Not Much Left to Say

Not Much Left to Say

I’m expecting an imminent downturn in the US indices, and just about everywhere else.

The small fourth wave from the week before last took 5 days to the downside. I predicted that the fifth wave up would take a similar amount of time, projecting a top either this past Friday or that it could last into Monday. Here we are.

Look for a turn down very early in the week (if we haven’t topped already).

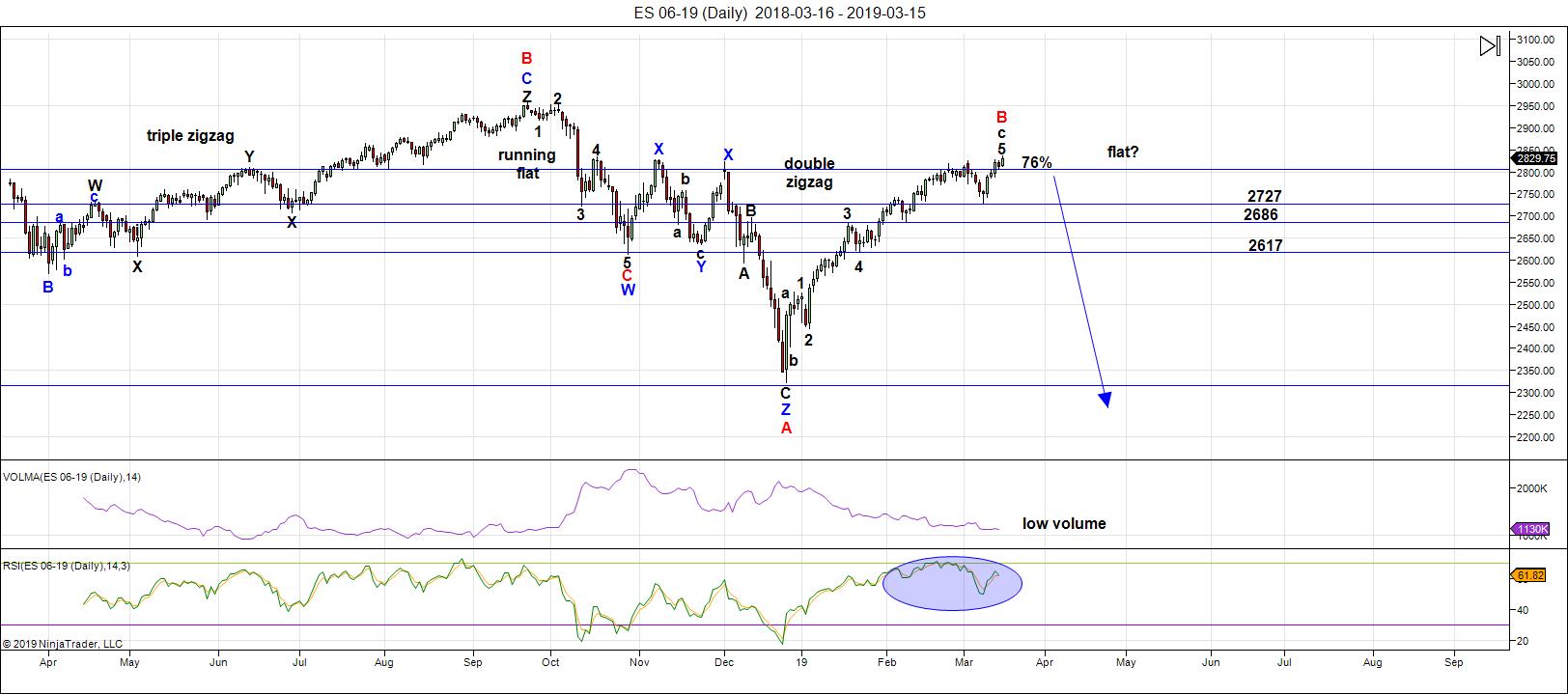

Above is the daily chart of the SP500. (click to expand)

I’ve labelled a possible flat in progress, showing a purple circle A, B, and C label on the chart. The C wave target is shown at 1.618 X the purple (A) wave, but the guideline is that the C wave can extend to 165% of the A wave.

The pattern to the downside can also be a set of zigzags. Less probably options are a triangle, or an ending diagonal.

The count on the upside is complete. Currency pairs are been oscillating up and down for weeks, as has oil. The US Dollar Index has retraced 62% of the previous wave to the upside and is ready for a turn up.

Everything is lined up (or almost lined up) for a turn. It’s now up to the market to follow through.

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We're still sitting near the top of a B wave that's risen to about the 76% level of the height of the previous set of waves down from the all-time high at October 3, 2018. Almost all the other assets I cover on a daily basis are hovering at inflection points. The "greed factor" is elevated as we've all but finished a small 5th wave up to a new high at about 2836.

The next major move is to the downside.

After a fourth wave down last week, this week, we tracked a small fifth wave to a new high. I'm unsure of the short term direction (whether we have one more slight high to go) but other than that, this corrective pattern up is done.

As I've been saying, the wave up from Dec. 26 is clearly corrective and, as a result, must fully retrace. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

Summary: My preference is for a dramatic drop in a C wave to a new low that should begin this week. The culmination of this drop should mark the bottom of large fourth wave in progress since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 27 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Thanks Peter! Appreciate your work…

Hi Peter and friends

this weeks energy chart certainly has a downward bias

the past two weeks energy flows trended very nicely

with the S&P. Remember the energy from the Sun can’t be manipulated;

it is what it is, but markets can be man-i-PPT-ulated.

https://ibb.co/xjfbkwK

Thanks for continuing to post here, Tom. It’s good stuff. You know you have my support.

any updates for next week

Thanks Tom.

A most sage reminder of the fact of how price is driven.

Right now the CBs are clearly buying, and so long as they persist, the trend, however weakly, will remain up in the immediate term. There is now talk about the FED “announcing” an end to QT, so they evidently think the rest of us ate plain stupid. Lol!

Thanks Tom.

A most sage reminder of the fact of how price is driven.

Right now the CBs are clearly buying, and so long as they persist, the trend, however weakly, will remain up in the immediate term. There is now talk about the FED “announcing” an end to QT, so they evidently think the rest of us are plain stupid. Lol!

I still say 2880 is next stop..for SPX. Trend is ur friend..and as u pointed out..Mr Verne..that trend is up. Not many bears..and def no follow thru on down days..

Unless SPX breaks below 50 sma imma bullish as all giddy up..

IMHO we have at least another 3-5 weeks of this up cycle b4 another shallow pullback. imma targeting this Fall for a significant pullback. Til then up..up..she goes. Hopefully we hit my 2950 target b4 the summer!

I think 2875 is a magnet. I have no interest in fighting the banksters. Their pockets are so much deeper. At some they will unwind and no one really knows when they will. I am looking for a slice through both 2800 and 2700 to have confidence in a major trend change. The herd is so gullible who knows how they will react to some silly announcement of QT ending. If we close above 2830 the bull put spreads will be rolled up one more strike per the plan.

Trade what you see, not what you hope…! 😉

Mr Verne..looking highly likely we get to ur 2875 & my 2880 target sooner..rather than later. Bears have zero follow thru..all momo is to upside. Looking to add another round of calls tomorrow if we get a good set up.

Thank you Peter. Thanks Tom.

Here is a question for observant forum members.

The market lows put in last December exceeded the lows of Feb by almost 200 points.

Now take a look at the relative performance of VIX and othet volatilty instruments at the respective lows.

Have you heard a SINGLE comment, or read a single WORD about this ANYWHERE?? Lame stream media or otherwise?

I have spent a lot of time looking and I have not found so much as a single reference to what should have prompted every single person trading these corrupt markets to sit bolt upright and shout WTF!!!!!

My question is very simple.

Does anyone else on the forum think that VIX anomaly means what I think it clearly does? 🙂

(And no, you don’t need to know what I think to think the same!).

I have wanted to pose this question for months now but thought it would be a useless exercise. The kind of crap that passes for informed cmarket ommentary on most public forums these days is enough to make one loose their lunch.

There are a few smart folk here and I would love to hear your take!

Emily (‘@Eternity100000’ or something) chimes in here from time to time and from having followed her public Twitter account I bet she’d have a good opinion on it. There is a lot to be said about divergence.

I noticed that too Mr Verne..

..Feb 2018..UVXY went from $49..to a peak of $139..in 9 trading days

..Dec 2018 UVXY went from $47..to a peak of $88..in 14 trading days

UVXY shoulda hit triple digits..pure manipulation..good ole fashion hammer down!

When was the leverage reduced on Volatility related etfs, what that before feb 2018?

It was reduced for triply leveraged products ( svxy, uvxy) only after the Feb blow-up.

That still does not explain the VIX anomaly.

If it was JUST manipulation, something derisively dismissed by some despite its being as plain as the nose on our faces, I would be a lot less worried. I think it is a lot worse than that….a LOT worse!

I often find myself wondering if I am looking at the same market as other folk when I hear the statements they make. I keep wondering: “What in the hell am I missing???!!!”

Rolling up and reloading bull credit put spread to 280/281 strikes, and rolling out expiration one week.

One hour chart looks to me like consolidation ahead of a move higher.

Hard exit on any CLOSE below 2800 via closure of 281 short puts.

Waiting for the banksters to unwind…until they do, forget about shorting this.market if you want to keep your money…

2800 HAS to fall impulsively with 2700 closely following to confirm they are selling imho…

Agree with you whole hearted..we are in a strong seasonal time o year & imma not planning for any significant pullback until at least the fall..

My best guess is they keep rampin this up for a few more months..get evry1 all bullish then yank da carpet out..

Til then..buy dem dips!

Thank you, Peter, for continuing to present the *science* of Elliott Wave and for sharing this weekly update. It has helped me work through issues with the theory coming from other sources. Your generosity in sharing your expertise is appreciated.

🙂

If only there was a filter on here so you could weed out the theories that make no sense.

Bought some more calls @ open 2825..

Placing stop @ 25% gain

Almost..to 50% gain

Raising stop to 50% gain

Now near 75% gain

Hit 75% gain..

Closing in on a triple!!!

Put in an order @ 10..for a double

Out at $9 for 80% gain..not a badda way to start the week!

Figures theres $11..need to be more patient..some days!

I wish I had your “hueos” Sir Charles.

I too am trading the bullish side, but with greater caution…these banksters are more wily than Wile E. Coyote! 😁

Meant “Huevos”. But you knew that! 😊

Don’t you just hate that?

I also sometimes forget to SCALE out of winning trades.

You can end up leaving a lot of moolah on the table when you don’t!!

Yeh Mr Verne..took a quick 100% on some 2830 puts on drop below 10 & 20 sma.. Indicators on fire today!

That was a nice pop from the sideways cosolidation price action.

Rolled up half 281 short puts to 282 to widen spread by a point an trail gains higher…will roll up 280 strike to 281 at the close to reduce exposure if we gap down…

Nice gain on short 282 puts. Tempted to roll again to 283 but size of position makes a three point spread a bit risky. Rolling 282 back down to lock in gains and keep spread at 1 point. I don’t trust these $#$^&^#@ banksters!! 😁

Great work Mr Verne..i saw the breakdown coming on 5 min chart..perfect setup for 10 point drop..caught most of it!

Last bankster cash dump at 2818.25.

If they don’t defend 2800 goes in short order and I buy back short puts with a smile! 😉

VIX 14 could be the old 15 pivot

The quant guys think it is 15.

Intermarket divergence at new SPX high.

Let’s see if we get a gap fill and outside reversal day, although those seem to matter little nowadays….

So far, gap providing support.

Odds are the banksters are still buying and we are heading higher.

If we take out today’s high selling 283 puts…bottom’s up. The banksters are buying….lol!

Yes, they are… buying under-performance financials and R2000 early. We’ll see if they get burned or move markets further HaHa

It really is way too funny. It is hard for them to hide the unwind as the initial wave down decisively closes the gap higher when they do. Any bounce at the gap is an almost certain sign of a bear trap.

Amazing how shooting stars these days mean absolutely nothing, except that they will probably be negated by bankster buying, lol!

Yes, technicals are really pushed around right now. Divergence is not a trigger, but they continue to build. I am watching SOXX with interest as they are weak today after being pumped. I haven’t traded actively like y’all in a while… just managing my hedges and adding/reducing in skimming patterns. Let’s see where the next big move goes. Cheers!

Smart!

This market will chew you up and spit you out if you don’t know what you are up against… 😟

Fractured markets. Lone high with gap support in SPX, bear flag in ES.

Somebody’s a LYING!!! 😁😁😁

Yep, pushing hard on VIX since noon while markets flat with some upside. Who’s zooming whom 😉

Yep. They cannot go much higher with VIX flying a green flag. If price does, it presages a gap down in our future…

Measured move for ES bear flag still keeps price above 2800 shelf so it looks to me like they are spoofing bearish traders. They are very clever snakes…..

Selling 283 puts. I do NOT recommend this for novices.

Will defend the wider spread with an equally deep in the money bear call spread if they pull a fast one. You cannot argue with price, and the banksters are buying…! 😎

Peter T, thank you very much!

Wondering if Charles bought the pre-noon dip?

Also wondering if /es can hit Jan. 30 high 2856 before it does a significant reversal?

nah..made 80% on calls at open & another 100% on puts on drop below 10 & 20 sma..

didnt like the set up on dip..but woulda worked out for a hat trick! Cant catch em all..

Looking for 15% scalp on move higher. Need SPY 282.70 to hit target. Close but not quite there…!

Taking the 20% and running like a WUS! 😀😀😀

One never goes poor takin winners off the table..

Yeh! When they start filling open orders above the bid you know insanity reigns!

Setting up for another good short entry..if another drop below 10 & 20..close to a good entry..

Retraced 62% of drop..now heading lower..macd, rsi, bollinger bands..& stochastics foreshaddowing a decline..

Jus needs to give up the ghost..

Dang..stuck in da muck..& runnin outta day! Choppy is da word!

Not liking the setup..takin my chips home 4 day..though wouldnt b surprised if we get a sharp drop at this point..

They are NOT going to make it that easy. They are also watching the indicators. I am expecting a massive final ramp higher and my finger is on the proverbial trigger…! 🙂

Yep, pushing hard on VIX since noon while markets flat with some upside. Who’s zooming whom 😉

Yes, I watch LR 8 and 15 (linear regression) periods, started to set up on SPY but then QQQ popped. I’ll be patient…

We’ve been riding that 2828 SPX S/R line all day, looks like it’s deciding which way to go….

till it doesn’t 🙂

Hey Peter T,

You (obviously) don’t have to discuss this until Wednesday, but could this be a failed 5th from 3/8 low? Thanks for all you do!

Look for one more VIX smash down on the final ramp higher. They are going to have to employ massive leverage to drive it back below the top wedge boundary just around 13.00.

I am going to predict that if they do the rebound is going to furious with a gap back above…you gotta see this to believe it.

See how they turned that potential bear flag in ES into a manic ramp higher?

They are pumping full throttle…Yikes!!! 🙂

Yeh, potential bear flag now looks like cup-with-handle, ending diagonal HaHa!! Might as well sit back and watch the J Powell show…

on ~about lowest volume of year. At least I have some great cannabis stocks 😉

Anyone sitting on FB puts? The insiders have been laving like rats jumping a sinking ship. How long you think before the herd finally gets wind of what is going on in that rats’ nest? hehe!

I thought of it..but ya couldnt pay me to buy puts on any stocks & hold over night. I agree FB will have its day..sometime..but like SPX & NQ..still much more upside before..you know whut..hits da fan!

VX may be giving us a truer picture…take a gander at this morning’s gap higher…!

Should hit..2850 in spx this week..then 2880..then 2900.

Could hit a high of 2950 before this final leg up ends..then a 200-300 point pullback.

Above 2950 is all gravy but jus staying long one day at a time.. currently 25% long & using day trades to capture intra day set ups.

..From 2940 top..on sept 21..been 65 trading days to dec 26 low at 2346

..From 2346 bottom..on dec 26..been 55 trading days to todays cycle high at 2835

Should be at least 10 more trading days with upside trend..with min target of 2880 on Spx

Lest anyone think that today’s action blew above the important technical points on the Wilshire 5000 Index chart (remember the Wilshire 5000 contains EVERY actively traded stock in the USA) posted this weekend, here is the Eliades update today with one line withdrawn (the tops line from December 3, 2018) and one very important parallel channel added. You are welcome to refer this link to friends but please give attribution to Eliades if you do so. It is his chart. I think we can safely say this is the bear’s last stand. One more point, and it could be the most important of all. On Wednesday of this week, there will be a full moon AND a vernal or spring equinox within four hours of each other. For those of you who are believers in the potential influence of astronomical configurations (note the suffix -nomical rather than -logical) on market patterns (how can you not be!), I should tease you and ask if you know when was the last time a full moon coincided with a vernal equinox.. This full moon will also be a SUPERMOON full moon, meaning it is particularly close to the earth, and, further, it will be the 3rd supermoon in a row since January… It occurs less than 4 hours after the arrival of the March 20 equinox. This is a relatively rare occurrence. The full moon and the Spring equinox won’t happen less than one day apart again for another 11 years, in March 2030!! But listen to this! That means you, too, Mr. superbull, Charles… 🙂 . The last time they occurred coincidentally was… be sure you are sitting down……… March 2000!!!!!!!!!!!!!!!! WOW! Just found that out this afernoon… One final item of potential importance. In the initial post, there was a bottom to top to top potential cycle that pointed to yesterday on a closing price chart, 120 trading days. On an intra-day bar chart, the dates would be 4-2-18, 9-21-18, AND 3-19-18, a time span of 121 trading days, resolving tomorrow…

Here is the link to the updated chart of the Wilshire with the green major parallel channel added. Click on it to enlarge… there is room for slightly more upside tomorrow. https://imgur.com/a/dr973u2#mC1HIqV

Gulp..why u always gotta rain on me parade..hardy har ha!

I may be a SUPER..bull but I do pay attention to ur warnings Mr G!!!

But..doesn’t a flat have to retrace..AT LEAST..90%?

That would be 2880 on spx as min..me thought?

Peter G, the voice of reason…BINGO (https://tinyurl.com/y5u9qegd)…will email you a chart tomorrow morning that should make your eyes pop! in the meantime, Tuesday, March 19 (tomorrow) is a PD-1 pivot day (https://tinyurl.com/y3zyhjad)…be well!

Sounds good to moi!

Sitting on a mountain of puts!

Peter G,

Thank you for following up on your last post! I was just about to ask you…”Where to from here?”

Peter G

Thanks for the post .

im seeing a conflict between the dow vs the spx .

other than that I am happily long from the dec 26 open where I added

my positions in individual stocks .

I took a 185 pt hit the other day in the futures on the short side and stopped myself out .

2875.15 is the .886 retrace on the ES . the jan 2018 highs on the ES sit at

2878.50 . From my perspective this is the key resistance on the ES .

As for the dow I still feel the jan 22 lows should be tested yet if not ill be ok.

The questions I have are mixed messages between the 2 index’s .

Spx showing bullish action and the dow as far as I can see still looks bearish .

march 20 is the equinox and I have no opinion on that .

mercury retrograde ????? best I can say at this point is march 28th

mercury goes direct . look at what happened when mercury went direct last time in dec . Something is a miss with the typical bearish cycle ( even if short term )

Longer term I still see a higher market into at least aug 13th to possibly jan 10 2020.

A cycle low is due in late may early june .

id love to be short but cant justify it at this moment .

givng the mkt a few days before deciding

“im seeing a conflict between the dow vs the spx”…carefully reread Peter G’s post…then ponder your post (https://worldcyclesinstitute.com/direction-down/#comment-37372)…are you looking in the right places?

1929 + 89 (Fibonacci years) = 2018

https://tinyurl.com/y2erxyjz

have the indices taken out the 2018 highs?

Peter G

Thanks again for your insight regardless of where you heard it I will

do a bit of research . I remember shorting the mkt very heavily in march 2000 .

I must say I have learned a few things since then .

Anyways I appreciate your input.

MOJO

I cant speak for Peter T

Failed 5th is a myth

This is when full moons will occur in 2019, according to NASA:

Date Name U.S. East UTC

Jan. 21 Wolf Moon 12:16 a.m. 4:16

Feb. 19 Snow Moon 10:53 a.m. 15:53

Mar. 20 Worm Moon 9:43 p.m. 1:43

Apr. 19 Pink Moon 7:12 a.m. 11:12

18-May Flower Moon 5:11 p.m. 21:11

Jun. 17 Strawberry Moon 4:31 a.m. 8:31

Jul. 16 Buck Moon 5:38 p.m. 21:38

Aug. 15 Sturgeon Moon 8:29 a.m. 12:29

Sep. 14 Harvest Moon 12:33 a.m. 4:33

Oct. 13 Hunter’s Moon 5:08 p.m. 21:08

Nov. 12 Beaver Moon 8:34 a.m. 13:34

Dec. 12 Cold Moon 12:12 a.m. 5:12

march equinox

Year

Spring Equinox (Northern Hemisphere)

2019

Wednesday, March 20, at 5:58 P.M. EDT

Peter G

Just sayin , good work on your part

The last time the Full Worm Moon happened less than one day of the March equinox was 19 years ago, in 2000, and the next time will be 11 years from now, in 2030.

But that’s not all: March’s full Moon will also be a supermoon, meaning that it will be slightly larger than most of the other full Moons this year.

What an extra-bright way to greet spring!!

The downer to this as I see it .

Mars Uranus cycle was turning bearish in the year 2000 and its basically a 2 year cycle .

19 years is an odd number .

Mars Uranus turned bullish on jan 4th 2019 and points higher for the entire year of 2019 .

that said there are other reasons to consider this as part of a shorter term cycle

which still has some time left in it .

we will see soon enough .

While many will poo poo this .

the question I ask is are we now in wave 3 which much much higher prices left to go ???

id love to be short I just cant justify it at this point .

sticking to my thoughts above .

good luck everyone .

I don’t know squat about astro matters either “-nomical” or “-logical”.

I do lnow a bit about volatility. I have been an avid reader of the work of Chris Cole and Francesco Filia. I am certainly not brave enough to make any kind of prediction about exactly when Mr Market is going to do what, but I will say this much.

If what is currently going on in the vol sphere does not scare the H-E double toothpicks out of you you really are not paying close enough attention…

FWIW, we have broken above and back-tested the top boundary of a monstrous bullish falling wedge…and I mean MONSTROUS!!!

You can also clearly see a gap higher in VX today, green indices notwithstanding. Simple, at least for me, is good….

Rotrot

I believe I am looking at the mkt from many angles and yes im looking in the right place .

I am not discounting Peter G at this point though because his point is well taken .

he may be using the whilshire , Peter T uses the ES along with many other securities he follows and I look at the dow fairly in depth .

The 3 of us are coming to the same conclusion which is the mkt should turn down.

If I was to quote verne ( which I cannot ) he would say something along the lines of price is of the most importance .

Price being the most important , The mkt is always correct and it is us whop are right or wrong in the end .

If the heavier weighted dow stocks go back above their respective Feb 25th highs

( this is 16 dow stocks not the actual dow ) then id have to label wave 3 up in progress with much higher prices to follow .

RIGHT NOW, price has not proven to me that the dow is bullish .

I have an issue with such a shallow wave 2 .

my thoughts are the cash dow is in a B wave and the SPX or ES

I try my best not to comment on . This is Peter T site so I must respect that by

leaving my thoughts on the spx to myself .

Joe, would you agree that a significant stock market top occurred in the year 2000? if so, when did it occur? DJIA? S&P 500? NASDAQ? NYSE? WLSH? TRAN? rotrot

Year 2021

run the fib numbers in reverse .

2021 minus 21 as an example 2000

2021- 34 = 1987

2021- 55 =1966

2021 – 89 = 1932

2018 + 3 = 2021

2016 + 5 = 2021

2013 im not sure how it fits .

That’s a far greater correlation then just 1929 and 2018

and I post this just for your own further thought .

Welcome to 1929 ( I mean 2019 oops )

https://www.msn.com/en-us/news/us/nebraska-flooding-has-turned-towns-into-islands-now-more-areas-could-get-submerged/ar-BBUTR6A?ocid=spartandhp

what does flooding in Nebraska have to do with anything ??

its kind of close but not exact .

looking up flooding in iowa in 1928 or 1929

also look up flooding in iowa in 2008

as martin Armstrong says : everything is connected .

its all I have .

enjoy the week I have filled my quota 🙂

I should not post this yet who really considers all this stuff

mercury retrograde dec 2018.

Nov 17 – Dec 6, 2018 ( dec 24-26th lows ) dec 6 plus 21 days = dec 27

mercury retrograde march 2019

Mar 4 – 27, 2019 march 27 plus 21 days = APRIL 17 2019 <— LOW ?

mercury retrograde 1929

Sep 26 – Oct 17, 1929 ( nov 7th was a bottom ) plus 21 days

https://www.armstrongeconomics.com/international-news/britain/britain-hard-exit-or-cancellation-of-brexit/

After months of political deadlock, the House of Commons voted by 413-202 last week to ask the EU to delay Britain’s exit. Prime Minister May has simply refused to listen to advice and keeps hoping that Parliament will surrender to her. Normally, after such a defeat, Prime Ministers would resign. But May withstood a no-confidence vote last year and cannot be challenged until December 2019. If the EU tries to force Britain to surrender, then there remains the risk of a hard-exit come March 29th, 2019.

The EU is fighting for its survival. To see Britain crumble would bring them great joy and they could use this against Italy or anyone one else who dares to think about leaving. Indeed, in recent days there has been a chorus of warnings coming from the key EU figures. They are kicking Britain when it is politically impotent and they are demanding that any British request for an extension of the two-year negotiating period must come with a “credible” plan for next steps. This appears to be deliberately trying to force Britain to capitulate and remains in the EU as a second rate member at best.

The European Council president, Donald Tusk, has said the EU wants a “reasoned” request for an extension, while Guy Verhofstadt, the European Parliament Brexit co-ordinator, said there must be a “clear opinion” from the House of Commons on what it really will accept. The vote in itself won’t prevent Britain from a hard exit. Actually, under the law, Britain will leave the EU on March 29th, with or without a deal. What the Eu is now gambling on is that Britain will be unable to come up with any plan that they would accept so they hope the stark choice between a hard-exit and an outright cancelation of Brexit altogether will mean the EU wins with the latter.

British politicians are jncorrigibly stupid, or corrupt, and possibly both.

Of course the EU is going grant the extension as it has always been their game plan to thwart the will of the people by delaying UK’s departure, and keeping them in limbo for as long as possible. May is party to, and complicit in the deception. The people will have to revolt to get it finally done. The currupticrats at the EU have far more to loose from Brexit than the UK does.

They (UK) in fact have been running a healthy budget surplus since the vote despite all the lying reports of economic gloom and doom.

The banksters contiinue to pump ouf of sheer desperation that is bordering on full- blown panic. What they are attempting to do via vol suppression is beyond insanity; that at least could be understood, forgiven even. The news about the incredible evil perpetrated by the tech titans will soon reach the drooling sleepy masses. Losses there will rock both the NASDAQ and the S&P 500. How interesting that one of the DOW’s biggest components, BA, responsible for 30% of its 2019 gains to date, is in very serious trouble. I always wondered exactly how the cabal would loose control and that is starting to become clearer.

Nothing can stop what is coming….NOTHING!!!!!

The mercury retrograde cycle I have written about several times .

this present cycle is not acting in the same manner as normal or better put usual .

I have written about the puetz cycle several times and while im not going into detail

about this i just want to note that when i see a cycle fail or not follow the typical high percentage path ( or pattern ) i try as best i can to figure out that oddity for future cycles . The norm would be a cycle low right now and i cannot call this a cycle low based on anything im looking at .

The ES in my opinion has moved higher while the dow has lagged because of late comers who are not paying attention to what is going on yet are in fear of missing out . Option traders tend to focus on the SPY or SPX , the little guy trades the Nasdaq ( or crypto i suppose )

My bias is not extremely bearish at this juncture yet i have serious doubts the dec 2018 lows get hit on this pullback . The shock that comes ( if it comes ) im betting is fairly steep yet short lived . Late may early June i still favor as a tradable low .

The mid April date a mini crash type low .

All short positions i put on i intend to exit near mid april and my intend is to be short as a hedge .

The Wilshire 5000 Total Market IndexSM is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data. Named for the nearly 5,000 stocks it contained at launch, it then grew to a high count of 7,562 on July 31, 1998. Since then, the count fell steadily to 3,776 as of December 31, 2013, where it has then bounced back to 3,818 as of September 30, 2014. The last time the Wilshire 5000 actually contained 5,000 or more companies was December 29, 2005.

Joe..2000 and fib 13..2013 No?

I have done same as you forward and backward..2021 is one of the the most correlated dates with major turning point fib numbers dates 2018,2016,2013,2008,2000,1987,1966,1932

so I have been also thinking the major tp year will be 2021.

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all US-stocks actively traded in the United States. As of June 30, 2018, the index contained only 3,486 components. The index is intended to measure the performance of most publicly traded companies headquartered in the United States, with readily available price data,. Hence, the index includes a majority of the common stocks and REITs traded primarily through New York Stock Exchange, NASDAQ, or the American Stock Exchange.

I actually have been confused on how to trade this right now..so have been just sitting…logic tells me this should go down..and been sitting on cash..so tempted to buy in but afraid will get killed..my major cross for spx has crossed for a long term buy..but ……

All index’s are weighted to some degree .

so just because it has more stocks in the index it does not always mean its more accurate .

The big boys ( big caps ) can rule the day and the rest of the stocks can wither away

The Nasdaq 100 in late 1999 early 2000 had only 6 stocks of 100 which moved it in a big way .

The dow it changes from 6 to 12 yet at the moment its 16 .

Dig into any index you wish you will see this play out .

The spx is no different

Add in ETF’s

I cant say this is true but from what ive heard there is more ETF’s now then actual stocks that trade .

i focus on the dow because i can decipher it relatively easy .

Regardless of which ETF a person buys which ones hold the same stocks ?

which mutual funds hold all the same stocks ?

i don’t use mutual funds or ETF’s because i want to know what i own next week

and next month .

buying a mutual fund you do not know what you are buying .

https://www.fool.com/investing/etf/2018/01/08/are-there-too-many-etfs-paid-post.aspx

https://www.statista.com/statistics/278249/global-number-of-etfs/

I use the etfs for short term triple leveraged trades..that has panned out well….but agreed to own long term better to own the stock..

Martin also..is saying most of the brokerages will close once it hits the fan..

and that only way to keep money safe will be to hold hold will be with direct stock.in your name not the brokerage house…but who knows when that will be the can seems to be constantly kicked down the road…

don’t know if you guys follow PBR..but just broke 2016 high….

sorry typo….2018

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.