We Wait …

Last week, I noted that “the ducks were all lined up” for a turn to the downside. These “ducks” are all the assets I cover on a daily basis.

But stubbornly, my ducks have not budged. They have been moving sideways this week in what might be a final contracting triangle. We don’t have a complete E wave in place for that triangle, so I can’t be sure it actually is one … until we drop down one more time to the lower trendline.

In any case, we need a new high before getting excited that this rally is done.

We wait.

In my experience, one of the biggest psychological fights traders have to deal with is FOMO — the fear of missing out — in other words, sitting on your hands and waiting for the set up.

Resisting “being in the game” is an extremely important part of being successful as a trader. It’s why I continually point to the Elliott Wave entry methodology as the least risky way to enter a trade: You wait to see a first wave of five waves, and only enter after a turn of corrective second wave (which has to retrace that first wave at least 62%, and then turn back in the direction of the first wave).

You lose very little of the trade (in fact, only 38% of the movement of the first wave) and it provides a relatively obvious point at which to place a stop. The most important benefit of this methodology is that it keeps you out of the fray of picking tops, which are notoriously difficult to enter safely (because it’s mostly guesswork — there are few signposts to go by). Picking top and bottoms is the way most people lose money.

So, it might hurt your brain to sit on your hands, but the payoff is well worth the struggle.

This ten week rally is a good example. People may not like the fact that I’ve been advocating not trading this countertrend move up. The reason is that corrective waves can travel farther than you have funds. From an Elliott Wave perspective, corrective waves are the most difficult waves to attempt to predict the end of, because they can be complex and have many possible points from which to measure a typical fibonacci turn point).

Corrective waves as part of a fourth wave (the corrective pattern that is the most dangerous one of all, because the bulls and bears are usually very closely matched) can be volatile, and patterns can easily morph into other patterns just when you think you’ve got it all figured out. In other words, the options for turns are more plentiful than just about any other pattern.

Staying out of a corrective wave for ten weeks might be difficult, but the larger payoff comes in multiple forms:

- you don’t waste your time watching every tick looking for an entry

- you fork over much less in trading fees (compared with day-traders)

- you know that a corrective wave has to completely retrace, so this gives you a relatively reliable target for an exit

- you experience far greater losses and longer trade runs

It’s a fight against human nature. FOMO is a very powerful force. The best way to combat it is to have a system and to stick to it. And when there simply aren’t any reliable setups, it’s much healthier to go fishing, or sailing, or skiing, or whatever your passion is … away from the market.

A Recap of Where We Are

This week, as has been the case for the past few weeks, it’s the US dollar that’s the asset to watch. It’s retraced 62% of the previous wave up, as I predicted it would. We now turned back up, but I expect a retrace of the 96 level. When it crosses that line and turns back up again, everything else should turn with it (USD currencies, all US equities’ indices, oil, and most likely silver and gold).

The “indicator” ducks that are all lined up are:

- market sentiment

- volume

- the EW count generally

- the ending diagonals in multiple assets (and asset classes)

- the time vs. percentage of retrace of this corrective wave up

Even though I’ve talked about all of these in previous posts (as we’ve waiting for this monster), here’s a brief summary.

Market Sentiment is at bullish extremes. You can get a bit more information at to the extreme levels by visiting this site.

Volume in emini futures is ridiculously low and it seems to market could collapse through lack of interest.

The EW count in the US indices is an ABC corrective wave, with the C wave having a full extended five waves in its count. Five waves requires a retrace – it represents a full count.

There are ending diagonals in WTI Oil, emini futures, the SP500, and USDCAD. Ending diagonals are ending patterns that forecast a dramatic turn and imminent trend change.

In terms of time, the corrective rally has now retraced roughly 75% of the previous 12 week drop to the Dec. 26 low. A 75% time expectation of the wave down would suggest about 9 weeks for the rally duration. We’re at nine and a half weeks this weekend. Ten weeks exactly takes us to Wednesday, March 6. It’s also a New Moon, and there’s talk of a US/China trade deal being signed on that date.

However, I’d sit on your hands and wait for a first and second combination before thinking that the turn is in. As I often say,

“Trade what you see, not what you think.”

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

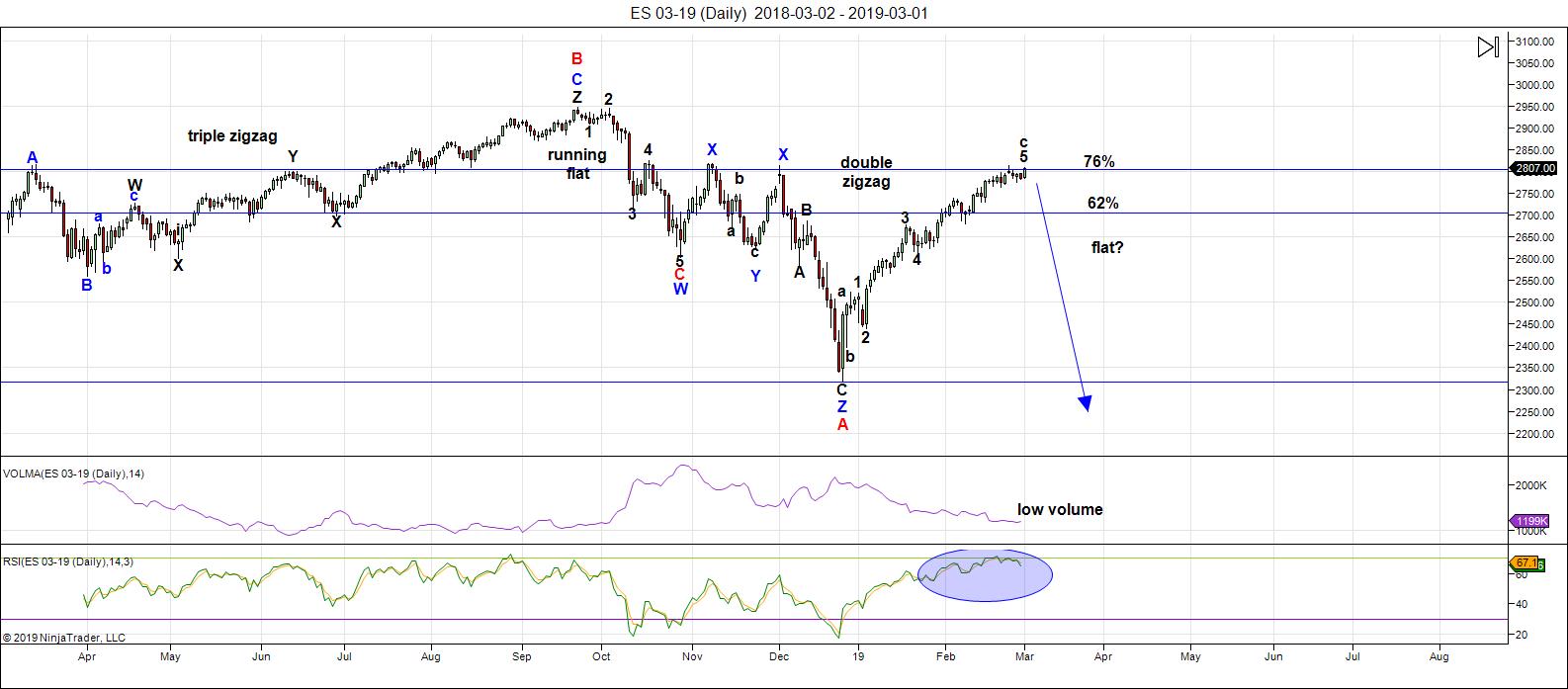

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Very little has changed in the past week. We're still sitting at the top of a B wave that's now risen to about the 76% level of the height of the previous set of waves down from the all-time high at October 3, 2018. Almost all the other assets I cover on a daily basis are hovering at inflection points. The "greed factor" is at an extreme; volume is at a low. It's past time to look for a turn down in a continuation of the larger fourth wave.

Towards the end of last week, it became obvious that both the SP500 and ES (emini futures) were tracing out a possible contracting triangle — they've both being going sideways for over a week. NQ appears to be at the top of an ending diagonal. Both of these patterns signal an imminent trend change.

As I've been saying, the wave from Dec. 26 is clearly corrective and, as a result, must fully retrace. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

There is a new moon on Wednesday, March 6, which is also apparently the day the US/China trade deal will be paraded in front of the public. This particular new moon has been described to me as a "hot mess," which is what we might also get as the core of the trade deal. So, between now and Wednesday offers a timeframe and a set of circumstances that points to a forming top.

Summary: My preference is for a dramatic drop in a C wave to a new low that should begin this week. The culmination of this drop should mark the bottom of large fourth wave in progress since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 6 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

VIX bull flag suggesting it should clear 20 before a bounce…

I covered another 25% on the back of this payroll number @ 2730. Will sell a bounce next week if we get one. Otherwise will stay short the remaining 50%. Lets go with Tom’s energy chart and look for a high on 3/15 !! The big support zone is 2615 – 2645.

Nice trading Vivek!

Thank you Tom your energy chart..has been a great addition..!awesome!!

Thank-you for the kind words Marie

I’m glad you’re enjoying the energy charts

got it short oil.happy day

Exited shorts. Have a nice weekend everyone!

Same here..nice ride down! Have a happy..go..lucky..weekend Ms Liz!

Long @ 2730 spx

Jus took 25%

Exited SPY 272/273 bear call spread.

Holding 273 calls for giggles… 🙂

Nice..Mr Verne..go get em tiger!

Yep!

So far 2720 being staunchly defended.

If we break that shelf, it will be first sign that….”There may be trouble ahead…!”

Yeah..imma still buying dips..havent even broken 50 day sma yet..til then up..up she goes.

have a great weekend!! was a good morning..

Hi Tom.

Wanted to get your O.K to share your chart this week with a few other traders I know.

you have my blessing Verne

p.s. please explain that these charts are not stock charts

but the ebb and flow of energy hitting our planet

and the markets relationship to this energy

as spelled out in the FED’s paper I posted a week ago

Thanks Tom.

Some of these guys are also academics and are fascinated by the correlation.

They did not believe me!! 🙂

Peter G

I have been noticing for a while now that the 5 day trin has been

doing basically this things you would look for using the 10 day trin .

no opinion at this point im just pointing it out since I know you look

at it as well .

Carter Worth of CNBC Fast Money (likely the most bullish program on TV)…listen carefully!

https://twitter.com/CNBCFastMoney/status/1104147127612125184

Said 3/12 will be high,

3/11 early will be a low (CET) and then up into monday evening because of 3/12 high.

https://worldcyclesinstitute.com/my-dawdling-ducks/comment-page-1/#comment-36957

what about 3/8? Mercury, Berg, Gann dates alone are nice to knows…how they fit into the bigger picture is really the issue…if you believe the market (S&P 500) is now in an intermediate down trend when do you expect a meaningful low to occur?

https://www.theocc.com/components/docs/about/publications/xcal2019.pdf

https://worldcyclesinstitute.com/my-dawdling-ducks/comment-page-2/#comment-37039

“11/3 will be a very significant low”

https://worldcyclesinstitute.com/next-up-down/comment-page-1/#comment-36011

“I expect the low in march before we get the last leg up into q3”

I dunno..imma still bullish until 50 day sma gives out. Its at 2673..SPX prob heads up to at least 2820 b4 a major turn down.

11/3 will be a very significant low. We have 2 pos sensitive degrees of the moon; early monday and late monday. This shows each market wants set it’s own low. As we can’t have 2 lows in a row the midpoint Must be a high. And that makes sense as 3/11 will be a high. And a low. So; for monday low – high – low. Tomorrow the rest of the week.

The major low 3/11 will start a classic 4 day inversion window into 3/15. Told you the tidal field is up into 3/15. 3/15 also Leonardo timing. So 3/15 will be tested as a high. 3/13 will be high as we have a negative degree of the moon 11:00 cet.

P.S. Tom?

The day of month indicator gives a high 3/10 and a low 3/11. This means ABC down with leg a monday morning, b up into midday and leg c down into 17:00-ish CET.

Sensitive degrees of the moon confirm we have 2 lows on monday. Logic dictates we need a high between 2 lows. I calculated the sensitive degrees also on the major turn years. In 1932 we had a neg degree around 13:00. This almost exactly the midpoint between 9:00 and 17:00. Anyway, 1932 confirms a high on Monday; the leg B up.

Sesitive degrees of the sun may also be used on the planets. Venus gives a low 3/10, hence the lw early monday morning in Europe. Mars gives a high 3/13 and a low 3/15. Mercury also gives a low 3/15.

For Tuesday we don’t have sensitive degrees. But we use the square of 9 to find vibrational degrees. Tuesday morning the vibrational degree gives change in trend 9:21 cet. In 1974 we saw a negative degree 9:12. So 1974 confirms a high Tuesday morning. 45 degrees point to a low 17:30 – ish (CET).

Wednesday will bring a high (see Mars) again early morning. In 2015 we saw a negative degree 9:57 CET. The low should com around 15:00 cet. In 1929 we saw a negative degree 21:08, so from a low in the afternoon (for you in the morning) we go up into 21:00 cet/15:00 your time.

The day of month gives a significant high 3/14. And the tidal field is bullish into 3/14-15. Ted Philips, the astrologer, says 3/14-15 is the most significant turn period of the month. 3/15 opex. Opex weeks usually bullish. 3/15 is a 4 day inversion windo from the 3/11 high. That is why the low 3/11 is signifcant.

3/15-18 should bring a significant change in trend as the tidal field turn bearish into 3/21-22 and then turns bullish again into 3/29 when Mercury turns direct again.

This week will be consolidating but next weekend should should be significant.

264 degrees is positive in Jack Gillens work and Jupiter is at 264 degrees from 3/27 into 4/25. 4/11 significant as Jupiter turns retro then. This all looks very bearish.

I am counting on Tom chart to confirm what I said above ;-).

Cheers,

André

Said earlier we are up into q3 (venus velocity/90 year on 1929).

This is whet Merriman says:

The 4-year cycle crest in the U.S. stock market may have occurred on October 3, 2018. And the 4-year cycle trough may have been completed on December 26, 2018, as the DJIA fell over 19%. If so, stocks are due to rally for at least 5-8 months, a view that is supported by Jupiter in Sagittarius, November 8, 2018 through December 2, 2019. This is a time when long-term cycle crests, or secondary crests, often occur. Once the crest is in, we look for a

severe decline into a low that is due 2020-2023 year, coinciding with the time band for the 6.5-year cycle trough.

I calculated the average weekly pattern (day of week or Dow) on the Dutch index.

8 high, 11 low, 13 high (Mars), 16 low (mars) and a high 18.

Critical reverse day : March 17** (Merriman). Confirms a significant high 3/18.

3/18 is 22,5 degrees in the galactic year. Next date 4/10 (Jupiter retro 4/11)

Equilibrium timing is based on the Gann principle that time is price. Usually we don’t see that in the market. W3 always starts from equilibrium and that is the function of w2; to test equilibrium.

We calculate artificial equilibrium prices using the time angle and artificial dates using the price angle. Now something weird; equilibrium timing on 1932 gives 2 dates : 3/20 and 3/21. This is a rare alignment as the dates normally are weeks apart.

Philips says 3/21 is the next important date. My equilibrium timing confirms. Remember the tidal fiels is bearish into 3/21-22. I expect a low around that date.

From an EW perspective, it seems to me the simple thing to look for would be for price to remain below 2767.66 on any bounce next week. I have seen a few counts that have a complete A down and therefore we could see a new high with an expanded flat B wave but so far as I am concerned, if we go past what looks like an initial impulse down I am going to assume the move down was a three and that we are going back up to a new high. Just one man’s opinion…

A new weekend post is live at: https://worldcyclesinstitute.com/the-rarest-of-patterns/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.