Last week, I stated my preference for a regular flat as the second downside pattern in this large fourth wave. There was an alternative of another pattern, such as a zigzag down to a new low, but it was less probable.

Although it took all week, we got a first wave down in 5 waves, which is the typical first wave of the C wave of a regular flat. After a second wave retrace, which should be complete by about Tuesday or Wednesday this week, expect the balance of the C wave to drop to a new low.

It should look something like this (about 2 mins in length):

Bambi Vs. Godzilla |

_______________________________

Bambi Meets Godzilla was a 1969 short student clip that gained notoriety the same year as the famous Woodstock festival, which was a point of a major third wave top in the market, as well as a solar maximum. It was Vietnam War time and there were violent clashes beginning against the establishment. This was just the tip of the iceberg, though, at the climate turned colder and dryer and we headed into a five year recession, culminating in Nixon’s impeachment. My video on this market and climate is here.

This is a similar point in time to today, albeit a much smaller cycle top to what we’re experiencing now.

My point in running this video is that there will be some complacency this week as the market appears to rise only to have the second shoe drop in a much bigger drop to a new low. That should shake things up!

Then we’ll turn around and head for the final all time high.

Pontificating Pundits

They were out in force on Thursday, proclaiming a 400 point DOW drop was the result of Trump’s declaration of a trade war. Never mind that the DOW had dropped 1300 points over the week before the trade war declaration (I guess it wasn’t convenient to point that out). And then on Friday, we rallied to almost completely wipe out that 400 week drop.

I can’t wait to see the grandstanding once we have what looks like a 2000 point drop in the DOW over the next ten days, or so!

Events, of course, don’t affect the market.

The Balance of the Regular Flat

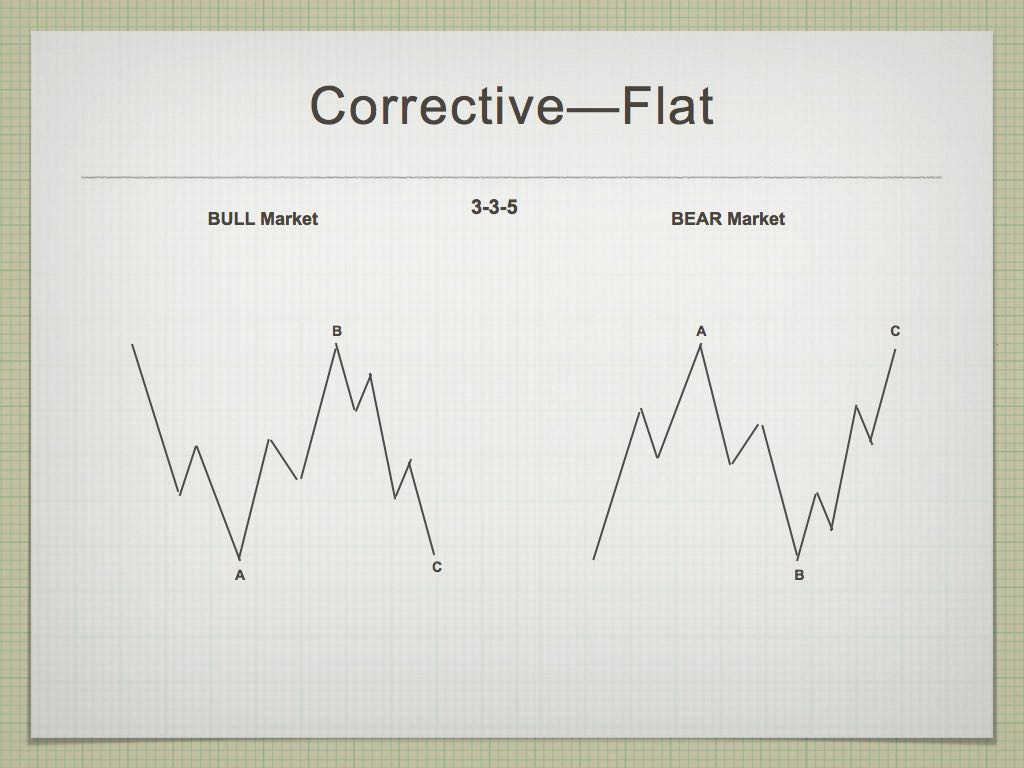

The pattern tracing out in ES, NQ, the Nasdaq, and the SP500 seems to me to be a regular flat. Here’s an description of the traits of a flat (from the Elliott Wave Principle):

“A flat correction usually retraces less of the proceeding impulse waves than does a zigzag. It tends to occur when the larger trend is strong, so it virtually always precedes or follows an extension. The more powerful the underlying trend, the briefer the flat tends to be. Within an impulse, the fourth way frequently sports of flat while the second wave rarely does.”

In both ES, NQ, the Nasdaq, and SP500 (and other US indices), the preceding wave up was an extended wave, so the fit here is quite good.

Above is a chart showing a very simple drawing of a regular flat. Think about the large fourth wave in ES that we’ve been tracing out since January 29. The BULL Market wave on the left in the chart relates to the pattern we have unfolding.

Above is a chart showing a very simple drawing of a regular flat. Think about the large fourth wave in ES that we’ve been tracing out since January 29. The BULL Market wave on the left in the chart relates to the pattern we have unfolding.

The first set of waves down from the 2875 area was in three waves (a zigzag). This is the A wave of the flat.

The wave up from about 2530 is also in three waves. This is the B wave of the flat (a 3-3-5 pattern). We’re now in the C wave which should trace out the five wave pattern of the flat (to the downside).

We now have the first wave down of the five wave pattern we’re expecting for the C wave of the flat, and are working on the second wave now.

Chart Show Changes

I’ve moved the Chart Show back to Wednesdays, but moved it until after the market closes. On fast moving days like we had on Thursday this week, it’s difficult to keep charts up-to-date during the day. Once the market closes, it’s much quieter. Market closes are very important and this new timing will allow you to plan for the coming day rather than have to contend with fast moves in the last few hours of the day that may impact the calls during the show. It will now be on Wednesdays at 5PM EST.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The expected regular flat has been pretty much confirmed with what appears to be a first wave down (in 5 waves) this week. On Friday, we had the expected turn up in what should be a second wave to around the 62% retrace level.

Expect a turn down this coming week into the balance of the C wave to a new low. I'll go with a rough target of 2420 on the downside, although the C wave down can end anywhere after at least tracing out a wave similar in length to that of the first ABC wave down.

The large ABC wave down took about 10 days to fully develop, the subsequent rally took eleven days, so I'd be expecting this entire C wave down to drop in a similar timeframe.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 14 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Bambi video was effective. I follow three other subscription-based sources (one uses fundamental analysis, one uses cycle analysis and the other uses EW like Peter) and all are expecting the same type of drop (2400 – 2500+) and within a similar time period, with one specifying March 7-9. Should be a roller coaster week or two for sure!

https://www.youtube.com/watch?v=7F4yHgXbdhA

Thanks Peter for the update:

This week I will stay long till March 8, and will wait how Thursday and Friday will be.

This could very well be a situation like Aug /Okt 2007, if so we will go up from the lows and make a slightly new highs and of March.

so far OK. This moment a “little” decline and then a hughe up until tomorrow open or Beige Book FED. Then the real decline begins. This is what my indicators predicts. They cannot give how deep we go. But it must be from some importance. Good luck and be carefull http://prognoseus500.simplesite.com/

After the high March 7/8 we have a pull back..

so far so good on the energy chart

https://ibb.co/nPKr57

Gary Cohn disturbs the pattern. Or Not? Watch the red line on the 6th. We did make the LOW on the 6th. There should be a rebound on 7/8. High 2720-2730?

And then ……. down. Later more

Anyone following the after market emini S&Ps? Down over 30!!

https://www.cnbc.com/2018/03/06/gary-cohn-plans-to-resign-as-trumps-top-economic-advisor-new-york-times.html

Ed

I have not had time to look at the ” Joe index ”

I have gone round trip Oregon to Honolulu and back then a flight to San francisco

Got on another tug and now in long beach California . I still see the March 17 and April 4 dates .

My bias is that April 4 should be a swing low of sorts and March 17 some sort of a high .

The April 4 date though I feel is more important .

Something is still a miss though as I see it .

There is another date which surrounds June 6 th .

Bottom line : we may just be in a range bound market until June 6.

The focal point though surrounds April 4.

If you count Nov 2016 to Jan 2018 or Feb 2017 to Jan 2018 you get 14 months or 11 months of

A pretty much vertical move on a monthly chart ( very general time of a 3 rd wave )

.382 times 14 = 5.34 months and .382 times 11 = 4.2 months . That is a very generic time frame

Which when added to late January 2018 does allow for that later June 6 th date as a swing low yet that

Date is also based on a sideways trading pattern which tends to have a bullish outcome .

I have a hard time considering this a bullish market considering the bearish cycles I am following yet

I can consider a right side translation cycle peak which if it does come into effect would lead to a crash

Later in the year .

At the moment I’m sticking with the bear yet I cannot allow for new all time highs following the month

Of March .

( June 6 low targets a Sept 9 high which is out of sync yet probable )

No change to my Oct and Jan 2019 cycle low dates .

Peter G

Thanks for the heads up on the overnight session .

An added note to my post above .

In a typical crash type move ( I have dug through several of them going back some 90 years )

Whether they are 1 minute charts or daily or weekly or hourly . The wave C tends to move

2.2 to 3.2 times the previous wave A . The 2.2 times A target becomes the pivot level once the

Crash phase is over . I have not yet found a failure I’m that analysis.

Take the the Dow 26616 high minus the Feb lows multiply by 2.2 and subtract that number from

The swing high that followed and write that price level down . That will become the pivot if the market

Decline accelerates . The 3.2 extension tends to be the extreme yet does not always get hit .

The 2.2 is more of a constant .

It is the break back above that 2.2 price extension that signals a low is in place .

Look through as many crashes as you can find in any time frame and you will find those price

Relationships .

Lastly there are some correlations I’m seeing between the nasdaq 100 from the year 2000 to today’s

Stock market averages . We did see an April low back then as well .

April 4 is more important than March 17 and April 4 is the ideal swing low yet the market needs to prove

That .

All from me for now

Joe,

The 2.2 x Wave A would take Wave C down to 19,500 level. Is my 4am math correct?

Thank for commenting! Always interesting and thought provoking!

Ed

I’ll assume your math is correct and make a mental note of it.

I don’t have much data available to check .

We will find out how far the decline goes soon enough and also

Find out if my timing is correct or not .

Thanks

For what it’s worth , it appears to me that the snow on the east coast is causing

Phones to not work . I tried calling a friend to see how she is holding up

And no connection . I have no idea how any of that will effect trading

Hi Joe, the 17th looks like a High according to my indicators and 1 of april my chinees indicator makes an enormes LOW. When such a date appears the EU and US indexes makes also a Low around that date. So 4th of april I can also confirm.

for today and tommorrow i have lost any confidence with the markets UP.

But this what i feel and not what my indicators are saying. Be carefull and us this information as confirmation

Looking at fractals, we also had a warning in 2015 Aug 12, days later we had a mini crash.

Caught the first step of Godzilla

Initial Investment – $3600.00 for 9 FC

Short trade of 9 FC( EPH8) entered on 3/06 at 2724.50

Trade exited at 2692.75 on 3/06

Gross gain on trade:$14287.50

Percentage gain on trade : 396.88%

Good for you, Barry!

Barry,

Would you tell me what 9 FC and EPH8 stands for?

Thx,

Jeff T

Jeff : EPH8 : E Mini S&P 500 March 2018 futures contract

9 FC : nine futures contracts

Barry

A reminder that the Chart Show is on in an hour … an hour after the market close.

The market should top right here, and decline into March 12.

https://www.youtube.com/watch?v=IcHm-JDUi9c

no time but, The High was on 8/3 and the Low on 13/3

http://prognoseus500.simplesite.com/

Really surprised this week by this bullish tone and move. i Honestly thought that Peters ES chart in his post was on the money but not sure if its gone up in smoke now with this weeks movement.

Joe thanks for your posts always helpful and proving to have high levels of accuracy too.

I would say we are still in the B wave of this wave 4., though now in the C part of the B wave. My guess would be we need to at least get over the Feb 27th high before it is complete. Seems like March 17th might be that point?

Other option would be wave B completes on Monday by gapping above the top of a bollinger band and reverses in Wave 1 of C into Wednesday morning, then wave 2 of C takes us into the March 17th date?

For what its worth

Watch the crypto currencies on Monday .

I don’t have any links but do have some good info

From a reliable friend who is heavy into them .

We should be able to find some validity over the weekend

If not right now. MasterCard is tied to lite coin which is set

To go live soon. The infrastructure is basically set up at this point .

What happens next I can’t say ( I don’t know ) but it’s worth

Researching . As for the overall stock market I still feel something is amiss

Maybe we are in a wave c of wave b to the upside ?

If so the Feb lows would be wave a of a triangle or a flat

March 17 should be some type of a high with an April 4 low

A higher high above the late Feb high yet not a new all time high

Would make sense on the Dow . How that fits with the other index’s

Not sure of

A typical retrace with either a flat or triangle can hit the .786-.886 range .

So I’ll assume we are nearing the inflection point .

The puetz window does look more and more like an inversion

Despite the other bearish cycles .

March 17-23 some sort of high with an April 4 low and

Also a June 6 low .

The next major bearish cycle after April 4 would be due to begin

In August as well as Sept 8.

In short it is looking like the stock index’s are holding up fairly

Well despite the bearish cycles so I’ll call it strength with in a bear cycle .

You never know for sure how a market will move in a bear cycle

You only know in hindsight , so far this bearish cycle has only produced

A pause ( sideways action )

More cycles to hit come August and Sept with the present bearish cycles

In effect .

That’s it for now

March 10, 2000

March 6, 2009

March 9, 2018

https://twitter.com/KimbleCharting/status/972222348815470592

in addition to the dates, take note of the RSI at the top of the chart…

Well the top can be in place, so from Monday risk is on… like the first week Okt 1987

John,

I politely ask if you can offer up more explanation on your statement?

Hi Ed,

Well , we have an important bradley turn March 8-10.

The tide is turning also today, we had a turn on March 2 (low).

And if you count the days , Aug 26 1987 till First week Okt (6) and compare them with Jan 26 2018 till now (feb was 28 calender days).

So This could be it, let’s find out soon.

John thanks for the detail.

I have watched your tidal waves closely they seem good thus far.

If you are using 1987 the predicted next decline will be violent in under 9 trading days. I just cant see it John but like you said we will indeed find out very soon

A new market post is live: https://worldcyclesinstitute.com/still-counting-on-a-flat/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.