There seem to be all kinds of theories floating around about the Rothschild family and a few other elite financiers who are believed have complete control over the media narrative through ownership. Well, that might be true, but I’m not finding the connection in my research.

I find that it’s a more natural economic phenomenon that wealth gradually gets concentrated in a few hands and that this happens right across the economy while at the same time, money gets “sucked out” of the economy. In other words, it’s like a blood sucker at work. If it sucks enough blood, it eventually kills the host; it destroys the very thing that’s keeping it alive in the first place. That’s what happening in slow motion.

But let’s look at the bigger picture, and that takes us back to the period just after the first world war.

At the time of the establishment of the Federal Reserve in the US (1913), the rest of the world was also undergoing a complete restructuring of the economic system, as a result of the first world war. Governments turned their attention to stabilized the financial system that had been so badly disrupted, and were forced to put an end to the gold standard as the basic for the world’s monetary system.

At the time of the establishment of the Federal Reserve in the US (1913), the rest of the world was also undergoing a complete restructuring of the economic system, as a result of the first world war. Governments turned their attention to stabilized the financial system that had been so badly disrupted, and were forced to put an end to the gold standard as the basic for the world’s monetary system.

The war had changed the position of the United States relative to the rest of the world. For example, it was now owed about $4 billion rather than owing $3 billion. Britain was on the reserve end of the stick, now owing about $13.5 billion rather than owed $18 billion.

There were additional factors in involved that helped create even more of an imbalance in payments between nations. As a result, trade and international currency valuations were being disrupted. A solution needed to be created to allow countries to be able to get back into some sort of financial balance.

Dr. Carroll Quigley* writes in his tome, “Tragedy and Hope,” that:

“… the powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank… sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.”

*Dr. Quigley is an American historian who had a great influence on Bill Clinton, as he had attended Quigley’s class as a freshman at Georgetown University.

He also writes:

“In January, 1924, Reginald McKenna, who have been Chancellor of the Exchequer in 1915 to 1916, as chairman of the board of the Midland Bank told its stockholders: “I am afraid the ordinary citizen will not like to be told that the banks can, and do, create money… and they who control the credit of the nation direct the policy of governments and hold in the hollow of their hands the destiny of the people.”

I’ve written about this before, of course, but this is a fairly succinct summary of the situation we face financially worldwide: debt slavery at the hands of a small group of elite bankers who so far, have been in almost complete control of what happens to any nation that crosses their path (and uses them as a creator of their nation’s money). The G7 nations all (except for Japan) have contracts to let the Bank of International Settlements create their money and charge them back interest for the favour, when each of these countries (as does Japan) could create their own money, with no attached charges.

This power to influence extends to the media. We can see this playing out in the US election. You would have to be dead not to see the obvious one-sidedness of the political reporting. It’s very much anti-Trump and pro-Clinton. Trump is anti-establishment, and Clinton (as Julian Assange most recently stated) is “the central cog of the establishment.”

Most news comes from either Reuters or the Associated Press. Reuters is a private company owned by a Canadian conglomerate, Thompson Corporation (Reuters was purchased in 2008 when it feel on hard times, due to the Great Recession). Associated Press is a multinational, non-profit news agency owned by its contributing media companies, so there’s no major financial influence in this case (in fact, any one company cannot own more that 15% of shares).

There are lots of conspiracy theories about both these key news sources being influenced by the Rothschild family, but I certainly can’t find a link. No matter, because the point is that two agencies channel the bulk of the news worldwide. There are very few independent investigative reporters anymore. The faltering economy has meant downsizing across all media and the highest paid were the first to go.

As per the graphic above, where there were once 50 independent media companies in the US, there are something like six. Wikipedia arguably has the most unbiased summary of the media ownership environment today.

The bottom line is that there are only two major sources of raw news. And there are very few distributors of that news in an economy that for a long time, has not been financially friendly to media companies. They’re selling out just to stay alive.

So let’s leave behind the idea that one or two people are controlling the narrative. I think the more likely scenario is that the competition between these media outlets is so intense that news stories are selected for their ability to titillate, excite, and therefore, draw viewership.

I’ve spent most of my life in commercial and corporate media and I’ve most often found this to be the case. We have a situation of media companies trying to stay alive by creating as much viewership as possible to attract more advertising dollars in return. That doesn’t necessarily support selecting stories either on importance or merit. In fact, it’s completely the opposite. You tend to take the most expedient route to delivering content.

The fact is that most media companies have a reduced ability to fund their own news gathering. What you have is an economic filtering system that results in a few major stories covered from two main sources.

Then there’s the required turn-around time, which is a matter of hours and often less. So we end up with “info-tainment” instead of news. Any perceived controversy ends up being the lead story, researched and verified, or not. The added competition from social media has watered down the potential audience even more.

We live in a world where whatever is adequate enough to do the job wins, and that’s the situation not only in media but throughout industry.

New cars are being recalled en masse, smart phones are blowing up, dishwashers have shorter and short life spans, air bags in cars simply don’t work as advertised. This is one of the key themes of major cycle tops: complexity. So much complexity exists in virtually all aspects of society that there’s an ever-increasing reduction in the benefit: The Law of Diminishing Returns.

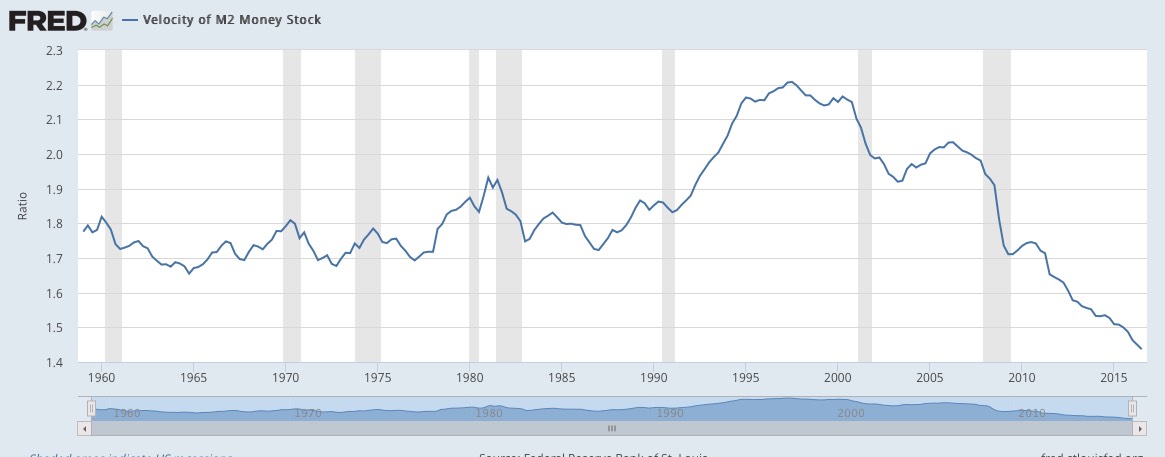

And that result, my friends, strangely enough, is a side effect of the reduction in the amount of money in the economy. The velocity of money has been dropping consistently (M2) since the late ’90s. That’s a measure of deflation. We’re in the early stages. Here’s the most recent chart from the Federal Reserve.

There is simply less money around to do the things we’re used to doing. That means cuts. Cuts to just about everything. Budgets get slashed, people get let go. It’s the beginning of a deflationary spiral.

So let me try to summarize this thread for today.

We have an international banking cartel in charge of the world economy. They create the money that each of the major economies use on a country-by-country basis and they charge compounding interest for this service. That interest pulls that same amount of money out of the economy (Canada for example, has paid this banking cartel over a trillion dollars in recent years). The money comes out of the economy because that interest is paid for by income taxes. Those taxes end up going out of the country to these European bankers.

Therefore, there’s less money in the economy, which over time, begins to deflate.

Only one of the industries that’s affected is the media. Concentration becomes reduced to a smaller group of players … the elite, or establishment, whatever you want to call them.

But it doesn’t stop there. The Bilderburg Group is made up of 120-140 powerful people who meet annually to discuss policy. They’re connected to just about everything on Earth. Here’s a chart showing their influence:

Chart of Bilderburg Group’s influence.

You don’t need to be a conspiracy theorist to see that the money lenders are back in control; the one percent is in charge of the economy internationally. Money and influence are concentrated in but a few at the very top. But this is the same story that gets told every 500 years, as I’ve posted before.

We’re seeing it play out most dramatically in the US election. But this revolution in power, money, and media is actually starting to take place all over the world. The establishment in democratic countries around the world is starting to lose its power. In some countries, of course, the reverse is happening—power is tightening up—there is a move to totalitarianism.

So thank goodness, in a way, for natural cycles, because they tend to exacerbate the situation and eventually bring a crash and a complete reset.

You simply can’t beat Mother Nature.

Trunews

I have another interview coming up on Trunews on November 11, 2016.

____________________________

Shuffle One Wave to the Right

They say first intuition is usually right. I should remember that!

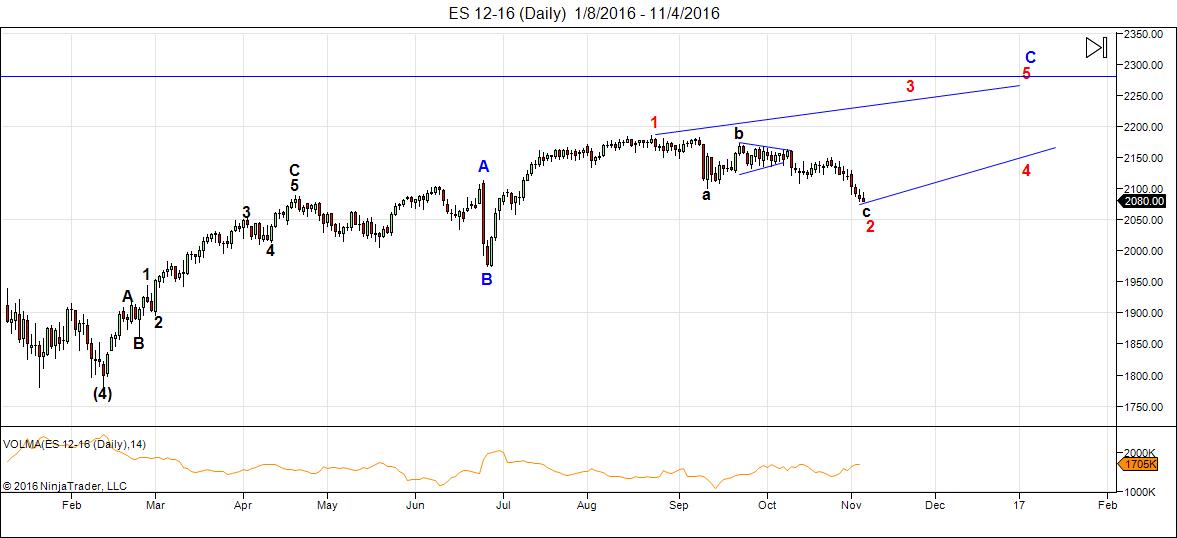

Originally, I had pegged the ending diagonal as being much smaller and the configuration I’m now forced to turn back to. But, once we have the turn up on Monday (that’s what I’m projecting), the rest of the ending diagonal is much more certain that it has been to this point.

My Original Ending Diagonal Projection (August 23, 2016)

Above is the daily ES projection from August 23, 2016. I should have stuck with this projection as this is exactly what appears to be playing out, except that wave 2 has not dropped as far as my original projection allowed for. There’s no way to know how far down it will drop. Once it does though, the lower range of the ending diagonal is in place.

_______________________

That was a little over 2 months ago. I changed my tune slightly and went with a version of the ending diagonal that put us in the fourth wave. That worked out just fine, until Friday, when we went just a bit too low for the wave we were in to be wave 4. So … back to the alternate. This wave down is most definitely wave 2 of the ending diagonal.

We simply shuffle our wave designations one to the right, but everything else remains the same. We’re now entering wave 3 (it should move up quite quickly). It has to get to a new high above the previous high and it has to trace out that distance in three waves. Then we’ll have a small fourth and a final fifth up to the top.

I’m now projecting a top at the end of the year or into early January.

Above is the daily chart of ES (emini SPX futures) with an updated projection for the ending diagonal.

USD currencies have turned up. The markets around the world (as I’ve been saying since September of 2015) are getting more and more closely aligned. We have an international “market convoy” for the first time in history. It’s not good news for bulls.

There is one final pattern that still has play out to put an end to the decadent party we’ve been experiencing for the past century or so. Elliott waves are the micro harbinger of the future. The turn will occur only when the last waves have found the top tick, when the mood of the masses have turned more negative than positive. That time is almost at hand.

Summary: We are completing the second wave of the ending diagonal before zigzagging to the top of the largest bubble in history. The long awaited bear market is getting closer.

Let’s look at a recent projection from the Trader’s Gold service.

Above is the daily chart of EURUSD. I had predicted a turn up in the euro was imminent on October 24. The euro has now turned as predicted and is heading up to finish the final E wave of the triangle.

___________________________

Sign up for: The Chart Show

Thursday, November 10 at Noon EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, and major USD currency pairs.

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, and major USD currency pairs.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

If EW 2 retraces 50-62% of EW1 just curious how your EW2 call fits when it has not even retraced .382 yet?

Great article as always! Thank you.

It’s an ending diagonal. A 62% retrace level doesn’t apply.

Hi Peter, I thought Bulkowski’s ending diagonal structure allowed for the wave 4 overlap of wave 1? Couldn’t that mean wave 4 is now complete (or almost complete)?

I don’t know what a Bulkowski is. The trendlines in SPX are no longer converging and so this wave down cannot be a fourth wave.

Today is Nov 7th , 1 day before the election and the key turn date

based on the mars Uranus pair . today as a high points to nov 14th

as a panicky low yet the bearish cycle still points lower into jan 20th .

staying bearish and looking at today as a Gift .

the 17700 level is now key support , Today Nov 7th ill add is the seasonal

low historically with a trend that runs from nov 7th to jan 16th .

that is the seasonal bias which is bullish .

this year despite today’s strong run up im looking for this market to turn

right back down.

the proof in the pudding will be shown come tomorrow and Wednesday .

Joe

My understanding of ending diagonals

are 3 wave moves with in each wave

wave 4 overlaps wave 1

each wave becomes weaker and weaker .

i am pretty sure this agrees with peter yet i wont speak for him .

Joe

Joe,

Not necessarily weaker, but shorter.

Joe, Your “looking at today as a gift” were my thoughts exactly.. I normally do not hold over night but the set up is just to good to resist.

2128 I started loading up short and if we continue higher I will add more. S&P 2134 just above is my stop – I will be neutral IF we get that high..

Just can’t get my head around a 2 wave that has not even traveled .382% of wave 1..

In line with Jody ‘s and Joe’s thinking with 30 minutes left in the trading day as I post this is a simple trendline on a closing price chart of SPX. Line is drawn through the closes of 11-3-15 and 6-8-16. The move up on 6-23 stopped just below the line. Line was broken above on 7-8 but after a continuation rally into 8-15 high, the line stopped the declines on 9-9 and 9-14 and 10-17. It held again temporarily on 10-28 and 10-31 (Friday-Monday), then convincingly broke below to the 11-4 low last week. Today’s rally could be a one-day wonder if the line rules again. Today the line is at 21215.85. As I post this with 30 minutes left in the trading day, the SPX is at 2125.87!!!

Extra digit on my “Today the line is at…” should, of course, be 2125.85

For my money, I’m looking for a deep ‘down’ towards DJIA 18070….but then a high towards 18500 or just lower. I ‘think’ that fits in with andre’s time pattern as well.

Ms H and Mr T are going to make things difficult for us poor traders for a couple of days. I’m on the side lines watching the show from ‘afar’….laughing, growling and sobbing in my whiskey glass in turn. Ugh that does sound distasteful . I’ll have to start with a fresh drink now.

Thanks Peter G, the closing price chart is an interesting concept and one I utilise and respect. Will watch your SPX trend line with interest as still resistance courtesy of the Sept and Oct lows, plus I’m currently still a bull at heart (though an extremely docile one whilst Mr Trump remains in the arena).

Appears the majority here are sold on bearish outcome and not surprising considering we are almost 90 days from ATH’s. I still hold massive respect for the 2000 (~666 times 3) price level vibration and also 2092 (SPX 666 low times pi).

On 3/4/16 my ephemeris lit up like a Christmas tree with many planetary aspects taking place, an important date to be respected with a SPX closing price of 1999 (1+9+9+9=28=10=1= a new start). FYI, was also 288 days (2 x 144) from previous ATH in May 2015 (also big planetary aspects).

Using an SPX closing chart, anchor Andrew’s Pitchfork from 3/4/16 into April high and June low for a bullish channel. Not perfect but the market only allows good. I’m still on bullish channel and Mr Temple’s wagon whilst the wheels are turning. Btw, note closing price for the June low ….2000 : )

Andre’,

So perhaps Monday is a “one day wonder”! Maybe Trump wins and then down into 11/11 for a low. Followed by a rally into 11/18 (perhaps 11/21) and then down into December 7th for a low. Then a Christmas rally into 12/30.

Then down into 3/27/2017 low! This is my interpretation of what you have said.

Your interpretation is correct, The low in 2017 could shift a bit into early april,

Hello andré,

Are we possibly seeing an inversion? What’s your current view? TIA

My view remains that we will go up into 11/18. That makes this week a w4. I see 2 trends one up and one down. Delta timing gives a low 11/11. But the tides were up. That is why markets are a bit erratic. After 11/18 it all will be much clearer. I think.

Thank you!

Can anyone add anything to that? Or correct anything I have said!

#China exports slump 7.3% in October, imports drop 1.4%

Andre,

I think once again you are spot on.

I also think no matter which way the election goes tonight the market sells off.

We got the Clinton relief rally yesterday. Her win is baked in now.

Back to Economics and chart reading once gain.

Harvey

I have backed my stop loss up from 2134 to 2150 after reviewing the charts a little closer.. If S&P can get above that target and Close above 2150 I will look to the long side of the market and scale out of my shorts.. I will however be shocked if it does but we have to trade what we see not what we think.. Good Luck everyone!! GoTrump:)

am seeing we are in resumption of Primary V, not due to make the final high until week of March 13 2017, in ending diagonal as Peter showed. The game is up above the 2160 level, that’s where the battle for the high will go on

Well… VXX putting in a tweezer bottom on the 60 min chart and SPX has dropped back below TS1.. Hmmmm.. Reversal?? We will see.. Well maybe not today the market likes to leave us hanging..

The SPX hits the combined resistance of the 50 and 100 day simple moving average at the high of the day as well.

Just saw that Ted.. Good spot.

So we look at the rules of EW for direction and they say W1 over balances the last wave.

So last SPX swing high 2154.79 pivot low 2083.79

Those are the lines in the sand.. If we start taking out 2154.79 it will give merit to W3 and if we break below 2083.79 at very least a W3 has not started, and i will double down on my short position and cover @ 2036..

Targets are

2036 T1

1991 T2

1880ish T3

Valley,

whats your PALS SYSTEM telling us

Bill

Hi Bill,

Phase: bearish all week post New Moon

Distance: bullish all week, post Apogee

Declination: bullish all week, post South declination

Seasonals: very bullish, pre holidays, November typically rallies

Summary: mostly bullish factors, all of which continue into next week.

Earlier in the week I showed a 5 wave down on the DJIA. The ‘problem’ with that wave count was the ‘tiny’ drop in the 5th wave below the 3rd.

So what I’m looking at now is the possibility of a 3rd of a 3rd.

The waves from the 15th Aug high to the 12 Sept low are 1,2, i and todays up wave a ii flat completing. If so we are going to see a very strong iii down of 3. People will say it was triggered by the election but I think it would have happened anyway.

Viva la Elliott Wave!! LOL!!

Oops ‘earlier in the week’ should read : ‘late last week’.

Haha, my 3rd of a 3rd turned out be a ‘C’ wave. Given today’s action I think we are headed towards new ATHs which will resolve into the ED.

Of course until it goes past 18450 on the DJIA there is the slim chance that we are going to see a 3rd of a 3rd of a 3rd……I’ve not been lucky enough to experience that in real time. Any way I’ll stay short until we break 18450 to the upside.

A man’s got to dream a little!! LOL

Let’s hope you are right purvez! 😉

Cheers,

W

Yeah me too Whazzup. Got some ‘stuff’ riding on that.

I should say that I have a very low tolerance for losing positions so my ‘stop loss’ for my current ‘stuff’ is 18400. However in terms of my ‘absolute’ wave count being wrong the stop loss would be at 18550……………the start point of my, i (lower case roman numeral one), count.

the cycles dominate the trend

the elections are just the trigger .

swing low should be Nov 14th .

the market is following the cycles darn near perfectly .

Nov 14 is a double time line , moon cycles and mars Uranus pair

we have not yet seen the panic portion .

when is mercury retrograde ?

Jan 20th stands as my swing low date

Andre your later dates I’m aware of and respect

yet Jan 20th is where my end date is , March 2 a possible low

which is the mars Uranus conjunction yet historically the panic low is before that conjunction .

following Jan 20 we should see new all time highs .

let the games begin 🙂

Joe

You are spot on again Joe, mercurius retograde December 19 till 31.

Thanks..

Google search Olga Morales

astrology for Gann traders

she wrote up something on this up coming super moon

in regards to both trump and Hillary .

it’s over my head yet worth a look .

Will trump be alive ?

who knows

This is an interesting link about history and humanity:

https://medium.com/@theonlytoby/history-tells-us-what-will-happen-next-with-brexit-trump-a3fefd154714#.hf7gkcpbo

Great read, thank you.

This guy seemed to be implying Trump is a demagogue like Hitler, Mao, Stalin, etc. How about the other side of the coin, George Washington led us to freedom, Abraham Lincoln led us to the elimination of slavery, and Roosevelt led the world from the horrors he implies Trump is – Hitler and Japan. Somebody will lead us from the corruption and inequity causing so many problems today. Exactly what Peter is calling for. The 4th Turning is the tour de force concerning these matters.

Wow!! a 1700 point round trip on the DJIA courtesy of the US elections. I wish someone had told me that yesterday!! All I made from that trip was a lousy 95 points. I was ‘asleep’ at the wheel for most of that time though.

Still 95 points is nearly DOUBLE my DRA (daily recommended allowance). So I’m not complaining.

Clearly this schizophrenic market loves to ‘hate’ & then ‘love’ the election result.

I am now SOOOO looking forward to shorting this thing to wherever and back. Not today though . Got to give the Donald some time to rest first before he opens his mouth and upsets the world.

Anytime your up big in the pre-market it is always best to cash out and then give it an hour to shake out, so I was happy with my first target I mentioned yesterday being met.

This uptrend does have me looking at all options before I officially say I am bullish.

One thing I had mentioned a month back or so was when in a rising wedge once you get the break of the trend-line watch for it to come back and check the underneath side of the bottom uptrend line before it starts to head back down, the reverse is the same for a falling wedge.

If you have been eyeballing the rising wedge from Feb low connecting the Brexit low we have broken that line and now just a few points (2172) from touching the underside. So I will be looking short again with a tight stop above 2176. Above 2176 would turn my market sentiment.

That should be it for upside.. If we continue higher tomorrow i will abandon all bearish sentiments.. If we start heading down a break of 2083 would lead me to believe we are in a W3 to the downside..

I see this as the A wave of wave 3 of the ending diagonal. My target for wave A is 2186. I am getting this from both the 1.618 extension from the bottom last week of 2083 to Tuesdays high of 2147 and from the 1.618 extension of today’s low of 2125 to the high around 11 a.m. of 2163.43 i will follow up with a chart.

http://invst.ly/2qa29

I can slo seeing wave A have completed already as the wave v is about the same size of wave i of this c of A.

“peep”…… just in case no one heard a peep from me in a while! was “getting out ” the trump vote!!!! oh yeah!

http://invst.ly/2qag4

The comments here really confuses me. Before some people said the market would go down and now some people said it will keep going up. I really don’t know what happened and what will happen. Who can help me?

Above 2176 look to go long. However today touched the underside of the triangle so if it’s going to turn down it will start tomorrow. In my opinion, not trading advise..

Jas-

That is why the cliche is do you own analysis exists, as everyone has different opinions. Personally I use Peter’s count to help set the larger frame work and then use short term technicals to determine when waves within that structure are coming to an end. For example i got long last Thursday as the RSI was getting very oversold and we had our third day in a row under a bollinger band. we had one more down day on Friday so i was early.

On the other hand Jody was still bearish at that point. From last thursday to yesterday there points in time where i looked right (Monday Tuesday) and when Jody looked right (Overnight Tuesday to Wednesday Morning). Sounds Jody covered for a gain early wednesday morning, i covered my long later Wednesday afternoon for a gain. Completely different analysis and completely different trade decision but positive outcomes for both of us.

From my reading on this website everyone is bearish from a long term point of view (myself included), but there is disagreement on when the top has already or will occur. To me the top has not happened yet. I am assuming this that we have a new all time high, a wave 4 and then a final all time high as peter suggests. I am certainly going to be looking for a solid motive wave move down after the next all time high (luri’s chart), but including seasonals and i am hesitant to think we see it, so i am not expecting the bull to end until late december.

That is my thought process, hopefully that is helpful.

To piggy back on that.. I do not like to hold over night so when I get a big gap over night I want to capture that profit asap so I cash pre-market and wait for the first 30 min candle to print and trade off the highs and lows of the candle stick.

If we start to break above that candle stick I go long and will put a stop at the 50% mark of that first candle and do the opposite if it starts to break the low. Some folk us the 5min candle and that works too I just like to give it a little room to breathe..

Update for today is – although 2176 was taken out S&P was quickly slapped down so I still am not quite ready to call a long. Today’s close will give some clues – Below 2150 the case to be bearish will improve and a close above 2176 I will have to be bullish but the rising wedge support was broken and we have now come back to check that trend line and are now heading lower so we shall see – but that is the method to determine a trend change with a nasty reversal to come.. Good Luck everyone!

jody,

you are a classic day trader.

I prefer Chart Technician.. 😀

Ted, thank you! Good trade!

who wants to take this? i am looking at the dow futures……

2 day time period in dow – 1406 dow points straight up? ….”2″ days?? WTF? price exhaustion type price thrust? volatile much?

http://invst.ly/2qlaj

Dow looks to be reversing right now..

15min Rising Wedge just broke.. W5 usually gets crazy right before it reverses.. UVXY is positive with Dow up 250.. Something weird is happening..

weird – as in “ha-ha”??, ……..or weird – as in “who let one go in this elevator – come on people – [really], this is such a small elevator”?

jody – i agree something “smells” rotten in the kingdom of denmark. it looks to me as price thrusting [of the ‘exhaustion’ variety.]

jody,

when carl ichan admitted he put 1 billion into the markets as they went limit down on election count tuesday night – i knew something was “up”.!

he is a close friend of trump – and for him to advertise his move as BTFD opportunity, meant Ichan wanted to initiate a short squeeze for the “optics” of the Trump markets, as well i figure he has been selling into the price thrust…..

Ichan was saying just 2 months back he was short and there was going to be a day of reckoning in the market.. All we can really believe is the price action in front of us.. What was odd about today was how Dow was up 260 at one point and S&P flat and Comp down 60 with the VIX up around 2pm.

This is why I look to the VIX (UVXY and SVXY) for clues and today it said we are going to head down tomorrow. It could be wrong but there was something very off today.. I don’t think I have ever seen such a big diversion in the indices..

Given that my last count was SO RIGHT….AND EVEN MORE SO WRONG here’s my latest:

I think the DJIA [at least…(I haven’t looked at others as I only trade the DJIA)] is trying to complete an Ending Diagonal. I have a small down wave yet to come and then a final up wave. As I write the DJIA is at 18856ish.

Please remember that I look at ALL the waves including the ones that are outside trading hours.

I should clarify that I’m expecting my ‘small’ down wave to be more than a 100 points…..that is small for the DJIA, isn’t it?

Hi purvez,

Is that your final high?

Do you have a chart with what you expect after the high?

Thanks.

John.

Hi John,

It will need to wait till tomorrow before I can post a chart.

No sorry its not the final wave high. I was just referring to the sub-waves.

I think a number of other people have suggested that this may well be the ‘A’ wave of wave 3 of the ED that Peter has been suggesting. I’ll take a closer look tomorrow before making my final decision.

purvez,

ahhh…its “tomorrow” – and no chart? did you get ‘sloshed” last night? huh? did you?

Speaking in my most officially capable tone, “you are SOOoooo grounded right now!! now get to your room – PRONTO!”

Luri if you tell me which direction my room is then I’ll go. Right now I’m safer on the sofa with the bottle of wine.

John I was referring to the ‘up’ wave since the overnight knee-jerk reaction low on the DJIA following the election. Here is my count for it:

https://postimg.org/image/pwohb2hd5/

Looking at it like this it seems highly improbable that we’ll go as high as the i-iii line is suggesting for the v the wave. But these are strange times!!

I think it is simply wave ‘a’ of 3 of the Ending Diagonal that Peter has been guiding us through.

Apologies for the delay in getting this out but I had some ‘unscheduled’ errands to run.

Thank you

These are strange times indeed… blow off top I think.

This looks like a B wave to me so far. Downside targets that i have are ~2144 and 2132 on SPX. With Andre’s suspected low for today, I am looking for a sell off to pick up sometime within the next hour or so. Not sure if we have a bounce today or just GAP up next monday.

Good Luck

“The supermoon (perigee full moon) on November 14, 2016, will bring the moon closer to Earth than it has been since January 26, 1948.” http://earthsky.org/?p=245367

The Teigin robbery & mass murder happened on that day. Four days later, Mahatma Gandhi was assassinated. Any negative vibrations for the 14th to maybe the 22nd? Last year, Nov 16th was a pivot low.

Hmmm that is interesting info LizH. We’ll wait in anticipation over the next few days.

Yeah, really interesting. I went into stockcharts.com and posted the chart for November, 1948 here: https://worldcyclesinstitute.com/forum/astro-and-cycle-turns/moon-in-1948-and-affect-on-dow/#p170

“The (previous) biggest surprise…1948 U.S. presidential election”

https://twitter.com/sentimentrader/status/796247792058593280

https://twitter.com/platypusfoot/status/797088920051687425

“Nov 17 potentially disastrous…”

Just wanted to put a plug in here for Peter’s chart show. I attended it yesterday and found it to be very helpful to me in identifying the potential tops and bottoms of a variety of asset classes, and which investment opportunities offered the greatest risk/reward. I made a couple new investments this morning in long only and inverse ETFs, and feel more confident in them than I otherwise would have. Thanks, Peter. I look forward to attending more of the shows.

Thanks, Oz! Much appreciated. 🙂

social mood is definately turning negative

ice forming off of Siberia is worth a look .

I admit I’m wrong yet forutunately I was concerned about

loss of internet while at sea and no money lost .

Dec 19 th the vote in the electoral college .

I’m not making any market forecasts other than

to note my errors .

Oct 24 th a diecast high , Nov 7 th a forecast high which

was supposed to be lower than the Oct 24 high .

I was wrong .

in 2006 the mars Uranus cycle failed and the market went higher

into the late 2007 top .

this time around all I can say is we had an oversold condition

which resolved with the market going to new highs .

Peters wave counts have been on track and his insights

have proven to be extremely valuable .

global cooling is proving itself to be true

social mood is turning more negative .

this will not turn out well

Joe

As I said last week; we had 2 different trends. The tides gave up inti 11 and delta gave a high 9 and a low 11.

Big picture : next weekend will be the big one. 11/18 very strong but I see a cluster of strong dates from 17 til 21. Most likely 17 will cause an inversion for a jump into 21. We will see a low on Monday 14 (high in the weekend) and then a high on Wednesday. Then a low Thursday a high Friday, a low in the weekend and the final high Monday post opex.

11/18 we have the sun 45 degrees on the mars/saturn midpoint. This is the same as 12/25/15, Then we saw a steep decline into 1/20 and another low 2/11,

After next weekend it wil be down into 12/6 with 25 low, 29 high. Still think the trend is down into april 2017. 12/30-31 will be a high but I would expect a lower high.

But for now we are up into next weekend with a consolidating up/down/up market.

May tomorrow some reasons for my expectations.

Thank you so much. Hope to sell high Monday morning.

Here’s my interview on TruNews from Friday, November 11, 2016: http://www.trunews.com/listen/11-11-16-peter-temple-america-under-new-management

peter,

you mean to tell me that they have “modern” communications up there in “Igloo” land of the arctic circle of Calgary?? and “wi – fii”….. pronounced [whuh EYE – ph EYE].

will surprises never cease!……. i was just reading in the READERS DIGEST that only last year you there up “north arctic – global cooling ville” got rid of your last calgary based “horse and buggy” repair shop!!

….excellent interview with Rick Wiles @ TruNews! :-))

luri,

Not quite correct. Our main mode of transportation is indeed horse and buggy, but this is oil country, so we just pour some of that black stuff in the rear end of our horsies and they go way faster. They also wear out faster and at the end of their lives, we grind them down into gloo to keep our Igs from falling apart. The chicks up here (who lay the Igs) need extra help to “keep it together” and not get frigid. As you likely know, we’re very green-conscious up here, so we like to put every bit of what we find under the snow and ice to good use.

btw, it’s pronounced … “whuh EYE—ph EYE, whuh EH?”

Tks for the kind word on the interview … EH?

ok -hahahaa – that was funny!!! lol!

DJ daily is completely out of bolls last Friday around 4 standard deviations – absolutely unsustainable.

means to watch for reversion to the mean!

i agree. the price thrust looks ‘exhaustive’…

the present bear cycles

planatary cycles better put are correlating much better

with this election and it’s aftermath than the stock market .

the rise in protesting should continue into the Jan 20 th end point

of the cycle .

what has happened

the democrat party has collapsed ( they lost power )

global cooling is excellerating

social mood has turned down .

following Jan 20 th

we should see acceptance of whoever becomes president ( trump included )

social mood should improve

the lies, propaganda of the media should become better known

the old line of well if it’s on the internet you shouldn’t trust it

Will probably be viewed as ,oh you saw that in tv ? it must be a lie

and the internet will become our source of truth ( more trusted then the media anyways )

next year in my opinion would be a 2nd wave up in terms of social mood

yet once the cycle peaks in late 2017-mid 2018 social mood will turn down violently as all of this corruption in government and the quest for power by the purple democrats comes back in full force .

( anyone notice the matching purple bill and Hillary were wearing ?)

red and blue brings purple ( funded by Soros )

this last fight for power in 2018 ? blows everything up and the economy

and stick market with it .

I continue to stand by my late 2017-mid 2018 stock market peak .

that said Jan 20 th 2017 is the cycle low which most likely will show up in social mood more so than stocks ( it just isn’t correlating very well to stocks )

Dec 19 is the electoral college vote , with a down cycle my take is

trump is put into office if he is alive yet the real take is social mood continues to fall .

this is the establishment crashing and yet fighting with everything they have to stay in power .

Joe

good interview Peter 🙂

A new post for the weekend is live now: https://worldcyclesinstitute.com/events-dont-move-the-market/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.