Ralph Nelson Elliott’s Work

Ralph Nelson Elliott’s Work

Ralph Elliott’s ground-breaking book, Nature’s Law — The Secret of the Universe, was published on June 10, 1946. He died less than two years later, on January 15, 1948. He has been in ill health for over twenty years, an affliction that struck a couple of years before the 1929 stock market crash.

In 1932, having lost a large amount of his own money in the crash, at the age of 64, he was forced to turn to a new profession; he became intensely interested in the stock market.

What’s remarkable about his work is that he undertook it without computers and, in fact, had to invent his own ruler, called a “proportional divider,” the fulcrum of which could be moved to measure a 61.8% (the fibonacci “golden mean”) wavelength at various degrees of trend (as the market traces out the same patterns over and over again in a fractal manner).

Even at this early stage, Elliott was able to predict market moves with astounding accuracy and became somewhat of a sensation among a relatively small contingent of wall street brokers, most notably Charles Collins and Hamilton Bolton. Both had written books on various aspects of the stock market during the 1930s.

It takes some time to get comfortable with the quite unbelievable accuracy of this method in determining market moves. It took me about five years to master (I’m continually finding new subtleties within it), which included an intense study of the market during that period (over 20,000 hours). It has taken a bit longer to feel totally comfortable with its reliability; it takes time to buy into the fact that it simply never fails to follow Elliott’s rules.

If it fails for some reason, it’s the analyst who’s at fault, in my experience. Typically, the analyst allows some level of bias to get into their analysis and this results often in missing key measurements, or simply not delving deeply enough into the wave pattern.

In my work, I’ve discovered errors in the Elliott Wave Principle book and refined some of the rules, discounted others, to develop a system that seems to me to be almost infallible. The small number of errors I make have always been due to my own lack of discipline.

The Elliott Wave Principle has proven to me to be astounding in its accuracy and reliability.

Impulsive (Motive) Waves are Quite Rare

Thanks to the work of Ralph Nelson Elliott in figuring out how the market moves, we know that ending waves are always in five waves. Final waves of a trend can either be a motive five pattern, an ending diagonal, or a triangle of five waves. Those are the only choices; the final wave must be a fifth wave and it must consist of five sub-waves.

The other place to find them, of course, is in a trending market. At the present time, we’re in a countertrend wave (a fourth wave). Trending waves in a five wave pattern are waves 1, 3, and 5.

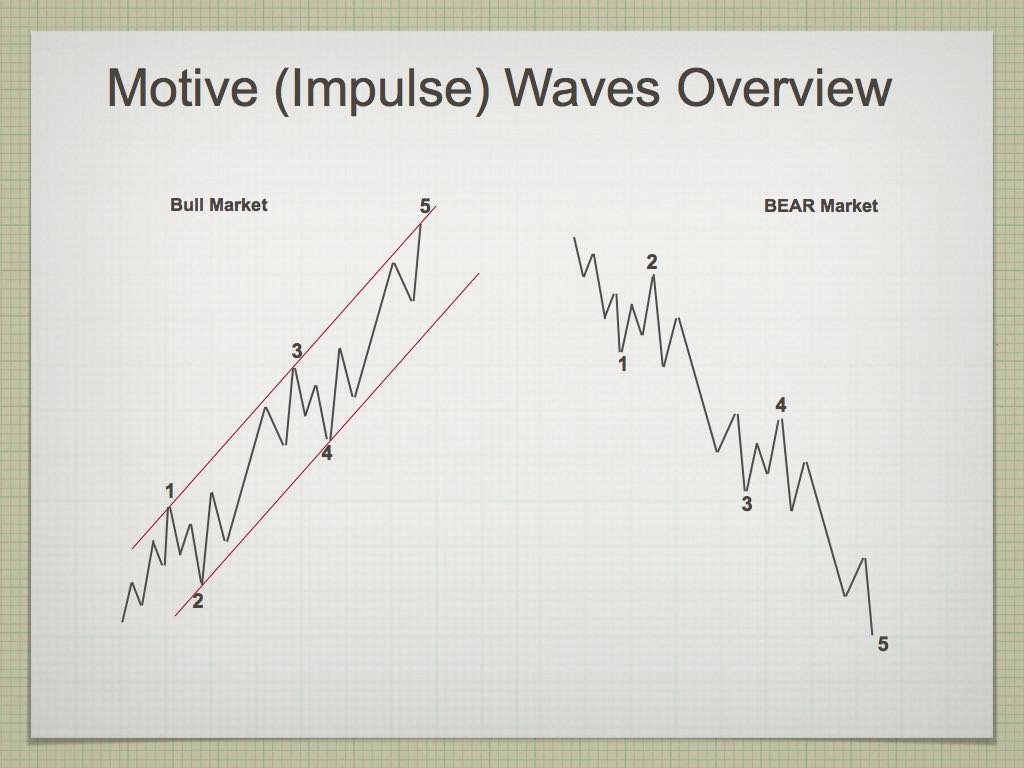

So, impulsive (motive) waves are unique patterns that are actually quite rare. While instances of these waves on occasion can look quite different than what you might expect, they must conform to a specific set of rules:

- (X) An impulse always subdivides into five waves.

- (X) Wave 1 always subdivides into an impulse.

- (X) Wave 3 always subdivides into an impulse.

- (X) Wave 5 always subdivides into an impulse, or a diagonal triangle.

- Wave 2 always subdivides into a zigzag, flat, or combination.

- Wave 4 always subdivides into a zigzag, flat, triangle, or combination.

- Wave 2 never moves beyond the start of wave 1.

- Wave 3 always moves beyond the end of wave 1.

- Wave 3 is never the shortest wave.

- Wave 4 never moves beyond the end of wave 1.

- Never are waves 1, 3, and 5 all extended.

These rules cannot be broken. If you were to analyze the current wave up from Dec. 26, you’d find it breaks the first four rules, which are arguably, the most important.

As a final fifth wave must be in five waves, this cannot be that wave, nor can it be the first wave of a five wave pattern. It is clearly a corrective wave.

Below is a visual representation of a five wave motive pattern.

What’s as important as the actual “count” (five waves) is the look and measurement of the underlying wave structure.

Corrective waves (waves 2 and 4) must be balanced in terms of size, and all waves must conform to specific fibonacci-based wave lengths, in order to meat the “impulsive” wave test. What’s referred to as “the right look” is often ignored by many analysts, and the specifics on wave measurement are for the most part, undocumented:

- Wave 1 is measured as a length of one unit. Based upon this measurement, wave 3 will be either 1.618 or 2.618 times the wave 1 length. Wave 5 is usually 1.618 times wave 1 but, occasionally, can extend to 2.618 times wave 1.

- Wave 2 must retrace 62% of wave 1 and wave 4 must retrace 38% of the combined length of waves 1 through 3.

The current wave up from Dec. 26 doesn’t even come close to meeting these requirements.

So, when I continually run up against the skepticism that this system can’t possible work, I “get it.” Most people aren’t willing to put in the work to master this method of forecasting the market. Those who do know that’s it’s the most accurate method known. It’s very simply how the market moves.

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

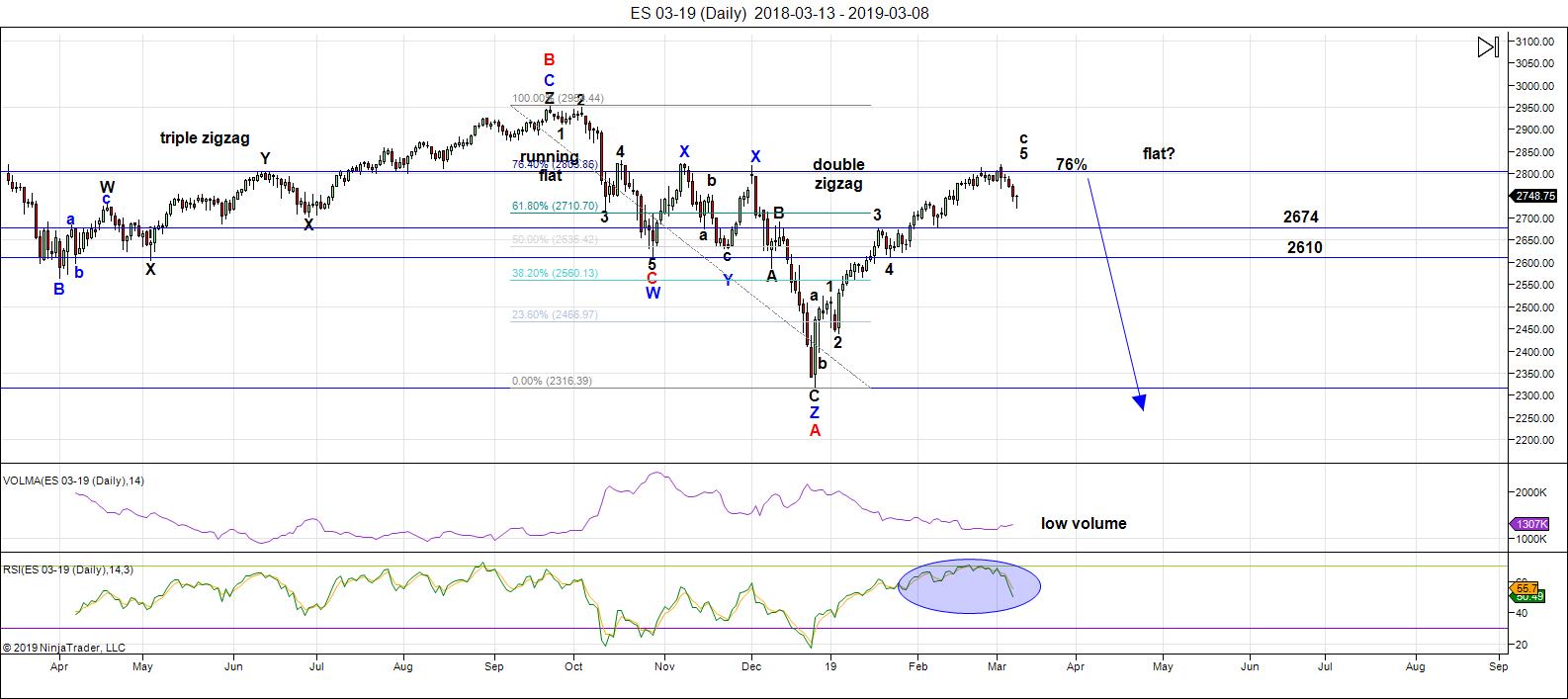

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We're still sitting near the top of a B wave that's risen to about the 76% level of the height of the previous set of waves down from the all-time high on October 3, 2018. Almost all the other assets I cover on a daily basis are hovering at inflection points. The "greed factor" is at near an extreme; volume is at a low. It's past time to look for a turn down in a continuation of the larger fourth wave.

This week, we tracked a small fourth wave downturn that took the entire week, kicked off by a three wave move to the downside. The current move is not quite finished but I expect it to be on Monday morning. If we get a substantial move below 2717, something else may be happening.

Expect a move up from there to the previous high (around 2820) before the long-awaited turn down. The 76% usually contains a large corrective rally.

Because this "fourth wave" down took a week to play out, I'd expect this fifth wave up to take the same period of time. As a result, I'd be looking for a high either on Friday of this coming week, or the following Monday.

As I've been saying, the wave up from Dec. 26 is clearly corrective and, as a result, must fully retrace. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

Summary: My preference is for a dramatic drop in a C wave to a new low that should begin this week. The culmination of this drop should mark the bottom of large fourth wave in progress since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 20 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

I am going to call out around April 29th as a turn date on TLT..so that should be the low.116..per Peter..TBT high .which would make sense for a turn of indicies to fall before

and my next turn major turn date I have is Jan 7, 2020.. so would be high of TLT which seems to be very inline with the forecasted EW moves..these are things I play with and found a pattern..more to watch and see if plays out..still watching to see if this pattern holds.

Marie:

Jan.7 2020 matches another analysis I am following, that is a “low” am I correct? would that be a low which will lower than the April 29 th ?

May I know where do you get those turn date from?

Thanks

Made 25% on my 2810 puts this am..too choppy for another go..waiting on my trusty indicators for new entry.

Lol!

Sitting on my hands, and waiting for Mr. Market to show his. Will complete exit from short puts on any close below 2800.

Will widen and re-deploy full spread on any close above 2820. Happy to enjoy premium decay while I wait!

Yep..i made 25% in the one trade & stayed awy. No conviction in either directo today..sometimes better to sit on ur hands then give them landlubbers any hard earned loot.

IWM chart is spot on ..those energy charts so far…crazy…

Truly Amazing!

Sure looking like we head higher….

Scratchin me head..how r u using the energy chart for success? Its interestin but havent figured a way to make loot with it..

Sideways action pointing to at least one more push higher.

Banksters definitely defending SPY 2800 and DJIA 25,700 ahead of OpEx/ Triple Witching.

Rolling up SPY bull put credit spreads a few strikes to 278/279.

Now watch them gap it down past 2800 and blow me out of the water…Lol!

Have great week-end all!

Today was eat ur lunch day..prem sellers gobbled up turkey all day from da bulls & da bears!

Yes they did. They are keeping price pinned in a narrow range ahead of OpEx to ensure contracts expire worthless. There will be a lot of volatility tomorrow to further muddy the waters, The energy chart is remarkable simple. The energy wave tracks price action up and down by specified dates.

A good strategy on OpEx is to sell 2 std deviation out of the money bull and bear spreads on expiration day and rake in the loot as the market makers whipsaw the trading pleebs….it really is way to funny to see how they do this every single time!

Verne, I’m curious how you can make money using this method. On my trade tab most indexes show near zero premium at two deviations from strike price? Do you go out a couple weeks to accompish this?

I forgot to point out that Tom said the amplitude of his energy chart waves can sometimes be inversely correlated with those of the market. I completely agree with his view that when that occurs it is not fortuitous….

Boo yeh..up..up she goes!

Anyone played the BA calls? I was looking at the 380 calls around 11 am since BA seemed to be basing on the 5min and suddenly saw chart spiking up. From 25 cents to over $1 in seconds. I sold too soon.

That’s still a great trade. Can you share how you place an order when options are jumping up every second as BA did today? Do you market order?

Hi P,

I placed a limit order. I never place a market order. Understand that I was already looking at the BA daily, H1, M5, M1 charts before the “news” happened. On the M30, either it’s an ending diagonal or triangle. Lots of open interest in the 380 puts for 3/15 opex so I figured that would be the target if there’s some hint of “bullish” news especially if it broke through the upper line of the downtrend channel.

I placed a limit order that’s a few cents over the bid but a little less than the ask. The spread was narrower than the 370 calls if I recall correctly. It all happened very fast. At 11:11 am. How weird was that.

I’m bearish though. BA has potential to slice through 200sma.

BA was going parabolic. Late last month Morgan Stanley gave a $500 price target but if you look at macd it was going lower as the price went higher. If you bought a few April puts back then you might have endured pain a couple of days but it eventually paid off.

Thank you Liz! Very detailed, kind answer 🙂

Shun…I am not sure ..on direction I have been able to figure out turn dates just not direction yet I am trying to use..other charts indicies..usd..to try to figure out direction..i think I will be able to know..once the April Pattern plays out..

from July 8, 2016..there has been an approximate pattern on TBT

it is 1.168..432 days there is a turn..so that is the Major Turn date going forward..

so. and dates are approx within day or 2..turns but some right on target

July 8, 2016

September 7, 2017

November 7, 2018

There is also a possible very large Gartley pattern from the 2016 date..numbers are slightly off but seem to be in range for a possible low.in TBT.in 2020

so that is why I am still unsure about direction..

so if so..it would mean a high for TLT..

i have probably jinxed it since i said it outlaid ;)…have a good weekend!

out loud damn autocorrect

out loud damn auto correct

Computer with a naughty sense of humor…! 🙂

A few posts back a few of us were commenting on the strange musings of Marty Armstrong, arguably one of the most market savvy guys alive. His specific reference to foreign investors as the source of the market ramp of the December lows in particular had me wondering what on earth had happened to him to voice such a total and complete fabrication, as anyone following global money flows would sure recognize. Interesting that Zerohedge weighed in on what has actually been happening.

https://www.zerohedge.com/news/2019-03-15/foreigners-dumped-most-us-investments-decade-january

Buying..selling

hardy har ha. Just a bit off!

Bull credit put spreads roll ups all worked to perfection this week.

Thanks again to Tom C for this week’s awesome energy chart!

Exited half 278/279 put spreads today on this morning manic upward thrust.

Steep momentum divergences persist on the extended ramp higher. I will continue to hold remaining 278/279 put spread until market CLOSES under 2800.00

In my humble opinion, unless you are as nimble as Sir Charles, this is the safest way to trade a B wave counter-trend rally. It really is amazing that one can get positioned ahead of what is like going to me a gut-wrenching C wave to the downside, while being PAID to do so…Lol! Thanks again to Peter T for being magnanimous enough to let some of us post our trading ideas as we try to help and learn from one another.

Have a wonderful week-end everyone and see y’all at next week’s Chart Show.

Don’t miss it people!

Be there…or be square! Lock and Load!!! 🙂

Yes Mr Verne got a triple digit mover on the 2815 calls @ open. In at $5 out at $12 for almost 150%..still bullish until cross below 50 sma. Pretty soon we gonna get a golden cross as 50 crosses back above 200..my target for spx still @ 2950. No getting into season bullish time of year. Prob not a significant pullback until Fall 2019.

S&P broke thru..resistance this week. Trend still up & next targets are 2850..2880..2900..2940 & 2950 before a pullback. 2018 bottom was best buying opportunity we will prob see in a long time. Wave 2 of 5..could be 200 to 300 points but no where near the 600 point gift we got in Dec. Market outlook is..bright & sunny..no clouds in sight!

Anything is possible, and I certainly could be wrong on this score. But it seems to me that when you take a peek under the hood, this market is now a very dangerous place to be comfortably long, and I am not even talking about the possible EW count. As many of you know, I observe volatility very carefully, and we now have yet another risk parity distortion potentially worse than the one we saw in Jan 2018. Steep negative momentum divergences at these new highs can also not safely be ignored in my humble opinion. You cannot sustain a bull market by an attempt to artificially suppress volatility, and egaging in reckless destruction of price discovery by distorting perception of risk. This is exactly what CBs are now doing. It NEVER ends well….EVER!!!

And of course, there is that small matter of Peter T’s call for a devastating C wave to the downside…😎

Good observation Mr Verne..i hadda min target at 2820..& its past that point..everything all gravy now cuz ive been long since low 2600s on spx..only 25% long with calls..now waiting on break below 200 sma to sell longs & will only go short if we break 50 sma. Yet..SPX close to a golden cross.. if that hits imma backing up the truck & gettin busy wit some cash..

Still think spx hits at least 2880..too much momo..bulls well in control..with no follow thru from any bears..plus lotsa cash on sidelines that keeps dripping in. Evry dip gettin bought up..as they say..a market that refuses to go down is a bull market..this is not a bear market rally..as bad news is also bein ignored showin strong bullish sentiment..now also heading into one of strongest seasonal times of year..all backing up the bullish case. You couldnt pay me enough $ to short this market..except of course on a day trade..hardy har ha!

Hi Charles,

Very nice trade! As for the golden cross, check out the attempt from 11/4/15 to 12/30/15.

Hi Charles,

Very nice trade! As for the golden cross, check out the attempt from 11/4/15 to 12/30/15.

And for the seasonality observation, last year Mar 13 swing high down to April 2 low.

Lemme look at ur period in question Ms Liz..

FWIW..i always trade bullish when 50 day above 200 day & SPX above both lines..works like a snake charmer!

Ms Liz..ur correct that 1..in 2015 was..a failure

BUT..the next one in Apr..around the 20th..in 2016 was an absolute pot..o..gold!

Over 750 points if u bought on gold cross..& sold on death cross in Dec 2018!!! Key is to know ur exits!

BUT..your point is well taken..my stop would be at 50 sma.

Regarding seasonality..historically mar to may..is the 2nd most bullish 3 month time of year..

Oct..to..dec..santa rally..is most bullish time of year.

My money is on a..BIG rally between now and end of May!

Maybe a healthy pullback this Fall..

I dont think this is a..B wave..as SIR PETER has labeled..

Currently..almost same time length as..A wave.. both almost 12 weeks..& its above the 80% retrace level..going into new ATH soon IMHO. My guess is SIR PETER will be joining me on the bullish side VERY soon..

If the entire structure down off the ATH high is tracing out a flat, a 90% B wave retrace is required for a regular flat.

Yeh Mr Verne..thats where my 2880 target came from. Thats the 90% retrace. If it gets beyond there imma thinking we go to a new high.. either way imma bullish! Still plenty a upside

I do have to try and suppress a smile when I read your reference to the “Santa Rally”.

Mr. Market threw a curveball last Winter. I suspect he could be angling for a repeat performance this Spring! 🙂

Hardy har ha..touché Mr Verne!

Yes..Mr Market caught me with ny drawers down last winter..but thankfully on the back 9..

Any good golfer..worth his piss pot..like any good trader..paces himself. That philosophy has always done me good!

Dont take risks u cant afford & dont invest $ u cant kiss goodbye..

Ive always taken that ..a step further cuz I like to play with house moola..I prepare my trend trades in 1/4 lots..just like a golfer playing 36 holes..its pace my friend..so when it comes down to the last 1/4 imma way ahead..so even if imma wrong I still won. I hope u get the reference!

I sell 25% after a double..25% after a triple..and hold the next two 1/4 trades..free trades as long as the wind blows me direction..my last 1/4 trade is from low 2600s so even a stop out at 50 day sma is a win..but obviously i hope she goes much higher!

Last 2 posts were 2-26 and 3-6 right at the most recent highs (+ 1 day). Here’s some food for thought for bulls from Peter Eliades regarding the Wilshire 5000 Index, the most broadly based index of all. It includes every actively traded stock in USA. The suggestion from both charts is that there may well be some major surprises brewing for the bulls over the next few days… Remember to click on the charts to enlarge them… https://imgur.com/a/0F4QxvA

Good stuff Mr G..u always know how to knock da wind outta me sails..but we shall see..bullish trend seems destined to surprise us with more good times..BUT..if SIR PETERS count is correct..& ur trendlines r correct then Mr Markets bout to take a nose dive.. Break below 50 day & imma bearish with u brother!

Peter G, the voice of reason…you may want to pay careful attention to the ‘technical landscape’ on Tuesday, March 26, 2019…that is especially true if it looks like it will be a green close…

Peter G

Thank you for the low to high to high count on the whilshire

the dow though could still have a few trade days left in it if the correlation continues.

what im seeing is a bit bearish as well. the lesser weighted stocks in the cash dow have made a new recovery high while the heavier weighted stocks in the dow has failed

the lesser weighted dow stocks made their respective all time high on dec 3 2018 and the heavier weighted stocks peaked on oct 3 which was 2 months prior .

On Friday the lesser weighted group broke above its oct 3 high and now implies new all time highs and yet in the heavier weighted group it is a failure . The heavier weighted group test its respective oct 3 high .

Bottom line is : No true leadership within the dow

The lesser weighted stocks are showing more strength than the heavier weighted stocks The heavier weighted stocks move the dow obviously

what I said above means this

the lesser weighted dow stocks are sitting at new recovery highs and just below the all time highs while the heavier weighted dow stocks are failing .

all it would take is a couple days of buying in the heavier weighted stocks to drive the dow to a new all time high .

Add in mercury retrograde and the 10 day lag and I think you might just be right on time looking for a high .

UNH, MMM, GS, BA, AAPL are major drivers of the dow .

Those stocks will either need to split, whether or not they are remains to be seen.

The cash dow allocation wise is out of balance

You could add HD to the mix as well .

split all those stocks 2 for 1 and the dow becomes a much better balanced index.

for those who don’t understand the dow this is worth reading .

https://www.fool.com/investing/2019/03/13/dear-wall-street-dump-the-dow-jones-industrial-ave.aspx

30 stocks..dont make a good representation of the total market. SPX is 500 so more of a pulse..but even that is skewed by its composition..Equal weight SPX is more accurate or as SIR PETER does..look at NYSE for complete pic.

Charles

I agree yet there is more to it .

what is the % movement of each index ??? id say those 30 stocks have competed

fairly well .

Peter T

peter just saying thanks .

I spent some time checking out others wave counts this morning and found myself shaking my head . I realize you tend to stick to your counts and don’t get wishy washy on the if this than that . That is a good thing .

I have seen you change your mind so I do understand you take in what the market shows you .

if I was to point to what I think is strength in the dow it would be :

VZ, PG, NKE, MRK, V , MCD, MSFT, CSCO, AXP .

yet those stocks together do not up enough to move the dow by themselves

in a group .

that group though are at all time highs as of Fridays close and they as a group

broke out into all time high’s on feb 28th then had a small pullback into march 8th and have been up everyday since.

WBA has not done the dow any good yet its weight within the index is pretty small .

on march 8 2019 WBA tested its previous low which was on June 28 2018. almost a year ago .

Peter G

You may want to check out the 5 day $trin as well as the 5 day $add

vs the usual using 10 days .

Fridays close on the 5 day trin was an overbought reading

Britain wants out of the EU and supposedly could and should be leaving by march 29th yet…..

The EU will decide the terms and conditions of any extension.

Something to think about only because its completely ridiculous .

Hi Lon.

The trick is to set up the trades the week of expiration, not necessarily the same day, when bids can be actually BELOW intrinsic value, to say nothing of premium…

You are right that in some cases you may not get a bid if the spread is too narrow. The 2 STD price for contracts is your buy anchor for long leg of spread. You widen the spread from there toward the trading price commensurate with your risk tolerance….you want to pay as little as possible for long leg of spread…

Thanks Verne,

If I understand correctly you’re bracketing the current price with an Iron Condor double vertical, right? Your trades are interesting to me as I trade spreads on the indexes (SPY, XXXB, DIA). It would be educational to see a screen shot of the graphic analysis of your spreads, and how and when you close legs after a profitable move away from a pivot. On TDAmeritrade these are on the Analyze tab. If and when convenient, feel free to send one to my email. Thanks.

A new weekend blog post is live at: https://worldcyclesinstitute.com/direction-down/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.