Galileo: The Contrarian

Galieo Galiie (1564 – 1564) was an Italian astronomer, physicist, and engineer. He is considered “the father of modern physics, the scientific method, and modern science.”

He was the “disrupter” who introduced the theory that the Sun was the centre of our Solar System (ie. – the Earth revolved around the Sun —”heliocentrism”).

This idea was met with immediate opposition from his peers, and most notably, the religious establishment. He spent the rest of his life under house arrest. He published his work in Dialogue Concerning theh Two Chief World Systems, in 1632. However, It wasn’t until 1758 that Galileo’s works were removed from the Index of prohibited books.

It’s generally held that with the publication of Isaac Newton’s Principia Mathematica (1787), we entered The Age of Enlightenment. There were a slew of scientific discoveries, ground-breaking literary works, and inventions of all types that followed on its heels. After all, this cycle top was instrumental in bringing books to the population (Gutenberg Press in 1440). The year 1492 is generally considered the top of the 516 cycle.

Galileo was born in a world leaving behind feudalism and slowing moving to a new monetary system; a period 500 hundred years ago that marked a major shift into our modern world. It was moving too slowly for Galileo. The world was not ready to embrace his system at the turn of the 17th century; however, the Age of Enlightenment and the Elizabethan period set the stage for other scientists, musicians, politicians to usher in immense changes across a wide spectrum of professions.

These “golden ages” are natural phenomena. Each hundred year cycle has an golden age; there are particular periods in which warm temperatures and adequate rainfall create an era of optimism and human energy.

Where am I going with this? Well, cycles determine what history repeats and when. There are only certain periods in which we revere our politicians, for example (other periods when we consider them tyrants and authoritarian). Our most beloved kings, rulers, and politicians all reigned in times of abundant food and a relaltively warm climate that led to growth periods across the world.

The world might not yet be ready for the truth of the Elliott Wave system, but with the coming Awakening on the horizon, it may well be that it will find it’s platform in the years to come. The timing has to be right, just like the time is becoming right for a world-wide revolution, and market crash.

Know the Past. See the Future

____________________________________

Elliott Wave Objectivity vs. Subjective Stupidity

I get accused of all kinds of wild and imaginative actions I’ve supposedly taken here on the free blog (or words I’ve apparently written), none of which are true, many of which would seem to be illogical.

Being a member of Mensa International, I expect to have to deal with a lot of “out of left field” comments, but the stupidest comment of all has been recently, with a variation of the demand that I “change the count” on my charts because somebody thinks it would be the “right thing to do.” This shows a complete ignorance of Elliott Wave methodology, scientific method, and technical analysis.

There’s a page on “objectivity” right out of the book, the Elliott Wave Principle, itself.

“Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means and objective study, or as [Charles J,] Collins* put it, “a disciplined form of technical analysis.” Hamilton Bolton* used to say that one of the hardest things he had to learn was to believe what he saw. If you do not believe what you see, you are likely to read into your analysis what you think should be there for some other reason. At this point, your count becomes subjective and worthless.” — p94, Elliott Wave Principle

* Charles Collins and Hamilton Bolton were well-known and respected writers for the stock market during the 1920s and 30s

Summary: The reason for having objective technical analysis is that you DON’T arbitrarily change the count to conform to some pre-formulated plan or expectation. That would add bias to the count and render it worthless; unusable.

The Mother Ship Review: The NYSE

Above is the daily chart of the NYSE. I refer to this exchange as “The Mother Ship” because it spawns the DOWS (Industrials and Transports), the SP500, The Russells, and the OEX.

However, all those sub-indexes are traded directly, so they’re just chocked full of animal spirits. Only the NYSE gives a clear picture of what’s actually going on. As I have stated ad nauseam, you cannot analyze the market unless you’re looking at multiple indices, and most importantly, the NYSE as a whole.

There will never be a situation in which the NYSE will have a different overall count than the sub-indices. You can’t have the SP500 completing five cycle degree waves to a hew all time high and then plummeting unless all the relative sub-indices trace out the same count … which means they would all have to reach new highs. A fractured market with different counts (with some indexes at new high and others not) has never happened, it isn’t going to happen here, and it is very unlikely that it will ever happen in the future.

In the chart above, you can see that the B wave has traced out an ending diagonal at the top. An ending diagonal is an ending pattern. The fifth wave cannot be longer than the third wave (a hard Elliott Wave rule). At the moment, the fifth wave can still rise another ten points or so to adhere to that rule.

NOTE: The NYSE is nowhere near a top, and has no chance of getting there under the current wave structure.

The Herd’s Inherent Bias

Above is the 3 day chart of the SP500 going all the way back to the 2015 year. You’ll see that I’ve placed an ellipse around a small degree fourth wave in 2016, which has a similar pattern to the one we’re tracing out now (in the upper right area of this same chart). I’ve marked the current B wave up (blue B).

Above is the 3 day chart of the SP500 going all the way back to the 2015 year. You’ll see that I’ve placed an ellipse around a small degree fourth wave in 2016, which has a similar pattern to the one we’re tracing out now (in the upper right area of this same chart). I’ve marked the current B wave up (blue B).

You can see that the same pattern traced out in the most recent 4th wave of one lesser degree; the current dilemma with a corrective B wave up approaching a new high is a pattern that’s relatively common. One more reason to suspect that the current count will result in a similar result.

The put/call ratios are also similar to what they were back at the end of 2016.

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

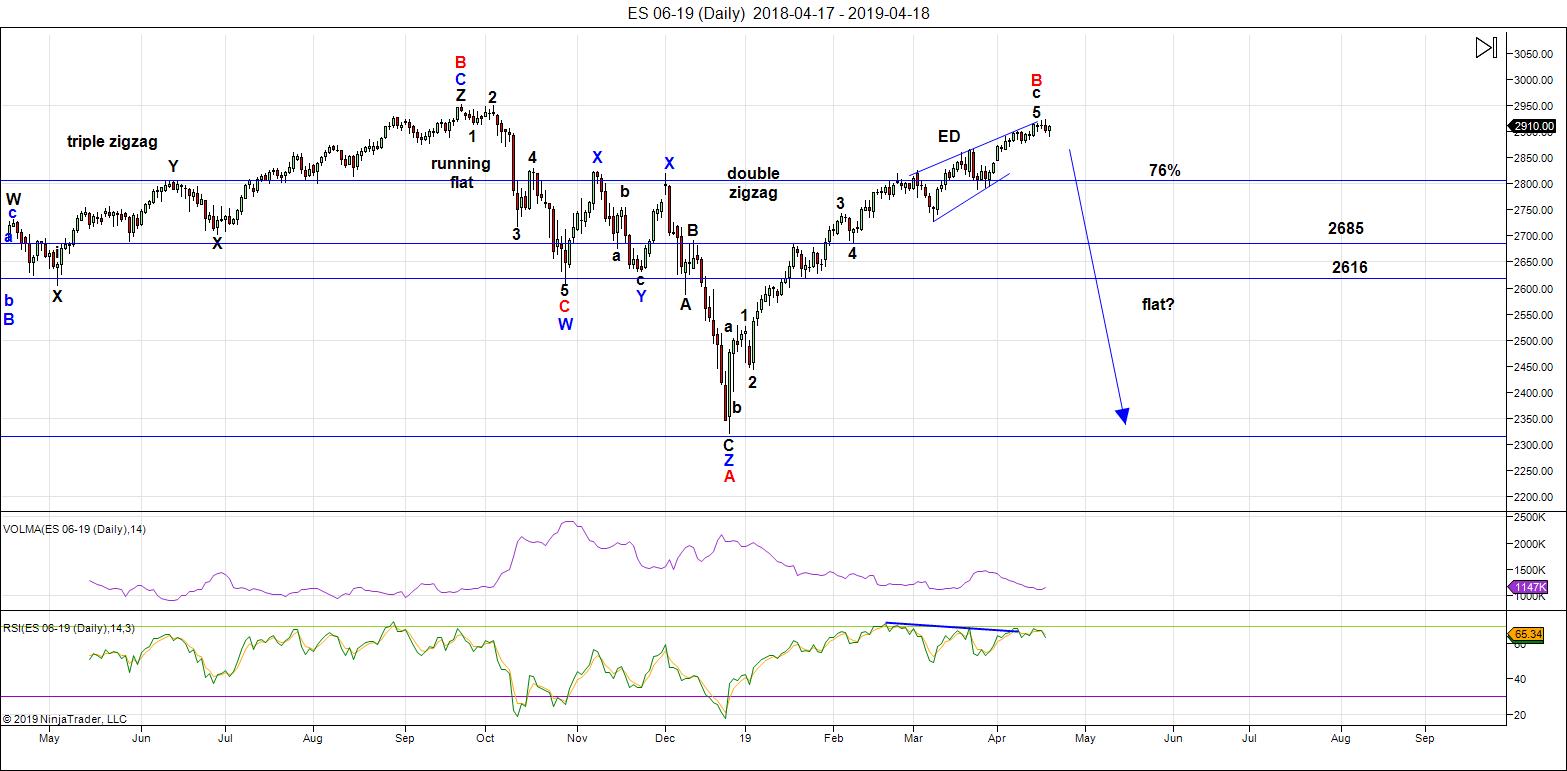

Above is the daily chart of ES (click to enlarge, as with any of my charts).

For the second weekend in a row, there's very little new.

We're still sitting near the top of a B wave that's risen to well above the 76% level of the height of the previous set of waves down from the all-time high at October 3, 2018. Almost all the other assets I cover on a daily basis are hovering near inflection points.

As I've been saying over and over like a broken record, all major asset classes are moving as one. That requires them all to reach new B wave highs before they can turn down together. It's like herding cats and is taking much longer than expected. It's also difficult to project a date for a top, because you have to take into account several assets.

IWM (Russell 2000) still needs new interim highs before everything heads down in a dramatic capitulation — it seems to the last NYSE index to require a top. On the currencies side, the US Dollar Index also has to complete its leg down before it turns up in earnest.

We appear to be in an ending diagonal in the SP500 and NQ. In ES — we now have an expanded triangle on an hourly chart, within the ending diagonal. All these indices are showing signs of exhaustion, with gaps that are being left unfilled.

The next major move is to the downside.

As I've been saying, the wave up from Dec. 26 is clearly corrective and, as a result, must fully retrace to the downside. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

Summary: My preference is for a dramatic drop in a C wave to a new low that should when all these asset classes I've identified have reached their targets. The culmination of this drop should mark the bottom of this large fourth wave in progress since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, April 24 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Looking for a VIX reclaim of breached most recent trend-line prior to the close….

DJIA open gap so far proving resistance. We take out this morning’s low and VIX high and that’s a wrap! 🙂

HOPE SO!

Thank you for the chart show..thanx for confirmation bout gold and silver..

Silver is the one I’m watching. It seems to be doing as expected, but everything’s at a crawl… sigh. You’re welcome.

I agree I think when it bounces it will go up more percentage wise than gold..that one is my bet…

Hearing smart money lately saying VIX < 13 like holding beach ball under water… we will see.

I think 4/23, 4/24, 4/25 were major swing highs for /es, /ym, /nq respectively. VIX 4/17 low looks firm for now.

Welcome back and thanks for sharing your view with us.

Energy chart for Friday

https://imgshare.io/image/april-26th-energy-chart-update.xwIu

Thanks Tom.

So looks like you are expecting a high around 1 pm tomorrow.

Tom – Whats a good email id if I want to communicate with you.

Thanks

Bill

I’m at work Bill

I don’t trade for a living

so sending e-mails here is not a good idea

The assault on a rising VIX yesterday was typically aggressive. However, if you look at the 30 minute chart you will notice something quite interesting: TWO intra-day gaps higher. Looks like we have a fearless accunulation of vol! 😊

Mind the gaps!

Another rare one in ES on 30 minute chart.

I don’t think it’s the banksters, too pathetic. I suspect it is some front running algo anticipating continued defense of the 2900 support shelf. It would be hilarious if price instead gaps down past 2900. VIX resisting the short sellers….

Yep! I forgot about the GDP report. Definitely brainless algos! 😁

Yeh, US growth slowing at a slower rate. That should be good for a 3000 SPX 🙂

Wanna bet it gets “revised”? Hehe! 😁

I’ll be focusing on 25412 on the cash Dow over the next month .

That’s roughly 1000 points lower .

Many stocks look like they are rolling over .

Sticking with the may 22- June 3 time period as a cycle low .

Going below 25412 does project even lower targets but

Sticking with one leg at a time .

month of June would be bullish under this scenerio

With much higher targets

SPX possible 3500 ish .

The bearish window opening presently will need to really prove itself

Over the next month to alter my bullish bias into mid August – Sept 6

And possibly into Jan 2020 .

I agree. It is possible the banksters will not unwind, or will releverage after only a brief pullback to ambush bearish trades. You simply cannot underestimate their ability to massage price in this market in the short and intermediate term. Any failure to impulsively break BOTH 2900 AND 2800 suggests to me that they are playing possum.

I also want to see VIX clear 15 and not look back with successive days of full green candles. My bearish scenario calls for a high degree C wave down and if the wave fails to exhibit those characteristic it means I am wrong and something else is unfolding.

Well, the brainless algos apparently did not “think” it prudent to stay in that idiot ramp for too long. That was a pretty swift gap closure…😬

A good start would be a take out of yesterdays lows, therfore hammering the attempted hammer, so to speak! 😉

If my theory about leveraged CB buying is valid, we should see a strong reaction around 2900.

They will either ramp it off that level or they will unwind the leverage that overcame that prior reistance. If the latter happens, we head to the 2800 pivot lickity split. 😎

Kinda hate it when the chop in market feels like a nuthin-burger, but I guess something working with the hedge and long short the right sectors. Still poised for an event 😉

I am thinking the same…some kind of black swan to propel the market out of the doldrums.

The low volume is the culprit.

Curious that after buying the lows yesterday the banksters nevertheless failed to close the open gap.

I am wondering why. The absence of any serious selling just might allow them to keep the market in sideways mode, and that would be a bummer! They are not buying, but they are not so far unwinding either…. 😡

Yeh, back to the lows they bot yesterday, but INTC tumble-dried the SOXX. Now the Russell2000 best index today… rotation without direction.

Thank you, for providing us your insight into the market. I have a question, Peter. In my opinion, you have advanced EW theory and stuck to the original concept as proposed by Mr. Elliot.

Therefore, have you combined the art of tape reading with the wave principle in your study of the market throughout the years? Mr. Elliot spoke little on volume in comparison to Richard Wyckoff, henceforth do you think it possible to work out future wave patterns in the short term if you apply tape reading? I know Bill Williams did a study on volume but it was rather basic in comparison to Richard Wyckoff and Richard Ney.

Cheers Peter.

Hi Omar,

I’m not sure what you’re asking me: “have you combined the art of tape reading with the wave principle in your study of the market throughout the years?” Could you be more specific?

And thanks for the names of past luminaries. I’ll get familiar with them. Very interesting …

Taking the money and running on INTC.

The island reversal played out nicely and paid huge today.

Thanks Joe! (and Peter T!) 🙂

Did the same thing with SOXS this morning B)

No problem, I will elaborate further on my question.

Richard Wyckoff was a legendary trader. He had access to some of the biggest institutional investors of his time during the 1920s, (Jesse Livermore, JP Morgan, Andrew Carnegie, and Charles Dow). He took the best of there principles and introduced the Wyckoff Method which had 200,000 subscribers at the peak of its fame the biggest in wall street at the time.

Richard Wyckoff had three major rules: 1) The Law of Supply and Demand 2) The Law of Cause and Effect 3) The Law of Effort vs Result. He believed the relationship between price and volume was the key to forecasting the movement of the stock market and that this was controlled by the Composite Operator a group of institutional investors who manipulate price like a merchandising business.

Based upon these rules he made a model describing whether the institutional investor was accumulating or distribution the stock. In his opinion, the institutional investor due to the size of there orders can’t hide their footprint in the market as the ticker would show it. The modern day version of the ticker is the tick volume which Wyckoff called tape reading.

Wyckoff believed both accumulation and distribution are built through a trading range where there are five phases. The EW principle is brilliant, however, can we use tape reading to possibly work out the next wave pattern before it occurs? I have read most of the available literature on EW but work on volume is limited.

I hope that clears my question.

Hi Omar,

Thanks for clarifying. It’s an interesting thought, but in the case of the Elliott Wave (and the refinements I’ve made that make my analysis much more accurate than others), this would seem like a lot of work for a small incremental benefit. I use volume already as an indicator. But I don’t see how it would help in determining the next wave pattern, which I usually know ahead of time, anyway (or I know the options, at least).

Where EW is weak is in the timing component, so if there was a way this might help in that element, it might be interesting.

Thanks again for some more historical names and the work they’ve done. I find this information of great benefit.

Thank you, Peter. Its always refreshing to hear your opinion.

🙂

Speaking of Semis, SOXS filled open gap from 4/16 with some authority , by executing a gap higher in the opposite direction.

Start of a bull run? The INTC plunge may be just the begining for the entire sector. If that gap remains closed SOXS could return some nice coin over the next few weeks! 🙂

Yes, may revisit it.

It sure is starting to look like sideways consolidation ahead of yet another ramp higher.

Remaining above 2900 bullish short term imho…you just cannot underestimate the banksters!

Buying back RIOT 6.00 strike short calls. Nice 50%.

Don’t want to be avaricious! v😇

Interesting divergence. SPX gap fill. DJIA no cigar….

Another island reversal in UUP?

Red candle on Monday will confirm.

APRIL 26TH ENERGY CHART NOON UPDATE

https://ibb.co/sbH2x3f

Yep!

Sideways it is!

Nibbling on SOXS May 17 4.00 strike calls which look mighty tasty!

Taking a quick gander at the chart, the open gap at 6.07 from April 7 provides a target for a quick potential double. For educational purposes only mind you!

Open gaps tend to get filled. 🙂

Has the long-standing correlation between oil and equities been broken?

We do seem to have a reversal in the former.

Will the major indices play catch up?

Market prices have tended to move higher from sideways consolidations above support/resistance shelves.

DRIP has filled gap at 8.60 from April 20.

Next open gap at 9.66 from April 4 a likely target.

Gaps tend to get filled!

RIOT will likely test support shelf around 4.50, and then up, up and AWAAAY…!!! 🙂

Go Bitcoin!

Of course, I think McAfee”s call for a million by 2020 is a bit optimistic. ha!ha!

That ES chart is a mess.

It looks like a mild down-trend but the failure to take out 2900 imho remains a cautionary tale. No committed sellers in sight!

From the size of that INTC candle, boy, someone unloaded a BUNCH of shares today.

Yikes!

Yep, correlation of oil and market questionable. Oil VOL (.OVX) up 15%, first sign of life this year. QUAD3 usually favorable for oil. QQQ tracing same Jack and Jill pattern as yesterday… not sure if it means anything going into weekend.

The waiting game continues!

Perhaps more interesting things to come in the month of May!

Have a great week-end everyone.

Here’s to the (never) ending diagonal… Cheers!

BTW, that is an authentic TWS pattern in DRIP. Real ones are not seen very often! 🙂

ROTFL! 😁

https://www.zerohedge.com/news/2019-04-26/obstructiongate

This weekend may or may not be a precursor to the stock market

But if it was then I’d expect a mini crash .

The weather of the Pacific ocean from cape Mendocino to cape Blanco

Is typically a magnet for bad weather . So if your going to get hit by bad

Weather that is where you get it . Currently N 45 gusts to 50

15-18 ft seas and while we’re pulling at 3/4 full throttle we are going

Backwards at about .5 to 1 knot .

These type scenerios rarely happen .

Call it ” climate change ” or what ever but there is no doubt things have

Changed weather wise .

Not stock market related obviously .

Sunday more of the same weather and Monday it’s due to come down some .

Tuesday ( hopefully ) we make some headway .

Only mentioning this because at times I note weird markets when weather out

Here is at extremes .

SPX they say closed at a record , cash Dow still failed which was my basis

We are now into the last week of April- first week of may .

I must prepare for a bad month of may .

Verne

I read the article at zerohedge

I can only imagine how much worse it will become after the next election .

It doesn’t really matter who gets elected next .

Normally I’d think no way another trump but who really knows .

I think Armstrong may end up correct and we see an independed .

Trump also can be considered an independant .

I figure if both sides want him out this badly then having him in office is a good thing .

Also they can try to deffer attention away from themselves but it won’t work .

The elitist politicians have already lost power !

Socialism has died

Next come war to take the attention off our government being broke !

Peter t has touched on this from several angles as I’m sure you know

Years ending in 2’s have a history . If history repeats the odds favor

2022 as not so great .

Interesting quote :

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

A new post is live: https://worldcyclesinstitute.com/high-degree-counts/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.