Ahhh … another weekend of obsessing over this impending US market top. My focus has primarily been on the apparent non-confirmation between the currency pairs (including the US Dollar) and the imminent turn down of the US indices. I’m expecting a top in ES/SPX and their peers at the beginning of this week.

Non-Confirmation (Update)

The principle of confirmation is one of the common themes running throughout the entire subject of market analysis, and is used in conjunction with its counterpart—divergence.

Confirmation refers to the comparison of all technical signals and indicators to ensure that most of those indicators are pointing in the same direction and are confirming one another.

Divergence (non-confirmation) is the opposite of confirmation and refers to a situation where different technical indicators fail to confirm one another. It is one of the best early warning signals of impending trend reversals. — Technical Analysis of the Financial Markets, John J. Murphy

Last week when I introduced the non-confirmation idea, I was referring to the US Dollar and the EURUSD currency pair. It appeared that the US Dollar had traced out a five wave impulsive wave to the upside, while EURUSD had traced out five waves to the downside (except that they were overlapping, which then counts it as a ‘3,’ or a ‘corrective’ wave—in Elliott Wave parlance).

I no longer believe there to be a non-confirmation between the US Dollar and EURUSD. The US Dollar does not look to me as through the waves up conform to the rules for an impulsive five wave move. I believe this set of waves up is telling me that both the US dollar and EURUSD will completely retrace. In other words, there is one more wave to go for both before a complete trend change takes place in currencies (you’ll find more information on this below the chart of UUP).

The non-confirmation example now appears to be that of the US indices turning down (perhaps this Monday), which the currency pairs (all appear to have one more wave left to go) complete their journeys to their final targets. I had originally thought they would all turn in tandem, but I can’t now see how that can happen.

Non-confirmations are usually prevalent at a major market reversal (a change in trend).

The US Dollar

Above is an hourly chart of UUP (the ETF that is the surrogate for the US dollar). I can more easily access a smaller timeframe chart of UUP than I can of the US Dollar itself. The pattern is the same.

On this chart, I’ve identified some of the problems with classifying this wave up as an impulsive wave. As time progresses, it appears to be more and more a corrective wave. I now expect a turn down to a new low, while EURUSD turns up to a new high. Here’s a review of the items I’ve identified in the chart (from the bottom of the chart to the top):

- Wave 1 does not appear to be impulsive. It’s missing a second wave, however, there’s a gap at the point it should appear, so this red flag is questionable. A bigger issue is that fact that the fourth wave of that first wave did not retrace 38%, which is a requirement for fourth waves in an impulsive wave situation.

- The wave up from the wave 2 label is a sheer wave with no apparent subwaves (it appears to be a zigzag). This is not an impulsive pattern but rather a corrective pattern.

- The wave measurements are not correct for an impulsive wave. The third wave in an impulsive sequence should be 1.618 X the first wave. I’ve positioned the Fibonacci tool to show the relative length of the first wave positioned at the bottom of the second wave. It’s obvious the third wave is not anywhere close to the appropriate length.

- Wave C/5 has two waves which overlap (they should not) and a very odd pattern for the wave itself. It does not conform to the impulsive pattern a fifth wave should exhibit.

- Wave C/5 also appears to be approaching a double top, which an impulsive wave should not do.

In summary, the structure is overwhelmingly screaming at me … corrective.

The VIX

Above is the 2 hour chart of VIX. It’s current position is, of course, a major warning of an impending trend change. Complacency is at record highs while SP500 volatility is at record lows. In terms of the SP500, look out below!

I had predicted about three weeks ago that the VIX would need to reach a new low, or at least a double bottom, at the top of the US equities market. This would be an indicator of a US market top. Here we are with a small gap to fill to reach that target (you can see on the chart above).

You can find out more about the VIX and its meaning here.

CAUTION: There May Be Surprises!

I’m unsure as to how the US Dollar and USD currencies (which apparently have one more wave up to complete before a trend change) are going to be affected by an imminent change of trend in the US market.

Recently, as the US Dollar has been losing value (a bearish move), US indices have been bullish. Most recently (over the past few weeks), however, the USD currency pairs have been in a fourth wave (bearish) while the US indices have been rallying. I don’t know if the relationship has changed for the short term, or longer term, or if we’re just seeing a non-confirmation situation at a market top.

So we may see some surprises here while various assets move in relationships to each other that are different than we might expect.

Be careful while this situation resolves itself. Now’s not the time to take chances. There will be opportunities to get on board for this 5 year (at least) bear market.

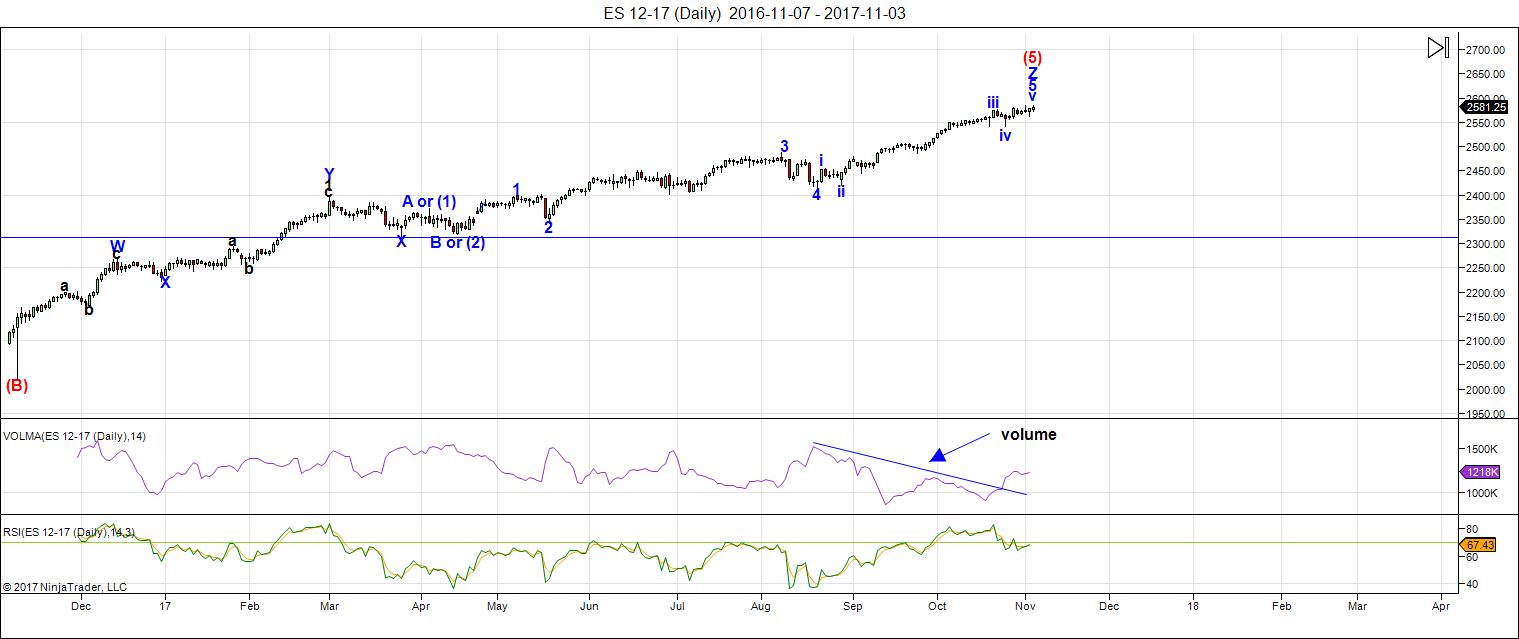

Here’s the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last week, I noted that the wave count for NQ was all but done and that ES had more subwaves to trace out, but was also very close to a top.

I expect a turn down for the US indices as early as Monday; this should mark the top of the rally and lead to a multi-year bear market. Over this weekend, we may see a few more points in ES, but my count is full and the market is exhibiting signs of being extremely tired. Note that VIX is almost at a new low, which I predicted a few weeks back.

Everything is set for a downturn and an end to the bull market. A fourth wave or drop with a further rally to a double top is also possible, but the market should turn down imminently.

Volume: Note that for some time now, volume has been expanding with selling, and drops considerably when the market heads back up. This is yet another signal of the larger, impending top. The turn up for the final leg is now showing signs of turning back down.

Summary: The count is full for NQ and ES, except for small subwaves as part of the final fifth wave.

___________________________

Trader’s Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a “snapshot” of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Wednesday, November 15 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won’t find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Looks like we are in for another boring choppy day based on sleepy futures. I guess we will just have to wait and seen what the week-end brings. 🙂

ok all you little people of the “shire”……. FRODO, and the others [you know who you are].

the alternate chart for the ED i posted yesterday, looks quite interesting today… we squeeked out a new high – which is the minimum requirement of the last wave – and then we started selling off…… hmmm….. are we entering MORDOR?? you make the call

https://invst.ly/5sdq7

by way of explanation – the dotted parallel pink lines you see on the chart, is a zone of stop losses…….

…..and for the sake of the alternate – i have adjusted the “alternate” ED to an alternate OF the “alternate”……………………. but what i dislike about this one is that wave “b” of wave “a” of w4 makes a new high above w3 …… AND wave b of w4 also makes a new high above w3……… me no likey 2 new highs in one wave….

https://invst.ly/5sdz7

have we reached the EW top? …..are the “explanations” for the next moves in equities around the world beginning to pour in? time will reveal all.

http://www.zerohedge.com/news/2017-11-09/violent-unexpected-tumble-sends-nikkei-plunging-over-500-points-recovering-losses

the “alternate” of the alternate option goes away once we hit the parallel purple trendline ………………………. which would imply a top of some degree is in place…..

https://invst.ly/5sfa5

THAT, is the way real EDs roll. Futures may be hinting Sauron at the door… ?

Peter T,

On the “one minute” SP500 chart it looks like 5 waves down to me. Then a .618% retracement that you indicated “had” to occur for a wave 2. Not a 50% retrace but a 61.8% retrace.

This morning a “potential” wave 3 down. Is that the way you see this or even close?

A potential first wave down and yes, you’ll be looking for a second wave retrace. The ending diagonal was in the final wave. It ended slightly below the upper trendline.

Tom

do you create that energy chart or do you get it from a solar site ?

if you cant answer I understand but there is something to what your doing .

Joe

Fact. Over 90% of day traders lose all their money over time. Trading the 1,3,5,or even the 15 minute charts is account suicide. It is all an illusion perpetrated by the trading establishment to legally steal your money while making you think it is your fault because you did not interpret some of the thousands of indicators correctly, or because you did not have the correct EW count, or because your ass-tro cycles got confuse with your anus. By the way there is never a correct EW count…..only the “current” count.

Who is buying the dip?? 😀

Anyone??

Not me … lol.

Of course, you know I will.

The Cartel, of course. How else to keep the lemmings lemming? 😀

we will know if this is the break jody, if wave 2 is quick and business like……

stop loss triggers should be hit sending us into a quick bounce….. selling into the bounce should overwhelm the bounce, and w3 should take over…..

if we meander, in a slow wave 2 – something else is going on…..

Oh boy! I meant it as a joke.. I did not think anyone would step in here because of how clear it is looking at all aspects of the market from currencies to Vix.

Not sure exactly how high the bulls think this thing will go but a quick peak at a monthly chart (pick any one of the 3) and you will see. On the Dow and S&P if you connect the 2004 top to the 2008 top it is clear. RSI, MACD, Stochastics and every momo indicator available is not just over sold but slammed into the red.

The run up is over – time for the other side of the trade.

I am !!!

Earlier this week , 2583 es today 2574 batch. Approx 2 % of portfolio added.

I patiently endured another round of scorn on another site when I posted I had backed up the truck at VIX lows yesterday.

I was silly being bearish while the market continued to make new all time highs I was told, and the remarkable run in the Nikkei was cited as further proof of my folly, no less! 😉

It is beginning to look to me like we have a short inversion taking place

if this holds true we have another week of bearish activity .

Bearish being relative mind you .

Mars Uranus called for a low on nov 7 yet all planetary pairs including the moon

called for a high nov 3 , Moon phases posted below

Full moon

November 3, 2017

Last quarter

November 10, 2017 < tomorrow

New moon

November 18, 2017 < another week to go ?

I think we have begun the topping process .

if this holds true we should see essentially a sideways market .

Better put though would be more equal ranges upwards and downwards

Time to start watching the moon phases 1st qtr last qtr as well as new and

full moons .

I am seeing a few conflicting cycles which tells me this will be more sideways then a huge dump or rally .

Nov 16 is a high and nov 17 is a low as example from 2 different methods .

nov 24 is a low and yet both dec 1 and dec 4 called highs , the next is dec 13-14th

which will be important . the jan 2 which is both a secondary high as well as the highest high .

dec 1-4th high

dec 13-14th very important date ( uses 3rd method plus )

Jan 2 and 4th everything lines up .

An interesting correlation also lining up yet check the date for yourself because

sometimes my dates are not exact because the data set was off .

secondary closing low in 1987 on the dow was Dec 3rd 1987 .

the crash closing low on my data shows Oct 16th and another close low oct 23

and the final higher close low Dec 3 . we are seeing some of this play out

right now as high's .

The market may have already topped yet I am going to let time run its course.

New highs coming or not doesn't matter to me at this point , what matters to me

is now strictly time . At some point the cycles come into rhythm and that is what I'm watching for .

Today looks like a very nice reversal to the upside and maybe it is yet

we ae in a conflicted cycle .

I must confess the astrological details are way above my pay grade, but I do know what to expect from a well-defined rising wedge..! 🙂

Nat gas has resistance around 3.30 yet there is a gap

in the 3.56-3.69 area that ideally should be filled .

a break above 3.17 was the bullish signal and the next

break above 3.99 would be a beautiful site to see as we

get into next year . Maybe the 6.90 range on UNG yet

UNG needs to break above that and go through 7.93

before I get excited and start targeting the 27.00 level.

My focus is going to become more commodity based

as we get into next year from the bullish perspective

and bearish overall from a stock index perspective .

I’m no gold fan at this juncture

Lastly

The ” Banksters”

It is a mistake to assume that the bankers control this market.

Agreed.

To argue that central bank purchases of equities has no effect on market price I find incomprehensible.

If all the share buybacks and direct injections of liquidity via outright share purchases by central banks were removed, does anyone seriously think markets would be trading at these levels? Seems irrational to me…!

Verne

Planetary pairs based on observations .

your comments about others comments are interesting .

the masses are buying the dips .

I have one last indicator I look at in regards to that and while it doesn’t

fit exactly to some of Peter T’s comments ill note it here just because.

What I have seen near important tops is a constant buy side as prices

fall . By that I mean the drops come and the rallys extend in duration upwards

yet price fails . what you see is 3 high’s , the first high being the high

the second and third highs are based on duration .

example , you get the all time high and say the market drops 100 points

over 12 days ( just giving you an idea of what it looks like )

the next rally may last 15 days yet the market will only gain maybe 60 points

and price fails and you get another drop back down , could be 40 pts or even a new low , then you get another rally of say 25 days duration yet prices again fails

yet the overall view was buyers continuing to buy the dip and convinced

the bull market is alive and well when it is in fact NOT.

It is something I look for near major tops and its happened enough times

that I watch for it before becoming aggressively bearish .

an up day in the market would be plus 1 regardless of points and a down day would be minus 1 regardless of the points moved .

Those guys giving you crap are buyers today and will be buyers over the next few months , they will be the ones who throw in the towel and give us the initial big dump . but it is a process and it takes time for the mindset to change .

anyways enough posting from me today .

my take is the topping process has begun

Thanks Joe.

It seems to me the pattern of elevator drops wiping out weeks of escalator grinds higher is already underway, the exception to your example being relentless new all time highs. I can only assume the raging bulls are paying no attention whatsoever to market breadth. Ignorance, or gullibility? I have no idea…

https://invst.ly/5siob

the alternate of “alternates” that this might still be 4th wave, has been settled… as we have touched the level which makes this a parallel line…..

oh and joe, i completely disagree with you as to this being the “start” of the topping process. Distribution has been going on for an extended period of time already – although the “look” of this distribution has been unique. I will post a chart indicating “the look”………and “the look” being supported by the extraordinary insider “SELLS” to insider “BUYS” ratio over this same period.

chart for joe [ and frodo] and the rest of the shire……Lynette Zang from ITM tradings is the only public source available that tracks the insider buy/sell ratios for reference. i will get for you, so you can match it up against the chart.

https://invst.ly/5si-w

My hosting service is obviously having problems. My site has been slow all day and was down for a little while. Hopefully they clear it up soon.

Many thanks for making the site available Mr. T, and for your patient willingness to educate those of us less learned in the erudite finer points of EW. We don’t always agree, but I always learn something new! 🙂

Yep! The sneakiness of what has been going on has fooled an awful lot of folk…but NOT luri…!! lol! 🙂

We have a very impulsive first set of waves down. I can’t technically call a top until we have a full second wave and a turn down from that to a new low … but stay tuned …

…..yes YOU can peter……. yes you CAN call a top – just use your “spidey” senses!!!

Sorry, I get all those spidey tentacles screwing my keyboard … so I’ll wait. And I’ve been accused of calling tops many times before, which of course, I never have, since we haven’t had an impulsive wave down in 9 years … Will just play it technically safe.

🙂

……bu…….but wait a minute………. joe and verne told me that you were BITTEN by a radioactive arachnid years ago…… giving you these “spindles” thingys under your wrists that can blast-thrust super sticky silk……………….and that you had ….gulp………… “spidey senses”……………………

“JOE”………………………… “VERNE”…………………………… you both has some “ESPLAININ” to do!!!

[ 2582 on ES for 61.8% retrace – should be a sharp move/ no nonsense/ business like…….]

Looks like the sky is falling. Trump is out to get you ! North Korea is going to shoot some more bombs.. SELL, SELL Sell. Come on Bears, Stock Market crash is here, sell out now. The world is going to end. Get out now !! Before its is to late. LOLOLOL

Wash, Rinse and Repeat. !!!

Thank you bears, for covering your shorts and propelling the market up since 2009 at the 666 sp level

Dave…….. is that a “bead” of sweat rolling down your forehead? that “LOL” seemed NERVOUS to me………………………. yes dave – nervous!!!!!

oh yes, wait…………….’bear trap’…………’set up’……………’squeeze to new high’……rinse repeat…………………… this play will NEVER end………..EVER!!!

the reflation trade based on tax cuts pushed out to 2019…….hmmm…… but …but the whole narrative of ever higher prices is predicated on the REFLATION trade….

https://invst.ly/5skif BE WARNED!!!!! :-))

Luri, that chart you had of the es . I really thought you were out to lunch on that one. Remember the ES chart of 2720 ? I really thought you were drinking some kind of spiked Kool Aid. But after some careful thought and research, you maybe correct. LOL

dave….dave…………………Daaaaaaaaaaaaaaaave!

no need in “shooting” the messenger’s charts…………………as the truth will always be the truth!…………………………………………………. sob……………………

no, no……….i am OK……………………………. liz can i borrow one of your Italian made tissues from the second sleeve from your prada bag please……………… i have a “thing” in my eye, that is making it “tear”………………………………… i wouldn’t want dave thinking he MADE ME CRY………………………………..sob……………

Just hope you had tight stops on your longs Dave!

BTW are you playing the part of agent porvacateur? 🙂

I just noticed that we actually have a bearish engulfing candle in ES, and that is indeed a beautiful impulse down. This means we are now in a second wave ahead of “DA PLUNGE!” 🙂 🙂 🙂

https://invst.ly/5skp-

I have “resurrected” the ORIGINAL ED chart………………why?………dunno…….but it so happens that a 61.8% retrace [if we are done the first 5 waves], will be a “backtest” of the bottom trendline………

maybe that is why………………….. hmmmmm…………….. that is “why”….. cough……….

Yep. I have only two possibilities left. Either we are completing some kind of fourth wave, or we have a top. I expect a final fifth up will be confirmed by a fill of this morning’s gap as the first indication we have one more high to come. If it is a fourth wave, I think we will see a fifth wave down and a reversal tomorrow with another long lower wick that has so reliably marked reversal points of late.

verne,

quick, fast and business-like sharp — for w2 retracement – all in one day, as in today. then an immediate turn back down for a w3……… sorta like what is happening right now……. we shall see

https://invst.ly/5slkt

That’s the way, Uh Huh! Uh Huh!…I like it… 🙂

Having said that, I do not expect the cartel to give up. This market will fall in the face of their damndest efforts to keep it propped up. I think the key is this morning’s open gap. If they fill it all bets are off we we are probably going higher. They have pulled off that stunt too often for us not to be looking out for that possibility…

w2 is DONE !!!!!

https://invst.ly/5slwj

If it is, we should see it in the price action in futures. Perhaps the market is playing ‘possum? 🙂

I believe this is W(1) and will target just below SPX 2544

W(2) will bounce up to the 2577-2580 area

W(3) drops to 2490ish

W(4) back up to 2531or so

and

W(5) down to 2415 area

This count for me is on SPX on the intermediate time frame.

on the mi-nute time-frame we might be just starting the 5th leg of wave 1

Nope.. We came back into W(1) territory.. :/

Long lower wicks are bullish. Plain and simple. The banksters STILL have the bears totally intimidated and the latter clearly are allowing them to bid the market up from these impulsive declines as has been the case for many months now. If the long wick holds into the close, chances are that we are going higher….

Verne, you are correct. Market going higher.. Please see the chart of 2720 es from that legendary visionary Luri. LOLOLOL

verne,

all day i have been saying that the “hallmark” of a w2 ……… if this is in fact a change in trend……………. is a SHARP, FAST, BUSINESS LIKE 61.8% retracement…… what does that look like to y ou?

https://invst.ly/5sm25 ……..

I am sure about one thing. There will be HUGE movement one way or the other. Either we are seeing a very elegant bull trap being sprung ahead of a possible third wave down or that possible fourth correction is done. Frankly when I see corrections NOT completing swiftly at the start of a larger impulse down I tend to be skeptical…

never underestimate the banksters!! 🙂

hmmmm……so why are you so convinced that “the banksters” ONLY care about keeping the market going up?

…………….when you know as a FACT through history – bankers ALWAYS fund both sides [see WW2, see Bolshevik Revolution]…………… why do you think they have changed – to only see ONE SIDE?? ……………………………………….

………………….the word of the day – “rethink”…………………………………….

Well…..it is very complicated but here is the bottom line. An unraveling market is going to expose so much fraud and malfeasance in the financial markets that I think the banksters are absolutely terrified of the kind of fury it is going to unleash. I suspect we are going to see pitch-forks in the streets. Their hineys are on the line for this last bubble they arrogantly inflated…if it pops, there is going to be hell to pay! 🙂

verne – they thrive on “chaos”………… from chaos comes ……”order”……..

so the setup in the market is thus…….. as predicted, a QUICK, FAST, BUSINESS LIKE – all in one day – 61.8% retrace. Those reflect shorts closing positions/ stopped out of winning positions……………..

vix has spiked……………………………

You have CTA’s/Risk Parity that are well over allocated in equities BECAUSE of the vix squish…………………… now you will have the algos dump indiscriminately equity – because of that “over” allocation – which has an adverse reflection on the VIX squish……………….. which in turn becomes your reflexive loop………………………… downside theory…………. we shall see

Yep! I think the VAR volatility trade is where the sweet money is hiding. They may not run for the hills on the first leg down though. I am thinking we need a VIX close above 15 for the fireworks to really get going. I do hope we have a wave two and Nasdaq futures looks good for a wedge breakdown. One caveat I see is a mini head and shoulders pattern in the VIX chart with a measured move just to about a new 52 week low. I can’t stand the tension…will somebody make up my mind??!! lol! 😀

ES looks way cleaner than SPX

We have had a 5 wave move down and now snapped back just above 61.8%

One thing for certain we should know by morning..

jody,

there is no problem for w2 to return into the area of w1……as a w2 can retrace 99% of wave 1 and still be a w2…………………..

I agree.. In the earlier post I was looking at SPX.

ES looks different and cleaner.

I wouldn’t get too giddy yet with calling a top. There are lots of obvious problems with what went on today. I would be expecting another high.

Thank you Peter !! I am sure you just saved a few Newbies life savings.

haha … you just have to look at any of the other indices … NYSE, DOW, IWM, RUT, Nas Comp. I was out this aft and didn’t get a chance to look around to any depth. There are problems with the subwaves in ES and NQ as well. And the SPX is a mess—a very definite three. BUT … we’re close.

Yes, what Peter said. BTFD.

hypo:

7/27/17 low up to 8/8. Down to 8/9 then retrace, down to 8/11, etc.

Swing low Aug. 21.

Possible repeat of fractal.

10/25 low up to 11/8. Down to 11/9, retrace then….

Or it’s time for me to go to sleep.

So far futures not confirming completion of a corrective decline. I think the next best count is that we have a series of first and second waves to the downside. We did have just about a 60% retrace of Thursday’s decline. If that is correct, Mr. Market is playing possum and is going to whack the BTFD lemmings on Friday. I suspect it will be a C wave and complete on Monday morning when it will be the bears’ turn to get ambushed unless they are nimble!

Happy Trading! 🙂

verne,

lend me your eyes. what do you see……..a fractal of a fractal? megaphone topping pattern of a megaphone topping pattern? i see the next stop a retest of the 100dma which coincides with the top “teal” trendline of the larger megaphone topping pattern …………..

https://invst.ly/5st0a

its a simple “risk off” signal???? BE WARNED!

https://invst.ly/5st3r

By the way with regard to risk, it has been obvious for months that something or someone has been steadily, sneakily, stealthily selling this market. It is pure genius how they have done it and you would never know unless you looked very closely. After all are we relentlessly putting in new all time highs almost every single day? The narrowness of breadth in the Nasdaq particularly is absolutely mind-blowing, unlike anything I have EVER seen. I despise these #@%^^*&&(*^^^%^%^$$## banksters!!!! There! I’ve said it!!!!

BTW, another HO on Thursday makes 5 in the last two weeks and stark warning that there is a lot of PAIN in the future of folk bullish on this market. You just watch. The whining by all the talking heads about how no one saw it coming is going to make you puke. ‘Puff said!

if i am wrong – so be it……… i am human. to be truly human is to have the courage to make mistakes….

https://invst.ly/5ssk3

I for one do not think you are necessarily wrong luri. I could be off on the wave C speculation. Fascinating observation regarding the fractal. I would LOVE to see price take out that lower boundary line of the wedge, at which point even the blind will see what’s going down, pun intended! I suspect we will see some more wrangling prior. I remember being impatient and frustrated waiting for bonds to make the plunge out of its own huge ED last year and just at the time you are about to walk away in disgust…KA-BOOM!! 🙂

https://worldcyclesinstitute.com/the-fat-lady-sits-in-the-wings/#comment-23214

in spite of the SPX all time high registered on November 7, 2017, NYAD has been diverging negatively for the last three weeks…

NYAD was -402 today…the deterioration continues…Monday should be an interesting day for the stock market…

They are flailing around in futures like desperate drowning men about to go under for the third time. At some point, hopefully in the not too distant future, I expect to see SPX futures down triple digits, at which point I will cheerfully spit on the dirty banksters’ graves… ?

Nested first and second waves in ES?!

https://worldcyclesinstitute.com/unravelling-a-complex-topping-process/comment-page-1/#comment-23063

“Is the Topping Process in Motion? Key Divergences Starting to Form” – Harry Dent | November 9, 2017

http://tinyurl.com/ycks3bja

“Pancholi NOT Dent!”

Looks like a tug of war today. Bears with a slight edge.

However 10 T-Note has made a pretty big move up today.

Probably won’t see anything major happen into the close.

Just like you said Peter. Wow

https://www.msn.com/en-us/weather/topstories/how-will-la-ni%c3%b1a-impact-winter-2017/ar-BBENviu?li=BBnb7Kz

Yup, just as expected. 2008 was an extremely cold year relative to the recent average.

Luri

“JOE”………………………… “VERNE”…………………………… you both has some “ESPLAININ” to do!!!

What do I have to explain that I have not already ?

oh and joe, i completely disagree with you as to this being the “start” of the topping process. Distribution has been going on for an extended period of time already – although the “look” of this distribution has been unique. I will post a chart indicating “the look”………and “the look” being supported by the extraordinary insider “SELLS” to insider “BUYS” ratio over this same period.

I’m sticking to what I said , the ” Distribution” you show has a rising market.

The topping process is about price !

joe and verne told me that you were BITTEN by a radioactive arachnid years ago…… giving you these “spindles” thingys under your wrists that can blast-thrust super sticky silk……………….and that you had ….gulp………… “spidey senses”……………………

That last statement I assume you were joking around so I’m ok with your satire

yet being quoted as saying something I never have about peter or anyone for that matter does rub me a bit the wrong way .

I am sticking to my statement that the topping Process has only just begun .

I must stick to my own work and not rely on someone’s else’s work or assumptions.

Verne

as per the bankers etc….QE included.

I think has we not had any QE at all the market would have fallen further yet today the markets as well as the economy would be in much better shape .

All QE did was extend the bear market .

The bankers and the fed in my opinion have no control of the stock market.

The other argument people have is the assumption that when the fed

lets their bond purchases mature , they are selling bonds which is not true.

People also saying that rising interest rates are a bad thing which is also not true .

the initial rising of interest rates is bullish not bearish .

people buy stocks because they are rising and when the cost of borrowing money rises people will buy because they don’t want to pay a higher rate later .

Eventually rates reach a point were it becomes a negative but the initial rising of rates is not that point.

The tax plan and those deductions being put of until 2019 ???

fits very well with my own timing model which is calling for a low

in Jan 2019.

That delay though in my opinion is the republicans showing they have no balls

and are again proving they are more interested in getting re elected than doing what they need to do. So politics getting in the way of progress .

Thursdays drop fit the parameters of a mini crash almost to the Tick .

The early dec high I have been watching for as well as

the dec 1 dec 13 and jan 2 dates stand .

This gives us into Jan 2 for the Topping process to end.

Waves 1 and 2 or even waves A and B are noise ,

it is waves 3 and or wave C where it becomes much more interesting .

Just my thoughts .

Thursdays low as well as the Oct 26th closing price is where my interest lay.

It is to soon to call the top in place even though I just might be.

Well Joe I have to say we are in complete agreement so far as a top is concerned. I also believe that the fact that we are discussing it is prima facie evidence that a top is not in. Unlike you, however, I believe that that only reason the market remains aloft is due to CB buying. Now don’t get me wrong. I am not contending that they will remain in control in perpetuity. I am contending that the market finding its natural level in the coming waterfall will be the ultimate proof that they have indeed lost control. While prices remain elevated, the point it seems to me is self-evident, arguments about social mood notwithstanding.

I have to smile at people who believe the liars at the FED that they are withdrawing ANY stimulus from the markets. What a croc! This is what is going to make the coming market decline so amazing, and that is that it will eventually happen in the face of strenuous CB efforts to prevent it. The have not lost control yet, but they will…. 🙂

Sir I beg to differ on interest rates.. Interest rates play a huge part to whether or not people purchase homes and is very much on the minds of buyers that I see everyday. When interest rates rise the mentality of the buyers are “I will wait until they drop again”. Buyers have been conditioned over the past 10 years by the FED and when home loans creep up to even 4.75% it slows the market. When rates get to 6% or 7% maybe 8% the housing market will slow dramatically. Home Owners that have a 3.5% or 4% loan now will question “Is it really a good idea to sell my current home and buy a new one where my rate will double?” Rates are getting ready to rocket and the stock market is setting up to be crushed.

Not only that, but also ARM mortgages will put tremendous pressure on homeowners who have them. We will see more forrvlosures, further increasing supply…

joe,

laughter is precious……. we must laugh…….. ….Laughter compared with “accumulation” and “consumption” is incomparable….. You can take the true “one” with you at death…………whereas the “false” one stays……………….

I promise i will never mention your name again in my efforts to generate small moments of “laughter”…………………………………………..

as for “distribution” – i am of the opinion, that this …..”process””…..deals primarily with “psychology”. It is the process of recognizing that there is an ending of the “last fool” buyer………………….. it is a process by where “smart money” [institutional money] see the writing on the wall, and sells out positions to “weak hands” [usually retail money/ some hedge funds]. The process of distribution is USUALLY done in a rising market…….Usually, The chart result of “distribution” are “rounded” tops which create your “price phenomena” of lower highs, and lower lows…………………….Distribution has many faces, and this time distribution was completed in rising market……………………………………….the result this time would be an “anticipated” sharp “v” shaped top, versus your anticipated “rounded” top…….much as the NDX in 2000 was a sharp top……. “vertical price rises, brings about vertical price drops”………….

distribution is handing share ownership from “strong hands” to “weak hands”quietly over time…… This has been confirmed by stats coming out of the BofA stating that “institutions” have been large net sellers of equities in 2017 – and “retail” has been the buyer [well and also a nod to verne, because the central banks have also been buying. Although verne, i lump the central bank of switzerland under “hedge fund”. The swiss can purchase/sell secondary shares in their central bank. Its share price looks alot like “BITCOIN” – vertical.]

pss…… distribution usually happens over “YEARS”……… as it is a stealth process. therefore, the “topping” process, which is the manifestations of distribution can reflect this amount of time – if the top is “rounded” in nature.

If we have a “rare” V – shaped top, this implies that distribution has “already” been completed, and all that the market is looking for is a “catalyst” for weak buyers to be sellers. The result will be a “sharp” price reversal – from vertical price rise immediately into a vertical price drop. see chart below

https://invst.ly/5t3a6

Luri,

So in you opinion which will it be? I would have to think we will see a rounded transition , mainly due to the 4T US CB balance sheet and the corporate debt that has been accumulated trying to support their stock prices. Thoughts?

Jeff T

jeff…….

so, i am prepared to see an “inverted” v shape top, that is a sharp price reversal. 1987’ish in look………. why? you ask…………… vertical price rise precedes vertical price drops………….. it is that simple. said otherwise, when everyone is on ONE side of a trade – the only option is to “unwind” the trade at any cost – when the unwind happens

now the question pondered extensively [shout out to the great VERNE] is will central banks ALLOW the one way trades to unwind…….. he says NO – and it seems he is correct – with the magically appearance of “buys” at crucial price levels. This “interference” in the natural market process is ……………”WHY”…………..the top will be an inverted V shape [sharp price reversal]……………………….. a “catalyst” [your guess is as good as mine] will be the “spook” for the herd. Once spooked – the herd will OVERWHELM the efforts of ALL central banks collectively – and the herd will very quickly “unwind” the very unnatural ONE SIDED market. Some call this “reversion to the mean”…….or “reversion to fair value”…………………………….. i call it B.I.N.G.O!!!

sharp price reversal – no real “topping” – resulting in a vertical drop for equity index prices………………………BINGO!

Correction.

The Oct 19 and 25th close and Thursdays low is where my interest lay on the index’s.

the Oct 26 close is more tech related .

Verne

I will make a point of following up what I said about the topping process

and explain to you in detail and show you what I tried to explain about the

up day vs down day vs price failures in history so you can see in a chart

what I look for . I don’t know of anyone who does this yet maybe someone does.

it shows me anyways that the buyers who believe in the bull market continue to

extend uptrends as prices fall . I know that makes no sense using words yet it is crystal clear to me in a chart comparison and ill put together a few times in history when this has played out so you can see it for yourself .

Obviously that has nothing to do with bankers or the fed or QE etc and it is why

I don’t feel that fed policy or bankers really have any control of the market.

Joe I agree that there will be indeed some perpetual bullish traders that will keep buying them market on the way down but I don’t believe those players have anywhere the ability to move the market like big hedge funds, institutional investors, and central banks. The two former cohorts are generally considered to be “smart money” and generally the first to leave a doomed market. Retail investors are always the ones left holding the bag. Some folk are arguing that the CB are the cause of market crashes and actually sell the market during a time of crisis. I believe that is bunk. They have the most to loose and considering the size of the bond issues used to buy back shares, a crashing market will be a certain guarantee those bonds will blow up and cost the banks hundreds of billions. They are going to try and keep this thing elevated as their very survival depends on it. I am really at a loss to understand why people dismiss the role central banks have played in this market run-up. Just looks at the announcements of QE and history of market price and the evidence is undeniable!

Anyway, I am looking forward to your charts. Always open to another point of view.

Verne,

Other than QE, what ammunition do the CB’s/ruling elite/bankster’s have to stop the heard? To what desperation and extent will they go? In your humble opinion, of course.

Jeff T

I’m going to be doing some testing later tonight and over the weekend to try to determine why some commenters are being put into moderation continually. It will involve turning off certain elements, so you may find odd issues at times over the weekend when you try to leave a comment.

I will be turning it over to a coder next week hopefully once I get more info as to what might be causing it.

11/12-13 is a very strong turnwindow. Monday will bring the high and as far as I can see the last significant high. We’ll be down into july 2018. With retraces. There will be a rally into year end but that will be a lower high.

11/12 venus enters a bearisch mansion and Jupiter lattitude gives an extreme. The 80 year cycle gives a high 11/12. 11/13 we have a tidal inversion.

11/13 very strong vibration. 11/12 too.

This weekend should see the start of the bearmarket. Basically 10/16 was the high but the market made a 19 td overthrow. First low 12/1, but the cycle is down into july 2018.

Will give more arguments tomorrow, Rest of the mont is down. 11/17 will be tested as a (lower) high, 11/15 will be 37 months from 10/15/14 and will give a low. 11/17 will bring panic. Next week the herd will sense something is wrong; very wrong. Some buy the dip reflexes next week but there is no stopping this.

Cheers,

André

Thanks Andre! While I am not sure when this thing will finally break, I share the bearish outlook. I continue to be completely flummoxed by all the extremely bullish claims some folk ate making- coming tax cuts, central banks, strong economy, blah, blah, blah! I look at market internals and shake my head in disbelief at these new market highs with such extreme narrowness of breadth, I look at the historical EXTREME short volatility trade and wonder, how can ANYONE in their right mind have any doubt whatsoever about how this is going to end?!

Andrè, Do you think we take out the 8/21/17 low by 11/30/17 then really to a lower high starting 12/1/17?

Jody,

I think this weekend marks a significant change in trend. And I think we are down into july 2018. So the 8/21 low will be taken out.

André

https://twitter.com/TheVolumeMan/status/928760342385106944

“MARK LEIBOVIT’S ANNUAL FORECAST MODEL 2017. COST IS $12,000 ANNUALLY TO INSTITUTIONAL CLIENTS. CAUGHT AUGUST LOW, OUT OF SYNC EARLIER IN THE YEAR, BUT NOW LOOKS FOR A SHARP SELL-OFF BEGINNING NOW. ORIGINALLY PUBLISHED IN LATE JANUARY. WANT 2018’S FORECAST?”

Any discount for small fry? 🙂

It would be just like Mr. Market after disappointing the bears by bucking every seasonally bearish trend this year, to now reward eager bulls anticipating a Santa Claus Rally with coal in their stockings, lol!

I’ll save you $12,000! Leibovit simply takes the month of January each year and uses January’s performance as an indicator for the full year. There are 21 trading days, on average, in a month and around 252 in a year, so each day in January represents around 12 days in the upcoming market year. There are around 32 trading days remaining. 32/12 is 2 2/3 so simply look at the last 2 2/3 days of January for Leibovit’s forecast for the remainder of the year. That would be around 16 hours on an hourly (65 Minute) Dow chart. Looks like a sharp selloff to me. Voila, Leibovit’s forecast. Would people pay 12,000 for that? Sure, remember what Barnum said!!

just finished fine tuning an analog that was first distributed via email on November 5, 2017…as of today, the SPX all time high (2597.02) occurred on November 7, 2017…in my view, the two most critical time frames in the next month are Friday, December 1 and Monday, December 11…everything else might prove to be just ‘noise’…keep the following on your radar screen: FOMC December 12/13 and ECB December 14…

I have a somewhat different view. I could care less about what lying central bank mouthpieces say on those dates you mention. They are becoming increasingly irrelevant. They have been relentlessly pumping this market for years with an attitude of damn the consequences of such madness. Now as I look at market internals I see breadth weakening to a point that tells me their efforts are becoming null and void. It really matters little what they do at this point, much less what they say. I think they have reached their limit and this die is cast. Of course all the talking heads are going to link what the market does somehow to the bankster jawboning, while the truth is that what the market is going to do can be clearly seen from what the market is now doing…just my two pence…

interesting analog…however, very different from mine…

https://twitter.com/ECantoni/status/929266441265860608

rotrot,

…………………cantoni’s overlay contains both the “possible” and “probable”….. sharp price reversal in an inverted “v” shaped top, followed by very sharp price declines…. i “LIKE” it…………… time will be the narrator of how this story ends….. thank you.

in my view, it is time to pay attention to the BIG picture…the daily squiggles and wiggles could be a distraction…

Yep! That is why I took my trades out to March, 2018…don’t care what Mr Market does next week or next month…

rotrot,

this is what I can see upon the horizon – just over the second rainbow…….. beside the hostess twinkie wrapper…………………. the membrane of the market has been “S-T-E-T-C-H-E-D” to its breaking point.

example – https://invst.ly/5t45q

rotrot – do the sideway “splits”……………….. stretch those leg muscles completely……. you will get to a point upon which you can no longer continue to spit – naturally……. …”if” you continue – UNNATURALLY – the muscles and supporting muscles will “snap”………, and you lose the ability of those muscles to function – your muscles can no longer “flex” and “reflex”……………..

are you able to see any particular indicator that is showing that the market can no longer “flex” and “reflex”??? that we are at peak “stretch”…………???

hey rotrot, that chart i showed was of the dow on the monthly time frame. the distance was where prices reside now, and the 20 month moving average………………….versus the 20dma that i wrote mistakenly on the chart………

thank you……..and a small curtsy ……. as i slowly back out of the room……….

An amazing chart. I had a foaming at the mouth raging bull on another site tell me in no uncertain terms that there is no such thing as mean reversion when it comes to market price. I tried in vain to explain to that blissful soul that mean reversion is a mathematical concept and not a personal opinion, that mean reversion does not exist because it can be calculated, but that it can be calculated because it exists… *SIGH*

Whoa, Luri!!! Be very careful with “NEVER”s in market analysis. You or whoever put this chart together. I am assuming they mean percentage distance rather than points difference. The former would be significant—the latter would not. As to percentage comparisons, last month’s high was 18.13% above the 20 month MA. That is indeed quite an extension, but as to “never,” that’s way off. It happened as recently as April 2011 and April-May 2010. In 1987, practically the whole year up to the crash was spent very comfortably above that 18.133% envelope above the 20 month MA. Perhaps there is an MA we are historically high above, but it is not the 20 month MA on the Dow…

I know you did not ask me but I tbink their inability to hammer out a new VIX low was telling.

I am slowly starting to realize my presumption that everyone has taken as keen an interest as I have over the years in volatility is a huge mistake. I think simply trying to compare current readings with

past historical extremes is like comparing apples and oranges. The market is much higher and no one is considering the new unprecedented situation of so called “synthetic” volatility shorts due to the explosion of passive investing instruments. So my hair will remain on fire if you don’t mind, thank you! 🙂

excellent verne – excellento!!!………………. yes your study of the VIX does indeed show “peak” stretch……………… although according to dave, there is nary a market membrane “stretch” at all………….

HEADS UP!………………….. HAVE Y’ALL SEEN THIS??

https://www.youtube.com/watch?v=moO9dfYHrZA

We finally agree on some thing , Crooked Hiliary. I have more of a non bias, non emotional point of view, due to being a Canadian. No axe to grind. For most Americans, it is like, trying to see the forest thru the trees with your politics. Very difficult to see the WHOLE TRUTH. Most Americans are constantly bombarded with 1/2 truths that are twisted and misaligned by your news media. I shake my head in disgust, on how your news media takes every word that Trump tweets out and uses it against him. I certainly hope, Trump is going to clean out the sewer rats from the swamp in Washington. Including the Fake news media you have in the US.

That carrot top is a lot smarter than most folk, including the swamp people realize. The man is playing three dimensional chess to their vulgar and predictable checkers; you just watch…I cannot repeat here everything I am privy to here… lol!

Nysi has been declining for 19 TD since October 17. The longest decline this year was 20 TD from February 28 to March 27. Therefore,it’s likely to turn up next week. The $spx low for this decline was likely already seen at 2544.

The shortest rise this year was 15 TD while the longest was the last one at 36 TD. The rest of the rises this year led to 83-101 points rallies in $spx. Once $nysi turns up i expect $spx to rally until at least the week of December 4 and reach 2627-2645.

Yes , I know the world is going to, go to hell. All you bears, please keep on shorting this market and putting out the Bear Porn. When you have to cover, it just adds fuel to the market.. So thank you for your help. LOL

WELL…..well…….well!!! ……………………you know i HEARD they let you out of prison……………but i wasn’t really sure……….. is it true that the prosecution gave you your nickname – “GOLDILOCKS”………. as you had an obsession with “bears” – breaking into those poor “bear” houses, and sleeping on their poor “bear” beds, and stealing their “bear” necessities like their monsanto grown GMO porridge…………………………….. 5 to 10 years i heard you got!……………………. well, well…..well……………………..!

More like the other way around. The bears have no money, no house and no porridge. They lost most of their money trying to short this beautiful up rising market for years. LOL Its funny you called me Goldilocks, that use to be my nick name when I played soccer. With the money I am making making, I will be sure to put a way a few dollars for NON GMO porridge for you bears. LOL

LOL – ok dave……OK………..you win – i can see NOW……..that two years of accumulated buying pressure has never even remotely been released,,,,

Luri, do not get me wrong here with these markets. I certainly see a correction coming up shortly. Ideally middle of Dec thru to the end of Jan. I would love to see a 25% correction, I doubt it. Much less. I have lots of cash to put to work. I will deploying more funds into wheat on dips. It should be fascinating on the next correction, on how the bears will react. Will they see it as buying opportunity or will they turn their backs again shouting CRASH ,crash, crash. I suspect most bears will waste another opportunity as the market takes off to the up side once again.

Hyuk! Hyuk! I would ask for some of what Dave has been smoking except that I don’t…lol! 🙂

Buy! Buy! Buy!

Please do send VIX back below ten ONE MORE TIME….(if you can…) 🙂

Not EVERYONE is bearish on EVERYTHING. My long term trading account is stuffed to the gills with some select miners that pay dividends in the metal, with leaps on Jo and Weat. Come on man…! 🙂

Good to hear !

You got it Verne, one last time for vix to come back down. I doubt it would be a new low. How about a slightly higher low ? All the best.

Thanks! The long vol trade is the best risk/reward trade I have ever seen…EVER!!! 🙂

Dave November 11, 2017, 2:42 pm

Luri, do not get me wrong here with these markets. I certainly see a correction coming up shortly. Ideally middle of Dec thru to the end of Jan. I would love to see a 25% correction, I doubt it. Much less. I have lots of cash to put to work.

Hyuk! Hyuk! I would ask for some of what Dave has been smoking except that I don’t…lol!

Verne, you do not agree with me and others that we are going to have a correction in the markets. What kind of kool aid are you drinking ? LOLOLOL

Joe, sent you a email.

If one is looking down the road to diversify, sugar is looking rather interesting. The sugar etf SSG that I am looking at is down close to 30% I will start to buy the dips over the next several weeks for a long term hold. ( 5 years)

Agree on the sugar ETF. I’ve been monitoring it and am close to buying. I’ve been in lumber (CUT is one ETF for it) for a little while and it appears to have more room to run.

Cut is good for a relative short term play. I want to get a way from short term plays on the markets. Wheat, soy, corn and sugar will be strictly for my long term horizon. No trading in or out. All based on the mini ice age we will be going thru. Today in Vancouver, our local mountains opened up for skiing. We have not had our local ski hills open this early in 40 years.

https://www.youtube.com/watch?v=qeJiORotbr4&feature=youtu.be

This is a video on the bradely model. Before you start rolling your eyes in disgust, take a look. The turning point is much more powerful with a 100/100 turn for early Dec turn. The video will explain very clearly. Please note, it does not discuss much for Dec turn in the markets, you will have to go to the authors web page to find the bradely model turn date for early Dec.

Please note, Bradely turn dates. 80 % of the time, the turn dates usually turn one week later than the actual turn date. Dec 6th is the next turn date, give it one week to make its turn. So perhaps Dec 13th approx for the actual turn.

A new weekend blog post is live at: https://worldcyclesinstitute.com/last-rites/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.