I returned home from New York City on Friday night.

On Saturday, I went to turn on satellite TV and my remote control, which has been acting up for the past month, was completely dead. My conversation on the telephone with one of our national telcos took about an hour and a half, about half of it on hold. Three people later, I started to get some answers.

They wanted to charge me for a new remote, which they would send to me in about a week. I asked them to explain the logic of charging me for a failed piece of their equipment so that I could watch a service that I was already paying for monthly. I had to get elevated to a supervisor. Even he found a logical explanation a little difficult. I ended up getting the remote for free and they will credit my bill for the time that I can’t watch it (’cause I don’t have a remote). But I had to threaten to cancel to get their attention (which is typical these days). Deflation makes this possible. They’re so concerned about losing customers.

I also found out that one of my two internet services was completely down. It took me another hour to get hold of another telco just to get an appointment for a tech to look at it (again, I pay for two services, because one of them invariably has problems and goes down and, as a trader and market analyst … well … ). I’ve had so many problems over the past four months with this particular service that they told me they would “elevate the request to get a tech out today,” but I know that won’t make any difference … (past experience). It will happen when it happens … likely later on in the week.

My last run-in with this telco took 6 hours on the phone, two letters to head office (one by courier) and two and a half months to get resolved. I’d originally called them simply to upgrade the speed of my internet service. It’s a very long story from Hell.

I reflected on Saturday about the fact that four computer monitors have failed on me this year. My business telephone system quit on me a month ago and had to be replaced. On Friday, one of my two computers went completely dead in New York (I travel with two for that very reason).

Funny enough, none of this seems out of the ordinary anymore. I’m sure most of you have had similar issues (I hope not as many!)

While I was away, I spent hours trying to get my reports out due to being in a different environment and with a very slow internet service that I had to keep signing on to every time I would shut down my computer.

Whenever I access the internet these days, something has changed (I use so much software and different services and they’re all competing to stay fresh and new). I spend more time learning where buttons have gone to than I do actually completing the task.

The world has become so complicated that we’re hitting levels of productivity in the private sector that I would expect from the depths of government … yikes!

The Law of Diminishing Returns

Yes, this a real law from the field of economics:

This law refers to a point at which the level of profits or benefits gained is less than the amount of money or energy invested. In everyday experience, this law is expressed as “the gain is not worth the pain.”

Joseph Tainter wrote a very interesting book in 1990 entitled “The Collapse of Complex Societies.” You’ll find on my books page. It describes all of the major civilizations and how they all got overly complex before they collapsed. They met their ends, as I’ve stated so often before, at 500 year cycles tops.

But the point is that when times are good (warm-wet and there’s lots of eat), we humans grow our societies like crazy, and as time goes on, they become more and more complex and finally collapse on themselves. We become more and more unproductive, weighed down by all the “stuff” we’ve created, without much thought to the bigger picture.

There are lots of reasons for collapses of civilizations; this is just one of them.

Politicians continually create new laws until we have conflicting laws, one of top of another, many of which are outdated and no longer have application. Donald Trump is going to require that two laws have to be dismantled for every new law put on the books—a step in the right direction!

We have tax systems that nobody can figure out. You have to pay people just to figure out how much you owe.

To travel these days is a nightmare of TSA workers, rules for baggage, and additional seating charges that change constantly. I’m in awe of the British, though. Somehow it took them two weeks to get me my first British passport (online), and yet getting a Nexus card to go to the US a little bit faster took about 8 months and an interview at the airport.

Our cars are computers now and they continually break down. Often finding the problem is impossible; you have to replace the entire unit. My BMW motorcycle has a computer software upgrade every time I take it in for service. Some of these take 6-8 hours to upload!

We have air bags that blow up; we have computer monitors that fail (lol) and it’s more expensive to fix them than buy a new one (score one for pollution!).

Software companies are coming out with new versions in less than a year from the previous one and guess what: They’re finding them really hard to sell! That’s partly because we simply don’t want to learn a new program every month, to find out that there’s really nothing in it that will increase our productivity.

This is another sign of a cycle top. As a society, we’re simply “out of control.” Nobody’s thinking anymore. And quite frankly, people are getting to the point where they’re “mad as hell and they don’t want to take it anymore.”

So, for more reasons than just this, we’re going back to simpler times. It will impact everything. Even our music will become simpler. Look out for the coming ballads! I’ll be so glad for the change!

I don’t necessarily like where we’re going, but the current business environment is obviously “finished.” It’s simply unsustainable. The level of complexity is sometimes overwhelming and often illogical. I can’t keep up.

The underlying cause to much of what I’ve described is also economic, but having to do with inflation. Governments have inflated away the value of the dollar that companies are forced into lowering the work that goes into producing all these items and so they’re more cheaply made … overseas. We simply don’t have the money to put into research and development (or proper testing)( before we launch all this crap on what used to be an unsuspecting public.

They’re not so unsuspecting any more and so products stop selling. We spend most of our time yelling at the telcos, rather than getting our work done. However, the added stress is great for the drug industry!

Actually, yelling at the telcos can be fun, because you know they’re going to lose once you threaten to cancel.

My rant has a bit of a purpose. Stay sensitive to what’s going on around you. There are terrific savings starting to come about due to deflation. It’s time to start threatening cancellation to get better and less expensive service. This is just the start of a process that will go on for the next several years.

Longer term, we’re going to start seeing quality going back into products, less regulation, more customer service (or maybe I should say “some” customer service), and less stress.

However, it’s going to take a lot of pain to get there. This is just a reflection on what I see going on around us. I think it helps to understand it all so that you don’t end up going totally insane in the meantime … lol.

_________________________________

The US Market

I’ve decided to leave the bulk of last week’s post in place because we’re still in this ending diagonal, waiting for the 3rd wave to top.

This particular ending diagonal is extremely rare. In fact, nobody to my knowledge has ever seen one at cycle degree or higher at the end of a corrective wave (at least, in a bull market).

Ending Diagonals

We continue to work our way through the ending diagonal.

We continue to work our way through the ending diagonal.

Ending diagonals are rare at cycle degree. Wherever they trace out, they suggest a market that is extremely weak and barely able to achieve a new high. Although ending diagonals usually fall under the banner of a motive wave, they have properties more aligned with corrective waves. Ralph Elliott described an ending diagonal as occupying the fifth wave position of a motive wave when the preceding move has gone “too far too fast.” He maintained that it indicates “exhaustion of the larger movement.”

This particular version of an ending diagonal is extremely rare. That’s because it’s at the end of a corrective wave. And that, I believe, is primarily due to the fact that the rise from 2009 has a large central banker component—an “unnatural” element to it. It has fuelled the bullishness of the herd, but not in a sufficient way to effect a truly “motive” market. We’re barely making it to the top.

Last week, I posted a video relating to my original projection for a third wave with a maximum high of 2237. Once we exceeded that number, I immediately posted a video projecting higher levels due to the fact that I’d missed a tiny defining element of all ending diagonals: all waves must be zigzags.

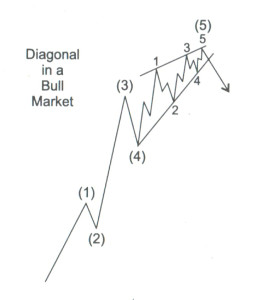

You can see in the diagram above that the first wave of the ending diagonal (wave 1) starting from (4) is in three waves. This is the usual structure of a motive wave—all waves must be zigzags, starting from the fourth wave of one degree higher. Usually, they begin after the fourth wave of a motive five wave pattern.

However, in the chart below, you can see that from the red (4) to the red wave 1 of the ending diagonal, there are only three waves (blue ABC). In fact, the three waves are a zigzag and actually make up the whole of the first wave of the ending diagonal. That’s because the wave from blue B to red wave 1 is in five waves (it is NOT a zigzag; it’s just a “zag”). This gets down really deep into the intricacies of Elliott waves—and supports it as a science.

And that gives me a new mini-module for the course I’m working on that nobody else seems to be aware of!

Projection for a Top

Based on the ending diagonal we’re currently in (which is the pattern playing out in all the major US indices), I’m still projecting a final top to our five hundred year set of Supercycle waves at the end of the 2016 year or, more likely into mid January.

______________________________

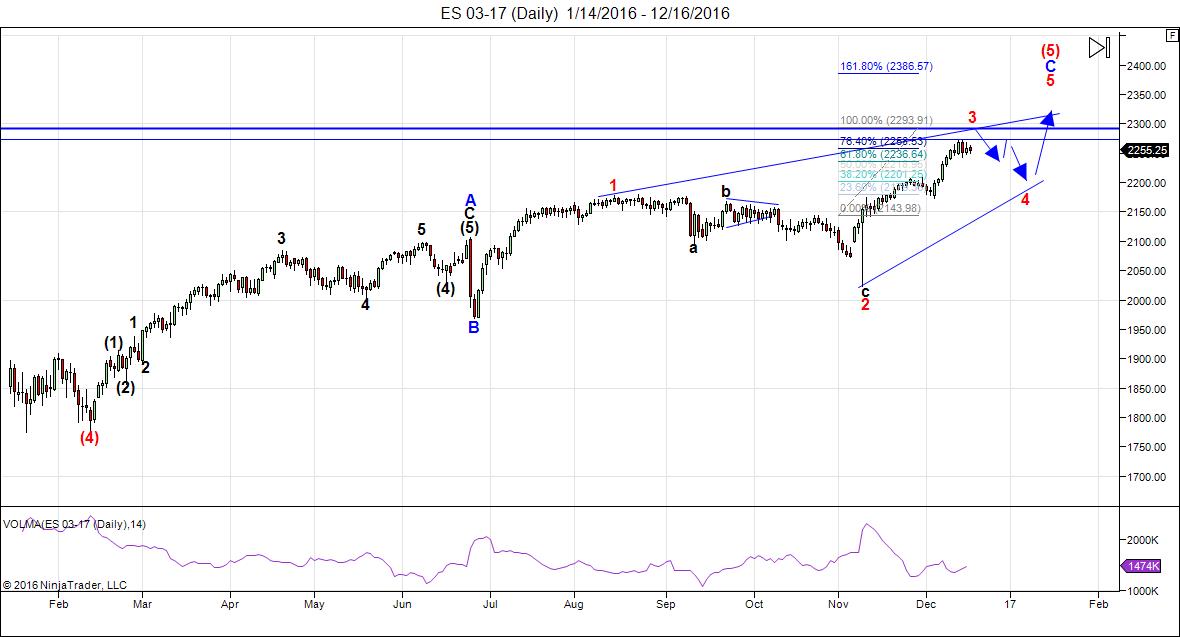

Here’s the latest daily chart of ES (emini futures):

Through fibonacci ratios, I’m projecting a possible top for the third wave of the ending diagonal for ES of 2294. By extension, it projects a top for the third wave for the SP500 of about 2296.

Note the extreme drop-off in volume for this wave (it’s the purple indicator line at the bottom of the chart). Volume is almost none existent. It should surge in the fourth wave down and we should get a volume surge during the first part of the fifth wave.

Here are the rules going forward:

- Wave 3 must be shorter than wave 1 and reach a new high.

- Wave 5 must be shorter than wave 3 and reach a new high (usually it does a “throw-over”—extends above the upper trendline defined by the tops of wave 1 and 3, but it is not necessary.

- Wave 4 must be shorter than wave 2 and must drop into the area of wave 1.

- All waves must be in 3’s (zigzags).

- The trendlines of the ending diagonal must converge.

Timing

Look for a top to wave three early this week.

I’m sliding slightly in terms of the final ending diagonal top but still looking at January, 2017. The combination of wave 4 and 5 in an ending diagonal is usually much shorter in time that the third wave. The third wave took about 6 weeks.

Summary: We’re completing the third wave of the ending diagonal before zigzagging to the top of the largest bubble in history. I expect a sharp drop in wave four of the ending diagonal this week. The long awaited bear market is getting closer.

___________________________

Sign up for: The Chart Show

Thursday, December 22 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Congrats to Peter on another interesting chart show. I think each new one is a little better than the prior one. This last one lasted a long time – 1.5 hours – but it was well worth the time and cost. I’m little hesitant to ask Peter to include more investments to evaluate given how long the shows last, but wanted to see if Emerging Market stocks (EEM) and real estate (REK, an inverse ETF) could possibly be added. Thanks.

Thanks, Oz,

You can ask me to look at these at the end of the show (they’re usually about an hour, but I warned this last one would be a bit longer due to the uncertainty right now in the market), but I have my hands full in terms of what I’m currently following. Anything more will lower the quality of my analysis.

The free holiday post is live. Thanks to all of you for your support over the past year!

https://worldcyclesinstitute.com/many-happy-market-returns/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.