Wave 1 up of the ending diagonal has been a very long parade. As Zerohedge noted on August 18, “options-traders-have-never-been-more-bullish.”

As I stated here last week, “I’m expecting some volatility very soon.” We may get an political/financial event early in the week. Look for a bearish rain cloud to form early in the week.

On a larger scale, I see the sentiment tide turning. Today Zerohedge reports that the FED has mounted a new Facebook page, but the comments are perhaps not what they expected. The perception of their usefulness in terms of supporting the economy is obviously changing. The pendulum swings and it’s getting close to swinging it the other direction, but we’re not quite there yet.

One of the luminaries whose work I’m researching in depth is Dr. Raymond Wheeler, in his description of the psychological traits of society at the turn from a warm dry climate to a cold climate (the first part of which, will be wet—hence the floods across the world that he predicted starting about the year 2000).

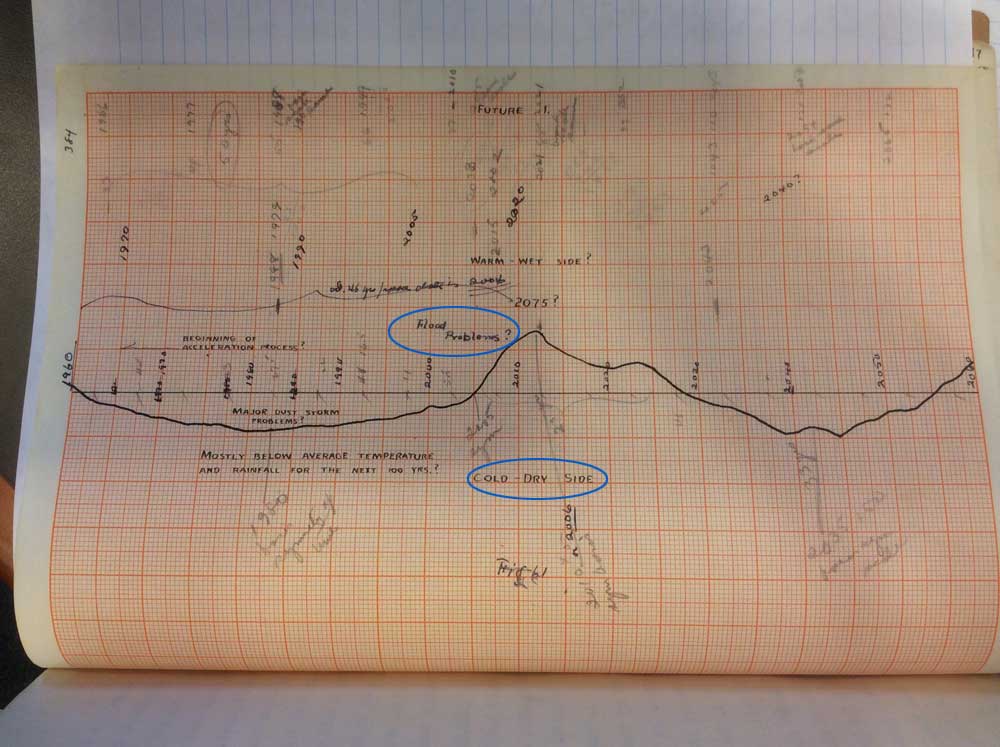

Above is a chart of Dr. Wheeler’s that I discovered in his original writings at Baruch College in New York a couple of months ago (the blue circles are my overlays). Before he died in 1962, Dr. Wheeler plotted out the weather past the year 2000 and projected major floods around the year 2010. We’re having major flooding around the world right now, and it’s likely to continue (I have a couple of dozen historical charts of his that go back to the year 600 BC which show the cycles quite clearly).

Being primarily a psychologist, he was most interested in how society changed at peaks and valleys of climate change. We’re currently moving from a warm dry-climate to a cold-wet climate (initially) and then a cold-dry extended period.

As we move from warm-dry to colder temperatures, we experience extreme climate and a period of flooding, but more importantly, perhaps, are the influences on how we think.

Last week, I listed a few “Traits of warm-dry moving to colder climate.” Let’s flesh a few of them out with some examples:

Decadence (and a general frustration with it as climate turns colder). A great example of this is the Zerohedge article today on Hillary Clinton flying 20 miles in her private jet to a Rothschild (the world’s bankster-family) fund-raiser. This likely wouldn’t have been reported until recently.

Cultural and economic collapse. The major economic collapse is still to come, of course, but since 2008, there has been a distinct cultural and economic change around the world. People are feeling it, but the stock market hasn’t shown it yet. However, the real estate market certainly has and even the last of the remaining real estate bubbles (Vancouver) are starting to roll over.

Rise of the masses against the establishment. You can see this through the following that Donald Trump has amassed. I think you’ll see an ebb and flow of support for him as the market continues to gyrate up and down over the next couple of months.

Migrations. The Syrian migration is the obvious one here, but there have been major migrations every 500 years.

Persecution of minorities (usually sanctioned by governments). You can see this is the very obvious (now) killing of the black population by the police in the US. It’s been going on for years and years, of course, but is now about to erupt in the opposite direction (think Dallas). Dallas was also the city where Kennedy was shot at another turning point in history. 1963 was a change in tone that ended up ushering in the recession that bottomed in 1974. It turned much colder and dryer during that brief period.

Poor leaders. I’ll point again here to the entire Republican slate and the choice that exists between the nominees (Clinton and Trump). We can see this in Canada with the current Prime Minister, who is more interested in “selfies” that actually governing the county. He is the least prepared to lead the country of any previous Canadian Prime Minister in history.

Race riots and civil wars. We have the beginnings of an uprising in the US. This should be the tip of the iceberg. There’s the Ukranian civil war in progress, and of course, Turkey is upside down at the moment.

Less concern for human life, individualism. There continue to be mass murders around the world, whether attributed to terrorism, or not.

Sabotage, fraud, scams. I’ve written about the climate and ozone scams. More and more financial fraud is coming to light. Back to Zerohedge for the latest for the trillions of funds unaccounted for within the Defence Department. No real surprise here!

Low birth rates. The low birth rate around the world has left the front pages, but it was front and center a couple of years ago. Birth rates always dive at the top of a warm-dry phase as we transition into a colder climate. They surge again in a warm-wet climate.

Epidemics (start to show up as we turn colder). We have the Zika virus which is not quite out of control, but getting there. Ebola has been put to rest for the moment, but I’m expecting it to raise its ugly head as climate continues colder.

Natural cycles always win out in the end.

Subscribing to Comments

You’re now able to subscribe to comments on individual posts. That triggers an email that will be sent to you instantly whenever there’s a reply to that comment. You’ll be able to subscribe to any replies that follow individual comments you make and you can subscribe to all comments on a post, so that you don’t miss an important comment during the week. You can also subscribe to all comments without making any comments yourself. Here’s the option just under the submit button:

You’ll also be able to unsubscribe at any time or change your subscription options. Remember, it’s per post. I do a new post each weekend, so if you want to subscribe to all comments, each week, you’ll need to re-subscribe each week to the new post. You should really need to worry about unsubscribing to old ones, as once a new post is live, you wouldn’t expect to get replies to old posts (as they’re not as readily available – although it could happen).

That’s not a worry, as you can change your overall subscriptions at any time. There’s a link in the email you receive to let you do that.

The Turn is Upon Us

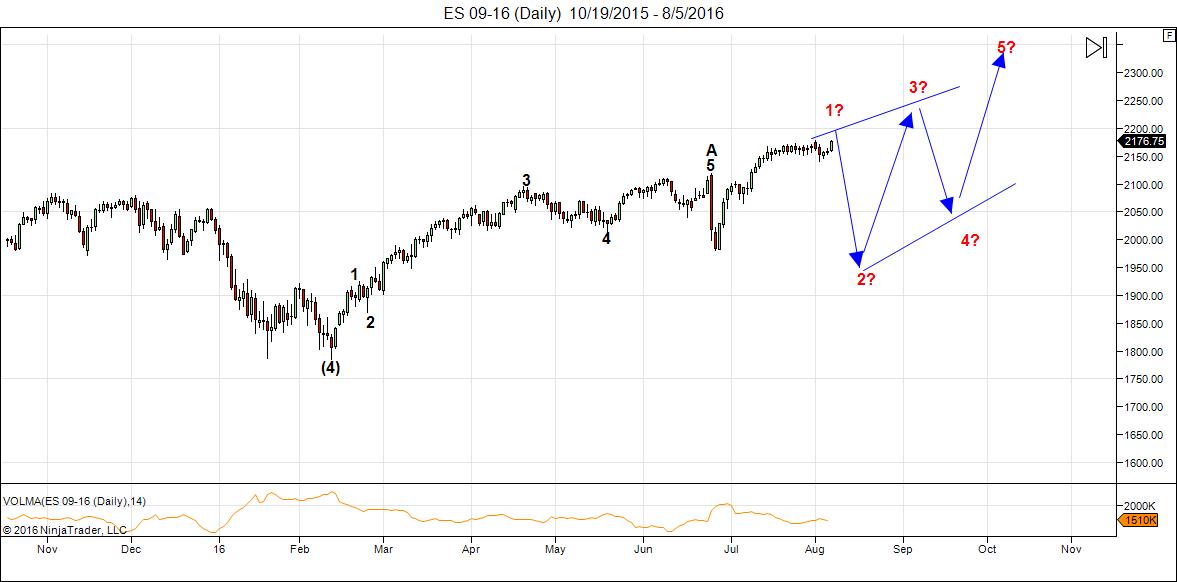

The major turn in the markets is a couple of months away in my estimation. We should continue to chug up and down in an ending diagonal before we get to the final top. The chart below is a rough estimation of how that might look.

Above is the daily chart of ES (SPX emini futures). We either at the top or close to the top of the first wave of the ending diagonal. The next major move is to the downside. We still have our work cut out for us in terms of reaching a final high.

Peter bottoms are easy to spot like the one in feb. But tops they drag for months. So if we go to 1940. It last for few weeks. Then they take it to 2250 it lasts for who knows. Then above it shows 2350 for fifth. So who know how long.

Kennedy was assassinated in Dallas on 11/22/1963. That was within 1 month (after some 53 odd years) of 6 turns of a Fibonacci 3.1614…. Same city, political implication, successful assignations,… Nothing new under the Sun. 6 no less! Do I really have to do a ‘do over’ of the 60’s and 70’s again. That really wasn’t good Karma. Sigh 🙁

haha ….thanks for the laugh!

I was at the original Woodstock in ’69, so that small part of it worked for me. At least, I remember it …

Peter,

I can’t do anything but laugh. It’s funny what things hit home on an issue that put it in perspective. It is different for everyone. As always, I appreciate the grounding. Well, I suppose I ( all of us actually) should strap it on, it could be a bumpy ride!

Steve

Peter,

Really, Woodstock! First person I’ve known that was actually there. How cool. Tell us about your thoughts at the time, and your thoughts now on that experience with the years of experience under your belt. Of course, based on how you look now, you were probably 3. In which case you might not have any memories!

Steve

Steve,

Thanks, but I was 19. 66 now. We’ll blame television makeup … haha.

I was living in Toronto having moved from New York 3 years earlier. We went down (2 friends and my sister) in a 66 Mustang. I’d been in hospital for four months when I was 17 and so I was able to play on parental guilt. The highlight for me was Janice Joplin and the Who.

We met a draft dodger from Florida in a tent and smoked what we called “grass” at the time—it was slightly more potent than the lawn variety, compared to what’s out there now (very cliché, but my first time, and I didn’t know how to inhale, ’cause I’d never smoked). The US was a much more “mature” environment (due to the war) compared to what I was used to coming from Toronto. So it was an eye-opener. I missed Sunday because I had to be back in Toronto for surgery on the Monday … so it was a bit of a whirlwind tour …

I’ll always remember the fold-up tables with “hippies” selling acid … right out in the open. A lot of memories. I think it rained … lol.

Good post, Peter! PALS this week:

Phase: negative all week

Distance: negative all week

Declination: negative Mon, Tues, positive Wed to Fri

Planets: Mercury inferior coming somewhat negative for markets

Seasonals: often big selling end of August

Summary: Short at moment. Expecting selling on and off next 5 weeks.

Thanks … we’re on the same page. Everything is really, really weak tonight …

Let’s pay attention to Valley! 🙂

Thanks, Peter! Been listening to Jay Kaeppel’s video on Better System Trader youtube channel. He has more ways to approach seasonal investing than a Ronco slice/dicer as seen on TV. One of his ideas is avoid September which has been a net negative for equities during last many decades.

Peter,

Another coincidence that I have received recently. I come from grabbing a bite to eat, and for whatever reason I go to my book shelf library and immediately go to a book I have been looking for but not seen in years. A book by Brad Steiger, ‘A Roadmap of Time’ which discusses the Maxwell/Wheeler weather cycles, jumped out at me. This book has been on my mind for several weeks, but I was unable to find because it was hiding in plain view. Again, all conscience serves a purpose. You may already have it, but if not and can’t find, let me know – happy to share.

Steve

Peter,

It has been a few years, so I decided to quickly review the above mentioned book. It was page 20 that reminded me of the insight that is applicable to the market, and page 28/29 that reflected a psychologist aha insight…lots of good info

Steve

Peter,

I just wanted to add I have been watching a raising wedge on the S&P 60 min chart and the formation appeared to have started 8-1 and topped out 8-15 with a break down on 8-16 at the opening bell.

Now we have a H&S pattern setting up and the neckline is appox @ 2166. A candle close below that should see selling pressure pick up and the next area of focus is S&P 2147.58.

With the measured move of the H&S we should blast through that area to the downside intensifying the selling.

I would think it would be safe to assume that a bunch of stops are just a few ticks below 2147.58 and we will see a flush once we start to breach that area confirming the count at that point.

Thanks for the post!

Jody

This is a ‘test’ post because the last post I can see is Jody’s on 21st August @10:21pm (don’t know which time zone). Since I can’t believe there have not been any further posts since then hence my post here to see if there is something wrong with my IT setup.

Apologies for the spurious post.

Purvez,

It’s such a quiet yet frustrating market, I think is all … until my friend, Janet, opens her trap, perhaps.

Peter, if that’s ALL it is then I’m contented. I would not want to miss out on the many varied and very interesting posts that people make here.

Thanks for letting me know.

Peter,

It has been very quite. I have been trading since 2008 and I don’t think I have seen it as slow as it has been the past month or so.

Something interesting I spotted in the charts today. I found a Bearish Gartley Harmonic Pattern on the S&P and the ratios fit perfect.

It looks like we might start our decent tomorrow, but this has been a crazy market so they could surprise us..

Jody

Jody,

Quiet it has indeed been. http://www.zerohedge.com/news/2016-08-23/its-scary-quiet-past-month-has-seen-least-volatility-1995

Janet Yellen has her Jackson Hole much anticipated speech on Friday morning. I think it will disappoint. 🙂

This what I post last weekend.

“This week seems quiet as short term there is some up force as I stated above. Next week things will get more volatile as the sun turns bearish as of Friday.”

Educational purposes only 😉

p.s.

The high may come Thursday; strong Gann cit and last quarter,

cheers,

André

8/27 is 180 degrees 2009 low. 0 degrees is low, 180 degrees opposite. 6 month cycle….

Thanks Andre.. keep posting….nick

To Propose a cycle/timing question to the group, what are the thoughts on a March 2017 top? This would seem to give enough time to let the wave 5 ending diagonal play out and would be a 17 year from the tech mania top. I also thought Andre may have mentioned March 2017 as an important date in a previous post, though it may have been the first major low instead of a high.

I still think short term (1-1.5 months) are that wave 2 down. However after that i am pretty open to whatever the markets and cycles tell us.

I think a wave down after this stupid up wave finishes, will go WAY FASTER since time is getting shorter and shorter to do the ‘falling down’ because this market has been UP for so long… That is why down movements are always so fast, the longer we go up, the shorter we have to go down so the more heavy it goes often??? 🙂

Cheers,

W

Ted,

Bulls take the stairs and Bears ride the elevator. The market sells off quicker than it goes up. We could get there in just a few days.

On the way down there are 2 spots I will anticipate a reversal ~ 2060ish area and if that breaks1975ish area.

I have my EMA’s set to alert me quickly when trend changes so i don’t get stuck on the wrong side of the trade.. I do not use the traditional time periods. I have found other ones that are way more useful for me anyways.

Peter, Thanks for the article..

Jody

Jody,

You’re welcome!

An important article on Deutsche Bank:

http://www.zerohedge.com/news/2016-08-24/deutsche-bank-ceo-warns-fatal-consequences-savers

Funny how the overlaid DB with a Lehman chart. I was thinking of how the Lehman failure effected the market as I read it.

I know you said Yellen might disappoint on Friday but if she does that would be shocking as she seems scared to death to ever do anything to spook the market.

The market needs an excuse to start the sell off; doesn’t really matter what Yellen says. Good news will be bad and bad news wil be – eh – bad. Time is running out – fast.

I love ELO : big wheels turning.

Most likely the weekend will be used to think about what is happening.

Sunday we have the 19 day Mercury cycle. Monday will be a dark day using Carolan’s lunar timing. Dark day means a high.

The market is very fragile now; so we should start counting in hours rather than days.

Time > Price right hè André? 😉

Right; time always the most important.

Once we turn down into 9/12-13. This weekend I’ll give you the roadmap into 10/14. Last weekends roadmap into 2017 is set in stone.

Found a new timing tool (through serendipity). I call it André’s power dates (APD)

Last one was 8/15 (gave the high) next 2 dates 8/29 and 9/12.

These dates are calculated from price but are in sync with upagrahas. This is the power of vibrations. The market is now in an ending wave into Monday and then the wait is over. Down into 9/12-13.

Will give you some more ADP’s this weekend into october.

LET THE WAIT BE OVER! GRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRRROWWWWWWWLLLLLLLLLLLLLL (a bear awakening ><). 🙂

Cheers,

W

The bear was just hybernating and wakes up with a hugh appetite. Boy, those bulls taste good.

I might add that this means that Monday we will start our journey into the march 2017 low. 3/25/17 is 2000 days from the 10/4/11 low.

As the sub dasha is bullish from 8/26 into 9/3 we will see low midweek and a pull up into 9/3. This is a 1929 powerdate and must be tested. The week after we will see a w3 wave down into 9/12. I expect bad news next weekend to cause the violent decline.

you turn dates match well with this predictive model based on natural cycles

https://postimg.org/image/9d9re1fzd/

Tom,

Thanks

Hi Tom,

Do you have more information or a website for this predictive model based on natural cycles? Looks interesting….

thanks,

Glenn

Bull Tome:

Last few PALS negative cycles have not produced any selling. Price is compressing and move when it happens should be same size as length of compression price line. So this should move price quite a lot one way or the other. We are only up 4% so far this year, so from historical perspective there is still upside of 10% by Dec. 31 to make a 14% year which is not unusual. A early September price ramp would confound market timers and add a bit of risk to trading around November election. So, I will be keeping option positions small on the put side, and if selling occurs next week will be 100% invested in SPY. (Also, Saturn in Sag (bullish), ZIRP (bullish), CB equity purchases (bullish) )

André,

Going to be interesting.. I am seeing a minute 1 complete with the gap this morning and we are in 2 now with the C leg left to finish tomorrow then a 3 down starting tomorrow sometime after lunch and the 4 mid week next week.

Either way I am ready for this thing to do something..

Jody,

This weekend I’ll give the cycle structure into the 10/14 low; the first date in the roadmap I gave last weekend.

My vibrational system gave 360 degrees on the 7/20/15 high 8/25. 7/20 was a major high and the start of the decline into 8/24/15.

The 360 degree timing confirms the bullish dasha timing 8/26. This is amazing. But it confirms that 8/29 will be a high like 7/20.

And that what comes next will resemble august 2015.

Only then the longer trend was still up. This is no longer the case.

So the recovery in 2015 will not come this time.

André

Today Jupiter moves to a bearish mansion. But the planetary indicator on Venus runs into 9/4. So the subdasha on the 1792 system turns bullish when Jupiter turns bearish to connect Jupiter with Venus. 9/3 is a 1929 APD; and Venus knows it.

See how everything aligns? This shouldn’t surprise us as it is all the same vibration.

The decline will start slowly and gain speed in steps. 9/3-5 and 10/3 are acceleration dates.

9/3 is Saturday so it may roll over to 9/5. Robert Gordon (Gann’s Tunnel through the air) was born 6/9 = 9/6. So Gann new 9/6 was a significant date.

Everything is connected; you’d better get used to it! Or not; what do I care 😉

Always fun and interesting to read Peter and Andre. Only Joe is missing right now… 😉

Ty guys!

W

Why wait for the weekend? Everything is programmed.

8/29 high

8/31 low

9/5 high

9/12 low

9/19 high

9/27 low

10/3 high

10/14 low.

For every turn I can give you at least 3 arguments. Please feel free to add or question something. Could give this into march 2017 but you would all forget the dates. So I’ll do it a step at the time.

I should have added : this is not trading advice!

Thanks very much Andre, I’ve got them printed and stuck on my screen.

I applied your numbers to my previously sent chart

it worked best when most weeks were inverted

https://postimg.org/image/hrduyc0bh/

Yours or mine?

your numbers

One control mechanism is the trading day system.

Highs usually come 115 TD after a previous high. 8/30 is 115 td from the 4/1 high and 10/3 is 115td from the 4/20 high.

Lows center around the 100 td mark but have a range that works in steps of 3 td.

The 5/19 low was 109 td 12/14/15. 9/1 wil be 106 td from the 4/4 low. That’s how I know 8/31 -ish must be a low.

10/12 is 109 td from 4/4 and 10/13 88 td from the 6/8 low and 10/12 is 100 td from the 5/19 low. So a low around 10/13-ish is confirmed by 88,100 and 109 td.

The fact that 3 turns confirm this date indicates this low is significant as per my roadmap.

Again this is just confirmation; the last step in the proces.

Just realized something. The 85-115 td range is general. When the trend is up the high will go for max momentum and that is 115 td. It could very well be that once the market turns the low wil do that.

9/7 is 97 (no typo) td from the 4/20 high. So a high 9/5-7-ish is likely. But it also indicates this is a very weak high.

9/20 is 106 td from 20/4. So this confirms the high 9/19 I gave. It also indicates it will be a stronger high than 9/5 as it goes 9 td deeper.

When highs are unable to reach the 115td mark the market is weak. And when in a down market the 115 td is touched (10/3) a lot of energy must be released,

Once we see lows on the 115 td mark the market will be in full bearish mode.

I am certain we will see this; but not just yet. This fits with my Idea we are just in the first wave down and the real mess will come next year in the fall of 2017. This will bring the 115td lows!

One scenario I have is a low in 2023; so plenty of time for the waves to unfold.

Cgeers,

André

Funny.

The 9/7 high (9/5) is at 97 td’s. The 9/20 at 106. That is +9. The 10/3 is at 115 or 106+9.

See how the market is building up strength, fighting harder to keep things afloat, and takes 9td steps. This supports the idea 10/3 will be a major crash date.

In Carolan’s technique 10/2-3 should bring the fall high this year.

The first 3 lows come at 106,112 and 100 td’s. This shows the lows are not very deep. As long as the highs draw more energy we will be absorbing. After the oktober low the roadmap projects a december high. The next wave down will be more severe.

In that sense the october low is not that deep; it is just that the high is too deep. So the recovery into december may be strong.

Never done this analysis but I think it can help a lot in judging where the market is.

thanks Andre ….nick,… get some sleep

Wow! Fear and greed at its best!

No fear, only greed

haha … well, we did get a fairly powerful B wave down …

The powerful down wave in the DJIA occurred in the last half hour. By my reckoning it is the start of a 3rd of a 3rd wave from the 15th August top. Sure is acting like a 3rd of a 3rd.

I would count to in the 3rd of the 3rd of the 1st

Dimitri, I think you mean, 3rd of the 1st, of the 3rd of the 3rd….but I’m just being pedantic here. I believe we have started our down wave to below Feb/last Aug lows so there is still quite a bit of mileage. Although at the rate of 200 DJIA points per half hour we’ll be there TOOO soon for my liking.

Purvez, it doesn’t matter while it keeps to be motive.

🙂 🙂 Haha yes you are right Dimitri.

It always amazes me how Yellen’s speeches, which are pretty much indecipherable, have such an effect.

Looks we have motive wave down in ES since the high of last Wednesday.

Of course much as I like my ‘3rd of a 3rd’ count we must keep in mind that this might just be the start of the ‘C’ wave of the correction that Peter has been calling for.

In which case we won’t get anywhere near the Feb/last Aug lows.

Open mind people…to all possibilities. That’s the key to survival in this jungle that we have chosen to inhabit..

Peter, I have an ‘admin’ related question about this blog/market forecast.

Quite by accident I scrolled too far down past the comments and found a link to a ‘Next post : August 25, 2016’. However that doesn’t appear within the Market Forecast section and you don’t mention it in the comments section like you do for the new Market Forecast post.

Is this something that is only for paid subscribers or should I be checking if you are posting something new beyond the ‘comments’ section?

Not being a paid subscriber I would not want to gain incorrect access to material that is only intended for paid subscribers.

Your clarification would be most welcome.

Thanks for your continued ‘free’ support as well.

Purvez,

Yes, you could do that for a short while, but the hole has been plugged … I’m waiting for a fix in code. I’m hoping I don’t have to removed those links altogether. Unfortunately, it registers next and previous posts from anywhere on the site. It used to take you to the Trader’s Gold area. Now it just takes you to the front page, so I think I’ll have to remove them until I get that code to change it so it just registers previous and past posts within a category (which this free blog is).

It’s become a somewhat complicated site … 🙂

Thanks for pointing it out. I found it a few days ago and have been attempting to work out a solution.

Peter, ooops, I didn’t mean to high light the ‘back door’. Sorry about that.

Do you do your own programming for the site? Depending on what the underlying infrastructure is of this blog I would be willing to help with my time in resolving small issues.

I am a web developer (although scaling down) and use Ruby on Rails with MySQL as the back end and of course Javascript at the front.

Be happy to help as a ‘thank you’ for providing us with a free venue. No charge from me….within reason.

Purvez,

I do … and it’s a thesis site (thesis theme on wordpress). There’s a box (part of thesis) that fixes this that isn’t posted anywhere and the guy who developed it is on holiday, I think. If I can get my hands on it, it’s a 5 second fix. I’m trying to track him down.

Yeah, I never thought about the previous and next post links being global. I just removed them. I can set up a widget that will do the same thing, I think. Those I have control over (and create a different sidebar for this particular blog template).

You know what all this is like. I used to write code in Director (multimedia) – created software in it (a little like javascript). I could at one time handle some PHP but I’ve given up on the big stuff.

Thanks for the offer. I really do appreciate it. I’m going to wait for the box if I can get in the next few days. If not, I may be getting back to you.

PS: I wouldn’t get too far in thinking this is the start of something bigger (today). I think we’re hanging up here for a little while longer. It’s a really complicated wave structure, that’s for sure.

Let’s say that today’s ‘down draft’ is a ‘tail fake’. In that case this is the next count that I like on the DJIA:

https://postimg.org/image/w0tw152ih/

Peter,

I share my expectations for free. So I don’t care who pays attention. I am not selling a paid service.

If I have to give evidence for or backtest everything I post here I see no point in posting anymore.

On this site we share ideas hoping we can inspire each other and learn. Still, the dates were carefullly determined and I have a lot of confidence in them. You may have noticed wallstreet made a low Friday. That is kind of what one would expect when the high must come on Monday.

We will get confirmation soon enough. If you have arguments why my dates are wrong, let’s hear them.

Have a nice day,

André

To avoid confusion; this is a response to that other Peter.

“On this site we share ideas hoping we can inspire each other and learn”

https://worldcyclesinstitute.com/a-bullish-world/#comment-10211

“thanks for prompting the ‘grey matter’ to consider various possibilities”

Hey André,

Look at this video it supports your theory from an esoteric point of view.

https://vimeo.com/176370337?ref=fb-share&1

Have a nice weekend.

Nice video; thanks.

I was doing some work on the site last night and lost a few of the yesterdays’ final comments. However, I can get to them and today I’ll will add some of the more important ones from the past couple of weeks to the forum.

Today, I’ll have a new post and share what I think is happening, both shorter term and longer term, from an ES perspective. The plot thickens …

There’s are a couple of new widgets in the sidebar: one for recent forum posts and one for recent blog posts.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.