We’re in for some very tough economic times ahead. However, it’s nothing that hasn’t happened before. If you buy into the phrase “History Rhymes.” then you’re aware that you can get a sense of the future through an understanding of the past. History does rhyme; in fact, it repeats in cycles, but never in exactly the same way.

We’re in for some very tough economic times ahead. However, it’s nothing that hasn’t happened before. If you buy into the phrase “History Rhymes.” then you’re aware that you can get a sense of the future through an understanding of the past. History does rhyme; in fact, it repeats in cycles, but never in exactly the same way.

“Those who cannot remember the past are condemned to repeat it.” — George Santayana

The phenomenon of history repeating is much more powerful than you might think. We’re going through a period now that mimics the top of the Roman Empire two thousand years ago. It’s also very similar to a major cycle high of one thousand years ago, and even 500 years ago when the age of feudalism died and the modern financial era we have today began. We’re heading for a major worldwide revolution and a financial system melt-down — a cycle we’ve seen play out at regular intervals ever since humans starting roaming the Earth.

What has been will be again,

what has been done will be done again;

there is nothing new under the sun. — Ecclesiastes 1:9

_________________________

The times, they are a-changin’ — Bob Dylan

Don’t worry, it’s not the end of the world, as some would have you think, but, as has happened so many times in history, we’re in for a financial re-set of sorts, a colder climate, and a much tougher social environment. There’s time to get ready, and the earlier you start to think about the future, the better.

Squirrels are the smart ones: They prepare for winter as it approaches.

We can learn from them.

Our world is a relatively small place, Earth. What happens on this planet is heavily influenced by the Sun and the other planets in our solar system. Our ancestors certainly knew this, and we’re about to be reminded of it in a very big way.

Earth is mid-range in terms of size: It’s smaller than the four gas planets (Jupiter, Saturn, Uranus, and Neptune) and larger than the other three rocky planets (Mercury, Mars, and Venus). The Sun is much more important to our lives, of course — it’s 400 times our size. It’s mostly responsible for our climate, despite what you hear from the climate scaremongers.

All these spinning globes affect us in many other ways through electromagnetic waves. Even the Moon exerts its presence upon us twice a day through tides (that’s its gravitation pull at work). But the Moon also determines our biorhythms. We know, for example, that without clocks and the light from the Sun, we’d operate on a 25 hour day (the time it takes the Moon to orbit the Earth). That’s not gravity at work, but rather electromagnetic waves. More on that here.

These repeating phenomena are called “cycles,” and even though we’re aware of many of them — the seasons, the appearance of the Sun every twenty-four hours, even rainfall and temperatures — there are many more that affect us without our knowledge.

True cycles are predictable, because they happen at regular intervals. Why? Because the planets never change their course. They exert their influence on us over and over and over again. It’s why you hear the phrase, “History Rhymes.” (that means it repeats, but not in the exactly the same way, every time).

In fact, the influence of the planets (and the ratio of the distance between them) is apparent in our DNA, the way we’re shaped as humans, and how plants grow. More info on this here.

| “As far back as I can remember, I’ve always been a strong believer in the importance of cycles. You’d better try to understand them, because all of your timing and often your luck is tied up in them.” — Lee Iacocca, past CEO of Chrysler, creator of Ford Mustang and Chrysler Minivan |

If you want to see cycles in action, you just have to spend some time watching the stock market, which is highly predictable, but so few actually spend the time to discover how and why it moves the way it does. It moves in either five waves (in a trend) or three waves (in a countertrend), based on the “Elliott Wave Principle.” You can find more on this by following the Market Forecast on my site, which is updated each weekend.

A Brief Look at the Science and History of Major Cycles

Now, let’s take a look at much larger cycles, spanning many decades, for example, 172 and 516 year cycles.

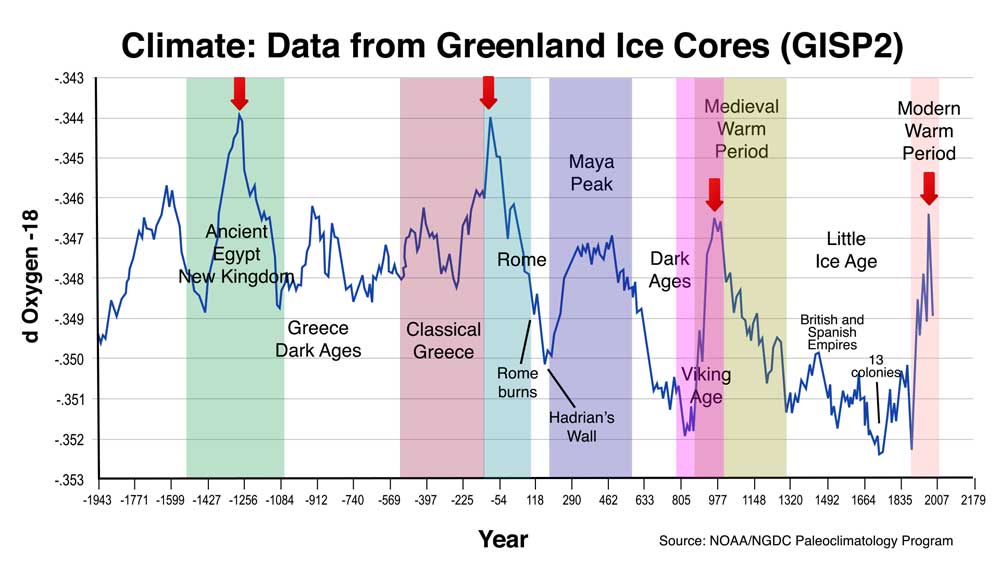

The data above comes from the National Oceanographic and Atmospheric Administration—from the Greenland Ice Core Research project ending in 1992. Ice cores are an extremely accurate method of determining temperature (blue line in the chart) back through the centuries. This data is undisputed by the scientific community, but has been suppressed by the UN-associated, man-made warming advocates. It also reinforces the findings of Dr. Raymond Wheeler in his research over fifty years earlier of tree ring data, weather records, military records, locust plagues, historical chronicles, sunspot records, etc. The results of Wheeler’s work tracks the Ice core results almost exactly.

The blue line that represents the major climate cycles is a temperature indicator. Rainfall more or less follows the temperature pattern but creates its own fluctuating cycles in its own rhythm.

The red arrows on the diagram above mark large cycles of approximately 1030 years. The period from about 1256 BC to 54 BC had one extra 172 year cycle. Otherwise, these cycles go back many thousands of years until the Ice Ages, approximately 11,700 years ago.

What has been will be again, what has been done will be done again; there is nothing new under the sun. — Ecclesiastes 1:9

You can find more information on cycles in my blog post, “An Introduction to Climate Cycles.”

500 Year Cycles

Technically, it’s a 516 year cycle. This is one of the most important large cycles, and is referred to as the “civilization cycle.” New civilizations (empires) generally form 200-300 years before the theoretical cycle peaks (the red arrows in the diagram above). “Theoretical peaks” refer to predictable cycle tops (ie – 172 cycle tops), as the tops can often vary slightly in years.

The dominant empire at the time of a 500 year cycle top starts to decline, or collapse, in the 100 to 300 years following. You’re currently watching the start of the decline of the American empire.

Supporting evidence for this cycle spans more than 5000 years covering empires such as: ancient China, Meso-America, Egypt, Greece, Rome, Medieval Europe, and modern Anglo-Saxon nations. In the diagram above, you can see how these great civilizations have formed during warm-wet climates and crumbled after the onset of colder, dryer climatic periods.

It’s gradually turning colder and dryer now despite the cult-like emotional response to the temperature highs of about two decades ago (1998 temperature peak). Humans react at highs and lows of temperature; they always have. There’s lots of support for this statement from history — a smaller reaction happened in the ’70s, when it started getting dryer and colder (on a smaller scale than what we’re about the experience).

The 2007 Turn

The predicted 516 year cycle top was in 2007, and sure enough, the stock market topped and we went into the “Great Recession.” As a stock market technical analyst (and cycles expert), I, and many others, expected the market to drop much farther than it did in 2008. BUT, central banks got involved in 2008 and injected trillions of dollars into the economy to keep the market up.

The problem is that they can’t stop a natural cycle; they can just delay it. In effect, they’re just shifting the top of the 500 year cycle one sub-cycle later. They also exacerbate the problem, as the eventual collapse becomes just that much larger. And that’s where we are today. The stock market is still up, but barely; underlying economic conditions are rapidly deteriorating. The world now is reportedly $255 trillion in debt.

Besides injecting money into the system, central banks have another tool: lowering interest rates. However, rates are already so low that central banks are, quite frankly out of ammunition. There is, at this point, little they can do to avoid the inevitable. All they’ve really done is to make the debt larger, people poorer, and created a situation that will be far worse when it unravels than it would otherwise have been.

Where We Are Now

A bit of background …

Dr. Raymond Wheeler, PhD spent a good portion of this life (along with 200 employees) documenting the cycles of history going back to the year 600 B.C. Dr. Wheeler created the Drought Clock, which illustrated the periodicity of these recurring cycles in a manner that shows their predictability, verifiable through observation, and supported by data from a variety of independent sources.

Dr. Raymond Wheeler, PhD spent a good portion of this life (along with 200 employees) documenting the cycles of history going back to the year 600 B.C. Dr. Wheeler created the Drought Clock, which illustrated the periodicity of these recurring cycles in a manner that shows their predictability, verifiable through observation, and supported by data from a variety of independent sources.

My work, over the past ten years, has been in studying, in more detail, the patterns of the larger worldwide cycles of 172 and 516 years (along with shorter ones) as identified by Dr. Raymond H. Wheeler and Stephen Puetz. Dr. Wheeler identified the cycle lengths for climate of 25, 100, 170, and 500 years, while Stephen Puetz has done the work to prove their veracity, shifting the 170 cycle, for example, to a more accurate 172 years, and addressing the probability factor surrounding major harmonic cycles going back to the formation of the Earth.

There are many other luminaries from the turn of the twentieth century that wrote extensively about cycles and their recurrence. You can find books on the subject through my recommended reading list.

The Coming Depression

At the time I’m writing this article, I believe we have another couple of years before things really start to fall apart. The stock market is in its latter stages of topping, but still has one more high to put in, somewhere close to the beginning of 2021. It will likely take another five years from the top to reach the ultimate bottom. At the bottom, I expect the DOW to be under 3,000 points (it’s above 27,000 points as I write this article).

As a reference, the DOW dropped 90% during the onset of the Great Depression in 1929/30.

Every 1,000 years, we go into a period that has historically been called, “The Dark Ages.” Don’t let that label scare you. The most recent “dark ages” period, from the 1500s to the 1800s saw several smaller empires emerge: Spain, Portugal, and England. At the bottom of the this period, in the 1600s, the New World (America) was established.

We’re moving into a time of pandemics, tougher climatic conditions, and civil wars. The good side of the experience of a colder/dryer climate is the furthering of democracy and freedom.

“As the warm-wet phase terminates, climate becomes drier and hotter. As it does, other phenomena manifest themselves: creativity declines; reaction and decadence set in; governments become despotic; minorities are persecuted; general health declines along with the birthrate; economic systems collapse; socialistic and communistic regimes rise under an epidemic of dictators; individual freedoms vanish; and the moral tone of society reaches a low level.

Towards the end of this period comes another series of wars we call nation-falling wars because many of the governments initiating them during this period are either tottering or about to collapse internally. These particularly savage conflicts occur on a falling temperature and rising rainfall curve.” — Dr. Raymond H. Wheeler

Current events show that another world revolution is occurring similar to

- the emergence of rational thought in the sixth century BC,

- the fall of Rome and other ancient civilizations in the 5th century (and the beginning of the medieval world based on feudalism), and

- the final collapse of the Middle Ages in the 15th century.

- The current convulsion is comparable to the birth of Christianity in the first century and to the birth of the modern nation as a feudal principality in the ninth and 10 centuries.

After the Crash

We’re going to experience a horrific stock market crash beginning most likely in the year 2021 (in the meantime, starting in November, 2019, watch for a huge stock market drop, foreshadowing the eventual larger collapse, perhaps).

The final stock market crash will result in a complete financial meltdown and the formation of a new monetary system, because the current one is quite frankly, a ponzi scheme. It starts with our banking system. You can find out more about that here.

As a result, we’re going to have a very tough couple of decades going forward. I’m now turning my attention to what you can do to shield your current wealth. I’ll be sharing much more in upcoming webinars and speaking engagements, but in the meantime, here’s a quick guide to some of the things you need to think about, depending upon where you live and your current situation.

How to Prepare

Food — If you’ve been paying attention to alternative news (because much of what’s really going on doesn’t reach the main stream media), you know that the violent changes in the weather (flooding, along with early winter storms) in the past two years has virtually destroyed the food supply in the U.S. midwest. This has always happened at these large cycle tops. For example, in 1315 in Europe (the year 1320 was the theoretical 172 year top):

Then in the summer of 1314, the weather turned cold and very wet. Rain fell incessantly. Crops rotted in the fields. Grain harvests were late and desperately short.

These disturbances seemed at first to be nearly another routine disaster of a sort that had often afflicted medieval Europe. Crops had fallen short before. In the winter of 1314, people tightened their belts and prayed for better times.

But the next harvest was worse. The spring of 1315 brought heavy rain throughout Europe. Stormy weather lashed the continent for months. Dykes collapsed in England and the low countries. Entire fields washed away in France. Villages were destroyed by rising rivers in Germany. Once again grain and fodder crops failed.

Then, inconceivably, torrential rains came again and 1316. The grain crop failed a third year in a row. Europe began to experience the worst famine in its history.

Some historians estimate that a 10th of Europe’s teaming population perished in the years 1315 to 1316. — The Great Wave by David Hackett Fischer

As it’s getting colder and dryer, we’re going to experience major food shortages brought on by a shorter growing season and the lack of rainfall. Historically, this combination has led to famine on an international level.

You can start to stock up on the necessities, start a garden, create other means of harvesting food (chickens for example — very popular in the Great Depression), or look into freeze dried foods that come in bulk and last up to 25 years. The best-tasting of the freeze dried offerings is from Mountain House.

Canadian Mountain House online packages can be found here.

Water — You can’t live very long without fresh water. With the coming stock market collapse, many of the businesses you frequent now will no longer exist. Transporation systems are already starting to collapse. National trucking companies are going bankrupt at a rate not seen before in modern history. The shipping industry has been in dire straits for the past few years.

The result is that bottled water will start to get difficult to obtain. It’s best to locate yourself close to fresh water, preferably within walking distance. There are lots of tools available to help you purify water that you might be drinking other than out of the tap, and as we know, you can’t always count on that for purity. My favourite is Lifestraw.

Energy — It’s getting colder and dryer overall and this will be continuing trend over the next couple of hundred years. My video on this subject is here.

The climate change “cult” has done their best to limit our energy resources just at the time we’re going to need them. Green energy does not have the power to provide needed energy in a downturn, particularly in colder countries. Another issue is infrastructure: Infrastructure in many cases has not been maintained. You’re seeing rolling blackouts in places like California, for example.

Governments around the world are bankrupt. In a stock market crash, jobs across many government-funded agencies will be reduced or eliminated. It makes sense if you own a home to consider a generator. There are lots of them on the market.

Money — Your money is changing in value (it’s been changing in value since the early ’70s). Governments always inflate away its value (in essence stealing from you) so that a dollar today is worth about four cents, compared to what is was worth a hundred years ago — it’s why everyone is so broke (wages have not kept up to the rise in prices or increases in taxation).

With deflation, currency becomes more scarce and more valuable. You’re about to see your money increase in buying power as prices for just about everything start to plummet.

It’s a complicated story but it’s well worth your while to learn about both inflation and deflation, as it will change the way you view the world at large.

Silver coins are a good idea when the financial situation worsens (the system collapses altogether). However, gold is an asset and under a deflationary environment, it drops in value, along with all other assets. I’ll be running webinars on money, deflation, gold and silver, and the banking system in the months to come.

Learn about the banking system. Private banks are not generally going to be a safe place to store your money; we’re going to see lots of bank failures internationally when the stock market plunges in a couple of years. More on how banks work here.

Health — Exercise is really important during a downturn like this. It helps to keep you psychologically as much as possible outside the realm of depression. Public and private health systems will end up with funding problems and there’ll be a health crisis right across the world. You need to keep your spirits up and create achievable goals even when things seem tough. Downturns like this have happened over and over again throughout history. The tough and tenacious always survive and prosper.

Colder and dryer climate sparks pandemics. You’re starting to see major diseases like black plague, measles, ebola, and others starting to crop up; we’ve already started into the colder climate cycle. Millions and millions of lives were lost in past cold-dry periods in the past. This time will not be any different. Pay attention to your health.

Shelter — Real estate prices have topped generally all over the world (as result of the turning of the 18.5 year real estate cycle). Dropping asset prices are deflationary, and it would be a good idea to understand how the changing value of money affects your net worth and what to do about it. You can find more information on deflation here.

At the bottom of the stock market crash, we’re expecting real estate prices to be about 20% of what they are now, so obviously buying a home now (or anytime in the past ten years) is not a good idea. Selling one and renting is a much better idea.

Large asset purchases of any type at the top of the a major cycle can have lasting negative effects on your net worth.

Safety — When populations get hungry, chaos erupts. Colder/dryer climate cycles usher in riots, unrest, and eventually, civil war. People in desperate situations do desperate things.

In the 1930s, many well-off families dressed in old clothes and made sure not to drive through town in an expensive car. Visible wealth of any kind tends to become a target quickly.

Depending upon where you live, it’s a good time to prepare methods to protect yourself in the face of an attack. When society starts to break down, you will need to be able to defend yourself. Police and other services will be limited, and possibly unavailable.

Psychological Support — Going forward, family is going to be much more important than ever before. Patch up any relationship issues, if possible — you may need to band together for lodging and security during the most difficult times ahead. Know who your friends are and take time to strengthen those bonds.

We’re going into a period which will be much more of a challenge than the 1930s (the Great Depression) — a complete financial meltdown will result in a depression several times deeper than we’ve seen in the past 500 years.

The first jobs that come back during a depression are blue collar jobs. People will need things fixed and if you have the ability to provide services to people in your community, you’ll be well sought-after, becoming a revered member of your commmunity.

Remember, we’re all going to be in the same leaky boat. If you have the ability and desire to help your fellow human beings, now is your time to shine.

_____________________________

Watch for the announcement of my upcoming online webinar: Navigating the Coming Crash. It’ll provide much more information that I can provide here on what’s coming. I want to help provide you with the knowledge you need to stay safe and prosper.

I appreciate and want to thank you for this article. I also appreciate the links. Have a great evening.

Not great news, I know, but I think it’s way better to be prepared …

It’s my understanding that during the great depression, people spent what little money they had at the nickelodeon (so 5ct) to escape the misery.

I wonder what the next nickelodeon will be…

– [ ] Autistic futures trader who triggered crash spared prison

MICHAEL TARM

Associated PressJanuary 28, 2020

– [ ]![]()

– [ ] View photos

More

CHICAGO (AP) — A U.S. judge Tuesday sentenced a socially awkward math whiz-turned-futures trader who earned tens of millions of dollars over several years and helped trigger a U.S. stock market “flash crash” from his parents’ suburban London home to time served and a year’s home confinement, sparing him imprisonment after prosecutors praised his cooperation and said his crimes were entirely unmotivated by greed.

Government prosecutors and defense lawyers described the 41-year-old Navinder Singh Sarao as autistic in memos filed before sentencing in Chicago federal court. They highlighted Sarao’s savant – like ability to spot numerical patterns in split seconds, saying he regarded trading as a video game in which the object was to compile points not money.

The sudden tanking of shares on May 6, 2010, earned Sarao nearly a million dollars and temporarily wiped billions of dollars off the value of publicly traded companies, denting investor confidence and leaving many wondering if the market was rigged.

Despite earning some $70 million as a trader over several years, Sarao often ate at McDonald’s using discount coupons. His priciest purchase as a multi-millionaire was a second-hand Volkswagen that cost under $10,000. His modest lifestyle has altered little from his days as an active trader, living today on $336 in British government benefits.

Before U.S. District Judge Virginia Kendall imposed a sentence, Sarao apologized to those he harmed with his market manipulation, and he expressed remorse for the trauma his prosecution put his family through.

“I will never do anything illegally again,” he said.

Defense attorney Roger Burlingame described his client as a “singularly sunny, childlike, guileless, trusting person who is instantly beloved by all who encounter him, including the FBI agents and prosecutors.”

“Navinder Sarao lives outside the reality those without his autism inhabit,” Burlingame added in his filing.

Before his own indictment, Sarao himself lost millions in assets to fraudsters who found him uniquely gullible and easy to cheat, his lawyer said.

Home confinement may not be much of a departure from Sarao’s typical life. He has lived in the same small room with his parents in Hounslow, United Kingdom, since childhood, rarely venturing out, in part due to his inability to complete the simplest everyday tasks, including doing laundry, Burlingame said.

Sarao spent four months in a British prison — the time Judge Kendall referred to as served — after a grand jury indicted him in Chicago in 2015. A U.S. judge later granted him bond, secured by his parents’ home, which allowed Sarao to return to Britain as criminal proceedings in the United States played out.

Sarao, his lawyer said, prefers the company of children and is obsessed with animals, repeatedly enlisting his lawyer’s help to convince his parents to let him keep rabbits. He fantasizes about setting up a home for unwanted pets but has no practical ability to make those plans a reality, Burlingame told the court.

He also walked prosecutors step-by-step through how he — and others — employed lightning fast programs to buy and sell in milliseconds, scooping up quickly-accumulating profits. His attorney said Sarao was motivated in part to begin using the techniques himself because he spotted how so many others were cheating the system.

In their sentencing memo, prosecutors agreed that imprisoning Sarao would be pointless, heralding the cooperation he pledged to provide in his plea deal, saying his “extraordinary” cooperation and insights have helped catch other market manipulators.

His lawyers said the time Sarao spent in jail in Britain was “unbearable” because of his autism, saying it amounted to “a torture of sensory stimulation, sleep deprivation and forced socialization,” and that he became suicidal. They said they were concerned that Sarao may not be able to survive another stint behind bars.

The 2015 indictment said Sarao manipulated E-Mini S&P, which helped spark the 2010 “flash crash” when the Dow Jones Industrial Average plunged 600 points in just five minutes before rebounding. Sarao allegedly earned around $900,000 in profit on that one day, according to court documents

How does this happen? Does it really only take one computer genius to destroy the stock market or cause so much damage, it will takes years to recover. Just today I read about Iranian hackers, 3 groups of them, finding back doors to large company computers so they can do damage without being detected. Getting too advanced and downright scary! Are our lives in the hands of a few hackers from anywhere? I was hoping it was only in the movie! Please offer us so hope!

Comments?