|

Upcoming Event: Dale tells me it will be 20-30 minutes at 10am. |

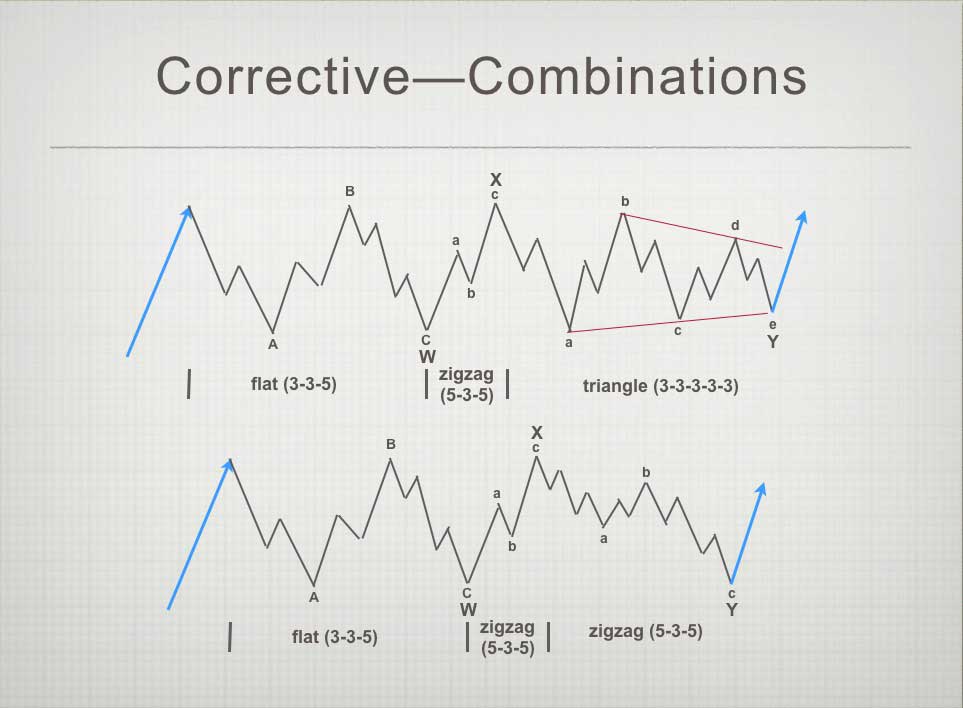

Fourth Wave Combinations

Fourth waves at this high level of trend typically form combination waves. What this means is that more than one Elliott wave corrective pattern traces out before the larger correction is done. The secret to trading it is to figure out each of the patterns before they’re complete. This task is make a little easier due to the fact that almost all waves have fibonacci relationships to other waves.

This weekend, I thought it appropriate to spend a little time on combination waves.

Above is a chart showing combinations and the patterns that make them out. The two combination patterns above are each referred to as “triple threes.” That’s because corrective waves form a 3 wave pattern overall and there are three corrective patterns in each of the two examples above.

Let’s look at the structure of these Elliott wave patterns that make up a combination. A flat is 3 waves (3-3-5), a zigzag is 3 waves (5-3-5), and a triangle (3-3-3-3-3) is counted in three waves, even thought there are 5 waves (each wave in three subwaves). I know, all very complicated. But as you study Elliott waves and see these patterns over and over again, they begin to make more sense the more you see them play out.

There are also “double threes,” which only contain two patterns.

The waves depicted above are horizontal in direction, but in reality, they would either slope up or down, depending in whether we’re in a bull or bear market.

Recent history example: In the large third wave up (on the daily chart below) ending March 3, it looks like we have a “triple three.” Within that combination pattern (corrective), we’ve had three zigzags in a row. One of those zigzags may have contained a running triangle, but overall, there are three corrective patterns. I find that odd for a third wave, but then this is an odd cycle degree fifth wave we’re in: It’s corrective, not motive (fifth waves of a major sequence are generally not corrective).

This entire 5th wave up (from ~1810 on Feb. 11, 2016) is a zigzag (a correction), and we’re in the fourth wave of the second 5 wave pattern.

Fourth waves are always corrective. In small degree, there may be only one pattern that plays out. At this high degree, you can pretty well count on at least two patterns (a “double three”).

We’ve completed one pattern, an expanded flat (there are three types of flats). Flats are are 3-3-5 combination. The next pattern could be a zigzag, another flat, or a triangle. If it’s a contracting triangle, it will be the final pattern (regular triangles are always the final pattern in a combination, if they’re there at all.

The Market This Week

Above is the daily chart of ES (click to enlarge).

We appear to be in the second pattern of an ABC 4th wave correction. The second pattern now in play seems to be tracing out a triangle. A triangle is always a final pattern in a combination sequence. If this is the case, I don't expect a wave below the previous low of about 2316.

The wave down on Thursday of last week appears to be an ending diagonal, which predicts a strong upturn when complete.

After completing the larger fourth wave, we'll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

_____________________________

Sign up for: The Chart Show

Thursday, April 20 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

dave , valley

my understanding of these storms is a bit simplistic .

when i see the red bars and the storm noted i wait

39 hours and more times then not the market has a decent

rally . today no different ( i missed this )

http://www.n3kl.org/sun/noaa.html

Nice pattern, Joe.

spx approaching the max pain level of 2360 ?

here we go again , another option expiry

looks like we found the edge of the cliff .

humor

https://www.bing.com/videos/search?q=jerry+seidfelt+first+loser&&view=detail&mid=0FBD40EA03F3E11E72850FBD40EA03F3E11E7285&FORM=VRDGAR

so here is the RUT chart i have been posting since “forever” to give guidance as to the market “WTF”??…….. BE WARNED!

it looks like this is all she wrote…the FAT lady has sung! [alex, can you hear the fatty?]

https://invst.ly/3s2ld

No right now I’m having a stroke, only thing I hear are my future kids asking “Dad, why did you try to short the great 700 points rally of 2017?” – for now the best response I have is “I thought WWIII would have been bearish”. TRUNC THAT WAVE, TRUUUUUNC…

alex,

methinks your future kids will completely appreciate their dad “short or NO short”……………. and remember – in life, you must “risk” greatly to be rewarded greatly………….. !!!

Note to self

always stick to my indicators .

the buy signal on the 10 day trin as well as the advance decline line

as well as the short and long term oscillators.

Dave you noted yesterday the intensity increased and i flipped

my point of view and admitted i was accepting i was wrong about

a high april 21 ??? i m glad i sat out of this market the past few days

despite it all .

i have avoided option expiration’s weeks for a few years now

its one of my rules .

that said .

the typical is what happens on Thursday look for the opposite on Friday .

not changing my view on the turn dates .

may 2 a low may 11 a high may 13 unknown and may 18-19th my key

date that i favor as a low .

May 2nd someone noted the fed meeting , the typical is a rally into fed meetings

more times then not so i will question that date yet it is still what i consider

a low . Today is the end of quarter plus 20 days and the 10 day lag of mercury

retrograde was yesterday ( april 9 plus 10 days ) .

this should become more interesting .

no opinion on this market from me at this juncture

im just thinking through a few things and thought id share .

Joe

just a thought after i posted

mercury retrograde 10 day lag april 19

mercury direct may 3rd , 10 day lag may 13th ( the unknown )

may 11th mars uranus high

Possible high may 11th 13th ?????

that was the thoughts

then may 18th -19th low

then june 30th high .

after that ???? ill have to see how this market actually moves

Thats it for now

Possible for fridays trading since we are now at the max pain level

of 2360 on the spx . a close anywhere in here today

tomorrow morning a flat to gap up open for options settlements

on the open , a sell off and then a rally to end the day relatively

unchanged ,

Thats my thought for the short term and now

ill go back to work 🙂

Ill dig through the internals over the weekend .

Im feeling a bit vindicated today which keeps the rest of my timing

dates in tack

energy streams tracking well

https://s4.postimg.org/m3kqdv3x9/April_19_to_21_energy_stream_update.gif

ive done very well following the energy stream this week. next week looks fairly bearish and tomorrow pretty bullish

looking to go long on a end of the day dip. thanks for sharing tom

Thanks Tom,

I can use it on the AEX too.

Thank you Tom

D up unfolding today as expected. albeit with a bit more bullish vigor. It should complete tomorrow with simultaneous completion of the right shoulder of the small H&S pattern. If it is indeed a triangle the E wave down has to stay above the C wave low of around 2327.58. If it is a H&S it will break through as the neckline is around 2329.00 Maybe overnight futures will give a clue. although they have not as of late been very predictive of price action during the following session. If the triangle low holds the move up will be very sharp and will offer an excellent long trade with a very clearly defined stop. Have a great evening all!

Here is my interview with Dale Pinkert on Wednesday morning. I’ll post it more formally this weekend. https://www.youtube.com/watch?v=9-m2egbxY7g

Excellent interview peter

“Three Peaks and a Domed House Top pattern (3PDH), is potentially in play again”

Jeff Hirsch, April 19, 2017

http://jeffhirsch.tumblr.com/post/159766934548/three-peaks-and-a-domed-house-top-in-play-again

https://www.stocktradersalmanac.com/UploadedImage/AIN_0517_20170418_S&P500_3PDH.jpg

I still have 2 batches shorts still floating in cyber land . Family situation yesterday, prevented me from off loading shorts in the morning. Could not take Peters course and Daniels seminar, grrrrrr. Hopefully Andre, received some intriguing info from Daniels seminar. I will hold my shorts for now. Hey Joe, congrats on stating that the 20 th was going to be the high, you were the only one I believe . All the best every one.

Dave,

You should have an email with the link to the video from yesterday. Nothing has changed in the market since then. However, considering your circumstances, I would be more than happy to either refund your payment or credit you for next week. Let me know.

Thanks Peter, I will opt for the credit for May session. I need to finish up with this family situation. I hope to resolve my situation by the end of next week, to have my full focus on your presentation in the first week of May. I need to get my self out of these shorts , most likely by next week. Thks

I’ll leave it open. You can let me know when and I’ll set it up.

Thank you !

Peter

as i look at the diagram you have posted as well

as your wave count i am noticing there is no X wave

on your chart . Also if i look at the Dow i can call the recent

low on april 19th W ? , trying to stick with the ES though at the moment

and keep with a 60 minute chart as you have posted

im considering tha the april 5th high was the X wave and

we have not yet seen the wave W low .im keeping it simple is all

we will know soon enough , a comment on your video , you stated

you do not believe in truncation, i tend to agree yet ill also say

you have probably researched that further than i have .

as for the ending diagonals though ??? I may be wrong here

( i know i am in some regards ) i have seen ending diagonals many

times at the tops of wave 3’s and i have seen them at bottoms.

i have not ever come across an ending diagonal at the top of a 5th of 5th

wave . you have stated it is a rare pattern , ill go with it , yet i have seen

leading diagonals several times on shorter term charts .

Retrot

something to think about with the 3 peaks domed house pattern

George Lindsay was an artist , he said that the chart should have the right look .

( im paraphrasing ) when using elliott wave you also want the “Right Look”

Sometimes the labels make sense yet the Right Look is not there .

The triangle formation to me does not have the right look for a few reasons

Triangles should have Overlapping B waves, The 2322.75 april 17th low on the ES

was a B wave low . for this to be a true triangle that low must be broken and in doing so the ES wont have the right look .

If we label the april 5th high as the high of B then a new low on the ES would be labeled as wave W and following wave would then be the X wave .

Bottom line : Peter, the combination wave idea you have posted at the top of the page i agree with yet right now it appears we are still in the early stages of that wave .

The alternate for me is we have ABC Down ABC up into april 5th and we are

now still in wave C down to a new low . that is strictly from a wave perspective

and tossing out my own timing work .

the question is : Where is wave W and wave X ??

Joe,

There is no X wave for three reasons: 1) I don’t like to confuse people who know little about EW with additional nomenclature that really means little other than to an analyst, 2) There’s no room on this small chart, 3) the combination isn’t complete yet.

But you can stick a W in your mind at the bottom of the flat, an X at the top of the B wave and and a Y at the E wave of the triangle.

As far as the rest of your comment, everything just looks fine to me, don’t really understand your point. And you have a bunch of other “stuff” mixed in with EW.

Dave

thanks for the compliment

ill admit i have spent countless hours researching the market

and spent countless years working on timing yet over the past year and

half i have not been prudent and i have not done a very good job paying

attention to the finer details of the markets . my reasons though are

im trying to get my trading room together along with the rest of this house

and its a ton of work . Once i have that together im intending to put everything

i have on excell into a software program that auto trades and i am still researching which software to use , my bias is to use tradestation yet i have not committed , initially ill have to go through back testing and using manual trading methods until i find the errors and consistencies and i am allowing a year to have everything programmed , yet my platform, trading desk , spots for monitors etc… is all designed into my room . Today is more work on the desk

which is a bit huge so i have a decent work space . im also including 7 shelves

for trade receipts for each day of the week and im going to log every trade

at the end of each week ( real trades ) . my goal is to be much more organized

on the paperwork as well finding the sweet spot in my methods and ill then focus my trading around those constants . what i have learned is pretty simple .

i use a combination of oscillators as well as the advance decline line and the Trin primarily . they all have there own successes and failures yet each has its own strong points at various degrees of trend . finding that sweet spot once i go through the back testing process will give me a limited amount of trades per each time frame . if i can find that sweet spot and create a higher degree win loss ratio then that will be the focus of the trading model and instead of trying to go

for a certain point gain ( trying to buy the low and sell the high per say )

ill instead focus on trading more contracts after the low and before the high

or sell after the high and cover before the low .

as an example , instead of taking say 50 points out of the market with 1 contract

ill take 25 points using 2 contracts that are focused in the sweet spot .

its going to be a 2 sided trading program, one side focused strictly on selling

short and one side focused strictly on buying long . In a perfect world

it will be 3 computers tied together , buy side on 1 sell side on 1 and the third taking in all of it and trading , i have room for 9 monitors so i can follow the indicators and watch in real time what i do manually and see how well or not my programming is in sinc with it all . lastly this model wont trade the first 30 minutes and it probably wont trade the last hour of the day .

That is my next year of work and i cant wait to begin .

in the mean time , i have shelving to put in today ?

I rarely trade option expiration weeks .

If anybody can find that sweet spot Joe, you will be the man to do it. Best of luck.

Hi Dave,

Ken Ring has a book on Kindle on The Lunar Code which summarized lunar effects on weather. If his data is correct, and something as sizable as weather is effected, human emotions are probably effected and by extension economic activity. Your statistical techniques are effective if used well, however, lunar effects are a free and unusually consistent help. For example, Danny at Lunatic Trader has data going back 70 years, in which a consistent pattern of most months is for gain days to cluster around new moon and loss days to cluster around full moon. This doesn’t work every month, and sometimes inverts for a year or two (like this year), but over the years has been consistant. Thanks!

Thanks Valley, I appreciate the info !

Hi Valley. I really appreciate Danny’s work. It helped me better understand your PALS system when I first encountered it here (later). The inversions of the cycle have interested me ever since I did a lot of study on Danny’s methods in 2015. I found that Venus and Mercury are the most likely culprits regarding this inversion. I’ll post a picture if I can, but the 2016 astronomical almanac from the US/UK Navy provided and easy to read chart that helped me see this cause and effect.

https://drive.google.com/file/d/1cFM83DLPdgJc4AcZXHe1FGZyXkqgTr7jAA/view?usp=drivesdk

A picture of the 2016 almanac with my notes.

Peter

thanks for the response

I get what your saying, Im just trying to keep up .

Your comments on the global warming and cooling cycles

in the interview caught my attention in regards to the 172

year cycle .

1932 to 2018 is 86 years ( 1/2 of 172 )

thanks for everything

Joe

btw, don’t get the DOW mixed up with my comments on ES. The DOW has a different pattern, as you no doubt know. I was referring only to ES/SPX.

Yeah, the 86 years is interesting, isn’t it? One of the books I’m reading at the moment is “The Great Wave” which goes back to the 1300s and maps the ups and downs in the economy through to today (some of his ideas on inflation I don’t agree with, but the rest looks fairly solid). I now have to equate it all with Puetz and Wheeler, which I’m sure will be a nightmare, but somebody has to do it …

Peter,

Or the Armstrong calculation of

Pi X 1,000 = 3.1419 X 1,000 =3,1419

3,1419 / 365.25 = 8.601 years

10 cycles of Pi = 86 years

Steve,

even more interesting …

That’s going to get me thinking. I haven’t heard pi used in that time ratio before …

1846 Plus 172 = 2018

1889 43 yrs

1932 43 yrs

1975 43 years

2018

i find it all fascinating

Dave,

I keep saying April 26 will be the low

Im full short to tank this baby…

Have a good weekend all..

John, I did not sell out. Just a few points from breaking even. I have to trust my technicals and gut instincts. Mr Market almost shook me out thou. Have a good weekend.

You should be able to get out unscathed on the E wave down, and perhaps even with profits in hand. I suspect the feeble momentum we have been seeing means it will end well short of the AC trendline. I have seen a recent count that has the SPX in a fourth wave triangle of a third wave at one lower degree than I was counting. The structure for that idea looks good and has fairly good proportions so I can’t exclude that possibility. This implies a short sharp fifth wave up to complete the impulse followed by a larger degree fourth wave. I have been curious about the lack of downside momentum on this fourth wave and it could be indeed that it is of one lower degree that I thought.

completely Inverted today, it happens

https://s21.postimg.org/4i3b6tg7b/April_19_to_21_energy_stream_update.gif

Thanks,

This week matched very well:

Next week will be interesting.

Top was already in yesterday time shifted..

Robert Prechter Talks About Elliott Waves and His New Book

http://www.safehaven.com/article/44221/robert-prechter-talks-about-elliott-waves-and-his-new-book

Peter

I won’t confuse the Dow to the es/spx

I’ll make a point of ordering that book.

As for putting it all together time wise

With puetz and wheeler , that’s the pleasure

Isn’t it ? It’s not work when you enjoy what you do

My work space is turn out awesome yet I’ve got

A good chunk of work left to do in this room .

I enjoy the work though so it’s not a bad thing

And it gives me something to do .

Lots of wood work, hoping to get the poly on the main

Desk Sunday . It will need a day to dry before I can coat

It again .

If all goes according to plan I’ll begin programming

August or September. It’s been a long process getting

To this point yet it’s my passion 🙂

Enjoy your weekend

Joe

Sorry, I didn’t quite word that confusion thing properly, was in a hurry. I was more making a comment that my analysis on SPX didn’t relate to the DOW. Obviously, you would confuse the two. Bad choice of words.

btw, I still have a video interview with Steve Puetz I’ve just got to mount sometime soon.

Early next week we will see a high. One timig system gives the high 4/24 and another one 4/25 and we have the full moon 4/26.

Really think 4/25 is the strongest. 4/24 is a dark day and should be a high. But delta gives a high 4/25. So I expect a low Monday/Tuesday and a test up into 4/25. But that should be it and then down into 4/27-8. Then up again into month end, a low 5/3 and the fatal high 5/5; this should really bring a major turn.

Too many reasons for this expectation; can’t give them all. But next week should be down. I have a tidal inversion 23 and 27/28 again; This is the cycle. Created a composite cycle with the Daniel code. This cycle gives a high 5/5 and a low 6/30.

Have to test this some more so no trading advice.

Next week VERY vibrational. Vibrations affect the world. From 12/25/16 into 11/11/17 Saturn and Uranus trine 3 times (due to retrograde motion). This will bring a change in the market that will last some years, 6/3 is the midpoint; major period,

Cheers,

André

Andre’,

A couple of questions…The term “dark day” refers to a turn or change in trend is my recollection from that same question earlier in the year. Is that right?

You have incorporated the “Danielcode” into your work. I had never heard of that before. Just curious…How long have been familiar with that type of analysis? You seem to have quite an extensive array of knowledge! Thanks for posting!!

Ed,

If you read Carolan you see the that 27th day after the new moon is a dark day. They are the worst in the 7th lunar month but they Always give a high. Carolans Dow Award must be available on the net and shows the details.

In the book of Daniel we can find cycles. Gann was a great advocate for studying the bible as he thought it was a coded text that gave all cycles.

I saw the cycles from a link I was given by Dimitri Tuesday (see above). All I did is create a composite of the cycles. My first impression is that it works. And it indicates 5/5 is a major change in trend. I have this in many other indicators aswell. 6/30 for a low is confirmed by mastertiming and tradingday cycles on 1932.

I defined a light day opposite this dark day. 4/10 was a light day. This kept the market up.

In the dow award you can also see that a full moon between October 3 and 19 is a bad omen. This year the full moon comes 10/5. This creates a setup for an october panic this year. In 2014 we had the full moon 10/8. We all know what happened then. To be exact both 27 and 28 are dark days, Carolan says it works only in october but he talks of major panics. I assume every dark day every month is bearish. Not a panic but down anyway.

All my timing system give a high on Monday and Tuesday. In 1929 4/23 was a high.

Thank you so much André! A high early next week implies Le Pen may not do well tomorrow.

Andre

I admire your passion as well as your work .

at some point i do hope our dates and cycles align .

i have may 2 low may 11-13th high and may 18-19th low and June 30th high .

the may 13th date is open yet im leaving it as a high , the rest stand as is .

Peter

its all good , id like to introduce something yet im not sure its needed.

there is a site called uno . it is a site where the collective of people

more or less vote on a question and the outcomes have been pretty

accurate , things like horse racing ,picking the trifecta etc…

caldaro has been testing this process on his site .

i think we all are doing basically the same thing here in regards to turn dates.

What im getting at and im not sure how to go about it. is pretty simple though.

if there was a way to keep track of the turn dates we all post and then

take notice of the ones we all have made a note of .

May 2-3 i have seen posted as well as late april etc…

Just a thought is all

Joe,

I see a low 5/3 and a high 5/11 so we are in sync. 5/25 is also a mjor date. So a low 5/18 would bring a high 5/25 and a low 5-30-ish. I still see 6/30 as a low. We’ll see.

To expand on the above

i guess if we had a ” Date tracker ” so to speak where people vote

on the next turn date . The date being the priority yet also a high or low

attached to it . a person could vote multiple times if need be to change

the high, low or add dates yet as the market moves through time i think

we could find a cycle with in our own social mood swings .

something like that anyways .

it is just something i have been think about for about a week now

so i have not thought it all through in detail

Joe, you are a true visionary with your analytical mind. I am game for this social experiment.

Joe, just one suggestion. Start this social experiment after mercury rectrograde period. Perhaps 2 to 3 weeks after may 3rd.

if your ok with this peter

ill attempt to do this

ill start here and see what i find and email you before

posting anything

joe

https://freeonlinesurveys.com/#/

Joe

I think this is what you are on about. Check out the jelly bean test. Brilliant

https://www.youtube.com/watch?v=iOucwX7Z1HU

Red Dog, Wow that was phenomenal.

Oke I have a 26 April Low (Mercury latitude south) after that May 3 high.

Good luck to all.

A storm brewing:

http://www.zerohedge.com/news/2017-04-22/despite-mounting-losses-mystery-trader-50-cent-doubles-down-massive-vix-spike-bet

I would say. this investor has more money than brains.

Well you want more grazy stuff…

https://www.youtube.com/watch?v=ZTXi_sd_tGE

A new blog post is live: https://worldcyclesinstitute.com/elliott-waves-and-probability/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.