Galileo: The Contrarian

Galieo Galiie (1564 – 1564) was an Italian astronomer, physicist, and engineer. He is considered “the father of modern physics, the scientific method, and modern science.”

He was the “disrupter” who introduced the theory that the Sun was the centre of our Solar System (ie. – the Earth revolved around the Sun —”heliocentrism”).

This idea was met with immediate opposition from his peers, and most notably, the religious establishment. He spent the rest of his life under house arrest. He published his work in Dialogue Concerning theh Two Chief World Systems, in 1632. However, It wasn’t until 1758 that Galileo’s works were removed from the Index of prohibited books.

It’s generally held that with the publication of Isaac Newton’s Principia Mathematica (1787), we entered The Age of Enlightenment. There were a slew of scientific discoveries, ground-breaking literary works, and inventions of all types that followed on its heels. After all, this cycle top was instrumental in bringing books to the population (Gutenberg Press in 1440). The year 1492 is generally considered the top of the 516 cycle.

Galileo was born in a world leaving behind feudalism and slowing moving to a new monetary system; a period 500 hundred years ago that marked a major shift into our modern world. It was moving too slowly for Galileo. The world was not ready to embrace his system at the turn of the 17th century; however, the Age of Enlightenment and the Elizabethan period set the stage for other scientists, musicians, politicians to usher in immense changes across a wide spectrum of professions.

These “golden ages” are natural phenomena. Each hundred year cycle has an golden age; there are particular periods in which warm temperatures and adequate rainfall create an era of optimism and human energy.

Where am I going with this? Well, cycles determine what history repeats and when. There are only certain periods in which we revere our politicians, for example (other periods when we consider them tyrants and authoritarian). Our most beloved kings, rulers, and politicians all reigned in times of abundant food and a relaltively warm climate that led to growth periods across the world.

The world might not yet be ready for the truth of the Elliott Wave system, but with the coming Awakening on the horizon, it may well be that it will find it’s platform in the years to come. The timing has to be right, just like the time is becoming right for a world-wide revolution, and market crash.

Know the Past. See the Future

____________________________________

Elliott Wave Objectivity vs. Subjective Stupidity

I get accused of all kinds of wild and imaginative actions I’ve supposedly taken here on the free blog (or words I’ve apparently written), none of which are true, many of which would seem to be illogical.

Being a member of Mensa International, I expect to have to deal with a lot of “out of left field” comments, but the stupidest comment of all has been recently, with a variation of the demand that I “change the count” on my charts because somebody thinks it would be the “right thing to do.” This shows a complete ignorance of Elliott Wave methodology, scientific method, and technical analysis.

There’s a page on “objectivity” right out of the book, the Elliott Wave Principle, itself.

“Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means and objective study, or as [Charles J,] Collins* put it, “a disciplined form of technical analysis.” Hamilton Bolton* used to say that one of the hardest things he had to learn was to believe what he saw. If you do not believe what you see, you are likely to read into your analysis what you think should be there for some other reason. At this point, your count becomes subjective and worthless.” — p94, Elliott Wave Principle

* Charles Collins and Hamilton Bolton were well-known and respected writers for the stock market during the 1920s and 30s

Summary: The reason for having objective technical analysis is that you DON’T arbitrarily change the count to conform to some pre-formulated plan or expectation. That would add bias to the count and render it worthless; unusable.

The Mother Ship Review: The NYSE

Above is the daily chart of the NYSE. I refer to this exchange as “The Mother Ship” because it spawns the DOWS (Industrials and Transports), the SP500, The Russells, and the OEX.

However, all those sub-indexes are traded directly, so they’re just chocked full of animal spirits. Only the NYSE gives a clear picture of what’s actually going on. As I have stated ad nauseam, you cannot analyze the market unless you’re looking at multiple indices, and most importantly, the NYSE as a whole.

There will never be a situation in which the NYSE will have a different overall count than the sub-indices. You can’t have the SP500 completing five cycle degree waves to a hew all time high and then plummeting unless all the relative sub-indices trace out the same count … which means they would all have to reach new highs. A fractured market with different counts (with some indexes at new high and others not) has never happened, it isn’t going to happen here, and it is very unlikely that it will ever happen in the future.

In the chart above, you can see that the B wave has traced out an ending diagonal at the top. An ending diagonal is an ending pattern. The fifth wave cannot be longer than the third wave (a hard Elliott Wave rule). At the moment, the fifth wave can still rise another ten points or so to adhere to that rule.

NOTE: The NYSE is nowhere near a top, and has no chance of getting there under the current wave structure.

The Herd’s Inherent Bias

Above is the 3 day chart of the SP500 going all the way back to the 2015 year. You’ll see that I’ve placed an ellipse around a small degree fourth wave in 2016, which has a similar pattern to the one we’re tracing out now (in the upper right area of this same chart). I’ve marked the current B wave up (blue B).

Above is the 3 day chart of the SP500 going all the way back to the 2015 year. You’ll see that I’ve placed an ellipse around a small degree fourth wave in 2016, which has a similar pattern to the one we’re tracing out now (in the upper right area of this same chart). I’ve marked the current B wave up (blue B).

You can see that the same pattern traced out in the most recent 4th wave of one lesser degree; the current dilemma with a corrective B wave up approaching a new high is a pattern that’s relatively common. One more reason to suspect that the current count will result in a similar result.

The put/call ratios are also similar to what they were back at the end of 2016.

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

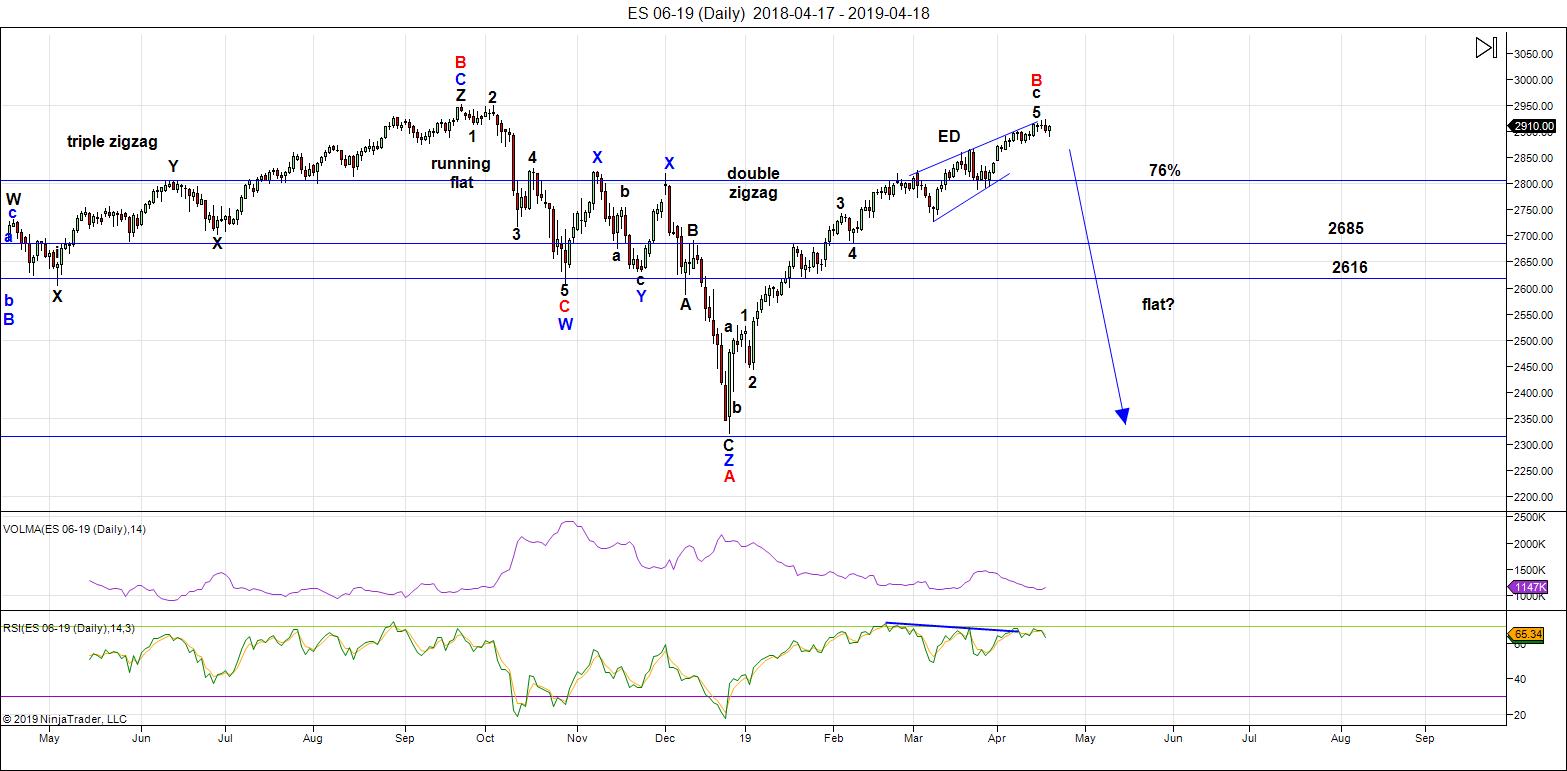

Above is the daily chart of ES (click to enlarge, as with any of my charts).

For the second weekend in a row, there's very little new.

We're still sitting near the top of a B wave that's risen to well above the 76% level of the height of the previous set of waves down from the all-time high at October 3, 2018. Almost all the other assets I cover on a daily basis are hovering near inflection points.

As I've been saying over and over like a broken record, all major asset classes are moving as one. That requires them all to reach new B wave highs before they can turn down together. It's like herding cats and is taking much longer than expected. It's also difficult to project a date for a top, because you have to take into account several assets.

IWM (Russell 2000) still needs new interim highs before everything heads down in a dramatic capitulation — it seems to the last NYSE index to require a top. On the currencies side, the US Dollar Index also has to complete its leg down before it turns up in earnest.

We appear to be in an ending diagonal in the SP500 and NQ. In ES — we now have an expanded triangle on an hourly chart, within the ending diagonal. All these indices are showing signs of exhaustion, with gaps that are being left unfilled.

The next major move is to the downside.

As I've been saying, the wave up from Dec. 26 is clearly corrective and, as a result, must fully retrace to the downside. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

Summary: My preference is for a dramatic drop in a C wave to a new low that should when all these asset classes I've identified have reached their targets. The culmination of this drop should mark the bottom of this large fourth wave in progress since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, April 24 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Hi Peter and friends

there’s the energy chart for this week

https://imgur.com/5kDypaf

click on image to zoom up

Hi Tom. Thank you!

It does indeed appear that the banksters have opted for a strategy of death by a “thousand cuts”. They continue to aggressively buy the 2900 level in a desperate attempt to keep prices aloft. This fierce resistance to the impending trend change is likely to issue in some kind of leading diagonal downward for a torturous start to a “C” wave. These typically result in very deep second waves which would be well I keeping with the relentless market intervention in a futile attempt to forestall the inevitable. Then….the fun would really begin.

A decisive break of 2900 in ES overnight probably means 2800 also falls this week, intervention or not….

Tom,

Can you please point me to resource how you calculate this. Thanks in advance.

Hi Bill

this is the only resource I have on the subject. I hope it helps

https://www.frbatlanta.org/research/publications/wp/2003/05.aspx

Thanks for this, Tom. Really good stuff!

The FED can see several days into the future. They tell Trump (thru his advisors) when to tweek “The china deal is going well”. Every minute of Trumps days is planned in advance, who he will see, the news it will create and the people needed to prop things up when the energy is waning. The next 2 days will be interesting.

That makes perfect sense to me Tom. I suspect it also explains the inversions. Absolutely fascinating!

Thanks Tom. much appreciated.

Peter, thank you for your work! Some people just want things to be the way they want them to be. Its hard to be patient some times.

🙂

05/20/2016 03:45 PM ET

|

Updated May 21, 2017

In what may be a first in the nation, this week the Portland, Oregon school board passed a sweeping “climate justice” resolution that commits the school district to “abandon the use of any adopted text material that is found to express doubt about the severity of the climate crisis or its roots in human activity.” The resolution further commits the school district to develop a plan to “address climate change and climate justice in all Portland Public Schools.”

https://m.huffpost.com/us/entry/us_10069106

So much B.S.

Peter t

In a satirical note to the above I’m thinking we should have an Elliott wave justice resolution

Obviously I do not believe that .

Thank you for your hard work

Indeed Galileo proved the heliocentric model to be correct, but it was Nicky C who proposed it first. Only bringing it up because that dude rattled some cages back then.

Right, but it made my story more complicated, so Nicky hit the floor for this one …

Thanx Tom..for energy chart..good luck to all trading this week may it finally start cracking…

Clearly no unwind in ES. If the cash session also remains above 2900 we likely head higher. CB purchases around support/resistance shelves imho continue to be the most reliable indicator of short to mid term market direction.

Traders who ignore this critical compnent of price action do so at their own financial peril, and any decline pausing around 2900 is almost certainly yet another bear trap. I have been using bounces off that level to add cheaper puts and it has worked like a charm owing to the predictability of the banksters. We may yet see expanded flats all around.

Have a great trading week all!

agreed..Verne..if we see 2910 as support going towards that 2930..spx

I am watching with great interest that 10% gap higher in VIX from last Thursday. These banksters are tricksy. The very last thing they want is for everyone and his granny figuring out that this move off the December lows is corrective and will be entirely retraced. They would love to keep the great unwashed comfortably ensconced in their “impulsive” counts higher

(now seemingly ubiquitous) while they stealthily unwind leverage with a series of VIX gaps higher. You can imagine the piling on that will ensue once traders realize the December lows are going to be taken out back and administered a very severe spanking, probably sometime around the middle of the third wave down. Now THAT is gonna be real interesting watching the banksters dump in wagon-loads of cash intra-day and get absolutely hammered as a high deggree third down unfolds. I hope for their sake that 2100 holds for if it does not, 1800 will be in play. Look for series gaps higher in VIX, which generally signal the beginning, and end, of exteneded runs. Let’s hope they do not fill the open VIX gap…Yikes!!

A move below this morning’s low will negate an attempt to “hammer” out an intra-day bottom. That is rare, with the ususal outcome being a frenzied closing of all opening gaps down. Tired banksters? Top heavy market?

This is not a trigger… don’t know the trigger but none yet… but…

*Defining consensus complacency: there’s currently a -169,908 net SHORT position (non-commercial CFTC futures & options contracts) on The VIX. That scores -1.9x on a 1-year z-score. Similar to 1/18 and 9/18… I know what i am NOT loading up 🙂

energy chart update

that late day pop seemed like a nice blow-off top

unless tomorrow is inverted? the trend is very clear

https://imgshare.io/image/april-22-evening-update.ykzy

Thank you Tom. Very helpful.

Very interesting that some cycle gurus now pointing to a move below 2900 as triggering a short term sell signal. Fascinating how different methodologies can arrive at the same conclusion!

Thanx Tom.

What a RIOT! 🙂

Time to ring the register!

Seems to be no end in sight to this leg higher. Very much looking forward to buying the drop whenever it happens as the safest trade is long until the end of this bull. S&P making a break for new ATHs. Not sure how that will change Peter’s forecast if it happens.

All I know is Charles Lloyd has been eerily accurate with his market calls. Another target he laid out (2930) has been hit today. I know he runs many of you the wrong way, but kudos to Charles.

IIRC he also has 2,940 and 2,950 in his sights. Simply amazing! I personally thought he was crazy when he said new all time highs would be here soon. Well here we are!

Yes indeed! We must give the man his due.

I learned a long time ago that there is a world of difference between trading the markets, and analysing the markets.

As I opined early on after watching what he did, the man is a trader. 🙂

Farewell, and adieu,

To you, Spanish ladies…. 🙂

Sold most of my shares of RIOT for 6.00 even. Holding only enough for covered calls.

Expecting pull-back and another opportunity to reload the wagons…

I told it would be an interesting day!

Do you think we have an inversion or you think its going down from here

The inversion is obvious but what the puppet masters have planned

is unknown. Tomorrow morning’s open will tell the whole story.

Perhaps earlier… 🙂

Thanks Tom, I had a turn date on April 22 and the next one is April 25, I suspect it will be a top.

Peter,

Many analysts are now considering SPX in an expanded flat:

https://elliottwave-forecast.com/elliottwave/elliott-wave-expand-flat-correction/

It seems like this could be the most likely pattern considering NDX is at all-time high and SPX is just a few points off. Do you see this as the possible pattern?

Thanks,

Prof Hawk

According to EW rules, if we get a new high and the move is corrective, there is no other choice.

Again, I’m fascinated that Charles Lloyd was calling for an expanded flat many months ago on this very blog. How is he doing it? I’m going to start calling him “fortune teller Charles”. LOL!

Charles was long SPY 290 calls today. He did quite well! 🙂

Joe are you still watching semi-conductors?

The immediate trend remains up, not a surprise in my view as there has been no unwind of leveraged trades, whether long equities or short vol. My view is also that despite the carnage of early 2018, the risk/parity trade was never fully unwound. Of course many retail investors and even some hedge funds got destroyed in a margin call nightmare, but based on what I saw, something stinks to high heaven and I think there is another shoe to drop. There should always be a number that tells a TRADER that he is wrong, or he will not survive as a trader. Having said that, it is quite remarkable listening to what even experienced traders who should know better, are saying about this market. Some people never learn, and human nature certainly never changes. The market is making new highs on persistent divergences and is now more extremely overbought than I have seen it in quite some time, and yet the masses are foaming at the mouth bullish. Fascinating!

The analysts maintainibg the view of a corrective move up are now few indeed! I am now more convinced than ever. I know these bastards, er…bankstets.

Watching VIX divergence keenly…

Willing to pay 3.00 per share for RIOT shares so I sold June 21 4.00 strike naked puts for 1.00.

Obviously, one should NEVER sell naked puts unless you intend, or are able to take assignment of ALL contracts sold.

Speaking of which, we have yet another insane cohort now even MORE massively short vol than early 2018. I suspected as much and frankly think it is worse than they are letting on. These people are stupid!

One fun thing about trading options is that if you know what to look for, you can sometimes find ridiculously mis-priced contracts. I mentioned the RIOT option trade I made a few months back as one such example. The bromide about “market efficiency” is quite amusing. I think I have found another one.

One of my legacy Gold miners. GORO, is displaying quite an option pricing anomaly.

Some nearer dated calls are showing a higher ask price than longer dated ( three months).

So much for model pricing!

I was able to snag September 2.50 strike calls for 1.20, a six month premium of a mere dime per contract.

I get to add substantially to my legacy GORO position by locking in those shares at a fraction of what I would pay to buy the shares outright, and with miniscule carrying cost to hold the trade. This frees up resources for other trades yet guarantees my shares at the desired price. Upside call price action is a cherry on top! 😎

Some may remember my post on 9-20-18 thinking that the SPX closing price that day could be an important high. Well, it was for around 7 months, but was finally exceeded yesterday. But guess what? The same phenomenon that occurred on 9-20-18 and was one of the factors prompting my leanings towards calling for an important high occurred again yesterday. SPX went to a new all-time-high close with the Ratio Adjusted McClellan Oscillator in negative territory. This coincident factor has occurred at several important tops. The last two occurrences (New SPX all-time-high, negative McClellan Oscillator) were 9-20-18 and 1-26-18!! Not bad, eh! But before you get too excited, we should point out that the most recent resolutions are not always the case. Although new highs with weak a McClellan Osc are very often signs of technical weakness and deteriorating internal strength, there have been time periods where the market simply hesitated momentarily, then kept climbing to new highs, sometimes even for years on end. 1995 is a good example. So take your pick. This combination has been a fingerprint for some very major market highs (1-11-73 is one that quickly comes to mind, 12-12-61 is another). Sometimes it simply marks an immediate pause for a few weeks or months (8-15-16 and 9-18-14 are two recent examples). Other times it has been almost an insignificant occurrence. But when you are faced with what qualifies as the most overvalued market in history, you pay attention to each potentially important signal. Don’t believe that? Check out this indicator at a 50 year high recently… https://imgur.com/a/ooM59Uo

By the way, this is not a frequent signal or occurrence. There was only one occurrence (SPX all-time high…Negative McClellan Oscillator) from 1999 to 2013. It occurred on July 19, 2007…OK, it was not the final high, but it led to an immediate 9.4% decline on a closing basis on SPX within a month!

Thanks for that insight Peter G.

Fascinating stats!

Zerohedge noting that two massive cohorts now oppositely positioned in this market, more so than at anytime in recent history,

and one of them is about to be proven spectacularly wrong. Even more amazing, the writer was NOT betting on the so- called “Smart Money”!

Oh, I know!

THIS time…..it’s different! 😀

Go GORO! 😜

A VIX move above 15 just might force them to abandon yet another potential bear trap.

If it does not clear that level….not buyiny what they are sellin’…😁

A true unwind will impulsively break 2900.

RIOT looking bullish. Selling a truck-load of June 21 3.00/4.00 bull put spread for 0.35

This beast is getting ready to rock!

We need to break 2925.82 today or we are looking at yet more bear bait. Huyk!

These banksters are tricksy!

If we don’t, at least one more ramp to rattle the cubbies…

Verne

Yes I have been following the semi conductors but I don’t have much

Info to add to the discussion . I have had no reception the past 2 days

And I forgot my upside target . Not sure if I mentioned 1600 or 1800 in

A previous thread on this site .

We are now about to enter the final week of April so Peter G your points

are being heard by me loud and clear .

I had mentioned I was looking for the cash Dow to break out to new highs

This week and a failure to do so would be a warning sign that something was wrong .

Based on Peter g I’m assuming the spx made a new high and the sox index has certainly

Gone up and up .

Last week of April to first week of may I have been saying I felt was the best time for a high

And a down move into may 22-June 3 .

I’m thinking for many stocks the high is probably in .

I’ll stand by my down month of may for now .

I’ll note the if I’m wrong just because .

I’m following 2 sets of parameters . One being the above which can bring a steep

Decline or a pause ( down month of may )

The next time frame is July 2 high to July 16 low .

Taking this 1 leg at a time .

The month of June can be extremely Bullish

It’s been a while since I’ve read through the details

Of a George Lindsay count from the middle section

They are a longer term count for the most part for timing

The market .

At times they show up on short term time frames .

It’s worth some research . I have his work at my house

So I can’t state the details accurately yet I think we

Had a mid section with in this rally phase from December .

Like Elliott wave theory or even planatary pairs or using

Fibonacci there is tons of bad info online but you Want

to read about lindsays work you can purchase

” the selected articles by the late George Lindsay ”

Lindsay was the most consistant market analyst of our time .

Possibly the most consistent ever .

thanx Joe haven’t read his work…I have been playing Dust for quick cash..right now and waiting for this thing to drop….My birthday is May 18 so that would be a great present :))…

May Day! May Day! 🙂

Doing the quick cash thing with RIOT bull put credit spreads.

Are you trading DUST long or short?

Thanks Joe. I am going to get that volume.

It really is tough to find good market commentary these days as you mentioned

To try and keep my own thinking clear I now rarely pay serious attention to stuff online. I used to subscibe to quite a few publications to try and get a broad market perspective but most things being put out there are worthless and I got rid of most of them. Lots of disinformation out there.

There is something very strange going on. Does anyone really believe that crap about futures ES and YM divergence is due to the 3M earnings report? I am not buying that hogwash. Something’s up….

In my humble opinion, here’s the most important article in zerohege in terms of future prospects for the economy.

https://www.zerohedge.com/news/2019-04-24/rothschilds-liquidating-royal-heirlooms-massive-auction

The Rothschilds are selling assets. They’re not stupid, and they’ve obviously decided that deflation is inevitable. So, if the nominal value of all these items is going south, they’re getting out. I think it speaks to the magnitude of the upcoming crash .. still a couple of years away … but a warning sign, for sure.

Peter the coming deflationary spiral is going to be a nightmare for politicians.

I am deeply amused by how Mr. Trump insists on being credited for the “booming” stock-market.

How do you think he will explain himself if he is re-elected? 🙂

Verne,

haha … that will be the question, for sure, and I don’t have an answer to THAT one! Really dumb to tie yourself to the market, what can I say? I think he’ll get back in, or a civil war will get in the way … We’re going to see tumultuous times, as you well know.

Kyle Bass on CNBC @ 10:30, I just saw a 1 hour private discussion on what is really happening in China… maybe worth a look

Can you provide a brief summary? 🙂

I’ll try 🙂

All China spending caused surplus to now dual deficit nation (current account and fiscal)… IN A CLOSED CAPITAL ACCOUNT SYSTEM!! And they continue to spend and stimulate in communist (not free trade) system with global growth slowing. “Take China’s number with large bucket of salt! China uses IPO fund as THEIR capital. Most reckless financial experiment ever. Non-performing loans alone could wipe out all equity with twin deficit and growth slowing. 50T debt with shadow banking counted at 10% vs 2008 at 2%. China goods trade through Hong Kong (no tariffs) with our sovereign deal. How long should that go on?? Think we’ll blink? Even shallow recession could cause20-40% drop in capital (in closed capital system). Repetitiveness for emphasis 😉 Cheers!

Wow! Sounds about right. Scary debt to capital ratio. The country technically probably insolvent.

So much for the “China Miracle”.

Sure looking like the DJIA plunge was yet another bankster feint. These guys are so predictable its not even funny.

The pivots are likely going to fall in unison when they truly unwind. Amusing trap for a few more cubbies… 😉

Hard push to get VIX < 13…

Yep! They are eventually going to loose that battle. We just don’t know when….time for patience…

They are fighting tooth and nail to forestall the impending decline.

Aggressively buying the fall to the defended pivots but the fracturing continues. Just a matter of time…and perhaps timing! 🙂

Energy Chart update for today

I can’t guarantee that drop @ 3ish will happen

but it look nasty if the controllers do allow it to happen???

https://ibb.co/Tw2KdG3

Clearly they see it too and are doing all they can to curb bearish enthusiasm…haha!

Thanks Tom.

on the one minute chart looks def like what the wave wants to do so fingers crossed…

Who on earth is buying MSFT and pushing it even farther away from critical long term moving averages???!!!

Looks to me like we have an exhaustion gap in the making. I’m taking a nibble! 🙂

The “Nothing to see here!” smashing of VIX is a riot!

We must be getting close…! 🙂

I am intrigued by the DJIA gap down in view of the fact that there are simply no sellers in the market ergo I tend to assume it to be some kind of head fake. On the other hand, it could also well be a stealthy leveraged exit. The other way these gaps take place is a reckless “selling at the market” right from the open, something I doubt is being done by retail investors who are all bullish. The 3M earning story was B.S cover in that case. These banksters are tricksy!

Very excited! Bryan Bottarelli’s new trading platform going live!

Lock and Load! 🙂 🙂 🙂

Anyone else seeing an interesting fractal in the price action today?!

More flatlines than fractals right now… waiting GDP tomorrow. I think there is good chance it will disappoint, but markets (banksters) are writing bad news off these days. Rate of change with comps will be much tougher Q2 and Q3 (reported Q3/Q4) but no one cares (until they do). Markets don’t seem to look forward anymore, so I will trade around the fringe until VOL kicks in.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.