Ending Diagonals

We’re very close to the end of this extremely frustrating “B wave.”

Last week, I predicted a final wave up was in the works and this weekend, it continues.

We have ending diagonals of one kind or another finishing up as the final pattern before what will be a dramatic turn down to a new low below 2100.

This weekend, we have a full moon while the current ED patterns call for more upside and a new high. The next few days should be bullish.

Looking at each of the US sub-indices, here are the patterns I’m seeing:

SP500 — ending expanding diagonal

DOW — ending expanding diagonal (almost did a double bottom, but not quite). The DOW appear quite weak, compared to the others.

IWM — regular ending diagonal

IWV — ending expanding diagonal

OEX — ending expanding diagonal

I’d say we’re getting ready for a very dramatic week.

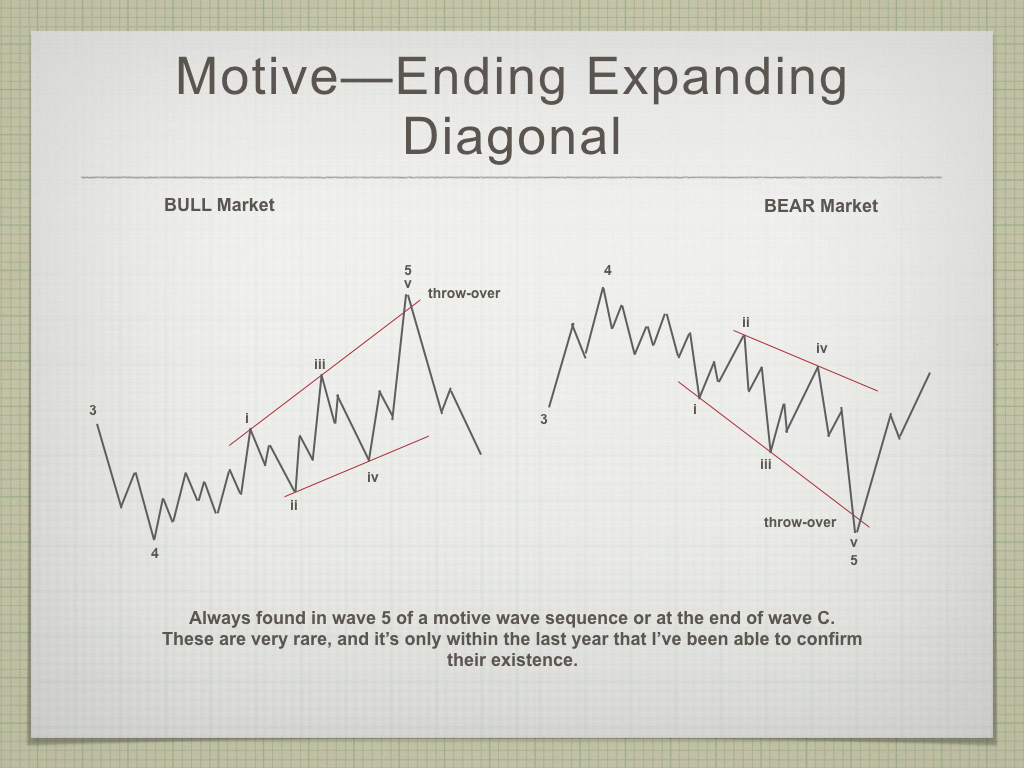

Above is a diagram of a rare ending expanding diagonal. The bull market version (left side) is the one that relates to our current situation. We’re close to the middle of the fifth wave up. The fifth wave targets the upper trendline, but often doesn’t quite make it; it should not rise above it.

The turn down is always dramatic and it retraces to the previous fourth wave of one lesser degree, which is below the start of the diagonal. After that, expect a second wave and then further downside.

_______________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last weekend, I predicted we had one more high to go before the long-awaited drop, due to the fact that we're in an ending expanding diagonal. We're not quite half-way to that top, and it's a rocky path, but a full moon this weekend should help get us there.

All US indices require a new high. The market will not come down until they reach it. Until this happens, the direction is still up.

The next major move is to the downside, and it's looking more and more that the turn will be in the first half of the week.

The wave up from Dec. 26 in ES is clearly corrective and, as a result, must fully retrace to the downside. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX, TSX, and other international exchanges.

Summary: My preference is for a dramatic drop in a 4th wave to a new low. The culmination of this drop should mark the bottom of a large fourth wave in progress in the NYSE since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that is quite fast; in any case, ES will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, May 29 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

yes

it’s obvious that the weekly inversion that occured 3 weeks ago

has reverted back to the original format

making tomorrow a very big down day

there was a lot of Vix alogo buying into the end of the day today

https://ibb.co/XWmVxsq

Futures action will tell the tale…Showtime!

energy chart update

https://imgshare.io/image/may-20th-may-24th-energy-chart-dst.ru1zn

Thanks Tom, I hope it will come true, May 24 is an important astro turn date.We are now in the green lunar period till June 7.

Tom,

rooting for you your chart will be put to test today. Also astro is negative today.

Intetesting slugfest around 2860. I am not sure who the combatants are as there clearly are few or no sellers in the market. The banksters seem determined to defend it so price action around that level appears significant. If my interpretation of a flat and ZZ upward for SPX and DJIA is correct, not only will 2860 fall, banksters notwithstanding, but 2840 will as well. We shall see.

I find it absolutely stunning that so few analysts besides Peter are calling the move off the December lows a corrective one. The only other one I know is Avi Gilburt and he has charted a downside price target also in the 1800-2100 price area for SPX

How is it that so many of these supposed experts, many of whom are charging for their “insight”, are going to mislead their readers about the biggest trading opportunity in years??!!

There will be more “stunning”! 😎

Buy-siders…. PMs (portfolio managers…

Bears again knocking on the 2860 door. Will they kick it in?

If they do, next, 2850…

Yep! They kicked it…! 😁

Yeh, indicates 2856 and counting. Verne, do you look at 1st hour trading for direction. I’m getting a confluence of traders that do… stockdisciplines.com “determines” key bullish (and bearish) intraday levels to watch. If market is above bullish (or below bearish) level for more than 30min of 1st hour, there is 80% probability of finishing higher (lower). I am starting to follow, wish I could backtest. I assume someone can, and did.

Mojo I do think that idea does have some merit.

Of course there are somtimes crazy market whipsaws but I agree with that thesis as generally being valid.

thanxxx!

Lol! The banksters are having a hissy fit as they are dragged kicking and screaming below 2860…Hyuk!

I enjoy watching those opening candles at 8am gather bid/ask orders on yesterday’s range 🙂

Early bird…you know! ☺

I do follow one other analyst /technician who I highly respect..who also see’s it the same as Peter..but he sees it as the probability that the B wave is done and we are in C down..so they are in respective company..

I bought some Juni calls on the AEX and will buy more if we go down again..

interesting..no close on the qqq gap and now a gap down and no movement on vix

05/22/2019 VIX Options Expiration

Probably nuthin’ burger till Fed minutes release… then maybe more n’burger.

and OpEx

With the banksters as busy as little beavers, reversal patterns don’t mean as much as they once did, but FWIW, we do have an island reversal to complement the gap higher yesterday.

true Verne

my brain missed that ..

Sold the calls again with a nice gain and I m waiting till maay 23/24 to go long again.

the other analyst also..just added a chart for the possibility of one more top..so very much in line with Peter..

NOT AN ENDORSEMENT…however, some may find it interesting…

What is a Black Hole? – Woody Dorsey | May 22, 2019

https://www.sentimenttiming.com/woody-dorsey-research-5-22-19/

Break of ES 2848 confirms immediate down-trend. Next stop, 2801?

I am curious…

Were any of you shaken out of short positions by that ridiculous bankster whipsaw yesterday ahead iof a third or C down?

Or did you call their bluff?

Be honest! ☺

Here is a little trading secret… “Intra-day Gaps”

Speaking of banksters….

https://www.cnbc.com/2019/05/16/eu-regulators-fine-five-banks-for-forex-rigging.html

And some of you think it hyperbole when I warn that they collude to trade AGAINST you…!

I didn’t have any in…been waiting..

thanks for the chart show always very informative..I know how much work that is..

I know someone mentioned they were in pot stocks..do you mind sharing which ones your in?..

I added to CGC a couple of days ago. Thinking of adding more today.

I am covering parts of my shorts here. For me, 2789 is the level and this market has had enough chances to show weakness and has refused to do so. Will re-evaluate in case we break below 2789. Otherwise, I will succumb to Joe’s call for bullish June.

Yep. It looks to me like downside momentum waning. The cycle guys calling for a bottom this week may be correct. Looks like ES now in a fourth so I expect 2800 to act as support. VIX remains remarkably aenemic further suggesting limited downside.

Have an awesome holiday week-end everyone!

Hi Tom, did your energy chart shift for 1 day, if so we will see a big bounce today or May 24.

I m curious what next week will bring?

In my astro work, I have a positive change in trend after May 31.

All the best

John.

Hi John

no big daily time shift

everything looks good

they really suppressed (flattened out) the pop and drop

the last two days

I’ve seen this before

no big surprise

https://ibb.co/bgQKQFB

Thanks Tom,

I have a possible change in polarity in the astro on May 24,.

Do you see an uptrend next week?

thinking could be a good oil bounce coming up to play…

I keep rolling my puts to take premium in. Not sure about whats happening, but it seems like corrective waves all around. 2789 is a big level for me. In case we break that, I will stop rolling my puts. Going with astro guys call for some kind of a bottom over the coming days.

thinking dow 25200 if it breaks that Possible..i am thinking if breaks that could go to 24000..but watching for divergence..does feel down is slowing down and then up like astro

some EW techs think this is possible beg (3) down and in (i) down of three with (ii) around 2550..so lets see where the up goes from here..

Btw thanx Vivek going to keep that stock on my radar..

Did buy a tad of QLD if we get a bounce tmo..

but thinking possible more likely one more down then up..has to break back up thru that 178

Hi Peter and friends

got some bad news

my wife’s mom passed

please send out a prayer for my dear wife Joanne

I will not be posting again until

sometime after the funeral

Tom

My sincere condolences, Tom. Please take good care of her/yourself.

Tom, my sincere condolences, take your time with your wife and family, I will send you my prayers.

All the best,

John.

So sad to hear Tom..you and your wife will be in my thoughts..and prayers..

Cash dow preferences :

A close tomorrow below 25450.24 and yet above 25280.09

The 25280.09 Level is a Weekly Close Only Pivot .

Time wise its looking like Tuesday May 28th as a beginning point for

speculative long entries yet as noted previously my time frame was may 25-june 3.

The weekly SPX / $vix is satisfied as of today so a slight negative close on Friday

is still ideal ( ideal mind you not necessarily real at this point )

2776.23 cash spx vs cash dow 24906 s where the line in the sand sits as far as im concerned . Closing below there is not a good sign at all yet poking below and then forcefully going back above is acceptable .

Were in the late stages of this cycle low period so I wont rule out a panicky bottom but im not seeing anything overly bearish at this point in time .

More work over the weekend putting the rest of the data I look at together .

Depending on what I see with the rest of this I may be long the overnight futures on Sunday and then adding to options positions on Tuesday.

Futures trades are generally scalping type moves and my options trades

are going to be position trades for the month of june .

As everyone knows . any position will be killed if the market does not move as I foresee it .

Until proven wrong I’m labeling this a cycle low .

No further comments from me until Wednesday .

My intent though is as posted above.

any comments in regards to time

My original time frame was may 22- June 3rd and that never changed

my bias to take some bullish spec trades as noted a few days ago

was for next week between may 25- June 3

All I need to do is collect the last of the data I use and see what it shows.

assuming which is a bad thing , assuming it shows what I think it does

ill stay on plan . Tuesday is a time count using a different method entirely .

to each is own .

I realize ray Charles can see the head and shoulders top formation

I realize how bearish the charts look .

For me though its timing first then indicators and then pattern last.

we all must do our own homework so please understand the risks in trading

I only post my thoughts because peter allows me a way to keep notes .

Hopefully you all find it helpful even if you do not agree .

Enjoy the weekend everyone

Thanks Joe,

I like the way you share your information, I m curious what the market will do if we enter the red moonperiod, June 7.

Untill now you have been spot on.

As to where we are headed, I must confess I have been really bothered by the market’s glaring failure to retest the critical 2910-2920 support/resistance shelf, but after yesterday’s almost perfect tag of the 2810 region, I am confident that that is exactly where we are headed next, a very trade-able SPX points of 50 or more imho. Then is when I think the party finally gets started. There has been tremendous technical damage inflicted on this market and no amount of bankster largesse will undo it in the weeks ahead. Get ready for Q.E. infinity….it’s coming….!

Tom C

I am not sure how to say anything.

I know its tough though and I have been through it .

I wish your wife the best and you as well .

Tom C

As we say in our Orthodox Christian faith, “May her memory be eternal,” and may God comfort you and your wife!!

Ptaying for you both Tom, for God’s great comfort…

Looks to me like the bulls are in serious trouble. Gap proving formidable resistance. Banksters are going to have to deploy some serious leverage to close it. Will they?

While SPX stays below 2900, the H&S top formation stays intact. A break below 2789 could usher that H&S drop towards 2720 and possibly lower. Its way too difficult to read into a series of 3 waves both up and down. If we close around 2800 today, it could spell trouble for the market next week. I have been rolling my puts as a way to play short rather than an outright position given how difficult the whole set of 3 waves has been.

Today’s gap provided solid support. Open gap above proved stiff resistance.

It is looking like unless the leveraged trade is deployed we are in for some sideways action the next several sessions.

Just read Avi’s market take on the price action and he thinks that the move below 2830 puts us on red alert for a water-fall decline. Could he be right and we see Armageddon after the holiday week-end in a series of first and second waves down?

Of course if one does not believe in LD as a first wave that eliminates any such count as that is the only way to view the initial wave down due to all the evident overlapping price action. While I am still expecting a deeper retrace, whatever the scenario, today’s open gap in my view remains a very cautionary note. I will be out of long trades and parked in a straddle over the week-end. I do think something big is afoot….

If you are in the US enjoy the holiday weekend!

Enjoy the weekend everyone…!

I am going to hold in Qld..I def can see it going both ways..but nothing ventured nothing gained…lol

Tom.

Please take care of your family…market can wait…my prayers are for your family.

Sometime exiting this world peacefully is better than suffering due to old age.

Fascinating market inflection point. Avi Gilburt is the second analyst I know who noticed the differing patterns among the indices. One great thing about EW is that there is always a number that says you are wrong, and if the LD down is valid, we can predict two things. First is that as tends to be the case with diagonals, the retrace will be very deep, but will NOT make a new high, BEFORE, price makes a new low. If that happens, clearly it would bolster Peter’s argument that the LD is a figment. If we get a lower high followed by a violent third wave down that also, imho would be probative as it is what is predicted by the LD pattern.

Intetesting week ahead!!!

SPX weekly…indicators continue to tell the tale!

https://twitter.com/allerotrot/status/1132260290240876544?s=21

In Tom’s absence I am trying to see how I can get the Kp and AP index from NOLA.

Here is a graph from last few days and clearly shows ups and downs in sunactivity

http://www-app3.gfz-potsdam.de/kp_index/musimon.gif

as per this site ftp://ftp.swpc.noaa.gov/pub/weekly/27DO.txt

A index ramps up on 2019 May 28 from 5 to 10 and again

ramps down May 31 to June 1 from 10 to 5.

Havent looked at hourly 3 hr chart, but may be a ramp from 28 tuesday to 29 wedenesday.

A new weekend blog post is live at: https://worldcyclesinstitute.com/cracks-in-the-narrative/

thanx Bill…

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.