|

Upcoming Event: Dale tells me it will be 20-30 minutes at 10am. |

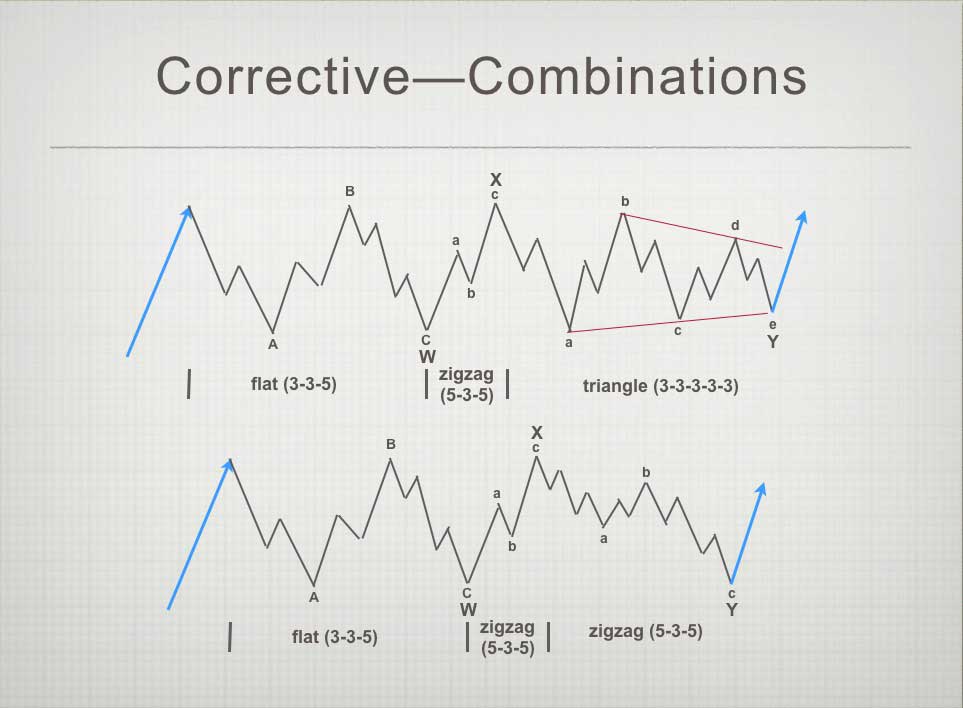

Fourth Wave Combinations

Fourth waves at this high level of trend typically form combination waves. What this means is that more than one Elliott wave corrective pattern traces out before the larger correction is done. The secret to trading it is to figure out each of the patterns before they’re complete. This task is make a little easier due to the fact that almost all waves have fibonacci relationships to other waves.

This weekend, I thought it appropriate to spend a little time on combination waves.

Above is a chart showing combinations and the patterns that make them out. The two combination patterns above are each referred to as “triple threes.” That’s because corrective waves form a 3 wave pattern overall and there are three corrective patterns in each of the two examples above.

Let’s look at the structure of these Elliott wave patterns that make up a combination. A flat is 3 waves (3-3-5), a zigzag is 3 waves (5-3-5), and a triangle (3-3-3-3-3) is counted in three waves, even thought there are 5 waves (each wave in three subwaves). I know, all very complicated. But as you study Elliott waves and see these patterns over and over again, they begin to make more sense the more you see them play out.

There are also “double threes,” which only contain two patterns.

The waves depicted above are horizontal in direction, but in reality, they would either slope up or down, depending in whether we’re in a bull or bear market.

Recent history example: In the large third wave up (on the daily chart below) ending March 3, it looks like we have a “triple three.” Within that combination pattern (corrective), we’ve had three zigzags in a row. One of those zigzags may have contained a running triangle, but overall, there are three corrective patterns. I find that odd for a third wave, but then this is an odd cycle degree fifth wave we’re in: It’s corrective, not motive (fifth waves of a major sequence are generally not corrective).

This entire 5th wave up (from ~1810 on Feb. 11, 2016) is a zigzag (a correction), and we’re in the fourth wave of the second 5 wave pattern.

Fourth waves are always corrective. In small degree, there may be only one pattern that plays out. At this high degree, you can pretty well count on at least two patterns (a “double three”).

We’ve completed one pattern, an expanded flat (there are three types of flats). Flats are are 3-3-5 combination. The next pattern could be a zigzag, another flat, or a triangle. If it’s a contracting triangle, it will be the final pattern (regular triangles are always the final pattern in a combination, if they’re there at all.

The Market This Week

Above is the daily chart of ES (click to enlarge).

We appear to be in the second pattern of an ABC 4th wave correction. The second pattern now in play seems to be tracing out a triangle. A triangle is always a final pattern in a combination sequence. If this is the case, I don't expect a wave below the previous low of about 2316.

The wave down on Thursday of last week appears to be an ending diagonal, which predicts a strong upturn when complete.

After completing the larger fourth wave, we'll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

_____________________________

Sign up for: The Chart Show

Thursday, April 20 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Peter thanks a lot for you. Please disregard the trolls and bashers. There are lot oeople who appreciate what you do

🙂

Peter,

Great work. As suggested this to be a triangle , from your experience how would it take to complete the wave 5 up from the day after point e this triangle pattern.

Thank you in advance

Vince

Sorry, I meant how long would the wave 5 take to complete after this triangle from point e…..

Andre’,

Seeking clarification once again! You believe “THE HIGH” was 2/1…I am assuming energy and vibrations indicated that, right?

4/17…you feel good about a high on this date. I am assuming +/- a day.

4/19…strong but is it up or down?

4/20…down day

4/21…a low

4/25 …a high

4/19 to 4/25…you describe as a “zone of death”…Can you elaborate on that?

5/4…high…then abc down into 5/11

Followed by a rally into 5/18…then say 5/19 is a major high but you also say 5/25 is an important high!

Can you help me out? I do try to keep up! Thanks!

Ed,

The deathzone is a Gann technique; it says market should turn 49 -55 days after a major turn.

1/2 was a major date. That the market didn’t collapse yet can’t change that.

I now believe 5/18-ish is the most significant high. We’ll have highs before and after but after 5/18 the market will down for a long time.

Assume we are still consolidating so highs and lows come almost every day. This week will bring a bit of bouncing around. 4/19 will be a high and the strongest of the week but not the big bang yet. 4/25 will be another important high. So volatility will start to pick up. 4/30 is another strong date.

I can’t help this is confusing; the market is just like that currently. Dates are getting stronger but still a lot of absorption going on.

Can’t see anyting bullish anymore. And with nuclear tension rising anything can happen. 19-25 a major window; both highs. But May should be much more significant than april.

Date for panic in the fall 9/25/17.

Hope this helps,

Cheers,

André

‘Everyone’ seems to be looking for a significant bounce, on other blogs

Still looking for April 20th as low for the month of April

The death of the speculator. Exchange fees going from a few $ a month to $9000 for EVERYONE Insane, yet true: https://www.sec.gov/rules/sro/nms/2017/34-80300.pdf …

Buying Bach one batch. 2335 ES. I have 2 batches of shorts going into later this week. Good luck to all.

Bought last batch 2337 ES. Fully short, very dangerous move on my part due to op week. But I have to trade on what I feel and not always on what I see. All the best every one.

IDK.. just looks like SPX 60min pulled back into its 21 EMA before heading lower.

I can’t give any merit to bounce as long as we are still under the moving averages.

I am looking for another roll over about here @ 2345.

We could tag underside of 50 dma at around 2353.00

Yes, would say only 10 pts more max. Tons or resistance above. I am flat over night and will wait to see what we do tomorrow. A gap up in resistance would be great.

I would use the 5 min candle to short once it took out the 5 min low tomorrow.

My red line is the 50 day SMA. The similar degree correction last June had three penetrations of the 50 day MA to the downside and the third move back above resumed the uptrend after moving back down to test the top side. I will be neutral with any close back above the 50 day. I will be long on any close above the April 5 high of 2378.36. We have only had two breaches so far so I am expecting we move back above, followed by the strongest move down below it to complete the correction after this current counter-trend move up, probably Wednesday toward the close if I were to hazard a guess.

PALS this week:

Trifecta bullish lunars: Phase post pre New Moon lunar square (7 days before NM), post South declination (17th), post apogee (15th). This kind of week only happens a few times pre year. Seasonals very strong post US tax day. Yet, thursday is Mercury inferior conjunction (mercury goes between sun and earth) which is a day before and after that is to be avoided. So, this week is very positive lunar/seasonals, but has wild card on Thursday.

Thanks Valley.

Great post peter

I pulled out my corrective wave diagrams a few days ago

and was happy to see your update 🙂

Andre

here we go again , lol

we both seeing the same dates yet with opposite interpretations

your april 19-25th vs my april 19-21st . we will see soon enough

a high or low yet im favoring a high with a may 13th-19th low.

Today’s rally broke out of the smaller degree downtrend and

option expiry’s tend to be up more so then down .

the the close above both the 20607 and 20611 levels today

gives a slight bullish close yet the next resistance of importance

is a close above 20668.

venus turned direct april 15th .

the next short term time lines are april 19-21 high

then a may 2 low followed by a may 19th low

my bullish window is the may 18th low

and a June 30th high .

if the timing is correct and peters count is correct

we should see some whip saws going forward.

no opinion on the wave count at this juncture .

the 10 day trin gave a buy signal today .

id be careful with any bearish trades this week

Just a thought

Good luck everyone

Joe

Joe,

I don’t give trading advice; just show what my system tells me. For now I stick with a high 5/18-ish. But we’ll see. If we can get our dates in line that would be great.

Told you this weekend Monday would bring a high. So far so good.

Cheers,

André

I am staying the course, with my three batches of shorts. Mr Market is cleaning out the shorts ( Bull Trap ) for the trap door to open. Good luck to all.

Dave

i read through that link you posted

i didnt see any cost numbers posted in that

how did you come up with 9000 fee ?

that would kill the stock market.

i havent gotten anything telling me about an

actual fee change

Joe

looks like there has already been a fee change

http://www.marketview.com/our-data/data-additions/exchange-and-data-fee-notice-17/

A great little documentary about the JFK Jr. assassination. This stuff just goes on and on …

https://www.youtube.com/watch?v=SAe2PC3Gv_Y

The sign up link for Thursday’s CHART SHOW is active again at the very bottom of the post.

thanks for the link peter

observation only

looking at es futures

daily chart

from the top

6 trade days down

5 trade days up

7 trade days down

labeled wave A ( 18 trade days total )

next we had

7 trade days up ( minor a up ? )

7 trades down into Mondays low ( before the open ) ( minor b down ?)

5 trade days up would be a high on Friday april 21 st

7 trade days up would be Tuesday april 25th

that assumes what has been going on keeps going on .

im attempting to put the timing with the wave count and in doing so

im having a hard time seeing the X wave at this juncture .

My bias is for this week to rise on whole yet im thinking its a B wave

and new lows to follow ( very premature at this point )

the alternate is we are in wave B of a triangle which is similar to

peters count . to prove that id need to see a break above 2388.75

yet that count is flawed .

an X wave does fit well i must admit .

my problem is with the timing . may 18th as a low does not allow

the time it would take to draw out a clean complex wave or even

a simple triangle , Thursdays lows were to deep for a b wave with in a c

wave of a triangle formation .( its about the overlaps )

Bottom line :

were in an X wave or a B wave ( im thinking the B wave based on timing )

2380 by Tuesday would fit .

then wave C down to complete wave 4.

wave A as noted lasted 18 trade days

wave B if it topped by Tuesday would be 21 trade days

if wave B topped Friday it would be 18 trade days which

implies both A down and B up were equal in time .

assuming that continues and wave C lasted 18 trade days

wave C would bottom May 17th

1 day before my may 18 window

and right on time with my may 13th – 19th time frame.

Mr market just needs to prove itself .

depending on how high we see this market go

ill use a simple 2 equal moves for the down side objective

and to be honest im not sure we fall that much .

2385 on the cash spx as a decent target for this leg up

and 2307-2306 on the downside is about all i see

and i don’t even like that as a wave count yet

it is the only bearish take i can see .

either way i see this week as up .

im done for the week unless i see something change .

good luck all

Hi Joe!

I agree with your count for a B wave per 21 April allthough I have 20 April as a turndate but with +1td deviation it will match yours! I also feel that the wave up for the B was to short…

Ah well, time will tell eh… ??

Aex target: 521 close / 523,xx intraday

ES: would think around 2366 max…

Cheers,

W

Peter

that video on jfk jr was an eye opener .

Not a huge surprise yet i had no idea

if that makes any sense

thanks again

I didn’t know about it either, but it certainly doesn’t surprise, based on what I already know.

That video left out the most important piece of info, and that was who was behind the hit. It is true that the killers of John’s father had a lot to fear from him as regards his political aspirations, but the more immediate threat was with respect to the senate seat from New York. Look at who got that seat and you will know who ordered his murder. It also explains why Ted backed Obama early in the presidential race – it was a little payback for what he knew they did to his nephew.

A little background on my new timing system. Short term the timing is exact. It gave a high on Monday, a low on Tuesday and a low Thursday (on SNP) and Friday (NDQ).

The solunar model (average of 5 19 year cycles) gives a high Monday a low Tuesday a high Wednesday and a low Friday.

Those systems are in sync on very different cycles.

Long term cycles in my system have the right length but come early. This system gave nov 2014 the high but the market made the high in may, six months later. This same system gave a high 12/15/16. So 5 to 6 months after this date the market should make the final high. Dec 16 was the completion of the cycle that started 2009.

This is why I expect a high may 18-20.

19/20 very strong dates. But 500 TD on the may high targets 5/3/17, So I expect early may to give a more significant turn.

Thursday is a high

Using the 4 year metonic system (50 lunations) we can create a different solunar model. This model gives a high Monday, a low Wednesday a (lower) high 4/20 and a low 4/21.

This supports what I wrote this weekend; 19 is the strongest high but Thursday will be the stongest down day.

andre

your timing has been very good for a long time now.

my longer term indicators are all rolling over and they

take months before they turn , shorter term though

i have oversold readings im looking at .

my main issue on timing has to do with low to high

and low to high to high counts .

the low in the year 1984 fits into this yet ill go with whats fresh in my head.

august 1982 to march 2000 was a low to high count of 211 months

counting forward 211 months from march 2000 targets oct 2017 .

oct 1987 to oct 2002 was 15 years , counting forward 15 years from oct 2002

targets oct 2017.

looking at the may 18th date i see it from 3 angles , 1 being the correlation

with 1987 and 1929 when those charts are lined up based on the moon.

the second reason is the mars uranus cycle and the 3rd reason is mercury retrograde.

the puetz window as i see it goes not apply this year so i have ignored that cycle

yet back in 1929 it was mercury retrograde that tanked the market .

the low back in January was timed by mercury retrograde using a 10 day lag.

this also worked last year .

This week will answer several questions for me , the temptation to buy

this mornings low at the .618 retrace of yesterdays rally was tempting for me

yet my issue on this is that i would prefer a low near the 3 rd hour of today’s trading . 12:34 – 12:46 new York time. that for me will give me a clue wether

we saw an impulsive wave up from yesterdays lows .

generally if you see a clean 5 wave move you can use the .382 and .786

time retracements and find market turns , if those time lines fail then most likely

it was not a 5 wave move .

looking at the $NYA on a 10 minute chart .

the top was march 1 at 1330 new york time

the swing low on march 27th came 10 minutes after the open at 0940

this was a decline lasting 674 10 minute bars .

adding 674 10 minute bars to the march 27th low targets april 20 3 hours after the open ( 1130 new york time )based on that i can call that a high to low to low

count which i have not been doing . its a turn time line though

using a 10 minute bar chart on the dow from the april 5th high

there is a high to low to low count which targets today at 1130 new york time

So to sum this up , id like to see a trade able low form this morning

in one of these time frames

one in about an hour from now , 1130 new york time plus minus 10 minutes

the other timeline being 1234 1246 plus minus 10 minutes.

if the first shows a low and we get a bounce then ill use the second time line

to take a very short term bullish stance .

other then that set up ill sit out today

Joe

now i need to see the bounce following this 1st timeline

the secondary timeline in 1 hours time is the most important for today

the 1st timeline can be considered a technical failure yet the low was

only 5 minutes late so far , that said im waiting the next hour

and sticking to my plan

The roll over i was anticipating is starting to take shape.

We have a nice head and shoulders setting up on the SPX 60 min (4)week time-frame you can see it nicely.

Watch the neckline – a break below 2329 with follow through should set up a measured move down to 2280.

If this is the same set up I seen a few years back on the TZA its going to get ugly real quick.

I took off one batch short off the table 2333 ES for a cheap bottle of Merlot. If we get a bounce today, I will buy the short again for April 20th.

Two batches of shorts left, Looking for a bounce to have three batches total going into Thursday. Good luck every one.

long at 20419 dow mini

reason improving adv dec line .

not going to hold this for very long

A good risk reward set up on your decision.

out at 20456 for 37 pts

nothing really changed though just have things to do .

plus 185 for the day .

adv dec line has 3 waves up needs a 4 then 5

I am buying back my one batch of short I sold earlier. It is not the ideal time, but I will be in meetings until after markets hours are closed. Bought 2339 es time stamped. 11.10 Back to three batches short into thursday.

Could this week be setting up as follows?

Monday was wave 1, Tuesday 2 (down), Wednesday wave 3 (way up)?

I wish I could comment on that question Valley. I am not a ew waver. Hopefully soon, I am going to take the plunge and take Peters one day course this Thursday. Best of luck to you.

possible high 45 minutes before the close

yet im not trading anymore today and its an options expiry

dave

Thanks

nice trades by you of late also .

im pout for the day

possible high 45 minutes before the close

yet im not trading anymore today and its an options expiry

dave

Thanks

nice trades by you of late also .

im out for the day

wave 4 in the advance decline line has been satisfied

yet the stock index are 3 wave moves from the looks of it .

id watch the market 45 minutes before the close if i was going to

take any bearish trades ( im not but thats where i would if i intended to )

back to work for me 🙂

decent day

Joe, help me see the wave 4 that you see! Daily, weekly, monthly….hourly?

The answer to Valleys question

SPX above 2349.15 yes

SPX below2329.12 no

The only problem is W1 will over balance the previous wave. The previous wave looks to have started at 2354.

Looks more like a H&S.

Thanks! Appreciate the EW advice.

I agree with H&S call. You can see it clearly from early March. Even more interesting, the measure distance of the decline takes it exactly to the bottom line of the bearish rising wedge. Good call Jody!

The low this morning now matters

we entered the time line and the market has turned up .

ill label it wave B of some kind of corrective rally

The hourly indicators are turning up from oversold levels

the advance decline line has 5 waves up yet id question that

wave count since its based on a very small time frame .

the 10 trin gave a buy signal yesterday and is acting bullish today

overall id call today a productive day for the bullish case.

that all said i took 37 pts out of the futures and im really waiting

untill the may 18th time frame and i want to see how this

entire week unfolds before taking any longer term bullish

trades .

Tom,

How is the energy stream doing still on track?

John.

The streams and the markets were nicely matched today

https://s3.postimg.org/eb687rn9f/april_18_and_19_energy_stream.gif

Thanks Tom,

So we made a little time shift have we seen the lows and are we up into opex?

It would be nice to see if it syncs for a lower low for April as I am gunning for. If his chart points straight up for the 20th, I will be on the other side of that trade. All the best.

Well, Im confident that we will see the lows around April 26 Dave.

Goodluck.

Thanks Tom,

Can you do a weekly chart with the shifts? Thanks!

this week so far

https://s1.postimg.org/ijup5bwkf/April_17_to_19_energy_stream.gif

Thanks Tom!

max pain for the spy

http://maximum-pain.com/options/max-pain?s=SPY&urk=SPY

Ed

Im watching several wave counts and honestly

its tough to pick one over the other . one day things work

the next they don’t .

every once in a while the put sellers get overly leveraged

and the market forces them to cover . this drives prices down

Dave is going with this thought i assume .

for these reasons i m open to what the market gives rather than

locking myself into any wave count .

overall i see peters combination pattern and it makes total sense

yet if it is to play out its going to take a while and its the timing

im looking at along with the indicators vs the wave count at the moment .

straight up looking at the wave count dow 20,240 is a fair target

to the down side . yet 19745 into mid may also fits .

the question becomes , will those who are short put options

have there heads handed to them ??? if so will the market wash out

and if the market washes out will it form a bottom ????

or will the market to the typical and buy call options into this decline

and then buy stocks and drive the value of those call options higher ??

if so max pain would be 2360 based on the link yet to me a better target

would be 2380 – 2385 spx.

i have just seen this to many times and it plays like Jerry Seinfeld first loser

joke , your short the market reaches the edge of the cliff then turns around

and takes your money away .

the entire rally from January to me is a bunch of 3’s ,

this decline is a bunch of 3’s

the march 27th low is important as is todays low

a failure ( key word ) to break down causes me to label both march 27th

and april 17th as B waves of what is becoming a complicated wave formation.

breaking down below those lows cleans up a lot of the mess.

that said , the market is oversold , the 10 trin has given a buy signal .

sorry i did not really answer your question yet right now the market

is open to flip either way and so im just allowing the data to give me clues which count is playing out day to day .

hopefully in not to long a time ill get it all figured out .

by then peter will be saying see here we go wave 4 🙂

Joe

André,

I know you like different technics of forcast.

So may be this one will be interesting for you:

http://www.safehaven.com/article/44197/viene-la-tormenta-theres-a-storm-coming

Dimitri,

Much appreciated. And I agree. Indeed a storm is coming and it will hit may 5th. Will explain later.

Thanks,

André

Thx Dimitri, pretty amazing!

Well the market is spiking bigly this am…but we have an André peakTM 🙂 so interesting day ahead.

Amazing how somebody tries to hummer the gold.

22.000 contracts yesterday, 25.000 today in one minute.

Just before London fix.

I remember in 2013 they arrived with 10.000 contracts to dump the price by 2-3 percent.

Now the price recovers immediately after the intervention.

What do u do when you’re a whale and want to buy moawr at a lower price? 😉

andre

what ever your thinking of on may 5th id dig into that

im looking at as well ( may 2nd )

im changing my tune on a couple things .

here is my thought process .

the financial institutions are basically short puts so

they do have a reason to support this market and collect

the premiums . keeping this market flat is in their best interest

if they are able to do so . this would imply a further drop

following options expiry . i don’t like trading option expiry weeks .

the key for me is 20400 on the cash dow on a closing basis .

it is based on an 8 month cycle i have been trying to refine over

the past 6 years and this year it appears to be playing out .

mercury retrograde plays into this by coincidence yet it

turns direct may 3rd . im accepting that i am wrong about

a swing high april 21 , it may still be a high yet may not be

a swing high .

the next turns are may 2nd a low may 11 a high and may 13???? unsure

may 18th -19th should be a Low .

20400 is key closing support ( keep in mind the march 27th print low

has not been broken yet the closing low has been , april 13th is the closing

low of this decline so far ) we are in a long fade downward from the march 1 closing high on the cash dow.

The daily dow close only chart has 5 waves down into the april 13th closing low

its a sloppy wave yet its 5 down. the bounce i labeled as an a wave assuming

a swing high into option expiry . yet there has been no significant bounce to prove that true . the closing high on april 17th is best seen as a pivot point

on a closing basis . it can be a wave 2 or a b wave high . this places the market now at another minor yet important juncture . if we stay flat or head lower

from here a close below 20400 on the cash Dow then the next support becomes

19748 yet 20054 ( the Feb 8th close ) would be my downside objective .

So this is what i was talking about yesterday . the market is approaching the edge of a cliff ( 20400-19748 is a fairly deep drop ) the drop should only last

about 5 trading days though . that’s a big drop in a short period of time .

19864.09 was the jan 31 close . its also very possible that level is broken

on at least a print basis .To add to this , i have noticed over the past few years

that our politicians here in the states tend to think everything is just fine

until there is a potential crisis . Maybe this decline is needed to give them

an incentive to do what they said they were going to do ( big if ) .

Most declines last roughly 50 trade days yet can last 60-90 days .

Today is a Fibonacci 34 trading days from the closing high .

adding 20 trade days ( about a month ) would be 54 days of downside

and may 19th . nothing outside the typical .

No futures buying for me .

Good luck all

Ill post a chart tomorrow on this 8 month pattern .

Joe

“…may 2nd a low may 11 a high and may 13???? unsure

may 18th -19th should be a Low”

May 2

May 8

May 16

May 32 ?

lol

lastly

closing high march 1

18 trade days later

closing low march 27

18 trade days later

Friday april 21st

anyone want to feel the fear of being short put options ????

3 Peaks and Domed House still “standing”……..we are in the “rooftop/Bull trap” peak of the house — BE WARNED!!!

https://invst.ly/3rua8

I never forget Iuri. Now if they stop buying the F/($/F&%($ dip LOL

alex,

stay with me on this one!!!…….”THE TITANIC HAS ALREADY SUNK!”………and for the sake of the continuity of charting, i am forced to be the “kate winslet” character [the one on the lifeboat], and you will have to be “leonardo di caprio” {the one in the water}…… “HANG ON ALEX – HELP IS ON IT’S WAY IN THE FORM OF A MARKET PLUNGE!”……….. i know this wasn’t part of the movie – [but in my opinion it should have been], if kate winslet had the presence of mind to have flashed some boob – di caprio would have held on!! i only have “man” boobs, i am willing to flash them if it means you hold on!

a close up of the peak of the 3pdh chart, you see prices need to move back to that shaded oval area on the left. that just “happens” to co incide with the 200 dma in dark black [go figure]……. before we get a “truncated” 5 in a dead cat bounce kinda of way………

you can see from the blow up, that prices are below the 20 [red] and 50 [blue] day moving average. the market has challenged these levels, and the 20 has crossed below the 50 – all supportive of the drop to the 200 dma – so once again alex – HOLD ON BUDDY! https://invst.ly/3ruy-

….oh yeah, and alex……

remember back on feb 11ish of 2016, {the bear trap low of the 3pdh chart}…… now remember a “low” was put in around jan 19th of 2016 of 1804 on the ES, we had a bounce and then we put in a lower low to 1802 on feb 11th………Now remember the dow across this same time frame – the dow ”failed” to put in a new low…..which was a heads up that it was a bear trap – AND – it put the DOW as the leader to the upside……now are you noticing that the DOW is now the “leader” to the downside?? BE WARNED!!!

lol Iuri don’t get my expectations so up please – I decided that a low profile and a lot of praying will help the collapse. Jokes apart, your analysis makes (a lot of) sense to me, I’m just suspicious of the monstrous resolution demonstrated by the CBs cartel and friends, relentless…it’s like they print money out of thin air…

alex, no worries, MAN BOOBED – HAIRY LIPPED yellin and the CB cabal and company have signaled clearly that the “PIN” for the bubble [shrinking the balance sheet/raising rates] is well underway, and that there is no stopping the gender neutral mafioso banking cabal NOW……..!!!! the POP is underway…..the TITANIC is sinking…….. !!! HANG ON BUDDY – HANG ON!!

Nicely laid out on your chart Luri.

My compliments, it’s nice to have some humor on the blog. It gets a little to serious at times here.

Thank you kindly dave – i try to make my charts “sweet and crunchy”. My charts should remind you of biting into an “in season” honeycrisp apple…..slurpppp……mmmm – yummy!!!! :-))

You and I are looking for the same thing..

I believe we are in a W1 down and it will take out

the lows of SPX 1810 just as everyone is going short

it will snap back for a W2.

I am looking for SPX 1750-1775ish around Mid May.

It appears we just wrapped a A-B-C correction and

we are getting ready to head much lower

1750 we’re talking Mid May now, 2017, in less than a month? That would b the happiest month of my life, hands down…

WTF.. haha.. meant mid Oct. 🙂

DJI did something critically revealing today. Triangles can be setups for great trades as the move out of them is so predictable. If this is a large degree triangle, since it was entered in an uptrend the break from it should be to the upside and these breaks are typically quite sharp. It is also quite common for triangles to occur in fourth wave positions prior to the final fifth wave and those fifth waves tend to be sharp and short. Here’s the thing: The new low that DJI made today eliminates the possible triangle for that index as it would have taken out its equivalent SPX C wave low. In my opinion this substantially reduces the triangle interpretation for SPX.

I cannot get over the fact that despite what was obviously to me a kind of blow-off move to the upside, nobody, and I mean NOBODY, seems to be seriously considering that we have a possible top in place. We could after all be looking at a series of nested first and second waves to the downside as Jody suggests, in which case all hell is about to break loose, market complacency notwithstanding. We should have clarity by the close tomorrow. We are starting to descend into an area of non-existent volume so the drop could be precipitous. Another thing I like about Jody’s idea of a first wave is that if a crash is going to come in the fall, it will be a third wave. A brutal first wave down now, followed by a deep second wave to convince everyone that happy days are here again should set things up for a Fall day of reckoning quite nicely. I am bearish.

“nobody, and I mean NOBODY, seems to be seriously considering that we have a possible top in place”

Well, except Mahendra

The problem is that this wave down since the 1st of March is overlapping and doesn’t look motive in futures

Aha! A voice of reason …

I can think of two instances in which an impending impulse down may not initially look that way. One is when you have a series of nested first and second waves, and the other is when you have a leading diagonal.

Likely pattern:

Down Thursday (Mercury Inferior Conjunction), volatile Friday. Up next week and into May 2 Fed Meeting.

Trading rule # 1. Take profits. I am taking one batch off. ES. 2333. Time stamped. 12.35.

Hoping for a retrace, I will buy back my short. Good luck to all.

12:35 is west coast time.

We will probably see the C minor wave up of the intermediate D of the triangle tomorrow. I would not be surprised to see it last most of the trading day to draw in as many bull as possible before the E wave down commences. VIX sported a long lower wick today so if we see divergence with SPX and VIX both moving higher tomorrow that would be a great signal to add to short the move up….

Dave

I was going to say you must be on west coast .

Me to .

Luri

i am still watching the 3 peaks yet from the stocks i showed back in march .

something else comes to my mind today after the close.

im covered in saw dust building my trading desk and cant wait to have

that space finished so i can get the computers in place etc…

anyways here goes .

we have a top to top to bottom count as a possibility yet

something doesn’t look right when i in put price into it .

im seeing a downside objective of cash dow 20131 on a print basis

it would be a very simple A B C .

March 1 high a march 27 low in wave A ( 18 trade days )

a separating B wave rally into april 5th ( DUH ! )

and another equal leg down ( yes we could extend the 1.618 instead of 1.0 )

this extends the time out instead of 2 more trading days into Friday.

it would last 9 more trading days into Drum roll ???

may 2nd , mercury turns direct may 3rd .also there is a mars Uranus

cycle low due May 2nd .

so ill adjust a few things

May 2nd low may 11 high may 13th still an unknown ( its 10 days after mercury

turns direct ) may 18th-19th low and a June 30th high .

I made it complicated and should have kept it simple .

ill guess and say we will see some bullish divergences show up as we

get closer to the low . id still look at Friday as some kind of low yet also

some kind of fake out .

um dare i say this ??? June 12th 2018 a major swing high ??

86 years from July 1932 would be July 2018 .( a B wave or 2nd wave top )

the years :

1846 top ( crash of 1847 ) LOW

crash of 1889 LOW

bottom of 1932 LOW

1975 low ( actually end of 1974 ) LOW

2018 Major Top.

43 year cycle ( 1/2 of the 86 year )

1932 low

1975 Low

2018 High to keep it simple .

Aug 1982 to the march 2000 top was 211 months

add 211 months to march 2000 you get Oct 2017 ( note peters timeline 🙂

Oct 1987 to Oct 2002 15 years

add 15 years to Oct 2002 you get Oct 2017

aug 1982 to march 2000 low to high , oct 2017 high ( low to high to high )

oct 1987 low oct 2002 low oct 2017 high , ( low to low to high )

everything points to October and as a high it is very bearish .

if its another low ???? it changes things .

thats my bigger picture thinking .

I need sandpaper lol .

Anyone interested in baby raccoon’s ??? i have a few laying around id like to get rid of … mamma decided she was entitled and has the right to use my attic

im trying to be a good socialist and let them stay yet im feeling my human rights are being violated . lol

Hey Joe, I will take a couple of your critters up to my cabin. I like those mask bandits. Lol. Joe, Rotrot, I have May 2nd also. This drop has more intensity, energy than what we have seen, in the last many weeks. Now Andre has May 5th. My gut feeling, is some thing is going to come out of the blue. Perhaps , politically, military ect Monday after market hours. This intensive drop in the markets Tuesday May very we’ll continue into May 5th. As for May 1st late in the day, I will definitely be going short. Some thing to ponder on.

Yes you are correct. Vancouver Canada.

Peter, what happened to the date/timestamps on the posts?!

DWL,

Do you mean on the posts, or on comments? Both are there when I look at them. What browser are you using on what system?

This is iPhone view (so safari)

http://imgur.com/Tg8FBcU

Peter, I signed up for your show for tomorrow. Will their be a reminder with a direct length to the show. What time does it start ? Thanks

I hope so. I’m changing platforms and doing more testing tonight, so hopefully it all works flawlessly tomorrow. You should get reminders and an email of the replay an hour after. For you (in Van, it’s 11am).

You should have got that info when you signed up. I haven’t seen a notice from paypal, but I see your name in there, so I’ll go check out all the links again. If you don’t get a notice before the show, be sure to let me know (I’ll be around) and I’ll send you the link.

It’s the first time through for this new platform and I expect things to go wrong (not that they will, but it makes me check everything a few times).

Great, looking forward to be deprogrammed from my old beliefs on EW. I hope the trickster as John called it ( mercury rectrograde ) behaves him self.

Valley, can you remind me of the significance of a solar storm relating to the markets. Thank you.

I am curious if anyone else sees a bullish pennant in the dollar. It looks to me like the flag pole is hinting at a strong upside move soon…but not before another small decline….

Solar storms and Mercury Inferior Conjunction (Thursday) seem connected. MIC’s are typically followed by weakness for 1 week. However, lunar pre perigee, pre new moon, and late April seasonals all positive. So, I moved to cash mid day Thursday.

Thank you for elaborating on the solar storms.

Andre’,

Are you still looking for a “low” on Friday? Any updates on your thinking would be appreciated!

My interpretation of your posts would be…the further we get into April and May…

the less likely a new all time high will be made. That thinking coincides with Jody and Verne’s view!

Dave

i copied this from armstrongs site

you were thinking something was brewing may 5th ?

my first thought was cinco de mayo ( trump bombs mexico 😉

The first round of the 2017 French presidential election is set to be held this coming Sunday on the 23rd of April 2017. Should no candidate win a majority, which is usually the case in France, a run-off election between the top two candidates will be held on May 7th, 2017.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.