| “At the extremes, the herd is always wrong. One should not under estimate its capacity for stupidity.” |

| The Secret Life of Real Estate, Phil Anderson, p 329 |

I attended a meeting this weekend — an association meeting with my speaking peers. These are professional speakers (and those who would like to be). I have often referred to these people as “salespeople on steroids.”

One senior member of the group mentioned to me that he had just made a major stock market investment. I reminded him of what I’ve been saying for the past couple of years about the market topping and he said something like, “Well, if that takes place, a lot of people are going to lose a lot of money.”

I was thinking, “…. yes,” but didn’t bother saying anything. What do you say to someone who decides to buy high … and I would guess, eventually sell low? Hence my posting of one of my favourite lines at the top of this post. It’s amazing to me how some people have no concept of money and its value. But there you have it.

“Nobody” will have seen this coming.

This chart below appeared in a post on zerohedge, which you can find here.

The chart of options strength signals, of course, that the top is near. The expectation of a higher market is now at all time highs. But, we’re not quite done. It should reach even crazier levels as we reach the ultimate peak. So, it’s not time quite yet to go long the VIX.

Herding Cats

During my 40 of so years as a television producer, I built a company with a team of creative types to support me in my work. There was an expression that I liked that usually pertained to IT people, but which also was a good descriptor of what it was like getting my staff into a meeting on time: It was like herding cats.

The market this past week reminded of that phrase, because there are times when it appears to make no sense … until I spend the time to review all the sub waves and determine wave counts sometimes right down to the one minute chart level.

I went into my analysis this weekend thinking that the US indices were completely out-of-sync with gold, the US Dollar, and other USD currency pairs. However, after a few hours of working through the subwaves on virtually everything, it’s become obvious to me that they’re not. What caused me some concern was the fourth wave we traced out in the US indices and futures. It was shorter than I expected and threw my thinking right out of whack (for Friday, at least).

I came back to one of my favourite rules about the market: The market does the most predictable thing in the most unpredictable way. And sure enough, that’s what my analysis has told me once again. We are going to end together, as I’ve been predicting for the past two years. The dollar is in charge (and it will signal the final trend change). All assets may not change direction the same day, but they don’t look to me like they turn that far apart.

This again reiterates the importance of considering all asset classes in the analysis of the ups and downs of this market. It makes my analysis here the “free blog” open to attack for the fact that you’re not privy to the extensive analysis I do each weekend across all major asset classes. If you don’t pay attention to the bigger picture, you can very quickly get lost in the very difficult structure of the US indices.

However, the entire market is moving as one. There can be no other conclusion than one that spells economic catastrophe is imminent.

_______________________

The Market This Week

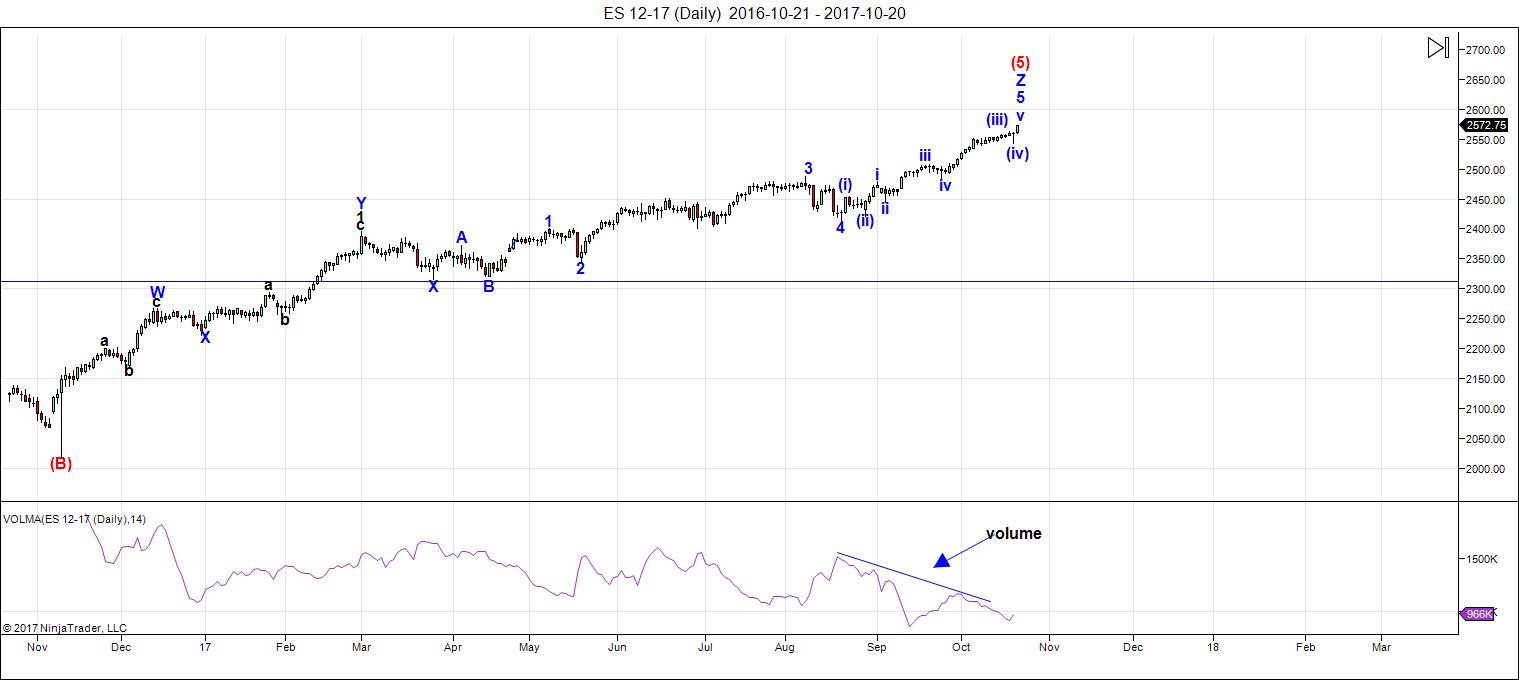

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

I have a full count on NQ/NDX but this week, ES faked us out with a very small fourth wave. We need a larger one to complete the wave count.

I spent many hours this weekend going through all the waves of all the assets I cover. That's because the US market appeared on Friday to be out-of-sync with the US dollar (something I didn't expect to happen). However, further reflection and analysis leads me to believe that's not the case. We're still on track for a final top ... it's imminent, but still likely a few weeks away ... we may move into November and there's no saying what the speed of the final fifth wave unfolding will be.

In any event, we're into the very final stages of this monster blow-off wave in the US indices. However, with the smallish fourth wave at the end of this week, the wave structure has an unfinished look to it. This supports a final fourth and fifth wave to parallel what's happening with the US dollar. Everything should top at the same time (as I've fairly vocal about since I began this site). This still appears to be the case. The market is "playing games" due to the difficultly of following the EW movement requirements across assets of different sized waves. It always amazes me how the market figures this all out without breaking any EW rules!

On a short term basis, I'm expecting a slightly larger fourth wave drop early this week (it may be another quick one and could be deeper than I expect—surprises are often to the downside in topping markets). My preliminary target is still 2530. The fourth wave we experienced this week was not large enough, and is now labelled as the fourth of the third of the fifth. The larger direction is still up. We still have the fifth wave of the fifth to go and that will play out across all asset classes, including gold.

Volume: Note that for some time now, volume has been expanding with selling, and drops considerably when the market heads back up. This is yet another signal of the larger, impending top. I've been predicting for quite some time here that it will drop off suddenly towards the top of the final fifth wave top. This it has indeed done.

Summary: The count is full for NQ, not quite full yet for ES. We're waiting for a valid fourth wave and then a final fifth wave up to a new high, to coincide with the currencies (most importantly, the US dollar).

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Wednesday, November 1 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

While it is certainly possible the stock index’s have further to go

I’m leaning to the side that the bull market is indeed over with .

Keeping my head on straight since I can see a high in Dec to as late as Jan 2 2018 yet

I’m not seeing any reason for the dow to extend further .

This is all the index’s ( most anyways ) added together .

I’m seeing Fibonacci relationships to price

At best just a bunch of sideways to up slop to finish this off

its a quarterly chart .

https://imgur.com/yBLI4eI

Oct 1972 plus 60 quarters = Oct 1987

Oct 1987 Plus 60 Quarters = Oct 2002

Oct 2002 Plus 60 Quarters = Oct 2017

Closing low not print low Qtr april 1982 Plus 71 Quarters

= Jan 2000,

Jan 2000 plus 71 Quarters = Oct 2017 .

This quarter Gives till the end of Oct yet I have

mentioned the other time frames.

Essentially I’m seeing Long term time counts adding up .

Shorter term .

quarterly of all index ( same chart posted above )

Oct 2011 Low

Oct 2014 High

and Oct 2017

bottom to top to top count .

BUll market is over or ends this quarter

ill keep my timing to allow for as late as Jan 2 2018

yet the bull market in the dow and the index’s is considered

Done as far as I’m concerned .

Still going to be patient and going to target a low in April may as

the first significant bottom

Dear luri,

Leading expanding diagonal is a lie if I remember correctly. Sir Peter Temple never saw one and I also think some people tried to add to Elliot’s work while they should not. Same with the Bible, do NOT add or leave out!

Cheers,

W

w,

what’s a little……………..”white lie”……….. now and then…….. it is an element of the planet – like carbon, and oxygen…………..

:-))) some of my patterns are “NON” EW in nature…… else i will get the sharp end of the “bosses” response……

My stick is a bit frayed at the moment …

Hi luri,

A lie remains a lie! Not something I like since we should not lie. 🙂

And I think best chance to be on the ‘right track’ is to stick to patterns that come from nature. EW shows them to us with thanks to Peter who mastered the technique.

Cheers,

W

Luri

I think we had a discussion on your wave counts a while back.

I cant see the a b 1 2 count as you have labeled .

Not saying your right or wrong just saying I see a 3 wave drop same as you

The cash dow and dow futures are weak today . The es is holding its own

the chart I’m following with all the index’s in it is at resistance .

Nat gas had a very nice spike up yet has been selling off al day .

To soon for me to call this yet if the market is going to sell off then the es would need to turn from near present levels and the dow as I see it would fail .

Testing a lot of things this morning so not focused on trading at the moment .

the dow needs to bounce further yet that may bring a new high in the es .

id rather see the dow futures poke just above 23416 and the cash dow poke above 23459.84. yet not make a new high .

I’m working with new software ( upgraded ) and have had to create new charts

and I’m learning the software’s. The overall picture looks bearish and

as I usually tend to think . This may be a triangle formation and if so this is a B wave .but in order for me to call this a triangle on the dow I need to see the levels I just mentioned .

The 120 minute index chart ( my group of indexes ) is in a similar position as the ES .The bulk of the heavy weights in the dow are failing . Next week may be the better time to get short .

More work to be done before I can conclude anything

joe,

thank you for the input………… your input is very helpful for me……. i am in the spaghetti phase of charting…………….where i keep throwing them against the wall to see which one sticks………………………… “its tough at the top……………….GULP”….

i already thrown another one against the wall this one is the

SPX rather than the ES from this morning…………………….

https://pbs.twimg.com/media/DNKEKGmW4AYdp4z.jpg

The fat lady is singing!!!!!!!

peter…………………..are you sure she BE singin’………………………. maybe its …..”flatulence”…………….. baked beans has a tendency for this type of “net effect”……

are you SURE she is singing?????

Damned if I don’t hear her singin’ Luri! I’m just not sure if I recognize the aria yet!

…………IT CAN BE ONLY ONE ARIA……………….

LA MAMMA MORTE!!!!!!

OK I caught a picture of her just before she left the stage. Carch it while you can. We finally reached the black channel line today!!

https://imgur.com/a/cZHcG

omg…..that is one absolutely ROTUND lady…………..

terminal resistance do you think? or potential for an overthrow?

C’mon, Luri, you know the Fat Lady is not allowed to answer that question. But just the fact that she appeared on stage gives a suggestive answer. By the way, after appearing to expire post-dying aria, she was heard in the first two rows to whisper, “George Lindsay…bottom to bottom to top count…158 weeks…you can blame him for this!” Listen again and see if you too can hear her!

https://imgur.com/a/cZHcG

peter…..peter…… silence is the sound of “truth”………. only when the charts become the ……….”silence”…………can the charts convey the truth!

“one” …….. of sour

“two”………..of sweet

“three”………of strong …….”AND”…….

“four”…………of weak.

This is the silent poem recipe for rum punch!…….

peter t –

technical question here – with this latest new “high” in the spx…………”technically” …….. speaking – do we have enough waves in place to count a complete 5 waves?

again…..purely technical question……….

Luri

I throw spaghetti to the ceiling all the time .

people rarely look up and the walls stay clean .

the only problem is I end up with a mess on the floor.

So just for grins Ill toss some of my spaghetti your way

What do you think of that ?

https://imgur.com/kP5LjsY

Maybe Peter G will Like it as well since he mentioned a high

in 2017 . ( NO peter G I wont hold it against you ) 🙂

Peter T I Realize this is a very simplistic Wave Count

yet it does fit ( no alternation though between waves 2 and 4 )

Both being simple .

A Bottom to Bottom to Top to Top count to boot .

and my timing .

I am probably so wrong I don’t even know it because everything

I look at says the same thing .. we are putting in a major top .

yet ill be patient into Dec 1 to as late as Jan 2 2018 .

On that chart above , if the NYA rallied about 2 more % and closed the year

there , it would show a 23 % rally which would be .618 % of wave 1 in % .

Yet basically I consider the bull market over despite it all .

not changing my mind with respect to my timing , dec 1 dec 13th and jan 2

are my turn dates I’m following . the nov 7 date I have issues with .

My home work is done , keeping a bearish bias despite it all into Jan 2019 .

Prove me wrong Mr Market and ill respect you if you do .

That’s all folks . I’m done posting charts for a while .

joe,

thank you, …..and i respect your simple long term chart. simple is always best.

it is just that george lindsay predicted an Oct 2017 top,,,,,and gosh darn it……… it will darn well turn out to be an Oct. 2017 top!!!! its that simple!!! no more highs after October………………..and no more pasta on the ceiling – its apple season now!! :-))

Markets hit lows when the energy charts go green then yellow and finally red. When the charts are dark blue like today and yesterday selling is weak.

The attached link shows how the small market sell off this week and the energy chart matched up very well. Red marked the significant low.

https://s1.postimg.org/544btefwrj/oct_23_to_27th_energy_comparison_chart.gif

Not sure why people continue to try to short this market. Truly amazing.

That’s exactly what I was hearing on March 9, 2009, but in opposite fashion. Why in the world would anyone buy stocks in this market? Actually your quote was heard on March 24, 2000. Around that time, the “esteemed” Jim Cramer posted 10 stocks to hold forever. He called them, “”The Winners Of The New World.” They were all tech stocks, as I recall, and within a year, the average price had declined over 90%. I’m not quite sure why you call it “amazing” but that alone strongly implies you are sure they will go up from here. That’s, of course, very possible and perhaps even probable, but take a look at the charts I posted above and you will know why people might short the market here. At such a juncture , you know your risk and, if so oriented, you “takes your chances,” so long as you have a point where the pattern you relied on would be considered broken. Let me ask you this? Do you think the next 20% from here will be up or down on the Dow? If you answer as your post suggests, I might be willing to wager you a bottle of 1998 Krug Clos d’Ambonnay Champagne on that one!! 🙂

I’m a bourbon guy, but I think the S&P sees 2650 and probably higher before the next major pullback. My comment earlier was referring to the multiple posts of traders trying to short this bull market for the last 4-5 months. It’s just crazy.

Dan,

I can’t recall anyone here who has been shorting the markets straight for the past 4 to 5 months. You have to read the posts carefully. We always talk about swing highs and swing lows, riding the waves up and down. Think of us as surfers in the market. We are riding the waves. I have talked about tsla and bidu. Momentum intra-day is not only to the upside but the downside as well.

I’m going to repost here what I said last May.

“It’s difficult for me to be too bearish because many invest in equities automatically via 529s, 401ks, IRAs and Healthcare FSAs. Some companies have stock plans too and employees contribute every paycheck with no transaction fees. I don’t think many of them look at charts and say, “Oh, the RSI is too high, I’m going to stop my contributions on the 15th or 30th.” I feel quite a number are passive investors.”

So, I can understand your bullish stance. It is in my best interest the bull market continues because of my long-term accounts. Now if rules are changed for 401ks and your contributions will no longer be a pre-tax deduction or the max annual contribution is reduced to $5000 or less, will that be still bullish for the markets? If healthcare premiums and deductibles continue to increase, will there be less money left for retirement saving?

Do you only initiate long positions? ETFs only? I could give you a list of stocks that are down huge from a year ago.

AMBA, BBBY, BKE, BOJA, BOOT, CMG, CVS, DDD, ELF, FINL, FIT, FOSL, GME, HABT, IMAX, JWN, KR, LB, M, MAT, ORLY, P, PBPB, REV, SBH, SEAS, SHLD, SLB, SPWR, TRIP, TSCO, UAA, ULTA, VRX, ZOES. There are a lot more. So if one of these stocks belongs in your portfolio, you’re not going to be too happy.

VRX, ULTA, CMG, KORS, UAA and LB used to be darling stocks and look where they are now. I’m sure you watch Cramer and Fast Money. How many ipos did they use the line “the next Chipotle” back when Chipotle was hot. If you look at LOCO, NDLS, PBPB, ZOES, HABT and SHAK, can you honestly tell me the line wasn’t a pump and dump scheme? Ditto with gpro, fitbit and all the 3D printers.

I just posted recently about Celgene which crashed near its 8/24/2015 crash low. Did anyone think that would happen to a blue chip stock?

I don’t have the charts in front of me right now but I thought I saw s&p 500 rsi > 80 already, it got hit also March 1 then I can’t quite recall the earlier dates but I think you can count with your fingers how many times it hit > 80 for the past decades. A pullback occurred immediately or eventually. I have some homework to do.

Thanks for your reply Liz, but it’s not everyone on this site or or on tv, but many are trying to call a top, but hopefully in doing so, they are long. I’m the type of trader that wants everyone to be on the winning side, which I know is impossible, but that is what I wish. I had a great Elliot Wave mentor, and in my opinion, we have a ways to go to the upside before any significant pullback takes place. As far as TSLA goes, I’m still long from 199.45, as I believe we are still in major 3 of Primary 3. But we’ll see. Thanks again.

dan,

having a ONE WAY market of the EXTREME – which is the trading case today, [long equities/short vix] and borne out by the positioning reports……………… is ……………………………… are you sitting…………………………. is a very UNHEALTHY market……………………and an unhealthy market is NOT the winning side for the majority of human beings……………………

its called ALL IN – and ALL IN markets are artificial and are dangerous [in this case, dangerous to the extreme]……… Healthy markets are bi-directional, and healthy markets are NOT afraid to pullback to close gap up’s….

plain and simple, this artificial asset bubble is devastating the real economy [financial engineering stock price through stock buybacks instead of real engineering in real R&D or real plant and real capital investments is one very REAL example]……….and by devastating the real economy you are laying harm to the overall system of human beings …….. human beings that need the real economy in order to “LIVE” their lives ……………………………….. Central Banks have made money free…………that is financial capital has NO cost………….whereas LABOR has cost……………… guess who LOSES??? Central Banks have declared WAR upon human beings……..AND their freedoms……………

So are you truly “the type of trader that wants everyone to be on the winning side”????? because of a “long” only trade- wave 3 of 3 count…………….its about price dan……………….really //////….REALLY////………………………………..what about our individual responsibility to the children yet to come…………are you THAT lost to our duty to the future, are you that lost to the bigger picture??????”

for me, a TRUE winning trade has to be good for me, as well as the system of human beings…………………………… so RING RING RING…… i am yet another one of those annoying……. ……. “many” ………that are trying to call a TOP……… uh huh……………………….

Dave…….. dave……”d-a-v-e”……………….

so getting “up” and “down” from your…………….”the market is only going up”…………. ……………”soapbox” ……………. as you do……..well it must do wonders for your “glutes” and “calves”. ………………………………..

lol…… sorry dave……. i meant to type “dan” in my comment, and i had “dave” on my brain…………

let me try that again………………Dan, …..dan……”dan”

so getting “up” and “down” from your…………….”the market is only going up”…………. ……………”soapbox” ……………. as you do……..well it must do wonders for your “glutes” and “calves”. ………………………………..

Your are not for given Luri ! LOLOL

10/25 was a strong date and should have been a high. So markets went up. So many people that just can’t believe it’s over and keep stuck in the ‘buy the dip’ reflex.

Next week will see the start of the bearmarket. 10/30 will be a high as 10/29 is yet another strong date (high). Things are cracking. The vix cycle gives a low 11/3. This will be a high and will bring panic, 11/7 will be a low. 11/13 another high but this will bring capitulation. I see lows 10/31 and 11/2.

The long term trend is down. 10/29 another significant weakening of trendforce. As we will be down for years the top will form slowly.

Strongest day next week 11/1 for many reasons. FB and AMZN give a the high 11/1 and then 95% of market cap is down.

Next week is pivotal. But the herd needs a rude awakening. 11/2 will be a low to test 11/3. This will bring the first awareness something is wrong, 11/7 will bring another buy the dip reflex (inversion window) to go up into 11/13. Then we all will know something is VERY wrong.

So it is turning; no doubt about that. The obscene rally up last few days is a warning for a steep decline. Markets always rally when they sense the trend is turning down. Not sure why.

10/29 we have a tidal inversion and the Sun and Mercury change mansion. Mars is still in a bearish mansion into 11/7. Next week has a bearish bias but there is a lot of absorption to do. 11/3 some panic and down into 11/7.

Long cycles trun slowly. But surely. The longer the cycles, the more energy they will bring.

11/3 was the low on SNP in 2016, so 11/3/17 is an anniversary. After 11/3 the consolidation will get less and we will see more volatile cycles. But 11/13 will bring a major change in trend and then hard down into 12/9.

We are so close now I can smell it.

Cheers,

André

yes 10/30 appears to be a high according to the energy streams

https://s1.postimg.org/98tfs4cmsf/oct_23_to_30th_energy_stream.png

Andre

Mars Uranus does call for a low on Nov 7 and Nov 7 is a seasonal low date

Yet I’m just going to say I have issues with that date based on a few things

I’m looking at . This year has played out fairly accurate for me overall

Yet the big error which I caught ahead of time was the August solar eclipse low

Which I had jumped up and down it would be a top. The puetz cycle inverted

And we got a crash to the upside . That crash pattern is allowing for a Nov 7 high

So I have a conflict with the Nov 7 date . Because of that conflict whether it turns out to

Be a low or a high I’m just not going to focus on it to much and let the market do it’s thing .

My main work relates to the Dow and Fridays rally in the Dow was pathetic which keeps

My cycles on track yet not exact but close enough . I felt like Friday was a suckers rally

Where big money left the table . I’ll need to dig over the weekend but that’s what I felt .

Here is my concerns , Dec 1 st should either the top or a very important swing high .

Here are the odd balls which are the variables and I do watch variables very closely .

Mercury retrograde Dec 3 to Dec 23 ? Mars Uranus opposition Dec 1 .

Mars Uranus by itself I’d sell the hell out of but with mercury retrograde I go ok what’s the fake out ?

Look up the past several mercury retrograde cycles . Typically if the start date is a high then 10 days later

Its a low . So Dec 1-3rd a high Dec 13 a low and then you count out to Dec 23 and the mercury retrograde cycles is over .

Yet that is not the entire equation we are dealing with on this cycle . The other scenario with mercury retrograde

Is what I call the 10 day lag . Dec 3 plus 10 days is Dec 13 and Dec 23 plus 10 days I’m calling Jan 2 .

Here is the mind $#+&” to it all . We began a Venus bull market on March 27 when Venus and mercury and the sun

All came together and look at what is taking place on or around Dec 13 th . We will have not just mercury 10 days into its retrograde cycle we will also have Venus and the sun and mercury all coming together again to signal the beginning of the Venus bear cycle . So that period us going to be somewhat nuts if a person is not quick on there feet .

To add to this the mars Uranus cycle has its opposition Dec 1 yet it has a few swings in which Jan 2 is another mars Uranus

Sub cycle high . So this entire mercury retrograde cycle from Dec 3 to Jan 2 ( includes the 10 day lag ) will be also be somewhat in sync with mars Uranus and will be the end portion of the Venus bull market .

We will be dealing with , mercury retrograde conjunctions with Venus and the sun along with mars Uranus opposition and it’s sub cycle high for all of December . Things can just go crazy or the market can just whip up and down with no rhyme or reason for all of December .

So my thought is we see a Dec 13 th high yet I’m labeling Dec 1 Dec 13 and Jan 2 as the major swing dates .

Could be Dec 1 high Dec 13 low Jan 2 high or Dec 13 high because of ‘Venus mercury sun conjunct yet with mercury

Retrograde it all might just get exaggerated . Now to confuse this further I must include the moon along with a few other planetary pairs yet to me that is my major last piece of the puzzle for a top .

The month of December I have to consider as topping yet all over the place and confusing

For most traders .

It swings potentially up and down and short lived .

That’s why I’m done posting charts for a bit even though I have

A decent understanding of how all these different cycles work individually .

There going to be crammed together all at once .

That’s it , just my thoughts

Hopefully anyone reading this makes sense out it because my brain is drained

Trying to explain it as best I can .

Joe

“the pivot dates for November might prove to be particularly important”

rotrot | September 23, 2017

Friday, November 3 (PD-3) for starters…

PD-3 (SPX minor highs and lows…the following trading day likely closes with a change in polarity)

Wednesday, October 25 was a PD-3…

Peter G and Andre’,

Very interesting posts! Same or similar conclusions reached with intriguing analysis and insight! Thank you both for posting your ideas and thoughts!

According to Gann squared numbers are the cause of a change in trend.

105 squared = 3 squared times 5 squared times 7 squared on 8/25/87 gives 10/31/17.

This fact alone should wake us up. Thing this was the cycel that kept us going.

Agree with RotRot that 11/3 will be tested. It will be a high. 11/7 will be a low

I agree with Joe that 12/1 could be a high. AFter a 11/24 low a 12/1 high and a 12/9-ish low before we start a rally/retrace into year end. The start of 2018 will be volatile as far as I can see now.

Thanks!

From 5/20/15 into 1/20/16 was 8 months or 249 degrees in the year. 3/1/17 we saw a high. add 8 months and we get 11/1.

2/1/16 was a high. add 21 months and we get 11/1. 21 is 225 degrees in the quare of nine and it is a fibo number.

We will see ups and downs along the way but next week will see the end of the bull market for years to come. I think..

typo 240 degrees,

if 158 weeks is a cycle (see above) then 316 weeks is also a cycle as strong harmonics always hae a 1:2 and 1:3 relation.

10/10/2002 was a significant change in trend and the start of a 5 year cycle up into 10/10/2007. 316 weeks from 10/10/2002 is 10/30/17.

Copper correlates with the market. Yesterday we talked about whether 11/7 would be a high or a low. What I see now is that copper gives a high 11/3, then a low 11/6. And then a high 11/7 to resume a down trend into 11/23.

So I agree with Joe this is a bit confusing, From 11/2 I see lower lows, indicating the market is down. And the highest high in copper was 10/16, the day Apple gave the high. 10/24 the highest close and lower into 10/27. So it really looks like a one day high within a down trend. Could be panic and a desparate attempt of the bulls to keep te trend going.

Copper gives a low 11/23, a high 12/1 and another low 12/7; pretty much what I said yesterday

A new post is live at: https://worldcyclesinstitute.com/the-fat-lady-sits-in-the-wings/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.