All About Deflation |

DEBT: The word that will become the most reviled word in the English language. It is the source of all our problems. As more and more money goes to servicing the debt, less is left for the free services we all enjoy. In fact, governments have borrowed heavily to give their constituents everything they ask for so that, in turn, they vote their governments back into office.

It’s a crazy system, because of course, the constituents (you and I) are on the hook for the debt, debt that by default, will move onto the shoulders of our children.

Contrary to the Keynesians‘ way of looking at the economy, you cannot spend your way out of debt! You simply postpone the inevitable, while digging a much deeper hole. That’s what central banks have done to us, through “stimulus” and buying up of bad debt—they’ve increased the debt, undermined the economy and made matters far worse. We’re about to pay the price.

Deflation Has Begun

I see deflation all through the market, but then I’m sensitized to it.

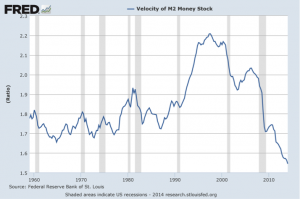

One measure of deflation is the velocity of money. On the left you can see a chart showing how the velocity has decreased dramatically over the past few years.

One measure of deflation is the velocity of money. On the left you can see a chart showing how the velocity has decreased dramatically over the past few years.

The velocity of money is the rate at which currency changes hands in the economy. If people stop spending, there’s less money changing hands and so it becomes more valuable; it is harder to come by (scarcity raises its value, like any other product or service).

If people aren’t spending (due to lack of disposable income), companies start lowering the price of items just to move inventory.

One of the most noticeable recent events is that Ford just marked down its flagship pickup truck, the F150 by $10,000! That’s because retail sales are sliding again … badly.

Travel is another area that’s been hit early and hard. There are deals to be had everywhere. Vacations have never been less expensive … and we’re just getting started!

In the spring of this year, economists started to blame the weather for the slowdown in retail sales. The fact of the matter is that unemployment was affecting sales. You can only blame the weather for so long …

But this is just the tip of the iceberg. And it doesn’t affect only prices. It also hits wages and employment generally (and assets … big time).

The Printing Money Myth

From time to time I hear people say “Don’t worry. If there’s a problem, the government will just print money.” That’s comforting, I guess, to someone who doesn’t understand how currency gets into the system.”

Our current financial system is built on debt and credit. The only way to get money into the system is to lend it, or buy up distressed assets. Nobody is going to drop thousands of dollars into each and every bank account in the nation (nice thought, though!).

So, the tactic has been to provide more credit to the banks and push them to lend more money at depressed interest rates. However, if people and businesses are not feeling confident about the economy, they’re not going to borrow. But banks have been trying to entice them into borrowing with interest rates that are next to zero.

To some extent they’ve been able to do this in real estate. They’ve created a bubble. People are bidding up the value of housing, due to the availability of low interest debt. However, interest rates will eventually go up, along with taxes. Bubbles always burst; they have all through history.

The result, of course, is that thousands will lose their homes, and end up with bad credit records.

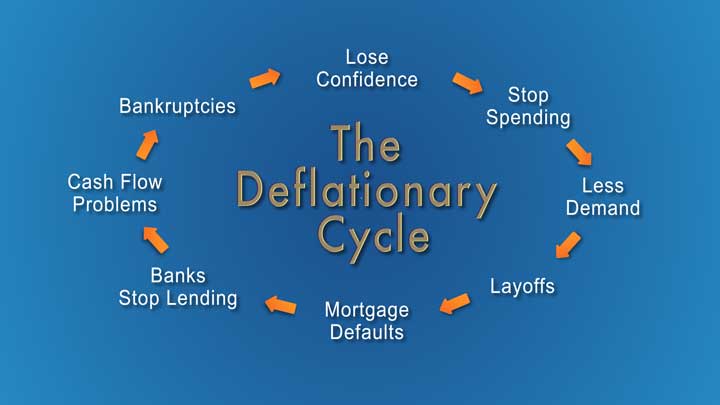

The Deflationary Cycle

And this brings us to the root cause of deflation—confidence—plain and simple. Confidence in the economy, and as a result, your own financial well-being.

If people lose confidence, they stop spending, that creates less demand for products, companies lay off workers, people start to default on mortgages, banks stop lending money, credit dries up, and the bankruptcies begin … and on and on in a vicious cycle.

That what happened in the 1930s. It’s what happened in 1835 (with the Panic of 1937 a couple of years later), the largest depression in US history until 1929 … and interestingly enough …. separated by common cycle lengths. History repeats.

So we’re sliding into a depression, but the government will be the last one to admit it. In Canada, we’re now in a technical recession, but the Minister of Finance just won’t even say the word. Well, there’s an election on the way here … and governments know that a bad economy gets them kicked out of office, even though they have nothing to do with it. Perception unfortunately, is reality.

Governments love inflation. Because inflation raises the Gross Domestic Product on paper (the country’s income) and allows them to borrow more money against it, putting you and me further in debt.

Worldwide Government Debt

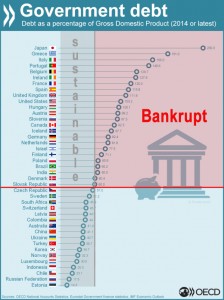

Look where they are now (click to enlarge). The chart on the left is up to date as of 2014.

Look where they are now (click to enlarge). The chart on the left is up to date as of 2014.

Most advanced nations are bankrupt. They’re well beyond the debt sustainability level, meaning it’s impossible for them to pay it back their loans. There are two options … default on the debt or inflate. In other words, print money.

But inflation lowers the value of our currency. Since 1913, North American currencies have dropped in value by about 96%. That’s right … $100 dollars back then is worth $4.00 now. Seem like it’s harder to stay afloat? Well, that’s because it is.

Inflation is not good unless you’re a business owner or have a salary pegged to the rate of inflation. Inflation is simply financial robbery.

In fact, central been trying to inflate (that’s called stimulus) but so far, it hasn’t worked. We keep sliding downhill economically … into deflation.

Deflation actually raises the value of currency … if you have it. Assets, like houses and cars and other things drop drastically in value … and so if you’re smart, deflation presents a huge opportunity.

Fiat Currency

It’s important to mention fiat currency, because this is the tool that allows bankers and politicians to line their pockets and steal from the people. It also allows deflation to set in.

At the end of World War II, at the Bretton Woods Conference, Europe and the rest of the world embarked on a lengthy period of reconstruction and economic development to recover from the devastation inflicted by the war. Gold had been the base reserve currency, but the new agreement named the US dollar as the base currency, pegged to the price of gold. It also set up a system whereby currencies could be free-floating and traded against each other.

However, on August 15, 1971 President Richard Nixon terminated the relationship of the dollar to gold, bringing the Bretton Woods system to an end. The US dollar was still the reserve currency but had nothing to back it up except the promise of the US to make good on its value.

Governments love fiat currency because it allows them to manipulate our money for their purposes. They can create inflation, which lowers the value of currency, while increasing the costs of products and services. They are very good at convincing the population that inflation is a “good idea.”

It also allows the government to borrow larger sums of money. Higher wages (as result of inflation) along with higher costs create a larger Gross National Product number and this allows them to justify greater amounts of debt. It’s simply a numbers game.

When currency is not pegged to money (gold or silver), its value is solely based upon confidence.

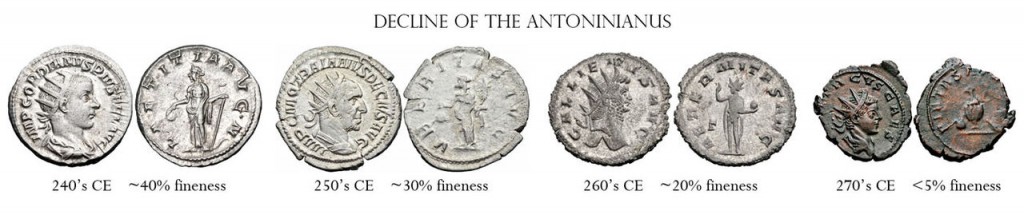

In Rome and other societies, the trick was to gradually remove the amount of precious metal (gold and silver) in coinage until the currency was worthless. This is inflation—just another method of achieving the same end.

However, what we have now is a situation in which the world is bankrupt and based on a currency system with nothing to support its failure.

Strategies for the Future

So what do you do to protect yourself against this ponzi scheme (and by the way, this is nothing new—governments have pulled the same tricks on their populace for centuries)?

In the shorter term, we’re expecting spiralling deflation. What happens during a depression is that as large financial contracts default, creditors want to get paid back in the reserve currency (which is the US dollar). This starts to make the demand for the dollar very much stronger and it goes up in value against other currencies. This causes deflation.

Eventually, we may end up with hyperinflation, but that’s likely sometime down the road. At that point, you want to have some gold in your portfolio, because currency eventually will need to pegged back to gold (money).

In the meantime, there are strategies that make a lot of sense during a deflationary phase. Let’s look at the list I ran through quickly in the video:

Cash is king. Currency goes up in value, while prices for just about everything that’s not a necessity, go down in value. Food is a notable exception. At the same time we have a major economic collapse, we also have a major worldwide drought. This raises the scarcity of food. Expect banks to stop lending and for the current credit card scheme to end. It’s a good idea to have cash on hand in a safe place just in case banks start to fail, as they have so often in the past.

Get out of debt, because interest rates are going up. They may not go up immediately, but governments are in debt. The only way they have of solving that problem is to tax the population. Banks, if they run into problems, will raise interest rates. They’ll also start to limit credit and call in loans.

If it makes sense, sell your home and buy it back in a few years at a fraction of the current selling price. In the 1930s, homes devalued by over 80% very quickly. Many homes previously owned by the fabulously wealthy or well-to-do (who has lost everything is the stock market crash) were on the market for fire sale prices. We expect to see this scenario once again. During deflation, all assets drop dramatically in price. You can already see this in the price of oil.

Hold off on major purchases … because things are going to get a lot cheaper. As people stop buying, products go down in value. Double this with the fact that currency is going up in value and you have lower priced services and products.

Traditional investment is dead. Markets have already topped. Lower demand right across the board will lower the price of most products and services. As a result, more and more companies will land on hard times. Most bonds are also vulnerable. We’ve already heard of major cities going bankrupt. If you read your history, you’ll know that no investment is safe during a major collapse. That’s why cash is king.

Community is exceptionally important. Mend any broken relationships with family and friends. You’re going to need them. Have services that you can offer to others, to make yourself a more valuable commodity.

In reality, deflation is cathartic, and a necessary condition to heal the economy.

These are only some of the strategies you can use to defend your wealth and sure your viability during an major downturn. I hope it provides a sense of what’s to come.

So don’t get fooled by the idea that inflation is a good thing. It’s ruined the world economy. We’re awash in debt. Thank you politicians and bankers!

Deflation is good .. if you’re prepared. The train is just leaving the station …. It’s time to do some research and get ready to buck the trend.

______________________________

Notes:

On Canada’s Technical Recession

Canada’s top banker had warned in 2014 that our economic growth would be ‘atrocious.’ That prediction has come true. Canada’s GDP shrank at a 0.6 per cent pace in the first quarters of 2015. It’s the first contraction in nearly four years and it was worse than what economists predicted.

On Deflation and Economic Booms.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

On Keynesians

Keynesians view deflation as the source of a destructive cycle in which; asset prices plunge, companies cut jobs, spending plummets, and a permanent recession sets in. Therefore, the prevailing current view maintains that deflation is something that needs immediate intervention of massive monetary stimulus–you can say they have become deflation phobic. This is why I find it fascinating that Keynesians, who proliferate in central banks and in the financial media, are relentlessly cheerleading the recent spate of deflationary data. And, just to be clear, deflation has not been limited to the New England Patriots’ footballs–it is everywhere you look.

Peter,

I hope that I can read back on this piece of art in a few years and say, I KNEW IT, he is not crazy! 🙂 It is cool to see somebody explain that the world is only ‘sunshine’ and things can/will go wrong. I see this stuff happening as well, but can’t explain it like you can!

Thanks for sharing Peter, PLEASE keep doing so!

Cheers,

W

🙂

I think we’re looking for 2020.86 SPX.

Hard to tell since the waves are so small, but I think I’ve seen one very small motive wave down now. We’re either looking for a second wave (62%) or a double top.

Hi Peter

I can see the deflation but there are a few things that don’t add up for me .

back in the early 1990’s everyone was saying Japanese interest rates must rise since they were way to low . the past few years when I look at the USA bond market I tell myself, remember Japan and don’t short the bond market even though rates should rise. so here we are today and we are talking deflation and how the banks are trying to entice people to borrow money by keeping rates low yet in general people are not biting .

if we go down this deflationary spiral how would raising interest rates really fit into this ? it just doesn’t make sense that we would have higher interest rates in a deflationary spiral . I do see how lack of confidence could create a bad credit type rise in government or municipal bonds but in order to create demand for loans rates would have to stay relatively low. I’ll add that as interest rates rise on gov debt ( assuming they do )then most likely I would expect taxes to rise which would create more deflation and add to the deflationary spiral . but where do you store the trillions of dollars around the world ? the US dollar most likely and could that also help hold up or drive the USA stock market temporarily ?

if you live in Europe you probably want your money somewhere else .

same holds true for Russia and many other countries ,the strong dollar may be a sign of capital pouring into the USA as a safe haven

Joe

Thanks for the comment, Joe, but I’m not sure of the question …

I do know there’s one on interest rates. During a deflationary spiral, if you came to me and wanted to borrow money, I’m sure going to want a good rate on it because risk is so much higher of you defaulting. The Fed will attempt to keep them low but it’s really out of their hands at that point. We’re already seeing long term interest rates heading up.

Again, it’s about confidence. People don’t lend at low interest rates if they fear default (in that case they don’t lend at all!) but rates go up even to the best customers. Money is harder to come by.

Hope I’ve helped answer your question.

Sorry – but interest rates go down in a deflationary scenario because there is no demand. Banks don’t even loan, they don’t care what the interest rate is. There is also a flight to safety, i.e. investors buy bonds. My proof? It is now June 25th, 2016 and interest rates are at long time, very low, lows…negative even. Eventually interest rates will go up yes….but first phase happens first and the debt unleveraging step too. Those are happening right now but will take a long time to play out before rates jack up.

Peter1

Economist

Love your work though…..keep going!

Peter1

Yes, you’re right on this, something I caught shortly after I shot this. I haven’t gone back to make that correction. I should have made that comment regarding taxes instead, which have shot up in Canada, at least. Interest rates are going to stay low for some time to come in today’s scenario, with credit freeze already starting to show signs of rearing its ugly head. Thanks for catching this—I was pretty sure somebody would before too long 🙂

Hi Peter

yes you did answer my question ,and after I asked it I thought it through .

higher rates implies higher taxes ,and who would want to lend money at low rates ? not a question just an agreement .I tend to think we’re going to see the mother of all deflations and I agree with everything you wrote .

what amazes me is that even though most everyone realizes that something isn’t right they don’t see what’s coming .I feel like we’re all trapped . I get the cash is king thinking but that in itself could also become a trap , let’s say the banking system fails and this time we don’t get the bailouts your money is lost .your money in any financial institution could end up trapped depending on how the government reacts

look at Greece as an example ,people being told they could get 30 a day .

in the USA were already limited with atm cards on how we can get per day .you sell your house thinking you will put your money in a safe financial institution only to find out the government has taken it over and will pay you 1200 a month or something crazy and now you basically have lost all control of your money. on the other hand you keep the house and they tax you on some UN realistic valuation yet you have something .bury your money in a matress and hoard your cash and the imf sdr becomes the world reserve currency and they ‘re value the US dollar overnight and suddenly your cash is worth half what it was . gold silver hard assets Is a spot to be but your not going to go to the store and pull out a silver dollar

the other possibility is a cashless system to track everyone for more taxes . in that case which is an extreme a can of soup would have a better value than anything . I certainly don’t want to see it get that bad but it could and if so it’s very hard to say where exactly one should put there money or what would really be considered a store or value .

the good side of this is we are seeing non politicians rising in the poles . my hope is they get into office and keep our constitution in tack and we don’t go down the road into economic totalitarianism .

Unfortunately, politicians aren’t going to change anything.

“Cash” is king. If it’s in the bank, it’s not cash, it’s digital numbers. A safety deposit box is a good place to keep cash. Your mattress is another (what they did in the 30s).

I didn’t get into gold in the article, because gold is going up first. But it will then head down in value and you want to pick some up. Eventually, they’ll have to tie currency back to real money … gold.

Hi Peter – I enjoyed your interview on Trunews and thank you for your insight. My question involves how you see the future value of Farm ground. Presently, I own about 200 acres of farm land in Indiana and am receiving cash rent from it. While I agree with you that assets have and will decrease in value, how does that relate to the need for feed and food in the future, as it relates to the value of my farm. In other words, do you think farm land is currently in a good position to increase or decrease, over the next ten years? Thank you.

Hi Everett,

I’m really not knowledgeable enough in farm land prices to answer your question. However, I got asked a question about grain futures and found a great file on the history of food production during the 30s: http://history.uwo.ca/Conferences/trade-and-conflict/files/marchildon.pdf

It depends, as you likely know, on why you are invested, your age, and how deep your pockets are. Everything generally goes down in a depression. There are also demand issues and what governments do (which usually is the wrong thing to do). We’re going into a long term drought, as well, so there are a lot of moving parts, many similar to the 30s. Sorry I can’t help with much more insight than that. History is key, as we tend to repeat the situation over and over.

Everett

Here’s perhaps a better example of farming in the 30s. You can find a lot of this information online by googling “farming in the great depression.” Hope this helps. http://www.iptv.org/iowapathways/mypath.cfm?ounid=ob_000064