Ahhh … another weekend of obsessing over this impending US market top. My focus has primarily been on the apparent non-confirmation between the currency pairs (including the US Dollar) and the imminent turn down of the US indices. I’m expecting a top in ES/SPX and their peers at the beginning of this week.

Non-Confirmation (Update)

The principle of confirmation is one of the common themes running throughout the entire subject of market analysis, and is used in conjunction with its counterpart—divergence.

Confirmation refers to the comparison of all technical signals and indicators to ensure that most of those indicators are pointing in the same direction and are confirming one another.

Divergence (non-confirmation) is the opposite of confirmation and refers to a situation where different technical indicators fail to confirm one another. It is one of the best early warning signals of impending trend reversals. — Technical Analysis of the Financial Markets, John J. Murphy

Last week when I introduced the non-confirmation idea, I was referring to the US Dollar and the EURUSD currency pair. It appeared that the US Dollar had traced out a five wave impulsive wave to the upside, while EURUSD had traced out five waves to the downside (except that they were overlapping, which then counts it as a ‘3,’ or a ‘corrective’ wave—in Elliott Wave parlance).

I no longer believe there to be a non-confirmation between the US Dollar and EURUSD. The US Dollar does not look to me as through the waves up conform to the rules for an impulsive five wave move. I believe this set of waves up is telling me that both the US dollar and EURUSD will completely retrace. In other words, there is one more wave to go for both before a complete trend change takes place in currencies (you’ll find more information on this below the chart of UUP).

The non-confirmation example now appears to be that of the US indices turning down (perhaps this Monday), which the currency pairs (all appear to have one more wave left to go) complete their journeys to their final targets. I had originally thought they would all turn in tandem, but I can’t now see how that can happen.

Non-confirmations are usually prevalent at a major market reversal (a change in trend).

The US Dollar

Above is an hourly chart of UUP (the ETF that is the surrogate for the US dollar). I can more easily access a smaller timeframe chart of UUP than I can of the US Dollar itself. The pattern is the same.

On this chart, I’ve identified some of the problems with classifying this wave up as an impulsive wave. As time progresses, it appears to be more and more a corrective wave. I now expect a turn down to a new low, while EURUSD turns up to a new high. Here’s a review of the items I’ve identified in the chart (from the bottom of the chart to the top):

- Wave 1 does not appear to be impulsive. It’s missing a second wave, however, there’s a gap at the point it should appear, so this red flag is questionable. A bigger issue is that fact that the fourth wave of that first wave did not retrace 38%, which is a requirement for fourth waves in an impulsive wave situation.

- The wave up from the wave 2 label is a sheer wave with no apparent subwaves (it appears to be a zigzag). This is not an impulsive pattern but rather a corrective pattern.

- The wave measurements are not correct for an impulsive wave. The third wave in an impulsive sequence should be 1.618 X the first wave. I’ve positioned the Fibonacci tool to show the relative length of the first wave positioned at the bottom of the second wave. It’s obvious the third wave is not anywhere close to the appropriate length.

- Wave C/5 has two waves which overlap (they should not) and a very odd pattern for the wave itself. It does not conform to the impulsive pattern a fifth wave should exhibit.

- Wave C/5 also appears to be approaching a double top, which an impulsive wave should not do.

In summary, the structure is overwhelmingly screaming at me … corrective.

The VIX

Above is the 2 hour chart of VIX. It’s current position is, of course, a major warning of an impending trend change. Complacency is at record highs while SP500 volatility is at record lows. In terms of the SP500, look out below!

I had predicted about three weeks ago that the VIX would need to reach a new low, or at least a double bottom, at the top of the US equities market. This would be an indicator of a US market top. Here we are with a small gap to fill to reach that target (you can see on the chart above).

You can find out more about the VIX and its meaning here.

CAUTION: There May Be Surprises!

I’m unsure as to how the US Dollar and USD currencies (which apparently have one more wave up to complete before a trend change) are going to be affected by an imminent change of trend in the US market.

Recently, as the US Dollar has been losing value (a bearish move), US indices have been bullish. Most recently (over the past few weeks), however, the USD currency pairs have been in a fourth wave (bearish) while the US indices have been rallying. I don’t know if the relationship has changed for the short term, or longer term, or if we’re just seeing a non-confirmation situation at a market top.

So we may see some surprises here while various assets move in relationships to each other that are different than we might expect.

Be careful while this situation resolves itself. Now’s not the time to take chances. There will be opportunities to get on board for this 5 year (at least) bear market.

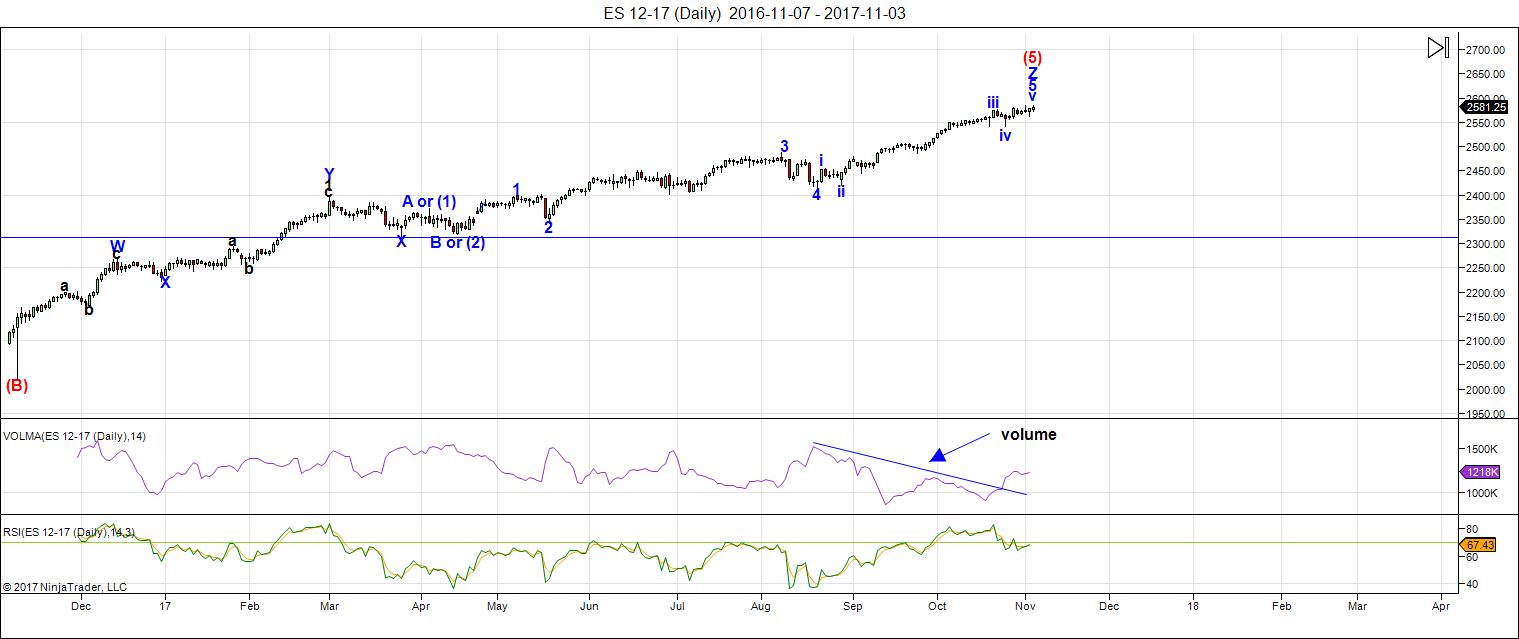

Here’s the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last week, I noted that the wave count for NQ was all but done and that ES had more subwaves to trace out, but was also very close to a top.

I expect a turn down for the US indices as early as Monday; this should mark the top of the rally and lead to a multi-year bear market. Over this weekend, we may see a few more points in ES, but my count is full and the market is exhibiting signs of being extremely tired. Note that VIX is almost at a new low, which I predicted a few weeks back.

Everything is set for a downturn and an end to the bull market. A fourth wave or drop with a further rally to a double top is also possible, but the market should turn down imminently.

Volume: Note that for some time now, volume has been expanding with selling, and drops considerably when the market heads back up. This is yet another signal of the larger, impending top. The turn up for the final leg is now showing signs of turning back down.

Summary: The count is full for NQ and ES, except for small subwaves as part of the final fifth wave.

___________________________

Trader’s Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a “snapshot” of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Wednesday, November 15 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won’t find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

well done…check your email for a chart you may find interesting!

Thanks Peter…..Nick..

Unless all these central banks stop printing money out of thin air and purchasing US stocks the trend will not end. If you or I printed money to but stocks we would go to jail. The central bankers talk about low inflation but the markets go higher each day and that price inflation is ignored? This is all a criminal enterprise created by the elites for the elites.

https://static.seekingalpha.com/uploads/2017/7/17/saupload_Wedgewood-Partners-18_thumb1.jpg

Yelp, they have already printed enough money (2008-2012) to cause a nuclear explosion and they are not even considering stopping printing. That money is sitting in banks and businesses waiting to be lent out. It is trillions.

Everyone underestimated the power and duration of the CB reflation trade. With all due respect to Prechter, they clearly can and do impact market price. I furthermore suspect that they are not truthfully reporting

the full extent of their intervention- remember the several hundred billion in unassigned liability BIS “discovered” recently?

What we also know is they are approaching the limit of their ability to propel the market higher by brute force. This again being clearly signaled by steadily declining market breadth. It is amazing how narrowly recent gains have been focused in a few heavily weighted stocks. This is the reason for the plethora of HOs we have been seeing. The turn is likely to be quite brutal, and all the talking heads will whine about how the market gave no indication of what was about to happen. Balderdash!

Thanks for the update Peter

I have to say that although they are printing they were doing that in 2011/2015/2016 and the printing did not stop the declines in those years. I suppose thats what makes elliot wave good!

Now there are many that say elliot wave is outdated and dead in modern markets well i dont believe this to be the case so i think this current market is a true test for EW. If peter proves correct many will have to say EW is alive and well!

As a novice, are there any straight forward, easy to understand risk-based instrument that I could research that would let me capture some return when the market starts to turn. This would be part of a speculative investment so not afraid if things don’t turn out as expected. Not looking for specific advice, just some ideas on a direction.

When the market is heading down SPXS, UVXY,TVIX & VXX gain in value. UVXY, TVIX and VXX are fast movers. Not trading advise.. Good Luck

Robert i am sure someone else will chime in but for me you must study the length of the primary sells once we change trend by this i mean the number of days and the % declines in most instances we sell circa 5% +/- 2 this may then be followed by a retrace. This is what peter is eluding too when he says we may double top. In most instances like 1987/1929 we retraces 61.8% approx before heading down hard.

Whilst markets behave differently every time and never exactly match one thing never changes and thats human behaviour.

Try and study historical data in this case the declines you will notice reoccurring patterns for sure

I hope that helps.

Hi All,

I am taking some time from trading until next year. Good luck and thanks again Peter for this unique site!

Tks. Take care, Valley.

Thanks Valley for your input all those years. Hope all is well with you.

This criminal should be locked up for life

then again the criminals are running the ponzi show

https://www.youtube.com/watch?v=1kuTG19Cu_Q

11/7 and 11/13 will be highs. So a low in between 11/9-10 Very likely this timewindow will bring the final high so we can begin our decline into july 2018,

Cheers,

André

That would be deeply ironic, namely Mr. Market bucking every seasonally bearish period this year, then taking the herd out back for a spanking as they breathlessly anticipate a “Santa Claus” rally. I am not necessarily saying that is what will happen- no one knows, but it would be ironic… 🙂

Andre thus far you are on the money sir.

When you say 11/13 being another high I assume you mean a lower high after the initial sell?

Do you concur with peters thoughts in that this could be a multi year top with a minimum 5 year decline or do you see a decline into July 2018 followed by more highs there after.

Well done again and I look forward to hearing your thoughts

thanks you in advance

I expect 11/13 to be lower. We’ll be down in 5 waves and the july 18 low will be just be the first leg. So I concur with Peter that this will be a multi year decline.

Thanks so much andre for the clarity, I appreciate it a lot. nearly every astrologer has been dead wrong with you and a few others being the exception.

I too believe this is a multi year high and one that will be remembered in history like the 1929/87 etc

Funny that everyone expects a seasonal rally into year end but what the majority fail to realise is that this has rallied non stop all year and all the old saying of “sell in may” etc have failed badly so why should the “santa clause” rally not fail to materialise too!

There are so many bulls out there right now its untrue. for me thi is worse than 2007/08 because at least that in its final stages started to give the majority a few signs prior to the top. This time its more like standing on the top of a large building and dropping a brick

thanks again

Hi Andre

Would it be possible to have your email address as i would like to ask you in some more detail about astrology and maybe some learning resources.

I dont want to clog the blog up by asking here.

If you dont want to post your email address on here maybe peter could pass you mine or visa versa or if you decide that this is not something you can help me with no worries at all.

Regardless for the astro information you have shared thus far

I meant

Regardless thanks for the astro stuff you have shared with us so far

apologies for missing out “thanks” Andre

m.s,

It’s okay to aks your questions here so everybody can can see the response. No need to do that private.

Cheers,

André

Ok thanks andre

So can you direct me on which educational resources i should read/research please?

M.s. I spent years of research on every technique available. There isn’t just one source. Every week I post my expectations. Just focus on that.

I have an email contact with some great analysts; some having their own adivisory firm. I give them things and they give me things. But I can’t do personal consults. You have to work hard. like verybody else,

In my weekly updates I try to help everybody, like Peter.

For now I can say the weekend will very pivotal. 111/11-12 is a strong turn period. Will give the arguments this weekend.

André

Hi All,

Great input here, thanks to all posters

Here is a weather link you might interesting

https://www.youtube.com/watch?time_continue=51&v=u081u7Wdf5M

Armstrong is looking for a low in wheat by q1 2018

Ranchida

thank you for the video 🙂

My own work with the sunspot cycles shows this past month as a fairly large

drop off in the sunspot averages .

My bias is we see a continued collapse , the 30 day period has already

showed this yet the 90 day period collapse is what I’m looking for and

all next year should be little to no sunspot activity .

Crop failures appear to be a given.

I’ve been watching for signs of life in wheat and have a small position in coffee. These seem to be the two with the best potential although sugar may form a db if it breaks down from its daily triangle and could be a great play later

“he can reach for the pickle jar alone, for all i care”……….

https://invst.ly/5pmxj

zoom zoom…… close up of that “c” of “v” of the ending diagonal chart [see above]

verne…… we BE close! https://invst.ly/5qg21

NEGATIVE THINKERS ALWAYS HAVE A NEGATIVE VISION.

So does the corollary apply and is that why sentiment on so many levels is at record high bullishness?

Hi Peter. Please see comments below. Thanks.

Fascinating. That is, the notion that Mr. Market has the slightest interest in the power of positive OR negative thinking. Price is what it is. Charts never lie. A one-sided trade, such as is currently the case with the countless masses short volatility, is demonstrating optimism with a vengeance. We all know how those kinds of trades resolve, crowd optimism notwithstanding…. 🙂

Verne, with all due respect. I have heard the same reasons, that has been voiced on this blog and other blogs since 2009. What I do not understand, is if one is bearish why not curtail your long portfolio to a 50 % position. As the market rises like it has been since 2009, take the profit and put it into a money market. I have never seen before in my life the extremes in either being a bear or a bull. It is a Ying and Yang situation. A complete polarity with bears and bulls in the market. On a physiological level, it is the integration of being a bull and a bear is where the truth is. In other words, having a balanced point of view despite what is going on in the outer world. All the best.

On the mundane level, the money flows are coming in from over sea”s. I have discussed this often. This is distorting the domestic sentiment readings that I no longer look at.

Clearly anyone who has been bearish since 2009 has been laughably wrong. I have not been on the site that long so I am unaware of the sentiment going back several years. I get what you are saying about arguing that a wave is corrective (which this one from March 2009 is if it is indeed a b wave), while missing an uptrend now lasting several years. For a trader that is sheer folly. The time frame and wave degree you are looking at is clearly critical when talking about trend.

While I am of the opinion that the Feb 2016 low was the end of a primary fourth wave, I am still now open to our completing a third wave and unsure about whether it is at minor or intermediate degree, so personally I am expecting at least one more good sized correction prior to a final top.

A good case can be made that the entire move up since the Feb 2015 low is directly or indirectly central bank driven. EW purists who keep repeating that Central Banks have no impact on market price are in my humble opinion completely divorced from reality and there is well over 8T of market value that makes that point. The fact of the matter is the perma-bears, while probably correct about the current move up being corrective, have been terribly wrong in underestimating the ability of central banks to continue to propel the market skyward. No question there are signs of flagging efficacy with this strategy (dwindling market breadth and volume) and the end could indeed be closer than I think. My larger thesis has the day of judgment being ushered in by a crisis in the bond market, which dwarfs the equities market, and unlike equities markets, is far too large for even central banks to even attempt manipulate. The pricing of bonds is where the real evidence of insanity in the investing world is most evident imho. It is also a place where a lot of fraud and hidden risk I think is being ignored. I would look to the action in bonds; I think that is where the real tale of the tape resides, and will be the clue to when this house of cards comes crashing earthward. In the meantime, we trade what we see, not what we feel… 🙂

Verne, I will do my best to elaborate more on ( NEGATIVE THINKERS ALWAYS HAVE A NEGATIVE VISION.) On a physiological level with in ones mind. It is easy to distort reality from the truth. Using the analogy, 1/2 glass empty type of person rather than a 1/2 Full glass type. You are more than likely to succeed in life if you are 1/2 full glass type of person. NO, that does not mean because you are positive that the market is going up. Mr Market does not care if you are a bull or a bear. It will do what it wants to, in any given linear time frame. If your mind has been programed to always look at life in a neg way, whether it is in politics, financials or in your life generally, more than likely you will fail to succeed. Your subconscious mind will gather in any information to to justify ones stubbornness ( YOUR BELIEFS WITHIN ONES SELF) In this case, the bears will always gravitate towards information that proves their false belief . (MARKET is going to crash) This is why I stay a way from BEAR PORN !! All the best every one.

Got to think that today should mark the high guys at the very latest tomorrow on the open. Targets are fulfilled by every measure. So the next 48 hours should be very interesting given where we are right now.

Peter’s last week seminar was exceptional given where we stand today. The bears are all dead now and other than this site there is literally no one calling for any form of decline even in the intermediate time let alone a 5 year plus decline.

I beg to differ with you. All the best.

I have no problem with you disagreeing Dave, thats what makes the market and i agree to a certain extent with what you said about foreign capital flows propelling this higher.

That is something Armstrong has been alluding to but markets always tear the rug out from under you and i have been bullish for over 7 years now but i am starting to feel that i should be 100% long and that much like 2007/08 was the point where we turned so i must trust my instincts.

Thanks for replying

is it…….”BOB’S YER UNCLE!”…………. time??? we shall see…..

https://invst.ly/5qsde

Yes the market is topping. It is only a matter of hours now.

It is finally here.. BOOM!

Not quite. Robert McHugh has been warning for several weeks not that indices are all completing very clearly defined rising wedges, which are usually terminal structures. He is also the only analyst I read who has been consistently pointing out the large number of HOs we have had this year and the early warning message it is sending about declining market breadth. I have been biting my tongue and taking quite a bit of ridicule pointing out bearish signs in this market by some folk who seem to think the uptrend will never end. In the meantime, the foxes are very slyly selling the market in a surreptitious way as the lemmings pile in…

Verne, I apologize if you thought I was ridicule you. That was not my intention. It was to have a conversation with an exchange of ideas. It is very healthy for financial blog, to have bulls and bears ideas and strategies.

I am going to go off line for a while, I can see that I am really the only one here who is on the bullish side. It makes it difficult to want to comment, now that the other bullish poster has gone. ( Valley ) I personally hope, all of you bears do capture the market crash if it happens. All the best every one.

Dave,

stay, and comment…….you are 100% correct…..we all need each other……that is why we are a “comm UNITY”………. we stick together…..so the bullish comments the better………if/ and until the market breaks down….the trend in prices is still to the upside…………. you have my respect too, and your input is important.

Oh my! You are as polite as they come Dave. You should see some of the comments I get from raging bulls on other sites that don’t want to hear even a whisper of bearish possibilities! 🙂

verne …..

you have my complete respect…….and there is never a need to bite your tongue here……you have said many…..many times over the last month or so, that this move in prices to the upside is “terminal” in nature………………… i respect this analysis……

wow,

a sweet little overthrow of the “potential” ending diagonal in the ES….. let’s see if it reverses back to that horizontal red line…….

https://invst.ly/5qtxf

and a close up of that final “c” of 5 ED with the overthrow……otherwise known as “bob’s yer uncle”…………………… we shall see……

https://invst.ly/5qtxw

huh – go figure……end of day on the “bob’s yer uncle” chart……..hmmmm

https://invst.ly/5quf8

and if we pull back to see the whole “potential” ending diagonal on the ES we see this……………and if i recall correctly, “if” this is an ED, then we should drop fairly quickly to the fat horizontal red line …….

https://invst.ly/5qufi

It’s here:)

Kaboom!

Jody,

Sincere or mocking?

It’s upon us or 1 small dip and rip then top. Either way we are very very close to the turn.

Thanks!

Hello Dave,

Are you different from this Dave who commented about the yin fire losing support in 2018 until 2022?

https://worldcyclesinstitute.com/september-lining-up-for-a-great-fall/#comment-20957

I don’t profess to have a market crystal ball, much less trying to tell anyone else how to trade. Having said that, just because the market is behaving irrationally does not mean you cannot trade it profitably. While I am not saying this is true of Dave, I have found that many who express his viewpoint assume that just because you are bearish, that means you are unwilling to trade the clear current trend if it happens to be up. Here is an example – do I think that VIX trading below ten at this juncture in the market is insane? Absolutely, I do. Nonetheless, if you look at how VIX has traded the last SEVEN Fridays, the banksters have faithfully driven it below 10.00 on a closing basis each and every Friday. It is truly amazing. I actually have some folk say to me that this is PROOF that the market will continue to ramp higher as price volatility divergence can persist for years! I know, I know…never mind where we are in the cycle and the duration of the current bull run; but I digress. For the last seven weeks, and particularly on Friday, rather than lament the mind-boggling insanity of VIX trading below 10.00, I have simply bought call options every time it did, and sold them on the inevitable pop back above that pivot for an average gain of 15% per trade, some more, some less. Rinse and repeat. The market does not care what I think, and traders should not care what the market does. Price is what it is, period! That strategy had nothing to do with being bearish (although I am) or bullish, but simply observing the price pattern. VIX has been clearly in a falling wedge and recently had a false break above the upper wedge boundary. Peter T pointed out that he expected a double bottom. I also did but for an entirely separate reason, and that is that initial false breaks above a falling wedge almost invariably put in a double bottom prior to a follow-on successful attempt. I happen to think the intra-day low last Friday of 8.99 might have done it, but would not be at all surprised to see a new 52 week low before it really takes off. I have friends who are fully long the FAB FIVE Nasdaq darlings and who have been for the past year and they HAVE made a ton of money. They remain long to this day, despite my urging to take some profits off the table. When I do they get that dreamy far-off look in their eyes that says…”just a little higher…!” I think that is absolutely insane. One guy has a very fat account and ALL OF IT is in those stocks. It just so happens that virtually ALL of the Nasdaq gains have recently been focused in those few stocks so right now he is looking like a genius, and does not seem to understand just how ominous that is. So far I have been wrong and he has been right to stay put, at least in the time frame we are now considering. Despite all the bearish warning flags in the market, the fact is that everyone subscribing to the BTFD market theory has done very well. No wonder so many of them are so arrogantly dismissive of those of us who would urge caution. I guess what I am ultimately saying to all those who remain convinced that risks in this market are minimal, is that it is not how much money you make in the market, but how much of it you keep….:Nuff said… 🙂

Yes LizH. That was one of the reasons, why I sold off part of my longs to 40% position. I am now at 54% long which includes positions in wheat and natural gas. The WT. and gas is for the next 5 years, I will not trade in or out. I plan on increasing my position in wheat over the next several months on the dips. I will maintain some sense of balance in my portfolio. That is my large portfolio which I do not trade in or out except perhaps for rotating into other sectors. My investment philosophy is a reflection of my own life. I never go to extremes whether in my emotions or going out with my friends drinking. I fully empathize with Verne with his discipline in not getting emotional and biting his tongue. If I find myself getting off balance with my emotions, I immediately walk a way from my computer and go for a walk and disperse the built up energy to clear my mind. I have made the biggest mistakes with my trading when my emotions get triggered by some one I am interacting on a blog. I always promised my self, I would always show respect to each and every one a blog. The only time I blew a fuse was with (WAZZUP) I felt like he was trying to suffocate any communication on the blog last winter and called him a pompous ass. LOLOL I even shocked my self with those remarks. Never a gain. I promise Peter. The bottom line LizH, always maintain a sense of balance in ones life including ones financial portfolio.

Good words, Dave

Thank you Sir.

Thank you Dave, Verne. On watch tomorrow is PCLN. Aug. 8 high down to 8/29 low, 61.8% retrace into 10/18, 10/23. Traded below 200sma after hours today to 1710. If sellers push it down to fill Feb. 27 gap, I intend to ride the wave with them.

Interesting story about PCLN. They once stiffed me for about 300.00 when I had to cancel a reservation and they refused to give me refund or allow a re-book. I got the money back by shorting the stock! (I actually sold a few bearish credit spreads over a few weeks lol!) 🙂

That stock, as well as AMZN, Alphabet, TSLA and a lot of other high flyers are going to make some folks a lot of moolah when the bear arrives…and it is going to happen a lot more quickly (making the moolah) than a people expect. While those guys are often the last to collapse, once they do it is truly spectacular!

Sold my puts! 🙂

……dave……. ohhhhhh …..daaaavvve – a thought here.

maybe………..just maybe………..in order to have a “balance in one’s life”……one must be “out of balance” elsewhere in the life…………….. “elsewhere” can include one’s trading life…..[that is, assuming one trades]…..

methinks “true” balance can only come from unbalance………………………i assume we have the potential to take with us upon dying, the knowledge and experience learned from the life,…………the money and the trades and the “stuff” accumulated through a life of consumption – not so much……that stuff stays behind……………..

for me, i pick “unbalance”…………… :-)))) huh………….did you like my thinking there dave????

I have been to the other Dark side ( Unbalanced ) Never again. True harmony is being in alignment with your higher level of integrity. ( Balanced approach to life). LOL

Dave and Verne and ill include Liz

AS Jim Cramer would say , there is always a bull market somewhere .

ill elaborate and say there is also always a bear market somewhere .

you could have been short TEVA all year as just 1 example .

Liz I get the feeling that you actually follow several stocks and you have what

you call passive investments . point being we few have a bullish bias amongst

our shorter term bearish views . Dave your not the only bull here .

Some stocks tend to hold up and rally in bear markets . its not always

sell all your stocks and buy gold or sell your gold and buy everything else .

my target’s for the dow have been exceeded and because of that I have gotten quiet . I have also stated my reasoning’s for a Dec high which was an adjustment

to my prior June 2018 high. I have reduced my exposure because of my own technical analysis as well as my own timing. early in the year I decided to not buy more stocks and to continue to reduce my exposer . having said that I see no reason today based on what the market has done to reduce further.

I do not intend to add any stocks and I am tech heavy because of that the market has done . my initial balance was fairly equal . I have cut back tech only to see it continue to rise .

my timing though which I have explained prior is focused on dec 1 to jan 2.

I have pinpointed dec 13th . those time frames do not change and as much as

id prefer to be a year younger the fact is time goes forward not backwards .

dave , I have to say liz brings up an important point when she mentions your ying vs yang in 2018 . I think it may prove in your best interest to keep your own work in mind as we enter next year . I’m not arguing just saying lets not get caught up in the euphoria .

Verne , you are correct that this market is out of wack yet please do not let that

guide you . ill can tell you from my own pervious experiences that fighting

a trend and trying to convince yourself that you are right and the market is wrong is a path to extreme financial pain . also Verne I understand you trade on a short term basis , so I understand your viewpoints are not always your trade of the day so to speak .

Ill finish by saying this is not a football game, we don’t get to say my team won or your team lost.

The battles between us is not needed, this is us against the market not us against each other.

I wrote up a long winded messages months ago on the differences between the vix and vxo and at the time I felt it landed on deaf ears . Nobody listened to me then and ill guess no ones listens to me this time . the lowest low on the $vxo

was 2.10 ( not a typo ! ) that low was in 1993 . the vxo rose from 1993 and peaked

in 1998 along with the bull market ( yes it spiked on drops but the trend was up in the vxo and the stock market index’s ) the vxo declined from 1998 to 2005 , a 7 year decline the year 2005 was both a high and a low in the vxo .

2008 was the year of the most recent alltime high in the vxo and it has been declining ever since .

1993 is the lowest low in the vxo that I can see , 2005 the next lowest low .

12 years apart . add 12 years to 2005 and you get 2017 which is shaping up

top be another low . while the vxo has not yet tested its all time low of 2.10

if it were to close the year wear it is today it would be an all time yearly closing low .

The vix and vxo to me are just a gauge of range expansion and nothing more.

the vix and vxo are declining because the range of the spx or oex are declining

the bull market from 1993 into 1998 was a bull market with an expanding range and that was what drove the vix and vxo higher .

If you ask me this low interest rate and low vix vxo environment are a good thing to see . id love to see the vix get to 5 and the vxo to break below 2.10 ( doubt it happens ) a vix below 8.60 I welcome as we enter the month of December .

please mr market drive the options premiums into the toilet .

A few well placed Feb 2019 options will fit into my bearish thoughts for all of 2018.

I still agree with Andre that we see a significant decline into April 2018

Andre said may 2018. so April may 2018 fits . and if so its going to feel like the year 2000 all over again .

Keeping my plan in check and not going to change it until the market proves me wrong ,

come jan 2019 though I flip back to the bullish side of things.

we have a tax cut coming lol ( dec 8 a budget is due )

its all coming together

Hi Joe, I was wondering if you use EW in your market assessment, and if you do, what degtee wave structure you think we are in. It sounds to me like you think the coming decline will only be a corrective wave, is that correct?

so in the overnight hours, the ES reversed yesterday’s “end of day” drop, and headed higher. It produced a “proper” overthrow of the “potential” ending diagonal.

We must wait and see if we drop quickly to the base of the ED in a first sign that a change in trend of some kind has occurred………

https://invst.ly/5rflm

Yep. If it is an ED the reversal will be all business and no BS…confirmed with a demolition of the lower boundary. Problem is we keep seeing those patterns arrested and reversed. I have never seen anything quite like it!

Luri Thanks for the chart

The reversal from those out of hours highs has been stellar. Andre has given a time window that confirms your ED so let wait and see. I have a feeling today may be your day Luri.

German dax had a powerful reversal this morning from the word go almost. Pretty much times with Trumps S.korean speech but having listened to it i dont hear anything inflammitory

Kaboom….stick a fork in it!!!!

no selling at all and from the first tick it was bought up. No Kaboom yet guys

I do not trust intra-day reversals. This market will collapse when, and only when banksters have lost the ability to keep jacking it higher apart from any true price discovery considerations. The absence of any real selling pressure as someone has noted, means that they are still firmly in charge. I am of the opinion that battle will take place in the futures market, where we will see them utterly fail to arrest a truly waterfall decline after the market puts it its final top. That is the time I will be fully short, not one market tick before…

SPX 2564 and below should erase any doubts to the Bulls that the up trend is still intact.

There is 1 issue i am having with this last wave. I don’t see a clear (4) – that does not mean its there, its just not clear to me.

What will be the 100% absolute is the break down below 2564.

Hearing all the bullish sentiment especially on the business news is the fact when you look at a Dow, Comp or Spx chart it is straight up. There is NO possible way it is sustainable. When I see the same formation on a smaller time frame I short the crap out of it and it always ends the same way. With a nasty reversal – because it is a blow off final wave.

To read or listen to the so called professionals and their forecast really has me scratching my head.

Really? Are we looking at the same charts? If so how in the world do you have a job in money management?

It is over folks. Time to correct.

Looks like with the classic over shoot and now reversing this could be it, but want to see Spx below 2564.

Jody i think we need a break of 2540 and sustained daily closes below that level, usually at least 2 lower low closes and that for me will be the “put the fork” in it moment

M.S – what wave count would that represent for you?

Do you use EW or just support and resistance?

Do you have a large triangle on your charts?

Once you pop out of the top of a triangle and reverse as we did today then bust the bottom trend-line which is at 2570ish it is a wrap.

Hi Jody

I dont use EW per say not to the level you guys have as you are all more skilled than me. I use as you said support and resistance and then confirmation rules for these levels to be classed as a definitive break.

Andre’s astro day is today and he has been on the money compared to all other astro people so i am eagerly watching today, not expecting a massive drop but a nice gentle 1%+ down would give me hope

There will be nothing gentle about the reversal. It will be hard and fast and when everyone is finally convinced it is here and go short it will reverse for a W(2) correction.

Elliot Wave will give you the clues to keep you on the correct side of the trade.

If your serious about your investing I would implore you to take advantage of Peter’s “Traders Gold” program. Good Luck.

jody, ms, verne, joe, liz, dave, neil, peter……..ummmmmmmm …..andre…….. verne….[no i said verne already]……ahhhhhhhhh…. and wilbur ross………

…..think projectile vomit……………… https://invst.ly/5rmei

I don’t mind the double dearie! 🙂

Oh, and BTW luri, are we now expecting “One toke UNDER the line”?…the purple line that is! 🙂

I don’t want to supplant Dr. Faber as Mr. Doom and Gloom, but the main reason I have refused to go fully long this market, despite the clear uptrend is a deep concern about the non-existent volume. Long traders harbor absolutely no concern that they will be able to easily exit their long positions at the first sign of market trouble. What if that trouble develops overnight and everyone decides, AT THE SAME TIME, that it is time to exit?? Remember, NO VOLUME!! That is the main reason I refuse to be committed to any long, or long term trades, I don’t care how high it goes. It just does not seem prudent to me.

HAHAHA! What are these people smoking..

https://www.cnbc.com/2017/11/07/the-bull-market-has-8-to-10-more-years-left-jeff-saut.html

See what I mean? 🙂

I guess looking at volume and breadth is not part of his market studies. lol

so Mr. Creosote …….”IS”……….. the bull market in equities………………there is no doubt in my mind as to this comparison!

…………………..and of course, can i offer you a “thin” mint!

https://www.youtube.com/watch?v=rXH_12QWWg8

I would normally quickly conclude we have an exhaustion gap based on this morning’s price action but we all know better. The persistence (and perversity) with which these have been filled only to be immediately reversed lately ( at least five in the last few months) illustrates the obsessive determination on the part of you-know-who to keep this market from any kind of correction. Let them keep flailing away. I patiently await the futures reckoning… 🙂

I am buying the dip. I am trying to get my portfolio back up to a comfortable mid 60 % long. es 2484

Do be careful!

As mentioned before, history has a tendency to repeat.

1929 -1931 was the last time Republicans controlled the senate,

House and President – elect Herbert Hoover was not a politician, but a successful businessman who was not loved within his own party. Yet, people thought his business- savvy experience would thrust the economy and markets to new heights and it did in his first year in office. Than we all know what happened afterwards. Does the past repeat again. No, lightning does not strike twice in the same place, or does it ? LOL

Dave i concur but what about the unlimited QE these lunatics have thrown at this market, do this decrease the chance of HERBERT 2 the sequel actually being produced ?

MS. the markets will eventually cave in on it self, due to corruption and greed. Just like the great Roman empire, due to taxation corruption and greed. As for now, if I cannot beet them. I might as well join them for the ride.

Dave when you wrote the script for “HERBERT 2” we needed a bit of theme music……dundun deeee!

Lol

We are in the 8th inning of this game. But as Joe said, their are always opportunities in the markets at any given time. Wheat and natural gas ?

Luri, how about a chart showing es 2720 just to humor me. LOL

at the risk of feeling “dirty” and “used”……………………… i am working on it dave….

LOLOLOLOLO0L THANKS LURI !

the rate of ascent shows clearly the corruption and price rigging.

the distance between the middle of the bollinger band and prices now also highlights the overt controls on prices…..

here it is, simple and sweet….. please excuse me while i “take” a shower…. lol

https://invst.ly/5rp3g

another look with the subchannel.

https://invst.ly/5rp73

Luri, congratulations for jumping from the Dark side of life into the light. You now have been baptists ed. Do you notice how your mind body and soul feels now ? Feeling more at peace within your self. Even the flowers seem brighter, which is a direct reflection of your transformation you went thru. All of us Bulls would like to thank you for joining our exclusive team. LOLOL

Hey Valley, the coast is clear. I just recruited a new member. Come on back. LOL

verrrrnnnnnne……………………HHHhhhheeeeeelp! do i need to eat some “garlic”…………………. adorn myself in “crosses” ……….and do mortal battle with the forces of EVIL……using my original and authenticated “buffy the vampire slayer” wooden stake!!! [omg, liz i loved that series…….]

two words dave – “GALATIC CROSS!!” learn about……..the ancients were screaming for us to understand……………. 25,920 year procession of the equinoxes……. 12/21/2017 winter equinox is the designated date…………………………………

You are a good man Luri, despite what they say about you. LOL

Luri,

Hmmm. How did you know I like the Buffy show?

Dave,

Isn’t December a water month because it’s winter/snow season. So shouldn’t water extinguish yin fire? Or does it reignite whenever it hears jingle bells?

As corrupt as a Chicago Congressman….! 🙂

The FED has ended QE and It has shown up in the numbers already to a tune of 6 billion reduction in their balance sheet. Their goal is 50 Billion a month.

The FED is tightening meaning money is coming OUT of the system which = drop in stocks.

We have a clear 5 wave down and now in either a W(2) or W(B) playing out – either way W(3) or W(C) will show up tomorrow which will be a nasty drop. After the next wave down we will be able to clearly identify what this move is by the following wave.

It could be that W(4) I said could be missing with 1 final push OR the turn is already in.

If this is a corrective wave after seeing the first leg complete it would have to be a 5-3-5. It is not complete and we are heading lower regardless.

good summary, Jody. We’re in wave 2.

Music to my ears Peter! Thx!

The banksters continue to demonstrate that they are firmly in control with yet another DJI green close today. In my humble opinion this is NOT the way the real deal is going to unfold. I think we will get a very good indication tonight in the futures market of what to expect next. I think it is going to be quite a dogfight and somebody is going to clearly be the looser! Either I get even cheaper volatility tomorrow, or the bear will clearly be upon us. I’ll happily take either outcome. Later! 🙂

Verne,

Wave 2 is not complete. I would expect futures to be green over night with a positive open, possibly a gap up. Target Spx 2592

2592 in Spx would be a 62% retrace up of this first leg down.

Then Spx 2571 at a min target to possibly 2558.

2571 and 2558 are fib ratios off 2592 if that is in fact the stopping point.

We will know more tomorrow.

I agree. The choppy over-lapping price action makes me a bit tentative about whether we have actually seen the possible diagonal complete. I have another possible count that still sees an an incomplete fourth, with a final zig zag up for a fifth. On the other hand, VIX appears to have put in a final low with a bullish engulfing candle today. I still expect that reversal out of the posible ED to smack me up the side of the head…no wondering if we are actually done… 🙂

[TIME TO SHORT STOCKS BUCKO] – Dr. Fly | Tue Nov 7, 2017 3:26pm EST

http://ibankcoin.com/flyblog/2017/11/07/time-short-stocks-bucko/#sthash.E2soEzcr.dTvQP2G7.dpbsoff color

ADVISORY: it is not my intention to offend anyone…this character routinely uses language that is not politically correct…however, his analysis of the stock market is consistently spot on…

Something to keep in mind..

Wave 2 can retrace 99.9% of wave 1

Usually Wave 2 retraces 61.8% and on occasion 50% of wave 1

If 2597 is the top and 2584 is the bottom of the first wave

2592 would be 61.8%

2590 would be 50%

I rather see a gap up tomorrow then reverse. If you gap down sometimes they try to back a fill.

Another key to today was the outside reversal.

Wave 2 never retraces 50%. Only 62% or it’s not wave 2.

Peter,

I know we have differed on this before, however in “Elliott Wave Principle. Frost and Prechter” – it states on pg 135 about half way down…..

“Sharp Corrections tend more often to retrace 61.8% or 50% of the previous wave, particularly when they occur as wave 2 of an impulse, wave B of a larger zigzag, or wave X in a multiple zigzag.

It’s incorrect and why so many wannabees out there can’t count waves. There are quite a few errors in that book.

A B wave will do that, but not an impulsive wave. Never. All you have to do is find me one example of where that’s the case. Start looking ….

🙂

And I thought that Book was the Bible of EW.. lol

What is a better reference book for all the rules of EW?

There isn’t a better reference, but it’s a starter book. For example, there’s no such thing as a leading diagonal or a truncation. Nobody’s ever seen either one. His examples in the book are wrong in those areas. I’ve gone back and tested them all.

You only have to subscribe to EWI for awhile to see all the whacky charts those folks put out there. It honestly makes me crazy. It is what it is, unfortunately, but as I say, it’s a great starter book. For the most part it’s accurate.

Another error is that they state somewhere that a second wave only has to retrace 38%. Wrong. And fourth waves MUST retrace 38% in an impulsive wave. That’s one of the key ways you can tell if a wave is impulsive. If it doesn’t, it’s not. Period. And that fact alone is a defining factor in whether your count will be correct.

All these errors and laxness is why most EW folks think the wave up from 2009 is an impulsive wave. It’s definitely not. It’s corrective; it’s a B wave. And that’s why all their counts are wrongo.

🙂

You’ll learn more about EW from watching the markets and doing measurements and seeing what pans out and what doesn’t. It takes a lot of time, though …

So SPX 2592.22 (approx) would be the 61.8% retrace.

So we have to open up tomorrow a few points to validate the count.

As it stands at the close today we have only retraced approx 50% – just under. SPX 2590.35 was the close and 2590.71 would be the 50% mark.

Thanks for the clarification.

yup.

🙂

ES just became a ‘3’ so that potentially negates the impulsive wave down. I certainly didn’t want that to happen …

Just curious.

Did ES just become a three because it did not retrace 61.8%?

It went to a new low and yes, it hasn’t traced out a valid second wave. So I expect we’re at least going back to the top.

And it wasn’t confirmed by NQ, so we have a mess.

There are certainly some bearish signs. But we have been seeing those for quite some time. My opinion now is being very heavily informed by the proven perversity of the central banksters, and my own instincts regarding previously traded ED reversals. While I think we are very close, to me personally the reversal so far lacks conviction. I do fully realize I could be quite wrong on this score, but I will wait for the futures battle as I think that will be conclusive…

……aaaand!……… you ALL know what i am going to do know!!!! ………..that’s right……its the RUT time……when all is lost, look to the RUT – it lead the way up, it will lead the way down…….

BE WARNED!………….. and a special shout out to [bless you] “evil” dave – BE WARNED!

https://invst.ly/5rqls

I have been called a lot of things in my life. But never Evil. That’s a first. Lol

Yep! I think small caps will lead the plunge. My Jan TZA calls were under water for few weeks but popped into the green yesterday. McHugh issued a sell signal for RUT.

Peter, I think it might be the wave 4 I had mentioned earlier. As it unfolds obviously it will give more clues but it looks pretty good as an ED with this wave heading down to the bottom trend line of the diagonal, then over shoot out of the top of the triangle just above SPX 2600.

Luri’s Triangle would be a good reference but the top line is actually at the top of W(3). If that line is moved up one peak – that is W(1) and we just finished W(3).

W(4) has A and B done now with wave C coming tomorrow and approx 18pts to the downside.

Then W(5) to wrap it all up..

However if we close well below that bottom trend line wave 2 was only 50% ?…

I agree Jody. We are not quite done…

I will know a little more after this next drop and how far it drops – along with the open tomorrow.

jody,

what you been smokin young man? this is a clear 5 count on ES….

https://invst.ly/5rwny

…….with fib retracement…..

https://invst.ly/5rwpr

best view………………and again i count a perfect 5 waves – motive in nature….

https://invst.ly/5rwtb

……………..how are you possibly seeing only 3 waves?

The count does not viooate qny rules so far as I can tell, but the 2- 4 wave disproportion does stand out. When this beast turns, the smaller degee corrective waves are probably going to compkete intra- day. At least that has been my experience trading impulse waves to the downside. I also would not expect an opening gap ahead of an impoulse down to be filled by a corrective wave. Just my two pence. 🙂

thanks verne,

i would expect chop-like tendencies off the top – and as for disproportionate 2’s and 4’s – take a look at the 2’s and 4’s created on this entire move up in prices from the 09 lows……………. very few of them retraced the “ideal” amount……. this is the way of CTA’s today…..

as for the ED, well i will give it to Thurs to make it down to the base, and that dark red line on the chart. We will be able to tell if prices are being “walked” down – or they drop hard…….. we must sit back and be patient. The ‘tax reform” being dead, has the potential to illicit selling. The RUT is breaking down through crucial technical points on its megaphone topping pattern…… i will be watching this price action closely. keep in mind that the RUT topped 10/9 and had a very bearish reversal/ run at the top on 11/1 in which it failed to make a new high. The RUT was “risk on” signal for the CTA’s during the bull run. the % ratio of risk on/risk off [dow] in favor of the RUT was an algo “bullish buy sign”….. this clear signal has completely reversed since 10/9…….. which, for me, is a clear sign the market is topping….general algo signal is now pointing to “risk off”………

https://invst.ly/5r-9m

https://invst.ly/5r-aa

Yes the move down looks good. I was referring to the triangle. Peter is saying because the bounce stopped @ 2590 which is on 50% retrace not 61.8% then ES made a new low after the close that SPX is probably going back up.

I always thought wave 2 could be either 61.8 or 50% because of what the Elliott Wave Principle reads. Peter says that is incorrect. It must be 61.8%.

Plug power PLUG

Reports earnings tomorrow .

If they finally show proof of free cash flow the stock

Might finally gain some respect yet if not it will be

Another let down by management to its share holders .

I think this stock can take off yet I would not risk to much on it .

Long beach California wants to do away with diesel and if plug

Can get there tech into vehicles and not just forklifts the future

Will be good. Management though has been known to over promise

And disappoint, tomorrow’s earnings report will be important .

Need to see how free cash flow is more so than gross revenue.

On a technical basis the new high ( not all time high ) is a bullish sign .

FOSL used to be the leader selling watches yet that industry is failing .

FOSL has gone into the smart watch sector which is the future yet it’s behind

The curve and late to the party . They know how to dominate yet until they prove

Their product is better it’s a waiting game .

The smart watch or better out smart band is a future tech.

No doubt it dove tails with medicine . A dr being able to monitor

You while your home etc….

Anyone who has been to Disney world has seen the smart band of the future .

But what do these bands have inside them ?????

In regards to electric cars they are mining lithium yet a by product

From mining lithium is potash . There is an excess of potash available

And the excess is driving down prices ,

Intel and amd are now working together to compete against amd.

I need to research this further yet I believe they are combining an Intel chip

With an amd gpu . Like I said I need to research this further . If they actually

Do this then we are in for a whole new direction in computing power .

Doesn’t really change my view of Intel or amd or nvidea . It just tells me

The future in computers will be a cpu and gpu combination for all tasks .

Not just gpu for graphics . Nvidea recently stated the cpu is dead lol

Obviously Intel and amd are trying to prove that wrong .

Nvidea is ahead of the game on many fronts . No opinion on stock prices .

3 d printing ? How about a 3 d printer that can print out steel parts ???

The problem is after the part is printed you then have to send out the part

To get the steel checked for strength, cracks etc .

So instead of trying to figure out who sells 700,000 dollar

3 d printers , my question is who makes the testing equipment

That can check the steel as the part is being printed . Then

If the part has a flaw ,that flaw is discovered right when it happens .

Anyone who prints parts would need that equipment regardless of

Which printer they purchased .

We are in my opinion moving not from an agriculture society to an industrial

The industrial generation is over and more and more technologies are coming forward .

I’m no fan of tesla or an electric car since once we go electric then oil prices would drop

Which makes driving a gas powered car cheaper . I can buy a lot of gas vs a battery .

Fuel cell technology is the future not lithium in my humble opinion .

The great currency reset is upon us we are being told yet nobody

Seems to notice how that reset is unfolding .

My son asked me about bitcoin when it was 12 bucks , I now tell him

To make his own decisions . I had no idea what bitcoin was when he asked

And I didn’t get what was happening . No doubt in my mind the blockchain

Technology which is not perfect but it is damn good . It is the future .

Who will produce a crypto currency and tie it to an atm card ?

Most likely any public company that does that will move big and there are a couple

That are attempting to do just that .

We once had VHS vs beta max . Beta max was the better tech but VHS won

Msft did not dominate because it was a great product .

How do you get your cash out of bitcoin ?

Bitcoin reminds me of pokimon .

If and this is the big if …. If the governments around the world decided to regulate or just ban

Bitcoin who do you think would be privy to that info before the announcement ?

Do you think the government would say : in 4.months bitcoin will be illegal ?

Or do you think they would say . Bitcoin is being used by drug dealers and money

Laundering by criminals and is therefore illegal and banned as of today ?

Bitcoin futures would create a massive profit for the banks under that scenario if you ask me.

Has anyone followed the MAGA etf ? Yea an actual trump etf of sorts .

The future is right infront of our eyes , technology is expanding and becoming more and more

A part of our lives .

Anyone ever heard of RCA ? Or the booming railroads ? Us steel ? Ge ?

How about artificial intelligence ? Self driving cars ?

What do you think every electronic gadget in the future will have in it ?

If the world is going into a cooling cycle what will you need to live ?

How could technology get us through it ? What technologies do you

Think will we need ?

Can be simple like a green house or something complex relating to

How to get rid of the snow on your roof and around your house that never melted all summer long .

What will you do if your entire neighborhood is covered in snow 10 feet high and it doesn’t melt ?

Where would you even put it under that scenario ?

What if your house collapses because of the build up of snow ?

Sounds crazy I know yet as we move forward we should consider these possibilities.

Will going short a company that sells wine work ( grapes can freeze )

What companies or industries will fail .

Think this , what is the next RCA , or blockbuster or radio shack or Kmart etc….

Hand pick individual stocks or sectors where there is NO future and short them

Buy individual stocks or sectors where there is a future .

The great reset is already happening

Luri

It looks like a 3 wave move

Wave 4 overlaps wave 1

Where you have wave 1 and then wave I

To me the entire drop to your wave I was a 5 wave initial wave

Wave 4 overlapped so to me it’s a 3 wave move .

Also looking at your labels the entire structure looks weak .

Wave 3 on your labels compared to wave 5 on your labels do not have

What I’d consider the right look .

The next test though is the bounce and the following decline if we see one .

We made it to Nov 7 and my model called it a low and my crash inverted chart

Considered it a high so as I mentioned previously the Nov 7 date I had issues with .

Dec 1 Dec 13 and Jan 2 are my key dates . Other than that I have no opinion on the market

Short term .

Nat gas poked above 3.17 which to me us a bullish sign .

I don’t use the same math as Peter for my wave counts yet he is correct when he said

You need to observe previous wave counts in history and it is work and it does take time .

I’ll also agree that ewi, specially hochberg is terrible and I’m surprised he has lasted as long

as he has . Jeffrey Kennedy and another who’s name I forget are pretty good and worth

Learning from . I’ll still say prechter is an excellent market timer yet no doubt he is or has

Been doing some serious research trying to figure out how he has been very wrong

About some of his long term cycles work he posted several years ago.

On the other hand , if his long term cycles he posted several years ago are correct ?

I’m not saying I’m bullish mind you . But if prechters work I read several years ago is correct

Then this bull market has barely begun .

Sticking with my research .

Joe, that wave 1 overlap is of a lower degree so not an EW violation. I thought the same thing until I looked more closely…I agree about “The right look”. 🙂

Futures continue to signal no market turn. The banksters remain firmly in control of price so expect more chop. I will either cash in VIX 10 strike calls today, or lower cost basis by adding to them depending on what price does. Probably another boring day ahead. Happy trading everyone!

I have occasionally mentioned my thesis that the key sector to watch for signs of imminent market implosion is the bond market. Yesterday the yield curve posted its flattest reading in ten years at around 69 basis points. We all know the historical implications of an inverted yield curve. What I found absolutely fascinating is that some so-called economists are now starting to suggest that the yield curve is no longer a “useful” gauge of economic conditions. Could this merely be a variant of the age-old contention that “This time is different!”? We are certainly living in interesting times… 🙂

verne,

actually – if one ponders,…….. [is pondering allowed these days?]….each time “IS” different. The participants are “different”. 1929 had j.p morgan alive and controlling for example…. now gone……, the fashion is different…..remember we had ….gulp……”SHOULDER PADS”……in the late 80’s and early 90’s…………. etc, etc…….. each time “IS” different – that is exactly the reason the “results” turn out to be the SAME……. when you get your fingers burned, you learn to never repeat this pattern……. so if one generation is “dead”, there is a brand new generation to have their fingers “burned”………………..??

jody/verne/joe,

here is an alternate for the ED……..

https://invst.ly/5s1c8

I like it! 🙂 🙂

hmmmm……..

https://invst.ly/5s1xn

Luri,

Yes that is what I was talking about yesterday.

As far as SPX it still looks like we are in W(2) and could get that 2592 mark sometime today then roll. Either way the wave down is not complete yet.

jody,

i am unconvinced by the 62% rule for W2 as i have seen otherwise…..yikes……. [omg sorry boss – i know how you are with the concept of……..”wire” hangers]

If we are indeed looking at a second wave it is complex- some kind of double combination.

I have nowhere near the expertise to figure out which of the EW rules in Frost and Prechter’s are open to debate. It seems to me as traders the critical thing is for analysts we follow to get the immediate trend right.

Lara Iriarte also sees the market in an impulse up from the 2009 lows to complete a cycle fifth wave of a Super cycle fifth of a Grand Super Cycle One. I think McHugh also sees us in the C leg of a corrective abc for a cycle b corrective wave. The bottom line is that they have both labelled the current move up as an impulse and have been correct as to the immediate trend.

BTW, Lara also originally had the current move up labelled as a corrective b wave but discarded that label after the b wave exceceded 2X the a wave. I think this is not a strict EW but just one of the guidelines recommended by Frost and Prechter.

I am now officially calling for a dramatic drum roll as we trace out what I think will be the final zig zag in this long and sordid affair… 🙂

Luri

My focus has become the larger wave counts vs short term

your rut 2000 chart though looks interesting yet one thing I look at

in regards to triangles is the apex . A return to the apex is a signal that the prior move ended . to soon to call the rut 2 k over yet it does look a bit ugly .

as for the ending diagonal, I have not researched them enough to have an opinion . I have seen way to many wedges become channels so ill leave it at that.

23798.48 is a level I’m watching on the cash dow . not a target at this point just a level

Plug

not all that great and justifies a further wait before buying

Free Cash Flow: The sum of cash flows from operating and investing activities, plus inflows from project financing for PPA sites. We believe that with the significantly better mix of non-PPA deployments combined with consistently improved margins across the main lines of business, we will be cash flow positive on quarterly revenues starting in the second half of 2018.

Performance in Q3 was not met without some challenges, which will translate into downward pressure on full year guidance. In order to meet the demands of our customers, expediting the necessary production ramp ultimately led to a higher level of up-front expenditures. As we adjusted manufacturing processes to accommodate the ramp we also experienced some operational inefficiencies. We now forecast that the full year adjusted gross margin will be positive, but will be approximately 5% to 6%, falling below our previous guidance of 8% to 12%. As described previously, margins will expand as we move into 2018. Supply chain management and order volumes continue to drive down costs, as we continue to see higher equipment sales. We’ll also see improvements on the service side as we identify areas to optimize both stack and service labor efficiency. The shipment dates of a number of customer orders have been pulled into first quarter 2018. While this signals healthy growth for the business, in order to deliver on these orders, we expect higher than anticipated inventory build to take place in Q4. As a result, free cash flow use for the year will also be impacted, with our new forecast between $40 million-$45 million, although final numbers will be dependent on timing of cash conversion for Q4 deployments. Consistent with expectations, we anticipated significant cash collections to take place in the second half of the year. We maintain that we will be cash flow positive over this period, with collections in excess of $130 million. The majority of these collections will take place in Q4.

http://s21.q4cdn.com/824959975/files/doc_financials/2017/Q3/investor-letter-third-quarter-2017.pdf

I never use margin in my trading accounts…EVER!

If VIX makes a new 52 week low, I will for the very first time seriously consider it….

Well as “boss” said – 61.8% retrace a must – it is in.. We will know by the length of this next wave down if it is just a W(4) or W(3) to the downside.

For a W(4) we want to only see a 100% of W(A) so 2580ish area.

I would think a 1.618 of W(A) would throw off the angles of the ED.

Glenn Neely has some very interesting rule modifications for accurately counting Elliott waves. His guidelines regarding wave duration and trend channels would make a second wave assignment to the current move “difficult”…

verne,

glenn neely is a bonehead – and as a previously subscribed neely “member”, i witnessed his modified EW be the basis for one “wrong” market call after another……

bonehead!

Thanks for the heads up. There is nothing like first hand testimony. Another analyst I occasionally read cites him every now and then…

OMG – jody!!!!

we tagged 2592.02……what does it all mean??? …….and more importantly does anyone remember who shot “JR”?

Damn it Luri!!

Who shot JR kicked off the “Cliff Hanger Revolution”!

Now I can’t even watch one episode of Fixer Upper without having to wait until after the commercial to see the final reveal!

Oh and if this is W(2) any minute now we should blast to the downside:)

Patiently hoping for a VIX tag of the 9.50 pivot to back up the truck…very tough to stay disciplined and avoid jumping the gun…or is it the shark?! 🙂

Jody,

if this is w4,, there is a very good potential that the “c” wave of w4 is done. please look again at the alternate ED chart…..the last high was a “b” of w4 high, and what we had yesterday was a 5 wave “c” of w4……. we have a potential of w5 “a” being in place, and a “w5” “b” done….we are in a potential “c” of w5 now………

https://invst.ly/5s3jm

I am thinking just a of five, but you could be right…

but…but …verne,

here is the spx chart, and it is conveys something different.

https://pbs.twimg.com/media/DOIRMJNX4AU_6qY.jpg

….and verne…..please consider that w5 of the ED …….cough…. could fall short of the upper trendline.

for example – https://invst.ly/5s3z-

Oops! Quite right luri…and VIX appears to agree!! 🙂

??

Looks like we have a short term double bottom in VIX at 9.66 or thereabouts. I will give it another hour to take out that low, or it ain’t happening…

I like to see the first impulse down out of an ED demolish that lower boundary followed by “One last kiss good-bye”. Maybe the next wave down…?

expect the “unexpected”……….. it is too – “too” ……… for the ES and the spx to throwover the 2600 level…..it is too expected……so much so, that my intuition is telling me………..”maybe we will see one more throwover to 2600 – but i wouldn’t bet on it”………………….

expect the…..”unexpected”…………

Yeah…for the longest time I have had the feeling that the market turn is going to be a RUDE awakening…not this namby pamby back an forth. I want to see the banksters CRUSHED!!!

Not coddled… 🙂

I have to say looking at the futures price action, our being on the threshold of a third down seems to be doubtful at best. A third down next should see an early move in futures; that could of course change by the close. If it does not, I think we not quite done yet…

luri, I just read your comment about this time being different and I do think you have a great point there. I think there is a certain “normalcy bias” on the part of quite a few market participants and I had not considered that they possibly might comprise a large cohort. For example, I get blank stares when I point out how remarkable it is for the market go go an entire year without so much a single 5% pullback, much less a 10% “normal” correction. Same for volatility posting its lowest average yearly closing price EVER!!! If one has never experienced anything different, of course this would be “normal”. There is of course also the possibility that when a situation continues for so long a time it might very well dim memories of a time when things were different.

I actually stand in awe of the banksters. I think they have a lot more influence on markets than people give them credit for. What has been going on is anything BUT normal, and my frequent references to the “b” boys is anything but hyperbole…

Remember the arena in which I opined that the criminal banksters would meet their match due to the sheer size of the market? Well, there may be some stirrings of the contest having been engaged. I was going to mention this earlier but did not want to jump the gun so to speak. Go take a look at the chart of HYG and JNK and look at what has happened to price relative to the 200 day SMA. Now, THAT, is a picture worth a thousand EW counts! Tick…Tock.. 🙂

verne,

i will be the “bringer” of bad news…… those bankers you despise, they have set you’s UP – big time!

They have succeeded in completing an LBO [leveraged buy out] of the ENTIRE COUNTRY!! what are the key elements to an LBO…… company A buys company B all for debt…….. company A puts all the leverage on the books of company B along with all the “legacy” costs [pension obligation etc]………….company A then stripes all the “income producing assets” out of company B and places them far away in a shell corporation elsewhere………..

Company A then “implodes” company B in bankruptcy, and let the “courts” do the dirty work of giving pennies on the dollar to pensions and debt holders – all the while the income producing assets are still producing – elsewhere.

The debt and legacy costs are done “bankrupted” away, and company A is left with the income producing assets – free and clear.

This same process of LBO – its been done to America/Canada. All the income producing assets have been stripped out, and sent to Asia – “think” china…….. All the legacy costs and leverage has been left behind in the old company {USA}…….. now implode the old company in ‘bankruptcy” – and see what happens to the bloated pension obligations…….. legacy debt………the price of labor………….

the propaganda indexes of the SPX/NDX/DOW have been used as pure distraction / opium for the masses to keep their attention elsewhere, and to give the impression that all is running well…………………. Next up, you implode the mother of all bubbles to put the “country” into technical bankruptcy.

LBO courtesy of “EL BANKSTER”…………….they are all on the other side of the trade right now………..they know what will happen, and “WHY”……… do you?

LOL! That just about describes the current situation luri; well stated! 🙂

I just wonder how long bond holders think sky-rocketing rates is going to offer cold comfort; after all 100% of zero is still….well, you know…!

Energy stream update

the long term 27 day chart is working well so far this week

https://s1.postimg.org/8wi19x5okf/nov_6_thru_8_energy_chart_update.gif

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.