The Future is Very Predictable

The Future is Very Predictable

We’re heading for a complete financial meltdown on an international basis. That means a bonafide depression is coming in the next few years that will make the 1930s look like a little financial blip.

Most of the things you take for granted will not be there — government services, for example. Transportation systems are breaking down (companies are going bankrupt left and right) the the food supply (particularly in the US) has been hit extremely hard with the recent flooding and early winter snow storms (this almost always happens at major cycles tops).

If you know what to do in one of these downturns, you’ll be just fine, but if you’re blindsided by it and don’t take proper precautions, you’re in for a rough ride.

I’m preparing a webinar to help people understand what’s at stake and how to prepare, but that won’t be until January. In the meantime, this article explores some of the real forces that work that help predict the ups and downs of the stock market and broader economy.

I’m expecting a major stock market downturn before Christmas.

The Forces at Work

What fascinates me is the forces at work on a global scale that have made this turn so predictable in climate, the stock market, social mood, politics, war … you name it! There are multiple influences from different sources that cause these cycles to occur, and the outcome is inevitable. Here are the three key influencers, as far as I’m concerned:

Debt and credit. Both are about to implode. Banks are starting to fail around the world. Credit is drying up. Liquidity in the credit market is failing. In fact, the Federal Reserve has been attempting to shore up the banking system (which affects the stock market and most certainly the US Dollar), but it’s not having the desired effect. Confidence in their ability to influence the market and economy is waning, and rather dramatically so.

As I explain in this article, central banks have attempted to manipulate the economy, but they can’t win against nature’s law. Mother nature always wins; our ancestors knew that. We’ve simply lost our way.

Social Mood is Turning Negative. People are starting to wake up to the truth about what’s going on. Governments have turned more tyrannical as they reach peak debt levels. Propaganda is rampant across the world, most obviously in Western (“free”) democracies. Riots, unrest, and revolutions are proliferating in countries around the world. This weekend, almost a million people are marching in Hong Kong; France is embroiled in riots that have been going on for months. The tide is turning.

Humans herd, but as government propaganda ramps up to extreme levels (Assange, Snowden, the unmasking of the Deep State in the US, Brexit, increasing taxes, the climate change hoax, etc.), minds are turning to alternative news. Trust is government and the media is at a historic, all-time low). The herd is starting to get psychologically frayed around the outter edges (the “woke” movement is gaining steam).

I’ve always maintained that the market is a mathematical representation of the mood of the herd. Both are clearly at a turning point.

The Solar System. Here’s the most contentious issue amongst the herd, but it will become less so as the outcomes I’ve been predicting for so long come to fruition. We know that climate is a product of the Sun and planets (well, some of us do!). We have lots of data on electromagnetic waves and their ability to affect how we think (through their influence on the pineal gland). Our circadian rhythms are primarily a product of the movement of the Moon, for example. We know about the excitability factor (Alexander Chizhevsky) that accompanies solar maximums. I can personal attest to the effect the Moon has on the stock market, as I produce a video on the market every night (with an exceptionally high rate of accuracy).

People are angry all over the world right now. These mass changes in mood have been well documented by Dr. Raymond H. Wheeler, PhD, the same traits recurring at regular intervals (18.5, 57, 100, 172, and 516 years). This work has been backed up by the extensive research by scientist Stephen Puetz. There’s so much more documented evidence than I could ever present in this forum.

______________________________

Following is a reprint of a short article I wrote a couple of years ago (with some minor changes). It presents some example of the variety of influences that shape our experiences on Earth. At the end, you’ll find a chart showing the expected mini-crash I’m expecting to begin before Christmas.

The Much-Ignored Power of Mother Nature

Edward R. Dewey, who worked for US President Hoover in the 1930s was a pioneer in the discovery of nature’s cycles. They affect business, the markets, and so much more.

In the Great Depression, President Herbert Hoover asked Mr. Dewey, who at the time was the Chief Economic Analyst at the Department of Commerce, to figure out why the US continually experienced economic booms and busts. In the 1800s and early 1900s, there were eight economic downturns of varying degrees.

Dewey devoted the rest of his life to uncovering and understanding cycles. During his lifetime, he established over 3000 cycles in nature and business.

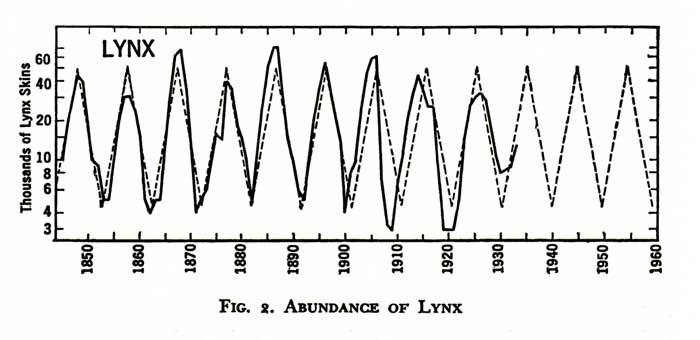

He found that the Canadian Lynx followed an abundance pattern of exactly 9.6 years. For over two hundred years, they’ve prospered and then died off in a regular rhythm. The coyote, red fox, fisher, marten, wolf, mink, and skunk have the same abundance patterns.

The chinch bug, which frequents much of the US Midwest, has a similar pattern—at its height swelling to as much as 70 million per acre down to just 1600 per square foot at the bottom.

The lemming, that little six inch rodent found in Norway, has a 3.86 year life pattern. Every 3.86 years, they come down from the hills, destroy everything in site by eating it, don’t stop when they get to the sea. .. and end up drowning. A few who remain behind for some unknown reason start up the next herd which, right on schedule, heads to the sea all over again.

The lemming, that little six inch rodent found in Norway, has a 3.86 year life pattern. Every 3.86 years, they come down from the hills, destroy everything in site by eating it, don’t stop when they get to the sea. .. and end up drowning. A few who remain behind for some unknown reason start up the next herd which, right on schedule, heads to the sea all over again.

These cycles are apparent in every living thing. Just as the Moon travelling around the Earth every 25 hours affects the ocean in a 12.5 hour cycle (the tide), our circadian rhythms are also influenced by the Moon. Research has proven this to be the case (eg – the work of Rutger Weaver and his underground bunker experiments).

You may want to argue about the fact that we’re influenced from beyond the confines of the Earth (even though the data is overwhelming), but it’s hard to argue with human nature. We continue along a path of habit, until a shock to the system causes us to reverse course.

A body will continue along a path until acted upon by an external force.

You can equate this with a law in physics: a body will continue along a path until acted upon by an external force. To reverse the direction will require a force larger than the force that created the motion in the first place.

Humans don’t change their views until acted upon by an overwhelming outside force or, which is more often the case, gradually changing their mind based upon a growing change in the thinking of the herd around them. Herds don’t change their thinking in a day.

As an example, review the gradual trend change in smoking habits that I wrote about a few years ago. It played out in five waves; trends always do. The higher the volume of participants, usually, the easier it is to track the underlying waves (for this reason, the five waves of a trend are not always obvious is smaller samples).

Remember those crazy lemmings: They don’t die till every bit of food is gone and they’re at the ocean.

Similarly, the herd isn’t going to change until they’re up against a brick wall. If things are working, they keep doing the same thing. So, there’s no way out of where we’re headed. Here are a couple of examples of human inertia:

Bankrupt Ontario. The Canadian province of Ontario is the most indebted sub-sovereign “state” in the entire world. It’s racked up over four times the per capita debt of California. In other words, it’s bankrupt several times over. Yet, the current premier of the province, Doug Ford, has been cutting government costs to try to balance the out-of-control budget left be Kathleen Wynne and other spend-crazy provincial governments before her.

Based upon these cutbacks, Premier Ford has been vilified in the press, booed by constituents, and has an apparent approval rating of under 30%. It is almost impossible for a politician to reign in spending. Greed is rampant at the top of these large cycles.

The State of Illinois: Across the border in the U.S., Illinois is facing a certain pension implosion, as the financial liabilities are limiting the state’s ability to meet its obligations to teachers, state workers, university employees, judges and lawmakers. Illinois politicians have shown no appetite to amend the constitution to reform pensions,

It’s human nature to fight change. We don’t do it until we’re forced. It’s going to be that way with the larger, worldwide economic situation. The world economy will have to crash before any action is taken. It’s been that way throughout history: Booms and busts over and over again. We never learn.

Black Swan Financial Events

I want to address “Black Swan” events, because people keep talking about them, expecting them to somehow affect the stock market, although they never have before. “Black Swan” events are sudden financial events that come out of nowhere and crash the stock market. It’s never actually happened, but that’s the myth.

I would agree that there are financial black swan events (Cuban Missile crisis, JPF Assassination, 9-11, Enron, Lehman, AIG, Brexit), but they don’t affect the stock market to any great degree. The Lehman collapse, which is supposedly a cause of the so-called, Great Recession,” happened a year after the top of the stock market. It was a result, not a cause. Various assets or indices may react within a small period of time, but the current pattern plays out; the overall trend does not change.

In the 1930s, Ralph Nelson Elliott discovered that stock markets actually follow predictable, natural laws. They can be measured and forecast using Fibonacci numbers. I’ve refined the Elliott Wave Principle over the past ten years to the point where it is highly accurate in any market in any timeframe. It’s actually “cycles in the stock market,” cycles that adhere to fibonacci price levels. Here’s my short fibonacci video.

Each stock market trend in five waves plays out the full predictive pattern of five waves and turns trend when those five waves are complete. It was hard for me to believe when I first started to study it, because the consensus amongst pundits (who apparently know very little about the market, in actuality) is that the market moves based on events. That unsupported “idea” couldn’t be further from the truth.

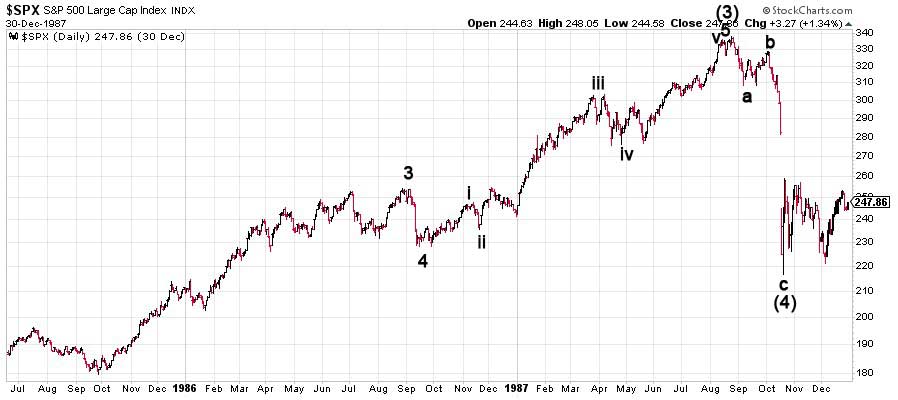

People point to October 19, 1987 as Black Monday … a financial black swan event in the stock market. But it wasn’t; it was highly predictable, as it was an Elliott Wave fourth wave playing out, as the two charts below illustrate. Crashes aren’t really crashes.

Above is daily chart of the SP500 from July, 1985 through December 30, 1987. You can see the end of the five wave build-up to the top at about 340 and then the “abc” (three wave) drop to the previous fourth wave. From an Elliott wave perspective, there is nothing black swanish about this at all. It was highly predictable. Fourth waves in an impulsive sequence revert back to the previous fourth in an ABC, three wave pattern, before they turn back up again to rejoin the trend.

Above is a daily chart of the SP500 from June 20, 1987 through December 30, 1987 (a much tighter timeframe). You can see how the October 19 “crash” is part of a C wave that was already about half-way through its projected path. The gap shown was the overnight progress, but the point is that the entire pattern is one that plays over and over again in an Elliott wave sequence at various degrees of trend, because progress is fractal.

The “crash” was simply a continuation of a C wave.

Let’s Let Nature Play On

Elliott waves are an guide and tracking system for the mood of the financial herd. The market will keep tracking upwards until all the events along the way turn the positive herd negative. It isn’t going to happen in a day. There will not be any single event that creates the turn. However, there may be a financial event close-by that will be blamed for the turn, even though the turn has already happened (and previously predicted).

The market will continue along its journey of churning out the same patterns over and over again, progressing through all the required waves as it always has done, until the positive mood of the crowd has been whittled away to nothing. At that point, the fifth way will finish, and the market will turn down.

Sometime during the third wave (or C wave, as the case may be), the pundits will call it an expected, unforeseen crash, even though the market turned a long time ago and the progress downward has been predicted to the day by Elliott Wave analysis.

You can’t stop this process before it’s played out to its natural end. Any one event will not do it. As with lemmings, we won’t be able to point to any one day in which they’ll all die out. It will take 3.86 years for the process to play out. There will be a day when 50% of the original population has died. And there will be a day when all of the lemmings sitting at the ocean’s edge are dead.

However, nothing will stop the process. As long as they’re hungry and feeling good, they’ll continue on with their journey, eating everything in site. Not one of them will confer with the others and collectively decide that if they move along this road, disaster is eventually going to strike. It might occur to a few of the smarter ones, but by and large, the herd will move along their path until they can’t move any more.

So the market moves towards the eventual trend reversal with its bullish and bearish waves along the way. Elliott waves give us the predictable guide as to when these subwaves might occur. Knowing what wave or pattern we’re in helps predict the outcome going forward. Since we began to track the market (in the 1700s), these waves have always played out in the same manner; the principle has never failed in all that time.

Nobody can know exactly when the herd will turn 51% negative. But it’s at about that point that the market will change trend. Sometime later, the herd-watchers will catch on and start blaming any event they can on the turn. But just like the progress of lemmings to the sea, it was bound to happen. The more astute of us can see it happening. And the herd will make sure it does, just as it always has before.

Let’s let nature play on, and admit that it’s far more powerful than the collective human race.

Caveat: As we know, emotional responses trump logic. So even though the facts don’t support market moves based upon events, nor early truncations of an Elliott wave pattern, I’m sure the discussion is going to go on and on …

The Coming “Crash”

Above is the 3 day chart of the SP500, the most watched (and traded) sub-index of the New York Stock Exchange.

I’ve explained that trending waves (which this certainly is) move in 5 waves to their completion (and resulting trend change). We’re currently right at the top of blue wave (3). There are two more waves to play out.

I’m expecting a turn down in a fourth wave as early at this coming week (December 11/12) is a likely candidate and a drop of over 1,000 points (the DOW will drop 10,000 points at the same time) to the area of the previous fourth wave (yellow (4)). I’m expecting that drop to take perhaps three months. Look for a final blast of Quantitative Easing at the bottom by central banks in a panic.

Then we’ll have one more wave up (wave 5) to a slight new high, topping perhaps in early 2021. After that, the final crash will indeed take place. It’s all very predictable.

For more information on Elliott Wave:

| The Elliott Wave Principle: Key to Market Behavior by A.J. Frost and Robert Prechter (2005) |

|

Beware the Chinese Curse: “May you live in interesting times.”

Know the Past. See the Future

Recommend books on Elliot Wave?

Good Idea! Thanks. I’ve stripped in a link to Amazon for the Elliott Wave Principle. I’m currently working on an updated version of my own. My longer list of recommended books is here: https://worldcyclesinstitute.com/books/

Pete – thought you might be interested in this

http://thelongview.com.au/index.html

http://thelongview.com.au/documents/MEGA-DROUGHT-DEVELOPING-Kevin-Long.pdf

Conditions on the eastern side of Oz are pretty bad. Drought and bush-fires (mainly in poorly managed National Parks). The herd are blaming CC and the current govt. All getting out of hand.

Red Dog,

That doesn’t sound good at all!

Hi Peter,

I think this must me the last wave up, the market should turn December 23 or just after Christmas…

Couldn’t agree more. Robert Prechter thought we were in some sort of an expanding wedge but threw that out the window. Has been saying for several months we are at the top. Today might have been a blow off. No reason for a 300 point rally in the Dow.

I have us extremely close to a top. The EWI folks don’t know much about Elliott Wave, unfortunately. I see all sorts of very strange counts from them that are simply “illegal.”

Wow, nice article, you have predicted the drop in March/April 2020 remarkably well. A rebound is not out of the question, and now I know to look for a fall back on the other side of that last wave. Thanks.