Influences That Drive Markets

For several years now, I’ve talked about the phenomenon of the US Dollar driving the market. It was met with a lot of skepticism in the early stages, but now, of course, it’s undeniable.

The international market has been moving “as one” for about three years now, all asset classes following the lead of the US Dollar Index. They were a bit skittish to begin with as they all started to gradually fall in line, but now, they’re all moving in tandem, even intraday.

The “cats” I’m referring to in the blog post title are various asset classes, and even international exchanges. They’re all coming to the predicted targets at the same time.

- The US Dollar Index is very close to E apex of a running triangle, the point at which I’ve been predicting a turn in the US indices to the downside.

- The US Indices have a full Elliott Wave count and new highs across all of them (except for the NYSE exchange, which I do not expect a new high from, but nonetheless, it’s at a point at which a turn is imminent. DAX, the German exchange, is in the exact same relative position.

- Oil is topping. Gold and silver are at fourth wave lows, expecting a rally (a rush to safety), but it will be short-lived, as the overall prediction is for much lower prices in both for some time to come. As the US dollar rises in value, gold and silver will decrease in nominal value. Deflation will gradually start to take hold.

It’s an extraordinary crescendo after ten years of central bankers attempting to inflate the worldwide economy to create perpetual prosperity across nations (while lining their own pockets). They’ve failed in the former, but done well in the latter. However, the economic failure we’re about to experience will eventually bring down the central banks.

All very predictable; it’s happened over and over in history every five hundred years, but not to the degree we’re experiencing now. We are $250 trillion dollars in debt (the largest debt in history), at least half of it created with the past ten years (thanks to central bankers).

The Forces at Work

What fascinates me is the forces at work on global scale that have made this turn so predictable in climate, the stock market, social mood, politics, war … you name it. There are multiple influences from different sources that cause these cycles to occur, but the outcome is inevitable. Here are the three key influencers as far as I’m concerned:

Debt and credit. Both are about to implode. Banks are starting to fail around the world. Credit is drying up. Liquidity in the credit market is failing. In fact, the Federal Reserve has been attempting to shore up the banking system (which affects the stock market and most certainly the US Dollar), but it’s not having the desired effect. Confidence in their ability to influence the market and economy is waning, and rather dramatically so.

Social Mood is Turning Negative. People are starting to wake up to the truth about what’s going on. Governments have turned more tyrannical as they reach peak debt levels. Propaganda is rampant across the world, most obviously in Western (“free”) democracies. Riots, unrest, and revolutions are proliferating in countries around the world. Humans herd, but as information leaks out (Assange, Snowden, the unmasking of the Deep State in the US, Brexit, increasing taxes, the climate change hoax, etc.), minds are turning to alternative news. Trust in government and the media is at a historic, all-time low). The herd is starting to get psychologically frayed around the outter edges (the “woke” movement is gaining steam).

I’ve always maintained that the market is a mathematical representation of the mood of the herd. Both are clearly at a turning point.

The Solar System. Here’s the most contentious issue, but it will become less so as the outcomes I’ve been predicting for so long come to fruition. We know that climate is a product of the Sun and planets (well, some of us do!). We have lots of data on electromagnetic waves and their ability to affect how we think through the pineal gland. Our circadian rhythms are primarily a product of the movement of the Moon, for example. We know about the excitability factor (Chizhevsky) that accompanies solar maximums. We can see the affect the Moon has on the stock market.

People are angry all over the world right now. These mass changes in mood have been well documented by Dr. Raymond H. Wheeler, PhD, the same traits recurring at regular intervals (18.5, 57, 100, 172, and 516 years). This work has been backed up by the extensive research by Stephen Puetz. And there’s so much more documented evidence than I could ever present in this forum.

______________________________

This weekend, I’ve posted reprint of a short article I wrote a couple of years ago (with some minor changes). It presents some example of the variety of influences that shape our experiences on Earth. It expands on how these various influences affect us all. You can find it here.

Beware the Chinese Curse: “May you live in interesting times.”

Know the Past. See the Future

____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

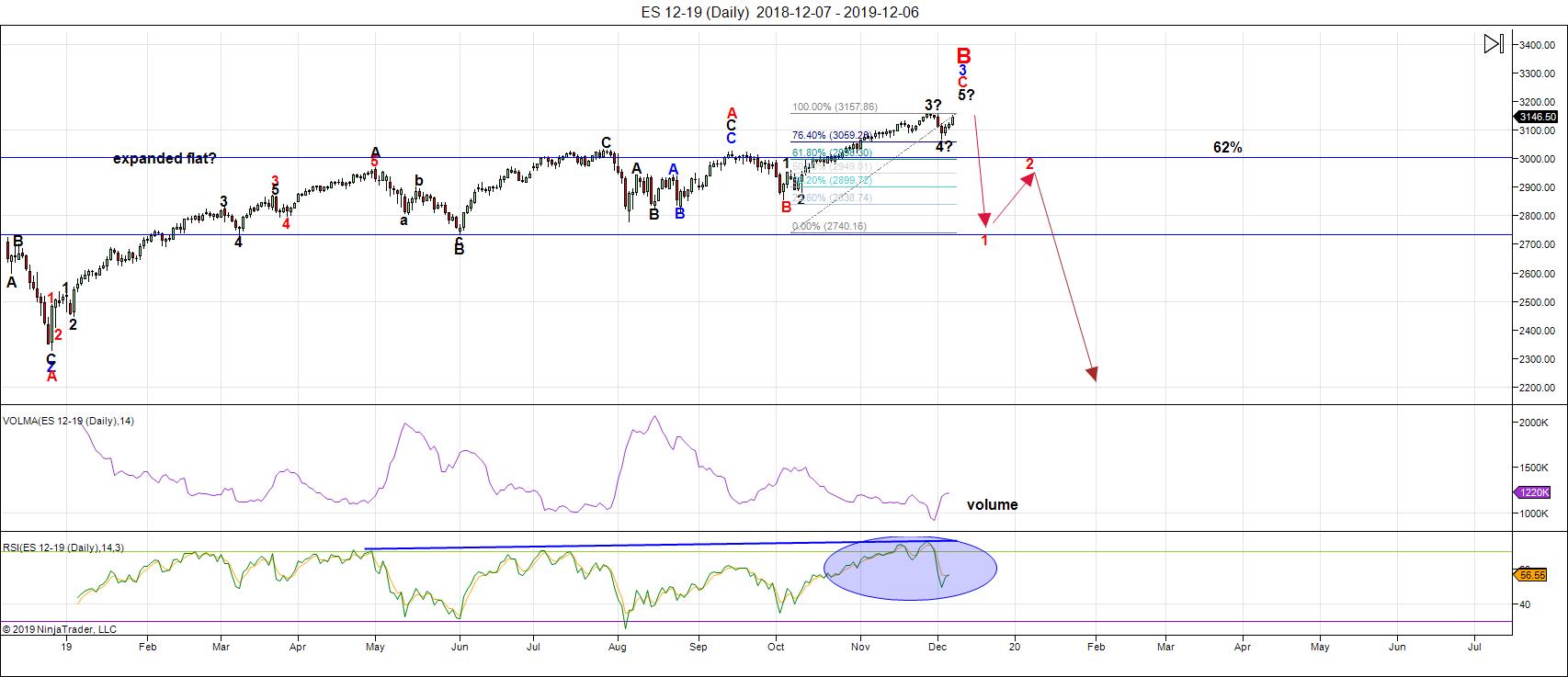

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last weekend, I called for a turn to the downside that could happen as early as Monday,

Last weekend, I called for a turn to the downside that could happen as early as Monday, December 2. Well we got that turn and a strongish drop, which was expanded upon on Tuesday. The waves down, however, were quite obviously corrective, the key being NQ, which had dropped down from a B wave (the A wave was corrective so the entire wave down would be corrective, as a result).

On Wednesday, we turned back up and I called for a new high, but I thought we might get a bit more weakness first, down to the typical 38% retrace level of the previous wave up (that target on the downside in ES would have been 3040), but that did not happen.

This tells me the wave up is not a motive wave, but what I'd classify as a "simple five."

The overall pattern up from the beginning of August is an anomaly. It is neither a diagonal, a triangle, nor motive. It's a corrective pattern of some kind, quite an unexpected rogue pattern in an overall corrective rally up from 2009.

Nonetheless, the next major move is to the downside. This weekend, we're sitting with virtually a full count in a final wave of five waves. The ending expanding diagonal that played out capped the third wave. The drop early this past week was a short fourth wave. I'm expecting a final high this week.

We have a Federal Reserve announcement on Wednesday. This is a good candidate for a turn to the downside (a trend change).

Oil is very near a high, and the US Dollar Index is very near my long-term target, which I'd identified as most probably coinciding with the top of the US indices, as I've described at the top of the blog post.

The larger pattern across the indices appears to be an expanded flat (a regular flat in the NYSE exchange). That projects a large wave down in 5 waves to an area under 2100 in ES.

_______________________

There is an option of a set of zigzags down to the same level, but it's much less probable because there are so many flats set up across multiple stocks and indices. If a zigzag is the pattern that traces out, the retraces up will not be as strong as they would be with the C wave of a flat. We'll get a lot of information about the probable path from the first wave down.

___________________________

Summary: The current B wave up is most probably the B wave of an expanded flat. The A wave ended on Jan. 26, 2018. The B wave up will end in a set of corrective subwaves. A trend change is imminent.

We're near the top this weekend of a final fifth wave. The turn may coincide with the Federal Reserve rate announcement on Wednesday.

I expect the ultimate bottom will be somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final slight new high in a fifth wave of this 500 year cycle top.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil).

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, December 18 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.