I returned home from New York City on Friday night.

On Saturday, I went to turn on satellite TV and my remote control, which has been acting up for the past month, was completely dead. My conversation on the telephone with one of our national telcos took about an hour and a half, about half of it on hold. Three people later, I started to get some answers.

They wanted to charge me for a new remote, which they would send to me in about a week. I asked them to explain the logic of charging me for a failed piece of their equipment so that I could watch a service that I was already paying for monthly. I had to get elevated to a supervisor. Even he found a logical explanation a little difficult. I ended up getting the remote for free and they will credit my bill for the time that I can’t watch it (’cause I don’t have a remote). But I had to threaten to cancel to get their attention (which is typical these days). Deflation makes this possible. They’re so concerned about losing customers.

I also found out that one of my two internet services was completely down. It took me another hour to get hold of another telco just to get an appointment for a tech to look at it (again, I pay for two services, because one of them invariably has problems and goes down and, as a trader and market analyst … well … ). I’ve had so many problems over the past four months with this particular service that they told me they would “elevate the request to get a tech out today,” but I know that won’t make any difference … (past experience). It will happen when it happens … likely later on in the week.

My last run-in with this telco took 6 hours on the phone, two letters to head office (one by courier) and two and a half months to get resolved. I’d originally called them simply to upgrade the speed of my internet service. It’s a very long story from Hell.

I reflected on Saturday about the fact that four computer monitors have failed on me this year. My business telephone system quit on me a month ago and had to be replaced. On Friday, one of my two computers went completely dead in New York (I travel with two for that very reason).

Funny enough, none of this seems out of the ordinary anymore. I’m sure most of you have had similar issues (I hope not as many!)

While I was away, I spent hours trying to get my reports out due to being in a different environment and with a very slow internet service that I had to keep signing on to every time I would shut down my computer.

Whenever I access the internet these days, something has changed (I use so much software and different services and they’re all competing to stay fresh and new). I spend more time learning where buttons have gone to than I do actually completing the task.

The world has become so complicated that we’re hitting levels of productivity in the private sector that I would expect from the depths of government … yikes!

The Law of Diminishing Returns

Yes, this a real law from the field of economics:

This law refers to a point at which the level of profits or benefits gained is less than the amount of money or energy invested. In everyday experience, this law is expressed as “the gain is not worth the pain.”

Joseph Tainter wrote a very interesting book in 1990 entitled “The Collapse of Complex Societies.” You’ll find on my books page. It describes all of the major civilizations and how they all got overly complex before they collapsed. They met their ends, as I’ve stated so often before, at 500 year cycles tops.

But the point is that when times are good (warm-wet and there’s lots of eat), we humans grow our societies like crazy, and as time goes on, they become more and more complex and finally collapse on themselves. We become more and more unproductive, weighed down by all the “stuff” we’ve created, without much thought to the bigger picture.

There are lots of reasons for collapses of civilizations; this is just one of them.

Politicians continually create new laws until we have conflicting laws, one of top of another, many of which are outdated and no longer have application. Donald Trump is going to require that two laws have to be dismantled for every new law put on the books—a step in the right direction!

We have tax systems that nobody can figure out. You have to pay people just to figure out how much you owe.

To travel these days is a nightmare of TSA workers, rules for baggage, and additional seating charges that change constantly. I’m in awe of the British, though. Somehow it took them two weeks to get me my first British passport (online), and yet getting a Nexus card to go to the US a little bit faster took about 8 months and an interview at the airport.

Our cars are computers now and they continually break down. Often finding the problem is impossible; you have to replace the entire unit. My BMW motorcycle has a computer software upgrade every time I take it in for service. Some of these take 6-8 hours to upload!

We have air bags that blow up; we have computer monitors that fail (lol) and it’s more expensive to fix them than buy a new one (score one for pollution!).

Software companies are coming out with new versions in less than a year from the previous one and guess what: They’re finding them really hard to sell! That’s partly because we simply don’t want to learn a new program every month, to find out that there’s really nothing in it that will increase our productivity.

This is another sign of a cycle top. As a society, we’re simply “out of control.” Nobody’s thinking anymore. And quite frankly, people are getting to the point where they’re “mad as hell and they don’t want to take it anymore.”

So, for more reasons than just this, we’re going back to simpler times. It will impact everything. Even our music will become simpler. Look out for the coming ballads! I’ll be so glad for the change!

I don’t necessarily like where we’re going, but the current business environment is obviously “finished.” It’s simply unsustainable. The level of complexity is sometimes overwhelming and often illogical. I can’t keep up.

The underlying cause to much of what I’ve described is also economic, but having to do with inflation. Governments have inflated away the value of the dollar that companies are forced into lowering the work that goes into producing all these items and so they’re more cheaply made … overseas. We simply don’t have the money to put into research and development (or proper testing)( before we launch all this crap on what used to be an unsuspecting public.

They’re not so unsuspecting any more and so products stop selling. We spend most of our time yelling at the telcos, rather than getting our work done. However, the added stress is great for the drug industry!

Actually, yelling at the telcos can be fun, because you know they’re going to lose once you threaten to cancel.

My rant has a bit of a purpose. Stay sensitive to what’s going on around you. There are terrific savings starting to come about due to deflation. It’s time to start threatening cancellation to get better and less expensive service. This is just the start of a process that will go on for the next several years.

Longer term, we’re going to start seeing quality going back into products, less regulation, more customer service (or maybe I should say “some” customer service), and less stress.

However, it’s going to take a lot of pain to get there. This is just a reflection on what I see going on around us. I think it helps to understand it all so that you don’t end up going totally insane in the meantime … lol.

_________________________________

The US Market

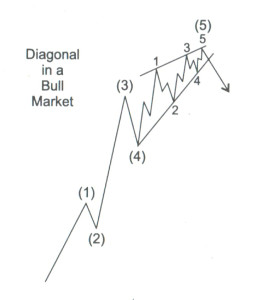

I’ve decided to leave the bulk of last week’s post in place because we’re still in this ending diagonal, waiting for the 3rd wave to top.

This particular ending diagonal is extremely rare. In fact, nobody to my knowledge has ever seen one at cycle degree or higher at the end of a corrective wave (at least, in a bull market).

Ending Diagonals

We continue to work our way through the ending diagonal.

We continue to work our way through the ending diagonal.

Ending diagonals are rare at cycle degree. Wherever they trace out, they suggest a market that is extremely weak and barely able to achieve a new high. Although ending diagonals usually fall under the banner of a motive wave, they have properties more aligned with corrective waves. Ralph Elliott described an ending diagonal as occupying the fifth wave position of a motive wave when the preceding move has gone “too far too fast.” He maintained that it indicates “exhaustion of the larger movement.”

This particular version of an ending diagonal is extremely rare. That’s because it’s at the end of a corrective wave. And that, I believe, is primarily due to the fact that the rise from 2009 has a large central banker component—an “unnatural” element to it. It has fuelled the bullishness of the herd, but not in a sufficient way to effect a truly “motive” market. We’re barely making it to the top.

Last week, I posted a video relating to my original projection for a third wave with a maximum high of 2237. Once we exceeded that number, I immediately posted a video projecting higher levels due to the fact that I’d missed a tiny defining element of all ending diagonals: all waves must be zigzags.

You can see in the diagram above that the first wave of the ending diagonal (wave 1) starting from (4) is in three waves. This is the usual structure of a motive wave—all waves must be zigzags, starting from the fourth wave of one degree higher. Usually, they begin after the fourth wave of a motive five wave pattern.

However, in the chart below, you can see that from the red (4) to the red wave 1 of the ending diagonal, there are only three waves (blue ABC). In fact, the three waves are a zigzag and actually make up the whole of the first wave of the ending diagonal. That’s because the wave from blue B to red wave 1 is in five waves (it is NOT a zigzag; it’s just a “zag”). This gets down really deep into the intricacies of Elliott waves—and supports it as a science.

And that gives me a new mini-module for the course I’m working on that nobody else seems to be aware of!

Projection for a Top

Based on the ending diagonal we’re currently in (which is the pattern playing out in all the major US indices), I’m still projecting a final top to our five hundred year set of Supercycle waves at the end of the 2016 year or, more likely into mid January.

______________________________

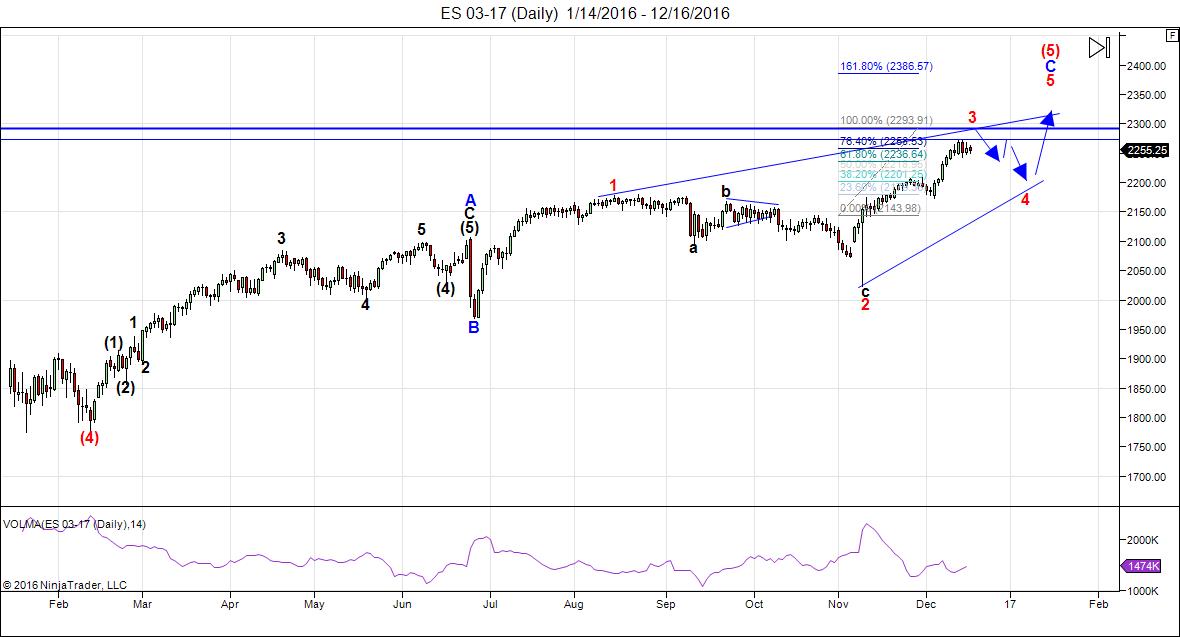

Here’s the latest daily chart of ES (emini futures):

Through fibonacci ratios, I’m projecting a possible top for the third wave of the ending diagonal for ES of 2294. By extension, it projects a top for the third wave for the SP500 of about 2296.

Note the extreme drop-off in volume for this wave (it’s the purple indicator line at the bottom of the chart). Volume is almost none existent. It should surge in the fourth wave down and we should get a volume surge during the first part of the fifth wave.

Here are the rules going forward:

- Wave 3 must be shorter than wave 1 and reach a new high.

- Wave 5 must be shorter than wave 3 and reach a new high (usually it does a “throw-over”—extends above the upper trendline defined by the tops of wave 1 and 3, but it is not necessary.

- Wave 4 must be shorter than wave 2 and must drop into the area of wave 1.

- All waves must be in 3’s (zigzags).

- The trendlines of the ending diagonal must converge.

Timing

Look for a top to wave three early this week.

I’m sliding slightly in terms of the final ending diagonal top but still looking at January, 2017. The combination of wave 4 and 5 in an ending diagonal is usually much shorter in time that the third wave. The third wave took about 6 weeks.

Summary: We’re completing the third wave of the ending diagonal before zigzagging to the top of the largest bubble in history. I expect a sharp drop in wave four of the ending diagonal this week. The long awaited bear market is getting closer.

___________________________

Sign up for: The Chart Show

Thursday, December 22 at 2:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Thanks , hang in there, this has long and hard ……Nick..

Hi Peter

Nice update today 🙂

analysis overload for me today .

I bought a 1959 Chevy flat bed with a dump bed

several months ago , have to say while the manual

steering is a work out the seat not so comfy the ride

is a bit rough , the push button by the gas petal to start it

is kind of odd top speed around 60 mph unless i want to

rev it up which i don’t want to do , an add on oil filter

on the fender well .

im kind of liking the old tech though and its solid

loaded 3000 pounds in it and didn’t even compress the springs

it can hold 4000 pounds .

no electronic ignition no fuel injection just a plane old

easy to fix heap lol .

I haven’t had to call the dealer for anything .

i have decided to keep my computer off for the overnight session .

i can see how many may try to jump the gun on either side

of this market tonight .

I have created a couple more charts to keep an eye on for this next year

yet not going to post any of them until march or may 2017 .

i am placing my mental stops at the 19000 area .

im not convinced we have topped yet as i began information overlaod right now .

i need time to think it through .

Jan 20-24th fits your mid Jan time frame as far as im concerned so im

not in a hurry to place any trades .

shutting this thing off .

thankfully my computer has been working

Joe

for those interested when we will know the truth behind the electors

http://www.270towin.com/news/2016/12/13/what-time-do-the-electors-meet-on-december-19_427.html#.WFceT4r56M_

By 3 pm est we should have a good idea how the election is going .

no trades for me until the last hour of the day .

id watch the sell side volume if your looking to take a bearish

trade .

no opinion for me what this market is going to do

Harry Dent the perma bear capitulates

http://www.talkmarkets.com/content/us-markets/this-blow-off-trump-rally-looks-real?post=115859

Peter, in the past, you’ve mentioned certian planetary events that appear to strongly correlate to market and political corrections/upheavals. Can you suggest a well researched, easy read book that explores this phenomenon? Do you have or can you do a post the explores this topic in more detail. Seems appropriate as we celebrate the birth of a King whose coming was announced to all in the sky. Also, would be interesting to see a graphic representation showing significant human or natural events and what planetary positioning, including sunspot and lunar phases, were also occurring at the same time. My hunch is there are also predictive cycle patterns in the data.

Robert,

the book that comes instantly to mind for me is “Cosmos and Psyche” by Richard Tarnas. My memory is that it doesn’t touch on the market, but it does go through each of the planets and their effects on history. Others here may have suggestions.

Hi Peter,

Richard Tarnas teaches at CIIS in San Francisco. Mainly psychoanalysis using astrology. By way, I was in New York last week on vacation. Hope your research was useful.

Arch’s site is here (for anyone interested): http://www.crawfordperspectives.com

The trip was good. I got as much out as was to be had. Now I have to put it all together. I got to visit Trump Tower and see the media frenzy first hand! It was extraordinary. Unfortunately, the pics I took of the line-ups to see the stars got beamed up with my iphone, which continues to be missing.

Glad to hear you accomplished your research goals. Sorry to hear of your phone. I went to Natural History Museum. Seeing things in tangible way really makes them more real. =)

Arch Crawford is the most notable expert in Astrological investing.

Hey, with much respect to jody and luri et al….here’s why I think the DJIA 20K is going to be broken. Believe me I WOULD much rather have the alternative.

https://postimg.org/image/4wk7n23tv/

Sincerely HOPE it doesn’t turn out this way.

Also IF the wave up AFTER the ‘e’ wave get’s longer than 1.28 times the ‘a’ wave then I think we may be in the territory of what joe is advocating. …. because thrusts from triangles complete at the same length as the ‘widest’ width of the triangle OR ……. THEY EXTEEEEEND!!….wildly….or even “WILDLY!!”

p,

ahhh “P”…that’s completely “disrespectful’ to myself and jody!!! you need to issue a respectful apology “IMMEDIATELY” – i suppose we can fit you for some ‘cement’ boots in the shape of that “TRI ANGLE” you “think” you are seeing!!!

do you like water p?? huh?….. does the THAMES call you to its banks each night?? the good thing -those “boots” we are preparing – you guessed it – they are “waterproof”…… [cough] :-))..

p,

is this a case of “buy” the rumor , ‘sell’ the news? that is, buy the election, and sell the electoral vote happening today.

luri, the action since the touch to the lower bound of the triangle has NOT been a ‘thrust’. We may ALL be saved. You from having to become a cobbler and me from having to wear your somewhat dubious handicraft.

Since IT IS a triangle it can only be the ‘other way around’. i.e. ‘b’ becomes ‘a’ etc. Hope you can follow that drift (or should I re-‘NUMBER’ them for your convenience?)

However that DOES mean that the ‘down wave is a ‘temporary’ one and we will see higher highs thereafter.

P.S. I DO like water. I swim 1Km a day and enjoy SCUBA….although not with the apparel that you are suggesting.

p….p…..”P”!

it is a “TRIANGLE” if and ONLY if jody and I “call” it a triangle – capiche! – …now “that’s it”……, i thought you would ‘see’ it our way…..[cough]…..

human life expectancy has ‘diminishing’ returns….. [cough]…… just so we understand each other…….. [cough] [sniff]……

goal seeking counts here p?? :-))

Aaah OK….I’ll quake in my cement boots then… when you deliver them. LOL!!

Hi Peter

I have a spreadsheet with daily Dow data

I got from Yahoo , the dates I used were based

On that data yet also it was indicator turns .

That said I have noticed errors in that data

Generally 1 day off . Most likely your dates

Are more accurate . Low to low to high

July 1932 Oct 1974 Dec 2016 makes sense

There are other dates and other Lindsay formats

I’m looking at yet they all matter .

One thing Lindsay did say is that some long term

Counts ( the 15 years low to high or 8 yrs low to high )

Bull market time counts etc . Should be used as a guide .

His low low high counts though tend to be more accurate .

I mentioned before that in the past I have given mercury

Retrograde a 10 day lag , that implies Dec 29 to Jan 18 i

Think my Jan 20 cycle date concerns me and that

Long term low low high count should at a minimum

Produce a market turn to some degree .

We should know pretty soon .

60 minute cash Dow looks like a triangle in some form

Yet it’s not textbook in my view

Valley,

Any update on PALS system.

Bill,

Phase: bullish next two weeks (post FM into NM and beyond)

Distance: apogee ahead, next two weeks should be bearish

Declination: post North, next two weeks bearish

Seasonals: christmas into New Years bullish

Summary: mixed PALS, no clear effect into the end of year.

To anyone 🙂

here is why i said the 60 minute chart ( dow ) is a triangle

of some form yet its not textbook.

there is more to a triangle form then just the narrowing trend lines

there is 8 various triangles under Elliott wave . 4 bullish and 4 bearish .

each leg travels in 3 waves labeled a b c . as you can see in the diagram

I’ve attached there should be an overlap of each minor b wave .

this doesn’t mean the market cant thrust upwards yet technically

and by following the rules we do not have a true triangle formation

on the 60 minute dow chart

http://imgur.com/BMPd3sy

Technical diagram along with 60 minute dow .

what ever we are seeing on the 60 minute chart

has not as of yet proven to be a triangle .

a break to the upside would therefor have more bullish

potential , not less.

more sideways movement is still possible .

im not making a bullish call or a forecast im just pointing out

what a textbook triangle would look like .

http://imgur.com/g2IOZ8Z

we need to read the market on the fly

here is another more complex wave to consider

again no opinion here just Elliott wave formations to

watch for

http://imgur.com/d25bCSH

futures imply a sell the market on the open of the cash market.

this assumes we are still in a triangle and not something else.

this would be textbook in my view yet its only a 200 point drop

nothing extremely bearish .

new highs would follow .

http://imgur.com/w9vCjVX

correction

same pattern is only a 100 point drop .

thats my notes for the day and its my only thoughts

very short term thinking yet this would take a few more days

to trace out . assuming its a 4th wave triangle and not something

more bullish .

sorry for the multi posts peter yet i wanted to clarify my thoughts

on triangles

Joe

bearish divergence and overall market not confirming the highs

we are seeing .

still in watching mode yet this is looking like a 3rd wave continuation

on weekly chart . 60 minute charts is failing to confirm

I’m taking my life in my own hands here and hoping that ‘THE’ Don luri is not lurking around!!

Here’s my updated chart from the ‘not to be mentioned tri-something’ ‘e’ wave.

If ‘they’ find me in the river Thames…. it’s because of a crazy english x’mas tradition and nothing to do with luri. Ok! Ok? I don’t know how to spell KAPICHE.

Ooops I nearly forgot to post the bleeding chart!!

https://postimg.org/image/8egrou6oh/

Regarding the above chart, I’m beginning to think that where I had my ‘v’ it should be iii and the action since then is the iv and the v. We are currently in the latter. Let’s see how far it goes.

The BIGGER question is whether this is completing the 3rd wave or the 5th wave.

I have no real bias towards either. However I intend to play it like it is the 5th wave and if I’m proven wrong then I’ll just abort and wait. THAT way if it is the 5th then I’ve caught it very near the top!!

Oops hadn’t seen joe’s multifarious posts on triangles before I offered mine. It’s a good thing that mine is NOT (luri you listening?) a triangle. It is ‘something else’ compleeeeteely DON. Honest!!

your a good man purvez

i took 1/3 of my position of nvda off at 63 to lower my risk

its a tough one to hold yet im letting it run.

my stocks have done well overall this year

i am not seeing confirmation on the 60 minute charts was

all i was saying and what i was looking at for a text book

triangle failed , the market is mixed as i see it .

that may change by the end of the day yet at the moment

its showing bearish divergence on 60 minute chart only .

the weekly chart says much higher to go .

the truth will be known soon enough

Joe

4 hour dow futures chart is a 3 wave move up

joe, please may I ask what is your ‘starting’ point for the 4 hour dow futures 3 wave move up? Thx in advance.

this market is looking exhausted .

wont be surprised to see all the December gains given back

in fairly short order , not what i want to see either .

will watch the last 2 hours of the day .

my concern is the daily sox index as well as the 60 minute sox .

semis have been the leaders this year

With the triangle over the past 4 days resolving to the upside it does swing the momo back to the bulls.. Congrats 20k is possible..

However if S&P gets below 2257 before Dow hits 20K I would say zero chance of Dow 20k at that point..

I am still skeptical though – Why – because of how hard they are pushing it on the news..

Either way we are coming to the end if we have not already topped at 2277..

It’s all about Japs buying.

Follow the white rabbit (JPY)

Purvez

im looking at some very bullish weekly charts

yet im not liking the 60 minute chart of all the index added together

and the 4 hour dow futures bothers me .

im hesitant to be bearish because as ive said many times

i have a bullish bias .

that said the market overall is not confirming todays highs

how this works out , if i had a firm opinion id be trading it

at the moment just following

the market failed so far from my point of view

short term time line runs from start of last hour of the day

so if we see a last hour sell off my index charts hold some merit

as does the 4 hour dow futures .

other than that im not sure ( hence watching for something to

form an opinion about the next move )

i don’t like to day trade

2 links showing my concerns

4 hour futures

60 minute index added

http://imgur.com/cZTZQzQ

http://imgur.com/ne0tm3Y

my post got sent but might be delayed

dec 14 and dec 16 are the lows on the 4 hour chart

Joe , thanks for the info on the lows for the 4 hr chart. I can see how you are counting the ‘abc’ up from the 14th low.

I agree that the ‘triangle’ count does have some ‘problems’ although they are tiny in the grand scheme of things hence my desire to stick with the triangle. I however accept that the resolution to the ‘up’ side has hardly been a ‘thrust’

I’m just keeping an open mind at the moment.

To many variables for me short term

best guess is ill take a nap and see

what the market looks like in a couple hours

and ill decide to trade or not the last hour of the day

Hehehe! I’m going to follow your advice but instead of taking a nap I’m going to take a glass of wine or 3. After all ‘its that time of the evening in the UK’!!

Bit more Climate Change (global warming). Oh-No we may be wrong.

http://www.news.com.au/technology/environment/natural-wonders/sahara-desert-sprinkled-with-snow-in-rare-weather-event/news-story/59df5e9bba5e4965965654cbef752bb0

Does Dow respond to resistance? liken to pulling up a freight train. Could blame mercury in retrograde for missing/delaying my forecast turn Monday 19th but possibly ‘drawing a longbow’.

Trend line about to challenge day 3 and hence looking shaky. Line commences Oct 1987 crash low to March 2002 high and extend right to pick up Oct 2007 high and today ……. well keeping us interested, standby

Additional resistance in form of a Jupiter planetary line at price of 20,003 – small slippage.

Wishing all a fantastic festive season….safe travels & cheers

im digging through long term data today and avoiding the market.

just thinking through from a multi decade type thinking .

here is some thoughts in regard to this threads theme

the law of diminishing returns.

keep in mind my data is based on a collection yet it should

hold fairly accurate .

annual closing percentage moves on the dow .

Historical high percentage years.

these are just the highest % years in order .

best 1 year Dow percent years 1900 to date

1915 up 81.71 %

1933 up 63.74 % 18 yrs from 1915

1954 up 43.96 % 21 yrs from 1933

1975 up 38.32 % 21 yrs from 1954

1995 up 33.49 % 20 yrs from 1975

2013 up 26.50 % 18 yrs from 1995

1900 and including 2015 ( 2015 was a down year on dow )

43 down years

73 up years

116 years of data

37% of time Dow is down

63 % of time Dow is up

Longest consecutive up yr to yr closes

9 yrs ( 1991-1999 , Includes both yrs )

next

6 yrs (2009-2014, Includes both yrs ) 2009 was an up yr

typical number of up yrs following a down yr

2 yrs . ( hence 2016 and 2017 can close up yr on yr and would be

more the norm )

longest to shortest yr on yr bear markets

4 yrs ( 1929-1932 , includes both yrs )

3 yrs ( 1901-1903, includes both yrs )

3 yrs ( 1939-1941, includes both yrs )

3 yrs ( 2000-2002, includes both yrs )

2007 was an up yr as was 2009 .

lots of 1 yr bear markets in history .

1 , 4 yrs of down yrs

3, 3 yrs of down yrs

6, 2 yrs of down yrs

18, 1 yr down year

how many 1 yr bull moves before falling back

to a negative yr ?

its only happened 3 time in the past 116 yrs

how many times after 2 yrs of up yrs have we

had a negative yr follow ?

its happened 13 times in the past 116 yrs

since 2015 was a down year for the dow .

2016 is shaping up to be an up yr

down yrs following a 1 yr up move has happened

3 times in the past 116 yrs . history says

we have a 2.5 % chance of 2017 being a bad yr . ( that’s the math )

if 2017 is an up yrs those odds increase by a factor of 4.

Just random annual data is all

ill go into the details later on stats above.

because i think the 2.5 % is not accurate .

the roaring 20’s ?

not so roaring if you think about it .

more like boom and bust .

1920 down

1921 and 1922 up

1923 down

1924 1925 up

1926 down

1927 1928 up

1929 1930 1931 1932 down

I have to correct my statement from yesterday. The triangle has NOT resolved yet. If S&P gets below 2258.20 I will have to say Dow 19987.63 is the top and S&P 2277 is the top.

S&P above 2272.78 then hello Dow 20k

jody,

i understand this ‘one way’ price move as a tax issue. this is a ‘tax issue’ going on here. Profit taking will happen in the first trading day of 2017 to take advantage of the ‘proposed’ tax reduction promised by Trump. Actually it could start 3 business days before the first trading day of 2017 – with the 3 days representing settlement in 2017.

after that point, it will be a scramble for the exits….. which will be similar to last year, but this time it will be……..way – BIGGER!! who will be the marginal buyer then ?? purvez? joe? :-)) …… Look to see the massive divergence that is happening now between index prices and insider selling.

If that was so evident all the specs would already speculate on this opening the shorts.

d,

the COT reports are bogus. the real shorting happens OTC – derivatives which never see the light of day.

Look to next week – the last trading week of 2016 to see if you see any positioning on the surface….

Luri,

Perhaps the Mercury Rx last year from Jan 4 to 25 had something to do with that? And didn’t it just start again this week?

skippy,

i am unable to answer that question….i hope this is so….. Andre, can you answer skippy’s question??

From now on it is down down down..

Odd thoughts

don’t hold me to this as this is a very broad brush i m painting with.

1966 was a down year and the starting point of a long bear market

1984 a down year and the beginning point of a long term bull market

1999 was an annual closing high

from 1966 to 1984 the market was both coming into and going out of

a bear market , 1966 to 1984 = 18 years

1999 minus 1966 ( a low to high count as crazy as that sounds )

was 33 yrs

1984 plus 33 years is the year 2017 .

in this case 1966 to 1999 low to high ( annual data )

i m calculating it in a very non traditional method yet i

can prove this .

1966 to 1999 33 yrs ( low to high )

1966 to 1984 ( low to low )

1984 to 2017 would be a low to high ( annual close , up yr is all )

1999 to 2017 18 yrs ( high to high )

just as 1966 to 1984 the market was going to into and coming out of

a bear market .

the years 1999 to 2017 the market has been coming out of

and going into a bear market .

( yea yeah 2000 2009 etc. yet this is from a very long term

thought process of 116 years of data .

another thing with the years ending in 7 from a yr on yr basis only .

1907 down

1917 down

1927 up

1937 down

1947 up

1957 down

1967 up

1977 down

1987 up ( yes 1987 was an up yr despite the crash )

1997 up

2007 up ( yup 2007 was an up yr despite it being the top )

5 down yrs ending in 7

6 yrs up ending in 7

imagine that ??? yr on yr not intra yr mind you

Dow could close up 1 pt and it would be an up yr

and stocks maybe got hammered so just pointing

out the facts is all .

another odd thing looking at yr on yr data .

assuming you were to just exit or enter dec 31 and exit dec 31 .

using the 1999 high start point .

1999 up

2000 down

2001 down

2002 down

2003 up

2004 down

2005 down

2006 up

2007 up

2008 down

lets say the yr 1999 was a number 10

1999 10 ( up yr )

2000 9 ( down yr )

2001 8 ( down yr )

2002 7 ( down yr )

2003 8 ( up yr )

2004 7 ( down yr )

2005 6 ( down yr )

5 of those 7 yrs you lost money .( if invested in just the dow )

on the other hand

beginning from 2005

2005 6 ( down yr )

2006 7 ( up yr )

2007 8 ( up yr )

2008 7 ( down yr )

2009 8 ( up yr )

2010 9 ( up yr )

2011 10 ( up yr ) ( note back to the 199y high with this odd method )

2012 11 ( up yr )

2013 12 ( up yr )

2014 13 ( up yr ) — 15 yrs from the 1999 high

2015 12 ( down yr )

2016 13 ( up yr )

odd way to look it i know but this is about picking the year

and ill use any data to correlate this i can.

what the above looks like

strange to consider 1966 a low

yet this is time im looking at more so than price .

see what the market looks like in a yr

if wrong no loss in trying

http://imgur.com/RfeHlWK

A picture (GRAPH) says a thousand words. Thanks Joe.

As mentioned from a previous post, I can see some kind of flash crash coming out of the blue. I am fully short at this time with my 3 batches. I am looking for a retest of last Jan lows. sp 1900 ? We may see one more up swing in the over all markets before the POSSIBILITY of the markets correcting. I will pull my shorts off the table if the Dow exceeds 20,039 level. Time frame, Jan 8th thru to the 21st Yes it is a long shot, but some thing wicked is coming our way. LOL Good luck every one

Hey Dave,

I also think we will drop like I said yesterday.

We decline now till Dec 28-30 after that recover till Jan 4, after that we will drop till Jan 15.

What is your timeframe for the drop Jan 8 till -21?

Thanks

Good luck John.

Hi John, I am not looking for a any fire works just yet. Christmas low volume week. Big boys at the Hampton’s partying away. I do not have a specific day for the market to be activated for the correction, just a narrow time period. ( Jan 8th thru the 21st )

After that correction, I can see the markets sky rocketing, making this trump rally look anemic. As always, do your own home work, check your ego at the door and go with your GUT FEELING not your emotions. All the best to you John and every one else !!

Thanks Dave.

The triangle has resolved to the downside.. Dow 20K is extremely unlikely at this point now.. I believe the tops are in..

Jody, I appreciate your input. I have been following your comments for quite some time.

Thx, Ed..

jody,

my two cents……..so i am still seeing consolidation at the top of the range. that is a ‘continuation’ type behavior. i need to see prices really breakdown. in the spx , on the small time frames [30 minute], did we see an island reversal this morning?? we gapped up on the 20th, consolidated, and this morning we gapped down in the same range as the gap up.

i think we see consolidation behavior until the middle of next week. this is a ‘tax’ issue behind holding to 2017…… …..

that having been said, i am confident of your turn levels….so we sit and wait, and watch……

Luri,

60 minute S&P chart, go to 11-4-16 bottom and bring your trend line up to touch 12-2-16 bottom through 12-21-16…

Only in extreme situations will that recover..

The drop i was looking for has satisfied its minimum downside.

i have no trades anymore.

the triangle i was looking at using all the index is similar

to the spx chart yet the spx chart allows for more downside.

im no longer looking lower.

the market may drop further yet in my view the next move short

term should be up in wave D

Tough call

daily close only spx should ideally close the day near

present levels . the B wave which should be broken

sits at 2254.24 is this is a triangle that level should break

yet the low at 2248.44 must hold .

daily spx is worth looking at . the recent high would only be

labeled as the B wave .

if its a triangle still forming the above applies .

C waves act like 3rd waves . so for me 2248 level is key .

the all index’s added though say this triangle form as i see it

is at wave C

the entire move is labeled A B C X a b the recent highs and were in

wave c , its the more complex diagram i posted the other day in this thread

diagram to consider

60 minute chart

http://imgur.com/d25bCSH

Joe,

I would implore you to look at the MacD on a daily S&P, Dow, Comp and Rut Chart.

Good Luck..

looks to me like this will last another week before completing

if the market actually does this then ill turn bullish near the end of dec

the 28-29th best guess , i need the weekend to go by before being able

to calculate it in the manner i am and my brain just isnt interested

in nailing the day right now .

mercury retro plus 10 days would be dec 29 ,

the old rule of thumb , so goes the first 5 days of jan so goes the month

of jan . so goes jan so goes the year .

i know its not a must but that is what people think .

http://imgur.com/5dnsG5G

Jody

Im viewing this next year as a blow type move .

im also taking the view that this market will have a 1999

type theme where money just goes into stocks and everyone

tunes out the fundamentals and everything just goes crazy .

common sense will go out the window and the market will just

go up and up and up despite valuations getting way way way

to high , this will feel just like real estate going into the 2005 top .

and then it ends badly . the wave count im watching for is a full

5 waves up and everything should be obvious at the top .

The decline will be brutal !

July August 2017 high of some sort .

Fully agree with you Joe. The blow off top will be spectacular. The bears will finally be put to rest. Their certainly will not be to many left at the final highs in the markets. Thanks again for all your insights.

Dave

Your welcome

im going to stop posting for the next several days .

i am thankful for peter to allow is site to post our thoughts

yet i don’t want to take away from his posts in anyway .

Peter has done a great job of navigating all the twists and turns

he was calling for a wave iv and i have dove tailed on that with this

triangle . My issue is the timing which is based on a lot of research

yet at the end of the day i completely agree with peter that we

are putting in a final high .

i have just allowed a year to year and a half before we see it .

how far prices go we really don’t know .

I have noticed this thread has died and i hope it is not because

of people blowing out their accounts .

for the record i rarely use options and while they do have there place

in trading they have an inherent loss built into them .

it hurts to be so right and yet so wrong if that makes sense .

Joe

I will stop posting also. Just for the record, I am not using options. I will eventually take one batch of my shorts and use options as we get closer to the end of the month thou. All the best.

http://www.zerohedge.com/news/2016-12-22/carl-icahn-concerned-about-lack-stock-selling-last-few-weeks

joe,

this is no year long blow off top! read this. Ichan has been appointed to Trump’s inner circle for advise. he is saying “bubbles from low interest rates”, he is saying “gov’t restrictions of borrowing money for companies to buy back stocks.”, he is saying “lets get the crash over with”…….. he is in the position now for markets to listen to him……they are aware that the fed has plans to drop the markets from a great height so that it is unable to recover……

:-))

If come News Years Eve S&P Closes above 2277 I would say 2500 is possible.. If it does not, there is zero possibility of that happening.. We have been on the wrong side of the trend line for too long now, but I guess that is what makes a market:)

We are grossly differed in opinion..

As a thanks (not sure how much it will be appreciated), I’m going to post my Trader’s Gold blog post this weekend in the free blog area, along with the usual video I do.

Thanks to everyone for sticking around and posting. I don’t think we have very long at all until this market gets really interesting. It’s really awful at the moment as it’s somewhat broken, low volume, and everything is more or less trying to move in tandem. But more on that on the weekend.

it will be very much appreciated…Merry Christmas!

And to you! Merry Xmas!

Joe and Dave, I enjoy your thoughts. Pls. continue posting. The holiday parties and prep keep us busy. Some of us have nothing new to add. Still seeking Andre’s hypo low on the 23rd. He says a test on the 29th. I’m not sure if he meant a retest of the 13th high or 23rd (maybe) low. John thinks differently so I’ll have to assess on the 27th, Tues at open and 11:30 EDT.

Peter, thank you so much! Have a wonderful Christmas everyone. ?

Peter

It’s always appreciated

Wishing you a merry Christmas 🙂

Little info for you : my parents came from Canada and all my cousins

Between bc , Prince Rupert ,and Ontario .

I would like to make it to kanora some time ( not sure I spelled correct )

My mom was born there in 1930

Me though as my uncle would say , I’m a yank lol

Liz , I’m not going anywhere I just have little to add on this market

I feel understanding the upside Potential is just as important

As understanding the downside .my posts of late were looking out

Longer term and I was brainstorming while posting which was just

My way of getting my ideas firmly in place .

Luri, I watched ichan’s interview and he used to be an aggressive trader .

He has been around and I respect what he says . That said, he says he’s

Hedged not selling out .

Dave, I’ve enjoyed our discussions , you trade shorter term than I do I think

Good luck

Merry Christmas everyone 🙂

Happy holidays etc…..

Joe

http://www.zerohedge.com/news/2016-12-22/federal-reserve-initiates-end-game-trump-heads-white-house

joe, et al, here is a good article. i have been following brandon smith for years, and his assertions have turned to fact. it is well worth reading, and that the upcoming “crash” will once again be ‘engineered”/rigged – and said ‘crash’ has been initiated.

:-)) be happy everyone…… and oh yes, i love homemade christmas ‘butter tarts” – “ahem”….[cough]…….. slurp….. yes…i looooooooooovvvvvveee THEM!!!

Merry Christmas to everybody. Been a bit quiet lately due to a research project. This is what it is about.

Gann said price is time. And with some turns (1982, 2011) we see that the price angle and the time angle are equal. But most of the time this isn’t the case.

Still, for every time angle we can find the matching price angle and visa versa. This gives us shadow dates and shadow prices. Every time/price combination with matching angles I call equilibrium points.

The key point is that timing with the shadow prices and shadow dates is really strong. But you won’t find this analysis anywhere as it is a lot of work to find these shadow angles. But I have found a technique to generate them automatically. So for any length of file I can add the shadow angles in minutes. And this is really important as we can now use these things in our analysis.

The shadow date on the SPX 8/15 high gives 12/21. And that was a high. The shadow date on the NYSE 4/27 high gives 12/26 and on the 5/19 low 1/20/17.

This leads me to think a major turn is close and 1/20 (the date has been mentioned before) will be a low.

The high so far was 12/13, the date I gave 2 weeks ago. I believe this is a very long term high.

Will supply more analysis over the long weekend but for next week I think 28/29 will bring capitulation. Arguments for this will come.

For now: enjoy the weekend.

Great work, much appreciated. I am still looking for a 1900 level low on the sp shortly. Within the next 3 weeks plus. Long shot I realize. Merry Christmas every one and may 2017 be the year for the BEARS to finally capture some great profit.

thanks Andre, Stay with us …nick

andre

good work , your thoughts are respected

luri

ill check it out .

Andre

I forget your april turn date .

I ask for different reasons than the stock market

yet im curious .

if you could post that date id be very appreciative

Joe

Next week Mercury moves between Sun and Earth (conjunction). Often this results in energy effects. Based on this I am looking for sell off in Dow next week with good likeliness.

Then, I am guessing Dow rises into the New Year by 5 to 7 % with peak towards end of January.

According to the 12/26/16 issue of Barron’s, “Historically, the last week of the year has been a nice gift to investors. Since 1928, the S&P 500 has gained 1.14 percentage points during the last five trading sessions of the year…well above the average 0.14 percentage point rise for all five-day periods.” Maybe the S&P 500’s wave 3 will finish by late next week, with the 4 down wave starting then or during the first week of the year.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.