The Last Legs

There are two legs left to this rally from December 26, 2018 across all the major US indices.

The down leg looks to have started on Friday and with the pulling of the Brexit vote on Saturday, we will likely see more downward movement. (the pound has already reacted negatively). This is the E leg of the contracting triangle, the final wave that completes it.

I told a UK trading buddy of mine on Friday night that, the state of the market at the close on Friday at the close predicted that the Brexit vote wouldn’t go well, because we’re expected a large drop. That was the case; the actual vote got pulled. Expect lower prices on the Sunday open.

The up leg will follow this one and be in five waves to a new high across all the indices. That wave will complete the almost year-long corrective rally (and non-confirmation) across the US major indices (ie – the DOW. SP500, Russell 3000, with the NYSE — the mother exchange).

The market is tired just like my doggy in the picture above. In fact, it’s exhausted. Gaps are routinely being left open and virtually everything is moving to the beat of the US Dollar.

You can also see revolutions starting to break out in countries around the world (Spain, France, Hong Kong, Chile, Ecuador, Haiti, Papua New Guinea, and others). This is not an anomaly; they will continue to crop up and get bigger as time goes on.

Then there are the loss of jobs, bankruptcies, and union strikes that are growing through out the world. The action of governments to these crises usually exacerbates the problem (as in the jailing of politicians from Catalonia for 13 years, or the restricting of imports of black outerwear in Hong Kong by the Chinese government so protesters can’t dress in black — this one is particularly stupid).

Add to that the corruption that continues to be exposed and you have a recipe for a major upheaval. When this market comes down, it will be fuel for the fires that are starting all over the world.

The Hunt for Red October

The end of October is rife with major events.

- Wednesday, October 30 is the next Federal Reserve announcement.

- Thursday, October 31 is the current Brexit deadline, although the UK government may ask for yet another delay to the beginning of January.

- November 1 is the next US Labor Report.

We’re looking ahead for a possible “trigger event.” The market will turn on schedule when the final pattern (a contracting triangle is complete). However, it’s usually accompanied by a major event sometime around that top.

Based upon the projection of a very large fourth wave drop in the SP500 to an area below 2100 suggests to me we’re going to see the demise of an European bank, perhaps Deutsche Bank. (there are other possible contenders out there, but this would be the biggest financially destructive potential catalyst).

_________________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

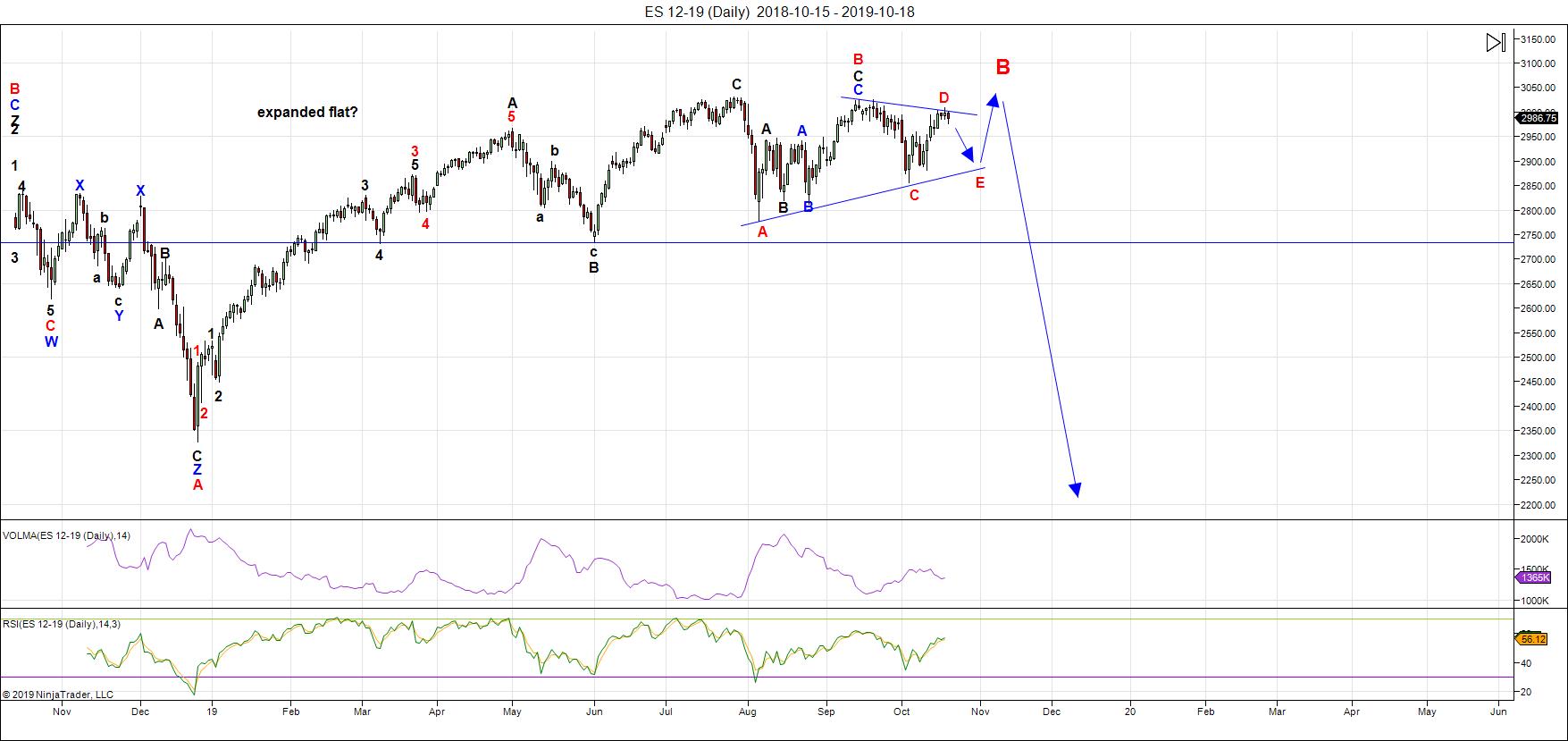

Above is the daily chart of ES (click to enlarge, as with any of my charts).

This past week was mostly sideways action across multiple asset classes.

In ES, we're now in the E leg of a contracting triangle (likewise across all the major US indices, except the Russel 2000 (IWM), which has a slightly different pattern, but still needs a new high).

Sideways action: The movement of the US Dollar dictates the direction and speed of movement of the US indices (and almost all the other asset classes) and it's been in a running triangle for many months. Now, the US indices are at a major top and also in a triangle (a contracting triangle). These triangle restrict movement. The influence of being at a major top also means upside access is extremely limited. It's safer on the short side than long.

Volatility: On the other hand, volume at the top is extremely low which can result in larger moves on news. One other element that's affecting the movement of the market is dollar liquidity. It was a problem last week and sent to the US Dollar index to new highs. This week, with the introduction of QE4, it's moving the dollar in the opposite direction and it now appears to be at an extreme. This weekend seems to be an inflection point, and we may see this logjam broken apart by the Brexit vote, slated for Satursday.

In summary, movement is constricted by triangles while, at the same time, within those triangles, we can experience volatility, which I expect this weekend in particular.

With the Brexit shenanigans going on in the United Kingdom, and the pulling of the Saturday vote, GBPUSD has dropped strongly. I expect a similar reaction in varying degree across the rest of the market. I expect volatility to continue until we top, keeping in mind the movement restrictions of the larger triange patterns.

We also have potential market-moving events at the end of October, which may prove to be our top.

Expectations short-term are that the US Dollar Index will turn to the upside, which will allow the eminis (ES.NQ) to complete the E leg of the triangle we're in — to continue a drop lower in three waves. This is the final E leg of a contracting triangle.

After that downward leg is complete, look for a final wave in the US indices (in five subwaves) to an all time new high, which will result in a trend reversal and start a mini-crash to new lows below the December 26, 2018 low.

Longer term in ES, I'm expecting the C wave of a an expanded flat to the downside. In that case, a first wave should drop to the 2725-30 area (previous fourth of one lesser degree) and then bounce in a second wave to the 2875 area (62% retrace), before a third wave down to about 2250. After that, a fourth and fifth wave down to under 2100 will round out the drop.

There is an option of a set of zigzags down to the same level, but it's less probable because there are so many flats set up across multiple stocks and indices. If a zigzag is the pattern that traces out, the retraces up will not be as strong as they would be with the C wave of a flat. We'll get a lot of information about the probable path from the first wave down.

The coming drop will be a world-wide phenomenon across all most all sectors. It will last into the New Year and most likely culminate in at the low in a final round of QE.

As I've said since the low on Dec. 26, the waves up are corrective in the NYSE-related indices, and as a result, will completely retrace. Expect an imminent top and a major move to a new low under 2100.

Summary: The most probable pattern tracing out at the top of this large corrective wave up from Jan. 26, 2018 is a contracting triangle. If so, after a final 5th wave high, the trend up will end, setting up for a devastating drop.

The larger degree pattern appears to be a flat (3-3-5 wave structures), which predicts a five wave dramatic drop to a new low below the A wave bottom at about 2300. The larger pattern in ES is a record-breaking broadening top (not an EW pattern).

I expect the ultimate bottom will be somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil).

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, October 30 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.