration is apparently, “chief strategist and senior counselor.” He’s been considered the mastermind behind the recent campaign and Trump’s messaging.

But, he’s also been criticized as a result of his association with the Breitbart News Network, described as an “alt-right” leaning organization. The media has labelled him as a “white nationalist and racist.”

In his recent interview, Bannon said, “I’m not a white nationalist, I’m a nationalist. I’m an economic nationalist. The globalists gutted the American working class and created a middle class in Asia. The issue now is about Americans looking to not get f*cked over.”

He also said, “I am Thomas Cromwell in the court of the Tudors.”

Now, that last line instantly grabbed my attention. Why? Well, you know I like to talk about this current cycle top as a major revolution. In fact, going back 515 years, there was a similar revolution, The Renaissance and The Reformation.

Note that with Bannon taking office in 2017, it’s exactly 477 after Thomas Cromwell took office. So Bannon is just at about the same spot chronologically in this revolution as Cromwell was in the revolution of the 16th century.

None of this might mean very much unless you know a little bit about British history of that time. Let’s take a look at the role of Thomas Cromwell in the politics and economics of that era.

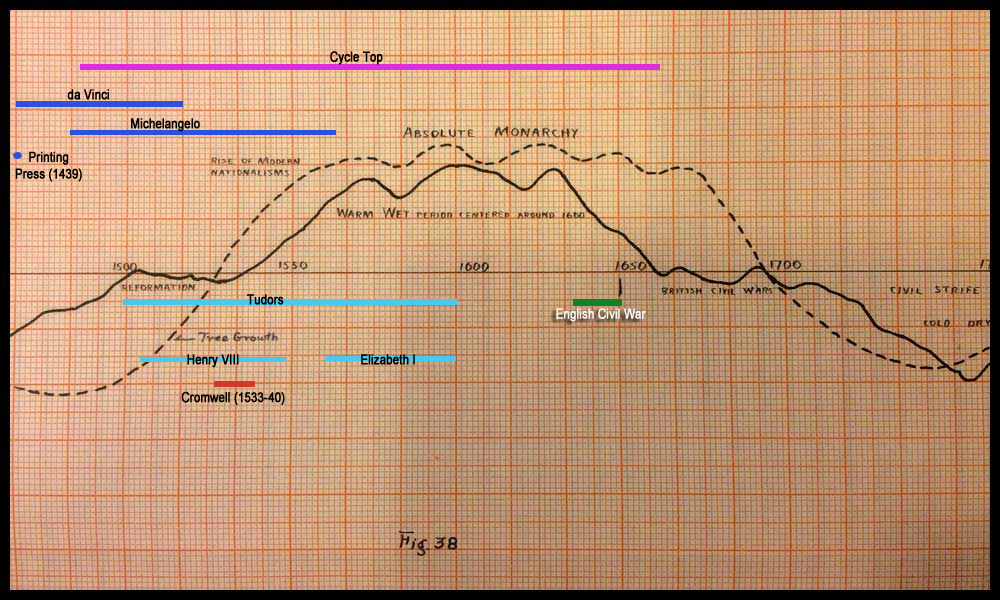

Above is a climate chart produced by Dr. Raymond Wheeler (in the 1940s) of the climate cycle turn at about 1600 AD. I’ve placed a purple line spanning the two cycle top dates of 1492 – 1664 (a total span of 172 years).

Notice that this top had an unusual warm-wet peak, but then turned dramatically colder at about 1630 AD. Warm-wet periods are “golden ages,” and you can see that the renaissance dominated this period, with the work of both da Vinci and Michelangelo playing major roles. The Reformation, which was also in full swing, made the period volatile from a social and political perspective. The Reformation was ushered in at the time of Martin Luther (1517) and Henry the VIII’s reign was a turning point for Great Britain in this respect.

When climate turns colder, however, it leads to civil war and in this case, that’s exactly what happened, with the English Civil War and many years of social unrest following.

Britain until this time has been Roman Catholic, but it was under the rule of Henry VIII that the Protestant religion began to take hold and it was Thomas Cromwell who was at the center of this dramatic change.

Thomas Cromwell (1485 – 1540)

Thomas Cromwell was in office from 1533 – 1540 under King Henry VIII and has been described as perhaps the greatest statesman Britain has ever had. But, while he rose to power quickly and became the king’s most trusted confidant, he met a sudden and untimely death in the Tower of London in 1540.

He began as a secretary for Cardinal Wolsey, but quickly rose to become the king’s most valuable advisor. He was known as “methodical, detached, and calculating,” not letting his emotions get in the way of this decisions. However, he was despised by the nobility, who were used to having the ear of the king. After all Cromwell was a lowly lawyer and his father had been a brewer and blacksmith, well known for his drunkenness.

At a time when the Roman Catholic church has been all-supreme, Henry VIII expelled them from England in favour of the Protestant church. That didn’t mean Henry was a Protestant; in fact, he wasn’t. He was an opportunist, who didn’t want the Pope controlling the people or his government and was more interested in the extreme wealth the church in England has amassed. It was Cromwell’s job to follow through on a mission to seize the lands of the church and sell them to the highest bidder, while at the same time, filling the government’s coffers.

The trigger for Henry that led him against the Roman Catholic church was a need for a marriage annulment from his first wife, Catharine of Aragon. However, the Pope would not grant his wish, and so he declared himself head of the English church.

This was fine with Cromwell, who realized that the Roman Catholic church was more interested in wealth and influence. It was also generally recognized as corrupt (a slight parallel with the recent financial clean of today’s church in Rome). So he was happy to work for the people and reform the church in England. Part of that reform was to legislate that taxes that were previously paid to Rome were paid directly to the government in England instead.

As he rose in government, though, he made lots of enemies, particularly among the nobles. He reformed both the government and church and built a bureaucracy of professionals outside the royal household. He helped usher in the first parliamentary controls but in the process, disregarded many of the wishes of age-old friends of the king.

Henry, during his reign, had six wives. And it was one of these wives that ended up being Cromwell’s undoing. He had been tasked with finding a worth candidate abroad and because the king was so picky, he contracted a well-known painter to produce portraits of each of the potential mates. A decision was made and Princess Anne (of German descent) arrived in England for the marriage.

However, their first meeting was a disaster, and the relationship didn’t get any better, In fact, it got much worse. But at this point, Henry had no easy way out. He told Cromwell to “make it happen,” however, which was an impossible task.

It didn’t take long for Cromwell’s enemies to make him the scapegoat. Misleading the king in those days was considered treason. He was arrested and very quickly ended up at the Tower of London. But there is a lot of confusion as to what happened next and how poor Cromwell ended up losing his head, but he did.

False letters alleged to be to Lutherans were found in his home and before Henry could get involved, Cromwell was executed, something Henry regretted for the rest of his life. Thomas was a victim of nobles and clerics—those who were out to get him because his was a commoner and fought all his life against the elite—the establishment of the day.

Bannon and Trump

This is the role that Bannon has cast himself in. He is working for King Trump suggesting that they are in an attempt to overthrow the establishment. The establishment are the elite of Washington and the international banking community. They are the globalists who have been getting richer at the expense of the middle classes all over the world. In the case of the US, these people would also include the Federal Reserve.

I have written about the key problem of the G7 countries today—the fact that, for the most part, their governments have contracts with the International Bank of Settlements who loan them money at compound interest. The vast amounts of debts that these western countries have amassed consists mostly of interest, which is paid directly to these European bankers. The money to pay this interest comes directly from taxation of the people. The money leaving each of these countries leads to deflation, and is what is going to collapse the stock market.

If this is the fight that Steve Bannon is alluding to, it’s the right fight, but it’s also a very dangerous one. Many have tried before and have failed. However, it’s the only way out of the current dilemma. Winning won’t be easy and we’re still going to get a financial collapse, no matter what. But the length and depth of the resulting very dark period ahead, ushered in by the coming depression, will be dependent on how quickly all these nations get control of their country’s purse.

And this is what caught my attention—when Bannon described himself as, “Cromwell in the House of Tudor.”

Cromwell – a more complete history here

Ending Diagonals

We continue to work our way through the ending diagonal.

Ending diagonals suggest a market that is extremely weak and barely able to trace out a new high. Although it falls under the banner of a motive wave, it has properties more aligned with corrective waves. Ralph Elliott described an ending diagonal as occupying the fifth wave position of a motive wave when the preceding move has gone “too far too fast.” He maintained that it indicates “exhaustion of the larger movement.”

Projection for a Top

Based on the ending diagonal we’re currently in (which is the pattern playing out in all the major US indices), I’m projecting a final top to our five hundred year set of Supercycle waves at the end of the 2016 year or into early January. I’m leaning much more to the middle or end of December than I am to January.

This past Friday (November 18) was an Andy Pancholi turn date, which saw all the major USD currencies turn. I expect this move to last at least several weeks and in fact, last until the top of the ending diagonal, which is also the top of this bull market and the ushering in of a very large move to the downside.

TruNews Interview

Here’s my interview on TruNews from Friday, November 11, 2016: http://www.trunews.com/listen/11-11-16-peter-temple-america-under-new-management

______________________________

Here’s the latest daily chart of ES (emini futures):

I’ve re-measured the potential targets for wave 3 of this ending diagonal, trying to make them as specific as I can. The top end for the 3rd wave is 2237 (where wave 1=3). The previous wave 1 high is 2184, so wave 3 has to exceed that level.

This will be followed by a smaller wave 4 down and then wave 5 to a final top.

Summary: We are completing the third wave of the ending diagonal before zigzagging to the top of the largest bubble in history. The long awaited bear market is getting closer.

Let’s look at a recent projection from the Trader’s Gold service.

Above is the daily chart of gold. Gold is heading down to complete the long-awaited B wave. The target looks now to be about 1170. We’re in a small bounce in a 4th wave and once that’s done, should head down to the yellow 5 target to 1170 or so. Then expect a turn up in a large C wave, with an upside target of around 1585 or so.

___________________________

Sign up for: The Chart Show

(Postponed this week due to US Thanksgiving)

Next Date: Thursday, December 1 at 2 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, and major USD currency pairs.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Good article. The main reason Trump is so hated is his threat to the elites’ power and wealth. However he is nouveau riche and so brash rude and boisterous. They absolutely detest him for that. How dare such a rube even be in a game with them, much less against them. How gauche, impertinent, rude!

12/29 Uranus direct. Could be important. Same happened 12/25/15. We know what happened then.

Andre’,

Please send me your email address. I would like to forwar you something!

Andre’

Forgot to include my email address…

Eddie0150@aol.com

Ed,

You can leave a private message in the forum. If you leave your email addres there I will certainly answer.

great update Peter

I’m liking your histocial format and how your tying the big picture

together

Joe

I agree, Joe. This is one of Peter’s best articles. Really nice how he effectively connects history, current events, cycles, and elliot wave in a well written survey.

Thanks, Valley. Special thanks to Mr. Bannon for making that possible. It’s not always so easy to make the connections, but this one was stunning imho. I find cycles fascinating but what I’m really looking for on a continuing basis is some of the science that gives me the link from exogenous waves (ie. those roaming balls up there in the heavens) to our little human brains … on a cause/effect basis …

WHUuuu?? …. huh…. i leave the house for a few “days” and all ‘bejesus’ breaks loose. We have Cromwell’s running rampant in Tudor houses – and weather forecasts which suggest that no one will EVER wear a “thong” AGAIN!!! obviously you all have had a screaming and insane “fun party’ whilst i was away – well my FOOT is going down -are you ready – “i am putting down my foot!!!”..be WARNED!

first – andre, this is the first time you have said anything concerning something “direct’ to uranus – what does that mean exactly?? i would imagine that on “full throttle” something “direct to uranus” would be like the WRATH of GOD!!

and peter……peter, peter ……pete – ‘R” – what am i going to do with you!!! …and what of the “internet”……. in Cromwell’s day – it took weeks on horseback from ‘spys’ within/without the realm to get word back to the ‘palace’ of the intrigue shaping the cycle of the day. Now its a couple of key strokes of 140 characters on Twitter, with a link to Instagram, and “boom” instant cycle……so can we say “cycle compression”?? :-))

so in closing – i will say the most important understanding known to man with respect to cycles is contained within the colloquial name of this plant…….. “Soleirolia soleirolii”

[for those too lazy to look up the colloquial name of this plant “Soleirolia soleirolii” is known as “Mind Your Own Business”!] :-))

Joe,

Do you happen to have a chart showing the 61.8% retracement in nationwide housing prices that you mentioned last week? Thank you in advance!

Hi Peter, thoughts on Dow Theory holding through the continuation of this ending diagonal, and whether it could actually diverge considering the significance of this peak? I’m sure you noticed DJTA this week. Thanks!

Hi Thomos,

I hadn’t seen it, as I hadn’t really expected it. I had thought transports would only retrace 62% and then turn down again. However, when I look at 2007, what happened is that transports peaked before the DOW and then came back and did a second top after the DOW had peaked. Will we get something similar here?

I’m expecting another wave down for the DOW (the 4th of the ending diagonal) and it looks like we’re in the midst of a fifth wave up on transports. That leads me to believe they may top together or at least very close together. Both would have a small wave down and then a wave up to a final high.

In any event, this looks like the final wave for transports. Thanks for bringing this to my attention. I hadn’t really looked at what happened in 2007 in that regard.

Peter, new to this school of thought and enjoy your unique perspective. Is it possible or even relevant to use your analysis technique for the ISM . There appears to be a strong directional trend line correlation between the ISM and S&P. Would be interesting to see if indeed the ISM and S&P “mirror’ each other and both are showing a significant correction followed by a longer downturn. Best regards.

Robert,

I don’t normally comment on individual stocks. If by ISM, you mean SLM Corp, then yes, it looks pretty much done. In a 5th wave (I can almost count 5 subwaves) and RSI expects a turn.

Probably talking about the Manufacturing Index.. J

Oh, yeah, the index. It doesn’t come up on my TC2000 system, but if I get a chance, I’ll go look for it elsewhere just to see. I knew those three letters were familiar, but I don’t ever look at that index.

Thanks, Jody.

Haha! Must be some of that Woodstock catching up to you.. Turn on, tune in and drop out right? lolol

Nope. My name is Peter. I will never grow old. It’s the fairy dust from Woodstock that’s part of the magic.

“All the world is made of faith, and trust, and pixie dust.”

🙂

My objective of SPX 2196 was hit.

I would think this would be about it, but am not ruling out up to SPX 2225.

I however would not test it long until then..

I am on the same page, don’t want to be long. I sold some puts on the VXX last friday and this morning for a strike of 28 that expires this friday. This is basically a play that volatility will increase for anyone not familiar with VXX.

I also see a trendline that connects the May 2015 peak and the August 15 2016 peak that is sitting around 2208-2210 on the SPX that i think could be a target. Maybe a Gap up tomorrow and reversal?

Yep.. Also connent a trend line from Oct 07 to Nov 14 and draw it across.. It is almost here…

PALS this week:

Phase: pre new moon, usually strong

Distance: post perigee, usually neutral

Declination: post North, usually weak

Seasonals: pre holidays, usually strong

Summary: Mildly positive this week. Will buy weakness Tuesday or Wednesday.

Bought back into market today near lows of day. All news is hyping this market and the Trump Economy, plus holiday time approaching makes me believe we will move another 5% higher by mid December.

Are you buying mid december options…

Hi Bill,

I am buying some seasonally strong stocks and will hold them until Monday. My options experience has been costly in commissions and time value loss so am moving to stocks for a while, until I have more precise entry and exit timing. =)

ed

I have a chart showing nationwide home prices going just slightly above the .618 retrace . I can’t post it from my phone and I’m currently off the Oregon coast , it’s a bit chilly out here yet it’s seasonal right ?

I use the k shiller data and put it into an excell spread sheet .

you can do a Google search for the link . it’s updated monthly with a 3 month lag , ( Jan data would come out in March-April as example )

not hard to find or plot, it just take time to set up is all .

I don’t think many realize the descrepency between individual home prices in different cities vs the national averages . in many cases the spread is huge .

Joe

Thanks Joe! I look forward to reading each and every post!

Peter

just info for you

a guy I work with has a fairly decent sized wheat farm

in eastern Oregon . they are close to bend .

no profit in last crop , cash price a couple weeks ago was

480 a bushel and he said break even was 510-520 a bushel

( I don’t remember the exact price ) I didn’t ask about the entire

year yet sounds like a bad year overall .

decent average yield is 90 bushels an acre .

yet yields can run from 25 to 150 an acre , good years bad years etc.

with this present cold cycle coming and the prospect of a la Nina

I am more than curious about a potential drought in the mid west

in the next year ?

additionally back in 1928 there was flooding in eastern Iowa .

we also had flooding in eastern Iowa in late 2008 .

I have not researched this a lot yet I do remember something about

flooding in eastern Iowa again this past year .

I still have my own model pointing to a change in direction which should be a low of sort ( based on the Dow ) for Jan 20 2017 and I see a potential time line for wheat in April 2017 ( which fits with Andre’s work )

I’m begining to think the grain markets , corn and wheat more so then soybeans yet all of them should be watched and researched for in depth .

my concern is obviously the US dollar and how it all must be thought through .

what really this comes down to for me is how do we get a decline in the economy and a rise in food prices with a strong us dollar ?

I don’t expect you to answer that but it’s the part of the puzzle I have yet to figure out .

Joe

Well, buddy,

I wish I had good news for you. Deflation always comes with depressions. That brings down prices for everything including food. My research of grain prices during the 1930s brings up some really dismal stories. Here’s one: https://www.edonline.sk.ca/bbcswebdav/library/materials/depression/depression/english/agriculture/worldgrain.html

In the 1930s, they used to regularly plow under crop as people starved. There was no money in it.

When it turns cold, the first part of the cold period is wet, and that’s part of the reason we have flooding all over the world right now. That should go on for a few more years, at least, I would think. But the larger over-arching cycle is dry and and time moves on, it will get much dryer, and I’m talking about the next 100 years.

So, it’s getting colder and dryer longer term, but it will take a few years to start taking hold.

The US dollar is going up. You can already see the euro tanking. This is just the start. The US dollar (reserve currency) going up is deflationary, so that closes up export markets for the US.

If you consider a possible La Nina, that just adds on one more negative an a bunch of other ones, so farming in not a profession I’d want to be in for the next century or so.

That being said, if Trump cuts loose from the Fed and the nation starts to print its own money, that could change the situation considerably. That’s the wild card, although even that is going to take some time. You don’t get money into an economy easily or quickly, even if you do have total control of it. The problem today always comes back to the compounding interest, which is sucking the money out of the economy (deflation) and sending it to banksters. And that’s happening around the world.

Peter,

Well said. I would add one other aspect that is currently a very big negative on a go forward basis, and if this could be changed would help us avert disaster. Regulation and tax policy. Socialism has discovered, with each turn of the screw, that it is not necessary to actually own the means of production to exercise control and manipulate outcomes. Regulations and Tax Policy work just as well, and are far more efficient; when their plans fail they can always blame the producers (and they are never at fault) and devise more control. Being involved in several companies of totally different businesses at an operational level, I can testify how destructive Regulation and Tax Policy are at the micro level to prices, employment, efficiency,… Efficiency would help a lot, but that would require giving people more freedom.

Also, I love your references to cycle points in the past, in this case the Tudors. Steve

There’s a book in my book list by Joe Tainter entitled, “The Collapse of Complex Societies” that ends up being one of the themes of these cycle tops. It’s one of my favourites and you’ve caused me to pick it up again, which is a good thing. It’s amazing to me as I look through it now, how each of the societies he researches tends to end at a 500 year cycle top.

I have to do a lot more writing, highlighting stories at the tops of each of these cycles, which is fun and fascinating. Thanks for the kind words and your insights, which I agree with.

Peter

this link is old history yet fits very well with

your work . with a read for those interested

http://www.bibliotecapleyades.net/ciencia/cycles/cycles08.htm

I have been chiming in with the Saturn in Sagitarrius stock market rally (mania) for several years based upon the 29.5 year cycle (80’s rally, 50’s rally, 20’s rally). Looks like the “Trump Effect” may be the catalyst for this tech fueled move. =)

Today I believe that the DJIA completed wave-a of wave-3 of the ending diagonal and is now set up for a 5-6 hundred point move to the downside. That would be a 38.2% retracement from the bottom of the ‘trump dump’…..at least on my charting system. If it gets to the 50% retracement then we are looking at a 8 hundred point move to the down side.

The main reason I think this is because wave-a completed with an ‘ending diagonal’ of it’s own.

It’s way too late to post a chart and I’ll ‘TRY’ to post one tomorrow (before my friend Luri ‘catches’ me out again) to show what I’m seeing.

ahh purvez [cough]

“i am standing right HERE!”….. i am the one with a permanent SCOWL on my chiseled Hollywood’esque’ face – well at least the hollywood hills’esque’ face – well maybe its more like a chiseled ‘san bernadino’esque’ – ok well , maybe its more like the LaBrea Tar Pits kinda chiseled ….bottom line purvez ..ahhh “i am standing right here!!”

Oh OK then it’s Thanksgiving and I need to do my bit so here’s the chart.

https://postimg.org/image/42tjrot43/

luri hope you are taking notes that I can still provide charts after my ‘xth’ bottle of wine.

lol – i beat you because i CARE purvez!!!

so that chart looks an awful lot like the electro cardiogram output of a ‘heart attack’ victim. Me thinks you were watching a rerun of an episode of “GREY’S ANATOMY” , with a full on case of vino hooked intravenously into your arm — now are you COMPLETELY 100% SURE of your wave count. What if this is IT? what if Nov. 29th will be engraved into the history books as the BIG ONE!! [24th is Tofu Turkey day, and 25th is holiday trading].

what if your ending diagonal of “A was the final and only ENDING DIAGONAL the market decides to give? what if lions layed down with lambs and smoked pot together!!! sorta fuzzy bunny, meets white rabbit – huh purvez?? “what if purvez!!” [cough] :-))

Weeelll, if all these ‘what ifs’ are going to happen in the market then either andre is going to have to change his Nov 29th date or the markets going to have to do some serious gyrating over the next few days. …And you know how ‘stubborn’ andre can get about his dates. LOL.

Either way it can’t be ‘My fault’. OK? OK!!

ahh Purvez –

purrrr — yeah – ITS YOUR FAULT!!…..i fell down and cut my knee — yeah ITS PURVEZ’S FAULT!…… oprah winfrey is clinically obese – yeah that’s purvez – its his fault…..the cycles of man inexplicably stopped – you guessed it, “purvez” he did it!!

happy thanksgiving “P”

ALSO – i give thanks to you purvez for your good humor, and AS WELL i give thanks for everyone here in this forum – and Peter, although you are in the arctic circle of humanity up there in calgary – i give the greatest of thanks to you!

luri, you can lay EVERYTHING ELSE on me….BUT NOT THE MARKETS. It’s them Banksters and other degenerates (yet to be identified) out there who are making mischief.

But WE will TRIUMPH!!…..one of these days. (NOTE: no calendar year stipulated)

Tanks, you.

11/29 is crash angle on 1982 low. First low 12/8.

Thank you andré :o)

Ok the Ending Diagonal is no longer valid on the DJIA futures. (Wave 3 (as I had marked it) became shorter than Wave 5 which is NOT ALLOWED.

So….I’m back to the drawing board but no alternative plan yet.

Waiting and watching…..with drink in hand. LOL.

p,

this is a “terminal” blow off you are witnessing! the RUT is up over 10% as compared to the NYSE Composite Index. that has happened ONLY once in history – a few weeks before the Nasdaq bubble popped. in my projection – this IS the terminal blow off!!!

luri, I DO HOPE SO. I’m tired of this infernal ramp…..I think I’ve said this before ‘somewhere’. Difficult to keep track off after all these ‘night caps’. eh!!

l,

Jeez … it’s loud in here! Nothing to do today? Earlier, you could hear a pin drop and I was thinking, “Oh good, turkey day in the US, they’ll all be stuffed and sleepy and I’ll get some writing done …” Delusional me.

Well, it is part of the blow-off, but not the entire thing. More to come, likely slowly, drip-drip-drip until we get closer to the new year, is my guess. And yeah, I went through RUT, IWM, IWV .. all ballistic. However, you can go look at NYSE, which isn’t even at a new high for this wave. I think the most likely cause is the ushering in of more liberal maryjane laws in how many states …? We’re up here just talking about liberalizing the law and yet I can look out my window to the south and all I see is a big plume of smoke.

Anyhow, currencies still have a ways to go and the dollar has a reversal to do, so I’m afraid it’s a little early go bogart that joint. I still put us in the third wave (said he from pristine, cool, (a little too) green (cause of the idiots and their carbon taxes), Alberta).

Oh, tell that buddy of yours (Purvez) that “eh” is a distinctly Canadian word and if he can’t produce a valid passport, I may have to restrict any comments in which he uses it without authority ….

so peter, are we talking an “EH” ‘trademark” infringement LAWSUIT against purvez?? wow purvez, i would suggest you reach into your pockets now, and hand over the keys to all your worldly assets – you be gettin’ SUED!!! oh yeah!!!

and remember – we BEAT you cause we CARE!! hehee…..

Yeah, and there’s at least 5 of us up here, two with skis on!

I’ll have to watch my ‘vocabulary’ from now on. LOL.

purvez,

for me i see the following – a 16 year broadening type pattern.

http://invst.ly/2tvzr

i have been waiting to see the final move of the pattern to “fractal” the larger one –

http://invst.ly/2tv-p

but nothing is as clear with respect to a terminal price thrust in a broadening pattern as this in the RUT. i have been trading on this pattern since late 2014.

http://invst.ly/2tw38

Yes luri, many have been watching that pattern too, including me. In the DJIA I’m expecting a move down to at least the sub 2000 range when it finally bursts. Hard to imagine that and even crazier sounding in print.

gold appears to be dropping with these bear cycles

Yet the Dow ? I’m thinking the 19600 range

anyone watching news on India ?

Joe

Solarham.com shows elevated geomagnetic levels, this may imbue market with more volatility on Monday (moved to cash mid day Friday). Next week PALS features really negative distance (apogee week), and declination (far south week); yet really strong seasonals (end of month buying) and phase (new moon). My guess is market sells off Monday and or Tuesday.

Not much to add. 11/29 is a crash date. And a pretty strong one. 11/21 should have given the turn (Saturn) but other cycles gave 11/29. Basically, 11/28-29-30 are all strong. But 29 is the strongest. Tomorrow I’ll give some arguments.

After Tuesday the first low is 12/8. This is a very strong date. Next strong date 12/15 (high), 12/23 (low) and 12/29 (high).

12/29 is a very strong date but everything else is down. So I expect a lower high.

Strongest dates in between are around 12/1 and 12/4-5. This will cause the abc down move.

Cheers,

André

Hi André,

When you say, for example, 11/29 is strong, does that mean thar particular date is bullish? Or the market is strong in terms of magnitude either up or down? Thanks in advance and if you don’t mind, may I ask if you use Twitter?

something to consider

we are in what has typically been a bearish stock market

and yet price has been rising for the averages .

any drop going forward would most likely be a retrace of this rally

that has unfolded since Feb 2016 . sure the drop can be a strong one yet

the cycles then turn up once we hit the cycle low date of Jan 20 2017.

to me this implies much much higher prices into the next cycle high which is due between Oct 2017 and mid 2018 .

gold though is following the bear cycles so I’d expect a low on or near Jan 20 , whether it’s a new low below the 2016 low or just a test I don’t know .

the cash Dow going above 19600 targets the 23000-27000 range and above 27000 targets 38,610 which is coincident to 100 times the 1929 high at 386.10. <—- imagine that if it happens .

the year 2017 minus the year 1929 =88 years , the year 2018 is a fibonacii 89 years . 1987 low to 2002 low was 15 years and adding 15 years targets Oct 2017 as a low to low to high count .

the 1920's rally lasted just over 8 years ( forget exact days weeks months ) March 2009 plus 8 years and 7 months ( 8.6 yrs ) = Oct 2017

Joe

The blog post for the weekend is live: https://worldcyclesinstitute.com/the-words-of-dr-wheeler/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.