The Eighteen Year Real Estate Cycle |

People fall in love with having a “dream home,” and cost is usually secondary. They get into debt up to the eyeballs.

People fall in love with having a “dream home,” and cost is usually secondary. They get into debt up to the eyeballs.

Really bad idea, particularly right now. That’s because we’re at the very top of the market. In fact, it’s a bubble … certainly in Canada (and Australia is close behind). The US had their housing bubble a few years ago … but the full extent of the downturn is still to be seen.

| Update: October, 2018

I originally posted this article in August of 2015. The low of the cycle, as mentioned in the article was the year 2000, so I’ve been expecting at top in the year 2018, which appears to be happening. Here are some recent figures:

Mall vacancies are at a seven year high. There’s even a mall in Calgary, Alberta, Canada, (my city) recently cited in zerohedge that has been built but is almost completely empty. One of the key identifiers of an impending bubble bursting is extreme building, both residentially and commercially, but particularly commercially. Past market tops have been rife with completely empty commercial buildings. |

Continuation of the original article:

We’re in a Worldwide Real Estate Bubble

Central banks have lowered interest rates to almost nothing in order to spur more borrowing. However, it results in more people buying homes they can’t really afford, and artificially drives up the price of those homes.

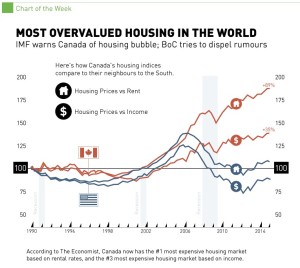

Here’s a visual from an article I clipped from zerohedge.com in March of this year about the Most Overvalued housing market in the world … by the Economist, a well-respected international financial magazine. You’ll find the full article here.

Here’s a visual from an article I clipped from zerohedge.com in March of this year about the Most Overvalued housing market in the world … by the Economist, a well-respected international financial magazine. You’ll find the full article here.

The other, possibly even bigger problem for Canada is that the International Monetary Fund (IMF) a month earlier than this article came out, sounded the alarm that Canada’s household debt is well above that of other countries. Canada (where I live) has the perfect storm just waiting to happen, and it won’t be long before it does.

But. guess who thinks it isn’t a problem? Stephen Harper, the Canadian Prime Minister, and the Bank of Canada (Canada’s central bank) both tried to quell fears that anything is amiss. Of course, they’re both heavily biased.

Funny enough, I noticed another article a few days ago on the site Marketwatch, about Millennials (25 to 34 year olds, in this case in the US) and the concern that they’re NOT buying homes. You’ll find the complete article here. I say, “Good for them!”

Funny enough, I noticed another article a few days ago on the site Marketwatch, about Millennials (25 to 34 year olds, in this case in the US) and the concern that they’re NOT buying homes. You’ll find the complete article here. I say, “Good for them!”

People just don’t get it. But Millennials do!

Buying a home right now would be really foolish. It’s the top of the market. You’ll be underwater financially in no time.

There’s a little more to it than that, actually. There’s an even larger, longer cycle in play right now … the 172 year cycle. (you can see my video on it here) It’s bottoming. What this means it that the usual 18.5 year real estate cycle is going to go a lot deeper than normal. Longer cycles are more powerful than shorter ones.

The 18.5 Year Real Estate Cycle

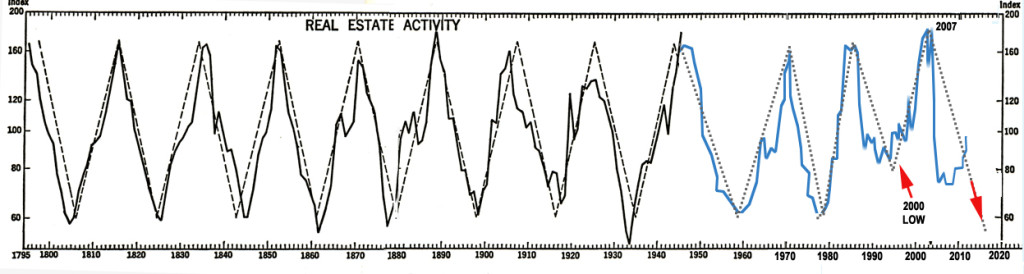

Edward R. Dewey spent an entire chapter on it in his book, “Cycles, the Science of Prediction.”

Above is a chart showing the pattern from 1795 through today. You can see how regular it is. It averages about 18 and a half years. If you’re smart, you buy a home at the bottom and sell (or keep it) at the top.

Above is a chart showing the pattern from 1795 through today. You can see how regular it is. It averages about 18 and a half years. If you’re smart, you buy a home at the bottom and sell (or keep it) at the top.

We had a major low in around the year 2000 in both the US and Canada. The US had a top around 2007 associated with the subprime crash. If you were to look at the appropriate chart (the real estate sector) in the US stock market, you’d see it peaking about now. It’s had a second top within the 18 year cycle. I would expect both the US and Canadian cycles to head down now and bottom in about 3 years.

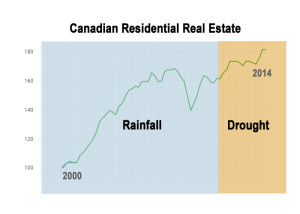

Here’s a chart of Canada’s real estate market over the past 18 years. It’s peaking right now and I would expect another low around the year 2018 … not very far away. The challenge with identifying the Canadian cycle is that they only started recording data about 20 years ago.

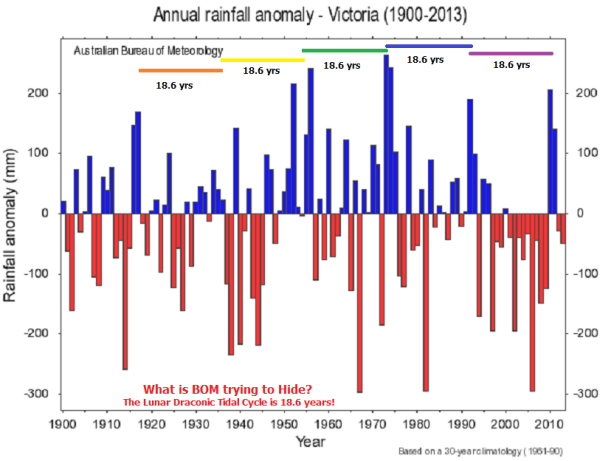

This 18.5 year real estate cycle is also a rainfall cycle. It’s called the 9.3 year rainfall cycle. Dr. Raymond H. Wheeler, the Father of Climate Cycles, found that it’s wet on the upside (wet leads to prosperous times) and dry on the downside (we’re in a drought right now … it’s getting cooler and dryer worldwide, which leads to depression). Droughts always lead to depression. They always have … throughout history.

Above is a rainfall cycle for Victoria, Australia, which shows the 18.6 year rainfall cycle in action (Source: TallBloke’s Talkshop)

Don’t get fooled by interest rates. As I mentioned earlier, central banks (like the Federal Reserve in the U.S., the European Central Bank, and the Bank of Canada) have instigated the lowest rates in history to try to spur the economy, but they’ve been unable to do it.

I’m expecting a very big crash very soon. The US stock market has already topped. Oil has tanked, but it’s got further to go. And interest rates are going up … quite a bit. Can you afford a big jump in interest rates? Well, I’d do the math before signing on the bottom line!

I’m expecting a very big crash very soon. The US stock market has already topped. Oil has tanked, but it’s got further to go. And interest rates are going up … quite a bit. Can you afford a big jump in interest rates? Well, I’d do the math before signing on the bottom line!

So … if you’re thinking about buying a home … think long and hard. Personally, I’d wait a few years until this bubble crashes and get in at the bottom. Some of us are projecting homes to be worth under 25% of what they are now in just five years – that’s not long to wait to get your dream home.

Edward Dewey, the Father of Cycles said:

“The building cycle is so long that most people don’t experience two cycles in their business life. For many individuals, an unfavourable first experience means a life-time tragedy.”

Pay careful attention to the real estate market, the stock market, and the economy. The central banks have created an extreme bubble and bubbles always burst. The signs are becoming more and more ominous. We’re likely only months away from a really large contraction.

Don’t let anyone tell you this time is different.

thanks

Good to hear from you! New market post https://worldcyclesinstitute.com/a-cautionary-tale/

Very insightful presentation Peter… I will put Dewey’s book, Cycles: The Science of Prediction, at the top of my list. Thanks!

For some reason, I still remember that real estate chart in Cycles when I read it in the 70’s. But Phillip J. Anderson says the 18 year cycle has already bottomed, and it is clear sailing until 2024. Any thoughts on this.

Hi Kent,

I can’t comment on someone’s else’s cycles analysis.

I can tell you that the Canadian and Australian markets are leading the bubble (currently right at the top), and with commodities having sunk to new lows and the most of the world markets starting to head down, I haven’t seen a bottom anywhere. Now, some might say the US had a bottom in 2008/9 but I attribute that to the subprime crisis and with the depression picking up steam, I expect everything to be in a trough by 2020 or so. The US market has a lot further down to go. This is going to be a big, long trough, so 2024 would certainly fit well within it. The US and Canada have been in a technical recession for months, and so everything is pointing down, as well as quite a number of cycles, not only the real estate cycle.

Don’t know that I’ve answered your question …

Hi Peter

your Canadian ?

both my parents came to the US from Canada and I still have cousins up there . I’m a yank though having grown up in Seattle and spent the summers sailing in the san Juan islands , great place . I live in southern Oregon now but visit family and friends each year in Seattle and from what I’ve seen the construction boom has gone crazy in downtown Seattle as well as Bellevue along with the smaller cities . it certainly has a topping feel to it .I’m curious though In regards to Canada real estate , didn’t they impose a transaction tax back in 2009-2010 on real estate ?

I have no idea how that effected the market or if it really effected anything ? also do you think the GST is a good thing ? would you think it would be benificial to have a similar tax in the USA now that you have seen it and lived with it ?

Joe

Joe,

Canadian, yup. I lived in NY though during my teenage years, where I learned to sail. I used to own a CC35 and spent years in the San Juans tooling around. I know the area backwards.

No, no transaction tax. Canada has the largest bubble in the world, more because of free money than anything else. GST is a consumer tax, so it’s better for lower incomes people. It’s all we have here in Alberta – no provincial tax (all the other provinces have a 5-10% tax on top of the 5% GST).

Thank you for that very informative post on the real estate cycle I just came upon it are you still calling for a downturn into about 2020?…thanks again & best regards

Hi Patrick,

I believe the downturn is imminent – this year. The bottom around 2020/21.

The Canadian housing bubble is still growing as foreign money is still coming in Ontario and BC except Vancouver for now. And Feb and other central banks keep pumping money to maintain the stock markets at all time high to get Hillary Clinton elected. Do you still believe the Canadian housing bubble will burst any time soon without any further government intervention? Thanks.

Hi Kevin,

Well, I don’t believe the connection between banks and Clinton, as International Bank of Settlements (the ones behind all this mess) aren’t creating more debt worldwide in the name of Clinton. Quite frankly, they’re done and the market knows it. Look for a top in the US by October. Every other market worldwide looks to be ahead of the US in that regard (and Canada just follows along).

Credit is starting to dry up. It won’t be long at all before the banks start getting worried about mortgages – it’s already happening here in Western Canada. Banks are starting to pull in loans. I know that personally from acquaintances who are going through the exercise.

I wouldn’t expect the real estate market to last beyond October, either.

Hi Peter,

Thank you for your reply. I know it sounds like a conspiracy, but it’s true that bankers from Wall Street want Clinton, not Trump, to get elected. And plus Fed and their Plunge Protection Team don’t want Trump either. Other central banks don’t want see another black swan event like Brexit. So they will do whatever they can to pump more liquidity into the market just like what Bank of England did i.e. to cut the interest rate to release more credit to the market.

I know it’s very easy to get mortgages (e.g. 2 year fixed is at 2.08%) from the big Five in Toronto right now. And Bank of Canada still has some room to release more credit into the market since Canadian economy is lagging showed from last report. What’s your thought on this? Thanks.

But the stock market did not tank in 2015. This prediction was WRONG! If I had listened to it, I would have lost money because the S&P went up since 2008 to now (2017).

Glad I missed this report when it came out!!! I would not have NOT bought and I would have no hope of getting into the the housing market now since prices have increased sooooo much. 2018 in Vancouver. There’s way too much misinformation out there !

Howdy

Any update to this please . Real estate markets seem to be doing just fine in 2018, in North America + Australia

Mick,

Real Estate bubbles are doing just fine, yes, but this is the year they will crash. The cracks are already starting to show in Toronto, Vancouver, New York, London, San Francisco, and down under. I’m getting around to updates, but the first level of business is a new webinar, “Navigating the Crash 2” will be announced this coming week.

I think you are wrong on the US real estate market, as we are now just in a correction/consolidation fase to gain new strength.

https://stockcharts.com/h-sc/ui?s=%24DJUSRE&p=M&b=5&g=0&id=t07054144901&a=390012627&r=1539081463114&cmd=print

Other countries are way more overpriced.

https://stockcharts.com/h-sc/ui?s=VNQ&p=D&yr=2&mn=0&dy=0&id=p43145866091&a=251824803&r=1539081572708&cmd=print

.

http://www.visualcapitalist.com/biggest-real-estate-bubbles-2018/

It’s not even debatable at this point, so I won’t.

Peter

i think you have a typo

quote from above , i think you meant year 2018

so I’ve been expecting at top in the year 2081, which appears is what is happening.

Good article on Cycles. It is very difficult to pinpoint the bottom and top of Multi regional assets. Robert Shiller did a pretty good job with his Case-Shiller Housing Index readily available at FRED. I believe if you look at the work, the bottom of the last cycle was 2010-2011. The 2000 time frame was tough of the Dot.coms, but US Real Estate hardly felt a tremor. The big Downdraft was the S&L Crisis and the resultant RTC liquidation through 1992/3. The Cycle repeats 18 years later with the completion of the cycle and the start of another in late 2010 to early 2011. Further, typically, there is a jeopardy time frame 7-9 years from bottom which coincides perfectly with the current Housing Downturn. Welcome to the correction.

i will stand by the ten years of extensive work I’ve done on this, the work of Dewey, Puetz, Wheeler, and Anderson, and the lunar nodal cycles, which it’s based on, of course, that hasn’t changed throughout the history of the planetary cycle.

Oh, I believe the 18 year cycle is correct. Your cycle end dates for Canada may be different than the US. When the US Housing bubble broke, Calgary and Edmonton had very little effect and prices continued to rise. In fact, the twin Oil Office buildings in downtown Calgary were constructed in that time frame, occupied and then the oil dropped causing the oil companies to go bust and millions of square feet of office was vacant. Those building are so expensive to maintain, the current owners are actually entertaining demolishing them! That is typical of late stage activity. FRED or the Federal Reserve Electronic Data is readily accessed by the public and the US Housing’ completion of the prior cycle and the beginning of this one is very clearly demarked. The Globe does not necessarily have the same timing model, but does seem to have the same cycle! You obviously have done your homework. Real Estate is much more “Regional” as Calgary has shown. Calgary enjoyed the huge oil boom and then bust which exaggerated the cycle effects. As you know, the ending of the cycle is really a process. Again, if you look at the FRED data, the US bottomed in the 2010 to 2011, (even to 2012) timeframe and started the current cycle. In the US, there is a correction typically 7-9 years from bottom. Existing home sales have dropped for 7 months in a row across the US.; welcome to the correction! However, in the US, it will be a correction in an ongoing Bull Market due to top in the 2023/24 time frame also known as the “Explosive Phase” . Very good work, Canadian and US cycles appear not to coincide. This “correction” which is coinciding with a Stock Market Bubble, a Bond market Bubble, a Liquidity Crunch, and the end of an Historic Credit Expansion will probably be vicious. Your advice to be cautious, that better pricing is available in a very short while, is ‘Spot On”. Those that are aware and prepared will earn incredible fortunes in the next 7 years!

https://fred.stlouisfed.org/series/CSUSHPISA

http://www.michaeldouville.com

Man up Peter. Your crash is imminent reminds me of all the gurus and experts who have never owned any rental property. If people want to know when a crash is imminent talk to people who have owned rental property over 30 years or more. They have seen a lot of boom and busts.

You have been so wrong Peter. You would have been broke by now if you were a bettor.

It’s 2019 February 21..NO crash in RE in Toronto. Prices in Toronto ( not GTA ) are up, up and going much higher in the next 3 years.

” A fool and his money are easily parted.” The Fool are all the so called “educated ‘ Lot with all the Bah humbug ” Titles.”

Hi Socrates (from what we not so affectionately refer to as the “Centre of the Universe”). That’s quite the prescient moniker, from my perspective.

I don’t spend much time of the real estate cycle anymore, as it’s already topped internationally. In my world, Toronto is tiny part of the “real” Universe. But I’m certainly familiar with the “island” attitude, as I still have family there.

I’m happy being this wrong: We sold a residence in Markham two years ago (now down 20%, or so) and pocketed some 140K we wouldn’t have otherwise seen. Did the same thing in Calgary three years ago. In fact, the differential was more than the original cost of the home. We all know (or should) where prices are now.

Real estate prices are down internationally right on schedule, with tops generally having been seen in 2017.

.

The 18.6 year real estate cycle is the lunar nodal cycle (actually two cycles of 9.25 years roughly). But it’s dwarfed by the much larger cycles or 172 and 516 years, which are playing out now. These are much bigger cycles that will eventually hit your little island (hope they don’t, but the writing’s on the wall).

Climate has already turned this year and is always a predictor of a market crash. It’s been that way throughout recorded history and very well documented.

Ontario is the last place I’d want to live in the financially inept western world. Ontario, as you probably know is the most indebted sub-sovereign state in the “real” Universe.

It has twice the per-capita debt of California (in a distant second place), and, as a share of the economy, is more than five times larger than CA (40% vs, 8% for California). Mr. Ford can hack away at the deficit, but the debt is another matter (he will have little influence on the eventual outcome). You can prop up an economy with debt for awhile, but in a fiat currency world, it never lasts; it never has.

Credit is freezing up on an international level and it’s only a matter of time before it comes down to roost locally. There are lots of easily accessed articles on that impending challenge.

Canadian banks have been downgraded by the IMF, and warned about more recently by both the IMF and the BIS. You’re going to see the Canadian stock market drop about 4K over the next three or so months, while the US market drops even further. Oil is headed down below $42 with the impending drop. Not a good sign for Canada.

I analyse and predict the markets on a daily basis and I rest on my record over the past three years. It’s public, and easily researched. The TSX has the scariest chart of any international exchange that I can find anywhere in the world. The bigger picture is where you want to focus your attention. Real estate is done.

So, there’s a tsunami coming and your island is dead centre in its path.

In the meantime, I’m happy being wrong and increasing my balance sheet, as a result. As we say in the market, the bigger they are, the harder they fall.

Peter,

What all you have said is correct. But makes no money.

Your other posters here with all their research and debt burdens by countries….except these countries are the richest in the World. The west are the richest countries through debt and fiat currency. If I had learnt this lesson in 1980 I would be like Buffett. But I got educated with all the trash…Mba, finance, med school, CSC courses etc.

Making money from RE has nothing to do with all the metrics bandied about.

Now here is the future in RE in one Market – USA. After the top in the Stock market in 202/2021 with the S&P at 3,200-3,600 the crash begins.

The RE in the USA will jump 700-900 percent from 2019-2026 ( top 2027). We only know the top one year later like in Toronto, Top in Jan 1990 only knew about by June 1991.

The parabolic move happens in the last 3 years. But the US real estate bottom was 2011. New York will go bankruct again or threaten to go. The two best stock markets in the next 10 years are…..well this is about RE.

So keep talking about debt, defeceits etc. It has nothing to do with anything. They talked about this in 1970/1975/1980/1987/1990/1998/2001/2008 and on and on.

Did Buffet go broke. Did 40 -30 year real estate investors go broke???

The crash in RE in TO and Vancouver and Australia is coming. But the gurus who the sheeple listen to had/have it all wrong. Pity how many people stayed out of the RE market in Toronto from 2008-2014 listening to the gurus and experts who did not own any rental property ever in their life.

Waiting for the crash just like August 1983 when Gold was 850 and the Dow was 850.

This is all opinion with no science or cyclic history to back it up.

The recent past (30-40 years you mention was all predicted). So is inflation, a pattern that happens every 172 years and then we go into deflation. That’s history; it’s cyclical. You make money from the cycles (at least I do).

I make money from knowing the market and predicting it; so do my clients. I’ve made money be calling the top in real estate. I’m quite happy, as you say, “being wrong.”

I sold a property in 2007 for about 1 million (a rental property) that I bought five years earlier for under 350K. I just keep being wrong … lol.

And yes, the top will be in 20/21. But there’s a ton of money to be made now.

I’ve spent too many successful years doing what I do to care what you think of me. Better Stay away from my upcoming books; you won’t like them.

So your oil comment now. Oil is going to $63-67 by June 2019 ( could happen before). I know the low in oil and its not 43. That happened on Dec 24, 2018. But first the high.

I day trade the RTY, ES, CL and GC. RTY is my main and ES I use time. I do not scalp. CL is wild at $10 a tick but technical. I position trade other commodities and currencies.

GC and SI should top around 1400-1480 and SI 16.84-18.00. Waiting to short these for a ride all the way down. Position trade these with puts and sell calls/free trades.

CL, HO and RBOB are going up till the time of June 2019 or when their price hits

I could go on about currencies, softs, financials, energies, metals, grains, meats etc but I only brought it up with your oil call of $42.

The gold and silver shares are going to drop hard after GC and SI top. Puts are in order.

CAD, EUR, GBP AUD. CHF, NZD, JPY are all in a range on a weekly/monthly chart. They will explode up. DX is topping. Euro has 57 percent of this index.

Just like you debt defecit, the stock market is a ponzi scheme, but if you know how to play it right you a billionaire. I wait for the stocks to jump out the window. Takes 10 years for the stock to go from 5-200 and then lose 50 percent in 1-2-3-4 months.

Ahh TIME is precious. It’s the real capital. So why go to school and study. Get the fiat currency early. Education even from Standford Instead, Northwestern Yale etc. is worthless according to the banker.

Education, like debt, defecits…all worthless. Pay no attention if you want to win this game of money in the real world we call Fiat Currency…Green.

Good luck.

I guess if you a guru, then I should become one. Not.

If the guys on Bay Street could make their money with their own money they would not need clients to suck out fees and write books.

The real people making money don’t need clients and don’t need anyone to know them.

While you did great, I was in the RE market from 1987 to 1990 with a lot of properties at a very young age. And it and I was worth millions. Unlike Reichmanns who cost the banks 10 billion dollars – they had coporate covenant- they still retained $300 million. Like Al S we all went to zero.

If you sold out in 2007 they you do not know the RE market. You listened to the gurus who told all the RE crash is coming to TO as the US market crashed and TO is next. You lost 500 percent minimum. The time to sell was 2016. Wynne delayed the boom and the price. So we have another time to sell. This is how it all works.

We have a WC here in 2026. The US, Canada and Mexico. Who’s RE market is going to be up and booming and who is going to be down??

No, i won’t be buying your book. I could write a book or two, but then again, I don’t need to sell my information.

“There is nothing new under the Sun.” Ecc.

6-9/10 will be a high. So early morning in europe a high. Late in the day a low. 6/12 harmonical date (12/6=2). I expect the high this year 9/14/2019. 6/21 is conjunct this date. This will be a high. The tidal field is bullish into 6/10 and then bearish into 6/17. A classic 4 day inversion window (delta system) will connect the 6/17 and 6/21 dates.

Fun to read folks predictions that were made and defended at the time of their prediction and seeing what really happened. No doubt that there are cycles in real estate just like almost everything else. Timing those real estate cycles will depend on location, asset type, asset class, interest rates, government regulation changes (such as Rent Control) and a whole lot of other factors.

I sell commercial real estate investment assets in the Chicagoland area and as of this date, June 25, 2019, I believe we are close to the top in valuation. We may remain at this level for some time due to the pro-business President the U.S.A. enjoys if he is re-elected or we may experience a “correction” if the U.S.A. gets a Democrat/Socialist as President in year 2020.

Every day property owners will tell me that every good asset they see is being offered at Crazy Prices…and they are selling at these prices. Every day I then ask, “Why Are You Not Selling?” I achieve record high sale prices because I use Regression Statistics to discover the “Best Buyers”. When the market changes, these Best Buyers are some of those hit hardest.

Side observation: When your barber and those in the service industry start talking about real estate assets they are buying….get liquid as there will be opportunities coming your way.

Wishing everyone well. Take Care. Kevin M. Lynch, CCIM

The real estate market has little to do with politics. It’s a natural cycle. But you’re right about talk hitting the media. It’s the same in the stock market, or anything else … when it hits the press, it’s over. Real estate has topped in most major markets around the world. This depression will be worldwide.

But markets top at different times. Calgary topped a few years ago. Vancouver’s done, Toronto on the way. We’ll eventually see homes at 20% (or less) based on today’s value.

I’m in the midst of updating this video with more recent figures. Thanks for the comment, Kevin.

When you update this, can you cover Los Angeles?

We seem to be defying the rest of the country/world.

It has slowed down a little, but not much. In 2011 as it bottomed, no one was selling. Where it is now is simply unsustainable. A crash (not correction) would be welcomed.

I hope to get to a revised video on this sometime this week. My report this weekend is late because I’m doing a video on the US Dollar Index … big picture … which I promised a while ago. I’ve spent quite a bit of time on it today.

Wow this is way off. Just from the. Bottom of 2009, we’re o ly 10yrs I to the 18yr real estate cycle. In a former underwriter, asset mgt. We wont see a crash likely til 2027… and a lot folks retiring with cash, who didnt dump their folks but just kept adding. I will sell my home by 2027 and reinvest my profits into life insurance and corporate bonds by then.

And for how many years is it you’ve been studying natural cycles?

This was an interesting read. I’m from Tasmania, Australia. My brother and I are considering buying houses and my parents upgrading theirs.

Whats your thoughts on the Aussie Market now Peter?

I take it we should wait a couple years before we jump in and buy houses? (to live in not rentals).

I’ve grown up hearing ‘renting is dead money’ so would love to hear your thoughts now. Thanks in advance.

It doesn’t matter where you are in the world, the real estate market is the same. We’ve passed the top of the market (a couple of years ago) and now we’re headed down. In about 5-7 years, homes will be worth around 20% or less of their current value. We’re going into a depression that will last decades and all depressions in history have been deflationary. That means all assets will drop in price as money goes up in value.

Rent for the next 5-7 years and at the bottom of the market, buy your dream home for a fraction of the price it’s at today.

Thanks for the great article Peter.

I suffered being on the wrong side of the cycle not knowing one even existed. At 57 now I’m finally learning. And hopefully enough to survive or even thrive through what’s coming next. As this covid crisis plays out it will be interesting to see just how impactful it will be on the cycles you speak of especially the confluence of the larger ones with the smaller ones and all mixed in with the folly of mankind in dealing with / attempting to prevent the impact of the virus on population totals. Crashing the world to avoid an inevitable bump in the road seems foolish to me but I don’t get to drive but rather hang on for the ride.

This covid crisis, of course, is not real and hasn’t had any effect on the market. It’s part of the bigger picture cyberwar going on in the US. The final chapter in that is still to come …

Hey Peter,

I was sent here by someone who saw your 18.5 year cycle and knew I had a big interest.

I think you’ve marked your charts differently than I’ve seen before, so I’m interested in your 2021 take on what this guy is saying for the property cycle from here onwards.

https://youtu.be/hguWlrh9Vd8

Looking forward to deepening my understanding and analysis of cycles!

Sorry, I don’t have time to look at other people’s hour-long videos. The real estate cycle has been topping and the larger 1030 year cycle in the stock market still have about a year to go. Topping of these very large cycles is a process. The 1030 year cycle (top was in 2007) takes typically 25-35 years to complete. Central bankers gunned the top with massive stimulus, which has pretty much played itself out.

Thanks for replying Peter, and fair point about long videos. Even listening at double speed, I much prefer transcripts myself.

But maybe a single graphic could cover the key bits of his take on the timing of the 18.5 year property cycle:

https://www.portphillippublishing.com.au/wp-content/uploads/2018/04/ppi_20180409_b.jpg

(And it comes from this page here: https://www.portphillippublishing.com.au/2018/04/09/where-are-we-in-the-real-estate-cycle/)

My apologies Peter. This is probably going to seem ignorant and/or rude.

Would it be ridiculous for me to ask how the Canadian (and Australian) real estate market has managed to do exactly the opposite of what you predicted in your 2015 video at the top of this article?

Hi Peter,

Your website looks great; good graphics and photo placement.

You are absolutely correct, there certainly is an 18.5 year Real Estate Cycle. By looking closely at Dewey’s work, the Mid-cycle correction or sometimes multiple corrections can be seen. By using the Federal Reserve Electronic Data or FRED, the US Housing can be viewed in much better clarity. The 2006 Real Estate Bubble top is extremely clear; as I am sure you who follows Cycles knows the top is a process completing through 2007 and then rolling over to start another 18.5 year cycle.

You certainly identified the two Mid-Cycle correction of this current Cycle. The first starting in March of 2018 and ending in the 4th Quarter (December of 2019) and then for Housing the 2nd very, very short correction of just the 2nd Quarter of 2020. Commercial and Retail are just now starting to come out of their 2nd Mid-Cycle correction. FRED is a great resource and shows the Housing Corrections clearly. Here is a Housing Chart from Zerohedge…2018 and just a bump in 2020 can be viewd.

https://cms.zerohedge.com/s3/files/inline-images/bfmD656.jpg?itok=yIOtjlm4

The Mid-Cycle corrections can and are often brutal! Just think of 1981-1982 in the US! 1992-1994 bottoming process started the New RE Cycle in the US, the Mid-Cycle correction of 1999-2000 was fairly mild setting the stage for the explosive phase running to the top in 2006-2007. This is for the United States. I do not follow Canadian Real Estate Cycles, but I am sure you are correct in the Cycle Duration.

As I have admitted, I am ignorant of Canadian Cycles, but if 2000 was a vicious Mid-Cycle correction in Canada mimicking, but not the actual Cycle Completion, then moving the cycle forward would seem to coincide with the US Housing Cycle which as you have clearly stated has predictable time frame segments. With the recent US National Price explosion of over 11%, it is difficult to believe, but the US RE Cycle appears to be in the Accumulation Phase heading into the Explosive phase where Fortunes are made…..and lost What are you thoughts as to whether both the US and Canada are on the same Time Frame? It appears they have the same Duration. Barring a Global Event or a “Mad Max Event”, the US Real Estate Cycle should complete in the Q4, 2023 – Q1, 2025 range and then start again!!!

I like your Website.

Wishing you the best,

Michael Douville

Hi Peter,

Your website looks great; good graphics and photo placement.

You are absolutely correct, there certainly is an 18.5 year Real Estate Cycle that repeats over and over so far for centuries. By looking closely at Dewey’s work, the Mid-cycle correction or sometimes multiple corrections can be seen. By using the Federal Reserve Electronic Data or FRED, the US Housing can be viewed in much better clarity. The 2006 Real Estate Bubble top is extremely clear; as I am sure you who follows Cycles knows the top is a process completing through 2007 and then rolling over to start another 18.5 year cycle.

You certainly identified the two Mid-Cycle correction of this current Cycle. The first starting in March of 2018 and ending in the 4th Quarter (December of 2019) and then for Housing the 2nd very, very short correction of just the 2nd Quarter of 2020. Commercial and Retail are just now starting to come out of their 2nd Mid-Cycle correction. FRED is a great resource and shows the Housing Corrections clearly. Here is a Housing Chart from Zerohedge…2018 and just a bump in 2020 can be viewed.

https://cms.zerohedge.com/s3/files/inline-images/bfmD656.jpg?itok=yIOtjlm4

The Mid-Cycle corrections can and are often brutal! Just think of 1981-1982 in the US! The 1992-1994 bottoming process started the New RE Cycle in the US; the Mid-Cycle correction of 1999-2000 was fairly mild setting the stage for the explosive phase running to the top in 2006-2007. This is for the United States. I do not follow Canadian Real Estate Cycles, but I am sure you are correct in the Cycle Duration.

As I have admitted, I am ignorant of Canadian Cycles, it seems the 80’s RE Cycle topped in 1988-1989. 18.5 years from that top is 2006-2007; perfect!!! If 2000 was a vicious Mid-Cycle correction in Canada mimicking, but not the actual Cycle Completion or Bottom then the Cycle Top would then be 2006-2007; same as in the US! 18.5 years from 2006 places the current Cycle Top at 2024.5! Using 1988-1989 and then 2006-2007 as US Real Estate Tops, Canadian RE would seem to coincide with the US Housing Cycle which as you have clearly stated has predictable time frame segments. With the recent US National Price explosion of over 11%, it is difficult to believe, but the US RE Cycle appears to be in the Accumulation Phase heading into the Explosive Phase indicating much, much higher prices. This is where Fortunes are made…..and lost What are you thoughts as to whether both the US and Canada are on the same Time Frame? It appears they have the same Duration. Barring a Global Event or a “Mad Max Event”, the US Real Estate Cycle should complete in the Q4, 2023 – Q1, 2025 range and then start again!!!

I like your Website.

Wishing you the best,

Michael Douville

Hi Michael,

Thanks for the very thoughful and extensive post. Sorry for the delay.

I haven’t checked back on this cycle for a while. We’re in a bit of an anomaly at the moment. 2007 was the 172, 515, and 1030 year cycle top, so it makes sense that it was also the 18.5 year cycle top and Steve Puetz also technically calls it a top. I’m fine with that.

What happened then, of course, was that the Illuminati (central bankers/Rothschilds) gunned the markets with the humongous debt injection and sent the markets up into what I call a rogue wave. it’s corrective, a B wave, that otherwise should not be there. So, we have a man-made extension to the cycles since 2009. We’re topping but I give the markets another year and a large drop and recovery before we completely tank and the DOW heads down to a target of 3K roughly. That’s the deflation I’ve been projecting for so many years.

Looking at HGX, it’s following the broader US market and so should do much the same. It’s in the same corrective wave up from 2009 that the rest of the US market is in, and it’s in the fifth wave of the pattern, so nearing a top. Whether it recovers for the last wave up with the rest of the market is a big question. Larger cycles, as I’m sure you know (with the knowledge you have, which seems extensive), trumps smaller waves.

I based my projections for Canada on a 2000 cycle low, which was out-of-sync with the US market, and that gave me a projected high around 2018. That aside, given that 2007 was the theortical master top, we’re now at the 14 point of this new 18 year cycle, with my major US market top projected in 2022 (the 15 year mark for the real estate cycle).

On top of all this, we’re going to a new financial system any day now (NESARA), so it’s going to be interesting to see how all this plays out, but I’m not giving housing much more upside, the same prognosis for the larger market. The central bankers have already been destroyed and the Fed has been rolled into the treasury. Big changes to be announced any day now.

I can’t project much more beyond. I’m highly accurate on the market (how most of we Elliott Wave people got into cycles) and cycles in the market are far more accurate than nature’s larger cyclses). So I have to wait to see what happens over the next few months, but we’re getting close to a top in everything over the next year, as far as my projections go.

Deflation like we’ve never seen coming, but I still think the ultimate high is a year away.

Thanks for the excellent post.

Peter

Hi Peter,

You hadn’t replied to my brief reply above, but I noticed you replied to Michael so I thought I’d give it one final try at deepening my understanding of your 18.6 property cycle variation.

My sense of the cycle is that the Canadian cycle matched the US cycle, and the peak was in 2007.

That would mean a next peak is due in 2025/6.

It would also mean that this is the last blow-off top part of the cycle, and house prices will go up, up and away from now until then.

And although I would certainly expect a sell-off in the second half of this year, I think by the end of 2022 we would be closer to all time highs in the Dow than Dow 3k.

Is there zero chance you have your timing for the property cycle misplaced?

Hi Martin,

I’m sorry, I don’t know what more I can give you, based on my most recent reply. Here’s the key paragraph:

“we’re going to a new financial system any day now (NESARA), so it’s going to be interesting to see how all this plays out, but I’m not giving housing much more upside, the same prognosis for the larger market. The central bankers have already been destroyed and the Fed has been rolled into the treasury. Big changes to be announced any day now.’

I haven’t looked at the real estate market in about five years. At the moment, we’re waiting for the worldwide financial system to oompletely change. This is a long-forecast debt jubilee, but we don’t know the precise details — nobody does. The US has been under limited martial law for years. The Fed has been rolled into the treasury. The Illuminati, who have ruled the world for 2000 years have been “taken out.” I expect the new system (GESARA) to be in place before this week is out. I can’t make any predictions (obviously) until we know the rules and see what happens.

The stock market since 2009 has been in a man-made corrective wave up. The current revolution is the largest one in the history of mankind, so I’m going to wait until the roll-over and a few months before any predictions, if even then. If we were forecasting based on natural cycles, we would not be where we are today. It’s an anomaly. The stock market should roll over next year (22). We’re heading into a deflationary market and HGX is at the top of a fifth wave and final wave.

This aged poorly.

You have to understand what’s going on in the world today. The economy is being manipulated. The entire financial system is changing.

Peter is absolutely correct, the World is awash in debt. This creates an unsustainable system and eventually the system will correct. Some assets will be incredibly adversely affected. My work suggests the Credit Market will reverse and the cost of Money will rise substantially. Just review the 78 year Interest Rate Cycle. The top is unmistakable and I believe the bottom is in. Rising rates are inverse to value with Bonds; Bonds and especially Bond Funds will be at risk. The next Recession may liquidate $Trillions in Corporate BBB’s and below which would certainly be a Deflationary Event as Peter suggest! Investments need a return and need a conservative vehicle for that return. Capital will seek that route. Bond Investors such as Pensions and Insurance Companies have been gravitating toward MBS in the belief that the Credit is at least backed by a Real Asset not a Zombie Company.

What would Deflationary Event look like? Without a Credit expansion, things will slow considerably and there will certainly be adjustments. Recessions kill Inflation. So no expanding Credit and no Inflation = declining prices.

However, declining from what level? My work suggests Real Estate prices are still rising and will climb the “Wall of Worry”. Not only is there dislocation of population into areas of demand causing Organic rising prices, but the Building Industry and their Financial backers took a beating in the Great Financial Crisis and consequently there is a shortage of housing in the US that will take a few years longer to cure. Millennials are also just starting to enter their Family Formation years. The Millennials are an extremely large Demographic group akin to the Baby Boomers and as such are also impacting housing.

My work suggests there is still a few years before the Cycle completion. Cycles have been completing for centuries; in a Real Estate Cycle completion, it is the DEBT that impacts the Investor the most. Real Estate protects purchasing power; as prices go up, rent goes up. When prices decline, rents decline. However, the purchasing power and therefore your Lifestyle, should remain the same after a period of adjustment. Peter is again correct in the HGX is following the Cycle. Good work!!!

Therefore, going into a Cycle Completion, debt should be eliminated or greatly reduced. Cash will be in demand as will Credit. So protect your ability to borrow. Review and Protect your Income Streams. There are many Strategies to reduce debt before the Cycle Completion, however, remember, “there are Bold pilots and Old pilots, but there are no old Bold pilots.”

Best,

Michael Douville

Thanks, Michael, for your very comprehensive explanation of where we are in the cycle. It’s been a busy week and I’m behind, but I’ll make a commitment to get back with more on this later today. You’re correct, of course, and you’re describing a natural cycle and what to expect with the current topping process. However, my take is that the top of the 1030 year cycle was in 2007 and all other smaller cycles are trumped by larger ones.

Since 2007, the stock market has been in an unnatural corrective B wave that still adheres to Elliott Wave rules and principles, but’s it’s in a topping process, which should last another year.

Just wanted to let you know that you and your extensive knowledge have been heard and once I get my market analysis finished today, I’ll get back to this with some futher thoughts.

We’re in a revolution at the moment, which always comes after a cycle top, but this one is the largest revolution in the history of mankind, so we’re witnessing a lot of manipulation by both sides, although we’re getting very close to a resolution. Our perception of the world has changed (not collectively, quite yet) and virtually everything is going to be different going forward, all for the better. These are interesting times.

Peter

Hi Michael,

My ability to keep any kind of organized schedule is almost impossible with what’s going on, some of which I’ll attempt to cover here. You can find much more in my weekly Market Reports, which are accessible by clicking that tab in the main menu of the site landing page.

What you’ve described is exactly where I was when I recorded this Real Estate video, and based on both Wheeler’s and Dewey’s work on cycles (more specifically Dewey’s detailed tracking of the 18.5 year cycle). I also knew (and have been saying for years) that we’re expecting a major revolution and quite possibly a debt jubilee, which is exactly where we’re going. I didn’t have any idea, though, of the size and impact this revolution would have on all of our lives. It’s by far the largest revolution in the history of mankind.

If you don’t have the background on this, I urge you to watch Fall of the Cabal, which you’ll find within the articles on the front page of the site (or search if on Bitchute.com).

This comment is hitting at a point where I’m expecting GESARA to come in at any time. You can find reference to it on yesterday’s blog post here: https://worldcyclesinstitute.com/gesara/

So … let’s assume that you have this knowledge, or this would be a very long post … lol.

The US Military and Allied Forces worldwide have now taken out the core of the Illuminati, who’ve ruled this planet for 2000 years (two major cycles). You always get a revolution after the top of the 1030 year cycle, which was at 2007. From 2009 onward, we’ve had a man-made B wave (Elliott Wave), which I project will end in about a year and the market will finally crash. In 2007, the Illuminati (Rothschilds et al) prolonged that cycle top by the horrendous injection into the banking system and subsequent B wave up in the markets worldwide. The market is moving altogether as one with the US Dollar and will eventually crash as one big worldwide market collapse.

So, here’s the transition. GESARA is about to be implemented; it involves many moving pieces, not just a new currency and financial structure. The plan is to run the two systems (Quantum financial and fiat) in tandem for about a year, which everyone transitions over from one to the other. You may as well consider this a re-boot of the world, in a sense. Virtually everything will change. We’re going to have two economies for a period (a year, at least, and perhaps much longer).

So the fiat dollar will go up in value while it begins to disappear. Debt is being forgiven worldwide and there is no more IRS or CRA; taxes, other than a consumption tax, will disappear. It’s obviously going to take a good 5 years or more to get through this. All of this is deflationary to varying degrees, as you no doubt know.

The change doesn’t just have to do with the change in currency. The money that has been stolen from “We the People” is all coming back (the STRAWMAN accounts set up at birth), so there will be an instant (well, it will actually take months) injection of large sums of money into everyone’s bank account (I’m being simplistic here). However, while that will inflate the US dollar short-term, the money is going to transition over the next year into the new currency, which will have a much lower value – yes, deflationary – and be tied to precious metals.

All the gold and other precious metals have been recovered from the tunnels under the Vatican and Buckingham Palace. The Royal Family and Pope (and Rothschilds) have been “taken out,” although there a whole lot of clean-up still going on.

So, we’ll have two economies for a year, at least, which fits perfectly with the Elliott Wave prognosis for the market to crash in about a year. We know in the interim that a whole new financial system for accepting the new currency will need to be implemented throughout society and that will take time.

When all the fiat money has moved over to the new QFS currency, I expect the market to crash big time, because, of course, it’s priced in fiat and that’s going to disappear. But during that year transition, I expect a mini-crash this fall (10K DOW, 2K SP500) before a final wave to a new high, which will be spurred by this huge STAWMAN cash injection. That should buoy the housing market.

But … when we get fully into the new currency, which will be priced at (linked to) low gold prices (my speculation here regarding the gold price pricing of the currency), deflation will have truly kicked in. I expect a spike in housing prices over the fall and into next year, but once the new currency is being used as much as fiat, then we’ll see the “legacy” fiat economy roll over for good. The White Hats have been predicting 1970s prices, and that’s exactly where we’re going … eventually (forced, rather than natural, but fitting with the natural cycles, which I always find amazing).

So, the White Hat forces are in full control at the moment, dictating both sides of the current narrative, locking down the world to allow the transition to take place. It’s an interesting time to be alive and watch all this taking place.

Now, I realize that this might sound other-worldly if you don’t know the background, but that’s the story in a very small nutshell. Man is forcing this “reset,” but it really is biblical in nature, because it’s pitting Satan against God and we’re finding out everything we’ve known is a lie, the truth having been hidden from us our whole life as a control mechanism. This particular revolution was predicted almost a hundred years ago. And history repeats.

And no, I’m not crazy … lol.

Anyway, that’s my attempt to answer your comment, which I thank you very much for spending the time to write out and post. You certainly “know your stuff.” Now, it’s time to start waking up the world as to what’s been going on the past five years, or so. Nobody can stop what’s going to happen now … the revolution has taken on a force of its own, and this is a very important week in the furthering of the story.

Hope this helps, but I completely understand if you’re shaking your head in disbelief.

Peter

As per my previous comments, there is another possibility….

IF the 18.6 year cycle actually peaked in 2007, then the next peak is in 2025/2026.

This means real estate prices will surge over the next 4-5 years for their final blow-off top, followed by a crash much more devastating than the mid-cycle 2020 hiccup.

Manipulation is a given, but so far the sequence is playing out exactly as per this “W.D. Gann’s Financial Time Table | Extended and Adjusted” post from 2012 (note the prediction for 2020 in particular):

http://time-price-research-astrofin.blogspot.com/2012/03/wd-ganns-financial-time-table-extended.html

And no, that website is nothing to do with me, unfortunately. Wish I knew all this back that long ago.

Hi Martin,

I’ll need to review previous comments of yours to respond more fully, but you’ve hit the nail on the head with this comment in terms of the cycle top being 2007. (I just added a comment a few minutes ago, but I’ll attempt to add to it, and this one later today). Thanks for the addition. It’s always terrific to find others that are on the same wavelength, so to speak!

Peter

Hi Martin, I just posted a reply to Michael, which I hope also serves to at least partially address your query about 2007.

Peter

So with 2007 as the peak, making 2025 the next real estate peak, that means we will not have a crash or “roll over” before then. We might have a dip through the next 6-12 months, but we will keep going higher in 2 years time, and much higher in 3-4 years time.

Comparing this with your comment above “… I project will end in about a year and the market will finally crash. “, it seems like we can come back to this thread in a couple of years, and see which ages best.

BTW, I certainly hope you are right because White Hats in full control sounds good.

Hi Martin,

Just the opposite. I guess I wasn’t clear.

There is no way house prices are going to stay anywhere near where they are once the currency has changed over. 2025 is a pipe dream. They’re promising 1970s prices and I’ve been promising those prices for the past 15 years. Natural cycles in the stock market are pointing to the same outcome; in fact, they’re stronger indicators than anything else.

Actually you were very clear Peter. Most forecasters hedge their bets, but you haven’t at all.

You see, I’m just following up the comment by Amery Jackson which said:

“This aged poorly.”

And so in a couple of years time, we will look back at this thread and see how well either of these cycles versions has aged then – will we be crashing with the 1030 cycle as you suggest, or booming as the 18.6 year cycle heads to its peak in 2025/26?

As I said, I hope the White Hats win. But the trend hasn’t followed your outline from 5 years ago so far.

Real Estate? My trend? Nope, can’t take credit for that! Dewey’s trend. He did the work; he deserves the credit. The Illuminati deserve the credit for the past 5 years. But, thankfully, they’re not around to collect on it. All gonzo.