The Last Spike

The “Last Spike” refers to the culmination of the building of Canada’s national railroad right across the country. It united the country by making travel across it infinitely easier than it ever had been before. The development of the railroad business led to an economic boom in both the US and Canada.

“The driving of the last spike may have been the great symbolic act of Canada’s first century, but it was actually a gloomy spectacle. The cash-starved Canadian Pacific Railway (CPR) couldn’t afford a splashy celebration, and so only a handful of dignitaries and company men convened on the dull, grey morning of 7 November 1885 to celebrate the completion of the transcontinental railway.”

It’s interesting to me that there are two stories surrounding the driving into the ground of the last spike. There as the official ceremony of the executive team (all for show) and the behind-the-scenes story, involving discrimination, racism, and extremely hard treatment of the workers overall. Fake news.

Fake news seems to be a phenomenon of market tops: Cycle tops tend to have lots of similar societal effects. You always find the highest building and largest construction projects culminate (or are suspended) as market tops.

“At the extremes, the herd is always wrong. One should not under estimate its capacity for stupidity.”—The Secret Life of Real Estate, Phil Anderson, p 329

The Last Spike ceremony marked the top of the market at that time in both the US and Canada.

Wikipedia: “Like the Long Depression that preceded it, the recession of 1882–85 was more of a price depression than a production depression. From 1879 to 1882, there had been a boom in railroad construction which came to an end, resulting in a decline in both railroad construction and in related industries, particularly iron and steel.[24] A major economic event during the recession was the Panic of 1884.”

We are in the last spike of this incessant bull market.

The last spike of markets around the world (the final five-wave rally we’ve now entered) will have an opposite effect on society. It will divide society to a degree we haven’t seen in five hundred years. In the coming decades, we’ll witness a complete breakdown in society. There will be a civil war in the US. Climate around the world will start to get colder and dryer. There will be food shortages worldwide. We’re going to see pandemics spread from their incubators (eg- the Black Plague in Madagascar) to affect areas now considered safe. The financial system will break down with hundreds of banks going under, credit will freeze up, government services will cease to exist in many jurisdictions. We’re going enter a period of spiralling deflation, which I’m explained here many time before.

It’s time to start considering your future, where you’re going to live, and how you’re going to ensure you have the necessities of life in a much more uncertain world.

To that end, this week I’m updating my “Navigating the Crash” webinar presentation and will be scheduling for the week after US Thanksgiving. I’m also putting together a webinar on basic Elliott Wave. More info on both to come next weekend.

Last Week Review

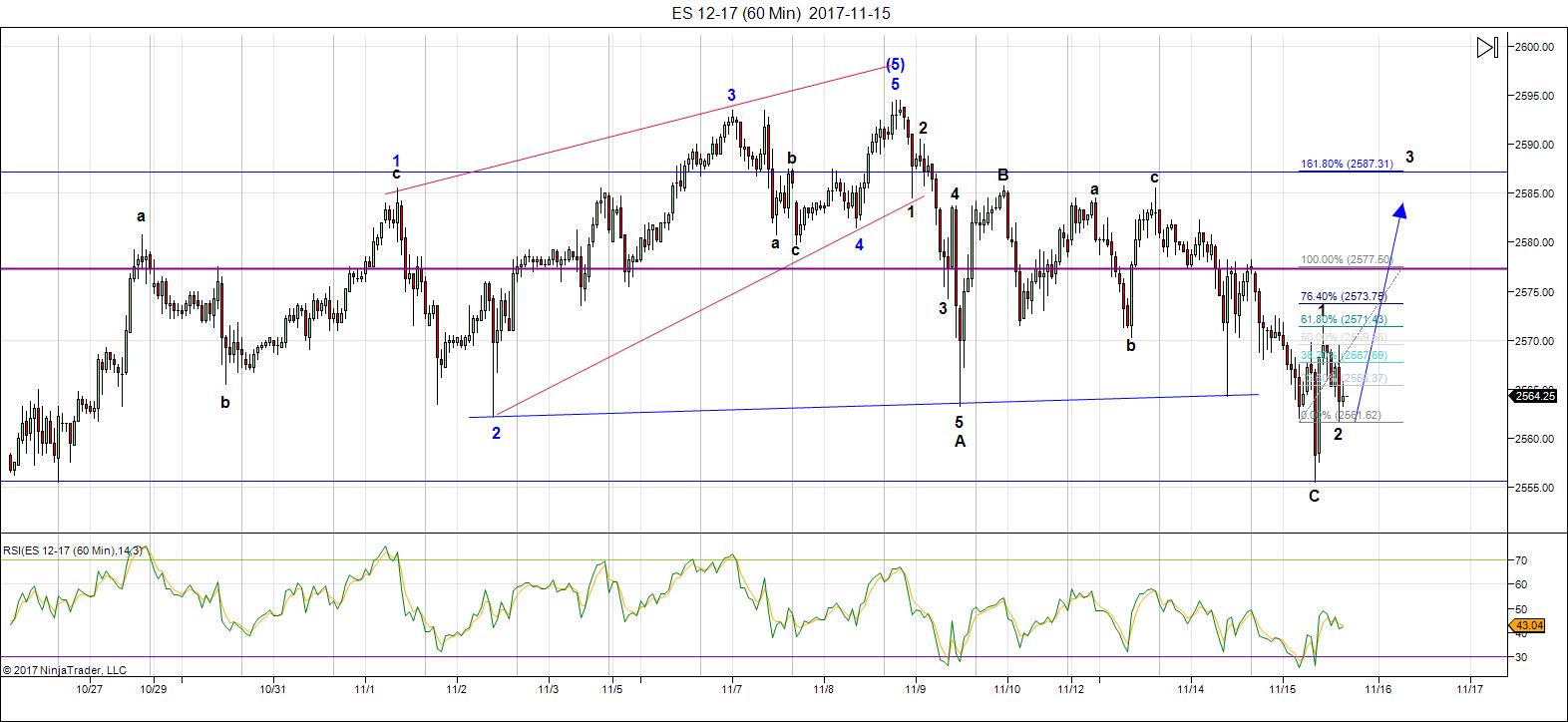

Above is the 60 minute chart of ES (e-mini futures). This is the hourly chart I provided here last weekend, projecting a drop in a C wave to 2563 and an immediate turn up to a new high. I had also cited the fact that we’ve gone sideways for approximately 3 weeks (the purple lines and circles on the chart).

Above is the same chart, same time frame, from my posting to my Trader’s Gold group on Wednesday evening, Nov. 15. This showed we’d achieved the goal and had turned up with an impulsive first wave and a second wave down that had retraced exactly 62% before bouncing into what would be an impulsive third wave.

Now, my target for the drop was 2563, which would have achieved a double bottom. We dropped a little bit lower, to 2555, where the C wave down was then exactly equal in length to the A wave, a common fibonacci ratio.

There are other common wave relationship between the A wave and the C was of a corrective move. They are:

- the C wave extends to a distance that is 1.618 X the length of the A wave

- the C wave itself measures 1.618 X the A wave.

After the turn, I was projecting a final new high. That’s up next and will unfold across all the major US indices.

This is just one example of the power of Elliott Wave. I allows me to predict the market like this on a consistent basis, which provides a high degree of confidence in trades.

A Higher Tide Floats All Boats

Whenever we get close to a major top in ES (emini futures), the comments start to flow predicting a top (or not). Usually these comments seem to come from those fixated one one index—the SP500. But, the market actually consists of more than one index, and the driver of the entire thing is the US dollar (the reserve currency).

Whenever we get close to a major top in ES (emini futures), the comments start to flow predicting a top (or not). Usually these comments seem to come from those fixated one one index—the SP500. But, the market actually consists of more than one index, and the driver of the entire thing is the US dollar (the reserve currency).

I have always maintained that once one index tops, they all have to (so that they stay in sync). This is a “market rule.”

But it’s more than this that keeps the SP500 from not topping until the others top. The next wave down will have to start with five waves—across all US indices. So to get to the point where that can happen, the indices all need a “fresh start”—in other words, a new high.

The key, as I preach over and over again, is to watch the entire market, certainly indices that are related to each other. Both the SPX and DOW are subsets of the NYSE. They move more or less together. The wave structures have to be correct in order for the next wave down to start.

In all US indices (and USD currencies), we appear to have one more small wave up to go—ending in a major turn of just about everything associated with the US dollar.

| UPDATE: Other US Major Indices (click charts below to expand) | |||

|---|---|---|---|

|

|

|

|

| NYSE | DOW | Russell 2000 | Russell 3000 |

______________________________

The Market This Week

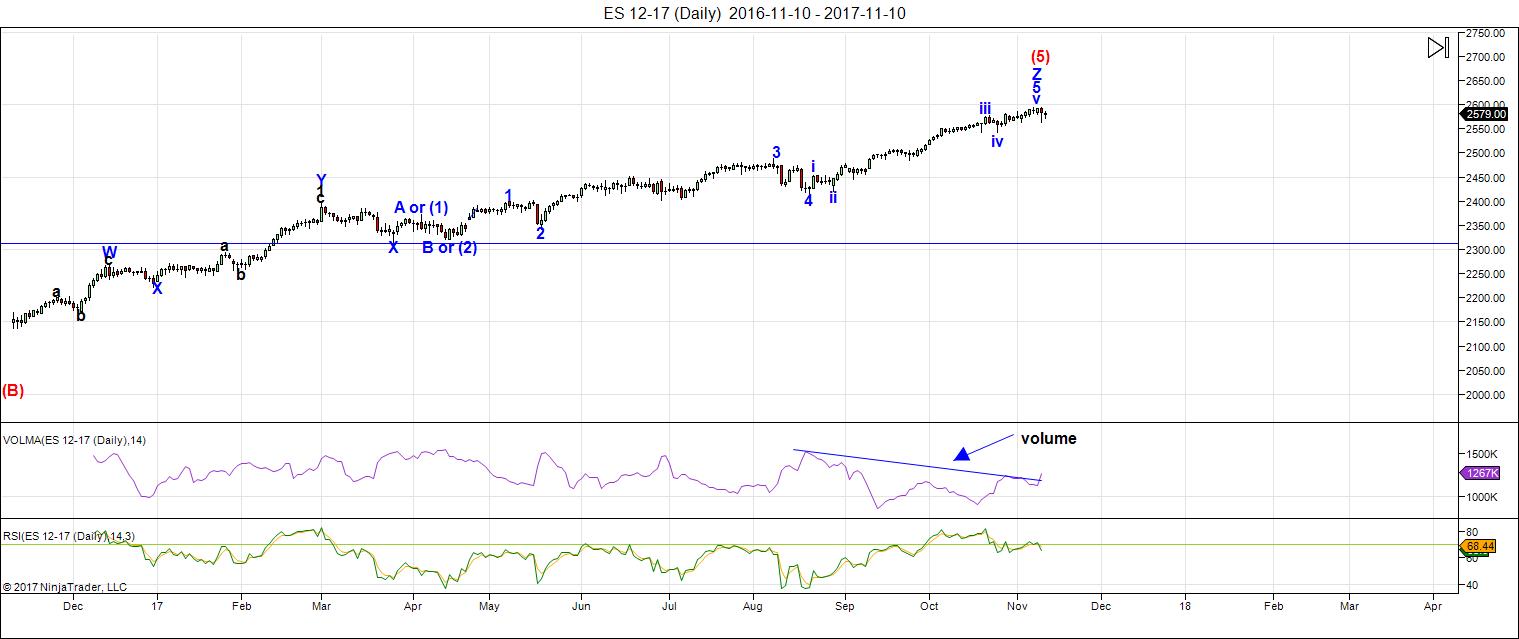

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to breach the previous high for the final time.

We're now down to hourly charts for all the action. It's been a day trading environment for the past few months.

Volume: Volume is expanding slightly as it does in a final wave to a top. RSI is already heading south, as we'd expect.

Summary: The count is full for NQ and ES, except for small subwaves that form the balance of a small fifth wave to the top. This final 5th wave up has to reach a new high, along with the rest of the major US indices ... and we're done. I'm looking at 2600 in ES as the potential final high (although the final wave could extend or compress)

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show (**cancelled this week)

Next Date: Thursday, November 30 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

1.057*365=385-386

1.083*365=395

1.25*365=456

Averaged=412

——————

.4038*365=147

.4166*365=152

.5*365= 182.5

Averaged= 160.5

—————————

Nov 2016 plus =

Aug 2017 plus =

Just notes

160.5/412=.3895

Patience another two weeks… ED is running wave iv and v still missing.

https://4.bp.blogspot.com/-UJty8yD6nZk/WhUDIOi9RTI/AAAAAAAAHtI/m0xMOnF7dHsTfozFMRiNn3iFjUN8Y-jAQCLcBGAs/s1600/w314-7.png

Correct.

🙂

https://worldcyclesinstitute.com/tick-tock/comment-page-2/#comment-23786

12/01-04/2017 & 12/11-13/2017 are the two most critical time frames in the next month…

Ed

I was playing with Fibonacci numbers

Jan 31 2018 lunar eclipse

Feb 15 2018 solar eclipse

Another none puetz window

Did we learn anything from the last one ?

Non, note none

Where was the stock market index’s July 21 2017.

I’m not going to ‘re explain , you have the data

Available to look up and put together .

We get 2 of these per year

A partial lunar eclipse took place on August 7/8, 2017,

The solar eclipse of August 21, 2017

Old info for references

It just so happens we have a solar eclipse on March 8-9 2016 (seen from Asia, Australia and Alaska). 2 weeks later, a partial lunar eclipse on March 23 2016 (seen from Asia, Australia and the Americas).

—

Sept 1 2016 solar eclipse, Sept 16/17 2016 lunar eclipse

July 13 2018 solar eclipse, July 27/28 2018 lunar eclipse

There is a rhythm to these cycles that is worth paying attention

To. There is a huge value in understanding the ” failures ”

I credit my research to Steve puetz, it is his work .

Do not assume my calling it a non puetz window as something

Negative .

Joe,

What “failures” are you referencing? What value do you see from understanding them?

Jeff T

It’s going to be an interesting year .

Time to prepare !

I am noting with interest days when the market is falling on low volume.

This is a huge tell. Why?

It is a huge tell because we see a market falling in the absence of intense selling pressure, and this implies need for a constant injection of liquidity to keep the market moving higher or even to prevent it from declining. The market has been moving higher on low volume for years so this in not a new phenomenon. Think about it….

Joe!

2018 will be I feel so too!

Can you explain your turndates? I have somewhat the same dates as you.

1-4 dec a high.

14-18 dec a low.

27-30 dec THE HIGH???

Cheers,

W

I found a wave count yesterday that also saw a recent triangle completed. It had a very brief e wave. It also violated an EW rule in that it had more than one multiple, but it got the thrust. I have traded enough triangles to recognize when one is developing even though I got the labels wrong. I guess this is the difference between being a trader and being an analyst. I still am not sure HOW to label it, bit I knew how to trade it…lol!

VIX down. Market down. We are in a small fourth wave methinks…one more move up before interim or final top. We could get an extended wave….

We actually have a full day session today. Friday is the shortened session.

if my memory serves me correctly, some who post here are ardent followers of Martin Armstrong…any of Armstrong’s followers want to comment on this?

http://tinyurl.com/y8w648kp

“The Economic Confidence Model has a turning point here this November 24/25. That can produce the temporary high.”

http://tinyurl.com/ya4o6wm5

Dave…what say you?

http://tinyurl.com/yawtnhvp

Dave M…what say you?

https://worldcyclesinstitute.com/what-goes-up-must-come-down/comment-page-1/#comment-24428

WADR to all the folks tossing out dates about what is going to happen and when, it has to be clear to all of us who have gone down that path that it is one of futility. Someone defined insanity as doing the same thing over and over again while expecting different results. Central banks are determined to keep the market afloat, and we simply are not fully able to take their measure in this regard. People who pooh pooh the idea of CB manipulation of markets in my opinion are not real traders.

I used to be part of an options trading posse led by a former CBOT floor trader in Chicago and ever so often on big option trades we executed we would see massive trades made against our position. What was happening would be as clear as the nose on our faces. Things got to be so ridiculous that we started trading only deep in the money options as we thought that would be safe. Wrong!

We then noticed at options expiration the bid on our in the money contracts would not even represent intrinsic value of the contracts! Market makers collude! Got it? I know you might find it shocking but if you don’t know that you have no business in a trading arena.

If you do not think markets are manipulated, you probably have not traded very much.

We dealt with this rogue behaviour by giving the market makers the finger big time.

How did we do it? We TOOK DELIVERY of our in the money contracts after weeks of setting up the SOBS. The thing is most option traders cannot afford to do this and the market makers know it, so trader often have to settle for getting robbed at expiration with ludicrous bids. I know some people on the inside who categorically state that traders and investors who deny central bank intervention in markets are either stupid or gullible. This person stated that they exercise even more control than the average trader and investor is aware of, like targeting specific trades! I believe it. Some hapless traders are not even aware that their own brokerage can and often does trade against their positions, and engage in stunts like running stops placed in the market.

My own view is that central banks can and do affect wave counts up to and including primary degree. I suspect that the may be limited at the cycle degree level, but even then I am not prepared to put money on it.

My point is that something is going to eventually overwhelm the “all-in” posture of central bank liquidity. We don’t know what, and we don’t know when. Technical indicators are telling us the market is stretched, and the wave counts are suggesting a top is close, but NONE of this is certain in the face of relentless central bank infusion of liquidity into the market. I remain convinced that the market is not going to correct, It is going to collapse. Every time I see a decline that is arrested in the slightest degree I therefore conclude the liquidity kings are still in charge. When this market finally breaks, there will be none of this agonizing over what the count might possibly be, or wondering whether or not a top is in. Of that I am sure.

Amen

Peter T,

Your opinion on this matter?

Jeff T

Jeff T,

In terms of the futility of trying to predict tops, I agree, as I’ve stated before. From an elliott wave perspective, it’s of low importance, as the waves always play out throughout various degrees of trend, all the way to the final wave five. When that wave with all its subwaves are done, then the market will turn. So, for me, calling a top before all the waves play out doesn’t make any sense. As we get closer to the end the top timing will become more obvious. For example, now we’re in a final ending diagonal in ES and in the final fourth sub wave in SPX. The top is weeks away maximum (in low single digits).

From an elliott wave perspective, as well, the market is not manipulated. The market moves in a natural predictable manner. The waves are playing out as they always have, the lengths of the waves are coming in as expected to their natural lengths. The patterns have been repeating over and over as they have throughout history. If it were manipulated, the waves would need to deviate from the elliott wave principle in some way, but they haven’t so far.

If the wave didn’t change, then I’d at least expect the wave lengths not to hit fibonacci targets. Well, they haven’t. The market has been wandering around at times due to low volume, but it has always come back to hit the logical elliott wave targets. It has done this over and over again, like clockwork.

I do not see any evidence anywhere of market manipulation.

In fact, recently, I went back to review the wave down in 2007/8 in the SPX, because it had been deemed an impulsive wave by Prechter and group. That would mean the wave principle doesn’t work, if in fact, it was an impulsive wave, because the market should not have gone to a new high after that an impulsive wave had completed. An impulsive wave down in 2007/8 should have led to a 62% retrace, and then another impulsive wave down after that, but of course, it didn’t. Even if it wasn’t impulsive, and was just a wave in 5 waves, there should have been a B wave and then another wave down to complete a zigzag.

However, a careful study of that 2007/8 wave down shows that it was a drop in 3 wave, the C wave being exactly 2.618 X the length of wave A; it was a complete zigzag, which is a corrective wave. If EWI actually knew how to count waves, that should have been obvious, but …

I mention this as an example of my experience that has led me to believe that EW is natural, a science, if you like. I have never seen a truncation, nor a set of waves that has deviated from the Elliott Wave Principle, and I’ve done a lot of analysis of past waves from different time periods.

I’m planning on sharing the 2007/8 SPX chart in the weekend post.

earlier today I emailed a number of associates (some of whom are posters/readers here) a comprehensive update/projections relative to the US Market; Asian Markets; European Markets; US Dollar; Crude Oil; Gold…it should be perfectly clear why some of us are selective about what we post on this public site?

Armstrong is a very smart dude. I am sure he does not buy the propaganda on the state of the economy. His confidence that the market is not going to “crash” is interesting. Maybe he envisions a long slow decline in markets as they are back-stopped by CBs or maybe he has bought the idea that CBs have abolished he business cycle, and recessions are a thing of the past, but I seriously doubt that….

https://tinyurl.com/yc3vegbg

“The Turning Point on the ECM is this weekend. We do happen to have a Directional Change next week in the Dow with the next turning point due the week of 12/04 and that is followed by the week of 12/18. What is most curious, is the fact that the Dow, Euro, Gold, and Oil all have the same timing targets, with oil showing the week of 12/04 is the strongest.

We are witnessing the global markets beginning to align. This is implying that international expectations are starting to dominate domestic or isolated market fundamentals.

We do not expect this turning point to be a monumental one. What this reflects is the markets are starting to align preparing for 2018 and the beginning of a new round of fun and games.”

karni,

this is the ES version of the ED in the spx you shared……yes, we are almost there….

2 weeks?? maybe less…….hmmm……..we shall see.

https://invst.ly/5wx0o

Oh, that was a chart of SPX that I commented on … my mistake. ES is in an ES, not SPX.

thanks for the clarification peter

I can think of two very spectacular CB battles in recent years that were absolutely fascinating to watch. In one the Central Bank of England lost a battle with George Soros over the pound. Very unusual for an individual to best a CB. The other was when SNB blew up hundreds of billions in trading accounts when they scrapped the Franc’s peg to the Euro….Ouch! 🙂

Luri-

I do think the bottom trend line could be as low as this (yes they are still converging)

https://invst.ly/5wxxx

i definitely see that, we shall see if prices drop that low for a w4…… although a drop that big is different from “the last spike” so to speak…….

time will show all to us mere mortals…….

Another tech whale is making an exit. Recently Bezos to the tune of over 1 billion worth of shares unloaded. Now Peter Thiel is unloading most of his Facebook stake. Keep in mind Nasdaq is uniquely displaying thin-ness of breadth with fewer of its stocks responsible for index gains than any other. There is a vast black hole between those few stock valuations, and the rest of the index. The collapse theme is starting to take form…tick…tick…tick…

Andre’…

All Hail the Vibrations!!!

I would not count your chickens before they hatch. Sorry to say, we still have 2615 2620 for the next high.

Dave M,

Why do you feel compelled to time and time again remind us all that you are bullish?

I have traded the markets longer than you have been alive! Good approach though to attack someone you do not even know. Very tiring!

By default I think you are attacking Peter T.

Well, Dave is heading to moderation for awhile. I’m getting tired of the attacks.

Hi Ed,

Uptil now Dave had been right like 90% of the time. It is good that there are more views and especially when one is biased to the bear or bull camp. He is trying to help us fix our bias, that is how I see it. ?

Anyway, good job Dave and of course our host aswell, Mr. Temple! ??

Cheers,

W

I agree that contrarian opinions are healthy and no one arguing that point. The issue is whether or not opinions are expressed in such a way as way as to be helpful to others, or to merely disparage those with a different view, which is childish. I tried to subtly point that out by suggesting people bullish opinions be accompanied by trades that show the validity (and commitment) of such expectations and that should have been easy in an uptrend but that was interpreted as being “passive/agressive”! I have never been too fond of psycho-babble!! 🙂

Peter T,

Your commentary “The Last Spike” posted on Sunday will prove to be prescient in my humble opinion! Not trading or investment advice.

“Nobody ever went broke underestimating the intelligence of the American public”

H.L. Mencken

Happy “T” day to all those in the “U.S.S.A of Trumplandia”, and to all those “north’ of the U.S.S.A of Trumplandia – “DUCK”……cause turkey and “flatulence” is like mustard and mayo on a ham sandwich………

the winds blow from south to north………………….. i am only pointing out the windflow convergence behaviors this time of year…………

now…. so far …..so good …………… i left my original lines in place….https://invst.ly/5×409

verne, what say you?……….. and where the heck is jody these days……..? Liz and joe, happy Thanksgiving!!…….. and a poem “appropriate”…….. from Emily Dickson.

“One Day is there of the Series

Termed Thanksgiving Day.

Celebrated part at Table

Part in Memory.

Neither Patriarch nor Pussy

I dissect the Play

Seems it to my Hooded thinking

Reflex Holiday.

Had there been no sharp Subtraction

From the early Sum —

Not an Acre or a Caption

Where was once a Room —

Not a Mention, whose small Pebble

Wrinkled any Sea,

Unto Such, were such Assembly

‘Twere Thanksgiving Day.”

luiri, I am counting an impulse up out of the “triangle formation” and see a final small fifth up underway. Scaling into short trades with a target of 2610 or so. As an options trader I need to get positioned when VIX is cheap!

😉

verne,

you bring a smile to my face!! thank you for being you!!!

now i know your trading skills are beyond reproach – but it is “I” ……and only “I”…………….who can issue the alert!! ………………. here it comes……… “BE WARNED”……………………now having said that, i must post the following chart

https://invst.ly/5x82c

🙂

We have been varned !

As an added note , shorting this market

Has been a lesson in futility as has been calling for its collapse .

Not saying I’m changing my bearish view nor my timing

Just noting the facts.

All trading involves analysis of some sort and trading

Against the trend takes courage no doubt .

To understand Armstrong’s bullish view you will need

To read more of his work . He has explained his reasons

And none of his reasons include central banks .

I’ll be out of phone for a few days and I’ll answer

The couple questions I’ve seen later when I have time

To write .

My turn dates have been explained over the past few months .

A failure is when the market goes in the wrong direction as

It was expected .

Elliott wave theory is extremely helpful and while you may

Make a profit while getting it wrong on a wave count that in

No way is a reflection on a wave count.

Even a broken clock is correct twice a day .

Since this is not a rants and rave page I’ll keep my

Focus on posting my trading thoughts rather than

Argue .

My bias remains downwards for next year and that bias

Is based on timing , the Elliot wave count and the technical

Analysis of the market .

Anyone can trade and make money yet as I remember

Back in my days of raising money ( been in the brokerage business )

3 people , 1 says this is what’s going to happen , the other says

This is what happened , and the 3 rd guy says What happened ?

Which person would you like to be ?

Enough said

Have a great weekend and happy thanksgiving everyone .

When you say shorting the market has been a lesson in futility it really depends on HOW you have been shorting the market. I have learned two critical things over the last few years. We all know corrections have been remarkably brief and shallow, and therefore short side trades had to be exited the INSTANT they became profitable. The mistake traders have been making is expecting a protracted decline. There have been many opportunities to short the market provided you remained nimble. Every move of VIX below 10.00 for the last two months has yielded a profitable “short” trade if you knew what you were doing and I posted several of my own trades here. There were seven straight opportunities, each coming on a Friday!

The other thing traders have not figured out is you don’t have to just short the INDICES!

Ever since we had that first HO in May that was a heads-up to start looking for particular weak sectors and stocks in the market. If you look at Barcharts list of new 52 week lows you would find a plethora of short candidates. Finding the weak sectors and stocks in the indices has been the key to successful short trades. This is one of the main things that folk who come on the forum and spout all sorts of bullish sentiment have apparently been either completely ignorant of, or deliberately ignoring, namely consistently deteriorating market breadth!

OK now I am giving away all my secrets but we are here to help one another are we not?? Happy Thanksgiving Everyone!! 🙂 🙂 🙂

Luri, Verne, thank you for the thanksgiving greetings. Happy Thanksgiving to everyone too! Hope the turkeys you’re roasting (or deep frying) turn out moist and delicious.

I like what Joe said before. He said, “Ill finish by saying this is not a football game, we don’t get to say my team won or your team lost. The battles between us is not needed, this is us against the market not us against each other.”

Although I am not sure what he meant when he said “against the market.” Short-term, I try to ride the waves whether up or down so I don’t really want to fight the wave. If I am uncertain of the incoming wave, I step away and watch from the shores. But if I see a down wave or up wave really strong intra-day, I don’t mind taking the risk and jumping in. For example, amzn yesterday, calls even bought in the middle of the day did well .

Verne, I really appreciate you posting your VIX trades. Dave or maybe it’s Dave M., I don’t know which one, did post a couple of bullish trades that worked. The others who are critical of the “bears” I’m guessing are just long via retirement funds hence they don’t have any swing or intra-day long trade ideas.

Great points LizH! Dave has indeed been right on some his calls which simply highlights different trading styles and perspectives. Some traders buy calls, others sell bull put spreads. My parents taught me to always assume everyone in the room was smarter than I….until proven otherwise! 🙂

BTW Joe, there is a reason Armstrong does not talk about the banksters. If you knew what they did to him you would understand… 🙁

Thank you luri 🙂

…..and may i say “thank you” in return…………………… best to you joe!

Old chart yet ‘re posting this just because .

The next subcycle low is due Nov 24.

So next week should be up .

Some may call this a lesson in futility yet

I’ll let my work stand or fall on its own.

This is not my ” opinion” , it’s one of my timing models

I would not expect each and every turn date to be

Exact but I do expect the overall trend to follow suit

Time will tell .

https://m.imgur.com/hxrl6vH

Another old post

Chart not updated

https://m.imgur.com/xtrviIZ

Very cool stuff Joe. You are worth more money.

Another busy weekend so my post on friday.

The gravity indicator gives 11/26. This date will bring a high. So 11/27 down. But 11/28 is a very strong date so we expect a low 11/27-28 to bring another high 11/28. Then down into 11/30 for a last leg up into 12/4. Mercury velocity is up into 12/3 so from this date on things will get more volatile. Venus velocity is up into 12/19. So the market is stuck between these two dates. As 12/11 is the midpoint, the final high will come 12/11-12. This confirms RotRot’s timing.

Cheers,

André

long term energy chart supports most of your turns Andre

https://s2.postimg.org/n4pev9mll/nov._27th_to_Dec._27th_energy_chart_nl.gif

Thanks

Zero Hedge reporting some rumblings in the Chinese bond market. Bonds represent the arena in which I have long contended the trouble will begin. The banksters can play all kinds of games in the equities markets. When it comes to bonds, they are like a 7 foot row boat in a cat five hurricane. The trouble will probably begin overseas, and so we will see the red flag in futures. I have a sneaking suspicion that just as we have seen VIX and markets fall in tandem recently, the opposite will happen just before all hell breaks loose, with VIX shooting higher even before the market breaks as the smart money get positioned early. Nothing new under the sun. All the complacent, clueless, and sleepy market participants will soon be learning a very powerful lesson -the emotion far more powerful than greed…is FEAR…!

http://www.zerohedge.com/news/2017-11-23/china-deleveraging-shifts-corporate-bonds-cascade-effect-begins

I should add that 12/20-24 will be the 3rd significant period in december, This will bring the final capitulation.

So, yes, it all takes more time than I expected. But when it turns we’ll be down for years. The more significant the turn, the rounder the top.

Thank you André!

Perhaps by then the holiday shopping data will be on record….

Sounds like that time period could see an initial impulse down completed if it brings some sort of capitulation…

Verne November 23, 2017, 11:53 am

BTW Joe, there is a reason Armstrong does not talk about the banksters. If you knew what they did to him you would understand… ?

Verne

Really ?

Again as I said before, you should read more of his work so you understand his

Reasons as well as methods not to mention whether or not he has mentioned

His comments on bankers or his case or his time spent in prison or dealing with

The courts judges etc….

Andre

Were close as well on our timing .

Things are finally lining up 🙂

Out of range soon so I’ll wish everyone a great weekend

Joe, I admit I have not read a lot of Armstrong’s work, but I read the court filings in his case, which I consider more important than what he himself states about that incident.. He still faces restrictions…

https://invst.ly/5xiav

the ES is wedging!

Long awaited new 52 week low in VIX….

so here is something worth noting……there is a smaller “potential” ED on the ES in its “last stage”……… https://invst.ly/5xlpq [in the teal green]

a “pop” on monday morning would sufficient. The NYA is only a fraction from making a new high also……which is the last hold out……….

and then there dark black ED, which means prices have to go down for monday…… and that would be the wC of w4….https://invst.ly/5xlqr

so Monday could be the “denouement” of “the last spike”……….

so come monday – WEAR ALL RED! [the defiant color of the christian martyr] because the non believers above will be ready to crucify…………..

Incredible! In all the years I have traded the markets, I have never seen a terminal wave at this many degrees of trend. It is really amazing to watch. I count at least five, and possibly six. If this is correct, we are about to witness one of the greatest wealth-transfer events in the history of markets!

Somebody pinch me to make sure I am not dreaming…! 🙂

Looks like one more up after a slight correction for a penultimate fourth….

verne,

for me, it seems the waves are “fortune telling” a potential “event” is close….an event that is significant enough to overwhelm CB price support efforts…….. time will reveal all……

Something’s up. That vicious spike down in VIX was met with a very firm:

‘Oh no you don’t!”

I think it safe to say we have a bottom in VIX, or will very shortly.

What a potential trade!!

Remember, fear, is the wild card beyond the ken of the most wily banksters! 🙂

Hello All,

Dave M said he’s been banished from this site. He always seemed like a polite poster so I can only assume it’s because he doesn’t follow the party line by being a bull.

I found this site as I am interested in cycles and solarcycles ceased functioning without John Hampson. But it seems this site is less about cycles and more about a slavish devotion to ewt which I don’t share.

Trading is hard and no one knows what will happen.

ATB,

Kerry

Hi Kerry. It is one thing to express a contrary view and if you have been reading the site for any length of time, clearly not all posters are bearish. Joe for example has rightly had a bullish short term perspective when many of us were leaning more bearish. It is quite another thing to make personal attacks and insult folk who don’t agree with your point of view. Peter T does not tolerate it, as well he shouldn’t.

Several of David M posts were anything but polite imho, and the one for which Peter T took action was downright offensive.

Fair enough Verne, I haven’t seen the offending post and so can’t comment. Different sites attract different leanings and this is a bears site. Moderation is good as the internet is a license to be offensive for many people, but opposing views are also good, when politely delivered.

Absolutely! 🙂

kerry – question?……why would you “assume” derogation to the forum as your FIRST assumption?? You stated, and i quote – ” I can only assume it’s because he doesn’t follow the party line by being a bull.”

…..If you think about it, the natural line of inquiry is to ask Dave – “what did you do to get yourself banned from the forum???”……………… but obviously never happened…………………..hmm……………….

………….so you failed to ask Dave directly – what I consider would reasonably and relevantly be the first question, …………………….and instead you “assumed” derogation to the entire forum and our ever gracious host…………………. hmmmm..

……………………….Do you see where i am going with this kerry??

No I don’t see where you are going with this Luri.

I asked Dave and got a different story, although he did say he accused others of losing money and encouraging novice traders to blow up their accounts by shorting a bull market.

This isn’t my battle but it does seem a shame when the only bull is banished. I have seen this on other sites too. In a bears den, bulls do need to speak up and sometimes shout.

So I did ask him, hmm …… Still not sure where you are going with this. As the posts have been deleted I can’t see for myself.

Dave is not banished. Being “put on moderation” just means that comments are reviewed before going live. Sometimes that takes less than a minute, sometimes longer, depending upon my availability. No big deal.

There was one small comment removed: It was a personal attack. I don’t allow personal attacks, as I’ve stated before.

Thanks Peter

………well, ladies and gentlemen of the jury…….kerry is “perplexed”……………………permanently perplexed…………………..

and therefore being “permanently” perplexed……….. is, for HIM, reason enough to bear “shoots” on all these unreasonable and rowdy folks of this particular cycles forum.

we “MUST” certainly be a crazed bunch …… a “bunch” that needs saving from “ourselves”…………………. “AND” of course the bull “shoots” offered and advised by Dave M and others…….. is a gift from the hand of god……or said otherwise, as heavenly “redemption”…….

so it seems we “bear shoots” are a “stupid” lot……….and we lack the “adult” capacity for making our own “trades”………………………. [for those that trade]

said otherwise……….according to the “bull shoots” …..it is to be expected that those stupid “bear shoots” members of the stupid “bear shoots” forum will flail mindlessly and go wildly running into speeding crosstown traffic …………

and we run into crosstown traffic for the sole reason that we are unreasonable “bears”……………………………

if we could only cross at the bull “shoots” crosswalks………………………….

so, to recap, “bull shoots”……..”bear shoots”…….blah blah blah……and yes, the “bear shoots” need saving from “ourselves”,………… hmmm……and finally “bear shoots” are “unreasonable” and “unbalanced”…………………….. oh yes, and that LURI is FAT!!

so i once again quote…..”” I can only assume it’s because he doesn’t follow the party line by being a bull.”

“wow”…… thank you lord for “the bible”………and for having the “bull shoots” divinely illuminated…………………………….. btw, for the public record, i had no idea there was a “banning”……….. i thought all bannings were done ritualistically at Bohemian Grove……….

p.s. – as an aside, a guest should always behave as a guest…and we are all guests in Peter’s house. I for one honor my host, and try my best to behave as a guests should……..

🙂

I still have no idea what you are saying

🙂 Trolls get banned …

a new blog post is live at: https://worldcyclesinstitute.com/the-penultimate-wave-2/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.